Inflation 2007 Inflation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Quarterly Economic Update

DSI Wealth Management Group Presents: QUARTERLY ECONOMIC UPDATE A review of 1Q 2014 QUOTE OF THE THE QUARTER IN BRIEF QUARTER Bulls didn’t quite trample bears in the opening quarter of 2014. The S&P 500 slid “If there is no 3.56% in January, advanced 4.31% in February and gained another 0.69% in March. struggle, there is no Still, Q1 ended with the Dow in the red YTD and only minor YTD gains for the progress.” Nasdaq, S&P and Russell 2000; the broad commodities market outperformed the stock market. Some fundamental economic indicators were unimpressive during the – Frederick Douglass quarter, and analysts wondered if a ferocious winter was partly to blame. The Federal Reserve kept tapering QE3 as Ben Bernanke handed the reins to Janet QUARTERLY TIP Yellen. Unrest and currency problems hit some key emerging-market economies. Given the choice Home prices kept rising as home sales leveled off. Wall Street hoped the year 1 between a great wouldn’t mimic the quarter. lifestyle today and financial freedom DOMESTIC ECONOMIC HEALTH tomorrow, many The quarter ended with a major jump in consumer confidence. The Conference people opt to live for Board’s index reached 82.3 in March, up 4.0 points in a month. Consumer spending today – but no one improved too, rising 0.2% in January and 0.3% in February. (In a contrasting note, becomes wealthy by the University of Michigan’s consumer sentiment index slipped 2.5 points across the spending or living on quarter to a final March mark of 80.0.)2,3 margin. -

Uncovered Equity “Disparity” in Emerging Markets

City Research Online City, University of London Institutional Repository Citation: Fuertes, A-M. ORCID: 0000-0001-6468-9845, Phylaktis, K. ORCID: 0000-0001- 9392-1682 and Yan, C. (2019). Uncovered Equity “Disparity” in Emerging Markets. Journal of International Money and Finance, doi: 10.1016/j.jimonfin.2019.102066 This is the accepted version of the paper. This version of the publication may differ from the final published version. Permanent repository link: https://openaccess.city.ac.uk/id/eprint/22585/ Link to published version: http://dx.doi.org/10.1016/j.jimonfin.2019.102066 Copyright: City Research Online aims to make research outputs of City, University of London available to a wider audience. Copyright and Moral Rights remain with the author(s) and/or copyright holders. URLs from City Research Online may be freely distributed and linked to. Reuse: Copies of full items can be used for personal research or study, educational, or not-for-profit purposes without prior permission or charge. Provided that the authors, title and full bibliographic details are credited, a hyperlink and/or URL is given for the original metadata page and the content is not changed in any way. City Research Online: http://openaccess.city.ac.uk/ [email protected] Journal of International Money & Finance, forthcoming Uncovered Equity “Disparity” in Emerging Markets Ana-Maria Fuertes, Kate Phylaktis*, Cheng Yan 11th July 2019 The portfolio-rebalancing theory of Hau and Rey (2006) yields the uncovered equity parity (UEP) prediction that local-currency equity return appreciation is offset by currency depreciation. Vector autoregressive model estimation and tests for eight Asian emerging markets using daily data reveal instead a positive nexus between equity returns and currency returns. -

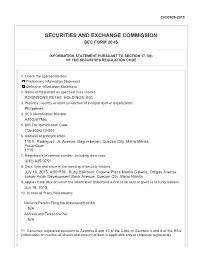

Securities and Exchange Commission Sec Form 20-Is

CR03839-2015 SECURITIES AND EXCHANGE COMMISSION SEC FORM 20-IS INFORMATION STATEMENT PURSUANT TO SECTION 17.1(b) OF THE SECURITIES REGULATION CODE 1. Check the appropriate box: Preliminary Information Statement Definitive Information Statement 2. Name of Registrant as specified in its charter ROBINSONS RETAIL HOLDINGS, INC. 3. Province, country or other jurisdiction of incorporation or organization Philippines 4. SEC Identification Number A200201756 5. BIR Tax Identification Code 216-303-212-000 6. Address of principal office 110 E. Rodriguez, Jr. Avenue, Bagumbayan, Quezon City, Metro Manila Postal Code 1110 7. Registrant's telephone number, including area code (632) 635-0751 8. Date, time and place of the meeting of security holders July 16, 2015, 4:00 P.M., Ruby Ballroom, Crowne Plaza Manila Galleria, Ortigas Avenue corner Asian Development Bank Avenue, Quezon City, Metro Manila 9. Approximate date on which the Information Statement is first to be sent or given to security holders Jun 18, 2015 10. In case of Proxy Solicitations: Name of Person Filing the Statement/Solicitor N/A Address and Telephone No. N/A 11. Securities registered pursuant to Sections 8 and 12 of the Code or Sections 4 and 8 of the RSA (information on number of shares and amount of debt is applicable only to corporate registrants): Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding Common shares 1,385,000,000 13. Are any or all of registrant's securities listed on a Stock Exchange? Yes No If yes, state the name of such stock exchange and the classes of securities listed therein: Robinsons Retail Holdings, Inc.’s common stock is listed on the Philippine Stock Exchange. -

CHAPTER 1 INTRODUCTION 1.1. Object Overview 1.1.1 Indonesia

CHAPTER 1 INTRODUCTION 1.1. Object Overview 1.1.1 Indonesia Composite Stock Price Index The Composite Stock Price Index is usually abbreviated as IHSG in English is also commonly called the Indonesia Composite Index, ICI, or IDX Composite. The definition of a Composite Stock Price Index (CSPI) or the meaning of JCI is one of several stock market indices (stock markets) used by the Indonesia Stock Exchange (BEI; formerly the Jakarta Stock Exchange (BEJ). The IHSG was first introduced on April 1, 1983, the function of the stock price index acts as an indicator that reflects the share price movements in the JSX in general (Oktarina, 2016). 1.1.2 Thailand Composite Stock Price Index The SET Index is a Thailand composite stock market index which is calculated from the prices of all common stocks (including unit trusts of property funds) on the main board of the Stock Exchange of Thailand (SET), except for stocks that have been suspended for more than one year. It is a market capitalization- weighted price Index which compares the current market value of all listed common shares with its value on the base date of April 30, 1975, which was when the Index was established and set at 100 point/ The SET Index calculation is adjusted in line with modifications in the values of stocks resulting from changes in the number of stocks due to various events, e.g., public offerings, exercised warrants, or conversions of preferred to common shares, in order to eliminate all effects other than price movements from the Index (Sutheebanjard and Premchaiswadi, 2010). -

Durations of Trade in the Philippine Stock Market: an Application of the Markov-Switching Multi-Fractal Duration (Msmd) Model

DURATIONS OF TRADE IN THE PHILIPPINE STOCK MARKET: AN APPLICATION OF THE MARKOV-SWITCHING MULTI-FRACTAL DURATION (MSMD) MODEL Jennifer E. Hinlo1 and Agustina Tan-Cruz2 ABSTRACT This study examined the durations of trade in the Philippine Stock Market using the Markov Switching Multi-Fractal Duration (MSMD) Model using tick data from 20 frequently traded stocks in the Philippine Stock Market. Results revealed that higher duration results to lower trading intensity because of low information of traders about the stocks during the period. The lesser attention paid to the stock, the more likely that trade will not happen. The higher trading intensity is a result of shorter trade durations, this means that the interval from one trading transaction to another is smaller. The higher the trading intensity implies higher price impact of trades and faster price adjustment to new trade-related information. Information flow affects intensities but it does not trigger trading automatically because investors have limited attention, and they need to allocate attention to process all kinds of information before making a trading decision. Keywords: Markov Switching Multi-Fractal Duration (MSMD) Model, Philippine Stock Market, Trade Durations EXECUTIVE SUMMARY This study examined the durations of trade in the Philippine Stock Exchange (PSE) using the Markov Switching Multi-Fractal Duration (MSMD) Model using top twenty (20) randomly selected active firms listed in the PSE. Tick-by-tick intra-day trading of the equities in the PSE were used, from May 2 to 31, 2013, from 9:00 – 3:30pm (where the PSEI has recorded its 31st all-time high index). -

Asia Bond Monitor—November 2016 Was Prepared by the Asianbondsonline (ABO) Team

Asia Bond Monitor November 2016 This publication reviews recent developments in East Asian local currency bond markets along with the outlook, risks, and policy options. It covers the 10 members of the Association of Southeast Asian Nations plus the People’s Republic of China; Hong Kong, China; and the Republic of Korea. About the Asian Development Bank ADB’s vision is an Asia and Pacific region free of poverty. Its mission is to help its developing member countries reduce poverty and improve the quality of life of their people. Despite the region’s many successes, it remains home to half of the world’s extreme poor. ADB is committed to reducing poverty through inclusive economic growth, environmentally sustainable growth, and regional integration. Based in Manila, ADB is owned by 67 members, including 48 from the region. Its main instruments for helping its developing member countries are policy dialogue, loans, equity investments, guarantees, grants, and technical assistance. ASIA BOND MONITOR NOVEMBER 2016 ASIAN DEVELOPMENT BANK 6 ADB Avenue, Mandaluyong City 1550 Metro Manila, Philippines ASIAN DEVELOPMENT BANK www.adb.org The Asia Bond Monitor (ABM) is part of the Asian How to reach us: Bond Markets Initiative (ABMI), an ASEAN+3 initiative Asian Development Bank supported by the Asian Development Bank. This report Economic Research and Regional Cooperation is part of the implementation of a technical assistance Department project funded by the Investment Climate Facilitation 6 ADB Avenue, Mandaluyong City Fund of the Government of Japan under the Regional 1550 Metro Manila, Philippines Cooperation and Integration Financing Partnership Tel +63 2 632 6688 Facility. -

The Factors Affecting Stock Market Volatility and Contagion: Thailand and South-East Asia Evidence

The Factors Affecting Stock Market Volatility and Contagion: Thailand and South-East Asia Evidence Thesis submitted in partial fulfilment of the requirements for the degree of Doctorate of Business Administration by Paramin Khositkulporn School of Business Victoria University Melbourne February 2013 Declaration I, Paramin Khositkulporn, declare that the DBA thesis entitled “The Factors Affecting Stock Market Volatility and Contagion: Thailand and South-East Asia Evidence” is no more than 65,000 words in length including quotes and exclusive of tables, figures, appendices, bibliography, references and footnotes. This thesis contains no material that has been submitted previously, in whole or in part, for the award of any other academic degree or diploma. Except where otherwise indicated, this thesis is my own work. Paramin Khositkulporn Date ii Contents Declaration ........................................................................................................................ ii Contents ........................................................................................................................... iii List of Tables .................................................................................................................... v List of Figures ................................................................................................................. vii List of Abbreviations ..................................................................................................... viii Acknowledgements ......................................................................................................... -

Execution Copy

EXECUTION COPY GUARANTEED SENIOR SECURED NOTES PROGRAMME issued by GOLDMAN SACHS BANK (EUROPE) PLC in respect qf which the payment and delivery obligations are guaranteedby THE GOLDMAN SACHS GROUP, INC. (the "PROGRAMME") "FINAL TERMS" DATED 1 1 AUGUST 2009 SERIES 2009-02 SENIOR SECURED FLOATING RATE NOTES, DUE II FEBRUARY 201 0 (the "SERIES") ISIN XS0443581235 Common Code 044358123 This document must be read in conjunction with the Base Prospectus and in particular, the Base Terms and Conditions of the Notes, as set out therein Full information on the Issuer, The Goldman Sachs Group Inc (the "Guarantor"), and the terms and conditions of the Notes, is only available on the basis of the combination of the Final Terms and the Base Prospectus The Base Prospectus is available for viewing at www financialregulator ie and during normal business hours at the registered office of the Issuer, and copies may be obtained from the specified office of the listing agent in Ireland The Issuer accepts responsibility for the information contained in these Final Terms. To the best of the knowledge and belief of the Issuer and the Guarantor (which have taken all reasonable care to ensure that such is the case) the information contained in the Base Prospectus, as completed and/or amended by these Final Terms in relation to the Series of Notes referred to above, is true and accurate in all material respects and, in the context of the issue of this Series, there are no other material facts the omission of which would make any statement in such information misleading Unless terms are defined herein, capitalized terrns shall have the meanings given to them in the Base Prospectus or in the indenture, between Goldman Sachs Bank (Europe) PLC, Goldman Sachs International and The Bank of New York Mellon, acting through its London Branch, dated as of 12 February 2009, as amended and restated as of 23 July 2009 (the "Indenture") There is hereby established pursuant to this Series Authorisation, a Series of Notes to be issued under the Indenture, which has the following terms. -

Association of South-East Asian Nations-US Stock Market

International Journal of Economics and Financial Issues ISSN: 2146-4138 available at http: www.econjournals.com International Journal of Economics and Financial Issues, 2017, 7(3), 684-705. Association of South-East Asian Nations-US Stock Market Associations in and Around US 2007-09 Financial Crisis: An Autoregressive Distributed Lag Application for Policy Implications Ranjan Dasgupta* Xavier University Bhubaneshwar, Xavier Square, Bhubaneshwar, Odisha, India. *Email: [email protected] ABSTRACT This study examines portfolio diversification and arbitrage opportunities available to international investors in 16 Asian and US stock markets by using most advanced autoregressive distributed lag methods in and around recent US sub-prime crisis of 2007-09 with selected structural breaks. Results show that in overall and during-the-crisis period these markets were co-integrated in long-run and there were not enough portfolio diversification opportunities for international investors like other sub-periods. The Indian and Chinese markets were strongest contenders among Asian and US to attract foreign inflows. In short-run, these markets show dynamic adjustments generally within 1 month which neutralizes arbitrage opportunities. Keywords: Asian and US Stock Markets, Autoregressive Distributed Lag, Co-integrations, Market Efficiency, Portfolio Diversification, US 2007-09 Crisis JEL Classifications: C32, G15 1. INTRODUCTION also suggested a positive association between market integration and informational efficiency. Dwyer and Wallace (1992) define Co-integration and linkages of international stock markets has market efficiency as the lack of arbitrage opportunities. Thus, it is been a serious proposition for the policy-makers, investors, evident that efficient markets are generally co-integrated. Also, the academicians and researchers worldwide especially post- removal of barriers between international markets would lead to liberalization in the 90s in most parts around the world. -

PSE AR 01 Body

Philippine Stock Exchange 2001 ANNUAL REPORT chairman’s report It was an extremely difficult period. The country was weighed down by a turbulent political crisis. The year 2001 opened with an ongoing impeachment trial of the Philippine president, accused of plunder and other offenses, which was started in the previous year. Unexpectedly, the trial was suddenly aborted followed by another peaceful people power at EDSA which forced Joseph Estrada to step down and was replaced by Gloria Macapagal Arroyo as President. Shortly thereafter, the nation saw a violent political upheaval in May. The supporters of the former President attacked the Malacañang Palace in an unsuccessful attempt to reinstate their leader. The domestic economy, already affected by the The steep decline in share prices in 2001 global economic slowdown, suffered the brunt of the resulted in a 27% drop in market capitalization to a political disturbances. The peso declined to P53 to $1 low of P1.9 trillion in October from a high of P2.6 – its lowest for the year. The economic problem was trillion in January. aggravated by the September 11 terrorist attacks in Despite last year’s gloomy condition in our stock the United States which heavily affected our export market, the PSE was able to launch the Small and industry and further depressed our currency. Medium Enterprise (SME) Board with the listing of the As a result of the weak economy and the political first SME company that conducted an IPO, the SQL* turmoil, our stock market, already saddled by the Wizard, Inc. Fortunately, two more companies were stringent provisions of the Securities Regulation Code, listed before the year ended, namely Primex recorded its worst performance in years. -

Weekly Report 27 Jan - 31 Jan 2020

ISSN 0118-1785 Weekly Report 27 Jan - 31 Jan 2020 Mil Php (truncated) and Total Value Traded PSEi 18,000 16,000 8,700 14,000 8,200 12,000 7,700 10,000 7,200 8,000 6,700 6,000 6,200 4,000 2,000 5,700 - 5,200 1-Feb 1-Mar 29-Mar 26-Apr 24-May 21-Jun 19-Jul 16-Aug 13-Sep 11-Oct 8-Nov 6-Dec 3-Jan 31-Jan Daily PSE Index (PSEi) Daily Foreign Transactions (in Thousand Php) Point % Foreign Date Open High Low Close Change Change Buying Selling Net Total Activity (%) 27-Jan 7,616.90 7,624.37 7,580.67 7,587.63 (35.78) (0.47) 2,170,726 2,104,043 66,683 4,274,770 49.72 28-Jan 7,563.12 7,563.12 7,468.70 7,468.70 (118.93) (1.57) 1,613,191 2,157,664 (544,473) 3,770,855 42.44 29-Jan 7,472.53 7,472.53 7,423.69 7,462.31 (6.39) (0.09) 2,453,119 2,804,110 (350,991) 5,257,229 53.05 30-Jan 7,466.45 7,484.65 7,392.68 7,392.68 (69.63) (0.93) 2,739,509 3,252,560 (513,051) 5,992,068 54.98 31-Jan 7,413.17 7,446.26 7,200.79 7,200.79 (191.89) (2.60) 4,278,576 5,980,417 (1,701,841) 10,258,994 61.82 Week 051 7,587.63 7,200.79 7,200.79 (422.62) (5.54) 13,255,121 16,298,794 (3,043,673) 29,553,915 53.84 YTD2 7,840.70 7,200.79 (614.47) (7.86) 69,886,294 77,419,883 (7,533,589) 147,306,178 57.20 Daily Trading Regular Market Non-regular Market (Block Sales & Odd Lot) Total Market Date Volume Value (Php) No. -

Notice of Annual Stockholders' Meeting

SECURITIES AND EXCHANGE COMMISSION SEC FORM 20-IS Information Statement Pursuant to Section 20 of The Securities Regulation Code 1. Check the appropriate box: [] Preliminary Information Statement [ ] Definitive Information Statement 2. Name of Company as specified in its charter: Philequity PSE Index Fund, Inc. 3. Province, country or other jurisdiction of incorporation or organization: Metro Manila, Philippines 4. SEC Identification Number: A1998-16221 5. BIR Tax Identification Code: 201-884-062-000 6. Address of principal office: 15th Floor, Philippine Stock Exchange, 5th Ave. cor. 28th Street, Bonifacio Global City, Taguig City, Metro Manila 1630 7. Company’s telephone number, including area code: (632) 250-8700 8. Date, time and place of the meeting of security holders: Date : 31 August 2019 Time : 9:40 a.m. Venue : Meralco Theatre, Ortigas Avenue, Pasig City 9. Approximate date on which the Information Statement is first to be sent or given to security holders: 07 August 2019 10. Securities registered pursuant to sections 4 and 8 of the Code (information on number of shares and amount of debt is applicable only to corporate registrants): Number of shares of Title of Each Class Common Stock Outstanding Common Stock, 722,466,748 P1.00 par value (as of 31 July 2019) 11. Are any or all Company’s securities listed on a Stock Exchange? Yes [ ] No [ ] WE ARE NOT ASKING OR REQUIRING YOU TO SEND US A PROXY 1 GENERAL INFORMATION Item 1. Date, Time, and Place of Meeting of Security Holders A. Date : 31 August 2019 Time : 9:40 a.m. Venue : Meralco Theatre, Ortigas Avenue, Pasig City Mailing Address: 15th Floor, Philippine Stock Exchange, 5th Ave.