Reply Evidence of Paul R. Carpenter of the Brattle Group, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Border Crossings of Natural Gas Pipelines, North America Cruces Fronterizos De Ductos De Gas Natural, América Del Norte

140°E 150°E 160°E 170°E 180° 170°W 160°W 150°W 140°W 130°W 120°W 110°W 100°W 90°W 80°W 70°W 60°W 50°W 40°W 30°W 20°W 10°W Border Crossings of Natural Gas Pipelines, North America Cruces Fronterizos de Ductos de Gas Natural, América del Norte E l l e s m e r e I s l a n d 70°N Passages Transfrontaliers de Pipelines de Gaz Naturel, Amérique du Nord Í l e d u E l l e s m e r e 70°N 60°N A l a s k a 60°N N o r t h w e s t Te r r i t o r i e s Yu k o n Te r r i t o i r e s d u N o r d - O u e s t N u n a v u t 50°N 26 N e w f o u n d l a n d a n d L a b r a d o r 50°N 25 Te r r e - N e u v e e t - L a b r a d o r A l b e r t a 23 B r i t i s h C o l u m b i a S a s k a t c h e w a n P a c i f i c C o l o m b i e - B r i t a n n i q u e Ve r m o n t M a n i t o b a 24 40°N O c e a n 22 N e w O n t a r i o Q u é b e c P r i n c e E d w a r d I s l a n d H aÎ ml e - d up P r isn c eh- É dio ura red 1 N e w 2 3 B r u n s w i c k 4 6 8 9 N o u v e a u 11 B r u n s w i c k O c é a n o 27 W a s h i n g t o n 7 P a c í f i c o 5 10 26 M a i n e 12 13 25 N o v a S c o t i a M o n t a n a N o u v e l l e - É c o s s e N o r t h D a k o t a 23 M i n n e s o t a Ve r m o n t 40°N N e w 24 H a m p s h i r e 22 M i c h i g a n 20 N e w M a s s a c h u s e t t s O r e g o n I d a h o W i s c o n s i n S o u t h D a k o t a 19 Yo r k A t l a n t i c 18 C o n n e c t i c u t 14 16 21 30°N O c é a n W y o m i n g R h o d e I s l a n d O c e a n 15 17 P e n n s y l v a n i a P a c i f i q u e N e b r a s k a I o w a N e w J e r s e y O h i o I n d i a n a M -

Pipeline and Processing Fac... - Pipeline Projects with Length Greater Than 20 Miles

12/29/2015 Pipeline and Processing Fac... - Pipeline projects with Length Greater than 20 Miles Pipeline projects with DEC-29-2015 Pipeline and Processing Facilities : SAVED REPORTS Length Greater than 1:37 PM 20 Miles Pipeline projects with Length Greater than 20 Miles Holding Company or Parent Operating Company: Project Status Project Project Name: Length Organization: Type: (New Miles) AK (6 Pipeline projects) Energia Cura Fairbanks Pipeline Doubtful New Arctic Fox (Fairbanks Pipeline) 443 Company Linc Energy Linc Energy On New Umiat Oil Field Pipeline 80 Hold/Postponed Alaska Housing Finance Alaska Gasline On New Alaska Stand Alone Pipeline (ASAP) 737 Corporation Development Hold/Postponed Corporation BP BP Under New Point Thomson Gas Field 22 Construction NovaGold Resources Inc. Donlin Gold, LLC Advanced New Donlin Gold 312 Development Alaska LNG Early New Alaska LNG (AKLNG) 800 Development TOT 2,394 AL (6 Pipeline projects) Southern Company Alabama Power Under New Gaston Natural Gas Pipeline 30 Construction Spectra Energy Spectra Energy Advanced New Sabal Trail 515 Development Williams Company Transcontinental Gas Early New Hillabee Expansion Project Phase 1 20 Pipeline Company LLC Development Miller Energy Resources Early New Trans - Foreland Pipeline (TFPL) system 23 Development Laclede Gas Alagasco On-going Replacement Alagasco Pipeline replacement program 850 PRP Williams Company Transcontinental Gas Early New Hillabee Expansion Project Phase 2 and 3 24 Pipeline Company LLC Development TOT 1,462 Alberta (43 Pipeline projects) TransCanada Imperial Oil Early New Mackenzie Gas Project 758 Development Enbridge Inc. Enbridge Income Fund Advanced New Northern Gateway Pipeline (westward 731 Development crude for export) TransCanada TransCanada Advanced New Keystone XL 1,661 Development Enhance Energy Inc. -

Canadian Energy Research Institute

Canadian Energy Research Institute Capacity of the Western Canada Natural Gas Pipeline System SUMMARY REPORT – VOLUME 2 Peter H. Howard P.Eng David McColl Dinara Millington Paul R. Kralovic Study No. 113 – Summary Report Volume 2 ISBN No. 1-896091-81-4 Purchased by the State of Alaska January 2008 Relevant • Independent • Objective CAPACITY OF THE WESTERN CANADA NATURAL GAS PIPELINE SYSTEM SUMMARY REPORT VOLUME 2 ii Capacity of the Western Canada Natural Gas Pipeline System Copyright © Canadian Energy Research Institute, 2008 Sections of this study may be reproduced in magazine and newspapers with acknowledgement to the Canadian Energy Research Institute ISBN 1-896091-81-4 Authors: Peter Howard David McColl Dinara Millington Paul R. Kralovic CANADIAN ENERGY RESEARCH INSTITUTE #150, 3512 – 33 STREET NW CALGARY, ALBERTA CANADA T2L A6 TELEPHONE: (403) 282-1231 January 2008 Printed in Canada January 2008 Canadian Energy Research Institute iii The Canadian Energy Research Institute (CERI) is a cooperative research organization established by government and industry parties in 1975. Our mission is to produce relevant, independent, objective economic research and education in energy and environmental issues to benefit business, government, and the public. The sponsors of the Institute are Natural Resources Canada; the Alberta Department of Energy; the Private Sector Sponsors of the Canadian Energy Research Institute (composed of more than one hundred corporate members from the energy production, transportation, marketing, distribution, and consuming sectors in Canada and abroad and the financial community); the University of Calgary; the Alberta Energy and Utilities Board; the British Columbia Ministry of Energy and Mines; the Northwest Territories Department of Resources, Wildlife and Economic Development; Indian and Northern Affairs Canada; Alberta Research Council; and the Alberta Utilities Consumer Advocate. -

QUARTERLY FOCUS: Planned Pipeline Construction Designed To

North American Gas Trade * North American Gas Trade * North American Gas Trade * North American Gas Trade * North American Gas Trade QUARTERLY FOCUS: Planned Pipeline Construction Designed to Foster Increased Gas Trade Between the United States and Canada INTRODUCTION capacity additions are projected to occur in the Midwestern and Northeastern corridors. Most of As a part of its regulatory oversight the planned capacity additions provide improved responsibilities, the Office of Natural Gas & access to western Canadian supplies; however, Petroleum Import and Export Activities several of the projects are being built to transport (Import/Export Office) performs various analytical Canadian natural gas reserves located offshore studies related to the import and export of natural Nova Scotia from Sable Island. gas. This Quarterly Focus looks at some of the planned pipeline construction projects which, if The Import/Export Office has obtained built, would increase the ability to transport information about these individual projects from additional volumes of natural gas between the various sources, including regulatory filings made United States and Canada. For the most part, these with the Federal Energy Regulatory Commission proposed projects are being designed to increase (FERC), Department of Energy (DOE), company the importation of natural gas. A similar review of representatives and Internet Web sites, and various proposed construction projects was the subject of trade journals. The review of proposed projects the Quarterly Focus written for the Quarterly include a number of projects recently announced Report issued in the second quarter of 1996; this by the sponsoring companies which have not report merely updates the status of some of the advanced much beyond the conceptual stage in projects reviewed earlier and examines some of development. -

Transporting Natural Gas

About U.S. Natural Gas Pipelines – Transporting Natural Gas The U.S. natural gas pipeline network is a highly U.S. Natural Gas Pipeline Network integrated transmission and distribution grid that can transport natural gas to and from nearly any location in the lower 48 States. The natural gas pipeline grid comprises: • More than 210 natural gas pipeline systems. • 300,000 miles of interstate and intrastate transmission pipelines (see mileage table). • More than 1,400 compressor stations that maintain pressure on the natural gas pipeline network and assure continuous forward movement of supplies (see map). • More than 11,000 delivery points, 5,000 click to enlarge receipt points, and 1,400 interconnection See Appendix A: Combined ‘Natural Gas points that provide for the transfer of natural Transportation’ maps gas throughout the United States. • 29 hubs or market centers that provide See Appendix B: Tables additional interconnections (see map). • 394 underground natural gas storage facilities (see map). Geographic Coverage of Pipeline Companies • 55 locations where natural gas can be United States - links to companies listed A-Z with U.S. map imported/exported via pipelines (see map). showing regional breakout detail • 5 LNG (liquefied natural gas) import facilities and 100 LNG peaking facilities. Northeast - CT, DE, MA, MD, ME, NH, NJ, NY, PA, RI, VA, VT, WV Learn more about the natural gas Midwest - IL, IN, MI, MN, OH, WI Southeast - AL, FL, GA, KY, MS, NC, SC, TN pipeline network: Southwest - AR, LA, NM, OK, TX Central - CO, IA, KS, -

Unplugging the Dirty Energy Economy / Ii

Polaris Institute, June 2015 The Polaris Institute is a public interest research organization based in Canada. Since 1997 Polaris has been dedicated to developing tools and strategies to take action on major public policy issues, including the corporate power that lies behind public policy making, on issues of energy security, water rights, climate change, green economy and global trade. Acknowledgements This Profile was researched and written by Mehreen Amani Khalfan, with additional research from Richard Girard, Daniel Cayley-Daoust, Erin Callary, Alexandra Bly and Brianna Aird. Special thanks to Heather Milton-Lightening and Clayton Thomas-Muller for their contributions. Cover design by Spencer Mann. This project was made possible through generous support from the European Climate Fund Polaris Institute 180 Metcalfe Street, Suite 500 Ottawa, ON K2P 1P5 Phone: 613-237-1717 Fax: 613-237-3359 Email: [email protected] www.polarisinstitute.org i / Polaris Institute Table of Contents SUMMARY ............................................................................................................................................................. 1 INTRODUCTION ..................................................................................................................................................... 4 CHAPTER 1 - ORGANIZATIONAL PROFILE ............................................................................................................... 6 1.1 TRANSCANADA’S BUSINESS STRUCTURE AND OPERATIONS .............................................................................................. -

Canadian Gas Pipelines Code of Conduct Compliance Report for the Year Ended December 31, 2020

450 – 1 Street SW Calgary, Alberta T2P 5H1 Tel: (403) 920-2977 Email: [email protected] April 27, 2021 Filed Electronically Canada Energy Regulator Suite 210, 517 Tenth Avenue SW Calgary, AB T2R 0A8 Attention: Mr. Jean-Denis Charlebois, Secretary of the Commission Dear Mr. Charlebois: Re: TC Energy Corporation (TC Energy) Canadian Gas Pipelines Code of Conduct Compliance Report for the Year Ended December 31, 2020 In accordance with section 5.3 of the Canadian Gas Pipelines Code of Conduct (Code) and its accompanying Compliance Plan (Plan), TC Energy is filing its Compliance Report for the year ended December 31, 2020. This filing will also be posted on http://www.tccustomerexpress.com/cgp-code-of-conduct.html. If you have any questions or concerns with respect to the enclosed, please contact the undersigned at (403) 920-2977 or by e-mail at [email protected]. Yours truly, TC Energy Corporation Original signed by Ryan V. Rodier Manager Inter-Affiliate, Compliance Training & Services Enclosure cc: Tolls, Tariff, Facilities & Procedures Committee Tolls Task Force COMPLIANCE REPORT: CANADIAN GAS PIPELINES CODE OF CONDUCT FOR YEAR ENDING DECEMBER 31, 2020 INTRODUCTION 1.1 Reporting Obligation This Compliance Report (Report) is prepared pursuant to section 5.3 of the Canadian Gas Pipelines Code of Conduct (Code) and its accompanying Compliance Plan (Plan). The Code applies to TransCanada PipeLines Limited (TCPL) in relation to the TCPL Mainline and TCPL’s wholly- owned, federally regulated gas pipelines in Canada which are Nova Gas Transmission Ltd. (NGTL), Foothills Pipe Lines Ltd. and Great Lakes Pipeline Canada Ltd. -

View Annual Report

TransCanada Corporation 2007 Annual Report for growth andvaluecreation for growth capturing opportunities our focus Operating one of the most sophisticated pipeline systems in the world, TransCanada moves 15 billion cubic feet of natural gas per day (20 per cent of North American production), delivering to markets throughout Canada and the U.S. With the acquisition of ANR in early 2007, TransCanada’s network of wholly owned pipelines now extends more than 59,000-kilometres (36,500 miles) and taps into virtually all major gas supply basins in North America. TransCanada is also one of the continent’s largest providers of gas storage and related services with approximately 355 billion cubic feet of storage capacity. We’re focused on optimizing our pipeline network by connecting new supply, providing better access to markets and introducing competitive and innovative approaches to meeting customer needs. More recently, TransCanada has made a significant entry into the oil pipeline business and created another platform for future growth. Our Keystone Oil Pipeline project is a cost-competitive way to link growing Canadian oil sands supply to refineries in the U.S. Midwest. This is a logical fit with our existing business competencies and an innovative way to maximize the use and value of our current pipeline assets. TransCanada’s Energy business concentrates on power generation and marketing, and gas storage. A growing independent power producer, TransCanada owns, or has interests in, approximately 7,700 megawatts of power generation in Canada and the United States. Our diversified power portfolio includes nuclear, natural gas, coal, hydro and wind generation. -

United States Securities and Exchange Commission Washington, D.C

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-35358 TC PipeLines, LP (Exact name of registrant as specified in its charter) Delaware 52-2135448 State or other jurisdiction (I.R.S. Employer of incorporation or organization Identification No.) 700 Louisiana Street Suite 700 77002-2761 Houston , Texas (Zip code) (Address of principal executive offices) 877-290-2772 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each Class Trading Symbol Name of each exchange on which registered Common units representing limited partner interests TCP NYSE Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Keystone Pipeline GP Ltd

TransCanada Keystone Pipeline GP Ltd. Keystone XL Pipeline Section 52 Application Section 4: Financing Page 1 of 3 1 4.0 FINANCING 2 This section demonstrates that TransCanada Keystone Pipeline GP Ltd. (“Keystone”) 3 will be able to fully finance its share of the capital expenditures required to construct 4 and place the Keystone XL Pipeline project (“Keystone XL Pipeline” or the “Project” 5 for the Canadian portion) in service. 6 4.1 Financing Methods and Sources 7 Keystone is owned, indirectly, by TransCanada Corporation (“TransCanada”) and 8 ConocoPhillips. Keystone is the general partner acting on behalf of the TransCanada 9 Keystone Pipeline Limited Partnership (the “Partnership”). The Partnership is also 10 owned by subsidiaries of TransCanada and ConocoPhillips. 11 12 Keystone will obtain the funds required for the construction of the Project from its 13 partners, their affiliates, and their ultimate parents. 14 On October 28, 2008, TransCanada announced that it had agreed to increase its equity 15 ownership in Keystone to 79.99% from 50%. ConocoPhillips’ equity ownership will 16 be reduced to 20.01%. 17 4.2 Ability to Finance 18 4.2.1 TransCanada 19 TransCanada currently generates approximately $2.8 billion of cash from its 20 operations each year and is rated at the “A” level by major Canadian and U.S. credit 21 rating agencies. Accordingly, TransCanada does not expect the financing of the 22 Keystone XL Pipeline project to have any impact on its financial risk or on wholly 23 owned regulated operations. TransCanada Keystone -

Final Creditor Listing

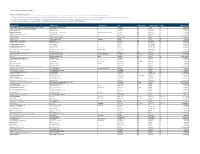

Just Energy Group - List of Known Creditors USD to CAD 1.2724 Notes to consolidated list of creditors 1. The attached list of creditors was prepared based on information available from the books and records of Just Energy Group Inc. and subsidiaries as of March 9, 2021 (the "Filing Date"). 2. The list is provided pursuant to section 23(1)(a) of the CCAA and regulations made thereunder. The list of creditors has been prepared without admission as to the liability for, or the quantum of, any of the amounts shown. 3. The dollar amounts are not to be used for the purpose of valuing any claims against Just Energy, as they are subject to change based on updated or additional information. 4. If a Claims Procedure is approved by the Court, creditors will be notified by the Monitor and invited to submit a proof of claim at that time. Vendor Name Address Line 1 Address Line 2 City State/Province Postal/Zip Code Country Amount ($CAD) Accounting Principals, Inc. Dba Parker+Lynch & Ajilon Profession 20 Greenway Plaza Suite 1050 Houston TX 77046 US 63,624.85 Ace American Insurance Company And Affiliates 436 Walnut St Philadelphia PA 19106 US 636,200.00 ACR Collections Inc. 100 King St W. Toronto ON M5X 1A3 CA 1,196.66 Adastra Corporation Royal Bank Plaza, South Tower 200 Bay Street, Suite 1401 Toronto ON M5J 2J2 CA 4,793.86 ADP International Services BV Po Box 842875 Boston MA 02284-2875 US 10,357.43 AEP Texas Central 539 N. Carancahua Street Corpus Christi TX 78478 US 1,834,827.47 AEP Texas North 539 N. -

ANNUAL REPORT 2018 Financial Highlights

ANNUAL REPORT 2018 Financial Highlights ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION 2018 DISTRIBUTABLE CASH FLOW AND AMORTIZATION (ADJUSTED EBITDA) 600 12% Iroquois 500 5% PNGTS 400 26% GTN 300 18% Northern Border 200 14% Bison 100 14% Great Lakes 0 3% Tuscarora 8% North Baja 2008(a) 2009(a) 2010 2011(a) 2012(a) 2013(a) 2014 2015(a) 2016(a) 2017 2018 (a) Recast information Year Ended December 31 2018 2017 2016 2015 2014 (millions of dollars, except unit amounts) Cash Flow Distributable cash flow (1) 391 310 313(4) 290(4) 255(4) Cash distributions paid 218 284 250 228 212 Class B Distributions paid 15 22 12 - - Income Statement Net income (loss) attributable to controlling interests (182) 252 248(4) 37(4) 195(4) Adjusted earnings (1) 317 252 248(4) 236(4) 195(4) EBITDA (1) 27 445 433(4) 223(4) 401(4) Adjusted EBITDA (1) 526 445 433(4) 422(4) 401(4) Balance Sheet Total assets (2) 2,899 3,559 3,354(4) 3,459(4) 3,343 Long-term debt (2) (including current maturities) 2,118 2,415 1,920(4) 1,980(4) 1,689 Partners’ equity 699 1,068 1,272(4) 1,391(4) 1,818(4) Common Unit Statistics (per unit) Cash distributions paid 2.95 3.88 3.66 3.46 3.30 Net income (loss) per common unit – basic and diluted (2.68) 3.16 3.21 (0.03) 2.67 Adjusted earnings per common unit – basic and diluted (1) 4.18 3.16 3.21 3.03 2.67 Common Units Outstanding (millions) Units issued (3) 0.7 3.2 3.1 0.7 1.3 Weighted average for the year (3) 71.3 69.2 65.7 63.9 62.7 End of year (3) 71.3 70.6 67.4 64.3 63.6 (1) Distributable cash flow, EBITDA, adjusted EBITDA, adjusted earnings and adjusted earnings per common unit are non-GAAP measures.