AXA Admits Payout Chaos

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alabama Credit Unions & Banker Myths

Alabama Credit Unions & Banker Myths Bumper profits and a massive concentration of market share aren’t enough for Alabama’s bankers. They want more. And they seem willing to do anything to get it. Indeed, banking industry publications recently distributed to state policy-makers use anecdotes, half-truths, and innuendo in an all-out assault the state’s credit unions. While its true that Alabama credit unions are growing, they aren’t, as bankers suggest, taking over the world. They remain true to their original purpose. And they certainly aren’t harming the state’s banks. Growth: Banking institution deposits in Alabama grew by $10.2 billion in the 88% ISN'T ENOUGH? five years ending June 2003. Since 1998 Alabama banking deposits have grown Alabama Bankers Want More 22% more than the total growth Market Share! recorded by the state’s’ credit unions (Mid-Year 2003 Deposits) since credit unions began operating in the state in 1927! Largest 10 Banks Market Share: Banking institutions 58% control 88% of all financial institution Smaller deposits in the state of Alabama – a CUs market share that is virtually unchanged 5% over the past decade. Small banks in Alabama have a lot more Largest 10 significant competitive threats to worry CUs Smaller 7% about than the threat of credit union Banks competition. Indeed, at the mid-year 30% 2003, the largest 10 banking institutions control 58% of total deposits in the state (or 66% of total banking deposits). In contrast, credit unions control just 12% of the market and the largest 10 credit unions control just 7% of the deposit market in Alabama. -

Controlling Banker's Bonuses: Efficient Regulation Or Politics of Envy?

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Matthews, Kent; Matthews, Owen Working Paper Controlling banker's bonuses: Efficient regulation or politics of envy? Cardiff Economics Working Papers, No. E2009/27 Provided in Cooperation with: Cardiff Business School, Cardiff University Suggested Citation: Matthews, Kent; Matthews, Owen (2009) : Controlling banker's bonuses: Efficient regulation or politics of envy?, Cardiff Economics Working Papers, No. E2009/27, Cardiff University, Cardiff Business School, Cardiff This Version is available at: http://hdl.handle.net/10419/65789 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der -

Insurance Special Report 2018 by Kim Rosenlof Industry Players Outline Challenges, Opportunities

SPECIAL report Insurance Special Report 2018 by Kim Rosenlof Industry players outline challenges, opportunities Keynote speaker Dr. Doris Höpke, a mem- ber of the Board of Management of Ger- man insurance giant Munich Reinsurance Company (Munich RE) since 2014, painted a cautiously optimistic picture of the U.S. general aviation insurance industry at the 2018 Aviation Insurance Association (AIA) conference held April 29 to May 1 in Austin, Texas. Höpke noted that while profitability remains a challenge in an environment where a judgment in excess of US$100 million can wipe out nearly 10 percent of aggregate annual premiums, new technologies and markets provide opportunities to return to profitability. JOHN A. MANFREDO “These days we are facing some chal- lenges that…could potentially change insurers can make a living on investment loss premium. This is an exposure show- that everybody adds value beyond capac- the entire business model of what we gains,” said Höpke. “This is in essence a ing that certainly the market cannot stand ity and beyond simply taking risks onto do,” said Höpke, “The biggest challenge misunderstanding of what insurance is on its own and it requires reinsurance to your balance sheet.” for us as a reinsurer is the [low] interest about. Our core is assessing and bearing transfer risk…But if historically the largest rate environment.” risk, and if we are not able to make a loss is 16 percent of the largest policy limit, New Insurance Markets: living on our underwriting results, there what about the remaining 84 percent? Cyber, Space, and Drones are many reasons to rethink how this This is capacity that is not needed. -

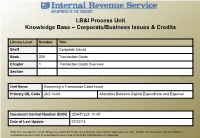

LB&I Process Unit Knowledge Base – Corporate/Business Issues & Credits

LB&I Process Unit Knowledge Base – Corporate/Business Issues & Credits Library Level Number Title Shelf Corporate Issues Book 225 Transaction Costs Chapter 1 Transaction Costs Overview Section Unit Name Examining a Transaction Costs Issue Primary UIL Code 263.14-00 Allocation Between Capital Expenditure and Expense Document Control Number (DCN) CDA/P/225_01-01 Date of Last Update 07/02/18 Note: This document is not an official pronouncement of law, and cannot be used, cited or relied upon as such. Further, this document may not contain a comprehensive discussion of all pertinent issues or law or the IRS's interpretation of current law. DRAFT Table of Contents (View this PowerPoint in “Presentation View” to click on the links below) Process Overview Detailed Explanation of the Process Process Applicability Summary of Process Steps . Step 1 – Proper Legal Entity . Step 2 – Facilitative Costs . Step 3 – Treatment of Facilitative Costs 2 DRAFT Table of Contents (cont’d) (View this PowerPoint in “Presentation View” to click on the links below) Definitions Other Considerations / Impact to Audit Index of Referenced Resources Training and Additional Resources Glossary of Terms and Acronyms Index of Related Practice Units 3 DRAFT Process Overview Examining a Transaction Costs Issue When executing a business transaction, a taxpayer may incur legal fees, accounting fees, consulting fees, investment advisory service fees and other transaction costs. If the cost facilitates a transaction described in Treas. Reg. 1.263(a)-5(a), the taxpayer must capitalize the cost. Transactions described in Treas. Reg. 1.263(a)-5(a) include acquiring or selling a trade or business, or changing a company’s capital structure. -

563-4101 Discount Medical Plan Organiza

INSURANCE COMPANY NAME PHONE NUMBER INSURANCE COMPANY TYPE 20/20 EYECARE PLAN, INC (954) 563-4101 DISCOUNT MEDICAL PLAN ORGANIZATION 21ST CENTURY INSURANCE COMPANY OF CALIFORNIA (302) 252-2060 PROPERTY AND CASUALTY INSURER 21ST SERVICES, LLC (612) 371-3008 LIFE EXPECTANCY PROVIDER 5 STAR LIFE INSURANCE COMPANY (703) 299-5794 LIFE AND HEALTH INSURER A I CREDIT CORP. (201) 631-5400 PREMIUM FINANCE COMPANY A-S ENERGY, INC. (903) 509-7255 SERVICE WARRANTY ASSOCIATION A.A.L.D., INC. (212) 440-7878 RISK PURCHASING GROUP A.G.I.A., INC. (805) 566-9191 THIRD PARTY ADMINISTRATOR AAA LIFE INSURANCE COMPANY (734) 591-6329 LIFE AND HEALTH INSURER AAFP INSURANCE SERVICES, INC. (816) 444-2644 THIRD PARTY ADMINISTRATOR ABCO PREMIUM FINANCE, INC. (305) 461-2555 PREMIUM FINANCE COMPANY ACA ASSURANCE (603) 625-8577 FRATERNAL BENEFIT SOCIETY ACA FINANCIAL GUARANTY CORPORATION (212) 375-2087 PROPERTY AND CASUALTY INSURER ACA INTERNATIONAL (202) 966-3934 RISK PURCHASING GROUP ACACIA LIFE INSURANCE COMPANY (800) 745-6665 x87759 LIFE AND HEALTH INSURER ACC CLIENT SERVICE COMPANIES RISK PURCHASING GROUP, INC. (941) 746-5531 RISK PURCHASING GROUP ACCENDO INSURANCE COMPANY (801) 350-6505 LIFE AND HEALTH INSURER ACCEPTANCE INDEMNITY INSURANCE COMPANY (919) 833-1600 PROPERTY AND CASUALTY INSURER ACCESS ADMINISTRATORS, INC. (972) 915-3234 THIRD PARTY ADMINISTRATOR ACCESS INSURANCE COMPANY (770) 234-3600 PROPERTY AND CASUALTY INSURER ACCESS ONE CONSUMER HEALTH, INC. (888) 804-7000 DISCOUNT MEDICAL PLAN ORGANIZATION ACCIDENT FUND INSURANCE COMPANY OF AMERICA (517) 367-1457 PROPERTY AND CASUALTY INSURER ACCIDENT INSURANCE COMPANY, INC. (866) 234-6484 PROPERTY AND CASUALTY INSURER ACCOUNTANTS INSURANCE PURCHASING GROUP ASSOCIATION (781) 449-7711 RISK PURCHASING GROUP ACCREDITED SURETY AND CASUALTY COMPANY, INC. -

Aspects of Insurance in Aviation Finance Rod D

Journal of Air Law and Commerce Volume 62 | Issue 2 Article 4 1996 Aspects of Insurance in Aviation Finance Rod D. Margo Follow this and additional works at: https://scholar.smu.edu/jalc Recommended Citation Rod D. Margo, Aspects of Insurance in Aviation Finance, 62 J. Air L. & Com. 423 (1996) https://scholar.smu.edu/jalc/vol62/iss2/4 This Article is brought to you for free and open access by the Law Journals at SMU Scholar. It has been accepted for inclusion in Journal of Air Law and Commerce by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. ASPECTS OF INSURANCE IN AVIATION FINANCE ROD D. MARGO* TABLE OF CONTENTS I. INTRODUCTION .................................. 424 II. THE NATURE OF INSURANCE ................... 428 A. INSURABLE INTEREST ............................ 430 B. THE DUTY OF DISCLOSURE ...................... 430 1. Good Faith .................................. 430 2. Nondisclosure and Misrepresentation.......... 431 III. THE INTERNATIONAL AVIATION INSURANCE M A RKET ........................................... 433 IV. THE ROLE OF THE INSURANCE BROKER ...... 435 V. CERTIFICATES OF INSURANCE AND LETTERS OF UNDERTAKING ............................... 437 VI. TYPES OF COVERAGE ............................ 439 A. HULL INSURANCE ............................... 439 B. LIABILITY INSURANCE ............................ 442 1. PassengerLiability Insurance ................. 443 2. Third Party Liability Insurance ............... 444 C. WAR AND ALLIED PERILS INSURANCE ............ 445 VII. PROTECTING THE INTERESTS OF FINAN CIERS ....................................... 449 A. PROTECTING THE INTERESTS OF FINANCIERS UNDER A HULL POLICY ......................... 449 1. Additional Insured Endorsement .............. 450 2. Loss Payable Clause.......................... 450 * Member of the California and District of Columbia bars; Partner, Condon & Forsyth, Los Angeles; Lecturer in law, UCLA School of Law, Los Angeles. I have received helpful advice and comments from individuals too numerous to men- tion. -

The Code of Hammurabi: an Economic Interpretation

International Journal of Business and Social Science Vol. 2 No. 8; May 2011 The Code of Hammurabi: An Economic Interpretation K.V. Nagarajan Department of Economics, School of Commerce and Administration Laurentian University, Sudbury Canada E-mail: [email protected], Fax: 705-675-4886 Introduction Hammurabi was the ruler of Babylon from 1792 B.C. to 1750 B.C1. He is much celebrated for proclaiming a set of laws, called the Code of Hammurabi (The Code henceforward). The Code was written in the Akkadian language and engraved on black diorite, measuring about two-and-a-quarter meters. The tablet is on display in the Louvre, Paris. The stone carving on which the laws are written was found in 1901-1902 by French archeologists at the Edomite capital Susa which is now part of the Kuzhisthan province in Iran. The Code was determined to be written circa 1780 B.C. Although there are other codes preceding it2, The Code is considered the first important legal code known to historians for its comprehensive coverage of topics and wide-spread application. It has been translated and analyzed by historians, legal and theological scholars (Goodspeed, 1902; Vincent, 1904; Duncan, 1904; Pfeiffer, 1920; Driver and Miles, 1952). The Code is well- known for embodying the principle of lex talionis (“eye for an eye”) which is described as a system of retributive justice. However, The Code is also much more complex than just describing offenses and punishments and not all punishments are of the retributive kind. The Code has great relevance to economists. However, very few studies have been undertaken from an economic or economic thought point of view. -

The Birth of Partnership Systems in Renaissance Florence1 John F

Chapter 6 Transposition and Refunctionality: The Birth of Partnership Systems in 1 Renaissance Florence John F. Padgett Inventions of any sort are hard to understand. They seem to come out of the blue, a rupture with the past, yet close investigation always reveals historical roots. Individual geniuses sometimes create them, but is “genius” just our celebratory label for a process that worked, which we do not understand? To proffer a tentative distinction: innovations improve on existing ways (i.e, activities, conceptions and purposes) of doing things, while inventions change the ways things are done. Under this definition, the key to classifying something as an invention is the degree to which it reverberates out to alter the interacting system of which it is a part. To some extent we understand micrologics of combination and recombination.2 Yet the invention puzzle is that some of these innovative recombinations cascade out to reconfigure entire interlinked ecologies of “ways of doing things,” whereas most innovations do not. The poisedness of a system to reconfiguration by an invention is as much a part of the phenomenon to be explained as is the system’s production of the invention itself. Invention “in the wild” cannot be understood through abstracting away from concrete social context, because inventions are permutations of that context.3 But to make progress in understanding discontinuous change we need to embed our analysis of transformation in the routine dynamics of actively self-reproducing social contexts, where constitutive elements and relations are generated and reinforced. 1 This chapter is an abridged version (40% cut) of John F. -

Reduce Premium Subsidies on Buy-Up Coverage by 5 (Against a Loss of Revenue Caused by Low Prices, Low Yields Percentage Points

58 ANALYTICAL PERSPECTIVES • Reduce premium subsidies on buy-up coverage by 5 (against a loss of revenue caused by low prices, low yields percentage points. or a combination of both) or yield protection (for produc- tion losses only), all within the same policy. RMA also • Increase the government’s share on underwriting continues to pursue a number of avenues to increase pro- gains to 20 percent from 5 percent. gram participation among underserved States and com- • Reduce the face value premium on Catastrophic modities by working on declining yield issues and looking Crop Insurance (CAT) by 25 percent and charge an at discount programs for good producers who pose less administrative fee on CAT equal to the greater of risk. $300 or 25 percent of the (restated) CAT premium, subject to a maximum fee of $5,000. Insurance against Security-Related Risks In addition to these changes, the Farm Bill authorized Terrorism Risk Insurance the Federal Crop Insurance Corporation (FCIC) to have the option of renegotiating the financial terms and condi- The Terrorism Risk Insurance Program (TRIP), autho- tions of the Standard Reinsurance Agreement with the rized under P.L. 107-297, helped stabilize the insurance crop insurance companies during FY 2010. If the FCIC industry during a time of significant transition follow- exercises this authority, it could result in more efficiency ing the terrorist attacks of September 11, 2001. Initially, for risk sharing between the government and the crop in- TRIP was a three-year Federal program that provided surance companies. a system of shared public and private compensation for There are various types of insurance programs. -

II. the Game of Credit: a Model Consider a Simple Two-Stage Game

II. The game of credit: a model Consider a simple two-stage game with complete but imperfect information. There are two players: the king and a banker. They interact as follows: First, the king borrows from the banker a certain amount of money K and several financial services F, offering him a contract (“asiento”). The asiento signed between a lender and the sovereign takes the form of a promise by the sovereign to repay the principal of the loan K plus interest, i, and a non-monetary reward, T. However, the lender will not receive the whole monetary profit (K plus i) promised in the contract at the end of the game. The sovereign will retain temporarily a portion g1 of the total monetary gains of the banker. This amount will be paid as debt in the future. The opportunity to borrow from a banker is an important benefit for the king and it is represented by the variable called V. This means how much the relationship with the banker is important for the king. V modifies the king’s payoffs. When the king does not need bankers, V is negative, and the contrary makes V positive. We assume that V has a large value because the king always needs credit and financial services from the bankers. The value of V is linked to the conditions that allow the king to establish a relationship with the banker. They are political, economic and social factors. Among the most important are the revenues available to borrow by the Monarchy. The rest of variables in this game are fixed by the negotiation between king and banker in a contract of credit and they are well known by both players (See all variables in appendix I). -

Travel Insurer Gets Picky January Next Year Will Be Subject to Enhanced Security Requirements

NOW INSIDE: privatehealthcarenews GLOBAL HEALTHCARE • IPMI • CORPORATE BENEFITS Page 24 Page 26 Page 46 Page 22 Page 32 ESSENTIAL READING FOR TRAVEL INSURANCE INDUSTRY PROFESSIONALS noveMBER 2008 • ISSUE 94 Not so routine transport In the last issue of ITIJ, we reported on a patient who was denied boarding by a pilot at Ercan airport in North Cyprus, an independent republic of Turkey. Less than two weeks later, a repatriation was held up at Istanbul airport. ITIJ tells Air Ambulance Worldwide’s bizarre story On 15 September this year, John Ray of Air Ambulance Worldwide was sent on a flight to escort a 26-year-old male, Reid Sanders, from the German Hospital in Istanbul, Turkey, to his home residence in Bend, Oregon. Sanders was an entertainer on a cruise ship, and had a history of diabetes. Having fallen unresponsive and unalert he had been transported via ground ambulance from the cruise ship port in Istanbul to the German Hospital. After a week in the hospital, Sanders’ doctors determined that he was fit to fly home, and could follow up with his personal care physician upon arrival. His mother and sister had come to Istanbul to accompany him home, and on the morning of 18 September, they all travelled with Ray to the airport. They arrived several hours early, in the small hours of the morning, and Sanders’ mother and sister went through to the departure gate whilst Ray and Sanders rearranged Sanders’ heavy luggage in order to avoid excessive weight charges. After the luggage was continued on page 6 Visa changes to US travel Important information for air ambulance companies and medical escorts: under the terms and conditions of the US Visa Waiver Program, all international travellers who wish to enter to the US from 1 Travel insurer gets picky January next year will be subject to enhanced security requirements. -

Nothing Left of Indopco: Let's Keep It That Way!

Florida State University Law Review Volume 29 Issue 1 Article 6 2001 Nothing Left of Indopco: Let's Keep it that Way! Jezabel Llorente [email protected] Follow this and additional works at: https://ir.law.fsu.edu/lr Part of the Law Commons Recommended Citation Jezabel Llorente, Nothing Left of Indopco: Let's Keep it that Way!, 29 Fla. St. U. L. Rev. (2001) . https://ir.law.fsu.edu/lr/vol29/iss1/6 This Comment is brought to you for free and open access by Scholarship Repository. It has been accepted for inclusion in Florida State University Law Review by an authorized editor of Scholarship Repository. For more information, please contact [email protected]. FLORIDA STATE UNIVERSITY LAW REVIEW DESCENT Aviam Soifer VOLUME 29 FALL 2001 NUMBER 1 Recommended citation: Aviam Soifer, Descent, 29 FLA. ST. U. L. REV. 269 (2001). FLORIDA STATE UNIVERSITY LAW REVIEW NOTHING LEFT OF INDOPCO: LET’S KEEP IT THAT WAY! Jezabel Llorente VOLUME 29 FALL 2001 NUMBER 1 Recommended citation: Jezabel Llorente, Nothing Left of Indopco: Let’s Keep it That Way!, 29 FLA. ST. U. L. REV. 277 (2001). NOTHING LEFT OF INDOPCO: LET’S KEEP IT THAT WAY! JEZABEL LLORENTE* I. INTRODUCTION..................................................................................................... 277 II. THE DISTINCTION BETWEEN CURRENT DEDUCTION AND CAPITAL EXPENSE .... 279 III. INDOPCO’S FAMILY TREE .................................................................................. 281 IV. THE IRS’S AGGRESSIVE POST-INDOPCO POSITIONS ......................................... 284 A. The IRS’s Position in PNC Bancorp ............................................................ 285 B. The IRS’s Position in Wells Fargo............................................................... 285 C. The IRS’s Position in Hostile Takeovers...................................................... 287 V. THE IRS’S AGGRESSIVE POST-INDOPCO POSITIONS PROMOTE BAD POLICY...