NZHC 1803 UNDER Part 18 of the High Court Rules B

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

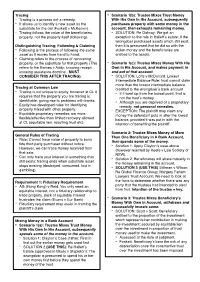

Tracing Is a Process Not a Remedy

Tracing - Scenario 1(b): Trustee Mixes Trust Money - Tracing is a process not a remedy. With His Own In His Account, subsequently - It allows us to identify a new asset as the purchases property with some money in the substitute for the old (Foskett v McKeown). account, then exhausts remaining money. - Tracing follows the value of the beneficiaries - SOLUTION: Re Oatway: We get an property, not the property itself (following). exception to the rule in Hallett’s estate: if the wrongdoer purchased assets which still exist, Distinguishing Tracing; Following & Claiming then it is presumed that he did so with the - Following is the process of following the same stolen money and the beneficiaries are asset as it moves from hand to hand. entitled to the assets. - Claiming refers to the process of recovering property, or the substitute for that property (This - Scenario 1(c): Trustee Mixes Money With His refers to the Barnes v Addy; knowing receipt, Own In His Account, and makes payment in knowing assistance doctrine - MUST and out of that account. CONSIDER THIS AFTER TRACING). - SOLUTION: Lofts v McDonald: Lowest Intermediate Balance Rule: trust cannot claim more than the lowest intermediate balance Tracing at Common Law - credited to the wrongdoer’s bank account Tracing is not unique to equity, however at CL it - If it went up from the lowest point, that is requires that the property you are tracing is not the trust’s money. identifiable, giving rise to problems with banks. - - Although you are deprived of a proprietary Equity has developed rules for identifying remedy, not personal remedies. -

Landmark Cases in Tracing – a Pitch

Landmark Cases in Tracing – A Pitch Landmark Cases in Tracing A pitch for an edited collection of in-depth case analyses Dr Derek Whayman, Newcastle University. [email protected] Prof Katy Barnett, University of Melbourne. [email protected] Theme and Justification Tracing is a process and claim used for recovering misappropriated property, mainly that originally held on trust or by a corporation. It allows claimants to recover not only the original misappropriated property, but also its substitute – what the property was exchanged for in a subsequent transaction. Since this claim is a right of property, it brings the claimant the advantage of priority over other creditors in insolvency and access to any increase in value, either in the property itself or from the substitute. If the property is passed to or from another person or, say, a shell company, the right to claim follows that property and is not left on the person. From this, it is no wonder it is popular with claimants. However, tracing is still under-researched and under-theorised. There is little agreement as to how this claim can be justified theoretically, what its limits are and how they vary in accordance with the multitude of different facts the courts have seen and will see in the future. Academics and judges are still feeling their way around its fundamental questions. Yet not only are the answers to these theoretical questions controverted, they go to the heart of what every litigant wants to know: what may or may not be claimed? These questions are of fundamental importance on a practical basis too. -

Intermediated Securities: Who Owns Your Shares? a Scoping Paper

6~~mission Reforming the law Intermediated securities: who owns your shares? A Scoping Paper 11 November 2020 © Crown copyright 2020 This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned. This publication is available at www.lawcom.gov.uk. Any enquiries regarding this publication should be sent to [email protected]. The Law Commission The Law Commission was set up by the Law Commissions Act 1965 for the purpose of promoting the reform of the law. The Law Commissioners are: The Right Honourable Lord Justice Green, Chairman Professor Sarah Green Professor Nicholas Hopkins Professor Penney Lewis Nicholas Paines QC The Chief Executive of the Law Commission is Phil Golding. The Law Commission is located at 1st Floor, Tower, 52 Queen Anne's Gate, London SW1H 9AG. The terms of this scoping paper were agreed on 30 September 2020. The text of this scoping paper is available on the Law Commission's website at http://www.lawcom.gov.uk. i Contents Page GLOSSARY VII LIST OF ABBREVIATIONS XIV REFERENCES TO LAW COMMISSION PUBLICATIONS XVI CHAPTER 1: INTRODUCTION 1 Background to this paper 1 Terms of reference and consultation 3 Intermediated securities: at a glance 4 The Law Commission’s view on intermediation 8 A range of possible solutions 8 Costs and benefits -

Claims Against Third-Party Recipients of Trust Property

Cambridge Law Journal, 76(2), July 2017, pp. 399–429 © Cambridge Law Journal and Contributors 2017. This is an Open Access article, distributed under the terms of the Creative Commons Attribution-NonCommercial-ShareAlike licence (http:// creativecommons.org/licenses/by-nc-sa/4.0/), which permits non-commercial re-use, distribution, and reproduction in any medium, provided the same Creative Commons licence is included and the original work is properly cited. The written permission of Cambridge University Press must be obtained for commercial re-use. doi:10.1017/S0008197317000423 CLAIMS AGAINST THIRD-PARTY RECIPIENTS OF TRUST PROPERTY DAVID SALMONS* ABSTRACT. This article argues that claims to recover trust property from third parties arise in response to a trustee’s duty to preserve identifiable property, and that unjust enrichment is incompatible with such claims. First, unjust enrichment can only assist with the recovery of abstract wealth and so it does not assist in the recovery of specific property. Second, it is difficult to identify a convincing justification for introducing unjust enrich- ment. Third, it will work to the detriment of innocent recipients. The article goes on to show how Re Diplock supports this analysis, by demonstrating that no duty of preservation had been breached and that a proprietary claim should not have been available in that case. The simple conclusion is that claims to recover specific property and claims for unjust enrichment should be seen as mutually exclusive. KEYWORDS: trusts, third parties, proprietary claims, knowing receipt, res- titution, unjust enrichment, Re Diplock. I. INTRODUCTION According to orthodox trust principles, where property is transferred in breach of trust, a beneficiary can either bring a proprietary claim to recover the property or a personal claim against a knowing recipient of the trust property (hereinafter, the combination of these two claims will be referred to as the “equitable regime”). -

Obligation and Property in Tracing Claims

CORE Metadata, citation and similar papers at core.ac.uk Provided by Newcastle University E-Prints Obligation and Property in Tracing Claims Derek Whayman* [email protected] Newcastle Law School Newcastle University 21–24 Windsor Terrace Newcastle upon Tyne NE1 7RU Abstract Tracing is said to be merely a process and separate from claiming. It is then characterised as a set of pure property identification rules which cannot vary from claim to claim. However, the development of tracing in equity relied heavily on the fiduciary obligation to support its rules. While many of tracing’s rules can be justified independently of the fiduciary obligation or rationalised as evidential presumptions, others cannot. This means it is impossible to detach the process from the claim. Furthermore, it would be undesirable to do so because it would reduce the flexibility of tracing. Introduction Tracing, according to the present conventional wisdom, is a process used to support a number of separate, mostly proprietary, claims. “[A] clear distinction must be drawn between the rules of following and tracing, which are essentially evidential in nature, and rules [of claiming] which determine substantive rights.”1 Any peculiarities of the claim should remain there and not fall in the rules of tracing. All tracing does is make the link – it identifies where the value is, whether it passes through a link between old property and its new substitute and to what extent. For example, if I spend £100 on a vase, tracing only says that the vase is subject to any claim that the £100 was. -

Tracing in the Age of Restitution 377

2003 Tracing in the Age of Restitution 377 TRACING IN THE AGE OF RESTITUTION MARGARET STONE∗ AND ALISTAIR MCKEOUGH∗∗ Restitution is a remedy by which a plaintiff may recover a benefit, enrichment or value that the defendant has obtained at the expense of the plaintiff. Although variously described as a right, a remedy and a mechanism, tracing is generally accepted as being more in the nature of a process1 and is a precursor to the assertion of a personal or a proprietary claim either at common law or in equity.2 Described in general terms, it is a process for identifying value that the defendant has received, whether or not in the form of specific assets, and establishing a link between that value and the plaintiff. Essentially, tracing and restitution are directed to the same issue.3 Expressed at a level of generality sufficient to comprehend both doctrines, the issue is the position of a person at whose expense another person has been benefited in circumstances where, for one or other reason, it is unjust that the beneficiary should retain the benefit. Both doctrines are directed to vesting that benefit, in some form or other, in the person at whose expense it was obtained and are limited to that benefit or to its equivalent value.4 The value of the benefit (be it property or otherwise) may be greater or less than the loss suffered or the expense occasioned and thus they differ from compensatory remedies which are directed to restoring the person’s former position irrespective of whether any benefit was received by the party obliged to make compensation or the value of any such benefit.5 ∗ Judge, Federal Court of Australia. -

Trusts & Equity Fall Term 2018 Lecture Notes – No. 16 ARE THIRD

Trusts & Equity Fall Term 2018 Lecture Notes – No. 16 ARE THIRD PARTIES LIABLE TO SUFFER A REMEDY? In Barnes v Addy (1874) L.R. 9 Ch. APP. 244, Lord Selborne L.C. described two distinct equitable actions available against a third party (i.e. someone outside the trust) popularly known as ‘knowing receiPt’ (available against a third party possessed of trust property in his or her personal capacity; i.e. not as an agent) and ‘knowing assistance’ (against a third party who is an accessory to breach of trust of fiduciary duty). • In both the areas of ‘knowing receipt’ and ‘knowing assistance’, the courts and commentators are drawn between two positions: are these forms of liability ‘wrongs’ (based on some degree of fault) or restitutionary responses based on unjust enrichment (favouring strict liability, subject to a defence of ‘change of position’)? • The claim of a bona fide purchaser for fair value without notice of the trust supersedes claims by the trustee or beneficiary; Nelson v Larholt [1948] 1 KB 339; Macmillan Inc v Bishopsgate Investment Trust (No 3) [1995] 3 All ER 747. • The third party in receipt of trust property disposed of in breach of trust by the trustee must be distinguished from the liability of a third party as a ‘trustee de son tort’; that is, a third party who is a stranger to the trust and who intermeddles with trust property and does acts characteristic of a trustee and commits a breach of trust. The trustee de son tort is personally liable to account to B as well as to hold any trust property on a constructive trust; Mara v Brown [1896] 1 Ch 199; Williams-Ashman v Price & Williams [1942] Ch 219; Re Barney [1892] 2 Ch 265. -

And Turner V Jacob (2006)

Landmark Cases in Tracing A Sample Chapter Re Tilley’s Will Trusts (1967) and Turner v Jacob (2006) Derek Whayman, Newcastle University: [email protected] 1. Introduction Many landmark cases have, if not grand facts, rather grand parties to them. This is a consequence of many of them having been decided a century or more ago, where, in practice, the services the courts provided were to mainly the wealthy and often grand. A case in point is seen in the first chapter of this (proposed) collection concerning Kirk v Webb (1698),1 which features a cast of post-restoration senior clergy, aristocrats and of course Barbara Palmer, Countess of Castlemaine, perhaps the most notorious of Charles II’s mistresses, and their son. The parties in Re Tilley’s Will Trusts (1967)2 and Turner v Jacob (2006)3 are from a time where the middle class had sufficient wealth and opportunities to invest, and our interest in these cases arises because their protagonists did not structure their investments – at least legally – wisely. Moreover, in Turner v Jacob we see a remarkable and thoroughly modern woman in Dorothy Turner in the events leading up to the case, one whose acts and intentions, it seems, influenced a modern court of equity to apply the law very carefully in a manner sensitive to her position. That these decisions are controversial in recent times is another piece of evidence supporting the proposition that equity in general, and tracing in particular, are still searching for their fundamental principles even today. For this reason, we must also look to the rather less grand- looking cases and those lower down in the hierarchy of the courts. -

Dummy Asset Tracing

Dummy Asset Tracing Tatiana Cutts LSE Law, Society and Economy Working Papers 4/2018 London School of Economics and Political Science Law Department This paper can be downloaded without charge from LSE Law, Society and Economy Working Papers at: www.lse.ac.uk/collections/law/wps/wps.htm and the Social Sciences Research Network electronic library at: https://ssrn.com/abstract=3137285 © Tatiana Cutts. Users may download and/or print one copy to facilitate their private study or for non-commercial research. Users may not engage in further distribution of this material or use it for any profit-making activities or any other form of commercial gain. Electronic copy available at: https://ssrn.com/abstract=3137285 Dummy Asset Tracing Tatiana Cutts* Abstract: Tracing is widely understood to be the process of demonstrating that two rights are connected through an exchange, such that a claim to the right given up can be transmitted to the right acquired. This has been termed “exchange-product tracing”, and – though its core case is the unauthorised substitution of a trust right – it is also thought that a bank transfer exemplifies a rights-exchange. I argue here that this is a mistake: a bank transfer does not involve a substitution of the kind envisaged by exchange product tracing. Rather, the process that we have called “tracing money” through a bank transfer involves two steps: (i) converting bank money, by artifice, into an asset independent of the underlying account; (ii) following that asset from one location to another. Together, I call these steps “dummy asset tracing”. In this article, I show that the twin steps of dummy asset tracing have led us to increase the ambit of third party liability at law and in equity: by simulating cash transfers, innocent bank payees have been made liable to claimants with whom they did not transact, and of whom they were wholly unaware. -

Tracing and Common Law Claims to Substitute Assets: Separating Myth from Reality

Tracing and Common Law Claims to Substitute Assets: Separating Myth From Reality Jonathan Silver Submitted in accordance with the requirements for the degree of Doctor of Philosophy De Montfort University Faculty of Business and Law, United Kingdom Supervisors Mr Tim Hillier Dr Tatiana Cutts March 2018 I confirm that the work submitted is my own. I further confirm that appropriate credit has been given within the thesis where reference has been made to the work of others. 1 Abstract Tracing is a process by which a claimant shows that an asset represents a substitute for an original asset for the purposes of making a claim in respect of that substitute. Orthodox tracing theory says that this process involves the following of the value inherent in the original into the substitute. Orthodox theory also states that tracing is a neutral process, unconnected to any claims that may be made in the substitute. The effect of accepting this orthodoxy has been that the true nature of the tracing process has become obscured. In particular the failure of orthodox theorists to correctly identify tracing as being an exercise that can only be justified within the context of a fiduciary relationship has led to the widespread belief that it is possible to trace at common law. It will be argued in this thesis that this cannot be the case because the common law allows no claims with respect to substitute assets, and this makes the tracing exercise redundant. The notion that it is possible to trace at common law is contrary to properly understood authority and has no normative foundations. -

Part Iv — Tracing

Equity and Trusts 04 – Tracing PART IV — TRACING I Introduction A Definition Tracing is a process for identifying value received by the defendant and establishing a causal connection between that value and the plaintiff. It is, in other words, a method of finding property held by the defendant to which a plaintiff is entitled. Despite often being described as a remedy, tracing is essentially an evidentiary technique, which may in turn give rise to remedies at the suit of the plaintiff. Tracing is simply a precursor to the assertion of their proprietary claim. Stone and McKeough observe that tracing is normally defined by reference to the colourful metaphor of ‘following property into the hands of another’.1 A more specific description follows: Tracing is the process by which a claimant who has been deprived of property (‘the original property’) seeks to assert legal or equitable title to other property (‘the target property’) because the target property has, in some way, been acquired from exploitation of the original property. The process involves establishing an unbroken chain of transfer and transformation from the original property to the target property. If this process is successful, the claimant can claim property rights in the target property and enlist an appropriate remedy in rem to recover it. Tracing only applies to fungible assets. A fungible asset is a generic right or resource such that any instance of it is as good as any other. For example, money is a fungible asset: in general, any coin or tendered instrument is as valuable as any other equivalent. -

Is the Thief a Trustee?

Is the Thief a Trustee? Principled Approaches to Proprietary Restitutionary Remedies William Michael Cheyne A dissertation submitted in partial fulfilment of the degree of Bachelor of Laws (with Honours) at the University of Otago October 2012 Acknowledgements I would like to thank: Professor Struan Scott for his thorough supervision, guidance and advice this year; Professor Stuart Anderson and Jessica Palmer for their helpful comments at my seminar; Dad, Kim and Jess for their careful proofreading; My family for their constant support and encouragement; Finally Miriam for her love. 1 Contents Acknowledgements .................................................................................................................... 1 Contents ..................................................................................................................................... 2 Chapter I: Introduction ............................................................................................................... 4 Chapter II: Theories of Trust ..................................................................................................... 6 A What are the Consequences of Finding a Trust? ................................................................ 7 1. Proprietary rights only ................................................................................................... 7 2. Personal rights in addition to proprietary rights ............................................................ 9 B What Gives Rise to a Trust? ............................................................................................