Confidence Games: How Does Regulation Constitute Markets?1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aaron Ihde's Contributions to the History of Chemistry

24 Bull. Hist. Chem., VOLUME 26, Number 1 (2001) AARON IHDE’S CONTRIBUTIONS TO THE HISTORY OF CHEMISTRY William B. Jensen, University of Cincinnati Aaron Ihde’s career at the University of Wisconsin spanned more than 60 years — first as a student, then as a faculty member, and, finally, as professor emeri- tus. The intellectual fruits of those six decades can be found in his collected papers, which occupy seven bound volumes in the stacks of the Memorial Library in Madison, Wisconsin. His complete bibliography lists more than 342 items, inclusive of the posthumous pa- per printed in this issue of the Bulletin. Of these, roughly 35 are actually the publications of his students and postdoctoral fellows; 64 deal with chemical research, education, and departmental matters, and 92 are book reviews. Roughly another 19 involve multiple editions of his books, reprintings of various papers, letters to newspaper editors, etc. The remaining 132 items rep- resent his legacy to the history of the chemistry com- munity and appear in the attached bibliography (1). Textbooks There is little doubt that Aaron’s textbooks represent his most important contribution to the history of chem- Aaron Ihde, 1968 istry (2). The best known of these are, of course, his The Development of Modern Chemistry, first published Dalton. This latter material was used in the form of by Harper and Row in 1964 and still available as a qual- photocopied handouts as the text for the first semester ity Dover paperback, and his volume of Selected Read- of his introductory history of chemistry course and was, ings in the History of Chemistry, culled from the pages in fact, the manuscript for a projected book designed to of the Journal of Chemical Education and coedited by supplement The Development of Modern Chemistry, the journal’s editor, William Kieffer. -

How Chemists Pushed for Consumer Protection:The Food and Drugs Act

How Chemists Pushed for Consumer Protection: The Food and Drugs Act of 1906 * Originally published in Chemical Heritage 24, no. 2 (Summer 2006): 6-11. By John P. Swann, Ph.D. Introduction The Food and Drugs Act of 1906 brought about a radical shift in the way Americans regarded some of the most fundamental commodities of life itself, like the foods we eat and the drugs we take to restore our health. Today we take the quality and veracity of these products for granted and justifiably complain if they have been compromised. Our expectations have been elevated over the past century by revisions in law and regulation; by shifts—sometimes of a tectonic nature—in the science and technology that apply to our food, drugs, and other consumer products; and by the individuals, organizations, commercial institutions, and media that drive, monitor, commend, and criticize the regulatory systems in place. But to appreciate how America first embraced the regulation of basic consumer products on a national scale, one needs to start with some of the most important people behind the effort—chemists. The USDA Bureau of Chemistry Chemistry helped us understand the foods we ate and the drugs we took even before 1906. In August 1862 Commissioner of Agriculture Isaac Newton appointed Charles M. Wetherill to undertake the duties of Department of Agriculture chemist, just three months after the creation of the department itself. Those duties began with inquiries into grape varieties for sugar content and other qualities. The commercial rationale behind this investigation was made clear in Wetherill’s first report in January 1863: “From small beginnings the culture of the wine grape has become a source of great national wealth, with abundant promise for the future.” But another important role of chemistry was in discerning fakery in the drug supply and in foods. -

Food Standards and the Peanut Butter & Jelly Sandwich

Food Standards and the Peanut Butter & Jelly Sandwich From: Food, Science, Policy, and Regulation in the Twentieth Century: International and Comparative Perspectives, David F. Smith and Jim Phillips, eds. (London and New York: Routledge, 2000) pp. 167-188. By Suzanne White Junod Britain’s 1875 and 1899 Sale of Food and Drugs Acts were similar in intent to the 1906 US Pure Food and Drugs Act, as Michael French and Jim Phillips have shown. Both statutes defined food adulterations as a danger to health and as consumer fraud. In Britain, the laws were interpreted and enforced by the Local Government Board and then, from its establishment in 1919, by the Ministry of Health. Issues of health rather than economics, therefore, dominated Britain’s regulatory focus. The US Congress, in contrast, rather than assigning enforcement of the 1906 Act to the Public Health Service, or to the Department of Commerce, as some had advocated, charged an originally obscure scientific bureau in the Department of Agriculture with enforcement of its 1906 statute. In the heyday of analytical chemistry, and in the midst of the bacteriological revolution, Congress transformed the Bureau of Chemistry into a regulatory agency, fully expecting that science would be the arbiter of both health and commercial issues. Led by ‘crusading chemist’ Harvey Washington Wiley, the predecessor of the modern Food and Drug Administration initiated food regulatory policies that were more interventionist from their inception. [1] Debates about the effects of federal regulation on the US economy have been fierce, with economists and historians on both sides of the issue generating a rich literature. -

Notes for Tour of Townsend Mansion, Home of the Cosmos

NOTES FOR TOUR OF TOWNSEND MANSION HOME OF THE COSMOS CLUB July 2015 Harvey Alter (CC: 1970) Editor Updated: Jean Taylor Federico (CC: 1992), Betty C. Monkman (CC: 2004), FOREWORD & ACKNOWLEDGEMENTS These notes are for docent training, both background and possible speaking text for a walking tour of the Club. The material is largely taken from notes prepared by Bill Hall (CC: 1995) in 2000, Ed Bowles (CC: 1973) in 2004, and Judy Holoviak (CC: 1999) in 2004 to whom grateful credit is given. Many of the details are from Wilcomb Washburn’s centennial history of the Club. The material on Jules Allard is from the research of Paul Miller, curator of the Newport Preservation Society. The material was assembled by Jack Mansfield (CC: 1998), to whom thanks are given. Members Jean Taylor Federico and Betty Monkman with curatorial assistant, Peggy Newman updated the tour and added references to notable objects and paintings in the Cosmos Club collection in August, 2009. This material was revised in 2010 and 2013 to note location changes. Assistance has been provided by our Associate Curators: Leslie Jones, Maggie Dimmock, and Yve Colby. Acknowledgement is made of the comprehensive report on the historic structures of the Townsend Mansion by Denys Peter Myers (CC: 1977), 1990 rev. 1993. The notes are divided into two parts. The first is an overview of the Club’s history. The second part is tour background. The portion in bold is recommended as speaking notes for tour guides followed by information that will be useful for elaboration and answering questions. The notes are organized by floor, room and section of the Club, not necessarily in the order tours may take. -

Harvey Wiley, the Man Who Changed America One Bite at a Time Rishit Shaquib Junior Division Individual Documentary Process Pape

Harvey Wiley, The Man Who Changed America One Bite at A Time Rishit Shaquib Junior Division Individual Documentary Process Paper: 500 Words When we first received the topic breakthroughs in history, I immediately thought of people we often heard about such as Martin Luther King Jr. and Albert Einstein, and although these are famous pioneers in science and social change, I didn’t want to tell a well-known story. One day while researching I came across the story of a man who poisoned a group of applicants in order to pass some of America’s first food and drug bills. I began to research further into the topic and came across a man by the name of Harvey Wiley. His story intrigued me and the more I researched the more interesting the story became. I soon found that this story was the perfect one for me to tell. In order to conduct my research, I developed a timeline which also assisted in how I developed my documentary. By outlining important people and significant events, I could effectively organize my research. I used a variety of sources, spending time in local and online libraries looking for encyclopedias and books as well as scouring the web for valuable sources of information. I was cautious in citing websites as they are vulnerable to bias, and glorification which I didn’t want influencing my documentary. Archives played a valuable role throughout my research, often providing other sources to research and a great source of primary sources. I reached out and utilized a multitude of archives, such as those from Harvard, and from The Library of Congress where I found many documents from his work. -

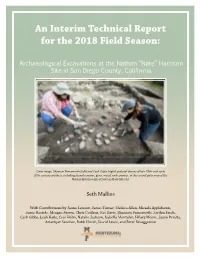

An Interim Technical Report for the 2018 Field Season

An Interim Technical Report for the 2018 Field Season: Archaeological Excavations at the Nathan “Nate” Harrison Site in San Diego County, California Cover image. Shannon Farnsworth (left) and Caeli Gibbs (right) pedestal dozens of late 19th- and early 20th-century artifacts, including faunal remains, glass, metal, and ceramics, in the central patio area of the Nathan Harrison site (Courtesy Robb Hirsch). Seth Mallios With Contributions by Jaime Lennox, James Turner, Melissa Allen, Micaela Applebaum, Jamie Bastide, Meagan Brown, Chris Coulson, Kat Davis, Shannon Farnsworth, Jordan Finch, Caeli Gibbs, Leah Hails, Cece Holm, Natalie Jackson, Isabella Montalvo, Hilary Moore, Jason Peralta, Amethyst Sanchez, Robb Hirsch, David Lewis, and Peter Brueggeman Published by Montezuma Publishing Aztec Shops Ltd. San Diego State University San Diego, California 92182-1701 619-594-7552 www.montezumapublishing.com Copyright © 2018 All Rights Reserved. ISBN: 978-0-7442-3708-5 Copyright © 2018 by Montezuma Publishing and the author(s), Seth Mallios et al. The compilation, formatting, printing and binding of this work is the exclusive copyright of Montezuma Publishing and the author(s), Seth Mallios et al. All rights reserved. No part of this work may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, including digital, except as may be expressly permitted by the applicable copyright statutes or with written permission of the Publisher or Author(s). Publishing Manager: Kim Mazyck Design and Formatting: Lia Dearborn Cover Design: Lia Dearborn Quality Control: Joshua Segui THE NATHAN “NATE” HARRISON HISTORICAL ARCHAEOLOGY PROJECT iv AN INTERIM TECHNICAL REPORT FOR THE 2018 FIELD SEASON Abstract San Diego State University (SDSU) Department of Anthropology Professor Seth Mallios directed scientific archaeological excavations at the Nathan “Nate” Harrison site in San Diego County for a seventh field season in 2018. -

Gender, Environment, and the Rise of Nutritional Science

THESIS “LEARNING WHAT TO EAT”: GENDER, ENVIRONMENT, AND THE RISE OF NUTRITIONAL SCIENCE IN TWENTIETH CENTURY AMERICA Submitted by Kayla Steele Department of History In partial fulfillment of the requirements For the Degree of Master of Arts Colorado State University Fort Collins, Colorado Summer 2012 Master’s Committee: Advisor: Mark Fiege Co-Advisor: Ruth Alexander Adrian Howkins Sue Doe ABSTRACT “LEARNING WHAT TO EAT”: GENDER, ENVIRONMENT, AND THE RISE OF NUTRITIONAL SCIENCE IN TWENTIETH CENTURY AMERICA This thesis examines the development of nutritional science from the 1910s to 1940s in the United States. Scientists, home economists, dieticians, nurses, advertisers, and magazine columnists in this period taught Americans to value food primarily for its nutritional components—primarily the quantity of calories, protein, vitamins, and minerals in every item of food—instead of other qualities such as taste or personal preference. I argue that most food experts believed nutritional science could help them modernize society by teaching Americans to choose the most economically efficient foods that could optimize the human body for perfect health and labor; this goal formed the ideology of nutrition, or nutritionism, which dominated education campaigns in the early twentieth century. Nutrition advocates believed that food preserved a vital connection between Americans and the natural world, and their simplified version of nutritional science could modernize the connection by making it more rational and efficient. However, advocates’ efforts also instilled a number of problematic tensions in the ways Americans came to view their food, as the relentless focus on invisible nutrients encouraged Americans to look for artificial sources of nutrients such as vitamin pills and stripped Americans of the ability to evaluate food themselves and forced them to rely on scientific expertise for guidance. -

Charles D. Walcott Collection, 1851-1940 and Undated

Charles D. Walcott Collection, 1851-1940 and undated Finding aid prepared by Smithsonian Institution Archives Smithsonian Institution Archives Washington, D.C. Contact us at [email protected] Table of Contents Collection Overview ........................................................................................................ 1 Administrative Information .............................................................................................. 1 Historical Note.................................................................................................................. 1 Chronology....................................................................................................................... 3 Introduction....................................................................................................................... 7 Descriptive Entry.............................................................................................................. 8 Names and Subjects ...................................................................................................... 9 Container Listing ........................................................................................................... 10 Series 1: PERSONAL CORRESPONDENCE, 1873-1928 AND UNDATED.......... 10 Series 2: FAMILY CORRESPONDENCE AND RELATED MATERIALS, 1851-1922 AND UNDATED...................................................................................................... 14 Series 3: CORRESPONDENCE AND RELATED MATERIALS CONCERNING B. STUART WALCOTT, -

Those Good Gertrudes: a Social History of Women Teachers in America Author’S Annotated Introduction to Manuscript Collections

Those Good Gertrudes: A Social History of Women Teachers in America Author’s Annotated Introduction to Manuscript Collections Researching this book led the author to promising collections in many archives in the United States, and to Australia and Canada where scholarship flourishes on teachers and teaching. This addendum is an annotated introduction to virtually all the collections examined for Those Good Gertrudes, the majority of them not cited nor referenced in the published book because of space limitations. The organization is alphabetical, by state and collection title. Annotations generally feature the collection‘s relevance to the particular focus of this work: American women teachers and their place in history. However, researchers working on related subjects may find useful material in various of these collections—for example on child-rearing and family life, genealogy, local history, regionalism, the frontier experience, industrialization, cross-national comparisons, and the expression and effects of social diversity rooted in social class, religion, race and ethnicity, politics, and the saliency of gender identity. A few generally-obscure printed works unpublished student-authored papers housed in archival libraries are cited. Each annotation is followed, where recoverable, by the date [in brackets] when the collection was first consulted by the author. Be advised that collections (as with some of the following) may change over time—by additions, deletions, mergers, renaming, and relocation—or be withdrawn entirely. Moreover, Finding Aids and collection inventories differ markedly from one depository to another in their on-line accessibility, completeness, & stability. A small number of collections are missing, probably the result of being misfiled; if located they will be added, and the listing updated. -

1 Corporate Crime and the Regulatory State: the Case

CORPORATE CRIME AND THE REGULATORY STATE: THE CASE OF PURDUE PHARMA AND OXYCONTIN® By O. HAYDEN GRIFFIN, III A DISSERTATION PRESENTED TO THE GRADUATE SCHOOL OF THE UNIVERSITY OF FLORIDA IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PHILOSOPHY UNIVERSITY OF FLORIDA 2011 1 © 2011 O. HAYDEN GRIFFIN, III 2 To my mother and father, thanks for all the love and support through the odyssey that was my education. You both mean the world to me and none of this would have been possible without the two of you. 3 ACKNOWLEDGMENTS I would first like to thank Joe Spillane for being my mentor for the full five years I was a graduate student at the University of Florida. From the advice he provided on seminar papers, to suggesting books and articles I should read, to critiquing my ideas, to shaping my research agenda, to the endless work he did with me on my dissertation – no other person will likely have the same impact on my career. I have not always made things easy for myself and unfortunately, this has often provided him with more than a few headaches along the way. Thus, I would like to thank him for seeing me through; I will always be grateful. I would like to thank Lonn Lanza-Kaduce for all the help he has provided me as both an advisor, a teacher and a committee member. I would also like to thank him for providing me with the opportunity to teach and all the advice he provided, especially early in my tenure in graduate school. -

“The Pastime of Millions”: James B. Haggin's Elmendorf Farm and the Commercialization of Pedigree Animal Breeding, 1897-19

University of Kentucky UKnowledge Theses and Dissertations--History History 2012 “THE PASTIME OF MILLIONS”: JAMES B. HAGGIN’S ELMENDORF FARM AND THE COMMERCIALIZATION OF PEDIGREE ANIMAL BREEDING, 1897-1920 Amber Fogle Sergent University of Kentucky, [email protected] Right click to open a feedback form in a new tab to let us know how this document benefits ou.y Recommended Citation Sergent, Amber Fogle, "“THE PASTIME OF MILLIONS”: JAMES B. HAGGIN’S ELMENDORF FARM AND THE COMMERCIALIZATION OF PEDIGREE ANIMAL BREEDING, 1897-1920" (2012). Theses and Dissertations-- History. 6. https://uknowledge.uky.edu/history_etds/6 This Doctoral Dissertation is brought to you for free and open access by the History at UKnowledge. It has been accepted for inclusion in Theses and Dissertations--History by an authorized administrator of UKnowledge. For more information, please contact [email protected]. STUDENT AGREEMENT: I represent that my thesis or dissertation and abstract are my original work. Proper attribution has been given to all outside sources. I understand that I am solely responsible for obtaining any needed copyright permissions. I have obtained and attached hereto needed written permission statements(s) from the owner(s) of each third-party copyrighted matter to be included in my work, allowing electronic distribution (if such use is not permitted by the fair use doctrine). I hereby grant to The University of Kentucky and its agents the non-exclusive license to archive and make accessible my work in whole or in part in all forms of media, now or hereafter known. I agree that the document mentioned above may be made available immediately for worldwide access unless a preapproved embargo applies. -

Harvey Washington Wiley, M.D. First Head of Bureau of Chemistry (Today’S FDA) from January 1, 1907 Until March 15, 1912

Harvey Washington Wiley, M.D. First Head of Bureau of Chemistry (today’s FDA) from January 1, 1907 until March 15, 1912 Harvey Washington Wiley was born in a log farmhouse in Indiana, in 1844. A top graduate of Hanover College (1867), Wiley then studied at Indiana Medical College where he received his M.D. in 1871. After he graduated, Wiley accepted a position teaching chemistry at the medical college, where he taught Indiana's first laboratory course in chemistry beginning in 1873. Following a brief interlude at Harvard, where he was awarded a B.S. degree after only a few months of intense effort, he accepted a faculty position in chemistry at the newly opened Purdue University in 1874. In 1878, Wiley traveled overseas where he attended the lectures of August Wilhelm von Hoffman the celebrated German discoverer of several organic tar derivatives, including analine. While in Germany, Wiley was elected to the prestigious German Chemical Society founded by Hoffman. Wiley spent most of his time in the Imperial Food Laboratory in Bismarck working with Eugene Sell, mastering the use of the polariscope and studying sugar chemistry. Upon his return to Purdue, Wiley was asked by the Indiana State Board of Health to analyze the sugars and syrups on sale in the state to detect any adulteration. He spent his last years at Purdue studying sorghum culture and sugar chemistry, hoping, as did others, to help the United States develop a strong domestic sugar industry. His first published paper in 1881 discussed the adulteration of sugar with glucose. Wiley was offered the position of Chief Chemist in the U.