IRB Infrastructure Developers Limited April 07, 2021 Ratings Instruments Amount (Rs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Management Discussion and Analysis

Corporate Overview Statutory Reports Financial Statements Management Discussion and Analysis Management Discussion and Analysis 1. INFRASTRUCTURE INDUSTRY OVERVIEW & create investor-friendly highway development initiatives OUTLOOK have already started the process of recouping the deficit In FY 2016-17, India’s infrastructure industry, including of last few years. The next fiscal year is likely to show an the road sector, continued on its path of recovery. The increase in BOT (Toll) bids with the Government aiming to Government has been undertaking initiatives to revive build 41 kms per day of roads. entrepreneurs’ interests in the road sector through innovative models like Hybrid Annuity. As a result, 3. COMPANY AND BUSINESS OVERVIEW around 4,337 kms ([approx. 422 km of Build-Operate- A. Company Overview Transfer(BOT) projects, 2,434 km of Hyrbid Annuity IRB Infrastructure Developers Ltd. (IRB), incorporated in projects, 1,481 km of Engineering-Procurement- 1998, has strong in-house integrated project execution Construction (EPC) projects]) of National Highways capabilities in both its business verticals viz. Construction improvement work were awarded by the National and Operation & Maintenance of Highways. It is the first Highways Authority of India (NHAI) in FY 2016-17. Most mover and pioneer in the road BOT business and is one of of the bids for the road projects saw good participation India’s largest road BOT operators with a rich portfolio of than the earlier years. NHAI has been focusing on 22 Road BOT projects. It also has approximately 18.79% addressing land acquisition and environmental clearances share of the Golden Quadrilateral Highway Network for its upcoming projects. -

IRB Toll Road Portfolio IRB’S Portfolio of Road 18 Assets Amount in Rs Mn Adaptability to Changing Market Portfolio Highlights Competitive Advantage Conditions

Investor Presentation March 2020 Safe Harbour 2 This presentation has been prepared by IRB Infrastructure Developers Limited (the “Company”) solely for your information and for your use and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person (whether within or outside your organization or firm) or published in whole or in part, for any purpose. By attending or receiving this presentation, you are agreeing to be bound by the restrictions set forth herein regarding the information disclosed in these materials. The information contained in this presentation does not constitute or form any part of any offer, sale invitation or recommendation to purchase or subscribe for any securities or units in any jurisdiction, and neither the issue of the information nor anything contained herein shall form the basis of, or be relied upon in connection with, any contract or commitment on the part of any person to proceed with any transaction. The information contained in these materials has not been independently verified. No representation or warranty, express or implied, is made and no reliance should be placed on the accuracy, fairness or completeness of the information presented or contained in these materials. Any forward-looking statements in this presentation are subject to risks and uncertainties that could cause actual results to differ materially from those that may be inferred to being expressed in, or implied by, such statements. Such forward-looking statements are not indicative or guarantees of future performance. Any forward-looking statements, projections and industry data included in this presentation are for information only and the Company is not responsible for such statements and projections or for any updates thereto. -

Grant Thornton India LLP

Dealtracker Providing M&A and Private Equity Deal Insights 8th Annual Edition 2012 © Grant Thornton India LLP. All rights reserved. This document captures the list of deals announced based on information available in the public domain and based on public announcements. Grant Thornton India LLP does not take any responsibility for the information, any errors or any decision by the reader based on this information. This document should not be relied upon as a substitute for detailed advise and hence, we do not accept responsibility for any loss as a result of relying on the material contained herein. Further, our analysis of the deal values are based on publicly available information and based on appropriate assumptions (wherever necessary). Hence, if different assumptions were to be applied, the outcomes and results would be different. © Grant Thornton India LLP. All rights reserved. 2 Contents From the 4 - Foreword Editor's Desk 6 - Year Round Up 2012: 10 – M&A Round Up Mergers & 15 – Domestic Acquisitions 17 – Cross border 1001 25 – PE Round Up Private 27 – Top Deals Equity 29 – PE – Sector Highlight 31 – PE – City Break up deals Other 33 – IPO & QIP Features 35 – Deal List $49bn © Grant Thornton India LLP. All rights reserved. 3 Foreword The on-going Eurozone worries, weakening rupee and Contrary to expectations, inbound deal activity reverted a uncertain Indian economy with a slowdown in the to the single-digit levels seen in 2010, notching up US$ reform process, impacted M&A deal activity in certain 7 bn in deal value, after putting in a robust performance periods of 2012. -

IRB Infrastructure Developers Ltd. TP: INR 295 - ACCUMULATE

IRB Infrastructure Developers Ltd. TP: INR 295 - ACCUMULATE Stability, Growth and Returns 26 March 2018 IRB Infrastructure has a portfolio of 14 BOT assets with a market share of 11.64% in the Infrastructure golden quadrilateral and road portfolio of 7,767 lane kms as of 31st December 2017. Large Initiation part of IRB’s portfolio is along the high traffic-density corridors in Western India making it one of the best plays on anticipated traffic-growth. In March 2018 alone the group has so far received letter of award for 3 HAM projects and emerged as preferred Key Statistics bidder for another project on DBFOT basis aggregating INR 89.1 bn augmenting its CMP (INR)* 215.8 construction orderbook to INR 153 bn as of 22th March 2018 from INR 74 bn as of 31st Upside/downside (%) 36.7 December 2017 providing revenue visibility over the next three years. We believe IRB’s Market Cap (INR/USDmn) 75,755/ 1,168 foray into HAM with more assured cash flows and the upcoming TOT opportunity should provide the next leg of growth and drive re-rating. Shares outstanding (mn) 351 3 months avg volume (mn) 1.48 ✓ Foray into HAM and TOT – Catalyst for re-rating: Given the dearth of BOT projects, Dividend Yield (FY17, %) 2.3 and management’s reluctance to actively bid for EPC given the intense competitive action in EPC space, IRB’s shares have underperformed major road builders (12m 52 Wk high/low 267/198 performance of -9% vs. +53%) and are trading at a 44% discount to its peer group Sensex/Nifty 32,596/9,998 (FY19e EV/EBITDA of 6.0x vs. -

Financials Auditors’�Report

financials auditors’report TOTHEMEMBERSOFICICILIMITED WehaveauditedtheattachedBalanceSheetofICICILimitedasatMarch31,2000andtheannexedRevenue Accountfortheyearendedonthatdateandreportthat: (1) AsrequiredbytheManufacturingandOtherCompanies(Auditor’sReport)Order,1988issuedbytheCompany LawBoardintermsofSection227(4A)oftheCompaniesAct,1956,weencloseintheAnnexureastatement onthemattersspecifiedinparagraphs4and5ofthesaidOrdertotheextentapplicabletotheCompany. (2) FurthertoourcommentsintheAnnexurereferredtoinparagraph(1)above: (a) wehaveobtainedalltheinformationandexplanationswhich,tothebestofourknowledgeandbelief, werenecessaryforthepurposesofouraudit; (b) inouropinion,properbooksofaccountasrequiredbylawhavebeenkeptbytheCompanysofaras appearsfromourexaminationofthebooks; (c) theBalanceSheetandRevenueAccountdealtwithbythisreportareinagreementwiththebooksof accountoftheCompany; (d) inouropinion,theBalanceSheetandRevenueAccountdealtwithbythisreportareincompliancewith theAccountingStandardsreferredtoinSection211(3C)oftheCompaniesAct,1956,insofarastheyare applicabletotheCompany; (e) inouropinionandtothebestofourinformationandaccordingtotheexplanationsgiventous,thesaid accountsreadwiththenotesthereon,givetheinformationrequiredbytheCompaniesAct,1956,inthe mannersorequiredandgiveatrueandfairview: (i) inthecaseoftheBalanceSheet,ofthestateofaffairsoftheCompanyasatMarch31,2000;and (ii) inthecaseoftheRevenueAccount,oftheprofitfortheyearendedonthatdate. ForN.M.RAIJI&CO. ForS.B.BILLIMORIA&CO. CharteredAccountants CharteredAccountants A.R.GANDHI S.J.MERCHANT -

Revision in Credit Rating- IRB Infrastructure Developers Limited

Rating Rationale August 28, 2020 | Mumbai IRB Infrastructure Developers Limited Long-term rating downgraded to 'CRISIL A/Stable' ; short-term rating reaffirmed Rating Action Total Bank Loan Facilities Rated Rs.4200 Crore CRISIL A/Stable (Downgraded from 'CRISIL Long Term Rating A+/Stable') Short Term Rating CRISIL A1 (Reaffirmed) 1 crore = 10 million Refer to annexure for Details of Instruments & Bank Facilities Detailed Rationale CRISIL has downgraded its rating on the long term bank facilities of IRB Infrastructure Developers Limited (IRBIDL) to 'CRISIL A/Stable' from 'CRISIL A+/Stable' while reaffirming the short term rating at 'CRISIL A1'. The rating action is on account of weakening of the company's financial risk profile because of significant increase in debt owing to higher-than-anticipated investment in the Mumbai Pune Expressway project coupled with lower operating performance due to the Covid-19 pandemic. Additionally, the company's weakened order book is limiting its revenue visibility over the medium term. Equity requirement of Rs 1,438 crore for the Mumbai Pune Expressway project was expected to be funded by IRBIDL only to the extent of 51% while its financial partner was to fund the remaining 49%. However, due to the Covid-19 pandemic, the financial partner was unable to secure necessary approvals in time to come in as an equity partner and has instead provided debt of Rs 750 crore to IRBIDL. Thus the company's debt has increased to Rs 4,697 crore as on June 30, 2020 from Rs 3,457 crore as on March 31, 2020. High debt coupled with low operating performance due to the impact of the pandemic will weaken the financial risk profile. -

IRB-INFRA-2014-2015.Pdf

Corporate Overview Statutory Reports Financial Statements 02 Progressing with Foresight 32 Management Discussion and Consolidated Financial 04 Robust Project Portfolio Analysis Statements 06 Charting a Progressive Journey 40 Board’s Report 92 Independent Auditors’ Report 08 Chairman & Managing Director’s 74 Corporate Governance Report 98 Consolidated Balance Sheet Communiqué 99 Consolidated Statement of Profit 10 Key Performance Indicators and Loss 12 Operational Highlights 100 Consolidated Cash Flow Statement 14 Partnering a Nation on the Move 102 Notes 16 Identifying the Right Opportunities 18 Pursuing Consistent Growth Standalone Financial Statements 20 Strong Execution Capabilities 141 Independent Auditors’ Report 22 The Way Forward 144 Balance Sheet 24 Strengthening Communities 145 Statement of Profit and Loss 26 The Board of Directors 146 Cash Flow Statement 28 The Executive Team 148 Notes 30 Corporate Information 178 Form AOC - I Forward-looking statement In this Annual Report, we have disclosed forward words such as ‘anticipate’, ‘estimate’, ‘expects’, uncertainties materialise, or should underlying looking information to enable investors to ‘projects’, ‘intends’, ‘plans’, ‘believes’, and words of assumptions prove inaccurate, actual results could comprehend our prospects and take investment similar substance in connection with any discussion vary materially from those anticipated, estimated decisions. This report and other statements of future performance. We cannot guarantee that or projected. Readers should keep this in mind. - written and oral - that we periodically make these forward looking statements will be realised, We undertake no obligation to publicly update any contain forward looking statements that set out although we believe we have been prudent in our forward looking statement, whether as a result of anticipated results based on the management’s assumptions. -

Accelerated Deployment of Renewable Energy Sector

Accelerated Deployment of Renewable Energy Sector Financial Instruments for catalyzing private sector investment for Indian RE sector Draft Report for Discussion Disclaimer This Report has been prepared on the basis set out in our contract for ‘Service Provider for Supporting Structural Reforms in the Indian Power Sector’ with the Secretary of State for International Development at the Department for International Development (“the Client”) dated 4 November 2016 (the “Services Contract”), and should be read in conjunction with the Services Contract. Nothing in this report constitutes a valuation or legal advice. We have not veried the reliability or accuracy of any information obtained in the course of our work, other than in the limited circumstances set out in the Services Contract. This Report is for the benet of the Client only. This Report has not been designed to be of benet to anyone except the Client. In preparing this Report we have not taken into account the interests, needs or circumstances of anyone apart from the Client, even though we may have been aware that others might read this Report. We have prepared this report for the benet of the Client alone. This Report is not suitable to be relied on by any party wishing to acquire rights against KPMG in India (other than the Client) for any purpose or in any context. Any party other than the Client that obtains access to this Report or a copy (under the Freedom of Information Act 2000, the Freedom of Information (Scotland) Act 2002, through the Client’s Publication Scheme or otherwise) and chooses to rely on this Report (or any part of it) does so at its own risk. -

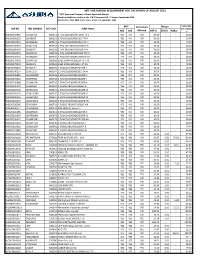

Mtf Var Margin Requirement for the Month

MTF VAR MARGIN REQUIREMENT FOR THE MONTH OF AUGUST 2021 **MTF Approved Category of Stock Applicable Margin Stocks available for trading in the F & O Segment VaR + 3 times of applicable ELM Stocks other than F&O stocks VaR + 5 times of applicable ELM MTF Derivatives Margin TOTAL REQ. ISIN NO NSE SYMBOL BSE CODE SCRIP Name ALLOWED MTF MARGIN NSE BSE Allowed VAR % ELM % Adhoc ** IN0020150085 SGBNOV23 800251 2.75% GOLDBONDS 2023 TR-1 YES NO NO 10.00 - - 10.00 IN0020150101 SGBFEB24 800252 2.75%GOLDBONDS2024 TR-II YES NO NO 10.00 - - 10.00 IN0020150119 SGBMAR24 800253 2.75%GOLDBONDS2024 TR-III YES NO NO 10.00 - - 10.00 IN0020160027 SGBAUG24 800254 2.75% GOLDBONDS2024TR-IV YES NO NO 10.00 - - 10.00 IN0020160043 SGBSEP24 800258 2.75% GOLDBONDS2024TR-V YES NO NO 10.00 - - 10.00 IN0020160076 SGBNOV24 800259 2.50% GOLDBONDS2024 TR-VI YES NO NO 10.00 - - 10.00 IN0020160126 SGBMAR25 800265 2.50%GOLDBONDS 2025TR-VII YES NO NO 10.00 - - 10.00 IN0020170018 SGBMAY25 800268 SGB2.50%MAY2025SR-I 17-18 YES NO NO 10.00 - - 10.00 IN0020170034 SGBJUL25 800269 SGB2.50%JUL2025SR-II17-18 YES NO NO 10.00 - - 10.00 IN0020190073 SGBJUN27 800295 2.50%GOLDBONDS2027SR-I YES NO NO 10.00 - - 10.00 IN0020190107 SGBAUG27 800297 2.50%GOLDBONDS2027SR-III YES NO NO 10.00 - - 10.00 IN0020190552 SGBMAR28X 800315 2.50%GOLDBONDS2028SR-X YES NO NO 10.00 - - 10.00 IN0020200062 SGBAPR28I 800318 2.50%GOLDBONDS2028SR-I YES NO NO 10.00 - - 10.00 IN0020200088 SGBMAY28 800320 2.50%GOLDBONDS2028SR-II YES NO NO 10.00 - - 10.00 IN0020200104 SGBJUN28 800322 2.5%GOLDBONDS2028SR-III YES NO NO -

Market Radar 06-01-2020

Market Radar 06-01-2020 12700 Nifty Outlook: 12200 11700 Nifty's sacrosanct support of 12190 was held on Friday from where Nifty witnessed a 11200 bounce towards the end of the day. Expect 10700 10200 Resistance 12265 / 12303 lower opening in Nifty initially around 12190 Pivot 12228 9700 from where a bounce back could be seen. Support 12190 / 12153 Nifty - Daily Reduce longs if Nifty stays below 12130- 9200 12120 region. Near term scenario Best case: 12100/12300 Worst case: 10300/9500 Traders' corner Yesterday's picks Stocks Ltp %Chg S2 S1 PV R1 R2 Bias Notes Stocks %gain/loss OIL 155.95 1.89 152 154 156 158.0 160.1 EMA combo break, MACD above signal line. QUESS 4.47 TORNTPHARM 1900.1 1.85 1835 1868 1894 1926 1952 MACD above signal line, EMA combo break. GICRE 3.87 TATACOFFEE 93.9 1.57 91 92 94 96 98 MACD exhaustion seen, EMA combo break. IBULHSGFIN 3.16 SPARC 164.45 2.49 156 160 164 168 172 EMA combo break, MACD to cross signal line. L&TFH 1.12 Note: The rationale mentioned above are valid for the day only. Kindly use them accordingly. 3.16 Opening Sentiments 2.00 Global Equities Commodities & Currencies 2000 FII/DII activity (Rs. Cr.) Sector performance (%) 1.00 Indices %Chg Asset Last %Chg 1000 0.00 NIKKEI CRUDE 70.26 2.42 0 -1.00 SHANGHAI 0.36 COPPER 48920 -0.31 -1000 -2.00 SGX NIFTY -0.40 GOLD 1577.02 1.60 -2000 -3.00 S&P500 -0.71 USDINR 71.9675 0.62 -3000 2-Jan 1-Jan 31-Dec 30-Dec 27-Dec 26-Dec Economic calendar - pg 4.. -

![IRB MP Expressway Private Limited: [ICRA]A+ (Stable) Assigned](https://docslib.b-cdn.net/cover/4726/irb-mp-expressway-private-limited-icra-a-stable-assigned-4904726.webp)

IRB MP Expressway Private Limited: [ICRA]A+ (Stable) Assigned

August 26, 2020 IRB MP Expressway Private Limited: [ICRA]A+ (Stable) assigned Summary of rating action Current Rated Amount Instrument* Rating Action (Rs. crore) Fund Based – Term Loan 6610.00 [ICRA]A+ (Stable); Assigned Total 6610.00 *Instrument details are provided in Annexure-1 Rationale The assigned rating factors in the favorable location of IRB MP Expressway Private Limited (IMPEPL), criticality of the project stretch connecting Mumbai and Pune, two major metropolitan cities in Maharashtra with an established traffic density, growth rates and IRB’s long tolling track record (of new Mumbai-Pune stretch and NH-4) of more than 13 years. The new Mumbai-Pune stretch, which accounts for 75% of IMPEPL toll collections, witnessed healthy growth in traffic at a CAGR of 8.54% in PCU terms during FY2008-FY2019 - primarily driven by growth in passenger vehicle traffic. The toll collection rights for both the stretches - the new Mumbai-Pune as well as NH-4 - was with Mumbai Pune Expressway Limited (MPEL), an SPV promoted by the Maharashtra State Road Development Corporation Limited (MSRDC) for the period August 10, 2019 – February 29, 2020. The overall growth in toll collections for FY2020 stood at 6.7%1 (tolled by a different contractor under MSRDC prior to March 1, 2020). The rating also derives comfort from the presence of structural features such as benefit of the debt service reserve account (DSRA) equivalent to one quarter of the debt servicing obligation, a tightly defined escrow mechanism, right to accelerate2 mechanism and restricted payment covenant with lock up DSCR of 1.2 times. -

Annual Deal Tracker

Annual Deal List February 2020 Contents Section Page M&A 04 Domestic 05 Mergers and internal restructuring 16 M&A: Inbound 17 M&A: Outbound 21 Private equity 25 IPO 62 QIP 64 Disclaimer This document captures the list of deals announced based on information available in the public domain and based on public announcements. Grant Thornton India LLP does not take any responsibility for the information, any errors or any decision by the reader based on this information. This document should not be relied upon as a substitute for detailed advice and hence, we do not accept responsibility for any loss as a result of relying on the material contained herein. Further, our analysis of the deal values is based on publicly available information and based on appropriate assumptions (wherever necessary). Hence, if different assumptions were to be applied, the outcomes and results would be different. This document contains the deals announced and closed as of 20 December 2019. 02 Industry 4.0: Transforming the manufacturing landscape Annual Deal List 2019 0 3 M&A 04 Annual Deal List 2019 I. Domestic Acquirer Target Sector USDm % Stake Reliance Strategic Business Asteria Aerospace Pvt. Ltd. Aerospace and defence 3.30 52% Ventures Limited Ashok Leyland Ltd. Ashley Aviation Ltd. Aerospace and defence 0.08 27% PI Industries Ltd. Isagro (Asia) Agrochemicals Private Limited Agriculture and forestry 49.00 100% Luxmi Tea Co. Pvt. Ltd. Mcleod Russel India Ltd. - Specified assets of Agriculture and forestry 21.43 100% Addabarie Tea Estate, Mahakali Tea Estate and Dirai Tea Estate Mahindra CIE Automotive Ltd.