Greentown China Holdings Limited (綠城中國控股有限公司)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Three Red Lines” Policy

Real Estate Developers with High Leverage to See Inventory Quality Tested Under Broader “Three Red Lines” Policy October 28, 2020 In our view, the widening of regulations aimed at controlling real estate developers’ interest- ANALYSTS bearing debt would further reduce the industry’s overall credit risk in the long term. However, the nearer term may see less headroom for highly leveraged developers to finance in the capital Xiaoliang Liu, CFA market, pushing them to sell off inventory to ease liquidity pressure. Beijing +86-10-6516-6040 The People’s Bank of China said in September that measures aimed at monitoring the funding [email protected] and financial management of key real estate developers will steadily be expanded. Media reports suggest that the new regulations would see a cap of 15% on annual growth of interest-bearing Jin Wang debt for all property developers. Developers will be assessed against three indicators, which are Beijing called “red lines”: whether asset liability ratios (excluding advance) exceeded 70%; whether net +86-10-6516-6034 gearing ratio exceeded 100%; whether cash to short-term debt ratios went below 1.0. Developers [email protected] which breached all three red lines won’t be allowed to increase their debt. If only one or two of the red lines are breached, such developers would have their interest-bearing debt growth capped at 5% and 10% respectively. The first half of the year saw debt grow rapidly among developers. In a sample of 87 real estate developers that we are monitoring, more than 40% saw their interest-bearing debt grow at a faster rate than 15% year over year as of the end of June (see the chart below). -

PB 14-21: Is China's Property Market Heading Toward Collapse?

Policy Brief NUMBER PB14-21 AUGUST 2014 and controversies. Without properly understanding the market’s Is China’s Property Market history and mechanisms, many analysts often compare today’s situation in China with the Japanese property bubble and its Heading toward Collapse? subsequent collapse in the early 1990s and the US housing market collapse in 2008, suggesting China is about to experi- ence something of similar proportions. Li-Gang Liu Th e fears about China’s property market are likely over- blown. First, China’s private housing market is young. It did Li-Gang Liu, visiting fellow at the Peterson Institute for International not exist until 1998. Over the last 16 years, the property sector Economics, is chief economist for Greater China at the Australia and New Zealand Banking Group in Hong Kong. Previously, he worked for the has seen large swings in both prices and levels of investment. Hong Kong Monetary Authority, the Asian Development Bank Institute, Cyclical downturns have resulted from macroeconomic condi- and the World Bank. tions, credit restrictions, and the government’s attempts to curb either the overheating or overcooling of the sector. Th is Author’s note: I acknowledge Nicholas Borst, Gary Clyde Hufbauer, Ken Kuttner, Adam S. Posen, Ted Truman, Steven R. Weisman, and an anony- cyclicality is a good thing to the extent that investors tend to mous reviewer for their excellent comments, which have helped improved this article substantially. All remaining errors are mine alone. As long as urbanization continues and © Peterson Institute for International Economics. All rights reserved. appropriate policies are adopted, this China’s property market has slowed signifi cantly since the property market downturn should fi rst half of 2014, with sharp declines in sales and a buildup prove to be merely cyclical. -

China Property – Equity & Bond Weekly Wrap

China Property – Equity & Bond weekly wrap Industry Overview Equity/Fixed Income | China | Real Estate/Property 26 March 2012 Macro factors dominate again Equity research Raymond Ngai, CFA >> +852 2536 3987 Equities slumped 4.9%, bonds yields widened to 13.19% Research Analyst Merrill Lynch (Hong Kong) Chinese developers’ shares fell another -4.9% w/w last week, after a 2.3% [email protected] decline. Overall stock market sentiment was not too good in the past week, with Matthew Chow, CFA >> +852 2161 7877 some soft macro numbers coming out from the US and Europe; and actually the Research Analyst Merrill Lynch (Hong Kong) HSCEI index was also down 5% w/w last week, on concerns of weaker economic [email protected] growth (as well as speculation over possible political tensions within China.) Sunny Tam, CFA >> +852 2536 3446 Chinese developers’ bond yields also widened another 62bps to an average Research Analyst 13.19% vs 12.57% in the week before. In the past week, macro factors seem to Merrill Lynch (Hong Kong) dominate share/bond prices again. However, looking ahead March sales numbers [email protected] for developers to be released in early April may give more indication as to how Liying Du >> +852 2161 7008 Research Analyst realistic developers’ 2012 sales targets are, and could provide more company Merrill Lynch (Hong Kong) specific drivers for the sector. [email protected] Credit Research Proposal for more property tax pilot cities approved Alwyn Pang, CFA +852 2536 3485 Last week, the National Development and Reform Committee's 2012 Economic Research Analyst Reform Proposals were approved by the State Council. -

SOHO CHINA LIMITED SOHO中國有限公司 (Incorporated in the Cayman Islands with Limited Liability) 13.51A (Stock Code: 410)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited 14.58(1) take no responsibility for the contents of this announcement, make no representation as to Note 5, 13.52 its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SOHO CHINA LIMITED SOHO中國有限公司 (incorporated in the Cayman Islands with limited liability) 13.51A (Stock Code: 410) DISCLOSEABLE TRANSACTION PROPOSED ACQUISITION OF SHANGHAI TIANSHAN ROAD PROJECT PROPOSED ACQUISITION The Board wishes to announce that on 17 April 2012, the Company and SOHO Shanghai, a wholly-owned subsidiary of the Company, as purchaser entered into the Framework Agreement with Greentown Holdings and the Vendors, as vendors for the acquisition of the entire equity interests in Greentown Plaza Development and all the rights and title to the Loans at an aggregate consideration of RMB2,137,720,000 (subject to adjustments, if any). As at the date of this announcement, the registered capital of Greentown Plaza Development is RMB100,000,000 and is owned as to 70% by Greentown Real Estate and 30% by MaAnShan Development. Greetown Plaza Development is responsible for development of the Tianshan Road Project. The Tianshan Road Project is at the most prime location of the Hongqiao Foreign Trade Center, in Changning District, Shanghai. Being the first business district for foreign enterprises in Shanghai, this area is home to over 4,400 enterprises and organisations with a high concentration of foreign enterprises (over 50% of the companies are foreign invested enterprises including many multinational companies such as Intel, GE, Samsung and Shell). -

U.S. Investors Are Funding Malign PRC Companies on Major Indices

U.S. DEPARTMENT OF STATE Office of the Spokesperson For Immediate Release FACT SHEET December 8, 2020 U.S. Investors Are Funding Malign PRC Companies on Major Indices “Under Xi Jinping, the CCP has prioritized something called ‘military-civil fusion.’ … Chinese companies and researchers must… under penalty of law – share technology with the Chinese military. The goal is to ensure that the People’s Liberation Army has military dominance. And the PLA’s core mission is to sustain the Chinese Communist Party’s grip on power.” – Secretary of State Michael R. Pompeo, January 13, 2020 The Chinese Communist Party’s (CCP) threat to American national security extends into our financial markets and impacts American investors. Many major stock and bond indices developed by index providers like MSCI and FTSE include malign People’s Republic of China (PRC) companies that are listed on the Department of Commerce’s Entity List and/or the Department of Defense’s List of “Communist Chinese military companies” (CCMCs). The money flowing into these index funds – often passively, from U.S. retail investors – supports Chinese companies involved in both civilian and military production. Some of these companies produce technologies for the surveillance of civilians and repression of human rights, as is the case with Uyghurs and other Muslim minority groups in Xinjiang, China, as well as in other repressive regimes, such as Iran and Venezuela. As of December 2020, at least 24 of the 35 parent-level CCMCs had affiliates’ securities included on a major securities index. This includes at least 71 distinct affiliate-level securities issuers. -

International China

International China and an example that firms from other parts of the world can learn from, instead of trying to become one of the top US and UK firms.” Where else in the world have Similar ambitions are evident in The Lawyer’s inter- you seen a law firm growing views with Fangda chair of management committee by 27 per cent year-on-year Jonathan Zhou and Han Kun’s CEO Joyce Li. Han Kun for 15 consecutive years? We emerged as the fastest growing firm in last year’s China Land of report after tripling its annual turnover between 2013 expect to reach the $1bn and 2015. It also more than doubled its revenue per mark in five years” lawyer (RPL) over the same period. In 2016, its revenue Anthony Qiao, Zhong Lun grew again by 40 per cent from RMB320m in 2015 to RMB450m. the bold So why are these three firms striding ahead of the rest of Chinese firms and how can they reach their ambitious goals? Here are the key findings ofThe Lawyer’s research. Three firms from the China Top 30 “We’re not trying to duplicate the models of any suc- cessful global firms, because China is vastly different Dare to change stand out for their stunning growth from the US or the UK market,” says Zhong Lun’s part- All three firms are developing at an extraordinary pace and unshakeable belief that they will ner and CEO Anthony Qiao. “We want to be a global thanks to recent strategic overhauls and some hard Yun Kriegler be challengers to the global elite Chinese firm.” decisions. -

China to Keep Watch on TPP

Table for strangers Hainan helps visitors Memory protection Special police target tourism An app connects amateur chefs industry irregularities in Sanya with willing dining companions Database to be created on > CHINA, PAGE 4 > LIFE, PAGE 9 the Nanjing Massacre > p3 MONDAY, October 12, 2015 chinadailyusa.com $1 COMMERCE China to keep watch on TPP Such trade deals can disrupt non-signatories: offi cial By ZHONG NAN highly unlikely that the TPP would in Beijing lead to the creation of a trade bloc [email protected] that excludes China. “The economic development China will conduct comprehensive mode in China has already changed and systematic assessments of the from low-end product trade to ‘going fallout from the Trans-Pacifi c Part- global’ strategies like setting up or nership, a broad agreement between moving manufacturing facilities and 12 Pacifi c Rim countries, including to more direct investment in over- Japan and the United States, since it seas markets,” said Fan. believes that such deals have disrup- Besides the US, other signatories tive eff ects on non-signatory nations, to the TPP are Australia, Brunei, a top government offi cial said. Canada, Chile, Japan, Malaysia, Mex- Commerce Minister Gao Hucheng ico, New Zealand, Peru, Singapore said China is of the view that changes and Vietnam. in the global trade pattern should be China has to date signed bilateral decided by adjustments in the indus- and multilateral free trade agree- trial structure and through product ments with seven TPP members. competitiveness in global -

Annual Report 2015 2015 Annual Report 2015 Annual

GREENTOWN CHINA HOLDINGS LIMITED GREENTOWN ANNUAL REPORT 2015 2015 ANNUAL 2015 ANNUAL REPORT GREENTOWN CHINA HOLDINGS LIMITED (incorporated in the Cayman Islands with limited liability) (Stock Code: 03900) Welcome to your home of Greentown. Walk into a world of luxury and style. Transform your dreams into reality here. From the minute you set foot on the majestic doorway that leads into the elegant hallway, you will be embraced by the luxury and grace of a bygone era. Traditional style combined with contemporary detailing gives the place a personal touch with a flair of splendour. Each unit is tastefully designed for home lovers who have an eye for quality and beauty. Nestled in breath-taking landscaped gardens, these homes allow you to experience the magical powers of nature in your own private setting. Join the Greentown family and live the dream of many others today. Find your home with Greentown and enjoy the luxury of life with peace of mind. Contents 002 Corporate Profile 004 Corporate Information 006 Financial Highlights 008 Chairman’s Statement 010 CEO’s Report 012 Property Portfolio 025 Management Discussion and Analysis 042 Biographical Details of Directors and Senior Management 052 Sustainability and Corporate Social Responsibility 060 Investor Relations 064 Corporate Governance Report 071 Report of the Directors 092 Independent Auditor’s Report 094 Consolidated Financial Statements 218 Definition 002 Greentown China Holdings Limited Annual Report 2015 Corporate Profile GREENTOWN CHINA HOLDINGS LIMITED IS ONE OF THE LEADING PROPERTY DEVELOPERS IN CHINA. IT COMMANDS A LEADING POSITION IN THE INDUSTRY BY LEVERAGING ON ITS QUALITY PROPERTIES, UNIQUE ARCHITECTURAL AESTHETICS AND CUSTOMER-FOCUSED RESIDENCE SERVICES. -

Annual Report

年 報 Annual Report GREENTOWN CHINA HOLDINGS LIMITED (incorporated in the Cayman Islands with limited liability) Stock Code: 03900 Welcome to your home of Greentown. Walk into a world of luxury and style. Transform your dreams into reality here. From the minute you set foot on the majestic doorway that leads into the elegant hallway, you will be embraced by the luxury and grace of a bygone era. Traditional style combined with contemporary detailing gives the place a personal touch with a flair of splendour. Each unit is tastefully designed for home lovers who have an eye for quality and beauty. Nestled in breath-taking landscaped gardens, these homes allow you to experience the magical powers of nature in your own private setting. Join the Greentown family and live the dream of many others today. Find your home with Greentown and enjoy the luxury of life with peace of mind. Contents 002 Corporate Profile 004 Corporate Information 006 Financial Highlights 008 Chairman’s Statement 010 CEO’s Report 014 Property Portfolio 026 Management Discussion and Analysis 044 Biographical Details of Directors and Senior Management 052 Environmental and Social Responsibility Report 084 Corporate Governance Report 090 Investor Relations 094 Report of the Directors 114 Independent Auditor’s Report 123 Consolidated Statement of Profit or Loss and Other Comprehensive Income 124 Consolidated Statement of Financial Position 126 Consolidated Statement of Changes in Equity 127 Consolidated Statement of Cash Flows 130 Notes to the Consolidated Financial Statements 291 Definition Corporate Profile Greentown China Holdings Limited maintains a leading position in the industry with high construction quality and excellent living services. -

Report Template

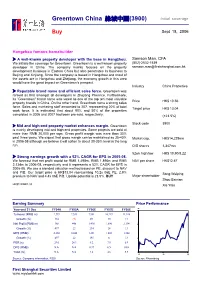

Greentown China 綠城中國(3900) Initial coverage Buy Sept 18, 2006 Hangzhou famous homebuilder ¾ A well-known property developer with the base in Hangzhou. Samson Man, CFA We initiate the coverage for Greentown. Greentown is a well-known property (852)-2532-1539 developer in China. The company mainly focuses on the property [email protected] development business in Eastern China but also penetrates its business to Beijing and Xinjiang. Since the company is based in Hangzhou and most of the assets are in Hangzhou and Zhejiang, the economy growth in this area would have the great impact on Greentown’s prospect. Industry China Properties ¾ Reputable brand name and efficient sales force. Greentown was ranked as first amongst all developers in Zhejiang Province. Furthermore, its ”Greentown” brand name was voted as one of the top ten most valuable Price HK$ 10.56 property brands in China. On the other hand, Greentown owns a strong sales force. Sales and marketing staff amounted to 207, representing 20% of total Target price HK$ 13.04 work force. It is estimated that about 90% and 50% of the properties completed in 2006 and 2007 had been pre-sold, respectively. (+23.5%) Stock code 3900 ¾ Mid and high-end property market enhances margin. Greentown is mainly developing mid and high-end properties. Some projects are sold at more than RMB 20,000 per sqm. Gross profit margin was more than 30% past three years. We expect that gross margin can be maintained as 35-40% Market cap. HK$14,229mn in 2006-08 although we believe it will soften to about 30-35% level in the long run. -

Soho China Limited (410 HK)-OW: Decent Progress but Shanghai

Company report FIG Real Estate Equity – China Soho China Limited (410 HK) Overweight OW: Decent progress but Shanghai faces more Target price (HKD) 6.50 competition Share price (HKD) 5.36 Forecast dividend yield (%) 5.8 Decent leasing progress underpinned by favourable office Potential return (%) 27.1 market dynamics in Beijing and Shanghai Note: Potential return equals the percentage difference between the current share price and Net gearing set to increase further, absent an asset sale the target price, plus the forecast dividend yield Dec 2014 a 2015 e 2016 e HSBC EPS 0.34 0.23 0.14 Maintain OW with a new TP of HKD6.50 (vs. HKD6.60) HSBC PE 12.6 18.9 31.3 Performance 1M 3M 12M Absolute (%) -1.7 -7.9 -10.1 Headline miss in FY14 results; other line items were in-line. FY14 core profit of Relative^ (%) -0.9 -8.0 -30.1 RMB1,778m is down 60% y-o-y, 11% and 17% below our and consensus estimates, Note: (V) = volatile (please see disclosure appendix) mainly due to a 9% miss in property development revenue. Core profit margin of 29% was slightly below our forecast of 30%. Final dividend of RMB0.13 and the full year 6 March 2015 dividend of RMB0.25 remain flat y-o-y. The implied dividend yield is 5.8%, consistent Michelle Kwok* with yield levels that SOHO has been paying over the past five years. Analyst The Hongkong and Shanghai Banking Some encourage leasing progress, but much work needs to be done in 2015. -

Annual Report 2007 3 Live Demonstration of Beijing Majestic Mansion Ultimate Grace of Living Corporate Profile

The homes built by Greentown lead lifestyle. Our premier class of architecture fully demonstrates dynamic blend of taste and culture. The architecture characteristics embrace the culture of city and show respect to natural landscape. Join us to live elegantly and delicately. Since its establishment, Greentown is determined to create beauty for the city with an idealistic human-oriented spirit adopted through the course of development and after-sales services for its property products, and bring ideal life for its customers with quality properties. Contents Corporate Information 3 Corporate Profile 6 Portfolio 8 Year in Review 44 Chairman’s Statement 48 CEO’s Review 49 Management Discussion and Analysis 58 Directors and Senior Management 74 Corporate Governance Report 84 Report of the Directors 90 Report of the Auditors 99 Consolidated Income Statement 101 Consolidated Balance Sheet 102 Consolidated Statement of Changes in Equity 104 Consolidated Cash Flow Statement 105 Notes to the Consolidated Financial Statements 107 Five Year Financial Summary 201 Valuation Report and Analysis 202 Corporate Information Directors Remuneration Committee Legal Advisors to Our Company Executive Directors Mr. JIA Shenghua as to Hong Kong law and U.S. law: Mr. SONG Weiping (Chairman) Mr. SZE Tsai Ping, Michael Herbert Smith Mr. SHOU Bainian Mr. CHEN Shunhua (Executive Vice-Chairman) as to PRC law: Mr. CHEN Shunhua Nomination Committee Zhejiang T&C Law Firm Mr. GUO Jiafeng Mr. SZE Tsai Ping, Michael Mr. TSUI Yiu Wa, Alec as to Cayman Islands law and Independent Non-Executive Directors Mr. SHOU Bainian British Virgin Islands law: Maples and Calder Mr. JIA Shenghua Mr.