D.G C:P Part-1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2017 As at June 30, 2017

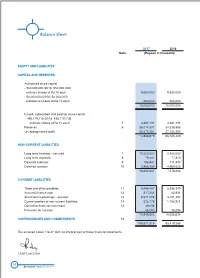

Balance Sheet 2017 2016 Note (Rupees in thousand) EQUITY AND LIABILITIES CAPITAL AND RESERVES Authorised share capital - 950,000,000 (2016: 950,000,000) ordinary shares of Rs 10 each 9,500,000 9,500,000 - 50,000,000 (2016: 50,000,000) preference shares of Rs 10 each 500,000 500,000 10,000,000 10,000,000 Issued, subscribed and paid up share capital 438,119,118 (2016: 438,119,118) ordinary shares of Rs 10 each 5 4,381,191 4,381,191 Reserves 6 38,014,337 34,238,885 Un-appropriated profit 32,473,351 27,163,353 74,868,879 65,783,429 NON-CURRENT LIABILITIES Long term finances - secured 7 12,520,000 2,400,000 Long term deposits 8 79,441 77,813 Deferred liabilities 9 186,837 111,334 Deferred taxation 10 5,866,359 4,989,055 18,652,637 7,578,202 CURRENT LIABILITIES Trade and other payables 11 5,454,447 5,366,340 Accrued finance cost 12 217,204 52,931 Short term borrowings - secured 13 8,571,228 3,451,352 Current portion of non-current liabilities 14 523,778 1,150,921 Derivative financial instrument 15 48,056 - Provision for taxation 35,090 35,090 14,849,803 10,056,634 CONTINGENCIES AND COMMITMENTS 16 108,371,319 83,418,265 The annexed notes 1 to 47 form an integral part of these financial statements. Chief Executive 97 DG Cement Annual Report 2017 As At June 30, 2017 2017 2016 Note (Rupees in thousand) ASSETS NON-CURRENT ASSETS Property, plant and equipment 17 62,447,737 39,576,830 Intangible assets 18 - - Investments 19 18,564,054 12,947,976 Long term loans and deposits 20 58,844 57,938 81,070,635 52,582,744 CURRENT ASSETS Stores, spare parts -

Annual Report 2013 22 23

Operating as an Open-end Equity Fund Since 1962, NI(U)T is the flagship carrier of a diversified portfolio of collective Investment Schemes managed by NITL. With net assets of over PKR 47.297 billion and 55,109 unit holders, it is the first and largest mutual fund in Pakistan. 20 21 NATIONAL INVESTMENT (UNIT) TRUST FUND MANAGER REPORT 2012-2013 NI(U)T Objective The core objective of NI(U)T is to maximize return for Unit holders, provide a regular stream of current income through dividends, while long term growth is achieved by the management of diversified portfolio and investments into growth and high yielding equity securities. CORPORATE INFORMATION Profile of Investment Manager National Investment Trust Ltd. (NITL) is the first Asset Management Company of Pakistan, formed in 1962. NITL is the largest asset management company of Pakistan with approximately Rs. 81 billion assets under management. The family of Funds of NIT comprises of five funds including 3 equity Funds and 2 fixed income nature Funds. NIT’s distribution network comprises of 24 NIT branches and various Authorized bank branches all over Pakistan. To cater the matters relating to investments in NIT and day to day inquiries / issues of NIT’s unit holders, state of the art Investors’ Facilitation Centre is also in place. The Board of Directors of NITL consists of top executives from leading financial institutions, prominent industrialists and nominee of Govt. of Pakistan. The Company has been assigned an Asset Manager rating of “AM2-” by Pakistan Credit Rating Agency, which FUND NAME reflects the company’s very strong capacity to manage the risks inherent in the asset management business and the asset manager meets very high investment management industry standards and benchmarks. -

Mrs. Naz Mansha Mian Raza Mansha

D. G. KHAN CEMENT COMPANY LIMITED PROFILE OF CANDIDATES CONSENTED TO CONTEST ELECTION OF DIRECTORS TO BE HELD IN ANNUAL GENERAL MEETING SCHEDULED ON OCTOBER 31, 2016 MRS. NAZ MANSHA Mrs. Naz Mansha has over 30 years’ experience as a Director on the Board of different companies. She has been associated with D. G. Khan Cement Company Limited (DGKCC) since 1994 and she is also a Director on the Board of Nishat Paper Products Company Limited, a subsidiary of DGKCC. MIAN RAZA MANSHA Mian Raza Mansha has more than 21 years diversified professional experience in various business sectors including Banking, Textile, Power, Cement, Insurance, Hotels, Properties, Natural Gas, Agriculture, Dairy etc. He received his Bachelor degree from the University of Pennsylvania, USA. Currently he is on the Board of: Director/Chief Executive Officer • D. G. Khan Cement Company Limited • Nishat Paper Products Co. Limited • Nishat Developers (Pvt.) Limited • Nishat (Gulberg) Hotels and Properties Ltd. Director • MCB Islamic Bank Limited • Nishat Hotels & Properties Limited • Sui Northern Gas Pipeline Limited • Adamjee Life Assurance Company Limited • MNET Services (Pvt.) Limited • Nishat (Raiwind) Hotels and Properties Ltd. D. G. KHAN CEMENT COMPANY LIMITED PROFILE OF CANDIDATES CONSENTED TO CONTEST ELECTION OF DIRECTORS TO BE HELD IN ANNUAL GENERAL MEETING SCHEDULED ON OCTOBER 31, 2016 • Nishat (Aziz Avenue) Hotels and Properties Ltd • Nishat Dairy (Pvt.) Limited • Euronet Pakistan (Pvt.) Limited • Nishat Agriculture Farming (Pvt.) Limited • Nishat Farm Supplies (Pvt.) Limited MR. KHALID NIAZ KHAWAJA Mr. Khalid Niaz Khawaja is a Fellow of Institute of Bankers, Pakistan. He has more than 44 years’ experience to work in different capacities in banking industry and CEO in one of the leading Leasing company. -

Standard Capital Securities (Pvt.) Ltd

Standard Capital Securities (Pvt.) Ltd. SCS Research | Market Report Committed to intelligent investing REP-033 also log onto www.jamapunji.pk Daily Market Summary Statistics Report…. July 1, 2020 REP-033 also log onto PSX Market Indexwww.jamapunji.pk 1-July-20 Current Net Net High Low Volume Indices Index Change Change % KSE 100 Index 34,889.41 34,924.29 34,409.87 (+467.49) +1.34% 196,705,840 KSE-30 Index 15,121.75 15,150.75 14,844.74 (+259.50) +1.72% 116,425,120 KMI-30 Index 56,561.65 56,661.86 54,995.25 (+1,566.40) +2.77% 130,754,297 All Share Index 24,959.44 24,996.90 24,660.31 (+299.13) +1.20% 315,035,920 KMI All Shares Index 17,441.70 17,475.04 17,069.10 (+372.60) +2.14% 186,744,837 NIT Pakistan Gateway 7,920.79 7,937.12 7,763.88 (+140.40) +1.80% 22,220,096 Index(NITPGI) UBL Pak. Enterprise 10,335.18 10,359.86 10,160.58 (+142.34) +1.40% 11,886,818 Index(UPP9) 30-June-20 Previous Net Net High Low Volume Indices Index Change Change % KSE 100 Index 34,421.92 34,424.61 34,146.05 (+240.12) +0.70% 124,361,318 KSE-30 Index 14,862.25 14,865.31 14,741.74 (+109.64) +0.74% 66,108,648 KMI-30 Index 54,995.25 55,215.22 54,840.77 (+27.53) +0.05% 66,155,990 All Share Index 24,660.31 24,699.82 24,474.85 (+149.48) +0.61% 223,159,558 KMI All Shares Index 17,069.10 17,126.05 17,017.82 (+14.23) +0.08% 98,992,840 NIT Pakistan Gateway 7,780.39 7,788.60 7,704.38 (+62.75) +0.81% 18,325,926 Index(NITPGI) UBL Pak. -

ADAMJEE LIFE ASSURANCE COMPANY LIMITED List of Associated Undertakings As of September, 2018

ADAMJEE LIFE ASSURANCE COMPANY LIMITED List of Associated Undertakings as of September, 2018 Parent / Holding Company Website Adamjee Insurance Co. Ltd http://www.adamjeeinsurance.com/ Associated Companies Website Hollard Life Assurance Company Limited/ IVM Intersurer B.V. https://www.hollard.co.za/ D.G.Khan Cement Co. Ltd. http://www.dgcement.com/ Din Leather Pvt Ltd. http://www.dinleather.dingroup.com.pk/ Din Textile Mills Ltd. http://www.dinleather.dingroup.com.pk/ Euronet Pakistan (Pvt.) Limited https://www.euronetpakistan.com/ Gulf Nishat Apparel Limited https://www.nishatpak.com/gna.html Hyundai Nishat Motor (Pvt) Limited http://www.nishatmillsltd.com/ Lalpir Power Limited (Formerly AES Lalpir (Pvt.) Ltd.) http://www.lalpir.com/ MCB Arif Habib Saving & Investment Ltd. http://www.mcbah.com/ MCB Bank Ltd. https://www.mcb.com.pk/ MCB Financial Services Ltd. https://www.mcb.com.pk/ MCB Foundation http://www.mcbef.com.pk/ MCB Islamic Bank Limited https://www.mcbislamicbank.com/ MNET Services (Pvt) Ltd. https://www.mcb.com.pk/about-mcb/group-companies Nishat Agriculture Farming (Pvt.) Limited (Common Directorship) http://www.nishatmillsltd.com/nishat/nishat-group.htm Nishat Chunian Power Limited. http://www.nishat.net/ Nishat Dairy Pvt Ltd (Common Directorship) http://www.nishatdairy.com/ Nishat Developers (Private) Limited http://www.nishatmillsltd.com/nishat/nishat-group.htm Nishat Farm Supplies (Pvt.) Limited http://www.nishatmillsltd.com/ Nishat Hospitality Pvt. Ltd. http://nishathospitality.com/ Nishat Hotels & Properties Ltd. https://nishathotels.com/ Nishat Linen https://www.nishatlinen.com/ Nishat Mills Ltd. http://www.nishatmillsltd.com/ Nishat Paper Products Co Ltd. http://www.nishatpaper.com/ Nishat Power Ltd. http://www.nishatpower.com/ Pakgen Power Limited (Formerly AES Pak Gen (Pvt) Co) http://pakgenpower.com/ Security General Insurance Co. -

Newsletter Vol-10

1 2 2nd International Conferences Conference on Business, Corner Economics and Education Management Professor at School of Management University Sukkur IBA University hosted Sains, Malaysia, Dr. Mohammad Memon, 2nd International Conference on Chairman BISE, Hyderabad and Economics, Business, Education Management (ICEBM). The conference was attended by more than 300 participants from 40 National and International Universities and more than 100 papers were presented in the conference. Chief Guest of the conference, leader of the opposition national assembly of Pakistan, Syed Khursheed Ahmed Shah while speaking to audience said “As a politician I often worry about the declining economic condition of the country, because 40 years ago Pakistan’s economy was far more better than Saudi Arabia, Korea and Dr. Dawood Ashraf Senior Researcher at other countries” Islamic Research and Training Institute Bangor The key note speakers including, University, Saudi Arabia shed light on the Dr. Rosella Castellano Professor and economic reforms and changing economic Researcher at University of Macerata, trends and urged to promote culture of savings Italy, Dr. Ramayah Tharasamy to safeguard future. Penalists including, Dr. Ijaz Shafi Gillani Head of Gallup Pakistan, Dr. Mohammad Zaki Rashdi Director and Associate Dean at Iqra University, Dr. Tariq Kaleem, Executive Director at Institute of Charter Accountants Pakistan and Ms. Almas Abbas held brainstorming session on economic and educational reforms. On the concluding day prizes and souvenirs were distributed among the winners by the Registrar Sukkur IBA University Engr. Zahid Hussain Khand. 3 Conference on the Concept of Community Colleges in Pakistan Conference on the Concept of Dahar while addressing the conference said that Community Colleges in Pakistan was Sindh government is doing its utmost to overcome organized by Sukkur IBA University shortcomings in the education sector. -

Standard Capital Securities (Pvt.) Ltd

Standard Capital Securities (Pvt.) Ltd. SCS Research | Market Report Committed to intelligent investing REP-033 also log onto www.jamapunji.pk Daily Market Summary Statistics Report…. November 3, 2020 REP-033 also log onto Sales desk note… www.jamapunji.pk KSE100 closed at 40480.88 i.e. 1368.7 point plus. It made a high of 40499.64. US election results will sway international markets. Results will likely to be known tomorrow morning in Pakistan. Some economic indicators showing improvement despite negative media coverage. Monthly exports, monthly revenue etc showing some improvement. Monthly CPI too deceased slightly. PM announced package for industries on reducing electricity tariffs. This was actually reported yesterday in press. Yesterday KSE100 rebounded from ~39200. It can show resistance at 41863. Faisal Shaji REP033 www.scstrade.com Disclaimer: This report has been prepared by Standard Capital Securities (Pvt) Ltd. and is provided for information purposes only. The information and data on which this report is based are obtained from sources which we believe to be reliable but we do not guarantee that it is accurate or complete. Standard Capital Securities (Pvt) Ltd. accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents. Investors are advised to take professional advice before making investments and Standard Capital Securities (Pvt) Ltd. does not take any responsibility and shall not be held liable for undue reliance on this report. This report may not be reproduced, distributed or published by any recipient for any purpose. Standard Capital Securities (Pvt.) Ltd. SCS Research | Market Report Committed to intelligent investing REP-033 also log onto www.jamapunji.pk Daily Market Summary Statistics Report…. -

Exd Company Profile

Company Profile AGENDA 01Su ExD - At a Glance 02Su SAP 03Su Oracle 04Su Digital 05Su Outsourcing 06Su Optimisation 07Su Core Values At a Glance Technology Services Outsourcing Services Optimization Services ■ ERP ■ IT Outsourcing ■ Technology Selection • SAP S/4HANA • IT/HR/Finance Organization ■ Business Process Reengineering • SAP Business One • IT Support Helpdesk ■ Change Management • SAP Business By Design • Software Development ■ System Audit & Review • SAP C/4HANA • Infrastructure Management ■ IT Organization Design • SAP Ariba • E-commerce ■ Development of IT Strategy • SAP SuccessFactors • Digital Media Marketing ■ IT Procurement Services • SAP Fiori • SAP Analytics ■ Accounting ■ IT Contract Negotiation • Oracle EBS • Back office services ■ TCO Reduction • Oracle Cloud ■ Training ■ Offsite Support • IFS • Help Desk (http://support.exdnow.com/) ■ Digital ■ Onsite Support • Secondary Sales Solution • Dedicated Resources • Big Data Analytics • E-commerce (Shopify/Magento) • On call basis • AI Chatbot Office Locations Office Locations Offices Opening Soon Karachi Lahore Toronto Islamabad Melbourne Denver Kuala Lumpur Dubai Riyadh Doha Awards FASTEST GROWING PARTNER 2011 Awards Recognitions INFORMATION ECONOMY REPORT The Software Industry & 2012 Developing Countries ExD was highlighted in the UNCTAD Information Economy Report 2012 from United Nations. Partners Our Customers Nishat Chunian Group Wateen Telecom Our Customers – List ▪ WASCO, Saudi Arabia ▪ Ghani group ▪ Saudi Electric Services Polytechnic, Dammam, Saudi Arabia ▪ Pepsico -

D.G. Khan Cement Company Limited

D.G. Khan Cement Company Limited CONTENTS D.G. Khan Cement Company Limited Corporate Profile 2 Directors’ Report 3 Condensed Interim Balance Sheet 6 Condensed Interim Profit and Loss Account 8 Condensed Interim Cash Flow Statement 9 Condensed Interim Statement of Changes in Equity 10 Selected Notes to the Condensed Interim Financial Statements 11 D.G. Khan Cement Company Limited and its Subsidiary Directors’ Report 19 Condensed Interim Consolidated Balance Sheet 20 Condensed Interim Consolidated Profit and Loss Account 22 Condensed Interim Consolidated Cash Flow Statement 23 Condensed Interim Consolidated Statement of Changes in Equity 24 Selected Notes to the Condensed Interim Consolidated Financial Statements 25 1 D.G. Khan Cement Company Limited CORPORATE PROFILE Board of Directors Mrs. Naz Mansha Chairperson Mian Raza Mansha Chief Executive Mr. Khalid Qadeer Qureshi Mr. Zaka-ud-Din Mr. Muhammad Azam Mr. Inayat Ullah Niazi Chief Financial Officer Ms. Nabiha Shahnawaz Cheema Audit Committee Mr. Khalid Qadeer Qureshi Member/Chairman Mr. Muhammad Azam Member Ms. Nabiha Shahnawaz Cheema Member Company Secretary Mr. Khalid Mahmood Chohan Bankers Allied Bank Limited Askari Bank Limited Bank Alfalah Limited Citibank N.A. Deutsche Bank AG Dubai Islamic Bank Pakistan Limited Faysal Bank Limited Habib Bank Limited HSBC Limited MCB Bank Limited Meezan Bank Limited National Bank of Pakistan NIB Bank Limited Standard Chartered Bank (Pakistan) Limited The Bank of Punjab The Royal Bank of Scotland (Formerly ABN AMRO Bank (Pakistan) Limited) United Bank Limited Auditors KPMG Taseer Hadi & Co., Chartered Accountants Legal Advisor Mr. Shahid Hamid, Bar-at-Law Registered Office Nishat House, 53-A, Lawrence Road, Lahore-Pakistan UAN: 92-42-111-11- 33 - 33 92-42-6367812 Fax: 92-42-6367414 Email: [email protected] web site: www.dgcement.com Factory 1. -

Nishat Chunian Limited Nishat (Chunian) Limited 1 2020 2020 2 Nishat (Chunian) Limited BRIEF PROFILE

ANNUAL REPORT 2020 Nishat Chunian Limited Nishat (Chunian) Limited 1 2020 2020 2 Nishat (Chunian) Limited BRIEF PROFILE Diversified into Retail Business 2016 The Linen Company (TLC) Diversified into Cinema Business 2015 NC Entertainment Private Limited 2014 46 MW Coal Based Power Plant Established a subsidiary company in 2013 USA 2 Spinning Mills acquired & a new Spin- 2013 ning Mill started 2010 IPP commercial operations 2006 Diversified into Home Textiles Acquisition of 2 Spinning Mills & 5th 2005 Spinning Mill Started 2000 2nd Spinning Mill started production 1998 Diversified into Weaving 1st Spinning Mill Setup 1991 Nishat (Chunian) Limited 2020 1 2020 2 Nishat (Chunian) Limited CONTENTS Company Information 04 Notice of Annual General Meeting 05 Chairperson’s Review Report 14 Director’s Report 17 Financial Highlights 26 Statement of Compliance with the Code of Corporate Governance 28 Review Report to the Members on Statement of Compliance with Best Practices of Code of Corporate Governance 30 Independent Auditor’s Report 31 Nishat (Chunian) Limited – Financial Statements Statement of Financial Position 36 Statement of Profit or Loss 38 Statement of Comprehensive Income 39 Statement of Cash Flows 40 Statement of Changes in Equity 41 Notes to the Financial Statements 42 Pattern of Shareholding 93 Categories of Shareholders 96 Consolidated Financial Statements Independent Auditor’s Report 98 Statement of Financial Position 102 Statement of Profit or Loss 104 Statement of Comprehensive Income 105 Statement of Cash Flows 106 Statement of Changes in Equity 107 Notes to the Consolidated Financial Statements 108 Forms 172 Nishat (Chunian) Limited 3 2020 COMPANY INFORMATION Board of Directors: Bankers to the Company: Mrs. -

List of Shareholders Without Cnic

D.G. KHAN CEMENT COMPANY LIMITED LIST OF SHAREHOLDERS WITHOUT CNIC Sr. No. DIVIDEND FOLIO NAME OF SHAREHOLDER TOTAL % of GROSS ZAKAT TAX NET DIVIDEND CINC NTN PASSPORT ADDRESS WARRANT NO. SHARES Shareholding DIVIDEND DEDUCTED DEDUCTED AMOUNT NO. NO. NO. 1 1006865066 000000000003 MR. JAVED AHMAD 118 0.00 590.00 30.00 103.00 457.00 C/O D.S. CORPORATION (PVT.) LTD. 20-K, GULBERG II, LAHORE 2 1006865067 000000000005 MR. MOHIB-UL-HAQ 366 0.00 1,830.00 - 320.00 1,510.00 APARTMENTS SF2, BLOCK-40 SEA VIEW APARTMENTS DEFENCE PHASE V KARACHI 3 1006865147 000000000867 MUHAMMAD ARSHAD FARUQUI 212 0.00 1,060.00 53.00 186.00 821.00 29/II, 16TH STREET KH-TANZEEM, PHASE 5, DEFENCE KARACHI. 4 1006865148 000000000888 MRS. SHAMIM AKHTER 6 0.00 30.00 2.00 5.00 23.00 12 SIND CLOTH MARKET M.A. JINNAH ROAD KARACHI. 5 1006865150 000000000943 YASMEEN AGHA 4,538 0.00 22,690.00 1,135.00 3,971.00 17,584.00 77/1, 12TH STREET, D.H.A., PHASE-VI KARACHI. 6 1006865151 000000000970 MISS SAIRA SHAFI 100 0.00 500.00 - 88.00 412.00 B-21, KDA SCHEME NO.1 OFF: SHAHRAH FAISAL KARACHI 7 1006865153 000000000984 MR. ISMAIL LALA 484 0.00 2,420.00 121.00 424.00 1,875.00 FLAT NO. 4, AZIZ MANSION 235 STRECHEN ROAD KARACHI.-74200 8 1006865154 000000000991 MR. IQBAL HUSSAIN SIDDIQUI 1 0.00 5.00 - 1.00 4.00 HOUSE NO. R-433, BLOCK NO. 18, F. -

D. G. Khan Cement Company Limited Profile of The

D. G. KHAN CEMENT COMPANY LIMITED PROFILE OF THE PERSONS CONSENTED TO CONTEST ELECTION OF DIRECTORS TO BE HELD IN ANNUAL GENERAL MEETING SCHEDULED ON OCTOBER 28, 2019 MRS. NAZ MANSHA Mrs. Naz Mansha has over 32 years’ experience as a Director on the Board of different companies. She has been associated with D. G. Khan Cement Company Limited (DGKCC) since 1994 and she is also a Chief Executive of Nishat Linen (Private) Limited, a subsidiary of Nishat Mills Limited and Director/Chief Executive of Emporium Properties (Pvt) Limited and Director on the Board of Golf View Land (Pvt) Limited. MIAN RAZA MANSHA Mian Raza Mansha has more than 23 years diversified professional experience in various business sectors including Banking, Textile, Power, Cement, Insurance, Hotels, Properties, Natural Gas, Agriculture, Dairy etc. He received his Bachelor degree from the University of Pennsylvania, USA. Currently he is on the Board of: Director/Chief Executive Officer • D. G. Khan Cement Company Limited • Nishat Paper Products Co. Limited • Nishat Developers (Pvt.) Limited • Nishat (Gulberg) Hotels and Properties Ltd. Director • MCB Islamic Bank Limited • Nishat Hotels & Properties Limited • MNET Services (Pvt.) Limited • Nishat (Raiwind) Hotels and Properties Ltd. • Nishat (Aziz Avenue) Hotels and Properties Ltd • Nishat Dairy (Pvt.) Limited • Euronet Pakistan (Pvt.) Limited • Nishat Agriculture Farming (Pvt.) Limited • Hyundai Nishat Motor (Pvt.) Limited • Nishat Agrotech Farms (Pvt) Limited MR. KHALID NIAZ KHAWAJA Mr. Khalid Niaz Khawaja is a Fellow of Institute of Bankers, Pakistan. He has more than 46 years’ experience to work in different capacities in banking industry and CEO in one of the leading Leasing company.