1St Quarter – Mackenzie China A-Shares CSI 300 Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chinaamc CSI 300 Index ETF (Stock Code: 83188/3188) Fund Factsheet

ChinaAMC CSI 300 Index ETF (Stock Code: 83188/3188) Fund Factsheet As of 29 Apr 2016 37/F, Bank of China Tower, 1 Garden Road, Hong Kong • ChinaAMC CSI 300 Index ETF (the ”Fund”) is a passively managed exchange traded fund and is listed on The Stock Exchange of Hong Kong Limited (the “SEHK”), investing primarily and directly in underlying A-Shares of CSI 300 Index through the Renminbi Qualified Foreign Institutional Investor (“RQFII”) quota obtained by the Fund’s Manager. • The Fund is subject to single country (the PRC) concentration risk. Investing in emerging markets, such as the PRC, involves a greater risk such as greater political, tax, economic, foreign exchange, liquidity and regulatory risks. • The RQFII policy and rules are new and such policy and rules are subject to change, such changes may have retrospective effect. Repatriations of the invested capital and net profits by RQFIIs are permitted daily and are not subject to any lock-up periods or prior approval. There is no assurance, however, that repatriation restrictions will not be imposed in the future. Any new restrictions on repatriation may impact on the Fund’s ability to meet redemption requests. • There are risks and uncertainties associated with the current PRC tax laws and regulations. The Manager will at present make certain provisions for the Fund in respect of any potential tax liability. In case of any shortfall between the provision and actual tax liabilities, which will be debited from the Fund’s assets, the Fund’s asset value will be adversely affected. • The SEHK’s dual counter model in Hong Kong is new and the Fund is one of the first ETFs to have units traded and settled in RMB and HKD. -

1 30 May 2016 Adjustment for CES China Cross Border Index Series

30 May 2016 Adjustment for CES China Cross Border Index Series and Gaming Index China Exchanges Services Company Limited and its index services agent, China Securities Index Company Limited, will make the following changes to the constituents of CES China Cross Border Index Series and CES Gaming Top 10 Index. The adjustments will be implemented after the close of relevant exchange on 10 June 2016. The reserve list is effective immediately. CES China 120 Index Addition Code Exchange Stock Name 001979 SZE China Merchants Shekou Industrial Zone Holdings Co Ltd 300059 SZE East Money Information Co Ltd 600606 SSE Greenland Holdings Corporation Ltd 600871 SSE Sinopec Oilfield Service Corporation 0270 SEHK Guangdong Investment Ltd 3333 SEHK Evergrande Real Estate Group Ltd 3799 SEHK Dali Foods Group Co Ltd Deletion Code Exchange Stock Name 600031 SSE Sany Heavy Industry Co Ltd 601225 SSE Shaanxi Coal Industry Co Ltd 601600 SSE Aluminum Corporation of China Ltd 603288 SSE Foshan Haitian Flavouring and Food Co Ltd 0288 SEHK WH Group Ltd 1088 SEHK China Shenhua Energy Co Ltd 1114 SEHK Brilliance China Automotive Holdings Ltd Reserve List Share Rank Code Exchange Stock Name Segment A Shares 1 600061 SSE SDIC Essence Co Ltd 2 002027 SZE Focus Media Information Technology Co 1 Ltd 3 601111 SSE Air China Ltd 4 002673 SZE Western Securities Co Ltd 5 600518 SSE Kangmei Pharmaceutical Co Ltd 1 2018 SEHK AAC Technologies Holdings Inc 2 1988 SEHK China Minsheng Banking Corp Ltd HK-listed Shenzhou International Group Holdings Mainland 3 2313 SEHK Shares -

C-Shares CSI 300 Index ETF Prospectus 匯添富資產管理(香 港)有限公司

China Universal International ETF Series C-Shares CSI 300 Index ETF Prospectus 匯添富資產管理(香 港)有限公司 China Universal Asset Management (Hong Kong) Company Limited 2701 One IFC, 1 Harbour View Street, Central, Hong Kong Tel: (852) 3983 5600 Fax: (852) 3983 5799 Email: [email protected] Web: www.99fund.com.hk Important - If you are in any doubt about the contents of this Prospectus, you should consult your stockbroker, bank manager, solicitor, accountant and/or other financial adviser for independent professional financial advice. CHINA UNIVERSAL INTERNATIONAL ETF SERIES (a Hong Kong umbrella unit trust authorized under Section 104 of the Securities and Futures Ordinance (Cap. 571) of Hong Kong) C-Shares CSI 300 Index ETF (Stock Codes: 83008 (RMB counter) and 03008 (HKD counter)) PROSPECTUS MANAGER China Universal Asset Management (Hong Kong) Company Limited LISTING AGENT FOR C-Shares CSI 300 Index ETF GF Capital (Hong Kong) Limited 3 July 2013 The Stock Exchange of Hong Kong Limited (“SEHK”), Hong Kong Exchanges and Clearing Limited (“HKEx”), Hong Kong Securities Clearing Company Limited (“HKSCC”) and the Hong Kong Securities and Futures Commission (“Commission”) take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. China Universal International ETF Series (“Trust”) and its sub-funds set out in Part 2 of this Prospectus, including its initial Sub-Fund, C-Shares CSI 300 Index ETF (“CSI 300 ETF”) (collectively referred to as the “Sub- Funds”) have been authorised by the Commission pursuant to section 104 of the Securities and Futures Ordinance. -

E FUND CSI 100 A-Share Index ETF

IMPORTANT: The Stock Exchange of Hong Kong Limited (the “SEHK”), Hong Kong Exchanges and Clearing Limited (“HKEx”), the Securities and Futures Commission (“SFC”) and the Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Announcement. The Manager accepts full responsibility for the accuracy of the information contained in this Announcement as at the date of publication, and confirms, having made all reasonable enquiries, that to the best of its knowledge and belief, there are no other facts the omission of which would make any statement misleading and opinions expressed in this Announcement have been arrived at after due and careful consideration. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF IN DOUBT, PLEASE SEEK PROFESSIONAL ADVICE. E FUND CSI 100 A-Share Index ETF RMB Counter Stock Code: 83100 HKD Counter Stock Code: 03100 (Sub-fund of E Fund ETFs Trust (the “Trust”), a Hong Kong umbrella unit trust, authorised under Section 104 of the Securities and Futures Ordinance (Cap. 571 of the laws of Hong Kong SAR)) Announcement Change of Underlying Index and Change of Name and Short Name of the Sub-Fund Dear Unitholders, E Fund Management (Hong Kong) Co., Limited (the “Manager”), the manager of the Trust and the Sub- Fund, hereby announces that, with effect from 7 December 2020 (the “Effective Date”), the underlying index of the Sub-Fund will be changed to CSI 300 Index. -

Chinaamc CSI 300 Index ETF (The "Fund"), Investor Should Refer to the Fund's Prospectus for Details, Including the Risk Factors

Investment involves risks, including the loss of principle. Past performance is not indicative of future results. Before investing in the ChinaAMC CSI 300 Index ETF (the "Fund"), investor should refer to the Fund's prospectus for details, including the risk factors. You should not make investment decision based on the information on this material alone. Please note: • The Fund aims to provide investment result that, before fees and expenses, closely corresponds to the performance of the CSI 300 Index (the "Index"). The Fund invests in the PRC's securities market through the RQFII investment quota granted to the Manager and the Stock Connect. • The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region (the PRC) and may likely be more volatile than a broad-based fund. • The Fund is subject to risks relating to the RQFII regime, such as default in execution or settlement of transaction by a PRC broker or the PRC Custodian, change of RQFII policy and rules and uncertainty to their implementa- tion, repatriation restrictions and insufficient RQFII quota to the Fund. • The Fund is subject to risks associated with the Stock Connect, such as change of relevant rules and regulations, quota limitations, suspension of the Stock Connect programme. In the event that the Fund’s ability to invest in A-Shares through the Stock Connect on a timely basis is adversely affected, the Manager can only rely on RQFII investments to achieve the Fund’s investment objective. • Investing in emerging markets, such as the PRC, involves a greater risk such as greater political, tax, economic, foreign exchange, liquidity and regulatory risks. -

Schedule of Investments (Unaudited) Ishares MSCI Total International Index Fund (Percentages Shown Are Based on Net Assets) September 30, 2020

Schedule of Investments (unaudited) iShares MSCI Total International Index Fund (Percentages shown are based on Net Assets) September 30, 2020 Mutual Fund Value Total International ex U.S. Index Master Portfolio of Master Investment Portfolio $ 1,034,086,323 Total Investments — 100.4% (Cost: $929,170,670) 1,034,086,323 Liabilities in Excess of Other Assets — (0.4)% (3,643,126) Net Assets — 100.0% $ 1,030,443,197 iShares MSCI Total International Index Fund (the “Fund”) seeks to achieve its investment objective by investing all of its assets in International Tilts Master Portfolio (the “Master Portfolio”), which has the same investment objective and strategies as the Fund. As of September 30, 2020, the value of the investment and the percentage owned by the Fund of the Master Portfolio was $1,034,086,323 and 99.9%, respectively. The Fund records its investment in the Master Portfolio at fair value. The Fund’s investment in the Master Portfolio is valued pursuant to the pricing policies approved by the Board of Directors of the Master Portfolio. Fair Value Hierarchy as of Period End Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows: • Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access • Level 2 – Other observable inputs (including, but not limited to, quoted prices -

Stock Balances on 18 July 2020

Attachment 2 Stock Balances on 18 July 2020 Pre-set Stock Balances for Northbound Trading For each CCEP and each Institutional Investor (II) ID allocated to CCEP will have the maximum sellable quantity 10,000 for the following stocks during the MR on 18 July 2020. For each Short Selling Security in the testing, the maximum number of shares available for short selling is 10,000. Stock Balance SSE Stock Stock Code Eligible for Short Stock Name for each EP and Code Mapping in CCASS Sell II assigned 600016 90016 CHINA MINSHENG BANKING CORP., LTD. Yes 10,000 600019 90019 BAOSHAN IRON & STEEL CO., LTD. Yes 10,000 CHINA SOUTHERN AIRLINES COMPANY 600029 90029 Yes 10,000 LIMITED 600031 90031 SANY HEAVY INDUSTRY CO.,LTD Yes 10,000 600036 90036 CHINA MERCHANTS BANK CO.,LIMITED Yes 10,000 CHINA UNITED NETWORK COMMUNICATIONS 600050 90050 Yes 10,000 LIMITED 600276 90276 JIANGSU HENGRUI MEDICINE CO.,LTD. Yes 10,000 CHINA GRAND AUTOMOTIVE SERVICES GROUP 600297 90297 No 10,000 CO.,LTD 600690 90690 HAIER SMART HOME CO., LTD. Yes 10,000 INNER MONGOLIA YILI INDUSTRIAL GROUP 600887 90887 Yes 10,000 CO.,LTD Stock Balance SZSE Stock Stock Code Eligible for Short Stock Name for each EP and Code Mapping in CCASS Sell II assigned 000001 70001 PING AN BANK CO., LTD. Yes 10,000 000002 70002 CHINA VANKE CO., LTD Yes 10,000 000725 70725 BOE TECHNOLOGY GROUP CO., LTD Yes 10,000 FOCUS MEDIA INFORMATION TECHNOLOGY 002027 72027 Yes 10,000 CO.,LTD GREE ELECTRIC APPLIANCES,INC.OF ZHUHAI 000651 70651 Yes 10,000 CO.,LTD 000338 70338 WEICHAI POWER CO., LTD. -

Evidence from the CSI 300 Index Additions and Deletions

Asymmetric Responses to Stock Index Reconstitutions: Evidence from the CSI 300 Index Additions and Deletions Ching-Ting Lina,* a Department of Money and Banking, National Chengchi University, 64, Sec. 2, Zhi-Nan Road, Wenshan District, Taipei 11605, Taiwan R.O.C. Wei-Kuang Chenb,† b Department of Money and Banking and Risk and Insurance Research Center, National Chengchi University, 64, Sec. 2, Zhi-Nan Road, Wenshan District, Taipei 11605, Taiwan R.O.C. *Corresponding author. Tel: 886-2-2939-3091ext.81248. Email: [email protected]. †Tel: 886-2-2939-3091ext.81220. Email: [email protected]. Asymmetric Reponses to Stock Index Reconstitutions: Evidence from the CSI 300 Index Additions and Deletions Abstract This study investigates constituent changes to the CSI 300 index, which is scheduled semiannually in accordance with clearly-stated selection methodology. We find that stocks experience a permanent price increase and receive optimistic EPS forecasts from analysts following their addition to the index. These optimistic earnings expectations are supported by increased capital-raising activities and capital expenditure. Conversely, we do not find any significant results for index deletions. Evidence in the form of changes in the number of shareholders and shadow costs are consistent with the investor awareness theory. Increased investor awareness and monitoring forces newly-added firms to perform effectively, resulting in the attraction of more newly-issued capital from investors due to the firms’ lower cost of capital. Monitoring and management efficiency, however, would not lessen sharply for deletions. JEL Classification: G12, G14, G20. Keywords: CSI 300 index; stock index reconstitution; investor awareness; analyst EPS forecast; capital expenditure; asymmetric market response. -

A Sub-Fund of the World Index Shares Etfs (Stock Code : 2827)

W.I.S.E. – CSI 300 China Tracker® * (*This is a synthetic ETF) a sub-fund of the World Index Shares ETFs (stock code : 2827) PROSPECTUS 30 October 2015 IMPORTANT: If you are in doubt about the contents of this Prospectus, you should seek independent professional financial advice. The Stock Exchange of Hong Kong Limited (“SEHK”), the Securities and Futures Commission (“SFC”) and the Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. i IMPORTANT INFORMATION FOR INVESTORS Investors should note that an investment in the Sub-Fund is not the same as an investment in the underlying A Shares of the CSI 300 Index. The Sub-Fund primarily invests in A Share through A-Share access products, AXPs, each of which is a derivative instrument linked to an A Share or a basket of A Shares and the value of such AXPs depends entirely on the credit risk of the issuers. Also, as the Manager is a QFII, the Manager will invest directly in the PRC A Shares on behalf of the Sub-Fund to the extent of such portion of the Manager’s QFII investment quota as the Manager may allocate to the Sub-Fund. The Sub-Fund may also invest, and have direct access to, certain eligible A Shares of PRC companies listed on the Shanghai Stock Exchange (A Shares that are SSE Securities) via the Shanghai-Hong Kong Stock Connect (as defined in “Definition” section on page 9). -

Ishares Core CSI 300 ETF 82846/ As of 31/08/2021 9846

2846/ iShares Core CSI 300 ETF 82846/ As of 31/08/2021 9846 INVESTMENT OBJECTIVE FUND DETAILS The iShares Core CSI 300 Index ETF seeks to track the performance of an index Asset Class Equity composed of 300 large and mid-capitalization stocks traded on the Shanghai and Inception Date 12/11/2009 Shenzhen stock exchanges. Benchmark CSI 300 Index Number of Holdings 301 WHY 2846? Net Assets 244,617,181 CNY Management Fee (in 0.38 1 Exposure to the 300 largest stocks listed on Shanghai and Shenzhen stock %) exchanges Units Outstanding 7,750,000 2 Liquid trading vehicle for the China A-share market Domicile Hong Kong Base Currency RMB GROWTH OF 10,000 CNY SINCE INCEPTION Bloomberg CSIN0300 Benchmark Ticker TOP 10 HOLDINGS (%) KWEICHOW MOUTAI LTD A 4.97 CHINA MERCHANTS BANK LTD A 3.08 PING AN INSURANCE (GROUP) OF CHINA 2.74 WULIANGYE YIBIN LTD A 1.98 LONGI GREEN ENERGY Fund Benchmark TECHNOLOGY LTD 1.97 The chart shows change of investment amount based on a hypothetical investment in MIDEA GROUP LTD A 1.65 the Fund. INDUSTRIAL BANK LTD A 1.36 ANNUALIZED PERFORMANCE (%CNY) EAST MONEY INFORMATION LTD A 1.30 Cumulative Annualized BYD LTD A 1.28 1 Month 3 Month YTD 1 Year 3 Year 5 Year Since HANGZHOU HIKVISION DIGITAL Inception TECHNOL 1.22 Fund 0.09% -8.78% -6.68% 0.97% 14.46% 8.88% 2.83% Total 21.55 Benchmark 0.11% -8.69% -6.41% 1.40% 15.06% 9.64% 4.59% Holdings are subject to change. -

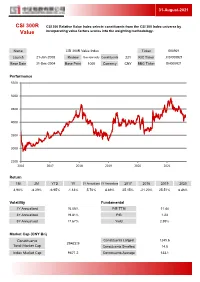

CSI 300R Value Index Ticker 000921

31-August-2021 CSI 300R CSI 300 Relative Value Index selects constituents from the CSI 300 Index universe by Value incorporating value factors scores into the weighting methodology. Name CSI 300R Value Index Ticker 000921 Launch 21-Jan-2008 Review Semiannually Constituents 221 RIC Ticker .CSI000921 Base Date 31-Dec-2004 Base Point 1000 Currency CNY BBG Ticker SH000921 Performance 5500 5000 4500 4000 3500 3000 2500 2016 2017 2018 2019 2020 2021 Return 1M 3M YTD 1Y 3Y Annualized 5Y Annualized 2017 2018 2019 2020 3.90% -8.29% -6.95% -1.13% 5.70% 4.89% 25.15% -21.20% 25.51% 8.46% Volatility Fundamental 1Y Annualized 16.05% P/E TTM 11.44 3Y Annualized 19.81% P/B 1.23 5Y Annualized 17.67% Yield 2.95% Market Cap (CNY Bn) Constituents Constituents Largest 1245.6 29422.9 Total Market Cap Constituents Smallest 14.8 Index Market Cap 9671.2 Constituents Average 133.1 31-August-2021 Exchange Breakdown Sector Breakdown 2.2% Energy 1.6% 3.8% Materials 7.3% 10.1% Industrials 26.8% Consumer Disc. 13.5% Shanghai Consumer Staples Shenzhen Health Care 11.8% 43.5% Financials 73.2% Information Tech. 4.0% Telecom. Services 2.3% Utilities Top 10 Constituents Ticker Name Sector Exchange Weight 600036 China Merchants Bank Co Ltd Financials Shanghai 6.27% 601318 Ping An Insurance (Group) Company of China Ltd Financials Shanghai 5.59% 601166 Industrial Bank Financials Shanghai 2.78% 000333 Midea Group CO., LTD Consumer Disc. Shenzhen 2.52% 600900 China Yangtze Power Co Ltd Utilities Shanghai 2.27% 600030 CITIC Securities Co Ltd Financials Shanghai 2.26% 000651 Gree Electric Appliances,Inc. -

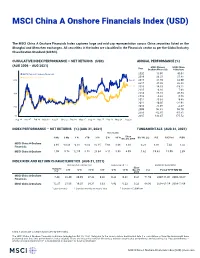

MSCI China a Onshore Financials Index (USD) (NET)

MSCI China A Onshore Financials Index (USD) The MSCI China A Onshore Financials Index captures large and mid cap representation across China securities listed on the Shanghai and Shenzhen exchanges. All securities in the index are classified in the Financials sector as per the Global Industry Classification Standard (GICS®). CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI China A MSCI China Year Onshore Financials A Onshore MSCI China A Onshore Financials 2020 13.95 40.04 MSCI China A Onshore 2019 36.27 37.48 600 599.61 2018 -21.59 -32.99 2017 27.55 20.28 518.63 2016 -14.53 -19.11 2015 -6.16 7.08 400 2014 85.16 46.53 2013 -5.68 0.75 2012 25.68 9.48 2011 -10.05 -22.91 200 2010 -22.95 -4.37 2009 98.61 96.70 2008 -62.85 -61.81 50 2007 133.47 175.52 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI China A Onshore 3.98 -13.48 -0.08 -8.83 10.15 5.98 8.66 8.38 3.21 8.86 7.43 1.02 Financials MSCI China A Onshore 1.09 -5.78 12.50 0.55 20.34 8.11 5.98 6.99 1.62 19.63 15.09 2.39 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD (%) 2000 MSCI China A Onshore 7.44 22.49 20.99 27.48 0.48 0.32 0.41 0.36 71.50 2007-11-01—2008-10-27 Financials MSCI China A Onshore 12.27 21.06 19.25 24.31 0.93 0.43 0.33 0.33 68.90 2008-01-14—2008-11-04 1 Last 12 months 2 Based on monthly net returns data 3 Based on ICE LIBOR 1M China A shares are quoted in local currency (Renminbi).