C-Shares CSI 300 Index ETF Prospectus 匯添富資產管理(香 港)有限公司

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chinaamc CSI 300 Index ETF (Stock Code: 83188/3188) Fund Factsheet

ChinaAMC CSI 300 Index ETF (Stock Code: 83188/3188) Fund Factsheet As of 29 Apr 2016 37/F, Bank of China Tower, 1 Garden Road, Hong Kong • ChinaAMC CSI 300 Index ETF (the ”Fund”) is a passively managed exchange traded fund and is listed on The Stock Exchange of Hong Kong Limited (the “SEHK”), investing primarily and directly in underlying A-Shares of CSI 300 Index through the Renminbi Qualified Foreign Institutional Investor (“RQFII”) quota obtained by the Fund’s Manager. • The Fund is subject to single country (the PRC) concentration risk. Investing in emerging markets, such as the PRC, involves a greater risk such as greater political, tax, economic, foreign exchange, liquidity and regulatory risks. • The RQFII policy and rules are new and such policy and rules are subject to change, such changes may have retrospective effect. Repatriations of the invested capital and net profits by RQFIIs are permitted daily and are not subject to any lock-up periods or prior approval. There is no assurance, however, that repatriation restrictions will not be imposed in the future. Any new restrictions on repatriation may impact on the Fund’s ability to meet redemption requests. • There are risks and uncertainties associated with the current PRC tax laws and regulations. The Manager will at present make certain provisions for the Fund in respect of any potential tax liability. In case of any shortfall between the provision and actual tax liabilities, which will be debited from the Fund’s assets, the Fund’s asset value will be adversely affected. • The SEHK’s dual counter model in Hong Kong is new and the Fund is one of the first ETFs to have units traded and settled in RMB and HKD. -

Labuan Bulletin of International Business & Finance, 9, 2011, 24 – 43

LLLaaabbbuuuaaannn BBBuuulllllllleeetttiiiinnn OF INTERNATIONAL BUSINESS & FINANCE Volume 9, 2011 ISSN 1675-7262 INTEGRATION ANALYSIS OF THE PEOPLE’S REPUBLIC OF CHINA STOCK MARKETS Hock Tsen Wong 1, Zhang Chen School of Business and Economics, Universiti Malaysia Sabah Abstract This study analyzes the integration between the People’s Republic of China stock markets, namely Shanghai Stock Exchange (SSE), Shenzhen Stock Exchange (SZSE), and Hong Kong Exchanges and Clearing Limited (HKEx), in both long run and short run for the period from 3 rd July 1997 to 30 th June 2010. As Hong Kong rejoined China in 1 st July 1997, this study would imply a view on economy development tendency particularly financial market trends after the twelve years. The result obtained from the tests indicates that there is no long-run stable relationship between the three stock markets, but short-run causality exists. JEL Classification: G14; G15 Keywords: Stock market; China; Hong Kong; Cointegration; Causality 1. Introduction As a result of economic globalization, more and more investors, portfolio managers, and policy makers concern more on long-run and short-run relationships between financial markets. The People’s Republic of China is one of the most economic powerful countries, which achieves rapid economic growth, and its finance market keeps a high speed of development and globalization (Malkiel et al., 2008). After Hong Kong rejoining China in 1997, the connection between China mainland and Hong Kong financial markets is tighter day after day. Analyzing the stock markets’ cointegration and causality would be helpful in carrying forward mainland China’s capital market internalized stably and assisting the enterprises and investors being 1 Corresponding author: Locked Bag No. -

E FUND CSI 100 A-Share Index ETF

IMPORTANT: The Stock Exchange of Hong Kong Limited (the “SEHK”), Hong Kong Exchanges and Clearing Limited (“HKEx”), the Securities and Futures Commission (“SFC”) and the Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Announcement. The Manager accepts full responsibility for the accuracy of the information contained in this Announcement as at the date of publication, and confirms, having made all reasonable enquiries, that to the best of its knowledge and belief, there are no other facts the omission of which would make any statement misleading and opinions expressed in this Announcement have been arrived at after due and careful consideration. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF IN DOUBT, PLEASE SEEK PROFESSIONAL ADVICE. E FUND CSI 100 A-Share Index ETF RMB Counter Stock Code: 83100 HKD Counter Stock Code: 03100 (Sub-fund of E Fund ETFs Trust (the “Trust”), a Hong Kong umbrella unit trust, authorised under Section 104 of the Securities and Futures Ordinance (Cap. 571 of the laws of Hong Kong SAR)) Announcement Change of Underlying Index and Change of Name and Short Name of the Sub-Fund Dear Unitholders, E Fund Management (Hong Kong) Co., Limited (the “Manager”), the manager of the Trust and the Sub- Fund, hereby announces that, with effect from 7 December 2020 (the “Effective Date”), the underlying index of the Sub-Fund will be changed to CSI 300 Index. -

Chinaamc CSI 300 Index ETF (The "Fund"), Investor Should Refer to the Fund's Prospectus for Details, Including the Risk Factors

Investment involves risks, including the loss of principle. Past performance is not indicative of future results. Before investing in the ChinaAMC CSI 300 Index ETF (the "Fund"), investor should refer to the Fund's prospectus for details, including the risk factors. You should not make investment decision based on the information on this material alone. Please note: • The Fund aims to provide investment result that, before fees and expenses, closely corresponds to the performance of the CSI 300 Index (the "Index"). The Fund invests in the PRC's securities market through the RQFII investment quota granted to the Manager and the Stock Connect. • The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region (the PRC) and may likely be more volatile than a broad-based fund. • The Fund is subject to risks relating to the RQFII regime, such as default in execution or settlement of transaction by a PRC broker or the PRC Custodian, change of RQFII policy and rules and uncertainty to their implementa- tion, repatriation restrictions and insufficient RQFII quota to the Fund. • The Fund is subject to risks associated with the Stock Connect, such as change of relevant rules and regulations, quota limitations, suspension of the Stock Connect programme. In the event that the Fund’s ability to invest in A-Shares through the Stock Connect on a timely basis is adversely affected, the Manager can only rely on RQFII investments to achieve the Fund’s investment objective. • Investing in emerging markets, such as the PRC, involves a greater risk such as greater political, tax, economic, foreign exchange, liquidity and regulatory risks. -

China's Banking Sector and the Attractiveness of Dim Sum Bond

China's banking sector and the attractiveness of Dim Sum Bond Antonello Avino in collaboration with Fjorda Vacchetti and Ludovico Gerli March 2016 Abstract China's banking system has tremendously grown in recent years. `The Big Four' keep dominating the Chinese banking system as well as they are playing an important role all over the world, mentioning in the first four positions of the largest banks ranking. In spite of its expansion, the banking sector is still suffering from serious structural and administrative issues. In order to deeply figure them out, we are going to perform a meticulous analysis of the banking sector, specifying what is the financial system adopted by China, what kinds of banks operate along with the first four banks and how the regulatory system has changed over time. Also, we are going to discuss the `parallel' banking, well-known as `shadow banking', which slowed down the growth of the banking system. Even though financial consequences of the global crisis on china have been extremely smalls, it still possible to focus our attention on changes and development of Chinese structure. This country suffered few losses in the short run whereas many projects (like the stimulus plan on 2008), reorganizations and reforms were planned in order to avoid contrary effects in the long run, both for real and financial economy. Finally, we will give a brief overview of the Dim Sum bond market aimed to internationalize the renminbi currency outside Mainland China and to lower the cost of capital. I Market-oriented or bank-oriented? Economic history and empirical economic analysis showed that the corporate finance was influenced by two different models of government in the financial market: the so-called market-oriented system, and the bank-oriented system or oriented intermediation. -

Chinese Stock Market Performance in the Time of Novel Coronavirus Pandemic

Munich Personal RePEc Archive Chinese stock market performance in the time of novel coronavirus pandemic Liew, Venus Khim-Sen and Puah, Chin-Hong Universiti Malaysia Sarawak 1 April 2020 Online at https://mpra.ub.uni-muenchen.de/100414/ MPRA Paper No. 100414, posted 17 May 2020 12:42 UTC Chinese stock market performance in the time of novel coronavirus pandemic Venus Khim-Sen Liew* Faculty of Economics and Business Universiti Malaysia Sarawak [email protected] Chin-Hong Puah Faculty of Economics and Business Universiti Malaysia Sarawak [email protected] Abstract This paper aims to quantify the effect of the deadly novel coronavirus (COVID-19) pandemic outbreak on Chinese stock market performance. Shanghai Stock Exchange Composite Index and its component sectorial indices are examined in this study. The pandemic is represented by a lockdown dummy, new COVID-19 cases and a dummy for 3 February 2020. First, descriptive analysis is performed on these indices to compare their performances before and during the lockdown period. Next, regression analysis with Exponential Generalized Autoregressive Conditional Heteroscedasticity specification is estimated to quantify the pandemic effect on the Chinese stock market. This paper finds that health care, information technology and telecommunication services sectors were relatively more pandemic-resistant, while other sectors were more severely hurt by the pandemic outbreak. The extent to which each sector was affected by pandemic and sentiments in other financial and commodity markets were reported in details in this paper. The findings of this paper are resourceful for investors to avoid huge loss amid pandemic outburst and the China Securities Regulatory Commission in handling future pandemic occurrence to cool down excessive market sentiments. -

Evidence from the CSI 300 Index Additions and Deletions

Asymmetric Responses to Stock Index Reconstitutions: Evidence from the CSI 300 Index Additions and Deletions Ching-Ting Lina,* a Department of Money and Banking, National Chengchi University, 64, Sec. 2, Zhi-Nan Road, Wenshan District, Taipei 11605, Taiwan R.O.C. Wei-Kuang Chenb,† b Department of Money and Banking and Risk and Insurance Research Center, National Chengchi University, 64, Sec. 2, Zhi-Nan Road, Wenshan District, Taipei 11605, Taiwan R.O.C. *Corresponding author. Tel: 886-2-2939-3091ext.81248. Email: [email protected]. †Tel: 886-2-2939-3091ext.81220. Email: [email protected]. Asymmetric Reponses to Stock Index Reconstitutions: Evidence from the CSI 300 Index Additions and Deletions Abstract This study investigates constituent changes to the CSI 300 index, which is scheduled semiannually in accordance with clearly-stated selection methodology. We find that stocks experience a permanent price increase and receive optimistic EPS forecasts from analysts following their addition to the index. These optimistic earnings expectations are supported by increased capital-raising activities and capital expenditure. Conversely, we do not find any significant results for index deletions. Evidence in the form of changes in the number of shareholders and shadow costs are consistent with the investor awareness theory. Increased investor awareness and monitoring forces newly-added firms to perform effectively, resulting in the attraction of more newly-issued capital from investors due to the firms’ lower cost of capital. Monitoring and management efficiency, however, would not lessen sharply for deletions. JEL Classification: G12, G14, G20. Keywords: CSI 300 index; stock index reconstitution; investor awareness; analyst EPS forecast; capital expenditure; asymmetric market response. -

A Sub-Fund of the World Index Shares Etfs (Stock Code : 2827)

W.I.S.E. – CSI 300 China Tracker® * (*This is a synthetic ETF) a sub-fund of the World Index Shares ETFs (stock code : 2827) PROSPECTUS 30 October 2015 IMPORTANT: If you are in doubt about the contents of this Prospectus, you should seek independent professional financial advice. The Stock Exchange of Hong Kong Limited (“SEHK”), the Securities and Futures Commission (“SFC”) and the Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. i IMPORTANT INFORMATION FOR INVESTORS Investors should note that an investment in the Sub-Fund is not the same as an investment in the underlying A Shares of the CSI 300 Index. The Sub-Fund primarily invests in A Share through A-Share access products, AXPs, each of which is a derivative instrument linked to an A Share or a basket of A Shares and the value of such AXPs depends entirely on the credit risk of the issuers. Also, as the Manager is a QFII, the Manager will invest directly in the PRC A Shares on behalf of the Sub-Fund to the extent of such portion of the Manager’s QFII investment quota as the Manager may allocate to the Sub-Fund. The Sub-Fund may also invest, and have direct access to, certain eligible A Shares of PRC companies listed on the Shanghai Stock Exchange (A Shares that are SSE Securities) via the Shanghai-Hong Kong Stock Connect (as defined in “Definition” section on page 9). -

Interim Report 2019

INTERIM REPORT 2019 2019 INTERIM REPORT www.cs.ecitic.com I M P O R T A N T N O T I C E The Board and the Supervisory Committee of the Company and the Directors, Supervisors and Senior Management warrant the truthfulness, accuracy and completeness of contents of this interim report and that there is no false representation, misleading statement contained herein or material omission from this interim report, for which they will assume joint and several liabilities. This interim report was considered and approved at the 44th Meeting of the Sixth Session of the Board. All Directors attended the meeting. No Director raised any objection to this interim report. The 2019 interim financial statements of the Company were unaudited. PricewaterhouseCoopers Zhong Tian LLP and PricewaterhouseCoopers issued review opinions in accordance with the China and international review standards, respectively. Mr. ZHANG Youjun, head of the Company, Mr. LI Jiong, the person-in-charge of accounting affairs and Ms. KANG Jiang, head of the Company’s accounting department, warrant that the financial statements set out in this interim report are true, accurate and complete. There was no profit distribution plan or plan of conversion of the capital reserve into the share capital of the Company for the first half of 2019. Forward looking statements, including future plans and development strategies, contained in this interim report do not constitute a substantive commitment to investors by the Company. Investors should be aware of investment risks. There was no appropriation of funds of the Company by the related/connected parties for non-operating purposes. -

Ishares Core CSI 300 ETF 82846/ As of 31/08/2021 9846

2846/ iShares Core CSI 300 ETF 82846/ As of 31/08/2021 9846 INVESTMENT OBJECTIVE FUND DETAILS The iShares Core CSI 300 Index ETF seeks to track the performance of an index Asset Class Equity composed of 300 large and mid-capitalization stocks traded on the Shanghai and Inception Date 12/11/2009 Shenzhen stock exchanges. Benchmark CSI 300 Index Number of Holdings 301 WHY 2846? Net Assets 244,617,181 CNY Management Fee (in 0.38 1 Exposure to the 300 largest stocks listed on Shanghai and Shenzhen stock %) exchanges Units Outstanding 7,750,000 2 Liquid trading vehicle for the China A-share market Domicile Hong Kong Base Currency RMB GROWTH OF 10,000 CNY SINCE INCEPTION Bloomberg CSIN0300 Benchmark Ticker TOP 10 HOLDINGS (%) KWEICHOW MOUTAI LTD A 4.97 CHINA MERCHANTS BANK LTD A 3.08 PING AN INSURANCE (GROUP) OF CHINA 2.74 WULIANGYE YIBIN LTD A 1.98 LONGI GREEN ENERGY Fund Benchmark TECHNOLOGY LTD 1.97 The chart shows change of investment amount based on a hypothetical investment in MIDEA GROUP LTD A 1.65 the Fund. INDUSTRIAL BANK LTD A 1.36 ANNUALIZED PERFORMANCE (%CNY) EAST MONEY INFORMATION LTD A 1.30 Cumulative Annualized BYD LTD A 1.28 1 Month 3 Month YTD 1 Year 3 Year 5 Year Since HANGZHOU HIKVISION DIGITAL Inception TECHNOL 1.22 Fund 0.09% -8.78% -6.68% 0.97% 14.46% 8.88% 2.83% Total 21.55 Benchmark 0.11% -8.69% -6.41% 1.40% 15.06% 9.64% 4.59% Holdings are subject to change. -

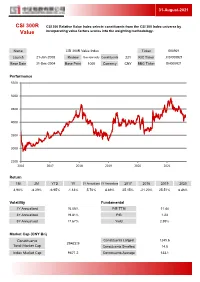

CSI 300R Value Index Ticker 000921

31-August-2021 CSI 300R CSI 300 Relative Value Index selects constituents from the CSI 300 Index universe by Value incorporating value factors scores into the weighting methodology. Name CSI 300R Value Index Ticker 000921 Launch 21-Jan-2008 Review Semiannually Constituents 221 RIC Ticker .CSI000921 Base Date 31-Dec-2004 Base Point 1000 Currency CNY BBG Ticker SH000921 Performance 5500 5000 4500 4000 3500 3000 2500 2016 2017 2018 2019 2020 2021 Return 1M 3M YTD 1Y 3Y Annualized 5Y Annualized 2017 2018 2019 2020 3.90% -8.29% -6.95% -1.13% 5.70% 4.89% 25.15% -21.20% 25.51% 8.46% Volatility Fundamental 1Y Annualized 16.05% P/E TTM 11.44 3Y Annualized 19.81% P/B 1.23 5Y Annualized 17.67% Yield 2.95% Market Cap (CNY Bn) Constituents Constituents Largest 1245.6 29422.9 Total Market Cap Constituents Smallest 14.8 Index Market Cap 9671.2 Constituents Average 133.1 31-August-2021 Exchange Breakdown Sector Breakdown 2.2% Energy 1.6% 3.8% Materials 7.3% 10.1% Industrials 26.8% Consumer Disc. 13.5% Shanghai Consumer Staples Shenzhen Health Care 11.8% 43.5% Financials 73.2% Information Tech. 4.0% Telecom. Services 2.3% Utilities Top 10 Constituents Ticker Name Sector Exchange Weight 600036 China Merchants Bank Co Ltd Financials Shanghai 6.27% 601318 Ping An Insurance (Group) Company of China Ltd Financials Shanghai 5.59% 601166 Industrial Bank Financials Shanghai 2.78% 000333 Midea Group CO., LTD Consumer Disc. Shenzhen 2.52% 600900 China Yangtze Power Co Ltd Utilities Shanghai 2.27% 600030 CITIC Securities Co Ltd Financials Shanghai 2.26% 000651 Gree Electric Appliances,Inc. -

Securities Clearing and Settlement in China

OCCASIONAL PAPER SERIES NO 116 / JULY 2010 SECURITIES CLEARING AND SETTLEMENT IN CHINA MARKETS, INFRASTRUCTURES AND POLICY-MAKING by Patrick Hess OCCASIONAL PAPER SERIES NO 116 / JULY 2010 SECURITIES CLEARING AND SETTLEMENT IN CHINA MARKETS, INFRASTRUCTURES AND POLICY-MAKING 1 by Patrick Hess 2 NOTE: This Occasional Paper should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the author and do not necessarily reflect those of the ECB. In 2010 all ECB publications feature a motif taken from the €500 banknote. This paper can be downloaded without charge from http://www.ecb.europa.eu or from the Social Science Research Network electronic library at http://ssrn.com/abstract_id=1632989. 1 The research that this paper summarises has benefited largely from meetings held in November 2009 in Beijing between the author and representatives of the People’s Bank of China (PBC), the Chinese securities regulator, the two mainland CSDs and the National Clearing Center of the PBC. The author is indebted to those institutions and representatives for the support and information provided, and assumes full responsibility for any mistakes. He is also grateful for the support and comments received within the ECB. The Renminbi (RMB) conversion rates used in the paper are RMB 9.60:1 for EUR and RMB 6.83:1 for USD. 2 TARGET2-Securities Programme, European Central Bank, E-mail: [email protected] © European Central Bank, 2010 Address Kaiserstrasse 29 60311 Frankfurt am Main, Germany Postal address Postfach 16 03 19 60066 Frankfurt am Main, Germany Telephone +49 69 1344 0 Internet http://www.ecb.europa.eu Fax +49 69 1344 6000 All rights reserved.