1 30 May 2016 Adjustment for CES China Cross Border Index Series

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Schedule of Investments (Unaudited) Ishares MSCI Total International Index Fund (Percentages Shown Are Based on Net Assets) September 30, 2020

Schedule of Investments (unaudited) iShares MSCI Total International Index Fund (Percentages shown are based on Net Assets) September 30, 2020 Mutual Fund Value Total International ex U.S. Index Master Portfolio of Master Investment Portfolio $ 1,034,086,323 Total Investments — 100.4% (Cost: $929,170,670) 1,034,086,323 Liabilities in Excess of Other Assets — (0.4)% (3,643,126) Net Assets — 100.0% $ 1,030,443,197 iShares MSCI Total International Index Fund (the “Fund”) seeks to achieve its investment objective by investing all of its assets in International Tilts Master Portfolio (the “Master Portfolio”), which has the same investment objective and strategies as the Fund. As of September 30, 2020, the value of the investment and the percentage owned by the Fund of the Master Portfolio was $1,034,086,323 and 99.9%, respectively. The Fund records its investment in the Master Portfolio at fair value. The Fund’s investment in the Master Portfolio is valued pursuant to the pricing policies approved by the Board of Directors of the Master Portfolio. Fair Value Hierarchy as of Period End Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows: • Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access • Level 2 – Other observable inputs (including, but not limited to, quoted prices -

Stock Balances on 18 July 2020

Attachment 2 Stock Balances on 18 July 2020 Pre-set Stock Balances for Northbound Trading For each CCEP and each Institutional Investor (II) ID allocated to CCEP will have the maximum sellable quantity 10,000 for the following stocks during the MR on 18 July 2020. For each Short Selling Security in the testing, the maximum number of shares available for short selling is 10,000. Stock Balance SSE Stock Stock Code Eligible for Short Stock Name for each EP and Code Mapping in CCASS Sell II assigned 600016 90016 CHINA MINSHENG BANKING CORP., LTD. Yes 10,000 600019 90019 BAOSHAN IRON & STEEL CO., LTD. Yes 10,000 CHINA SOUTHERN AIRLINES COMPANY 600029 90029 Yes 10,000 LIMITED 600031 90031 SANY HEAVY INDUSTRY CO.,LTD Yes 10,000 600036 90036 CHINA MERCHANTS BANK CO.,LIMITED Yes 10,000 CHINA UNITED NETWORK COMMUNICATIONS 600050 90050 Yes 10,000 LIMITED 600276 90276 JIANGSU HENGRUI MEDICINE CO.,LTD. Yes 10,000 CHINA GRAND AUTOMOTIVE SERVICES GROUP 600297 90297 No 10,000 CO.,LTD 600690 90690 HAIER SMART HOME CO., LTD. Yes 10,000 INNER MONGOLIA YILI INDUSTRIAL GROUP 600887 90887 Yes 10,000 CO.,LTD Stock Balance SZSE Stock Stock Code Eligible for Short Stock Name for each EP and Code Mapping in CCASS Sell II assigned 000001 70001 PING AN BANK CO., LTD. Yes 10,000 000002 70002 CHINA VANKE CO., LTD Yes 10,000 000725 70725 BOE TECHNOLOGY GROUP CO., LTD Yes 10,000 FOCUS MEDIA INFORMATION TECHNOLOGY 002027 72027 Yes 10,000 CO.,LTD GREE ELECTRIC APPLIANCES,INC.OF ZHUHAI 000651 70651 Yes 10,000 CO.,LTD 000338 70338 WEICHAI POWER CO., LTD. -

Ishares Core CSI 300 ETF 82846/ As of 31/08/2021 9846

2846/ iShares Core CSI 300 ETF 82846/ As of 31/08/2021 9846 INVESTMENT OBJECTIVE FUND DETAILS The iShares Core CSI 300 Index ETF seeks to track the performance of an index Asset Class Equity composed of 300 large and mid-capitalization stocks traded on the Shanghai and Inception Date 12/11/2009 Shenzhen stock exchanges. Benchmark CSI 300 Index Number of Holdings 301 WHY 2846? Net Assets 244,617,181 CNY Management Fee (in 0.38 1 Exposure to the 300 largest stocks listed on Shanghai and Shenzhen stock %) exchanges Units Outstanding 7,750,000 2 Liquid trading vehicle for the China A-share market Domicile Hong Kong Base Currency RMB GROWTH OF 10,000 CNY SINCE INCEPTION Bloomberg CSIN0300 Benchmark Ticker TOP 10 HOLDINGS (%) KWEICHOW MOUTAI LTD A 4.97 CHINA MERCHANTS BANK LTD A 3.08 PING AN INSURANCE (GROUP) OF CHINA 2.74 WULIANGYE YIBIN LTD A 1.98 LONGI GREEN ENERGY Fund Benchmark TECHNOLOGY LTD 1.97 The chart shows change of investment amount based on a hypothetical investment in MIDEA GROUP LTD A 1.65 the Fund. INDUSTRIAL BANK LTD A 1.36 ANNUALIZED PERFORMANCE (%CNY) EAST MONEY INFORMATION LTD A 1.30 Cumulative Annualized BYD LTD A 1.28 1 Month 3 Month YTD 1 Year 3 Year 5 Year Since HANGZHOU HIKVISION DIGITAL Inception TECHNOL 1.22 Fund 0.09% -8.78% -6.68% 0.97% 14.46% 8.88% 2.83% Total 21.55 Benchmark 0.11% -8.69% -6.41% 1.40% 15.06% 9.64% 4.59% Holdings are subject to change. -

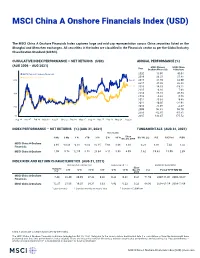

MSCI China a Onshore Financials Index (USD) (NET)

MSCI China A Onshore Financials Index (USD) The MSCI China A Onshore Financials Index captures large and mid cap representation across China securities listed on the Shanghai and Shenzhen exchanges. All securities in the index are classified in the Financials sector as per the Global Industry Classification Standard (GICS®). CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI China A MSCI China Year Onshore Financials A Onshore MSCI China A Onshore Financials 2020 13.95 40.04 MSCI China A Onshore 2019 36.27 37.48 600 599.61 2018 -21.59 -32.99 2017 27.55 20.28 518.63 2016 -14.53 -19.11 2015 -6.16 7.08 400 2014 85.16 46.53 2013 -5.68 0.75 2012 25.68 9.48 2011 -10.05 -22.91 200 2010 -22.95 -4.37 2009 98.61 96.70 2008 -62.85 -61.81 50 2007 133.47 175.52 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI China A Onshore 3.98 -13.48 -0.08 -8.83 10.15 5.98 8.66 8.38 3.21 8.86 7.43 1.02 Financials MSCI China A Onshore 1.09 -5.78 12.50 0.55 20.34 8.11 5.98 6.99 1.62 19.63 15.09 2.39 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD (%) 2000 MSCI China A Onshore 7.44 22.49 20.99 27.48 0.48 0.32 0.41 0.36 71.50 2007-11-01—2008-10-27 Financials MSCI China A Onshore 12.27 21.06 19.25 24.31 0.93 0.43 0.33 0.33 68.90 2008-01-14—2008-11-04 1 Last 12 months 2 Based on monthly net returns data 3 Based on ICE LIBOR 1M China A shares are quoted in local currency (Renminbi). -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 6 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 8 Xtrackers MSCI All China Equity ETF .................................................... 10 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 12 Fees and Expenses ....................................................................... 14 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 15 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 20 Xtrackers MSCI All China Equity ETF .................................................... 28 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 33 Statements of Assets and Liabilities ........................................................ 42 Statements of Operations ................................................................. 43 Statements of Changes in Net -

FTIF - Templeton China Fund August 31, 2021

FTIF - Templeton China Fund August 31, 2021 August 31, 2021 FTIF - Templeton China Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date BK6YZP5 ALIBABA GROUP HOLDING LTD 1,680,789 $35,194,810 6.83% N/A N/A A-LIVING SMART CITY SERVICES CO BFWK4M2 2,612,241 $10,381,878 2.02% N/A N/A LTD B1YVKN8 ANTA SPORTS PRODUCTS LTD 885,305 $18,184,810 3.53% N/A N/A B0FXT17 BAIDU INC 55,805 $8,762,501 1.70% N/A N/A 06684L103 BAOZUN INC 27,710 $667,256 0.13% N/A N/A BGDY260 BEIGENE LTD 334,950 $7,937,467 1.54% N/A N/A BFNLRN6 BILIBILI INC 60,964 $4,891,141 0.95% N/A N/A B01B1L9 -

Ishares Core CSI 300 ETF Factsheet

2846/ iShares Core CSI 300 ETF 82846/ As of 31/08/2021 9846 IMPORTANT: Investment involves risk, including the loss of principal. Investors should refer to the Prospectus and Key Facts Statement of the iShares Core CSI 300 Index ETF (the “ETF”) for details, including the risk factors. Investors should not base investment decisions on this marketing material alone. Investors should note: • The ETF aims to provide investment results that, before fees and expenses, closely correspond to the performance of CSI 300 Index (the “Underlying Index”). • Generally, investments in emerging markets, such as the A Share market, may involve increased risks such as liquidity risks, currency risks/control, political and economic uncertainties, legal, regulatory and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. The A Share market may be more volatile and unstable than those in the more developed markets. The ETF’s exposure is concentrated in the PRC and may be more volatile than funds adopting a more diversified strategy. • The ETF currently does not provision for withholding tax on capital gains (“CGT”) arising from its investment via RQFII or its investment via Stock Connect. There are risks and uncertainties associated with the current PRC tax laws, regulations and practice in respect of capital gains realized on the ETF’s PRC investments, which may have retrospective effect. Any increased tax liabilities on the ETF may adversely affect its value, and the resultant tax liability would be eventually borne by investors. • The ETF is subject to restrictions and requirements applicable to RQFII investment, and the applicable laws, rules and regulations in the PRC, which are subject to change and such change may have potential retrospective effect. -

Semi-Annual Report DBX ETF Trust

November 30, 2020 Semi-Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Portfolio Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 3 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 4 Xtrackers MSCI All China Equity ETF .................................................... 5 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 6 Fees and Expenses ....................................................................... 7 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 8 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 13 Xtrackers MSCI All China Equity ETF .................................................... 21 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 26 Statements of Assets and Liabilities ........................................................ 34 Statements of Operations ................................................................. 35 Statements of Changes in Net Assets ....................................................... 36 Financial Highlights -

Stock Balances on 1 August 2020

Attachment 2 Stock Balances on 1 August 2020 Pre-set Stock Balances for Northbound Trading For each CCEP and each Institutional Investor (II) ID allocated to CCEP will have the maximum sellable quantity 10,000 for the following stocks during the MR on 1 August 2020. For each Short Selling Security in the testing, the maximum number of shares available for short selling is 10,000. Stock Balance SSE Stock Stock Code Eligible for Short Stock Name for each EP and Code Mapping in CCASS Sell II assigned 600016 90016 CHINA MINSHENG BANKING CORP., LTD. Yes 10,000 600019 90019 BAOSHAN IRON & STEEL CO., LTD. Yes 10,000 CHINA SOUTHERN AIRLINES COMPANY 600029 90029 Yes 10,000 LIMITED 600031 90031 SANY HEAVY INDUSTRY CO.,LTD Yes 10,000 600036 90036 CHINA MERCHANTS BANK CO.,LIMITED Yes 10,000 CHINA UNITED NETWORK COMMUNICATIONS 600050 90050 Yes 10,000 LIMITED 600276 90276 JIANGSU HENGRUI MEDICINE CO.,LTD. Yes 10,000 CHINA GRAND AUTOMOTIVE SERVICES GROUP 600297 90297 No 10,000 CO.,LTD 600690 90690 HAIER SMART HOME CO., LTD. Yes 10,000 INNER MONGOLIA YILI INDUSTRIAL GROUP 600887 90887 Yes 10,000 CO.,LTD Stock Balance SZSE Stock Stock Code Eligible for Short Stock Name for each EP and Code Mapping in CCASS Sell II assigned 000001 70001 PING AN BANK CO., LTD. Yes 10,000 000002 70002 CHINA VANKE CO., LTD Yes 10,000 000725 70725 BOE TECHNOLOGY GROUP CO., LTD Yes 10,000 FOCUS MEDIA INFORMATION TECHNOLOGY 002027 72027 Yes 10,000 CO.,LTD GREE ELECTRIC APPLIANCES,INC.OF ZHUHAI 000651 70651 Yes 10,000 CO.,LTD 000338 70338 WEICHAI POWER CO., LTD. -

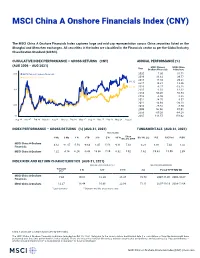

MSCI China a Onshore Financials Index (CNY)

MSCI China A Onshore Financials Index (CNY) The MSCI China A Onshore Financials Index captures large and mid cap representation across China securities listed on the Shanghai and Shenzhen exchanges. All securities in the index are classified in the Financials sector as per the Global Industry Classification Standard (GICS®). CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (CNY) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI China A MSCI China Year Onshore Financials A Onshore 600 MSCI China A Onshore Financials 2020 7.30 31.71 MSCI China A Onshore 2019 38.62 39.77 2018 -17.10 -29.21 504.52 2017 19.81 12.89 431.67 2016 -8.27 -13.28 400 2015 -1.58 12.22 2014 90.45 50.53 2013 -8.06 -1.88 2012 24.75 8.57 2011 -13.93 -26.28 200 2010 -25.51 -7.59 2009 98.96 97.01 2008 -65.26 -64.28 50 2007 118.57 158.02 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI China A Onshore 4.12 -11.87 -5.50 -9.64 8.45 5.58 9.11 7.33 3.21 8.86 7.43 1.02 Financials MSCI China A Onshore 1.22 -4.14 6.24 -0.48 18.36 7.59 6.32 5.92 1.62 19.63 15.09 2.39 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 MAXIMUM DRAWDOWN Turnover (%) 1 3 Yr 5 Yr 10 Yr (%) Period YYYY-MM-DD MSCI China A Onshore 7.44 19.81 18.30 26.37 73.78 2007-11-01—2008-10-27 Financials MSCI China A Onshore 12.27 18.44 16.66 22.99 71.11 2007-10-16—2008-11-04 1 Last 12 months 2 Based on monthly gross returns data China A shares are quoted in local currency (Renminbi). -

Mainstay Candriam Emerging Markets Equity Fund Q3 Holdings

MainStay Candriam Emerging Markets Equity Fund Portfolio of Investments July 31, 2021† (Unaudited) Shares Value Common Stocks 96.5% Argentina 0.4% MercadoLibre, Inc. (Internet & Direct Marketing Retail) (a) 240 $ 376,488 Brazil 7.0% Banco BTG Pactual SA (Capital Markets) 124,000 696,633 Banco Inter SA (Banks) 52,000 708,676 Banco Santander Brasil SA (Banks) 162,000 1,260,976 Cosan SA (Oil, Gas & Consumable Fuels) 264,000 1,295,099 Localiza Rent a Car SA (Road & Rail) 32,000 381,856 Meliuz SA (Interactive Media & Services) 19,700 256,829 Notre Dame Intermedica Participacoes SA (Health Care Providers & Services) 18,000 276,485 Pagseguro Digital Ltd., Class A (IT Services) (a) 5,500 304,920 Smartfit Escola de Ginastica e Danca SA (Hotels, Restaurants & Leisure) (a) 31,000 163,623 VTEX, Class A (Interactive Media & Services) (a) 7,500 183,750 WEG SA (Electrical Equipment) 66,000 452,524 5,981,371 China 35.4% Aier Eye Hospital Group Co. Ltd., Class A (Health Care Providers & Services) 42,787 389,015 Airtac International Group (Machinery) 15,400 495,069 Alibaba Group Holding Ltd. (Internet & Direct Marketing Retail) (a) 123,000 2,991,449 Alibaba Health Information Technology Ltd. (Health Care Technology) (a) 23,000 35,753 Baidu, Inc., Sponsored ADR (Interactive Media & Services) (a) 900 147,609 Bank of Ningbo Co. Ltd., Class A (Banks) 96,000 481,762 Bilibili, Inc., Sponsored ADR (Entertainment) (a) 1,700 145,486 BYD Co. Ltd., Class H (Automobiles) 5,500 169,151 CanSino Biologics, Inc., Class H (Pharmaceuticals) (a)(b) 9,000 381,025 China Construction Bank Corp., Class H (Banks) 1,380,000 962,483 China Feihe Ltd. -

Factsheet BGF China A-Shares Fund Class I2 Hedged

BLACKROCK GLOBAL FUNDS BGF China A-Shares Fund Class I2 Hedged EUR AUGUST 2021 FACTSHEET Performance, Portfolio Breakdowns and Net Assets information as at: 31-Aug-2021. All Capital at risk. All financial investments involve other data as at 09-Sep-2021. an element of risk. Therefore, the value of your For Investors in Austria. Investors should read the Key Investor Information Document and investment and the income from it will vary and Prospectus prior to investing. your initial investment amount cannot be guaranteed. FUND OVERVIEW The Fund aims to achieve long-term capital growth on the Fund’s assets. The Fund invests at SYNTHETIC RISK & REWARD least 70% of its total assets in a concentrated portfolio of equity securities (e.g. shares) of INDICATOR (SRRI) companies listed in the onshore equity markets of the People’s Republic of China (known as “A Lower Risk Higher Risk Shares”) (which excludes Hong Kong, the Macau Special Administrative Regions and Taiwan). Potentially Lower Rewards Potentially Higher Rewards The Fund may also invest up to 30% of total assets in offshore Chinese equity markets (which includes Hong Kong, the Macau Special Administrative Regions and Taiwan). 1 2 3 4 5 6 7 GROWTH OF HYPOTHETICAL 10,000 KEY FACTS Asset Class Equity Morningstar Category - Inception Date 09-Oct-2019 Unit Class Launch Date 02-Jul-2020 Fund Base Currency USD Share Class Currency EUR Total Fund Size (M) 18.57 USD Domicile Luxembourg Fund Type UCITS ISIN LU2183146278 Bloomberg Ticker - Distribution Type Minimum Initial Investment 10,000,000 USD* Fund * or currency equivalent Share Class and Benchmark performance displayed in EUR.