Mackenzie China A-Shares Csi 300 Index Etf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chinaamc CSI 300 Index ETF (Stock Code: 83188/3188) Fund Factsheet

ChinaAMC CSI 300 Index ETF (Stock Code: 83188/3188) Fund Factsheet As of 29 Apr 2016 37/F, Bank of China Tower, 1 Garden Road, Hong Kong • ChinaAMC CSI 300 Index ETF (the ”Fund”) is a passively managed exchange traded fund and is listed on The Stock Exchange of Hong Kong Limited (the “SEHK”), investing primarily and directly in underlying A-Shares of CSI 300 Index through the Renminbi Qualified Foreign Institutional Investor (“RQFII”) quota obtained by the Fund’s Manager. • The Fund is subject to single country (the PRC) concentration risk. Investing in emerging markets, such as the PRC, involves a greater risk such as greater political, tax, economic, foreign exchange, liquidity and regulatory risks. • The RQFII policy and rules are new and such policy and rules are subject to change, such changes may have retrospective effect. Repatriations of the invested capital and net profits by RQFIIs are permitted daily and are not subject to any lock-up periods or prior approval. There is no assurance, however, that repatriation restrictions will not be imposed in the future. Any new restrictions on repatriation may impact on the Fund’s ability to meet redemption requests. • There are risks and uncertainties associated with the current PRC tax laws and regulations. The Manager will at present make certain provisions for the Fund in respect of any potential tax liability. In case of any shortfall between the provision and actual tax liabilities, which will be debited from the Fund’s assets, the Fund’s asset value will be adversely affected. • The SEHK’s dual counter model in Hong Kong is new and the Fund is one of the first ETFs to have units traded and settled in RMB and HKD. -

C-Shares CSI 300 Index ETF Prospectus 匯添富資產管理(香 港)有限公司

China Universal International ETF Series C-Shares CSI 300 Index ETF Prospectus 匯添富資產管理(香 港)有限公司 China Universal Asset Management (Hong Kong) Company Limited 2701 One IFC, 1 Harbour View Street, Central, Hong Kong Tel: (852) 3983 5600 Fax: (852) 3983 5799 Email: [email protected] Web: www.99fund.com.hk Important - If you are in any doubt about the contents of this Prospectus, you should consult your stockbroker, bank manager, solicitor, accountant and/or other financial adviser for independent professional financial advice. CHINA UNIVERSAL INTERNATIONAL ETF SERIES (a Hong Kong umbrella unit trust authorized under Section 104 of the Securities and Futures Ordinance (Cap. 571) of Hong Kong) C-Shares CSI 300 Index ETF (Stock Codes: 83008 (RMB counter) and 03008 (HKD counter)) PROSPECTUS MANAGER China Universal Asset Management (Hong Kong) Company Limited LISTING AGENT FOR C-Shares CSI 300 Index ETF GF Capital (Hong Kong) Limited 3 July 2013 The Stock Exchange of Hong Kong Limited (“SEHK”), Hong Kong Exchanges and Clearing Limited (“HKEx”), Hong Kong Securities Clearing Company Limited (“HKSCC”) and the Hong Kong Securities and Futures Commission (“Commission”) take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. China Universal International ETF Series (“Trust”) and its sub-funds set out in Part 2 of this Prospectus, including its initial Sub-Fund, C-Shares CSI 300 Index ETF (“CSI 300 ETF”) (collectively referred to as the “Sub- Funds”) have been authorised by the Commission pursuant to section 104 of the Securities and Futures Ordinance. -

葡萄酒 House Pouring Wine

葡萄酒 House Pouring Wine 150ml 750ml 有气的葡萄酒 Sparkling Wine Glass Bottle SP101 Pol Remy Brut Nv (France) $12 $44 白葡萄酒 White Wine W201 Bellevie Pavillon Sauvignon Blanc (France) $11 $40 W202 Pierre Jean Colombard Chardonnay (France) $12 $44 W203 De Bortoli DB Family Selection $13 $50 Sauvignon Blanc (Australia) 红葡萄酒 Red Wine R301 Bellevie Pavillon Merlot (France) $11 $40 R302 Pierre Jean Merlot (France) $12 $44 R303 De Bortoli DB Family Selection $13 $50 Cabernet Sauvignon (Australia) 葡萄酒促销 Wine Promotion *Special deal with minimum purchase of 2 bottles house pouring wine to entitle to 15% discount off from the usual price listed above. Prices subjected to prevailing GST and Service Charge. 消费税与服务费另计。 All photos are meant for reference only. Presentation of dishes may vary without prior notice. 照片只供参考之用,摆设更改恕不作另行通知。 主酒单 Master Wine List 150ml 750ml 有气的葡萄酒 Sparkling Wine Glass Bottle SP101 Pol Remy Brut Nv (France) $12 $44 Pol Remy is produced in Burgundy, France from classic wine varieties perfect for the production of sparkling wine. It is light, fresh and fruity with aromas of apple and peach. With a delightfully easy-drinking style, it exudes aromas of creamy lemon and peach. The palate is gently off-dry and flows through to a satisfying finish. 香槟 Champagne CH102 Henri Abele Brut NV (France) $110 Pale golden colour with greenish highlights. Remarkably fine bubbles and a beautiful, persistent bead. Attractive and luscious, with hints of hawthorn and acacia blossoms as well as overtones of peach and apricot. Exceptional ripeness on the palate. Toasty, honey, and cinnamon flavours. This elegant cuvée has a full bodied, generous aftertaste. -

FTSE Publications

2 FTSE Russell Publications 01 October 2020 FTSE Value Stocks China A Share Indicative Index Weight Data as at Closing on 30 September 2020 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Agricultural Bank of China (A) 4.01 CHINA Fuyao Glass Group Industries (A) 1.43 CHINA Seazen Holdings (A) 0.81 CHINA Aisino Corporation (A) 0.52 CHINA Gemdale (A) 1.37 CHINA Shanghai Fosun Pharmaceutical Group (A) 1.63 CHINA Anhui Conch Cement (A) 3.15 CHINA GoerTek (A) 2.12 CHINA Shenwan Hongyuan Group (A) 1.11 CHINA AVIC Investment Holdings (A) 0.61 CHINA Gree Electric Appliances Inc of Zhuhai (A) 7.48 CHINA Shenzhen Overseas Chinese Town Holdings 0.66 CHINA Bank of China (A) 2.23 CHINA Guangdong Haid Group (A) 1.24 CHINA (A) Bank Of Nanjing (A) 1.32 CHINA Guotai Junan Securities (A) 1.99 CHINA Sichuan Chuantou Energy (A) 0.71 CHINA Bank of Ningbo (A) 2 CHINA Hangzhou Hikvision Digital Technology (A) 3.56 CHINA Tbea (A) 0.86 CHINA Beijing Dabeinong Technology Group (A) 0.56 CHINA Henan Shuanghui Investment & Development 1.49 CHINA Tonghua Dongbao Medicines(A) 0.59 CHINA China Construction Bank (A) 1.83 CHINA (A) Weichai Power (A) 2.09 CHINA China Life Insurance (A) 2.14 CHINA Hengtong Optic-Electric (A) 0.59 CHINA Wuliangye Yibin (A) 9.84 CHINA China Merchants Shekou Industrial Zone 1.03 CHINA Industrial and Commercial Bank of China (A) 3.5 CHINA XCMG Construction Machinery (A) 0.73 CHINA Holdings (A) Inner Mongolia Yili Industrial(A) 6.32 CHINA Xinjiang Goldwind Science&Technology (A) 0.74 -

Luzhou Laojiao Co., Ltd. 2018 Annual Report April 2019

2018 Annual Report of Luzhou Laojiao Co.,Ltd. Luzhou Laojiao Co., Ltd. 2018 Annual Report April 2019 1 2018 Annual Report of Luzhou Laojiao Co.,Ltd. Section I Important Statements, Contents and Definitions The Board of Directors, Board of Supervisors, directors, supervisors and senior management guarantee that the information presented in this report is free of any false records, misleading statements or material omissions, and shall Individually and together be legally liable for truthfulness, accuracy and completeness of its contents. Mr. Liu Miao, responsible person for the Company, Ms. Xie Hong, responsible person for accounting work and Mr. Yan Li, responsible person for the Company’s financial affairs (Accounting Supervisor) have warranted that the financial statements in this report are true and complete. Other directors attended the board meeting to deliberate this report by themselves except the following directors. Name of directors who did not Position of directors who did not Reason for not attending Name of attend the meeting in person attend the meeting in person the meeting in person deputies Liu Miao Chairman of the Board work Lin Feng Shen Caihong Director work Jiang Yuhui Affected by risks, uncertainties and assumptions, the forward-looking statements concerning business objectives and future plans made in this report based on the subjective assumptions and judgments of the future policies and economic conditions may be significantly different from the actual results. Such statements shall not be considered as virtual promises of the Company to investors, and the investors and relevant persons shall maintain adequate risk awareness and shall understand the differences between plans, forecasts and commitments. -

E FUND CSI 100 A-Share Index ETF

IMPORTANT: The Stock Exchange of Hong Kong Limited (the “SEHK”), Hong Kong Exchanges and Clearing Limited (“HKEx”), the Securities and Futures Commission (“SFC”) and the Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Announcement. The Manager accepts full responsibility for the accuracy of the information contained in this Announcement as at the date of publication, and confirms, having made all reasonable enquiries, that to the best of its knowledge and belief, there are no other facts the omission of which would make any statement misleading and opinions expressed in this Announcement have been arrived at after due and careful consideration. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF IN DOUBT, PLEASE SEEK PROFESSIONAL ADVICE. E FUND CSI 100 A-Share Index ETF RMB Counter Stock Code: 83100 HKD Counter Stock Code: 03100 (Sub-fund of E Fund ETFs Trust (the “Trust”), a Hong Kong umbrella unit trust, authorised under Section 104 of the Securities and Futures Ordinance (Cap. 571 of the laws of Hong Kong SAR)) Announcement Change of Underlying Index and Change of Name and Short Name of the Sub-Fund Dear Unitholders, E Fund Management (Hong Kong) Co., Limited (the “Manager”), the manager of the Trust and the Sub- Fund, hereby announces that, with effect from 7 December 2020 (the “Effective Date”), the underlying index of the Sub-Fund will be changed to CSI 300 Index. -

Chinaamc CSI 300 Index ETF (The "Fund"), Investor Should Refer to the Fund's Prospectus for Details, Including the Risk Factors

Investment involves risks, including the loss of principle. Past performance is not indicative of future results. Before investing in the ChinaAMC CSI 300 Index ETF (the "Fund"), investor should refer to the Fund's prospectus for details, including the risk factors. You should not make investment decision based on the information on this material alone. Please note: • The Fund aims to provide investment result that, before fees and expenses, closely corresponds to the performance of the CSI 300 Index (the "Index"). The Fund invests in the PRC's securities market through the RQFII investment quota granted to the Manager and the Stock Connect. • The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region (the PRC) and may likely be more volatile than a broad-based fund. • The Fund is subject to risks relating to the RQFII regime, such as default in execution or settlement of transaction by a PRC broker or the PRC Custodian, change of RQFII policy and rules and uncertainty to their implementa- tion, repatriation restrictions and insufficient RQFII quota to the Fund. • The Fund is subject to risks associated with the Stock Connect, such as change of relevant rules and regulations, quota limitations, suspension of the Stock Connect programme. In the event that the Fund’s ability to invest in A-Shares through the Stock Connect on a timely basis is adversely affected, the Manager can only rely on RQFII investments to achieve the Fund’s investment objective. • Investing in emerging markets, such as the PRC, involves a greater risk such as greater political, tax, economic, foreign exchange, liquidity and regulatory risks. -

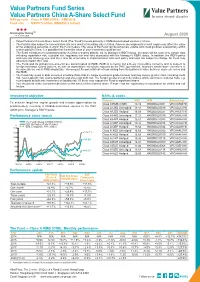

Value Partners Fund Series Value Partners China A-Share Select Fund

Value Partners Fund Series Value Partners China A-Share Select Fund NAV per unit : Class A RMB (CNH) – RMB19.19 Fund size : USD57.3 million (RMB393.2 million) HHH Morningstar RatingTM1 As at 31-08-2020 August 2020 • Value Partners China A-Share Select Fund (The “Fund”) invests primarily in RMB-denominated equities in China. • The Fund is also subject to concentration risk as a result of investing only in China. Adverse developments in such region may affect the value of the underlying securities in which the Fund invests. The value of the Fund can be extremely volatile and could go down substantially within a short period of time. It is possible that the entire value of your investment could be lost. • The Fund intends to invest predominantly in China A-shares directly, via its Manager’s RQFII quota. Investors will be subject to certain risks including repatriation risk, custodial risk, regulatory risk and risks associated with the Manager’s RQFII status. In addition, the RQFII policy and rules are relatively new and there may be uncertainty in implementation and such policy and rules are subject to change. All these may adversely impact the Fund. • The Fund and its primary investments are denominated in RMB. RMB is currently not a freely convertible currency and is subject to foreign exchange control policies, as well as repatriation restrictions imposed by the PRC government. Investors whose base currencies of investments are not in RMB should take into account the potential risk of loss arising from fluctuations in value between such currencies and the RMB. -

China Weigao Reducer Success Case (Large Enterprise Version) Serial Company Name Serial Company Name

China Weigao reducer success case (large enterprise version) serial Company Name serial Company Name 1 Shanghai Automobile Group Co., Ltd. 231 Chongqing Textile Holding (Group) Company 2 Dongfeng Motor Corporation 232 Aoyang Group Co., Ltd. 3 Huawei Investment Holdings Co., Ltd. 233 Guangxi Shenglong Metallurgy Co., Ltd. 4 China Ordnance Equipment Group Corporation 234 Lingyuan Iron and Steel Group Co., Ltd. 5 China Minmetals Corporation 235 Futong Group Co., Ltd. 6 China FAW Group Corporation 236 Yongfeng Group Co., Ltd. 7 China Ordnance Industry Corporation 237 Shandong Taishan Iron and Steel Group Co., Ltd. 8 Beijing Automobile Group Co., Ltd. 238 Xinjiang Zhongtai (Group) Co., Ltd. 9 Shandong Weiqiao Venture Group Co., Ltd. 239 Guangdong Haida Group Co., Ltd. 10 China Aviation Industry Corporation 240 Jiangsu Yangzijiang Shipbuilding Group Corporation 11 Zhengwei International Group Co., Ltd. 241 Shenzhen Oufeiguang Technology Co., Ltd. 12 China Baowu Iron and Steel Group Co., Ltd. 242 Dongchen Holding Group Co., Ltd. 13 Lenovo Holdings Co., Ltd. 243 Xinjiang Goldwind Technology Co., Ltd. 14 China National Chemical Corporation 244 Wanji Holding Group Co., Ltd. 15 Hegang Group Co., Ltd. 245 Tsingtao Brewery Co., Ltd. 16 China Shipbuilding Industry Corporation 246 Tasly Holding Group Co., Ltd. 17 Guangzhou Automobile Industry Group Co., Ltd. 247 Wanfeng Auto Holding Group Co., Ltd. 18 Aluminum Corporation of China 248 Wuhan Institute of Posts and Telecommunications 19 China National Building Material Group Co., Ltd. 249 Red Lion Holdings Group Co., Ltd. 20 Hengli Group Co., Ltd. 250 Xinjiang Tianye (Group) Co., Ltd. 21 CRRC Corporation Limited 251 Juhua Group Company 22 Xinxing Jihua Group Co., Ltd. -

Luzhou Laojiao Co., Ltd. 2020 Interim Report

2020 Interim Report of Luzhou Laojiao Co., Ltd. Luzhou Laojiao Co., Ltd. 2020 Interim Report August 2020 1 2020 Interim Report of Luzhou Laojiao Co., Ltd. Section I Important Statements, Contents and Definitions The Board of Directors, Board of Supervisors, as well as directors, supervisors and senior management other than the following directors, supervisors and senior management that have expressed dissent against this report guarantee that the information presented in this report is free of any false records, misleading statements or material omissions, and shall individually and together be legally liable for truthfulness, accuracy and completeness of its contents. Liu Miao, responsible person for the Company, Xie Hong, responsible person for accounting work and Yan Li, responsible person for the Company’s financial affairs (Accounting Supervisor) have warranted that the financial statements in this report are true and complete. All the directors attended the board meeting to deliberate this report by themselves. Affected by risks, uncertainties and assumptions, the forward-looking statements concerning business objectives and future plans made in this report based on the subjective assumptions and judgments of the future policies and economic conditions may be significantly different from the actual results. Such statements shall not be considered as virtual promises of the Company to investors, and the investors and relevant persons shall maintain adequate risk awareness and shall understand the differences between plans, forecasts and commitments. The Company has no interim dividend plan, either in the form of cash or stock. This Report has been prepared in both Chinese and English. Should there be any discrepancies or misunderstandings between the two versions, the Chinese version shall prevail. -

Evidence from the CSI 300 Index Additions and Deletions

Asymmetric Responses to Stock Index Reconstitutions: Evidence from the CSI 300 Index Additions and Deletions Ching-Ting Lina,* a Department of Money and Banking, National Chengchi University, 64, Sec. 2, Zhi-Nan Road, Wenshan District, Taipei 11605, Taiwan R.O.C. Wei-Kuang Chenb,† b Department of Money and Banking and Risk and Insurance Research Center, National Chengchi University, 64, Sec. 2, Zhi-Nan Road, Wenshan District, Taipei 11605, Taiwan R.O.C. *Corresponding author. Tel: 886-2-2939-3091ext.81248. Email: [email protected]. †Tel: 886-2-2939-3091ext.81220. Email: [email protected]. Asymmetric Reponses to Stock Index Reconstitutions: Evidence from the CSI 300 Index Additions and Deletions Abstract This study investigates constituent changes to the CSI 300 index, which is scheduled semiannually in accordance with clearly-stated selection methodology. We find that stocks experience a permanent price increase and receive optimistic EPS forecasts from analysts following their addition to the index. These optimistic earnings expectations are supported by increased capital-raising activities and capital expenditure. Conversely, we do not find any significant results for index deletions. Evidence in the form of changes in the number of shareholders and shadow costs are consistent with the investor awareness theory. Increased investor awareness and monitoring forces newly-added firms to perform effectively, resulting in the attraction of more newly-issued capital from investors due to the firms’ lower cost of capital. Monitoring and management efficiency, however, would not lessen sharply for deletions. JEL Classification: G12, G14, G20. Keywords: CSI 300 index; stock index reconstitution; investor awareness; analyst EPS forecast; capital expenditure; asymmetric market response. -

A Sub-Fund of the World Index Shares Etfs (Stock Code : 2827)

W.I.S.E. – CSI 300 China Tracker® * (*This is a synthetic ETF) a sub-fund of the World Index Shares ETFs (stock code : 2827) PROSPECTUS 30 October 2015 IMPORTANT: If you are in doubt about the contents of this Prospectus, you should seek independent professional financial advice. The Stock Exchange of Hong Kong Limited (“SEHK”), the Securities and Futures Commission (“SFC”) and the Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. i IMPORTANT INFORMATION FOR INVESTORS Investors should note that an investment in the Sub-Fund is not the same as an investment in the underlying A Shares of the CSI 300 Index. The Sub-Fund primarily invests in A Share through A-Share access products, AXPs, each of which is a derivative instrument linked to an A Share or a basket of A Shares and the value of such AXPs depends entirely on the credit risk of the issuers. Also, as the Manager is a QFII, the Manager will invest directly in the PRC A Shares on behalf of the Sub-Fund to the extent of such portion of the Manager’s QFII investment quota as the Manager may allocate to the Sub-Fund. The Sub-Fund may also invest, and have direct access to, certain eligible A Shares of PRC companies listed on the Shanghai Stock Exchange (A Shares that are SSE Securities) via the Shanghai-Hong Kong Stock Connect (as defined in “Definition” section on page 9).