Tax Policy at the Crossroads →

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TALES from the KPMG SKUNK WORKS: the BASIS-SHIFT OR DEFECTIVE-REDEMPTION SHELTER by Calvin H

(C) Tax Analysts 2005. All rights reserved. does not claim copyright in any public domain or third party content. TALES FROM THE KPMG SKUNK WORKS: THE BASIS-SHIFT OR DEFECTIVE-REDEMPTION SHELTER By Calvin H. Johnson Table of Contents Calvin H. Johnson is professor of law at the Uni- versity of Texas at Austin. This report arises out of his I. Was FLIP/OPIS Fair Game? ............433 testimony before the U.S. Senate Permanent Subcom- A. Description of the FLIP/OPIS Basis-Shift mittee on Investigation hearings on the role of profes- Shelter ........................ 433 sionals in the U.S. tax shelter industry. Prof. Johnson has agreed to serve as an expert for plaintiffs who B. The Heart of the Shelter ............ 435 bought KPMG shelters and seek recovery of costs. He C. The Paramount Substance-Over-Form thanks James Martens and Samuel Buell for comments Doctrines ....................... 438 on an earlier draft, but acknowledges responsibility II. FLIP/OPIS and Professional Standards ... 440 for errors. A. The One-in-Three Chance Test ........ 440 In this report, Johnson argues that the basis-shift or B. One-in-Three Applied to Outcomes .... 441 defective-redemption shelter, called FLIP or OPIS by III. Concluding Remarks ................ 442 KPMG, was an early product of KPMG’s endeavor to develop complete tax packages that could be sold for KPMG, the fourth largest accounting firm, is negoti- multimillion-dollar fees to many customers. The ating with the Justice Department over the terms by which it might avoid criminal indictment for its conduct FLIP/OPIS shelter gives a rare opportunity, he says, to 1 see both KPMG internal deliberations and also the arising out of its tax shelters. -

Getting Acquainted with VAT (C) Tax Analysts 2011

Introduction: Getting Acquainted With VAT (C) Tax Analysts 2011. All rights reserved. does not claim copyright in any public domain or third party content. By Martin A. Sullivan Martin A. Sullivan is a contributing editor to Tax Analysts. Until recently, most talk about a value added tax in the United States was an academic exercise. Policy experts kept telling anyone who would listen that we could boost our competitive- ness if some form of a VAT was used to replace all, or at least the worst parts, of our clunky income tax. But there was no pressing need for a VAT and no political incentive to undertake the arduous task of orchestrating a major tax reform. But times are changing. Between the 2007 and 2010 fiscal years, the national debt increased from 36 percent to 62 percent of gross national product. And matters are only getting worse. America is relentlessly moving toward the edge of a fiscal abyss. In Wash- ington, while our leaders may talk tough, they are not taking action. To avoid upsetting voters, they are careful not to even hint at spending cuts or tax increases of the size needed to make a real dent in the problem. With no limit on the national credit card, the daily push and pull of politics continues unhindered by the impending crisis. Our system of checks and balances and the usual political gridlock are partly to blame. Also part of the mix is our national mental block about the federal debt. The tough choices that must be made are outside the scope of current political discourse. -

Tax Policy— Unfinished Business

37th Annual Spring Symposium and State-Local Tax Program Tax Policy— Unfinished Business Tangle of Taxes Health Policy Tax Policy and Retirement Issues in Corporate Taxation Tax Compliance Thoughts for the New Congress The Role of Federal and State Federal Impact on State Spending May 17–18, 2007 Holiday Inn Capitol Washington DC REGISTRATION — Columbia Foyer President Thursday, May 17, 8:00 AM - 4:00 PM Robert Tannenwald Friday, May 18, 8:00 AM - 12:30 PM Program Chair All sessions will meet in the COLUMBIA BALLROOM Thomas Woodward Executive Director J. Fred Giertz Thursday, May 17 8:45–9:00 AM WELCOME AND INTRODUCTION 9:00–10:30 AM ROUNDTABLE: RICHARD MUSGRAVE REMEMBERED Organizer: Diane Lim Rogers, Committee on the Budget, U.S. House of Representatives Moderator: Henry Aaron, The Brookings Institution Discussants: Helen Ladd, Duke University; Wallace Oates, University of Maryland ; Joel Slemrod, University of Michigan 10:30–10:45 AM BREAK 10:45–12:15 PM TANGLES OF TAXES: PROBLEMS IN THE TAX CODE Organizer/Moderator: Roberton Williams Jr., Urban-Brookings Tax Policy Center Alex Brill, American Enterprise Institute — The Individual Income Tax After 2010: Post-Permanencism Ellen Harrison, Winthrop Shaw Pittman LLP — Estate Planning Under the Bush Tax Cuts Leonard Burman, William Gale, Gregory Leiserson, and Jeffery Rohaly, Urban-Brookings Tax Policy Center — The AMT: What’s Wrong and How to Fix It Discussants: Roberta Mann, Widener University School of Law; David Weiner, Congressional Budget Office 12:30–1:45 PM LUNCHEON - DISCOVERY BALLROOM Speaker: Peter Orszag, Director, Congressional Budget Office Presentation of Davie-Davis Award for Public Service 2:00–3:30 PM HEALTH POLICY: THE ROLE FOR TAXES Organizer: Timothy Dowd, Joint Committee on Taxation Moderator: Alexandra Minicozzi, Office of Tax Analysis, U.S. -

Brief of Amici Curiae Bipartisan Economic Scholars

No. 19-840 In the Supreme Court of the United States _________ CALIFORNIA, ET AL., Petitioners, v. TEXAS, ET AL., Respondents. _________ On Writ of Certiorari to the United States Court of Appeals for the Fifth Circuit _________ BRIEF AMICI CURIAE FOR BIPARTISAN ECONOMIC SCHOLARS IN SUPPORT OF PETITIONERS _________ SHANNA H. RIFKIN MATTHEW S. HELLMAN JENNER & BLOCK LLP Counsel of Record 353 N. Clark Street JENNER & BLOCK LLP Chicago, IL 60654 1099 New York Avenue, NW Washington, DC 20001 (202) 639-6000 May 13, 2020 [email protected] i TABLE OF CONTENTS TABLE OF AUTHORITIES ......................................... iii INTEREST OF AMICI CURIAE .................................. 1 INTRODUCTION AND SUMMARY OF ARGUMENT ....................................................................... 3 ARGUMENT ....................................................................... 5 I. The Fifth Circuit’s Severability Analysis Lacks Any Economic Foundation And Would Cause Egregious Harm To Those Currently Enrolled In Medicaid And Private Individual Market Insurance As Well As Health Care Providers. ....................................................................... 5 A. Economic Data Establish That The ACA Markets Can Operate Without The Mandate. ................................................................... 5 B. There Is No Economic Reason Why Congress Would Have Wanted The Myriad Other Provisions In The ACA To Be Invalidated. ....................................................... 10 II. Because The ACA Can Operate Effectively Without -

HAMILTON Achieving Progressive Tax Reform PROJECT in an Increasingly Global Economy Strategy Paper JUNE 2007 Jason Furman, Lawrence H

THE HAMILTON Achieving Progressive Tax Reform PROJECT in an Increasingly Global Economy STRATEGY PAPER JUNE 2007 Jason Furman, Lawrence H. Summers, and Jason Bordoff The Brookings Institution The Hamilton Project seeks to advance America’s promise of opportunity, prosperity, and growth. The Project’s economic strategy reflects a judgment that long-term prosperity is best achieved by making economic growth broad-based, by enhancing individual economic security, and by embracing a role for effective government in making needed public investments. Our strategy—strikingly different from the theories driving economic policy in recent years—calls for fiscal discipline and for increased public investment in key growth- enhancing areas. The Project will put forward innovative policy ideas from leading economic thinkers throughout the United States—ideas based on experience and evidence, not ideology and doctrine—to introduce new, sometimes controversial, policy options into the national debate with the goal of improving our country’s economic policy. The Project is named after Alexander Hamilton, the nation’s first treasury secretary, who laid the foundation for the modern American economy. Consistent with the guiding principles of the Project, Hamilton stood for sound fiscal policy, believed that broad-based opportunity for advancement would drive American economic growth, and recognized that “prudent aids and encouragements on the part of government” are necessary to enhance and guide market forces. THE Advancing Opportunity, HAMILTON Prosperity and Growth PROJECT Printed on recycled paper. THE HAMILTON PROJECT Achieving Progressive Tax Reform in an Increasingly Global Economy Jason Furman Lawrence H. Summers Jason Bordoff The Brookings Institution JUNE 2007 The views expressed in this strategy paper are those of the authors and are not necessarily those of The Hamilton Project Advisory Council or the trustees, officers, or staff members of the Brookings Institution. -

Tax Stimulus Options in the Aftermath of the Terrorist Attack

TAX STIMULUS OPTIONS IN THE AFTERMATH OF THE TERRORIST ATTACK By William Gale, Peter Orszag, and Gene Sperling William Gale is the Joseph A. Pechman Senior outlook thus suggests the need for policies that Fellow in Economic Studies at the Brookings Institu- stimulate the economy in the short run. The budget tion. Peter Orszag is Senior Fellow in Economic outlook suggests that the long-run revenue impact Studies at the Brookings Institution. Gene Sperling is of stimulus policies should be limited, so as to avoid Visiting Fellow in Economic Studies at the Brookings exacerbating the nation’s long-term fiscal challen- Institution, and served as chief economic adviser to ges, which would raise interest rates and undermine President Clinton. The authors thank Henry Aaron, the effectiveness of the stimulus. Michael Armacost, Alan Auerbach, Leonard Burman, In short, say the authors, the most effective Christopher Carroll, Robert Cumby, Al Davis, Eric stimulus package would be temporary and maxi- Engen, Joel Friedman, Jane Gravelle, Robert mize its “bang for the buck.” It would direct the Greenstein, Richard Kogan, Iris Lav, Alice Rivlin, Joel largest share of its tax cuts toward spurring new Slemrod, and Jonathan Talisman for helpful discus- economic activity, and it would minimize long-term sions. The opinions expressed represent those of the revenue losses. This reasoning suggests five prin- authors and should not be attributed to the staff, of- ciples for designing the most effective tax stimulus ficers, or trustees of the Brookings Institution. package: (1) Allow only temporary, not permanent, In the aftermath of the recent terrorist attacks, the items. -

Scholars Criticize International Tax

CURRENT AND QUOTABLE (C) Tax Analysts 2015. All rights reserved. does not claim copyright in any public domain or third party content. tax notes™ Scholars Criticize International profits as a share of GDP — at 9.8% — are nearly at all-time highs.2 Their U.S. taxes as a share of GDP Tax Reform Proposals are just 1.9%, which are near all-time lows.3 [See Figure below] And U.S. corporate taxes as a share of federal revenue have plummeted from 32.1% in This letter to Congress from 24 international tax 4 experts expresses opposition to international tax 1952 to 10.6% last year. Finally, the number of reform proposals under consideration that would cross-border acquisitions involving U.S. and other establish a territorial tax system and a low deemed OECD countries has remained relatively constant repatriation tax rate of 14 percent on $2.1 trillion in over the last decade — U.S. firms acquired 324 existing offshore profits. The letter also summarizes OECD firms in 2006 and 238 in 2014 and OECD research showing that there is no factual basis for firms acquired 311 U.S. firms in 2006 and 226 in the assertion that U.S. multinationals cannot com- 2014.5 pete globally because of the U.S. tax system and U.S. tax rates. There is no factual basis for the assertion that U.S. multinationals cannot compete globally because of the U.S. tax system. The effective tax rates on their Dear Member of Congress: worldwide income, including U.S. taxes, are typi- As legal scholars, economists and practitioners cally far below the 35% statutory rate — at one-half who are experts on international tax issues, we are the 35% rate or even less, according to some esti- writing to express our opposition to current propos- mates. -

The Viability of the Fair Tax

The Fair Tax 1 Running head: THE FAIR TAX The Viability of The Fair Tax Jonathan Clark A Senior Thesis submitted in partial fulfillment of the requirements for graduation in the Honors Program Liberty University Fall 2008 The Fair Tax 2 Acceptance of Senior Honors Thesis This Senior Honors Thesis is accepted in partial fulfillment of the requirements for graduation from the Honors Program of Liberty University. ______________________________ Gene Sullivan, Ph.D. Thesis Chair ______________________________ Donald Fowler, Th.D. Committee Member ______________________________ JoAnn Gilmore, M.B.A. Committee Member ______________________________ James Nutter, D.A. Honors Director ______________________________ Date The Fair Tax 3 Abstract This thesis begins by investigating the current system of federal taxation in the United States and examining the flaws within the system. It will then deal with a proposal put forth to reform the current tax system, namely the Fair Tax. The Fair Tax will be examined in great depth and all aspects of it will be explained. The objective of this paper is to determine if the Fair Tax is a viable solution for fundamental tax reform in America. Both advantages and disadvantages of the Fair Tax will objectively be pointed out and an educated opinion will be given regarding its feasibility. The Fair Tax 4 The Viability of the Fair Tax In 1986 the United States federal tax code was changed dramatically in hopes of simplifying the previous tax code. Since that time the code has undergone various changes that now leave Americans with over 60,000 pages of tax code, rules, and rulings that even the most adept tax professionals do not understand. -

On the Margin

© 2020 Tax Analysts. All rights reserved. Analysts does not claim copyright in any public domain or third party content. ON THE MARGIN tax notes federal High Tax, Low Tax? Comparing Income Tax and Wealth Tax Rates by Erin Melly and Alan D. Viard Without taking a position on the merits of wealth taxation,1 we provide a framework for properly interpreting wealth tax rates and their relationship to income tax rates. Because wealth taxes impose a flow of taxes on a stock of wealth, they cannot be properly stated without specifying a time unit. For example, the top tax rate in the wealth tax proposal by Sen. Elizabeth Warren, D-Mass., is not 6 percent but is instead 6 percent per year. No time units are required for income tax rates, for which a flow of taxes is imposed on a flow of income. We discuss how to translate wealth tax rates into equivalent income tax rates for both safe and Erin Melly is a research associate and Alan D. risky assets. We show that apparently low wealth Viard is a resident scholar at the American tax rates are equivalent to apparently high income Enterprise Institute. They thank Karlyn tax rates and vice versa. Bowman, Alex Brill, Jason Saving, and Michael We critically assess the public and political Strain for helpful comments. discussion of wealth tax rates. We find that the In this article, Melly and Viard clarify the media and the candidates have a mixed record fundamental differences between wealth tax regarding the clarity and accuracy of their rates and income tax rates, and they critique the public discussion of wealth tax rates. -

Notes for Tax Policy Course

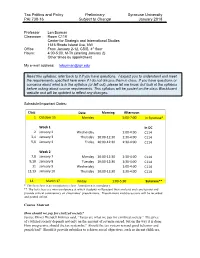

Tax Politics and Policy Preliminary Syracuse University PAI 730-16 Subject to Change January 2018 Professor Len Burman Classroom Room C119 Center for Strategic and International Studies 1616 Rhode Island Ave, NW Office From January 2-12, CSIS, 4th floor Hours: 4:00-5:00, M-Th (starting January 2) Other times by appointment My e-mail address: [email protected] Read this syllabus; refer back to it if you have questions. I expect you to understand and meet the requirements specified here even if I do not discuss them in class. If you have questions or concerns about what is in the syllabus (or left out), please let me know, but look at the syllabus before asking about course requirements. This syllabus will be posted on the class Blackboard website and will be updated to reflect any changes. Schedule/Important Dates: Class Date Morning Afternoon 1 October 15 Monday 5:00-7:00 In Syracuse* Week 1 In DC 2 January 2 Wednesday 1:00-4:00 C114 3,4 January 3 Thursday 10:00-12:30 1:30-4:00 C114 5,6 January 4 Friday 10:00-12:30 1:30-4:00 C114 Week 2 7,8 January 7 Monday 10:00-12:30 1:30-4:00 C114 9,10 January 8 Tuesday 10:00-12:30 1:30-4:00 C114 11 January 9 Wednesday 1:00-4:00 C114 12,13 January 10 Thursday 10:00-12:30 1:30-4:00 C114 14 March 1? Friday 1:00-5:30 Syracuse** * The first class is an introductory class. -

Total State and Local Business Taxes

Total state and local business taxes State-by-state estimates for fiscal year 2012 The authors Andrew Phillips is a principal in the Quantitative Economics and Statistics group of Ernst & Young LLP and directs EY’s Regional Economics practice. He has an MA in Economics from Johns Hopkins University and a BA in Economics from Emory University. Robert Cline is the National Director of State and Local Tax Policy Economics of Ernst & Young LLP. Robert is the former director of tax research for the States of Michigan and Minnesota. He has a PhD in Economics from the University of Michigan. Caroline Sallee is a manager in the Quantitative Economics and Statistics group. She has a Master’s degree in Public Policy from the University of Michigan. Michelle Klassen is an analyst in the Quantitative Economics and Statistics group. She has a BS in Economics from Virginia Tech. Daniel Sufranski is an analyst in the Quantitative Economics and Statistics group. He has a BA in Economics and Political Science from Washington University. This study was prepared by the Quantitative Economics and Statistics (QUEST) practice of Ernst & Young LLP in conjunction with the Council On State Taxation (COST). QUEST is a group of economists, statisticians, survey professionals and tax policy researchers within EY’s National Tax Practice, located in Washington, DC. QUEST provides quantitative advisory services and products to private and public sector clients that enhance business processes, support regulatory compliance, analyze proposed policy issues and provide litigation support. COST is a nonprofit trade association based in Washington, DC. COST was formed in 1969 as an advisory committee to the Council of State Chambers of Commerce and today has an independent membership of nearly 600 major corporations engaged in interstate and international business. -

EFFECTS of the TAX CUTS and JOBS ACT: a PRELIMINARY ANALYSIS William G

EFFECTS OF THE TAX CUTS AND JOBS ACT: A PRELIMINARY ANALYSIS William G. Gale, Hilary Gelfond, Aaron Krupkin, Mark J. Mazur, and Eric Toder June 13, 2018 ABSTRACT This paper examines the Tax Cuts and Jobs Act (TCJA) of 2017, the largest tax overhaul since 1986. The new tax law makes substantial changes to the rates and bases of both the individual and corporate income taxes, cutting the corporate income tax rate to 21 percent, redesigning international tax rules, and providing a deduction for pass-through income. TCJA will stimulate the economy in the near term. Most models indicate that the long-term impact on GDP will be small. The impact will be smaller on GNP than on GDP because the law will generate net capital inflows from abroad that have to be repaid in the future. The new law will reduce federal revenues by significant amounts, even after allowing for the modest impact on economic growth. It will make the distribution of after-tax income more unequal, raise federal debt, and impose burdens on future generations. When it is ultimately financed with spending cuts or other tax increases, as it must be in the long run, TCJA will, under the most plausible scenarios, end up making most households worse off than if TCJA had not been enacted. The new law simplifies taxes in some ways but creates new complexity and compliance issues in others. It will raise health care premiums and reduce health insurance coverage and will have adverse effects on charitable contributions and some state and local governments.