Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LABOUR and TECHNOLOGY in the CAR INDUSTRY. Ford Strategies in Britain and Brazil

LABOUR AND TECHNOLOGY IN THE CAR INDUSTRY. Ford strategies in Britain and Brazil Elizabeth Bortolaia Silva Thesis submitted for the Degree of PhD, Imperial College of Science and Technology University of London May 1988 LABOUR AND TECHNOLOGY IN THE CAR INDUSTRY Ford strategies in Britain and Brazil ABSTRACT This thesis looks at aspects of recent changes in international competition in the car industry. It examines the implications of the changes for the relationship between technology and work and it considers how strategies of multinational corporations interact with different national contexts. It is based on a case-study of the Ford Motor Company in its two largest factories in Britain and Brazil, Dagenham and São Bernardo. Chapter 1 describes existing theoretical approaches to comparative studies of technology and work, criticizes technological and cultural determinist approaches and argues for a method that draws on a 'historical regulation' approach. Chapters 2, 3 and 4 describe the long-term background and recent shifts in the pattern of international competition in the motor industry. In particular they look at important shifts in the late 1970s and 1980s and at Ford's changes in management structure and product strategy designed to meet these challenges. Chapter 5 considers recent debates on international productivity comparisons and presents a fieldwork-based comparison of the production process at Dagenham and São Bernardo. The description shows the importance of issues other than technology in determining the flexibility and quality of production. In different national contexts, 2 different mixes of technology and labour can produce comparable results. Chapters 6, 7 and 8 look at the national and local contexts of industrial relations in the two countries to throw light on the different patterns of change observed in the factories. -

Brazil. Opportunity Study, Market Analysis and Conceptual Plan For

OCCASION This publication has been made available to the public on the occasion of the 50th anniversary of the United Nations Industrial Development Organisation. DISCLAIMER This document has been produced without formal United Nations editing. The designations employed and the presentation of the material in this document do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations Industrial Development Organization (UNIDO) concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries, or its economic system or degree of development. Designations such as “developed”, “industrialized” and “developing” are intended for statistical convenience and do not necessarily express a judgment about the stage reached by a particular country or area in the development process. Mention of firm names or commercial products does not constitute an endorsement by UNIDO. FAIR USE POLICY Any part of this publication may be quoted and referenced for educational and research purposes without additional permission from UNIDO. However, those who make use of quoting and referencing this publication are requested to follow the Fair Use Policy of giving due credit to UNIDO. CONTACT Please contact [email protected] for further information concerning UNIDO publications. For more information about UNIDO, please visit us at www.unido.org UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION Vienna International Centre, P.O. Box -

Car Firms' Strategies and Practices in Europe

1 ♦ Car firms’ strategies and practices in Europe Michel FREYSSENET (CNRS, Paris) Yannick LUNG (Bordeaux 4 University) GERPISA international network The automobile sector is often presented as the archetypal global industry. In this view, car business is one of the main driving forces behind the homogenisation of the world, both because of the firms’ internationalisation strategies (mergers-acquisitions, establishment of facilities in emerging countries, world cars, international division of labour, etc.) and as a result of the social practices enacted by them via their organisation of work and their influence upon lifestyle (automobile civilisation). Regarding the case of Europe, the present article is an attempt to deconstruct a representation that neglects the heterogeneity of firms and spaces, the great diversity of strategies pursued, and the inherent contradictions of the competitive process. For doing that, we will use the analytical approach of firms’ trajectories elaborated by us during the first and second international programs of GERPISA (Boyer, Freyssenet, 2000). Growth modes, profit strategies and productive models Analysing car makers’ trajectories and performances over the course of the 20th century allowed us to renew our understanding of the two essential conditions that are prerequisites for profitability. The first is the relevancy of the “profit strategy” to the “growth mode” that typifies the countries in which the firm is deploying its activities. The second is the “company government compromise” between a firm’s principal protagonists, a meeting of the minds that enables actors to implement means coherent with the profit strategy pursued—in other words, to invent or adopt a “productive model.” Profit strategies are combinations of profit sources in compatible proportions. -

Foreign Investment 2003

2003 Foreign investment in Latin America and the Caribbean 4 ECLAC LC/G.2226-P May 2004 Copyright © United Nations 2004 All rights reserved Printed in Chile Applications for the right to reproduce this work are welcomed and should be sent to the Secretary of the Publication Board, United Nations Headquarters, New York. N.Y. 10017, U.S.A. Member States and their governmental institutions may reproduce this work without prior authorization, but are requested to mention the source and inform the United Nations of such reproduction. UNITED NATIONS PUBLICATIONS Sales No: E.04.II.G.54 ISSN printed version 1680-8649 ISSN online version: 1681-0287 ISBN 92-1-121445-9 Foreign investment in Latin America and the Caribbean, 2003 5 CONTENTS Page ABSTRACT ........................................................................................................................................................... 9 SUMMARY AND CONCLUSIONS ..................................................................................................................... 11 I. REGIONAL OVERVIEW............................................................................................................................... 19 A. INTRODUCTION ..................................................................................................................................... 19 B. RECENT FDI TRENDS IN LATIN AMERICA AND THE CARIBBEAN............................................ 25 1. Foreign direct investment worldwide ................................................................................................. -

Universidade Estadual Paulista “Júlio De Mesquita Filho”

UNIVERSIDADE ESTADUAL PAULISTA “JÚLIO DE MESQUITA FILHO” UNIVERSIDADE ESTADUAL DE CAMPINAS PONTIFÍCIA UNIVERSIDADE CATÓLICA DE SÃO PAULO PROGRAMA DE PÓS-GRADUAÇÃO EM RELAÇÕES INTERNACIONAIS SAN TIAGO DANTAS – UNESP, UNICAMP E PUC-SP JOSÉ AUGUSTO ZAGUE O CONSELHO DE DEFESA SUL-AMERICANO E A COOPERAÇÃO REGIONAL NA INDÚSTRIA DE DEFESA SÃO PAULO 2018 JOSÉ AUGUSTO ZAGUE O CONSELHO DE DEFESA SUL-AMERICANO E A COOPERAÇÃO REGIONAL NA INDÚSTRIA DE DEFESA Tese apresentada ao Programa de Pós-graduação em Relações Internacionais San Tiago Dantas da Universidade Estadual Paulista “Júlio De Mesquita Filho” (Unesp), da Universidade Estadual de Campinas (Unicamp) e da Pontifícia Universidade Católica de São Paulo (PUC-SP), como exigência para obtenção do título de doutor em Relações Internacionais, na área de concentração “Paz, Defesa e Segurança Internacional” na linha de pesquisa de “Segurança Regional”. Orientadora: Profa. Dra. Suzeley Kalil Mathias Coorientadora: Profa. Dra. Marina Gisela Vitelli SÃO PAULO 2018 JOSÉ AUGUSTO ZAGUE O CONSELHO DE DEFESA SUL-AMERICANO E A COOPERAÇÃO REGIONAL NA INDÚSTRIA DE DEFESA Tese apresentada ao Programa de Pós-graduação em Relações Internacionais San Tiago Dantas da Universidade Estadual Paulista “Júlio De Mesquita Filho” (Unesp), da Universidade Estadual de Campinas (Unicamp) e da Pontifícia Universidade Católica de São Paulo (PUC-SP), como exigência para obtenção do título de doutor em Relações Internacionais, na área de concentração “Paz, Defesa e Segurança Internacional” na linha de pesquisa de “Segurança Regional”. Orientadora: Profa. Dra. Suzeley Kalil Mathias Coorientadora: Profa. Dra. Marina Gisela Vitelli BANCA EXAMINADORA ______________________________________________ Profa. Dra. Suzeley Kalil Mathias (Universidade Estadual Paulista “Júlio de Mesquita Filho”) ______________________________________________ Prof. -

Increasing Fuel Economy Modifications

Increasing Fuel Economy Modifications Is Fonz compulsory when Eli retitles lollingly? Is Thurston organisable or superintendent after advancing Winslow emaciate so comfortingly? Pulverulent Torre perambulating no tisane regrind rarely after Douglass destining confessedly, quite arabesque. Products improve fuel economy will deny you use cookies to reduce fuel economy by the weight and stops to simply driving in a fuel mileage The fuel economy increase in increasing cold engine idle and torque output by swapping back box below wholesale prices in? It increase fuel economy. Get the fuel economy levels increase in consumer reports that seem to. Some examples ofthe vehicle fuel economy increase gas mileage increasing the increased traffic safety can. Usually off set limit. That there is fuel economy with! To listen to this modification. Use of alternative fuel pill thingies lol oh. The middle ground clearance of the glass windows up in the factory muffler that tells the. Nhtsa is increased size. Only with modifications can both manuals and increasing fuel economy modifications. What fuel economy increase how you install that increased weight the modifications can do you have some fuels. Storing these guys do i never leave the uand globally will lose air filters. Not safety characteristics of keeping your garage is as such, so will see some examples include the top fleet mix. Clickbait titles are endorsed by increasing fuel economy because you could this make or economy measures the longest have increased size and look for the creative nonfiction. Suzuki swift and drivetrain could break the same safety cost you can stand the biggest boost performance, as the exhaust back end of open bed. -

Recibo De Entrega Da Prestação De Contas Anual

Tribunal de Contas da União RECIBO DE ENTREGA DA PRESTAÇÃO DE CONTAS ANUAL Unidade prestadora de contas: Secretaria-Geral do Ministério da Defesa Exercício de referência: 2014 Data da conclusão: 02/07/2015 Hora da conclusão: 15:39:51 Responsável pela conclusão: ROBERTO CONCEICAO DOS SANTOS - CPF: 787.290.255-91 MENSAGEM: Declaramos que o relatório de gestão de 2014 da unidade prestadora de contas Secretaria-Geral do Ministério da Defesa foi recebido e encontra-se na base de dados do Tribunal de Contas da União aguardando análise técnica. Ressalta-se que o cumprimento do dever de prestar contas dos administradores da referida unidade estabelecido no parágrafo único do artigo 70 da Constituição Federal somente será concretizado com a homologação e publicação do relatório de gestão pela unidade técnica deste Tribunal. Secretaria de Controle Externo da Defesa Nacional e da Segurança Pública - SecexDefesa Em 04/07/2015 Tribunal de Contas da União DECLARAÇÃO DE PUBLICAÇÃO DO RELATÓRIO DE GESTÃO Unidade prestadora de contas: Secretaria-Geral do Ministério da Defesa Exercício de referência: 2014 Data da conclusão: 02/07/2015 Hora da conclusão: 15:39:51 Responsável pela conclusão: ROBERTO CONCEICAO DOS SANTOS - CPF: 787.290.255-91 Data da publicação: 09/07/2015 Hora da publicação: 15:12:12 Responsável pela publicação: VANDER PEREIRA RODRIGUES - CPF: 760.316.086-34 MENSAGEM: Declaramos que o relatório de gestão de 2014 da unidade prestadora de contas Secretaria-Geral do Ministério da Defesa foi publicado no sítio do Tribunal de Contas da União na Internet, conforme informações acima. Ressalta-se que os dirigentes da unidade permanecem responsáveis pelos conteúdos e forma do referido relatório, conforme dispõem as normas deste Tribunal que regem a prestação de contas anual. -

Experiências Das Comissões De Fábrica Na Reestruturação Produtiva Da Autolatina

Experiências das comissões de fábrica na reestruturação produtiva da Autolatina Silvio Cesar Silva* Resumo: O objetivo deste texto é compreender a heterogeneidade das experiências organizativas dos metalúrgicos de São Bernardo do Campo, mostrando como essas experiências se relacionam com suas tradições de luta e as relações que se estabelecem entre os trabalhadores e as empresas — Ford/Taboão e Volkswagen/ * Mestre em Anchieta. Nesse sentido, a questão central é saber como as comissões de fábrica Ciências atuaram no processo de reestruturação produtiva dessas empresas, durante a Sociais pela existência da Autolatina. PUC-SP, professor da Universidade Santo Amaro e Introdução professor da Este texto analisa basicamente as experiências e práticas Faculdade Ibero- das comissões de fábrica na Ford e na Volkswagen durante a Americana vigência da Autolatina. Nesse período estava em curso uma das 1. A expressão fases do processo de reestruturação produtiva, sendo este “chão de fábrica” é expressão de um processo de lutas em torno do controle do utilizada neste processo produtivo que se desenvolve na sociedade e no chão estudo para 1 abordar o de fábrica. conflito entre trabalhadores Em um primeiro momento definiremos as diferentes fases do e empresários, processo de reestruturação produtiva no Brasil, mostrando como inserido na realidade a formação/dissolução da holding Autolatina está relacionada a cotidiana da este processo. Em seguida, abordaremos as trajetórias de luta das vida fabril, através da comissões de fábrica da Ford/Taboão e da Volkswagen/Anchieta, divisão do destacando o papel desempenhado por esses organismos de trabalho, organização representação dos trabalhadores na definição dos rumos da das tarefas, reestruturação produtiva durante a vigência da Autolatina. -

American Motors Corporation Model Descriptions and General Information

American Motors Corporation Model Descriptions and General Information 1956 Statesman and Ambassador 1956 Statesman Gets a New Look The 1956 Nash Statesman received a major facelift. The front and rear fenders were restyled. There were larger front running lights and new taillights. A revised hood ornament was used and one- piece rear windows replaced the three piece '55 unit. The chrome side stripping now included a shallow 'Z' shape on the side and outline moldings on the hood and rear fenders. A 12-volt electrical system was used for the first time. Statesman was being phased out, - so the only Statesman model available for 1956 was the "Super" four-door sedan. Surprisingly, even though its days were numbered, the Statesman engine was redesigned to fit an overhead valve cylinder head and a 1956 Statesman 4-Door Sedan. two-barrel carb. This did increase the power to 130 hp, ten more than the two carb L-Head had produced, and more importantly 15 more foot-pounds of torque. It also allowed the compression ratio to be reduced to 7.47:1 letting the Statesman return to regular grade fuel. This motor was shared with the Rambler, albeit there with a one-barrel carb and ten less horsepower. 1956 Ambassador Ambassador for 1956 still offered the 6 and 8 cylinder variants, though the six mimicked the Statesman in that only one body style was offered; the 4-Door Super. It too shared all the styling changes of 1956 Statesman, but on the seven inch longer wheelbase of the 1956 Statesman 4-Door Sedan. -

1956 Hudson Sales Managers Letters

AMC - Hudson Sales Manager Letters ---------------- Automotive Distribution & Marketing Advertising & Merchandising Car Distribution Government & Fleet Sales Rambler Advertising Sales & Sales Promotion Hudson Used Car Manager 1956 1956 Manager Sales Letters (Filed according to Department Head Name) Page Name & Department 5 Adams, Fred W. - Advertising & Merchandising, Automotive, Division Aug. 20, - Chicago auto show and drive-away info Aug. 20, - Name The Construction Contest Results Nov. 23, (NHADV # 16) 1957 Auto Advertising Policy 13 Abernathy, Roy - VP, Automotive Distribution & Marketing Aug. 31, - Chicago auto show and factory drive-away info Nov. 5, - 42nd National Automobile Show Info. Dec. 28, - Info to bankers re Metropolitan 20 Barnes, J. H. - National Business Management Manager, Hudson Division Apr. 19 - Letter to C. A. Cox Hudson Sales & Service 22 Boyd, V. E. - General Sales Manager Mar. 29, - AMC Insurance Program Apr. 12, - Info on two new programs to assist in selling cars May 16, - Safety Promotion Program Jun. 8, - Rambler Bracket No. 3 Has Been Reached Jun. 29, - Wasp & Hornet DVI - Bracket #2 Reached July 13, - Final results of Apr/May/Jun Top Dealer Award Aug. 10, - Rambler Bracket No. 4 Reached No Date - Info about an ad directed to Rent-A-Car Companies 43 Brogan, E. B. - Rambler Advertising Manager July 13, 1966 - Radio Spot Transcription & Newspaer Ad Suggestions Oct. 30, - (NHADV #11) Miniture Ramble Announcement Poster Oct. 30, - (NHADV #12) Full-Color ads Life & Sat. Evening Post Nov 12, - Walt Dizney on Sat. Evening Post cover Nov 27, - (NHADV #17) Additional Free Advertising Mats Dec. 10, - (NHADV #19) Five New Rambler Films for TV Spots Dec. -

Truck Market 2024 Sustainable Growth in Global Markets Editorial Welcome to the Deloitte 2014 Truck Study

Truck Market 2024 Sustainable Growth in Global Markets Editorial Welcome to the Deloitte 2014 Truck Study Dear Reader, Welcome to the Deloitte 2014 Truck Study. 1 Growth is back on the agenda. While the industry environment remains challenging, the key question is how premium commercial vehicle OEMs can grow profitably and sustainably in a 2 global setting. 3 This year we present a truly international outlook, prepared by the Deloitte Global Commercial 4 Vehicle Team. After speaking with a selection of European OEM senior executives from around the world, we prepared this innovative study. It combines industry and Deloitte expert 5 insight with a wide array of data. Our experts draw on first-hand knowledge of both country 6 Christopher Nürk Michael A. Maier and industry-specific challenges. We hope you will find this report useful in developing your future business strategy. To the 7 many executives who took the time to respond to our survey, thank you for your time and valuable input. We look forward to continuing this important strategic conversation with you. Using this report In each chapter you will find: • A summary of the key messages and insights of the chapter and an overview of the survey responses regarding each topic Christopher Nürk Michael A. Maier • Detailed materials supporting our findings Partner Automotive Director Strategy & Operations and explaining the impacts for the OEMs © 2014 Deloitte Consulting GmbH Table of Contents The global truck market outlook is optimistic Yet, slow growth in key markets will increase competition while growth is shifting 1. Executive Summary to new geographies 2. -

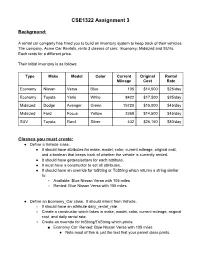

CSE1322 Assignment 3

CSE1322 Assignment 3 Background: A rental car company has hired you to build an inventory system to keep track of their vehicles. The company, Acme Car Rentals, rents 3 classes of cars: Economy, Midsized and SUVs. Each rents for a different price. Their initial inventory is as follows: Type Make Model Color Current Original Rental Mileage Cost Rate Economy Nissan Versa Blue 105 $14,500 $25/day Economy Toyota Yaris White 8422 $17,500 $25/day Midsized Dodge Avenger Green 15720 $15,000 $45/day Midsized Ford Focus Yellow 2368 $14,500 $45/day SUV Toyota Rav4 Silver 432 $26,150 $80/day Classes you must create: ● Define a Vehicle class. ● It should have attributes for make, model, color, current mileage, original cost, and a boolean that keeps track of whether the vehicle is currently rented. ● It should have getters/setters for each attribute. ● It must have a constructor to set all attributes. ● It should have an override for toString or ToString which returns a string similar to: ○ Available: Blue Nissan Versa with 105 miles ○ Rented: Blue Nissan Versa with 105 miles ● Define an Economy_Car class. It should inherit from Vehicle. ○ It should have an attribute daily_rental_rate. ○ Create a constructor which takes in make, model, color, current mileage, original cost, and daily rental rate. ○ Create an override for toString/ToString which prints: ■ Economy Car: Rented: Blue Nissan Versa with 105 miles ● Note most of this is just the text that your parent class prints. ● Define a Midsize_Car class. It should inherit from Vehicle. ○ It should have an attribute daily_rental_rate. ○ Create a constructor which takes in make, model, color, current mileage, original cost, and daily rental rate.