Denver Market Report – Office Q1 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

City of Littleton 2255 West Berry Avenue Littleton, CO 80120 Meeting Agenda

Littleton Center City of Littleton 2255 West Berry Avenue Littleton, CO 80120 Meeting Agenda Planning Commission Monday, January 9, 2017 6:30 PM Community Room Study Session 1. RTD and Southwest Rail Extension Updates a. ID# 17-10 Kent Bagley, Regional Transportation District, Board of Directors, District H Attachments: RTD Directors Map - District H 2. Board and Staff Updates The public is invited to attend all regular meetings or study sessions of the City Council or any City Board or Commission. Please call 303-795-3780 at least forty-eight (48) hours prior to the meeting if you believe you will need special assistance or any reasonable accommodation in order to be in attendance at or participate in any such meeting. For any additional information concerning City meetings, please call the above referenced number. City of Littleton Page 1 Printed on 1/5/2017 Littleton Center City of Littleton 2255 West Berry Avenue Littleton, CO 80120 Staff Communication File #: ID# 17-10, Version: 1 City of Littleton Page 1 of 1 Printed on 1/5/2017 powered by Legistar™ College View / South Platte Englewood Station Nine Mile Station 95 391 UV Harvey Park South FLOYD AV Wellshire 2 University Hills Hampden UV LAKEWOOD Bear Valley UV88 UV Nine Mile Station ZUNI ST HAMPDEN AV 285 30 Kennedy AURORA UV391 9E Wadsworth / Hampden UV95 Englewood Station ¤£285 ¤£285 E HAPPY CANYON RD¤£ UV I Southmoor Station S LOWELLS BLVD 225 0 0.5 1 KENYON AV AURORA ¨¦§ 83 ELATI ST ELATI UV Southmoor Station YOSEMITES ST Miles CLARKSONST Southmoor Park SHERIDAN DENVER Dayton -

2013 Transit-Oriented Development Status Report RTD and Fastracks Overview

2013 Transit-Oriented Development Status Report RTD and FasTracks Overview RTD oversees a 47-mile rail transit system that services 46 stations on five corridors including: • The 5.3-mile Central Corridor and 1.8-mile Central Platte Valley (CPV) Spur in central Denver • The 8.7-mile Southwest Line to Englewood, Sheridan, and Littleton • The 19.2-mile Southeast Line to Lone Tree and Aurora • The 12.1-mile West Line to Lakewood and Golden The FasTracks program, approved by district voters in a 2004 ballot initiative will: • add 122 miles of rail service • 18 miles of Bus Rapid Transit (BRT) • approximately 60 new stations along six new corridors • extend three existing light rail lines image courtesy Gensler Grand Opening / image courtesy RTD Construction cranes dominated the skyline in RTD and TOD STAMPs Underway STAMPs Kicking Off 2013, as the result of an apartment boom in in 2014 the metro area. Development in 2013 centered Transit-oriented development is typically on the hub of the FasTracks program: Denver higher density and incorporates a mixture C-470/Lucent Station I-25/Broadway Station Area Master Plan Area Master Plan Union Station which is scheduled to open in of different uses that generate transit rider- spring 2014. Significant development has also ship. Multiple TODs contribute to creating 104th Ave. Station TOD Fitzsimons Parkway occurred around other existing and future transit-oriented communities where people Master Planning Study Station Area Master Plan stations as construction of FasTracks corridors can live, work, reduce transportation costs, continues at a rapid pace. and improve overall health through increased 88th Avenue Station Civic Center Station muli-modal activity. -

RTD Director Map District E

SABLEBD Five Points 15TH ST City Park South Park Hill NMONACO STREET PKWY 225 E 18TH AVE E 17TH AVE 17TH AV 18thNLINCOLN ST St - California Station E 17TH AVE ¨¦§ North Capitol Hill City Park West YORKN ST E 17TH AVENUE PKWY E 16TH AVE YOSEMITEST CBD NLOGAN ST East Colfax MOLINEST UV32 §70 ¤£40 ¤£40 ¨¦ I E 14TH AVE Colfax Station NSTEELE ST HAVANA ST HAVANA 0 0.5 1 E 13TH AVE NQUEBEC ST Capitol Hill NCLARKSON ST Miles NCORONA ST E HALE PKWY LAREDO ST Civic CenterNBROADWAY Cheesman Park E 11TH AVE 11TH AV NGRANT ST Congress Park Hale Montclair 13th Avenue Station DELMAR PY AIRPORTBD PEORIA ST PEORIA E 8TH AVE ST DAYTON HOFFMAN BD Lincoln Park POTOMAC ST RTD Director 30 E 6TH AVE E 6TH AVENUE PKWY 6TH AV UV30 UV Districts N HOLLY ST E SPEER BLVD RDPICADILLY 4TH AV Country Club E 3RD AVE GUNCLUB RD 2ND AV Speer Hilltop Lowry Field Cherry Creek E 1ST AVE 1ST AV 2ND AV W 1ST AVE E 1ST AVE E 1ST AVE Abilene Station E BAYAUD AVE Alameda / Havana Legend Baker E ALAMEDA AVE E ALAMEDA AVE ALAMEDA AV Alameda Station " LightRail Stations Broadway Marketplace X SMONACO STREET PKWY S DAYTON ST SDAYTON E VIRGINIA AVE Windsor MOLINEST Aurora City Center Station ParkNRides Alameda Station Belcaro EXPOSITION AV E EXPOSITION AVE GLENDALE COUNTIES I-25 / BroadwaySEMERSON ST Station Washington Park West QUEBECS ST Washington Park Washington Virginia Vale Current Director Dist SSTEELE ST S QUEBEC ST TROY ST I-25¨¦§25 - Broadway StationGILPINS ST MISSISSIPPI AV MISSISSIPPI AV Other Director Dist E MISSISSIPPI AVE 85 E MISSISSIPPI AVE ¤£ FASTRACKS Ruby Hill -

Urban Corridor Study

Appendices South I-25 Urban Corridor Study Prepared for: Denver South Transportation Management Association (TMA) Prepared by: Economic & Planning Systems, Inc. Felsburg Holt & Ullevig Goodbee and Associates Sky to Ground Steer Davies Gleave May 4, 2016 EPS # 133068 Appendices Contents 1. SOUTH I-25 URBAN CORRI DOR STUDY ECONOMIC AND DEMOGRAPHI C DATA APPENDI X 2. SOUTH I-25 URBAN CORRI DOR STUDY – TRANSPORTATION AUDIT 3. BUSINESS PARK EVOLUTION WHITE PAPER 4. EMPLOYEE TRANSPORTATI ON SURVEY REPORT OF RESULTS 5. I-25 SOUTH STAKEHOLDER OUTREACH 6. UTILITY INFRASTRUCTURE EVALUATION – SOUTH I-25 URBAN CORRI DOR STUDY TECHNI CAL MEMORANDUM South I -25 Urban Corridor Study Economic and Demographic Data Appendix Denver LosAngeles Oakland Sacramento May 6, 2016 Outline • Employment Data • Housing Data • Demand vs. Capacity Analysis South I-25 Urban Corridor Study 1 EMPLOYMENT DATA South I-25 Urban Corridor Study 2 Study Corridor Boundaries South I-25 Urban Corridor Study 3 Historic Employment Trends 2005-2013 2013 Industry 2005 2013 Total Ann. # Ann. % % of Total Agriculture, Forestry, Fishing and Hunting 19 6 -13 -2 -13.6% 0.0% Mining, Quarrying, and Oil and Gas Extraction 421 1,102 681 85 12.8% 0.8% Utilities 86 6 -80 -10 -27.9% 0.0% Construction 5,840 3,855 -1,985 -248 -5.1% 2.9% Manufacturing 1,719 1,308 -411 -51 -3.4% 1.0% Wholesale Trade 8,249 8,527 278 35 0.4% 6.4% Retail Trade 8,646 9,150 504 63 0.7% 6.9% Transportation and Warehousing 1,190 913 -277 -35 -3.3% 0.7% Information 15,982 15,575 -407 -51 -0.3% 11.7% Finance and Insurance -

Leveraging Existing Transit Infrastructure for Equitable Vaccine Distribution Luna Hoopes Advanced Geospatial Methods Spring 2021 Client: Mile High Connects

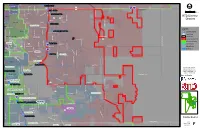

Leveraging Existing Transit Infrastructure for Equitable Vaccine Distribution Luna Hoopes Advanced Geospatial Methods Spring 2021 Client: Mile High Connects PAGE 1 BACKGROUND Mile High Connects is a Denver-based non-profit organization that aims to increase access to housing choices, good jobs, quality schools and essential services via public transit in the Denver Metro region. COVID Check Colorado launched in May 2020 in response to the COVID-19 pandemic and has provided COVID-19 testing. The organization is now working to ensure provision of COVID-19 vaccines to all Colorado residents. When the COVID-19 pandemic began, Mile High Connects engaged with COVID Check Colorado to identify areas of inequity around COVID-related services, primarily testing and vaccines. Because Mile High Connects prioritizes vulnerable populations who often rely on public transit, they are pursuing a partnership with the Regional Transportation District (RTD), in which RTD would provide the land and infrastructure for semi-permanent vaccine distribution sites in underserved areas. After review of existing RTD facilities and in conjunction with the client, it was determined that RTD Park-n-Ride locations are suited for semi-permanent vaccine distribution sites because of their established infrastructure such as protected areas, utility connections, and existing waste management services. The study area for this analysis is the RTD service area (see Figure 1). By responding to the following research question, this analysis is intended to help initiate a conversation between Mile High Connects and RTD to explore how RTD can provide resources in the vaccination effort. RESEARCH QUESTION Which RTD Park-n-Ride locations are eligible for installation of semi-permanent vaccine distribution sites? Eligibility is based on the lack of existing vaccine distribution sites in Park-n-Ride walksheds with a 20-minute walking time (1600 meters). -

R Light Rail Time Schedule & Line Route

R light rail time schedule & line map Lincoln Station to Peoria Station View In Website Mode The R light rail line (Lincoln Station to Peoria Station) has 2 routes. For regular weekdays, their operation hours are: (1) Lincoln Station: 4:13 AM - 10:21 PM (2) Peoria Station: 4:03 AM - 11:07 PM Use the Moovit App to ƒnd the closest R light rail station near you and ƒnd out when is the next R light rail arriving. Direction: Lincoln Station R light rail Time Schedule 16 stops Lincoln Station Route Timetable: VIEW LINE SCHEDULE Sunday 4:13 AM - 10:21 PM Monday 4:13 AM - 10:21 PM Peoria Station 11501 East 33rd Avenue, Aurora Tuesday 4:13 AM - 10:21 PM Fitzsimons Station Wednesday 4:13 AM - 10:21 PM 2550 Fitzsimons Parkway, Aurora Thursday 4:13 AM - 10:21 PM Colfax Station Friday 4:13 AM - 10:21 PM 13800 East Colfax Avenue, Aurora Saturday 4:13 AM - 10:21 PM 13th Ave Station 14110 E 13th Ave, Aurora 2nd & Abilene Station 14051 East Ellsworth Avenue, Aurora R light rail Info Direction: Lincoln Station Aurora Metro Center Station Stops: 16 14555 East Centrepoint Drive, Aurora Trip Duration: 52 min Line Summary: Peoria Station, Fitzsimons Station, Florida Station Colfax Station, 13th Ave Station, 2nd & Abilene 1490 S Abilene St, Aurora Station, Aurora Metro Center Station, Florida Station, Iliff Station, Nine Mile Station, Dayton Station, Iliff Station Belleview Station, Orchard Station, Arapahoe at 13905 E Wesley Ave, Aurora Village Center Station, Dry Creek Station, County Line Station, Lincoln Station Nine Mile Station 3181 South Parker Road, -

RTD Director Map District F

E MONTVIEW BLVDStapleton MONTVIEW BD South Park Hill MOLINEST Montview Station E 17TH AVE 17TH AV SABLEBD HAVANA ST HAVANA NQUEBEC ST YOSEMITEST 32 East Colfax UV 70 70 ¤£36 ¤£40 ¨¦§ ¨¦§ I UV32 RD PICADILLY E 14TH AVE ST DAYTON E 13TH AVE Colfax Station 0 0.5 1 POTOMAC ST Miles E 11TH AVE 11TH AV ST PEORIA 13th Avenue Station AIRPORTBD LAREDO ST HOFFMAN BD Montclair RTD Director 6TH AV UV30 UV30 4TH AV GUNCLUB RD Districts 2ND AV Lowry Field 1ST AV 2ND AV NMONACO STREET PKWY Abilene Station Alameda / Havana Hilltop E ALAMEDA AVE ALAMEDA AV SMONACO STREET PKWY Legend S DAYTON ST SDAYTON TROYST MOLINEST Windsor Aurora City Center Station EXPOSITION AV X" LightRail Stations SABLEBD ParkNRides S QUEBECS ST WATKINS RD (CR97) WATKINS Washington Virginia Vale MISSISSIPPI AV COUNTIES E MISSISSIPPI AVE MISSISSIPPI AV S QUEBEC WAY LOUISIANA AV 30 Current Director Dist DUNKIRK ST UV UVALDA ST UVALDA F PEORIAST FLORIDA AV Other Director Dist DAYTON ST DAYTON DENVER Florida Station BUCKLEYRD UV30 MEXICO AV FASTRACKS 225 Indian Creek LIMA ST LIMA ¨¦§ JEWELL AV UV83 JEWELL AV JEWELL AV LightrailLines SQUEBEC ST TELLURIDE ST BusRoutes 225 TOWERRD ¨¦§ CHAMBERSRD ILIFF AV ILIFF AV AURORA Goldsmith Iliff Station Olympic Park S SYRACUSE WAY E YALE AVE YALE AV YALE AV VENTURA ST Nine Mile Station Hampden Kennedy Nine Mile Station HAMPDEN AV LAREDO ST Southmoor Station Possible future stations and fasttrack projects are Dayton Station preliminary, should not be Southmoor Station considered final and could change or be removed S YOSEMITES ST Hampden South Dayton -

Transit-Oriented Development Status Report

Transit-Oriented Development Status Report November 2005 (Revised March 2006) Prepared for The RTD Board of Directors Prepared by Bill Sirois Manager of Transit Oriented Development Contents 1. Introduction 1 2. FasTracks TOD Update 2 a. Central/CPV Corridors 2 b. Southwest Corridor 7 c. Southeast Corridor 9 d. West Corridor 14 e. US 36 Corridor 17 f. East Corridor 21 g. Gold Line Corridor 24 h. North Metro Corridor 26 i. I-225 Corridor 28 3. Other TOD Activities 30 i Introduction There is a high level of transit-oriented development (TOD) activity occurring in the Denver Metro Region. The following report summarizes much of the activity that is currently underway. It is obvious from the very significant scope of development described herein that the Metro Region is fully aware of the upcoming FasTracks investments and are very knowledgeable about the potential of TOD. Based upon site visits and research, we know of no other urban transit system which approximates this level of planning and development. RTD will continue efforts to work with local governments, DRCOG and the development community to ensure that the FasTracks investment optimizes the potential for smart growth and development throughout the Metro Region. The intent of this report is to provide an update on the current status of development near stations within RTD’s rapid transit system. The report highlights current construction and pre-construction activities near stations as well as station area planning efforts. The report also highlights projects or areas where RTD is taking or has taken an active role in TOD and station development and what, if any, resource commitments RTD has provided on those projects. -

TOD 2009V4.Indd

Transit-Oriented Development Status Report 2009 December 2009 This is a controlled document; please do not dupli- cate. If additional copies are required, please request them from the FasTracks Document Control. This will assure that all recipients of the document receive revisions and additions. Approved By: Bill Van Meter, Acting Assistant General Manager Planning December 2009 Transit-Oriented Development Status Report 2009 TABLE OF CONTENTS 1.0 REPORT OVERVIEW ............................................................ 1-1 1.1 RTD and FasTracks Overview ..................................................................1-1 1.2 RTD and TOD ........................................................................................1-3 1.3 Report Format .......................................................................................1-4 2.0 SUMMARY OF TOD RELATED ACTIVITY ............................... 2-1 2.2 Planning, Zoning and Other Activity .........................................................2-2 3.0 DEVELOPMENT OVERVIEW .................................................. 3-1 3.1 Local TOD Developer Survey ...................................................................3-1 3.2 Regional TOD Trends ..............................................................................3-3 3.3 Perspectives on 2010 and Beyond ...........................................................3-5 4.0 CORRIDOR SUMMARIES ...................................................... 4-1 4.1 Central Corridor, Central Platte Valley Spur, Central Corridor -

News Release

NEWS RELEASE Media Contact: 720.326.7311, [email protected] Light rail wire replacement will affect service on RTD’s E and R Lines this weekend Bus shuttles will be offered between affected stations DENVER (Aug. 13, 2020) – Light rail service on the Regional Transportation District (RTD)’s E and R Lines will be affected from 3 a.m. Saturday through the end of the service day on Sunday, as overhead catenary system (OCS) wire is replaced along portions of the two lines. The OCS wires deliver power to the light rail vehicles through the pantograph that extends upward from the light rail vehicles and makes contact with the wire. While this work takes place, the E and R Lines will not run between Orchard and Dry Creek stations. The R Line will not run south of Orchard Station. Only the E Line will operate between Dry Creek and RidgeGate Parkway stations. The F Line is not running per the COVID-19 Service Plan. Bus shuttles between stations will be provided at the following locations: - Orchard Station – board at Gate B - Arapahoe at Village Center Station – board at Gate F - Dry Creek Station – board at Gate B Riders should plan for additional travel time between affected stations. Scheduled service on the E and R lines will resume Monday. Passengers are required to wear masks and asked to practice social distancing while riding on or waiting to board RTD vehicles. ABOUT RTD The Regional Transportation District develops, operates and maintains a public transportation system that meets the transit needs of close to 3 million people within an eight-county service area in the Denver Metro region. -

Welcome to Greenwood Village Corporate Capital of Colorado Greenwood Village Setting

Welcome to Greenwood Village Corporate Capital of Colorado Greenwood Village Setting Incorporated: 1950 Land Area: 8.4 sq. miles + / - Budget $35M Debt $0 Reserve $20M Population Daytime: 50,000 Residents: 14,000 Housing Single family 3,594 (60.8%) Multi-family 2,319 (39.2%) Commercial Real Estate Lease rates among 10 M sq. ft. of office the highest in metro 50 % Class A space area 90%+ occupancy rates in the Village Center transit adjacent development • The Southeast I-25 Corridor has historically played a prominent role in the economy of the metropolitan area and the State of Colorado. • Advent of light rail further reinforced a Greenwood Village address as a a great place to live and do business. • Future development will build upon the existing identity and recognize high quality transit systems as added location benefits. • For these reasons we think of growth in the I-25 Corridor as Transit Adjacent Development. Role of GV City Government in TAD Make strategic investments in public infrastructure that facilitates and supports private sector development Provide high quality city services that sustains an environment for quality development and the quality of life for residents. Southeast Corridor Stations Northern Part Belleview Station Orchard Station Village Center at Arapahoe Station Dry Creek Station I-225 Corridor Station Dayton Station Dayton Street Station • Named for the Dayton arterial street. • Located in the City of Greenwood Village. • Station responsibilities transferred to the City of Aurora through an IGA. • Land use and station planning responsibilities and station identity Lines H Line transferred to the City of Aurora. -

E Light Rail Time Schedule & Line Route

E light rail time schedule & line map Union Station to RidgeGate Parkway Station View In Website Mode The E light rail line (Union Station to RidgeGate Parkway Station) has 3 routes. For regular weekdays, their operation hours are: (1) Lincoln: 3:41 AM - 4:11 AM (2) Ridgegate: 3:25 AM - 10:18 PM (3) Union Station: 3:50 AM - 10:31 PM Use the Moovit App to ƒnd the closest E light rail station near you and ƒnd out when is the next E light rail arriving. Direction: Lincoln E light rail Time Schedule 12 stops Lincoln Route Timetable: VIEW LINE SCHEDULE Sunday 3:41 AM - 4:11 AM Monday 3:41 AM - 4:11 AM Evans Station 2151 South Delaware Street, Denver Tuesday 3:41 AM - 4:11 AM Louisiana & Pearl Station Wednesday 3:41 AM - 4:11 AM 755 East Louisiana Avenue, Denver Thursday 3:41 AM - 4:11 AM University Of Denver Station Friday 3:41 AM - 4:11 AM 1901 Buchtel Boulevard, Denver Saturday 3:41 AM - 4:11 AM Colorado Station 4298 East Colorado Center Drive, Denver Yale Station 5281 East Yale Circle, Denver E light rail Info Direction: Lincoln Southmoor Station Stops: 12 3690 S Hillcrest Dr, Denver Trip Duration: 34 min Line Summary: Evans Station, Louisiana & Pearl Belleview Station Station, University Of Denver Station, Colorado 4701 South Quebec Street, Denver Station, Yale Station, Southmoor Station, Belleview Station, Orchard Station, Arapahoe at Village Center Orchard Station Station, Dry Creek Station, County Line Station, 5662 Greenwood Plaza Boulevard, Greenwood Village Lincoln Station Arapahoe at Village Center Station 8820 E Caley Ave, Greenwood