Hotel Acquisition (HOTEL EMIT SHIBUYA)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Manager's Comment Performance Total Return

UPDATE 30 November 2017 Manager’s Comment Investment Objective: To achieve capital growth through a focused BTEM’s NAV was essentially unchanged over the month with portfolio of investments, particularly in companies whose share prices local currency gains - driven mostly by discount narrowing - stand at a discount to estimated underlying net asset value. being offset by adverse FX moves (a strengthening Pound). We now have over 20% of NAV in Japanese holdings and these were a key source of performance over the month. Tokyo Broadcasting System, Digital Garage, Toshiba Plant, and the Japan Special Situations Basket all performed strongly. Performance Total Return Outside of Japan, GP Investments, Cosan Limited (which was until now an undisclosed position), JPEL Private Equity, and This investment management report relates to performance figures to Third Point Offshore Investors contributed to returns; Exor, 30 November 2017. Investor AB, Adler, Symphony, and Swire Pacific were detractors. Month Financial Yr* Calendar Yr to date to date We wrote last month on Tokyo Broadcasting System (TBS) and our public campaign to encourage the company to reduce its stock portfolio. TBS’ BTEM NAV1 0.0% 3.5% 12.6% share price rose +20% over November on the back of publicity surrounding our actions and strong operating profit growth (+38% for H1-17) in the MSCI ACWI Ex US3 -1.1% 1.8% 14.1% underlying operating business. Despite the share price increase, non-core assets (listed equities, investment properties, and net cash) more than cover 1 the market cap with the high quality operating business being implicitly MSCI ACWI Ex US Value -1.4% 1.0% 10.0% assigned a negative value by the market. -

Japan Under Construction: Corruption, Politics, and Public Works

Preferred Citation: Woodall, Brian. Japan under Construction: Corruption, Politics, and Public Works. Berkeley, Calif: University of California Press, c1996 1996. http://ark.cdlib.org/ark:/13030/ft5489n9zf/ Japan Under Construction Corruption, Politics, and Public Works Brian Woodall UNIVERSITY OF CALIFORNIA PRESS Berkeley · Los Angeles · Oxford © 1996 The Regents of the University of California To Joyce, Leslie, and Melissa Preferred Citation: Woodall, Brian. Japan under Construction: Corruption, Politics, and Public Works. Berkeley, Calif: University of California Press, c1996 1996. http://ark.cdlib.org/ark:/13030/ft5489n9zf/ To Joyce, Leslie, and Melissa ― ix ― Acknowledgments In researching this book, I have drawn extensively on Japanese-language materials: newspaper reports, periodicals, industry association publications, and government documents. In addition, I conducted over one hundred open-ended interviews, primarily in 1987–1988 and in 1993–1994. Almost all of these interviews were conducted in Japanese, each lasting about an hour. I spoke with construction contractors, industry association officials, elected politicians and their aides, political party officials, government bureaucrats, newspaper reporters, and academics. Because of the highly sensitive, and sometimes sub rosa, nature of the subject matter, I cannot identify these individuals by name. For their willingness to answer sometimes naive questions and to assist in other ways, however, I owe a deep debt of gratitude. At the time I undertook this study, sensible people warned me about the quagmire that lay ahead. They alerted me to the difficulties of handling the shadowy actors engaged in the complex and secretive process of rigging bids on public works projects. Others warned me about dealings with the government bureaucrats and legislators who also animate the policymaking stage in this heretofore strictly "domestic" domain. -

Code Issue Size 1 1301 KYOKUYO CO.,LTD. Topixsmall TOPIX1000

TOPIX New Index Series (As end of October , 2012) (sort by Local Code) As of October 5, 2012 Code Issue TOPIX New Index Series Size 1 1301 KYOKUYO CO.,LTD. TOPIXSmall TOPIX1000 小型 2 1332 Nippon Suisan Kaisha,Ltd. TOPIX Mid400 TOPIX 500 TOPIX1000 中型 3 1334 Maruha Nichiro Holdings,Inc. TOPIX Mid400 TOPIX 500 TOPIX1000 中型 4 1352 HOHSUI CORPORATION TOPIXSmall 小型 5 1377 SAKATA SEED CORPORATION TOPIXSmall TOPIX1000 小型 6 1379 HOKUTO CORPORATION TOPIXSmall TOPIX1000 小型 7 1414 SHO-BOND Holdings Co.,Ltd. TOPIXSmall TOPIX1000 小型 8 1417 MIRAIT Holdings Corporation TOPIXSmall TOPIX1000 小型 9 1514 Sumiseki Holdings,Inc. TOPIXSmall 小型 10 1515 Nittetsu Mining Co.,Ltd. TOPIXSmall TOPIX1000 小型 11 1518 MITSUI MATSUSHIMA CO.,LTD. TOPIXSmall TOPIX1000 小型 12 1605 INPEX CORPORATION TOPIX Large70 TOPIX 100 TOPIX 500 TOPIX1000 大型 13 1606 Japan Drilling Co.,Ltd. TOPIXSmall 小型 14 1661 Kanto Natural Gas Development Co.,Ltd. TOPIXSmall TOPIX1000 小型 15 1662 Japan Petroleum Exploration Co.,Ltd. TOPIX Mid400 TOPIX 500 TOPIX1000 中型 16 1712 Daiseki Eco.Solution Co.,Ltd. TOPIXSmall 小型 17 1719 HAZAMA CORPORATION TOPIXSmall TOPIX1000 小型 18 1720 TOKYU CONSTRUCTION CO., LTD. TOPIXSmall 小型 19 1721 COMSYS Holdings Corporation TOPIX Mid400 TOPIX 500 TOPIX1000 中型 20 1722 MISAWA HOMES CO.,LTD. TOPIXSmall TOPIX1000 小型 21 1762 TAKAMATSU CONSTRUCTION GROUP CO.,LTD. TOPIXSmall 小型 22 1766 TOKEN CORPORATION TOPIXSmall TOPIX1000 小型 23 1780 YAMAURA CORPORATION TOPIXSmall 小型 24 1801 TAISEI CORPORATION TOPIX Mid400 TOPIX 500 TOPIX1000 中型 25 1802 OBAYASHI CORPORATION TOPIX Mid400 TOPIX 500 TOPIX1000 中型 26 1803 SHIMIZU CORPORATION TOPIX Mid400 TOPIX 500 TOPIX1000 中型 27 1805 TOBISHIMA CORPORATION TOPIXSmall TOPIX1000 小型 28 1808 HASEKO Corporation TOPIX Mid400 TOPIX 500 TOPIX1000 中型 29 1810 MATSUI CONSTRUCTION CO.,LTD. -

Exploring Japanese Culture In

JR Yamanote Line Suginami Ward Ikebukuro Kami Shimo Igusa Iogi Igusa Route Seibu-Shinjuku Line Chart JR Chuo Sobu Line 80min Narita Express Nishi Shinjuku Mitaka Kichijoji Ogikubo Ogikubo Asagaya Koenji Nakano NARITA Kugayama Minami Shin Higashi AIRPORT Asagaya Koenji Koenji Tokyo Metro Attention: JR Line Fujimigaoka Marunouchi Line 35min Keio Inokashira Keio Line Shibuya Limousine bus Chuo line express Line It does not stop at Koenji, Asagaya, or Nishi-Ogikubo Takaido Hamada Stations on weekends & holidays. -yama Nishi HANEDA Eifuku Eifuku Chuo Sobu line local Cho Meidai AIRPORT It stops at all stations unless terminating at Nakano. -mae Due to COVID-19, opening hours of stores may dier. We recommend checking their latest information before visiting. Suginami The information in this booklet is accurate as of March Map 2021. Ogikubo P28 Physical Space Academy Ogikubo Tokyo Metro Marunouchi Line 2 3 Kosugi-Yu Open hours: 15:30-1:45 * On Saturday and Sunday, 8:00-1:45 Closed on Thursday Address: 3-32-2, Koenji-Kita, Suginami Web: https://kosugiyu.co.jp/ Twitter: @kosugiyu Instagram: @kosugiyu_sento Facebook: @kosugiyu Tamano-Yu Open hours: 15:00-1:00 Closed on Monday and Tuesday Address: 1-13-7, Asagaya-Kita, * Standard Tokyo sento fee: ¥470 for an adult, ¥180 for up to12yrs, Sento - Public Bathhouse ¥80 for up to 6yrs The history of sento, public bathhouses, goes as far back It has been said that various other subjects were taboo, as the 6th century, originating as part of temple culture in such as monkeys (” saru” in Japanese, a homonym for the Japan. -

Suginami Guide Book

SUGINAMI GUIDE BOOK Quick City Overview 1 2 Suginami City in Numbers Intention to Settle Find it Easy to Live Here Population 574,280 No. of Households 325,518 87.6% 96.1% * According to 2019 Suginami Population Pyramid 100+ City residential opinion survey 95~99 Male 90~94 Female 85~89 Suginami City 80~84 75~79 70~74 65~69 60~64 No. of Trees 55~59 35,914 50~54 45~49 40~44 1st 35~39 Cherry Blossom 5,945 30~34 Area ㎢ 25~29 34.06 20~24 2nd 15~19 Japanese Zelkova 5,373 10~14 5~9 0~4 3rd Ginkgo 3,499 25000 20000 15000 10000 5000 0 0 5000 10000 15000 2000025000 (people) (people) * According to FY2017 Suginami City greenery fact- ¿QGLQJVXUYH\ 100+ 95~99 Male 90~94 Female Green Space Ratio 85~89 Japan 80~84 No. of Parks 75~79 % 70~74 327 21.77 65~69 *As of April 1, 2019 60~64 * According to FY2017 55~59 Suginami City greenery fact- 50~54 ¿QGLQJVXUYH\ 45~49 40~44 Park Area per Person 35~39 ㎡ 30~34 2.07 25~29 20~24 *As of April 1, 2019 15~19 10~14 5~9 0~4 The smallest 5000005 0004 0 000300340 20000200 10000100 010 00 10000 02000 002 300003 400004 5005000 (万人) As of(万人) October 2019 amount out of all Daily Amount of Garbage Generated per Resident 23 Special Wards for 8 years running! No. of Children Max. No. of Children Allowed to g/day Total Fertility Rate 466 (under age 15) enter the Certi ed Child Care Center *FY2018 No waiting list for childcare 60,323 1.03 12,080 since FY2018! * According to 2018 Tokyo *As of April 1, 2019 metropolitan demographic No. -

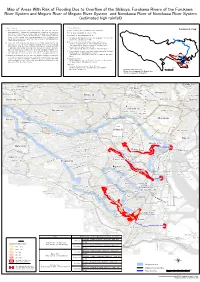

Map of Areas with Risk of Flooding Due to Overflow of the Shibuya

Map of Areas With Risk of Flooding Due to Overflow of the Shibuya, Furukawa Rivers of the Furukawa River System and Meguro River of Meguro River System and Nomikawa River of Nomikawa River System (estimated high rainfall) 1. About this map 2. Basic information Location map (1) Pursuant to the provisions of the Flood Control Act, this map shows the (1) Map created by the Tokyo Metropolitan Government areas expected to flood and anticipated depth of inundation that can occur (2) Risk areas designated on June 27, 2019 when there is the level of rainfall used as a basis for flood control measures for sections subject to flood warnings of the Shibuya, Furukawa (3) Released as TMG announcement No.162 Rivers of the Furukawa River System and Meguro River of Meguro River (4) Designation made based on Article 14, paragraph 2 of the Flood System and those subject to water-level notification of the Nomikawa River Control Act (Act No.193 of 1949) of Nomikawa River System. (5) River subject to flood warnings covered by this map (2) This river flood risk map uses a simulation to show inundation that can Shibuya, Furukawa Rivers of the Furukawa River System occur due to overflow of the Shibuya, Furukawa Rivers of the Furukawa Sumida River (The flood warning section is shown in the table below.) River System and Meguro River of Meguro River System and Nomikawa River Meguro River of Meguro River System of Nomikawa River System resulting from the level of rainfall used as a (The flood warning section is shown in the table below.) basis for flood control measures with an annual exceedance probability of 1 percent. -

Time-Out-Tokyo-Magazine-Issue-22

• G-SHOCK GMW-B5000D Time out TOKYO AD (H297xW225) Discover regional Japan in Tokyo From the courtly refinement of Kyoto to the street smart vibes of Osaka and the tropical flavour of Okinawa, Japan is an amazingly diverse country, with 47 prefectures having their own unique customs, culture and cuisine. Oh Inside yes, the amazing regional cuisines, which keep travellers salivating on every step of a Japanese journey, from the seafood mecca of Hokkaido in the cold north to Fukuoka, the birthplace of the globally famed tonkatsu ramen in the April – June 2019 southern Kyushu prefecture. We know it all too well, the struggle is real: there are too many places to visit, things to do, food to eat – and too little time to do it all. But the good news is that you can easily experience the best of regional Japan right here in Tokyo. Think of our city as a Japan taster, which will inspire you to go visit a different part of the country. START YOUR EXPLORATION ON PAGE 24 â Swing this way The best jazz bars and venues in Tokyo PAGE 60 â KEISUKE TANIGAWA KEISUKE Tsukiji goes dark The former fish market reinvents itself as a nightlife destination PAGE 62 GMW-B5000D â KEISUKE TANIGAWA KEISUKE KISA TOYOSHIMA Playing footsie For heaven’s sake Evolution End a long day of sightseeing Where to savour the drink at these footbath cafés of Japan: sake PAGE 50 PAGE 40 â â back to the HOGUREST PIPA100/DREAMSTIME Origin â FEATURES AND REGULARS 06 Tokyo Update 12 Courtesy Calls 14 Open Tokyo 18 To Do 24 Discover regional Japan in Tokyo 44 Eating & Drinking 48 Shopping & Style 50 Things to Do 54 Art & Culture 58 Music 62 Nightlife 64 LGBT 65 Film 66 Travel & Hotels 70 Getting Around 74 You know you’re in Tokyo when… SMARTPHONE LINK MULTI BAND 6 TOUGH SOLAR * Bluetooth® is a registered trademark or trademark of Bluetooth SIG, Inc. -

Published on 7 October 2015 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD. -

25.06.2014 PRIMA BOZZA Annotazioni

Mutamenti dei linguaggi nella scena contemporanea in Giappone a cura di Bonaventura Ruperti Mutamenti dei linguaggi della scena contemporanea in Giappone a cura di Bonaventura Ruperti © 2014 Libreria Editrice Cafoscarina ISBN: 978-88-7543-364-2 The editor and the Department of Asian and North African Studies of Ca’ Foscari University wish to express their appreciation for assistance given by the Japan Foundation towards the cost of publishing this book. Libreria Editrice Cafoscarina srl Dorsoduro 3259, 30123 Venezia www.cafoscarina.it Tutti i diritti riservati Prima edizione settembre 2014 CONTENTS Introduzione di Bonaventura Ruperti Il teatro in Giappone dalla modernità alla contemporaneità Cifre e linguaggi della scena contemporanea xx - Molteplicità di tendenze xx - La tradizione xx - Trapassi tra tradizione e modernità xx - La modernità xx - La contemporaneità xx - Altre sperimentazioni, nel confronto con le tradizioni xx - Incessanti mutazioni: il corpo e le interazioni tra le arti xx - Rivoluzione, mobilità e impulsi creativi xx - Umorismo e disincanto, silenzio e tragico nel quotidiano xx - Leggerezza del sogno, miti del passato e di un futuro imminente xx - Quiete, frantumazioni e innesti tecnologici xx - Intersezioni, frammenti e fuggevole precarietà xx 1 Katja Centonze Mutamenti del linguaggio estetico e segnico della danza: ankoku butō Prima del butō: L’importanza di Hijikata e la via verso il corpo che si ribella nelle arti sceniche xx - Kinjiki: il primo passo verso la rivoluzione semiotica della danza xx - Lo sguardo storico di Ichikawa Miyabi xx - Il corpo nudo: ratai xx - Le definizioni ankoku butō, ankoku buyō e di “danza” in Giappone xx - L’oggetto “nikutaizzato” come rivoluzione copernicana del butō: corpo e oggetto dalla manipolazione alla trasformazione xx 2 Cinzia Coden Kara Jūrō: la fisicità dell’attore cantastorie Kara e la compagnia Dainana byōtō xx - La nascita di una nuova estetica. -

HALF YEAR REPORT 2020 Introduction

Finding compelling opportunities around the world HALF YEAR REPORT 2020 Introduction Established in 1889, the Company’s TOTAL ASSETS† investment objective is to achieve £ 797 million* capital growth through a focused portfolio of investments, particularly ANNUALISED NAV TOTAL RETURN† in companies whose shares stand 10.6 %** at a discount to estimated underlying ONGOING CHARGES RATIO† net asset value. 0.94 %*** * As at 31 March 2020. ** Source: Morningstar, performance period 30 June 1985 to 31 March 2020, total return net of fees, GBP. The current approach to investment was adopted in 1985. *** As at 31 March 2020, includes: management fee 0.70%, marketing and administration costs. † For definitions, see Glossary on pages 22 to 23. CONTENTS RETAIL INVESTORS ADVISED BY IFAs 01 Financial Highlights The Company currently conducts its affairs so that its shares can be recommended by Independent Financial Advisers (‘IFAs’) 01 Performance Summary in the UK to ordinary retail investors in accordance with the 02 Chairman’s Statement Financial Conduct Authority rules in relation to non-mainstream 03 Investment Manager’s Report investment products and intends to continue to do so. The 10 Investment Portfolio shares are excluded from the Financial Conduct Authority’s 12 Statement of Comprehensive Income restrictions which apply to non-mainstream investment products 13 Statement of Changes in Equity because they are shares in an authorised investment trust. 14 Balance Sheet The Company is an Alternative Investment Fund (‘AIF’) under 15 Statement of Cash Flows the European Union’s Alternative Investment Fund Managers’ 16 Notes to the Financial Statements Directive (‘AIFMD’). Its Alternative Investment Fund Manager 21 Principal Risks and Uncertainties (‘AIFM’) is Asset Value Investors Limited. -

Form5500 Annual Return/Report of Employee Benefit Plan

Annual Return/Report of Employee Benefit Plan OMB Nos. 1210-0110 Form 5500 1210-0089 This form is required to be filed for employee benefit plans under sections 104 and 4065 of the Employee Retirement Income Security Act of 1974 (ERISA) and Department of the Treasury Internal Revenue Service sections 6057(b) and 6058(a) of the Internal Revenue Code (the Code). 2017 Department of Labor Complete all entries in accordance with Employee Benefits Security Administration the instructions to the Form 5500. Pension Benefit Guaranty Corporation This Form is Open to Public Inspection Part I Annual Report Identification Information For calendar plan year 2017 or fiscal plan year beginning 01/01/2017 and ending 12/31/2017 X a multiemployer plan a multiple-employer plan (Filers checking this box must attach a list of A This return/report is for: X X participating employer information in accordance with the form instructions.) X a single-employer plan X a DFE (specify) _C_ B This return/report is: X the first return/report X the final return/report X an amended return/report X a short plan year return/report (less than 12 months) C If the plan is a collectively-bargained plan, check here. X D Check box if filing under: X Form 5558 X automatic extension X the DFVC program X special extension (enter description) ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDE Part II Basic Plan Information—enter all requested information 1a Name of plan 1b Three-digit plan 001 ABCDEFGHIPRODUCERS-WRITERS ABCDEFGHI GUILD ABCDEFGHI OF AMERICA PENSIONABCDEFGHI PLAN ABCDEFGHI ABCDEFGHI ABCDEFGHI number (PN) 001 ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI 1c Effective date of plan YYYY-MM-DD03/31/1960 2a Plan sponsor’s name (employer, if for a single-employer plan) 2b Employer Identification Mailing address (include room, apt., suite no. -

Notice on Acquisition of Domestic Real Estate

December 17, 2012 To whom it may concern: <Investment Corporation> Japan Real Estate Investment Corporation Noritada Terasawa, Executive Director (TSE code: 8952) <Asset Management Company> Japan Real Estate Asset Management Co., Ltd. Hiroshi Katayama, CEO & President Contact: Ryuta Yoshida, General Manager, Planning Department Phone: +81-3-3211-7921 Notice on Acquisition of Domestic Real Estate Announcement is hereby made that on December 17, 2012, Japan Real Estate Investment Corporation (the “Company”) decided to acquire the following domestic real estate property. 1. Outline of the acquisition 1) Asset to be acquired: Domestic Real Estate Land: Ownership (share of co-ownership) Building: Compartmentalized building units and co-ownership of compartmentalized building units (ownership percentage for building: 2.859811%) (Note 1) 2) Name of asset: Harmony Tower 3) Acquisition price: ¥ 520 million 4) Scheduled acquisition date: December 19, 2012 (scheduled) 5) Seller: 4 individuals (Note 2) 6) Method of Settlement: Lump sum payment at closing of acquisition 7) Acquisition funds: Own funds (scheduled) Note 1: The Company acquired a share of ownership of the property (29.253305% of the share of ownership of the building) on February 28, 2005. Following the above acquisition of an additional share, the Company’s share of ownership of the building will be 32.113115%. Note 2: Details of the sellers are not disclosed due to non-approval of disclosure by individuals of the sellers. 2. Reason for the acquisition The Company will acquire the assets based on the basic policies and investment attitude for acquisition under the Articles of Incorporation of the Company. In particular, the following points have been highly evaluated in the determination of the acquisition.