The Irish Not-For-Profit Sector: Fundraising Performance Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Results Booklet 2018

Results Booklet 2018 Listowel, Co. Kerry National TidyTowns Winners, 2018 WINNERS TO DATE 1958 Glenties, Co.Donegal 1989 Ardagh, Co.Longford 1959 Glenties, Co.Donegal 1990 Malahide, Co.Dublin 1960 Glenties, Co.Donegal 1991 Malin, Co.Donegal 2 1961 Rathvilly, Co.Carlow 1992 Ardmore, Co.Waterford 1962 Glenties, Co.Donegal 1993 Keadue, Co.Roscommon 1963 Rathvilly, Co.Carlow 1994 Galbally, Co.Limerick 1964 Virginia, Co.Cavan 1995 Glenties, Co.Donegal 1965 Virginia, Co.Cavan 1996 Ardagh, Co.Longford 1966 Ballyjamesduff, Co.Cavan 1997 Terryglass, Co.Tipperary 1967 Ballyjamesduff, Co.Cavan 1998 Ardagh, Co.Longford 1968 Rathvilly, Co.Carlow 1999 Clonakilty, Co.Cork 1969 Tyrrellspass, Co.Westmeath 2000 Kenmare, Co.Kerry 1970 Malin, Co.Donegal 2001 Westport, Co.Mayo 1971 Ballyconnell, Co.Cavan 2002 Castletown, Co.Laois 1972 Trim, Co.Meath 2003 Keadue, Co.Roscommon 1973 Kiltegan, Co.Wicklow 2004 Lismore, Co Waterford 1974 Trim, Co.Meath, Ballyconnell, Co.Cavan 2005 Ennis, Co.Clare 1975 Kilsheelan, Co.Tipperary 2006 Westport, Co.Mayo 1976 Adare, Co.Limerick 2007 Aughrim, Co.Wicklow 1977 Multyfarnham, Co.Westmeath 2008 Westport, Co.Mayo 1978 Glaslough, Co.Monaghan 2009 Emly, Co.Tipperary 1979 Kilsheelan, Co.Tipperary 2010 Tallanstown, Co.Louth 1980 Newtowncashel, Co.Longford 2011 Killarney, Co.Kerry 1981 Mountshannon, Co.Clare 2012 Abbeyshrule, Co.Longford 1982 Dunmanway, Co.Cork 2013 Moynalty, Co.Meath 1983 Terryglass, Co.Tipperary 2014 Kilkenny City, Co.Kilkenny 1984 Trim, Co.Meath 2015 Letterkenny, Co.Donegal 1985 Kilkenny City, Co.Kilkenny 2016 -

Committee 1 Roscommon That the Revised Local Electoral Boundary Shall Ensure That In

18.331 Local Electoral Area Boundary Committees - Committee 1 Roscommon That the revised local electoral boundary shall ensure that in the case of Roscommon that a local electoral area shall be designed around the urban centre of Roscommon County Town and encompass the surrounding villages and rural hinterland thus taking account of local and community identities and linkages. Please see attached a map showing Roscommon County Town and its radius of linkage. These linkages include shopping, services including doctors and dentists, Garda Station, hospital, local schools, after school activities, sports, Library. At present people in the surrounding areas of Athleague DED, Fuerty, Castlecoote, Kilbegnet and Donamon continue to frequent Roscommon Town for all of the above. However they do not have ease of access to their Municipal District Office. The Roscommon Municipal District is a few minutes drive away however the Athlone Municipal District office is 40 minutes drive away. No other area in the County is so removed from an area office which is ironic considering it is just minutes from the Roscommon Municipal district. The Roscommon MD has an area office in Roscommon and Castlerea. The Boyle MD has an area office in Boyle and Ballaghaderren and Strokestown. And the Athlone MD has one area office in Monksland. The structure is not servicing the people of Athleague, Fuerty, Castlecoote, Rosmoylan and Donamon. The simple solution is to reconnect them electorally with their local town, the County Town, Roscommon. Roscommon Town Team is working very effectively servicing Roscommon Town and surrounding areas however it is not connected to Athleague, Fuerty, Castlecoote, Rosmoylan and Donamon as they are in the Athlone MD and their closest Town Team is in Monksland (40 minutes away). -

2013/B/41 Tuairisceáin Bhliantiúla Faighte Idir 16-Dei-2013 Agus 22-Dei-2013 Inneács De Na Cineál Áiteamh

AITHEANTAS EAGRÁIN: 2013/B/41 TUAIRISCEÁIN BHLIANTIÚLA FAIGHTE IDIR 16-DEI-2013 AGUS 22-DEI-2013 INNEÁCS DE NA CINEÁL ÁITEAMH B1AU - TUAIRISCEAN BLIANTUIL LE TUAIRISCEAN INIUCHORA B1 - TUAIRISCEAN BLIANTUIL - GAN CUNTAIS B1C - TUAIRISCEAN BLIANTUIL -GINEARALTA B1B - TUAIRISCEAN BLIANTUIL IONADUIL CRO GAZETTE, CÉADAOIN, 23ú DEIREADH FÓMHAIR 2013 3 TUAIRISCEÁIN BHLIANTIÚLA FAIGHTE IDIR 16-DEI-2013 AGUS 22-DEI-2013 Uimhir na Ainm na Cáipéis Dáta Uimhir na Ainm na Cáipéis Dáta CuideachtaCuideacht Faighte CuideachtaCuideacht Faighte 645 GALWAY ARTISANS' AND LABOURERS' B1C 25/09/2013 18602 JOHN J. CLANCY & COMPANY LIMITED B1C 14/10/2013 DWELLINGS BUILDING COMPANY 18638 THE GREVILLE ARMS LIMITED B1C 16/10/2013 LIMITED 18667 BALLYMACOLL STUD FARM LIMITED B1C 03/10/2013 1253 INCHICORE UNITED WORKING MAN'S B1C 09/10/2013 18903 JAMES P. JONES AND SON LIMITED B1C 15/10/2013 CLUB COMPANY LIMITED 19172 ALANNA LIMITED B1C 14/10/2013 1367 THWAITES LIMITED B1C 15/10/2013 19214 JOHN MCBRIDE (CRANFORD) LIMITED B1C 12/10/2013 1477 THE LIMERICK RACE COMPANY PUBLIC B1C 22/10/2013 19333 RECKITT BENCKISER HEALTHCARE B1C 25/09/2013 LIMITED COMPANY (IRELAND) LIMITED 1636 C&C MANAGEMENT SERVICES LIMITED B1C 09/10/2013 19334 DROXFIELD LIMITED B1C 15/10/2013 1715 FITZWILTON LIMITED B1C 26/09/2013 19374 FORTH ESTATES LIMITED B1C 15/10/2013 3673 WM. MAGNER LIMITED B1C 10/10/2013 19571 KELLIHERS PROPERTY HOLDING B1C 11/10/2013 4953 NORBERT DENTRESSANGLE OVERSEAS B1C 22/10/2013 COMPANY LIMITED IRELAND LIMITED 19647 JOHN J. FENNESSY LIMITED B1C 02/10/2013 5103 MACDONAGH BOLAND CROTTY B1C 01/10/2013 20194 J. -

Index 1986-2019 by Tom Norton MA

Index 1986-2019 by Tom Norton MA September 2019 1 Index to Co. Roscommon Historical and Archaeological Society Journal, 1986-20191 Tom Norton (Tom Norton was born in Roscommon Town and lived on Claw Inch island on Lough Ree until the late 1940s. Later, he went to school in Galway. He now works in Hampshire, England, as a freelance indexer and English teacher). The definite and indefinite articles are ignored in the alphabetical arrangement but are not inverted. For example, ‘The Famine’ will be found under ‘F’. The form of reference is volume number, followed by the page number. For example, ‘7.13’ is a reference to volume number 7, page 13. Volume/year numbers are as follows: 1=1986, 2=1988, 3=1990, 4=1992, 5=1994, 6=1996, 7=1998, 8=2000, 9=2002, 10=2006, 11=2009, 12=20132, 13=2016, 14=2019 1798 Rising and Col James Plunkett 7.100–1 memoirs 7.112–13 souvenir jewellery, advertisement, 1898: 7.13 Acheson, George R., photo 14.5 advertisements cornflour (1916) 13.156 farmhouse (1903) 9.118 Ford car (1916) 13.154 oil lamps (1916) 13.153 patent medicines (1890s) 7.36 patent medicines (1916) 13.152 servants encouraged to enlist (1915) 13.71 souvenir jewellery (1898) 7.13 agrarian violence ‘Agrarian violence in Kilbride & Kilgefin 1843-1844 13.43–5 Land League, and agrarian crime 9.59–61 land wars 12.51–60 ‘Roscommon Agrarian Unrest 1881-82’ 12.35–8 1 Copies of this index are freely available in electronic form from [email protected] 2 The volume number is not printed on the cover of this issue. -

The Irish Not-For-Profit Sector

The Irish Not-for-Profit Sector: Fundraising Performance Report 2017 2into3, Pembroke Hall, 38/39 Fitzwilliam Square, D02NX53 +353 1 234 3101 www.2into3.com Foreword Key Findings This is the 7th Irish Not-for-Profit Sector: Fundraising Performance Fundraised Income Increased by 6% in 2015, Driven Report prepared by 2into3. It provides a detailed overview of a by a Steep Rise in Donations to Religious representative sample of organisations and insights into their activities and experiences, especially in relation to fundraising. Organisations. This report estimates the total amount of fundraised income or The Irish Not-for-Profit Sector’s Fundraised Income philanthropy in Ireland in 2015 and takes into account the Totalled €823 Million in 2015 continuously evolving size of the sector in light of the Charities Regulatory Authority’s registered list of charities and the Benefacts Average Cost to Raise €1 in 2015 was 29c database. This year, the report also includes the funding model of the not-for-profit sector and of each subsector. Staff Numbers Increased by 4% While Benefacts provides a strong starting point for information on State Funding as a % of Total Income in 2015 was the sector, it is still an under researched area. There is still a lack of 47.5%, an Increase of 4% quantitative information available on the Irish not-for-profit sector. This report highlights the critical importance of making improvements Ireland’s Per Capita Giving is €176; €200 Less than of to the quality of data in the sector. There is a need for the sector to U.K. -

On the Edge of Roscommon Town, Oldwood Is an Executive Development in Stunning Surroundings

An executive development of luxurious two and three bedroom homes in the heart of Ireland 1 Welcome to Oldwood On the edge of Roscommon Town, Oldwood is an executive development in stunning surroundings. From here, you’re just a short walk from the town centre’s Where elegance meets efficiency numerous amenities – or the peace and quiet of the nearby While Oldwood’s location is important, what really sets it Mote Park forest. You can keep up with a busy lifestyle or apart is the attention to detail throughout every facet of find the perfect place to get some respite from it. its design and build. But that is just one part of what makes the development Every one of our homes includes the stylish details that so special. put a property in a class of its own, from a welcoming log burner to a sleek and stylish fitted kitchen. What’s more, considered design pays dividends in other ways. As one of the first developments to achieve A-rated energy efficient in every home, Oldwood creates energy savings of as much as 60% a year. There’s a lot to love. We invite you to step inside and see for yourself. 2 Careful design and construction make Oldwood stylish, efficient, and truly welcoming. 3 Tranquil surroundings with an unrivalled choice of amenities. At Oldwood, there’s something for every lifestyle. 4 A PLACE TO BUILD A LIFE Building a house is just the start. A new development only really comes to life when you start living there. At Oldwood, that life combines modern connections From sport to wide open space with charming surroundings. -

Chairman's Musings

NEWSLETTER ATHLONE BRANCH INLAND WATERWAYS ASSOCIATION OF IRELAND Summer 2014 www.athlone.iwai.ie Secretary Brian Corcoran [email protected] Chairman’s Musings Athlone Branch is Every year I feel blue leaving the river after the end of season cruise in company. Then again every year I look forward to the start of the season with the first CIC. This year’s CIC in May was a navigational adventure as we were guided by Pat McManus through the Woodshoal from Hodson Bay to Portrun, opening up 60!Come and celebrate. a new route on Lough Ree. We have a series of events lined up for There will be a party on Saturday the season from gentle CIC’s in June and in September to the more 12th July in Athlone Golf Club, Hodson Bay with adventurous rally in August plus partying at our 60th birthday in July and the October winter book launch. I hope you will join us when you can. a drinks reception, barbeque buffet, music and dancing. Contact Niamh Herraghty and book Dunrovin is still on our agenda, upgrading of old swing moorings, meeting with the your ticket as numbers will be limited. Phone or local authority and Waterways Ireland, engaging with the canal restoration group, text: 086 846 1564 or email niamhherraghty@ developing the website, getting new members and communicating with members hotmail.com through Facebook, texting and email and producing the well loved Aerial. If you have any issue or bright idea do contact your branch. Safe boating, St. Hilda’s Day Out Siobhan Bigley Sheila Herraghty In this issue: Chairperson On Friday 30th May 9 boats, plus the Viking Ship assembled at Sean’s Bar for 1.30pm. -

Charitable Tax Exemption

Charities granted tax exemption under s207 Taxes Consolidation Act (TCA) 1997 - 30 June 2021 Queries via Revenue's MyEnquiries facility to: Charities and Sports Exemption Unit or telephone 01 7383680 Chy No Charity Name Charity Address Taxation Officer Trinity College Dublin Financial Services Division 3 - 5 11 Trinity College Dublin College Green Dublin 2 21 National University Of Ireland 49 Merrion Sq Dublin 2 36 Association For Promoting Christian Knowledge Church Of Ireland House Church Avenue Rathmines Dublin 6 41 Saint Patrick's College Maynooth County Kildare 53 Saint Jarlath's College Trust Tuam Co Galway 54 Sunday School Society For Ireland Holy Trinity Church Church Ave Rathmines Dublin 6 61 Phibsboro Sunday And Daily Schools 23 Connaught St Phibsborough Dublin 7 62 Adelaide Blake Trust 66 Fitzwilliam Lane Dublin 2 63 Swords Old Borough School C/O Mr Richard Middleton Church Road Swords County Dublin 65 Waterford And Bishop Foy Endowed School Granore Grange Park Crescent Waterford 66 Governor Of Lifford Endowed Schools C/O Des West Secretary Carrickbrack House Convoy Co Donegal 68 Alexandra College Milltown Dublin 6 The Congregation Of The Holy Spirit Province Of 76 Ireland (The Province) Under The Protection Of The Temple Park Richmond Avenue South Dublin 6 Immaculate Heart Of Mary 79 Society Of Friends Paul Dooley Newtown School Waterford City 80 Mount Saint Josephs Abbey Mount Heaton Roscrea Co Tiobrad Aran 82 Crofton School Trust Ballycurry Ashford Co Wicklow 83 Kings Hospital Per The Bursar Ronald Wynne Kings Hospital Palmerstown -

Feasibility Study for Portrunny Amenity & Recreation Centre (“PARC”)

Feasibility Study for Portrunny Amenity & Recreation Centre (“PARC”) www.portrun.ie June 2019 This page intentionally left blank Contents Executive Summary ................................................................................................................................. 4 PART ONE: SITUATION ANALYSIS & OPPORTUNITY ASSESSMENT ......................................................... 6 1.0 Introduction ...................................................................................................................................... 6 2.0 Site Appraisal .................................................................................................................................... 7 2.1 Portrunny ...................................................................................................................................... 7 2.2 Proposed PARC Initiative .............................................................................................................. 9 2.3 Local Context ............................................................................................................................... 11 2.4 Regional Context ......................................................................................................................... 14 2.5 Current Initiatives Underway or Planned ................................................................................... 15 3.0 Strategic Context ............................................................................................................................ -

2019 List of Projects Funded

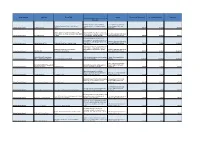

Local Authority Applicant Project Title Category Environment Fund Award Local Authority Award Total Award Description of Project (no more than 160 characters) A community prayer walk reflecting the C.Development of Community St. Mary's Community Prayer Walk (Willow commitment to the All-Ireland Pollinator Areas including Wildlife and Carlow County Council St. Mary's Church Structure) Plan. Biodiversity €325.00 €325.00 €650.00 Climate Action at New Oak Boys Soccer Club - Issue a reusable water bottle to all juvenile Reduce Single Use Plastic & Introduce Segregation club members as a mandatory piece of their A.Training, Education and similar Carlow County Council New Oak Boys FC of Waste kit. Registered in National Tap Map. Awareness-Raising Initiatives €450.00 €450.00 €900.00 Information boards for members of the public displaying information on bat survey and historic tree trail already carried on in A.Training, Education and similar Carlow County Council Myshall Muintir na Tíre Biodiversity Study Part 3 Myshall Village parts 1 and 2. Awareness-Raising Initiatives €600.00 €600.00 €1,200.00 Environmental awareness for primary level children of the ecology found in their own Biodiversity Life in the School Garden - back gardens, fields and school garden A.Training, Education and similar Carlow County Council Naturally Wild presentations and activities areas. Awareness-Raising Initiatives €600.00 €600.00 €1,200.00 Carlow/Kilkenny Energy Agency Work with sports clubs to complete energy F.Audits, Surveys and Action Carlow County Council T/A 3 Counties Energy Agency Community Energy Sports Audits audits on their facilities. Planning €1,000.00 €1,000.00 €2,000.00 C.Development of Community Ballinabranna/Milford/Raheendoran Erect swift boxes and a calling system to Areas including Wildlife and Carlow County Council Development Group Swift Bird Project promote conservation of the bird. -

Peatlands Community Engagement Scheme 2021 Organisation Project

Grants Awarded - Peatlands Community Engagement Scheme 2021 Organisation Project Location Description of Project Grant Awarded To procure equipment and software €12,605.33 to develop skills amongst the Abbeyleix Bog Project Co. Laois Abbeyleix Bog Project volunteers and to use this to collect survey data and map over 3,000 peat dams that were installed. To carry out maintenance work under €13,831.20 phase 4 of enhancement works to Cloonsellan Abbey Co. Roscommon existing bog road at Clooncraff Bog Conservation Group Loop Walk (part of Lough Ree Special Area of Conservation (SAC), Co. Roscommon), installation of seating and a wicker sculpture. Irish Peatlands Co. Kildare To upgrade a bog boardwalk, viewing €8,208.66 Conservation Council area and seat, install signage and seating and improve access. To deliver a volunteer work camp to clear scrub along the boundary of the nature reserve and offer educational visits to 15 schools/classes at Lodge Bog. ETHOS (Everything Co. Westmeath To undertake surveys and mapping of €4,950.00 Tyrellspass Has On Show) Cloncrow Bog Natural Heritage Area to inform the development of a proposed boardwalk. St. Brendan’s Community Co. Offaly To upgrade existing wooden trackway €20,000.00 School at Killaun Bog looped walk. NEWKD (North, East and Co. Kerry To design and print a brochure in €2,000.00 West Kerry Development), respect of local history of the bogs in Kerry to include maps, history, types of peat, existing and potential future usage, habitats, wildlife and vegetation. Connolly Tidy Villages Co. Clare To continue the development of a €5,200.00 looped bog walk to include a birdwatch hut and signage, to remove invasive species and host bog walks during the year. -

Listing of Cemeteries in County Roscommon, Ireland

The County Roscommon Graveyard Survey was carried out in 2005 on behalf of County Roscommon Heritage Forum List of Cemeteries in County Roscommon, Ireland Register of Date of X (ITM Y (ITM Nearest Condition of Wheelchair Location of Burials Start Opening of Current Status Register of Graveyard Name Coordinate) Coordinate) Type Townland Civil Parish Parish Diocese Denomination Owner Road Graveyard Description of Graveyard Access Access Inscriptions Date Graveyard of Graveyard Burials Parking Notes A vault at the rear of the church contains the remains of the wife of the Bishop of Elphin dated 1813. The Digby's of Rectangular in shape bounded by stone walls with ruins of None. This is a Drumdaff also buried here.The church was built in 1720 by Cloonygormica church within.Some headstones but majority just marker mixed burial Charles Hawkes and continued until mid 1800's.The last burial Aclare C of I 583317.8888 776149.5924 Graveyard Carrowbaun n Oran Elphin C of I L70001‐0Fair stones. Tarred road None ground. 0 CLOSED No Poor here was in 191 The meagre remains at the top of the graveyard are believed Well Large well maintained graveyard on a hillside .This site is full At enterance to to be the location of an ancient church dedicated to St. Ardcarne New 586529.8159 802099.6315 Graveyard Ardcarne Ardcarn Ardcarne Elphin RC RCC L10151‐0 Maintained but no attempt as yet to get an extension. Tarred road Fair graveyard. 0 OPEN Yes Good Michael the Archangel and was calledTeampall Mhichil. The church on this site was built in 1860 replacing an older one destroyed by fire.In 1997 a new famine memorial was errected in the adjoining graveyard to commerate over nine Well Old rectangular graveyard behind St.