104Th Annual Conference on Taxation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Policy— Unfinished Business

37th Annual Spring Symposium and State-Local Tax Program Tax Policy— Unfinished Business Tangle of Taxes Health Policy Tax Policy and Retirement Issues in Corporate Taxation Tax Compliance Thoughts for the New Congress The Role of Federal and State Federal Impact on State Spending May 17–18, 2007 Holiday Inn Capitol Washington DC REGISTRATION — Columbia Foyer President Thursday, May 17, 8:00 AM - 4:00 PM Robert Tannenwald Friday, May 18, 8:00 AM - 12:30 PM Program Chair All sessions will meet in the COLUMBIA BALLROOM Thomas Woodward Executive Director J. Fred Giertz Thursday, May 17 8:45–9:00 AM WELCOME AND INTRODUCTION 9:00–10:30 AM ROUNDTABLE: RICHARD MUSGRAVE REMEMBERED Organizer: Diane Lim Rogers, Committee on the Budget, U.S. House of Representatives Moderator: Henry Aaron, The Brookings Institution Discussants: Helen Ladd, Duke University; Wallace Oates, University of Maryland ; Joel Slemrod, University of Michigan 10:30–10:45 AM BREAK 10:45–12:15 PM TANGLES OF TAXES: PROBLEMS IN THE TAX CODE Organizer/Moderator: Roberton Williams Jr., Urban-Brookings Tax Policy Center Alex Brill, American Enterprise Institute — The Individual Income Tax After 2010: Post-Permanencism Ellen Harrison, Winthrop Shaw Pittman LLP — Estate Planning Under the Bush Tax Cuts Leonard Burman, William Gale, Gregory Leiserson, and Jeffery Rohaly, Urban-Brookings Tax Policy Center — The AMT: What’s Wrong and How to Fix It Discussants: Roberta Mann, Widener University School of Law; David Weiner, Congressional Budget Office 12:30–1:45 PM LUNCHEON - DISCOVERY BALLROOM Speaker: Peter Orszag, Director, Congressional Budget Office Presentation of Davie-Davis Award for Public Service 2:00–3:30 PM HEALTH POLICY: THE ROLE FOR TAXES Organizer: Timothy Dowd, Joint Committee on Taxation Moderator: Alexandra Minicozzi, Office of Tax Analysis, U.S. -

Tax Amnesty and Political Participation *

TAX AMNESTY AND POLITICAL PARTICIPATION * ABSTRACT In many countries thinking about a (new) tax amnesty is currently in vogue. However, cross-national ex- perience shows that the financial success of such a tax amnesty is not granted. Furthermore, it is debated whether in the long run tax amnesties undermine tax compliance. To measure the long run effects of an amnesty on compliance, experiments in different countries were conducted. In contrast to other experi- ments, we conduct an experiment in which the relationship between tax compliance and subjects’ possibil- ity to vote for or against an amnesty is analyzed. The results obtained from two experiments done in Costa Rica and Switzerland suggest that tax compliance only increases after voting, when people get the oppor- tunity to discuss prior to ballots. Thus, voting with discussion induces a kind of civic duty, as taxpayers become aware of the importance to contribute to the provision of public goods. JEL classification: H260, 9160 Keywords: tax amnesty, tax compliance, voting behavior, democracy * Benno Torgler, Georgia State University, Andrew Young School o f Policy Studies, Atlanta (USA), Center for Research in Economics, Management and the Arts (Switzerland), emails: [email protected] , [email protected]; Christoph A. Schaltegger, Swiss Federal Tax Administration, FTA, University o f St. Gallen, SIAW-HSG (Switzerland) and Center for Research in Economics, Management and the Arts (Switzerland), email: [email protected]. We wish to express our gratitude to Alberto Trejos (INCAE), Roderick MacGregor (INCAE) and Jesús Merino Serna (Universidad Fidélitas) who gave us the possibility to con- duct the laboratory experiment in Costa Rica and Markus Schaffner, who has done the experimental programming with z-Tree and has assisted the experiment. -

Brief of Amici Curiae Bipartisan Economic Scholars

No. 19-840 In the Supreme Court of the United States _________ CALIFORNIA, ET AL., Petitioners, v. TEXAS, ET AL., Respondents. _________ On Writ of Certiorari to the United States Court of Appeals for the Fifth Circuit _________ BRIEF AMICI CURIAE FOR BIPARTISAN ECONOMIC SCHOLARS IN SUPPORT OF PETITIONERS _________ SHANNA H. RIFKIN MATTHEW S. HELLMAN JENNER & BLOCK LLP Counsel of Record 353 N. Clark Street JENNER & BLOCK LLP Chicago, IL 60654 1099 New York Avenue, NW Washington, DC 20001 (202) 639-6000 May 13, 2020 [email protected] i TABLE OF CONTENTS TABLE OF AUTHORITIES ......................................... iii INTEREST OF AMICI CURIAE .................................. 1 INTRODUCTION AND SUMMARY OF ARGUMENT ....................................................................... 3 ARGUMENT ....................................................................... 5 I. The Fifth Circuit’s Severability Analysis Lacks Any Economic Foundation And Would Cause Egregious Harm To Those Currently Enrolled In Medicaid And Private Individual Market Insurance As Well As Health Care Providers. ....................................................................... 5 A. Economic Data Establish That The ACA Markets Can Operate Without The Mandate. ................................................................... 5 B. There Is No Economic Reason Why Congress Would Have Wanted The Myriad Other Provisions In The ACA To Be Invalidated. ....................................................... 10 II. Because The ACA Can Operate Effectively Without -

HAMILTON Achieving Progressive Tax Reform PROJECT in an Increasingly Global Economy Strategy Paper JUNE 2007 Jason Furman, Lawrence H

THE HAMILTON Achieving Progressive Tax Reform PROJECT in an Increasingly Global Economy STRATEGY PAPER JUNE 2007 Jason Furman, Lawrence H. Summers, and Jason Bordoff The Brookings Institution The Hamilton Project seeks to advance America’s promise of opportunity, prosperity, and growth. The Project’s economic strategy reflects a judgment that long-term prosperity is best achieved by making economic growth broad-based, by enhancing individual economic security, and by embracing a role for effective government in making needed public investments. Our strategy—strikingly different from the theories driving economic policy in recent years—calls for fiscal discipline and for increased public investment in key growth- enhancing areas. The Project will put forward innovative policy ideas from leading economic thinkers throughout the United States—ideas based on experience and evidence, not ideology and doctrine—to introduce new, sometimes controversial, policy options into the national debate with the goal of improving our country’s economic policy. The Project is named after Alexander Hamilton, the nation’s first treasury secretary, who laid the foundation for the modern American economy. Consistent with the guiding principles of the Project, Hamilton stood for sound fiscal policy, believed that broad-based opportunity for advancement would drive American economic growth, and recognized that “prudent aids and encouragements on the part of government” are necessary to enhance and guide market forces. THE Advancing Opportunity, HAMILTON Prosperity and Growth PROJECT Printed on recycled paper. THE HAMILTON PROJECT Achieving Progressive Tax Reform in an Increasingly Global Economy Jason Furman Lawrence H. Summers Jason Bordoff The Brookings Institution JUNE 2007 The views expressed in this strategy paper are those of the authors and are not necessarily those of The Hamilton Project Advisory Council or the trustees, officers, or staff members of the Brookings Institution. -

Tax Stimulus Options in the Aftermath of the Terrorist Attack

TAX STIMULUS OPTIONS IN THE AFTERMATH OF THE TERRORIST ATTACK By William Gale, Peter Orszag, and Gene Sperling William Gale is the Joseph A. Pechman Senior outlook thus suggests the need for policies that Fellow in Economic Studies at the Brookings Institu- stimulate the economy in the short run. The budget tion. Peter Orszag is Senior Fellow in Economic outlook suggests that the long-run revenue impact Studies at the Brookings Institution. Gene Sperling is of stimulus policies should be limited, so as to avoid Visiting Fellow in Economic Studies at the Brookings exacerbating the nation’s long-term fiscal challen- Institution, and served as chief economic adviser to ges, which would raise interest rates and undermine President Clinton. The authors thank Henry Aaron, the effectiveness of the stimulus. Michael Armacost, Alan Auerbach, Leonard Burman, In short, say the authors, the most effective Christopher Carroll, Robert Cumby, Al Davis, Eric stimulus package would be temporary and maxi- Engen, Joel Friedman, Jane Gravelle, Robert mize its “bang for the buck.” It would direct the Greenstein, Richard Kogan, Iris Lav, Alice Rivlin, Joel largest share of its tax cuts toward spurring new Slemrod, and Jonathan Talisman for helpful discus- economic activity, and it would minimize long-term sions. The opinions expressed represent those of the revenue losses. This reasoning suggests five prin- authors and should not be attributed to the staff, of- ciples for designing the most effective tax stimulus ficers, or trustees of the Brookings Institution. package: (1) Allow only temporary, not permanent, In the aftermath of the recent terrorist attacks, the items. -

What the Economic Report of the President Omits

Econ Journal Watch, Volume 3, Number 3, September 2006, pp 466-483. A Little More Liberty: What the JEL Omits in Its Account of What the Economic Report of the President Omits DANIEL B. KLEIN AND MICHAEL J. CLARK * A COMMENT ON: JOSEPH FARRELL, JONATHAN GRUBER, ROBERT E. HALL, GORDON H. HANSON, JOEL SLEMROD. 2005. REVIEWS OF THE 2005 ECONOMIC REPORT OF THE PRESIDENT. JOURNAL OF ECONOMIC LITERATURE. XLIII (SEPTEMBER): 801- 822. Abstract It is the highest impertinence and presumption, therefore, in kings and ministers, to pretend to watch over the œconomy of private people. Let them look well after their own expense, and they may safely trust private people with theirs. —Adam Smith (1776, 346) ADAM SMITH HELD THAT THE POLITICAL PROCESS—INVOLVING the mentalities of ordinary citizens, ministers, politicians, and intellectuals— is prone to an under-appreciation of the relative virtues of natural liberty and the social order that it generates. He attacked many economic policies by explaining how free individuals advance the interests of society. By describing how the independent actions of many individuals would generate * Department of Economics, George Mason University. Fairfax, VA 22030. For assistance with developing the survey of George Mason University professors, we thank Ted Balaker, Carl Close, Jerome Ellig, Adrian Moore, and Jane Shaw. For other suggestions we thank Erin Bartee. 466 ECONOMIC REPORT OF THE PRESIDENT beneficial order, and how government is riddled with knowledge and incentives problems, including vanity, conceit, and -

Optimal Taxation of Top Labor Incomes: a Tale of Three Elasticities†

American Economic Journal: Economic Policy 2014, 6(1): 230–271 http://dx.doi.org/10.1257/pol.6.1.230 Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities† By Thomas Piketty, Emmanuel Saez, and Stefanie Stantcheva* This paper derives optimal top tax rate formulas in a model where top earners respond to taxes through three channels: labor supply, tax avoidance, and compensation bargaining. The optimal top tax rate increases when there are zero-sum compensation-bargaining effects. We present empirical evidence consistent with bargaining effects. Top tax rate cuts are associated with top one percent pretax income shares increases but not higher economic growth. US CEO “pay for luck” is quantitatively more prevalent when top tax rates are low. International CEO pay levels are negatively correlated with top tax rates, even controlling for firms’ characteristics and perfor- mance. JEL D31, H21, H24, H26, M12 ( ) he share of total pretax income accruing to upper income groups has increased Tsharply in the United States. The top percentile income share has more than dou- bled from less than 10 percent in the 1970s to over 20 percent in recent years Piketty ( and Saez 2003 . This trend toward income concentration has taken place in a number ) of other countries, especially English-speaking countries, but is much more modest in continental Europe or Japan Atkinson, Piketty, and Saez 2011 and Alvaredo et al. ( 2011 . At the same time, top tax rates on upper income earners have declined sharply ) in many OECD countries, again particularly in English-speaking countries. While there have been many discussions both in the academic literature and the public debate about the causes of the surge in top incomes, there is not a fully com- pelling explanation. -

Tax Policy and the Missing Middle: Optimal Tax Remittance with firm-Level Administrative Costs☆

Journal of Public Economics 95 (2011) 1036–1047 Contents lists available at ScienceDirect Journal of Public Economics journal homepage: www.elsevier.com/locate/jpube Tax policy and the missing middle: Optimal tax remittance with firm-level administrative costs☆ Dhammika Dharmapala a, Joel Slemrod b,⁎, John Douglas Wilson c a University of Illinois at Urbana-Champaign, 504 East Pennsylvania Avenue, Champaign, IL 61820, United States b University of Michigan, 701 Tappan Street, Ann Arbor, MI 48109-1234, United States c Michigan State University, Marshall-Adams Hall, East Lansing, MI 48824, United States article info abstract Article history: We analyze the optimal taxation of firms when the government faces fixed (per-firm) administrative costs of Received 30 June 2009 tax collection. The tax instruments at the government's disposal are a fixed (per-firm) fee and a linear tax on Received in revised form 12 October 2010 output. If all firms in an industry are taxed, we show that it is optimal to impose a positive fee to internalize Accepted 20 October 2010 administrative costs. The output taxes satisfy the inverse elasticity rule for taxed industries, but industries Available online 3 December 2010 with sufficiently high administrative costs should be exempted from taxation. We also investigate the case where firms with outputs below a cutoff level can be exempted from taxation. It may be optimal to set the Keywords: fi fi Taxation cutoff high enough to exempt a sizable number of rms, even though some rms reduce their outputs to the Optimal taxation cutoff level, creating a “missing middle”: small and large firms – but not those of intermediate size – exist. -

FINANCIAL TRANSACTION TAXES in THEORY and PRACTICE Leonard E

FINANCIAL TRANSACTION TAXES IN THEORY AND PRACTICE Leonard E. Burman, William G. Gale, Sarah Gault, Bryan Kim, Jim Nunns, and Steve Rosenthal June 2015 DISCUSSION DRAFT - COMMENTS WELCOME CONTENTS Acknowledgments 1 Section 1: Introduction 2 Section 2: Background 5 FTT Defined 5 History of FTTs in the United States 5 Experience in Other Countries 6 Proposed FTTs 10 Other Taxes on the Financial Sector 12 Section 3: Design Issues 14 Section 4: The Financial Sector and Market Failure 19 Size of the Financial Sector 19 Systemic Risk 21 High-Frequency Trading and Flash Trading 22 Noise Trading 23 Section 5: Effects of an FTT 24 Trading Volume and Speculation 24 Liquidity 26 Price Discovery 27 Asset Price Volatility 28 Asset Prices and the Cost of Capital 29 Cascading and Intersectoral Distortions 30 Administrative and Compliance Costs 32 Section 6: New Revenue and Distributional Estimates 33 Modeling Issues 33 Revenue Effects 34 Distributional Effects 36 Section 7: Conclusion 39 Appendix A 40 References 43 ACKNOWLEDGMENTS Burman, Gault, Nunns, and Rosenthal: Urban Institute; Gale and Kim: Brookings Institution. Please send comments to [email protected] or [email protected]. We thank Donald Marron and Thornton Matheson for helpful comments and discussions, Elaine Eldridge and Elizabeth Forney for editorial assistance, Lydia Austin and Joanna Teitelbaum for preparing the document for publication, and the Laura and John Arnold Foundation for funding this work. The findings and conclusions contained within are solely the responsibility of the authors and do not necessarily reflect positions or policies of the Tax Policy Center, the Urban Institute, the Brookings Institution, or their funders. -

Notes for Tax Policy Course

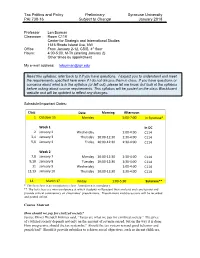

Tax Politics and Policy Preliminary Syracuse University PAI 730-16 Subject to Change January 2018 Professor Len Burman Classroom Room C119 Center for Strategic and International Studies 1616 Rhode Island Ave, NW Office From January 2-12, CSIS, 4th floor Hours: 4:00-5:00, M-Th (starting January 2) Other times by appointment My e-mail address: [email protected] Read this syllabus; refer back to it if you have questions. I expect you to understand and meet the requirements specified here even if I do not discuss them in class. If you have questions or concerns about what is in the syllabus (or left out), please let me know, but look at the syllabus before asking about course requirements. This syllabus will be posted on the class Blackboard website and will be updated to reflect any changes. Schedule/Important Dates: Class Date Morning Afternoon 1 October 15 Monday 5:00-7:00 In Syracuse* Week 1 In DC 2 January 2 Wednesday 1:00-4:00 C114 3,4 January 3 Thursday 10:00-12:30 1:30-4:00 C114 5,6 January 4 Friday 10:00-12:30 1:30-4:00 C114 Week 2 7,8 January 7 Monday 10:00-12:30 1:30-4:00 C114 9,10 January 8 Tuesday 10:00-12:30 1:30-4:00 C114 11 January 9 Wednesday 1:00-4:00 C114 12,13 January 10 Thursday 10:00-12:30 1:30-4:00 C114 14 March 1? Friday 1:00-5:30 Syracuse** * The first class is an introductory class. -

Download Report (PDF)

Shining Light On Corporate Tax Secrecy For Healthier State Budgets, Investments and Markets CALPIRG SUNSHINE FOR CALIFORNIA: Acknowledgements: Written by Phineas Baxandall, PhD., Tax and Budget Policy Analyst with the state PIRGs, and Emily Rusch, Consumer Advocate for CALPIRG Education Fund. © 2006, CALPIRG Education Fund Design: Public Interest GRFX The authors would like to thank Jean Ross of the California Budget Project and Lenny Goldberg of the California Tax Reform Association for their insights and assistance in the editing of the report. The authors alone bear responsibility for any factual errors. The views expressed in this report are those of the authors and do not necessarily express the views of funders of CALPIRG Edu- cation Fund or the state PIRGs. When corporate wrongdoing threatens our health and safety, or violates fundamental principles of fairness and justice, CALPIRG Education Fund stands up for the public interest. CALPIRG Education Fund, a 501 (c) (3) organization, conducts investigative research, publishes reports and exposés and, when necessary, takes corporate wrongdoers to court. Our results-oriented approach has won victories for Californians on a wide range of issues including health care re- form, energy policy, prescription drug prices, consumer privacy and product safety. For a copy of this report, visit our website or send a check for $15 made payable to CALPIRG Education Fund at the following address: CALPIRG Education Fund 1107 9th St., Suite 601 Sacramento, CA 95814 916-448-4516 www.calpirg.org CALPIRG | AUGUST 2006 1 CALPIRG SUNSHINE FOR CALIFORNIA: Corporate tax avoidance leaves taxpaying Companies can practice a wide variety of tax- households to pick up the tab for funding high- avoidance maneuvers, some of which are le- ways, schools, and other public structures. -

Nber Working Paper Series Tax Competition With

CORE Metadata, citation and similar papers at core.ac.uk Provided by Research Papers in Economics NBER WORKING PAPER SERIES TAX COMPETITION WITH PARASITIC TAX HAVENS Joel Slemrod John D. Wilson Working Paper 12225 http://www.nber.org/papers/w12225 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 May 2006 We are grateful for comments on an earlier draft provided by Clemens Fuest, Andreas Haufler, and participants in seminars at the University of Copenhagen and the University of Michigan. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research. ©2006 by Joel Slemrod and John D. Wilson. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Tax Competition and Parasitic Tax Havens Joel Slemrod and John D. Wilson NBER Working Paper No. 12225 May 2006 JEL No. H26, H87 ABSTRACT We develop a tax competition framework in which some jurisdictions, called tax havens, are parasitic on the revenues of other countries. The havens use real resources to help companies camouflage their home-country tax avoidance, and countries use resources in an attempt to limit the transfer of tax revenues to the havens. The equilibrium price for this service depends on the demand and supply for such protection. Recognizing that taxes on wage income are also evaded, we solve for the equilibrium tax rates on mobile capital and immobile labor, and we demonstrate that the full or partial elimination of tax havens would improve welfare in non-haven countries, in part because countries would be induced to increase their tax rates, which they have set at inefficiently low levels in an attempt to attract mobile capital.