Small Business Financing Profiles: Visible Minority Entrepreneurs

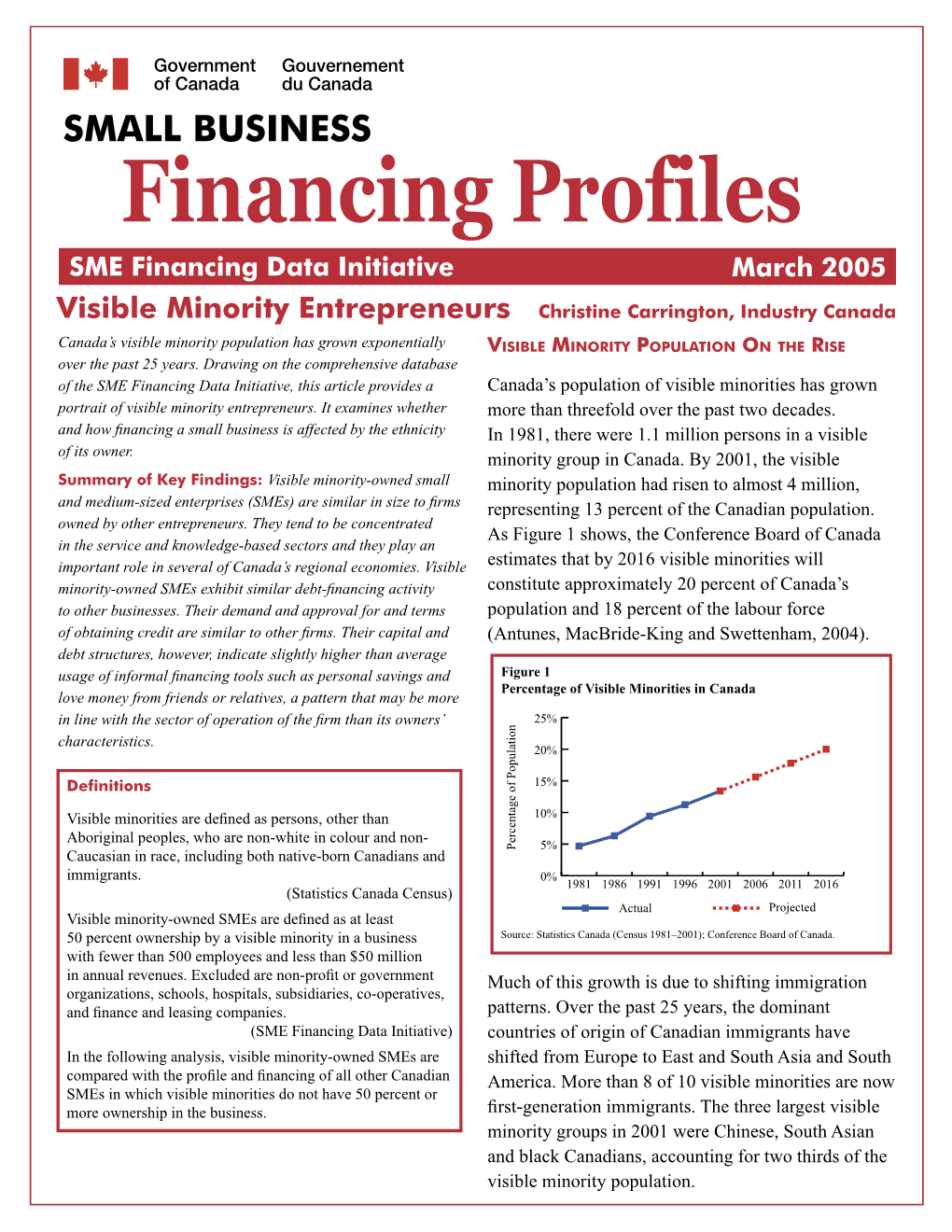

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Recent Immigration and the Formation of Visible Minority Neighbourhoods in Canada’S Large Cities

Catalogue no. 11F0019MIE — No. 221 ISSN: 1205-9153 ISBN: 0-662-37031-7 Research Paper Research Paper Analytical Studies Branch research paper series Recent immigration and the formation of visible minority neighbourhoods in Canada’s large cities By Feng Hou Business and Labour Market Analysis Division 24-F, R.H. Coats Building, Ottawa, K1A 0T6 Telephone: 1 800 263-1136 This paper represents the views of the author and does not necessarily reflect the opinions of Statistics Canada. Recent immigration and the formation of visible minority neighbourhoods in Canada’s large cities by Feng Hou 11F0019MIE No. 221 ISSN: 1205-9153 ISBN: 0-662-37031-7 Business and Labour Market Analysis Division 24-F, R.H. Coats Building, Ottawa, K1A 0T6 Statistics Canada How to obtain more information : National inquiries line: 1 800 263-1136 E-Mail inquiries: [email protected] July 2004 A part of this paper was presented at the conference on Canadian Immigration Policy for the 21st Century, October 18-19, 2002, Kingston, Ontario. Many thanks to Eric Fong, Mike Haan, John Myles, Garnett Picot, and Jeff Reitz for their constructive comments and suggestions. This paper represents the views of the author and does not necessarily reflect the opinions of Statistics Canada. Published by authority of the Minister responsible for Statistics Canada © Minister of Industry, 2004 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior written permission from Licence Services, Marketing Division, Statistics Canada, Ottawa, Ontario, Canada K1A 0T6. -

VISIBLE MINORITIES — Equity and Inclusion Lens

Diversity Snapshot VISIBLE MINORITIES — Equity and Inclusion Lens Diversity Snapshot VISIBLE MINORITIES We are diverse, and the fastest-growing population sector in Ottawa. One third of us are Canadians by birth and our families have been part of building Ottawa for more than a century. We are grouped together for being nonwhite, but in reality, we are a rich mix of ethnic origins and cultures from as many as 100 different nationalities. 1. Who we are . 3 2. Contributions we make . 4 3. Barriers and inequities. 5 1) Attitudes. 5 2) Stereotypes. 5 3) Denial of racism. 6 4) Income . 6 5) Employment . 7 6) Advancement opportunities. 7 7) Workplace harassment . 7 8) Racial profiling. 8 9) Housing and neighbourhood . 9 10) Civic and political engagement. 9 4. We envision – a racism-free city. 10 What can I do?. 10 5. Council mandates and legislation. 11 6. What’s happening in Ottawa. 11 7. Relevant practices in other cities. 12 8. Sources. 12 9. Definitions. 13 10. Acknowledgements . 15 This document is one of 11 Diversity Snapshots that serve as background information to aid the City of Ottawa and its partners in implementing the Equity and Inclusion Lens. To access, visit Ozone or contact us at [email protected]. A City for Everyone — 2 Diversity Snapshot VISIBLE MINORITIES — Equity and Inclusion Lens 1. Who we are IN OTTAWA We are diverse, and the fastest-growing population sector in Ottawa (SPC 2008-a). Many of us (32.8 per Ottawa has the second cent) are Canadians by birth and our families have been highest proportion of visible part of building Ottawa for over 100 years (SPC 2008-b). -

Montreal Intercultural Profile June 2019

Montreal Intercultural Profile June 2019 Index 1. Introduction 2 2. Federal and provincial policy context 3 3. Local Diversity and Policy Context 8 4. Governance and democratic participation 13 5. Welcome policies 14 6. Education, training and language 15 7. Employment and business 17 8. Public spaces, neighbourhoods and social mixing 19 9. Mediation 21 10. Civil Society 22 11. Culture 23 12. Conclusions and recommendations 26 ANNEX 1. VISIT PROGRAMME 28 Montreal Intercultural Profile This report is based upon the visit of the Council of Europe’s expert team on 13 and 14 May 2019 comprising Ivana d’Alessandro and Daniel de Torres. It should be read in parallel with the Council of Europe’s response to Montreal ICC Index questionnaire1, which contains many recommendations and pointers to examples of good practice. 1. Introduction Montréal is located in Québec province, south-eastern Canada. With 1,704,694 inhabitants (2016) it is the second most-populous city in the country. At 365 km2, the city of Montreal occupies about three-fourths of Montréal Island (Île de Montréal), the largest of the 234 islands of the Hochelaga Archipelago, one of three archipelagos near the confluence of the Ottawa and St. Lawrence rivers. The city was founded in 1642 by European settlers in view to establish a Catholic missionary community on Île de Montréal. It was to be called Ville-Marie, after the Virgin Mary. Its current name comes from Mount Royal, the triple-peaked hill in the heart of the city. From the time of the confederation of Canada (1867), Montréal was the largest metropolitan centre in the country until it was overtaken by Toronto in the ‘70s. -

Visible Minorities in Canada

Canadian Centre for Justice Statistics Profile Series This paper is one in a series of ten profiles funded through the federal Policy Research Initiative. The objective of these profiles is to provide data analysis on the experience of various groups as victims and offenders* in the criminal justice system. The profiles are based on Statistics Canada sources and include a mix of demographic, economic and justice data as well as information specific to each group. Other profiles in this series include: • Aboriginal People in Canada • Canadians with Disabilities • Canadians with Literacy Problems** • Canadians with Low Incomes Visible • Children and Youth in Canada • Immigrants in Canada • Religious Groups in Canada • Seniors in Canada Minorities • Women in Canada * Data on offenders is only available for the following: Aboriginal People, Children and Youth, Seniors, and in Canada Women. ** The literacy profile does not include a criminal justice component. Catalogue No. 85F0033MIE ISSN 1496-4562 ISBN 0-662-30009-2 June 2001 Published by authority of the Minister responsible for Statistics Canada © Minister of Industry, 2001 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior written permission from Licence Services, Marketing Division, Statistics Canada, Ottawa, Ontario, Canada K1A 0T6. How to obtain more information Specific inquiries about this product and related statistics or services should be directed to: Canadian Centre for Justice Statistics, toll free 1 800 387-2231 or (613) 951-9023, Statistics Canada, Ottawa, Ontario, K1A 0T6. For information on the wide range of data available from Statistics Canada, you can contact us by calling one of our toll-free numbers. -

Census Ethnic Origins, Visible Minorities

BULLETIN | 2016 Ethnic origins, visible minorities Census and aboriginal peoples Ethnic origins Waterloo Region residents reported coming in second and third amongst ethnic origins, the fastest growth rate over 220 different ethnic origins residents. German and Portuguese was in the number of people reporting in the 2016 Census. In the region, ancestries were more common in East Indian ancestry, which increased approximately one in four residents had Waterloo Region compared to Ontario by 43.8 per cent to 19,325 individuals in Canadian ancestry, more than any other in general, whereas Italian and Chinese 2016. ethnic origin (Table 1). European ethnic ancestries were reported less in origins were also reported frequently, Waterloo Region than in the province. with English and German ancestries Common non-European ancestries reported included East Indian, Chinese Ethnic origin, unlike nationality and First Nations. or birth place, refers to the ethnic or cultural background of Between 2006 and 2016, the most an individual’s ancestors. In the growth was amongst those who 2016 Census, individuals could reported a Canadian ethnic origin, report up to six origins on their while the highest percentage growth Canadian, English, and German was for those who reported East Indian were the maternal and paternal sides. In most commonly total, 48 per cent of Waterloo ancestry. Over this 10 year period, the number of people reporting Canadian 3 reported ethnic origins Region residents recorded more of Waterloo Region than one ethnic origin. ethnic origins -

Visible Minority Populations in Canada 2016 Census Data Ghada Mandil

JUNE 2020 Visible Minority Populations in Canada 2016 Census Data Ghada Mandil 1 CONTENTS Purpose and Methodology 3 Summary of Findings 3 Immigrant Status 4 Generation Status 5 Labour Force 6 Employment Income 7 Income Groups 8 Education 9 2 Purpose and Methodology than 1% of the Arab visible minority population is third generation, which is lower than almost all The purpose of this report is to provide other visible minority populations. information about the Arab visible minority population in Canada in comparison to other • Of the visible minority populations, the Arab visible minority populations in Canada. The data visible minority population has the highest presented in this report has been collected from unemployment rate at 13.5; the unemployment the Statistics Canada 2016 Census of Population rate of the total visible minority population in Program data, specifically, theimmigration and Canada is more than 30% lower than the Arab ethnocultural diversity data tables. This report visible minority population. compares the Arab visible minority population • Of the visible minority populations, the Arab in Canada to other visible minority populations visible minority population has the third lowest in Canada through various variables, including median employment income; the average immigrant status, generation status, labour employment income of the Arab visible minority force, employment income, income groups, and population is among the bottom half of the visible education. minority populations. According to Statistics Canada, visible minority • Almost 25% of the Arab visible minority refers to whether a person belongs to a visible population is in the under $10,000 (including minority group as defined by the Employment loss) income group; this is a higher portion of Equity Act and, if so, the visible minority group the population than most other visible minority to which the person belongs. -

A New Canada: an Identity Shaped by Diversity

11 THE CRIC PAPERS A New Canada: An Identity Shaped by Diversity By Andrew Parkin and Matthew Mendelsohn OCTOBER 2003 Table of Contents 1 Preface 2Introduction 3 PART 1: Diversity Attitudes Toward Diversity The Broad Base of Support Some International Comparisons 6 PART 2: Discrimination Racism and Prejudice Fairness in the Workplace The Police Gender 10 PART 3: Identity National Identity Personal Identity Ethnicity Without Walls Changes in Quebec Religion 18 Conclusion Preface This CRIC paper looks at a country in transformation, METHODOLOGY a Canada where many values and attitudes prevalent 40 years ago have been replaced with a fresh CRIC, The Globe and Mail, and the Canadian Opinion outlook. At the beginning of the 1960s, a majority Research Archive designed the survey. It was carried thought Canada should keep in place the restrictive out between April 21 and May 4, 2003 by Ipsos-Reid. immigration policy that kept non-whites out of the A representative sample of 2,000 randomly selected country.1 Today, such a view would be resolutely Canadians was interviewed by telephone. A survey rejected, as most Canadians, and an overwhelmingly of this size has a margin of error of plus or minus large majority of younger Canadians, not only accept 2.2 percent, 19 times out of 20. The survey sample the country’s diversity, they celebrate it. In fact, included 1,000 respondents between the ages of Canada stands out from other western countries in 18 and 30, and 1,000 respondents 31 years and older. terms of the extent of its comfort with cultural pluralism. -

“The Ways We 'See' Ontario's Underrepresented: Mythologizing

“The Ways We ‘See’ Ontario’s Underrepresented: Mythologizing Visible Minorities” David Michon Intern, 2007-2008 Ontario Legislature Internship Programme (OLIP) Room 1303, Whitney Block, 99 Wellesley Street West, Queen's Park, Toronto, Ontario M7A 1A2 (w) 416 325 0040 (c) 416 892 8199 [email protected] www.olip.ontla.on.ca Paper delivered at the Annual Meeting of the Canadian Political Science Association, 11:00 a.m., Thursday, 5 June 2008,Vancouver, British Columbia Introduction ‘Canada is a nation of immigrants,’ we often proselytize. Indeed, it is amongst the most multicultural countries that exist, and Ontario is its most diverse province. Visible minority populations are growing, and statistical data illustrates their impressive demographic weight, particularly in the Greater Toronto Area. Yet, to date there are no sufficient mechanisms to ensure the inclusion of these underrepresented populations at Queen’s Park, Ontario’s provincial legislature. Furthermore, the narrative of this nascent democratic project is far more complicated than its sister politically progressive project based on the feminist agenda lending to number of inherent hurdles in the way of its achievement. Linked in part to Ontario and Canada’s commitment to “multiculturalism,” visible minority representation easy fits as part of the collective mythology. Multiculturalism (and by extension multiracialism) in Ontario and in its parliament is often harkened as an essential element of collective identity—at least in normative or aspirational terms. Yet, multiculturalism is far from a clear-cut polity. We must muddle through all the intricacies and layers of our identities and classify others and ourselves in order to address the inherent ethno- and andocentrisms of our style of democracy. -

Insights Into the Arab Population in Canada Based on the 2016 Census Data Ghada Mandil

august 2019 Insights into the Arab Population in Canada Based on the 2016 Census Data Ghada Mandil 1 CONTENTS Purpose and Methodology 3 Summary of Key Findings 3 The Arab Population in Canada 4 a. Ethnic Origin of Arab Population in Canada 4 b. Ethnic Origin of Arab Population in Ontario 5 c. Ethnic Origin of Arab Population in Quebec 6 d. Ethnic Origin of Arab Population in Alberta 7 e. Arab Population in Metropolitan Areas 7 f. Arab Population by Ethnic Origin in Toronto, Ottawa-Gatineau, and Montreal 8 g. Arab Population in Federal Electoral Districts 9 Arab Population in Canada by Age Group 9 Arab Place of Birth and Immigration Admission Category 10 Arab Place of Birth and Citizenship Status 11 a. Select Places of Birth and Citizenship Status 11 Generation Status 12 Prevalence and Use of the Arabic Language in Canada 12 Education and Fields of Study 13 a. Top 10 Fields of Study 13 Labour Force 14 Income Groups 15 2 Purpose and Methodology reported being ‘Arab’ and ‘White’, they would have been excluded from the Arab visible minority The purpose of this report is to provide population. Also, if a person reported being ‘Arab’ information about the Arab population in and provided a European write-in response such Canada. The data presented in this report has as ‘French’, they would have been excluded from been collected from the Statistics Canada 2016 the Arab visible minority population as well2. The Census of Population Program data, with a focus exclusion of some Arabs from the Arab visible on the Immigration and Ethno-cultural Diversity minority population count significantly reduces topic in order to understand the distribution and the number of individuals in the Arab visible demographics of the Arab population in Canada. -

Visible Minorities and Job Mobility: Evidence from a Workplace Panel Survey

DISCUSSION PAPER SERIES IZA DP No. 12736 Visible Minorities and Job Mobility: Evidence from a Workplace Panel Survey Mohsen Javdani OCTOBER 2019 DISCUSSION PAPER SERIES IZA DP No. 12736 Visible Minorities and Job Mobility: Evidence from a Workplace Panel Survey Mohsen Javdani University of British Columbia, Okanagan and IZA OCTOBER 2019 Any opinions expressed in this paper are those of the author(s) and not those of IZA. Research published in this series may include views on policy, but IZA takes no institutional policy positions. The IZA research network is committed to the IZA Guiding Principles of Research Integrity. The IZA Institute of Labor Economics is an independent economic research institute that conducts research in labor economics and offers evidence-based policy advice on labor market issues. Supported by the Deutsche Post Foundation, IZA runs the world’s largest network of economists, whose research aims to provide answers to the global labor market challenges of our time. Our key objective is to build bridges between academic research, policymakers and society. IZA Discussion Papers often represent preliminary work and are circulated to encourage discussion. Citation of such a paper should account for its provisional character. A revised version may be available directly from the author. ISSN: 2365-9793 IZA – Institute of Labor Economics Schaumburg-Lippe-Straße 5–9 Phone: +49-228-3894-0 53113 Bonn, Germany Email: [email protected] www.iza.org IZA DP No. 12736 OCTOBER 2019 ABSTRACT Visible Minorities and Job Mobility: Evidence from a Workplace Panel Survey In this study we use Canadian linked employer-employee data to examine whether visible minority Canadian-borns experience any differences in their inter-firm and intra-firm job mobility, as well as wage returns associated with them, compared to white Canadian-borns. -

Visible Minority Women by Tina Chui and Hélène Maheux

Component of Statistics Canada Catalogue no. 89-503-X Women in Canada: A Gender-based Statistical Report Article W Visible Minority Women by Tina Chui and Hélène Maheux July 2011 How to obtain more information For information about this product or the wide range of services and data available from Statistics Canada, visit our website at www.statcan.gc.ca, e-mail us at [email protected], or telephone us, Monday to Friday from 8:30 a.m. to 4:30 p.m., at the following numbers: Statistics Canada’s National Contact Centre Toll-free telephone (Canada and United States): Inquiries line 1-800-263-1136 National telecommunications device for the hearing impaired 1-800-363-7629 Fax line 1-877-287-4369 Local or international calls: Inquiries line 1-613-951-8116 Fax line 1-613-951-0581 Depository Services Program Inquiries line 1-800-635-7943 Fax line 1-800-565-7757 To access this product This product, Catalogue no. 89-503-X, is available free in electronic format. To obtain a single issue, visit our website at www.statcan.gc.ca and browse by “Key resource” > “Publications.” Standards of service to the public Statistics Canada is committed to serving its clients in a prompt, reliable and courteous manner. To this end, Statistics Canada has developed standards of service that its employees observe. To obtain a copy of these service standards, please contact Statistics Canada toll-free at 1-800-263-1136. The service standards are also published on www.statcan.gc.ca under “About us” “The agency” > “Providing services to Canadians.” Statistics Canada Social and Aboriginal Statistics Division Women in Canada: A Gender-based Statistical Report Visible Minority Women Published by authority of the Minister responsible for Statistics Canada © Minister of Industry, 2011 All rights reserved. -

Not All Visible Minorities Face Labour Market Discrimination

NOT ALL VISIBLE MINORITIES FACE LABOUR MARKET DISCRIMINATION The most popular way of determining whether Canada’s visible minorities face discrimination in the labour market is simply to compare their average wages and annual earnings with those of white Canadians. This is naive in two ways: It does not distinguish among different visible minorities and it does not control for other possible differences between visible minorities and white Canadians—in education or experience, for instance. A statistical explanation of the wage gap finds that among native-born Canadians only blacks face a statistically significant wage gap once other variables are controlled for. Among immigrants, however, an Derek Hum unexplained wage gap is common. This suggests policy should focus less on employment or wage equity and more on helping immigrants integrate into and Wayne Simpson Canadian society. La façon la plus courante — et la plus simple — de juger si au Canada les minorités visibles sont en butte à la discrimination sur le marché du travail consiste à comparer les salaires moyens et les revenus annuels moyens de ces minorités avec ceux des Canadiens de race blanche. Mais le procédé comporte deux faiblesses : d’une part, il n’établit aucune distinction entre les diverses minorités visibles; et, d’autre part, il ne tient aucun compte d’autres différences observables entre minorités visibles et Canadiens de race blanche — en matière d’instruction et d’expérience, par exemple. Or, l’analyse statistique révèle que, une fois prises en compte les autres variables, l’écart salarial parmi les Canadiens de naissance ne touche de façon significative que les Noirs.