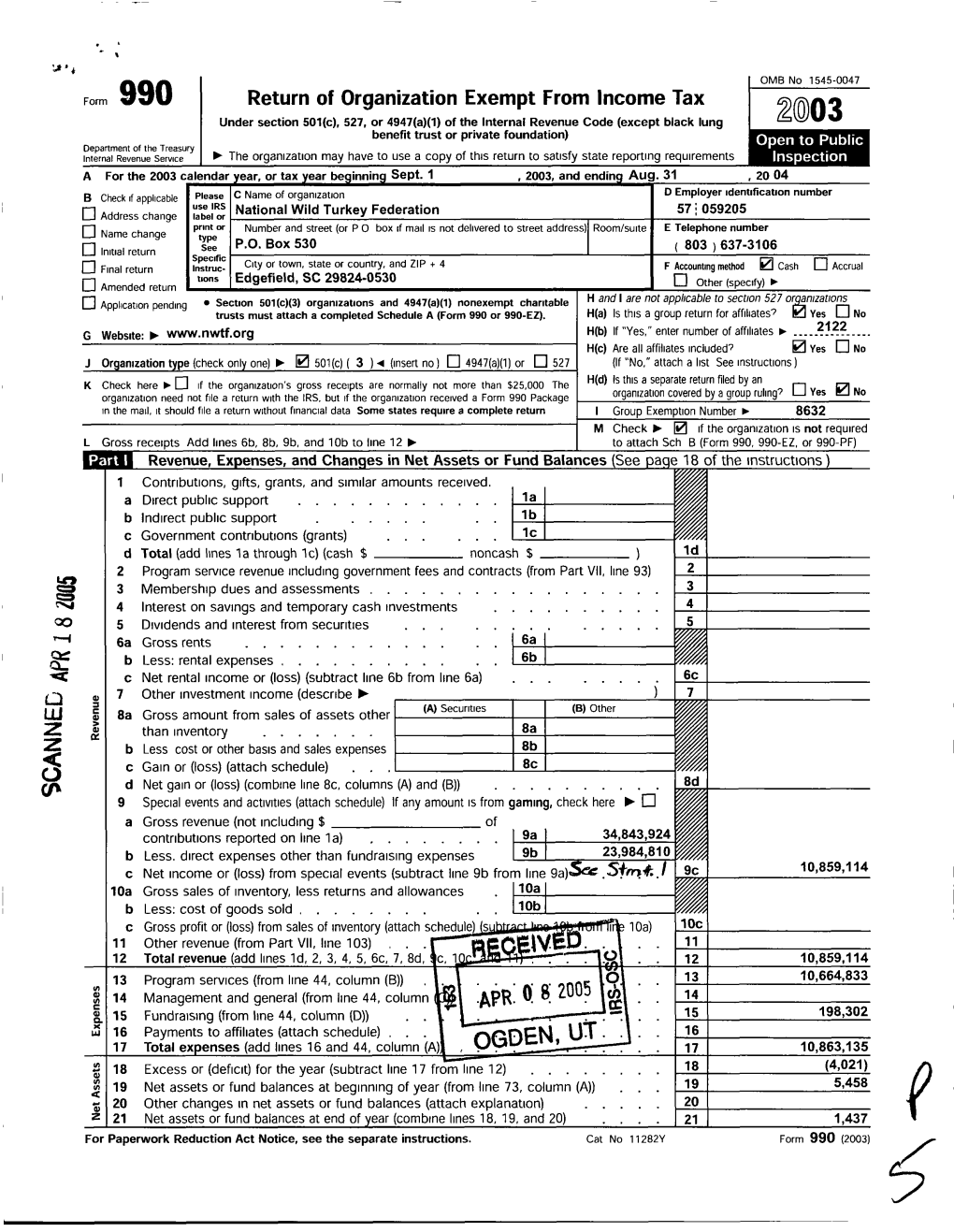

Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Geophysical Imaging of Karst Features in Missouri

Scholars' Mine Doctoral Dissertations Student Theses and Dissertations Spring 2016 Geophysical Imaging of Karst Features in Missouri Jeremiah Chukwunonso Obi Follow this and additional works at: https://scholarsmine.mst.edu/doctoral_dissertations Part of the Geological Engineering Commons, and the Geophysics and Seismology Commons Department: Geosciences and Geological and Petroleum Engineering Recommended Citation Obi, Jeremiah Chukwunonso, "Geophysical Imaging of Karst Features in Missouri" (2016). Doctoral Dissertations. 2485. https://scholarsmine.mst.edu/doctoral_dissertations/2485 This thesis is brought to you by Scholars' Mine, a service of the Missouri S&T Library and Learning Resources. This work is protected by U. S. Copyright Law. Unauthorized use including reproduction for redistribution requires the permission of the copyright holder. For more information, please contact [email protected]. GEOPHYSICAL IMAGING OF KARST FEATURES IN MISSOURI By JEREMIAH CHUKWUNONSO OBI A DISSERTATION Presented to the Faculty of the Graduate School of the MISSOURI UNIVERSITY OF SCIENCE AND TECHNOLOGY In Partial Fulfilment of the Requirements for the Degree DOCTOR OF PHILOSOPHY In GEOLOGICAL ENGINEERING 2016 Approved by Neil L. Anderson, Advisor J. David Rogers Kelly Liu Evgeniy V. Torgashov Mao Chen Ge © 2016 Jeremiah Chukwunonso Obi All Rights Reserved iii ABSTRACT Automated electrical resistivity tomography (ERT) supported with multichannel analysis of surface waves (MASW) and boring data were used to map karst related features in Missouri in order to understand karst processes better in Missouri. Previous works on karst in Missouri were mostly surficial mapping of bedrock outcrops and joints, which are not enough to define the internal structure of karst system, since most critical processes in karst occur underground. -

Paleozoic and Quaternary Geology of the St. Louis

Paleozoic and Quaternary Geology of the St. Louis Metro East Area of Western Illinois 63 rd Annual Tri-State Geological Field Conference October 6-8, 2000 Rodney D. Norby and Zakaria Lasemi, Editors ILLINOIS STATE GEOLOGICAL SURVEY Champaign, Illinois ISGS Guidebook 32 Cover photo Aerial view of Casper Stolle Quarry at the upper right, Falling Springs Quarry at the left, and the adjacent rural residential subdivision at the right, all situated at the northernmost extent of the karst terrain in St. Clair County, Illinois. Photograph taken April 7, 1988, U.S. Geological Survey, National Aerial Photography Program (NAPP1). ILLINOIS DEPARTMENT OF NATURAL RESOURCES © printed with soybean ink on recycled paper Printed by authority of the State of Illinois/2000/700 Paleozoic and Quaternary Geology of the St. Louis Metro East Area of Western Illinois Rodney D. Norby and Zakaria Lasemi, Editors and Field Conference Chairmen F. Brett Denny, Joseph A. Devera, David A. Grimley, Zakaria Lasemi, Donald G. Mikulic, Rodney D. Norby, and C. Pius Weibel Illinois State Geological Survey Joanne Kluessendorf University of Illinois rd 63 Annual Tri-State Geological Field Conference Sponsored by the Illinois State Geological Survey October 6-8, 2000 WISCONSIN ISGS Guidebook 32 Department of Natural Resources George H. Ryan, Governor William W. Shilts, Chief Illinois State Geological Survey 615 East Peabody Drive Champaign, IL 61820-6964 (217)333-4747 http://www.isgs.uiuc.edu Digitized by the Internet Archive in 2012 with funding from University of Illinois Urbana-Champaign http://archive.org/details/paleozoicquatern32tris 51 CONTENTS Middle Mississippian Carbonates in the St. Louis Metro East Area: Stratigraphy and Economic Significance Zakaria Lasemi and Rodney D. -

Funding Year 2010 Authorizations – 4Q2011

Universal Service Administrative Company Appendix SL30 Schools and Libraries 2Q2012 Funding Year 2010 Authorizations - 4Q2011 Page 1 of 196 Applicant Name City State Authorized 21ST CENTURY CHARTER SCHOOL @ COLORADO COLORADA SPRINGS CO 23,209.60 21ST CENTURY CHARTER SCHOOL @ FOUNTAIN SINDIANAPOLIS IN 13,374.00 21ST CENTURY CHARTER SCHOOL @ GARY GARY IN 55,638.50 21ST. CENTURY CHARTER SCHOOL INDIANAPOLIS IN 21,513.60 A E R O SPECIAL EDUCATION COOP BURBANK IL 12,270.34 A L BROWN HIGH SCHOOL KANNAPOLIS NC 33,994.17 A.C.E. CHARTER HIGH SCHOOL TUCSON AZ 2,844.80 A.W. BROWN FELLOWSHIP CHARTER SCHOOL DALLAS TX 169,806.21 A+ ARTS ACADEMY COLUMBUS OH 3,207.16 AAA ACADEMY POSEN IL 20,715.42 ABBE REGIONAL LIBRARY AIKEN SC 12,388.90 ABERDEEN SCHOOL DISTRICT ABERDEEN MS 49,402.84 ABERDEEN SCHOOL DISTRICT 5 ABERDEEN WA 921.68 ABERDEEN SCHOOL DISTRICT 6-1 ABERDEEN SD 5,577.37 ABILENE FREE PUBLIC LIBRARY ABILENE KS 10.50 ABILENE INDEP SCHOOL DISTRICT ABILENE TX 216,085.91 ABILENE UNIF SCH DISTRICT 435 ABILENE KS 298.57 ABINGTON HEIGHTS SCHOOL DIST CLARKS SUMMIT PA 28,832.77 ABRAHAM JOSHUA HESCHEL SCHOOLS NEW YORK NY 42,286.17 ABRAMS HEBREW ACADEMY YARDLEY PA 242.85 ABRAMSON NEW ORLEANS LA 2,088.03 ABSAROKEE SCHOOL DIST 52-52 C ABSAROKEE MT 617.40 ABSECON PUBLIC LIBRARY ABSECON NJ 598.84 ABYSSINIAN DEVELOPMENT CORPORATION NEW YORK NY 20,978.57 Academia Claret Bayamon PR 2,815.67 ACADEMIA CRISTO DE LOS MILAGROS CAGUAS PR 533.52 ACADEMIA DE LENGUA Y CULTURA ALBUQUERQUE NM 9,409.38 ACADEMIA DEL CARMEN CAROLINA PR 2,650.68 ACADEMIA DEL ESPIRITU SANTO BAYAMON -

SHOW-ME GOBBLER a Quarterly Publication of the George C

SHOW-ME GOBBLER A Quarterly Publication of the George C. Clark Missouri Chapter of the National Wild Turkey Federation Volume 26 Number 2 • November 2008 RHINE VALLEY CHAPTER OAK CREEK WHITETAIL RANCH FIRST ANNUAL JAKES DAY By Lyndon Ruediger WOW! ..................... Totally awesome!!.......... These few words most accurately describe the “special” JAKES event the Rhine Valley Chapter recently facilitated. You will notice that I used the word “facilitated” (that was deliberate) as this event was a cooperative effort between the Rhine Valley Chapter (Hermann) and the Oak Creek Whitetail Ranch (Bland, Missouri). A very significant portion of the effort required to achieve this success came from Donald and Angi Hill, owners of Oak Creek Ranch as well as that of their team of guides. First of all, let me tell you that the Rhine Valley Chapter and the Oak Creek Ranch originally became allies in promoting the JAKES program when, two years ago, Donald and Angi learned of the Rhine Valley Chapter JAKES event and brought Don Viehmann, Rhine Valley Chapter President, helping one of the young shooters at the “shot gun/still target” class. their two sons, Cody and Zack to that event. As a result of the great time they had there with the Rhine Valley folks that day, they have looked for numerous ways in Now, having given you that back ground let me tell you why this event was so which to help the Rhine Valley Chapter JAKES program over the past several “totally awesome.” years. Having this event at Oak Creek Ranch ( a private hunting ranch specializing in, As a result of these positive experiences with the Rhine Valley JAKES program, among other species, “monster “ Canadian whitetail bucks ) creates some unique Donald and Angi decided they wanted to host a JAKES event at their ranch and in opportunities for a JAKES event that any NWTF chapter could normally only order to obtain the very best results for their efforts, who better to turn to then the dream about. -

Cuivre River Watershed and Inventory Assessment

Cuivre River Watershed and Inventory Assessment, February 3, 1993 Prepared by Devon L. Weirich, Fisheries Management Biologist Missouri Department of Conservation, Kirksville, MO 63501 Table of Contents Acknowledgements ....................................................................................................................................... 4 Executive Summary ...................................................................................................................................... 5 Location ........................................................................................................................................................ 6 Geology ......................................................................................................................................................... 8 Physiographic Region ............................................................................................................................... 8 Geology ..................................................................................................................................................... 8 Soils .......................................................................................................................................................... 9 Stream Order ............................................................................................................................................. 9 Watershed Area/Stream Length ............................................................................................................... -

Base Map Supplement

Atlas of Missouri Amphibians and Reptiles for 2020 Richard E. Daniel and Brian S. Edmond Atlas of Missouri Amphibians and Reptiles for 2020 Richard E. Daniel Division of Biological Sciences University of Missouri-Columbia 114 LeFevre Hall Columbia MO 65211 [email protected] Brian S. Edmond Computer Services Missouri State University 901 South National Ave Springfield MO 65897 [email protected] Recommended citation: Daniel, R.E. and B.S. Edmond. 2021. Atlas of Missouri Amphibians and Reptiles for 2020. <http://atlas.moherp.org/pubs/atlas20.pdf> Updated: 08 April 2021 17:59 Copyright (C) 1997-2021. All rights reserved. Table of Contents Table of Contents (Use Table of Contents page from color version of document.) Atlas of Missouri Amphibians and Reptiles for 2020 2 Introduction - Nomenclature and Taxonomy request. Readers may contribute new records and read more Introduction about project details online (Edmond and Daniel 2021). Since 1988, members of the Missouri Herpetological Questions, comments, and suggestions should be directed Association have compiled new county distribution records to the senior author. for amphibians and reptiles native to the state (Johnson and Powell 1988; Powell et al.. 1989, 1990, 1991, 1992, 1993a, 1994, 1995, 1996, 1997; Daniel et al.. 1998, 1999; Daniel Nomenclature and Taxonomy and Edmond 2000, 2001; Daniel et al.. 2002, 2003, 2004, Scientific and common names used in this publication 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, follow Crother et al.. (2017). The chosen common name 2014, 2015, 2016, 2017, 2018, 2019, 2020). Cumulative represents the most restrictive name available and refers to accounts of these new records were presented in Powell et the subspecies found within the state of Missouri. -

Savannas and Woodlands of Northern Missouri Message from the President

FALL/WINTER 2013 VOLUME 34 NUMBER 3 & 4 MissouriThe Missouri Prairie Foundation Prairie JournalProtecting Native Grasslands E-news alerts provide MPF members with news about more events. Send your e-mail address to [email protected] to be added to the e-news list. MPF does not share e-mail addresses with other groups. Events are also posted at www.moprairie.org. Savannas and Woodlands of Northern Missouri Message from the President Spring Creek CCS Strategy Area KIRKSVILLE Mystic Plains COA RUNGE PRAIRIE The mission of the Missouri Prairie Foundation (MPF) is to protect and restore prairie and other native grassland communities through acquisition, management, education, and research. Officers President Jon Wingo, Wentzville, MO FRANK OBERLE FRANK Immediate Past President Stanley M. Parrish, Walnut Grove, MO Vice President Doris Sherrick, Peculiar, MO his past August, I had the pleasure of representing the Missouri Vice President of Science and Management Bruce Schuette, Troy, MO Secretary Van Wiskur, Pleasant Hill, MO Prairie Foundation (MPF) at the National Wildlife Federation’s Treasurer Laura Church, Kansas City, MO America’s Grasslands Conference in Manhattan, Kansas near Directors TKonza Prairie. It was a rewarding experience listening to other accounts of Dale Blevins, Independence, MO preserving, restoring, and reconstructing prairie. Glenn Chambers, Columbia, MO The one thing that really struck home with me was when a cattle Margo Farnsworth, Smithville, MO rancher from southern Kansas was asked what he thought of the disaster Page Hereford, St. Louis, MO Wayne Morton, M.D., Osceola, MO assistance program for cattle that is currently being considered. He said Steve Mowry, Trimble, MO he really didn’t want to become dependent on it; he might be tempted to Jan Sassmann, Bland, MO not keep as much in his savings account—and then went on to explain his Bonnie Teel, Rich Hill, MO savings were not in the bank, but in the prairie soils that grew his grass. -

Show-Me Gobbler a Tri-Annual Publication of the George C

Show-Me Gobbler A Tri-Annual Publication of the George C. Clark Missouri Chapter of the National Wild Turkey Federation Volume 36 Number 3 • December 2017 Making New Hunters Through Hunter Education Programs One of the Missouri State Chapters goals outlined in the Save the Habitat. Save the Hunt. 10 year plan is to recruit, retain, or reactivate (R3) 20,000 hunt- ers by the year 2023. Two of the primary strategies to achieve this goal is to provide mentored hunt- ing opportunities and assist with hunter education program delivery. This past summer your super fund dollars helped support the Discover Nature Girls Camps that occurred in all 8 MDC regions. Annually, these camps are designed to provide 20-50 girls ages 11-15 with a weekend of outdoor education, exposure to a variety of outdoor related activities, and their hunter education training and certification. This past summer, 250 girls attended 30 young ladies, their chaperones, and MDC Conservation Agent Brian Bartlett are pictured at one of the 8 Discover Nature Girls Camps hosted by the Missouri Department of Conservation (MDC) and sponsored by the National Wild Turkey Federation (NWTF), the Missouri these 8 camps, received their hunter education Conservation Heritage Foundation (MCHF) and a host of other supporters. certification, and were a part of the R3 effort here in Missouri. For more information about similar events go to: https://mdc-event-web.s3licensing.com/ conservation sales tax that provides 60% of the Missouri Saving the Hunt Department of Conservations operating revenue to provide the services we depend upon. However, the ma- The NWTF is one of many conservation based nongov- jority of the remaining funding necessary is still hunter ernmental organizations (NGO’s) here in Missouri that dependent and most other states don’t have this source all do great work in “Saving the Habitat.” Missouri also and are even more dependent upon hunter numbers for probably does a better job than most anywhere else in their funding. -

Missouri's Forest Resource Assessment and Strategy

2010 Missouri’s Forest Resource Assessment and Strategy Seeking a Sustainable Future for Missouri’s Forest Resources Assessment prepared by: Missouri Department of Conservation, U.S.D.A Forest Service Northern Research Station Forest Inventory and Analysis Program Strategy prepared by: Missouri Department of Conservation Acknowledgements The author gives special thanks to John Fleming, now retired from the Missouri Department of Conservation (MDC), for his guidance and unlimited support in developing this project; to Mike Morris, MDC, for patiently fulfilling my requests for maps, data and other support; to Keith Moser, U.S. Forest Service – Northern Research Station, for producing and supplying a large amount of Forest Inventory and Analysis Data, for his content contributions and his invaluable review; to Tom Treiman, MDC, for providing helpful insights and review; to Sherri Wormstead, U.S. Forest Service – Northeastern Area - State and Private Forestry, for her tireless work collaborating with NA/NAASF to compile and create terrific guidance to states for preparing State Forest Resource Assessments and Strategies; and to Lisa Allen, MDC State Forester, for believing in this project and dedicating the resources needed to pull it off. Much thanks also goes to our MDC FRAS interdivisional team for offering their ideas and review: Paul Calvert (Fisheries Division), Dennis Figg (Wildlife Division), Tim Nigh (Resource Science Division) and Bill White (Private Lands Division); to MDC’s Forestry Division Leadership, Program Staff and Regional Supervisors who endured countless questions and requests for information or review; and last, but certainly not least, to the countless stakeholder groups and individuals who participated in meetings and other feedback opportunities and who will ultimately make FRAS the success it is intended to be. -

ON the LOOSE CAMPING – Page 1 on the LOOSE – Camping Section

Everything you need to know about more than 90 of the best camps in the region Including more than 60 High Adventure opportunities Images courtesy of: http://signal.baldwincity.com/news/2011/oct/20/local-boy-scouts-troop-remained-busy-during-summer/ http://i4.ytimg.com/vi/obn8RVY_szM/mgdefault.jpg http://www/sccovington.com/philmont/trek_info/equipment/tents.htm This is a publication of Tamegonit Lodge, the Order of the Arrow lodge affiliated with the Heart of America Council, BSA. Updated: December 2012 Additional copies of this publication are available through the Program Services Department at the Heart of America Council Scout Service Center 10210 Holmes Road Kansas City, Missouri 64131 Phone: (816) 942-9333 Toll Free: (800) 776-1110 Fax: (816) 942-8086 Online: www.hoac-bsa.org Camps: Revised December 2012; Rivers: Revised November 2008; Caves: Revised July 2007; Trails: Revised March 2010; High Adventure: Revised September 2007 Camps: Revised 12/2012; Rivers: Revised 11/2008; Caves: Revised 7/2007; Trails: Revised 3/2010; High Adventure: Revised 9/2007 THIS PAGE IS INTENTIONALLY LEFT BLANK HOAC – Order of the Arrow – ON THE LOOSE CAMPING – Page 1 ON THE LOOSE – Camping Section Table of Contents C Camp Geiger .....................................................11 Camp Jayhawk.............................................................11 Camp Oakledge ................................................12 Camp Orr..........................................................12 Camp Prairie Schooner.....................................13 -

Linking Ecological and Social Dimensions of Missouri Landscapes

LINKING ECOLOGICAL AND SOCIAL DIMENSIONS OF MISSOURI LANDSCAPES A Thesis presented to the Faculty of the Graduate School University of Missouri-Columbia In Partial Fulfillment Of the Requirements for the Degree Master of Science in Forestry by ADAM DANIEL BAER Drs. Hong He and Bernard J. Lewis, Thesis Co-Advisors DECEMBER 2005 ACKNOWLEDGEMENTS I want to first thank the Missouri Department of Conservation (MDC) and liaison Timothy A. Nigh for their willingness to collaborate with the University of Missouri- Columbia (MU) with respect to the project entitled, “Linking Ecological and Social Dimensions of Missouri Landscapes”. Their support via a graduate research assistantship is much appreciated. I also owe a debt of gratitude to my co-advisors (Drs. Hong S. He and Bernard J. Lewis) who allowed me the opportunity to pursue a graduate level education at MU. Over the past two and a half years, Hong and Dr. Lewis have facilitated my development into a well-rounded Forestry professional. I would also like to acknowledge my outside committee member Dr. Matthew W. Foulkes from the Geography Department for his technical and theoretical support. Also deserved of special recognition is Dr. David R. Larsen, Professor of Forest Biometrics at MU, for his encouragement and statistical guidance (especially with CART analysis). The members of the GIS and Spatial Analysis Lab at MU (Bo Shang, Robert Chastain, Dong Ko, Jian Yang, Shawn White, and Sara Bellchamber) also deserve my utmost appreciation. Many good times were shared and friendships kindled in the dungeon (3 ABNR). A special thanks goes out to the ‘Axe Holes’ flag football team, the distraction that helped maintain my sanity.