The Trilateral Commission

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

To Grow in a Sustainable and Profitable Manner and to Play an Active Part in the Industry’S Current Consolidation Process

MAGAZINE in the Annual Report 2010 Ro to OMGRow Deutsche wohnen Magazine in the Annual Report 2010 Deutsche wohnen The German economy and real estate market are currently particularly attractive, espe- cially globally operating investors are increasingly recognising the advantages offered by Germany: Its real estate market has been extremely stable for over 20 years, giving it a special status in comparison to elsewhere in the world. The best prospects are offered by the residential asset class in German metropolitan areas. Metropolitan areas are becoming increasingly attractive and important, and are a magnet for many people. It is exactly in this area that Deutsche Wohnen, one of the leading German residential property companies, has the core of its portfolio. With a current total of 47,688 residential units – including acquisitions – and 443 commercial properties, mainly in Berlin and the greater Rhine-Main area, the company is excellently placed to participate significantly in the growth potential of the market. The focus of its operating activities is the manage- ment and development of its own portfolio, whose value is continually increasing. The continuous optimisation of its core holdings and strategic additions and disposals are allowing Deutsche Wohnen as a large publicly listed residential property company to grow in a sustainable and profitable manner and to play an active part in the industry’s current consolidation process. The shares of Deutsche Wohnen AG are listed in the MDAX index of Deutsche Börse. Deutsche Wohnen is looking back on a very successful SUSTAINABLE financial year. What is on the agenda for 2011?Michael Zahn: “We operate in the fast-growing areas of Germany and our property know-how allows us to derive the best PROFITABLE possible value from our portfolios. -

Growthovation

innGROWTHovation 2004 annual report and 2005 proxy statement Corning today: CORNING INCORPORATED IS A DIVERSIFIED TECHNOLOGY COMPANY WITH A RICH HISTORY SPANNING MORE THAN 150 YEARS. CORNING CONCENTRATES EFFORTS ON HIGH-IMPACT GROWTH OPPORTUNITIES WORLDWIDE.WE COMBINE OUR EXPERTISE IN SPECIALTY GLASS, CERAMIC MATERIALS, POLYMERS AND THE MANIPULATION OF THE PROPERTIES OF LIGHT WITH STRONG PROCESS AND MANUFACTURING CAPABILITIES TO DEVELOP, ENGINEER AND COMMERCIALIZE SIGNIFICANT INNOVATIVE PRODUCTS FOR THE FLAT PANEL DISPLAY, TELECOMMUNICATIONS, ENVIRONMENTAL AND LIFE SCIENCES MARKETS. James R. Houghton Chairman & Chief Executive Officer to our Shareholders: CORNING INCORPORATED’S PERFORMANCE DURING 2004 TELLS A STORY NOT ONLY OF TURNAROUND, BUT OF GROWTH. IT IS A STORY NOT ONLY OF SURVIVING THE GREATEST CHALLENGES IN OUR HISTORY, BUT OF THRIVING AGAIN IN SOME OF THE WORLD’S MOST EXCITING TECHNOLOGY MARKETS. For two years in a row, Corning management and staff all I Protecting our financial health over the world have delivered significant improvement for our shareholders, continuing to implement the plan our Corning’s liquidity remains strong. We ended the year with Management Committee formulated and launched in mid- $1.9 billion in cash and short-term investments — exceeding 2002. We have rebuilt a strong financial foundation for the the target we had set for ourselves. Our $2 billion revolving company — and in turn, we have been able to invest in credit agreement remains untouched, just as it has been for several significant growth initiatives that are building our the past several years. strategic position and yielding returns for our shareholders. We reduced our overall debt to less than $2.7 billion. -

'Politieke Partijen Hebben Kansen'

Jaargang 8, nummer 83, 26 februari 2018 'Politieke partijen hebben kansen' Gerrit Voerman: Groei moeilijk, maar wel mogelijk Politieke partijen hebben, ondanks de gestage teruggang, toekomstkansen. 'Het is moeilijk om nieuwe leden te winnen', zegt Gerrit Voerman, hoogleraar aan de Rijksuniversiteit Groningen. 'Maar het blijkt mogelijk. En het is nodig.' Het Documentatiecentrum Nederlandse Politieke Partijen publiceerde deze maand de jaarlijkse stand: een groei van het ledenaantal met 10 procent, grotendeels dankzij Forum voor Democratie. 'Een verkiezingsjaar laat altijd aanwas zien', zegt Voerman. 'Wat opvalt is de sterke groei voor Baudet’s FvD met name onder jongeren. Het blijkt mogelijk om, met inzet van sociale media, jongeren aan je te binden.' Lees verder › Het karwei Het karwei zit er op. Vorige week heeft Nederland afscheid genomen van Ruud Lubbers, de langstzittende minister-president. Als leider van drie kabinetten tussen 1982 en 1994 loodste 'Ruud Shock' het land door de grootste crisis sinds de Tweede Wereldoorlog. Bij zijn overlijden werd hij geprezen als een icoon van een tijdperk. Net als Drees eerder. Premier Mark Rutte herdacht zijn voorganger tijdens de herdenkingsdienst in Rotterdam. Lubbers' biografie staat op www.parlement.com. Lees verder › Grafrede bij het afscheid van de politieke partij Column Geerten Bogaard, universitair docent Leiden '…Wij zijn hier bijeen om de politieke partij in de gemeenten te begraven. U ziet nog geen kist, maar die komt straks wel. Dat maakt voor deze gelegenheid ook niet zo veel uit. Want voor zover u al niet zeker weet dat politieke partijen op sterven na dood zijn, dan hoopt u daar in ieder geval sterk op. -

Who's Afraid of a Pan-European Spectrum Policy?

International Journal of Communication 12(2018), 337–358 1932–8036/20180005 Who’s Afraid of a Pan-European Spectrum Policy? The EU and the Battles Over the UHF Broadcast Band MARKO ALA-FOSSI University of Tampere, Finland1 MONTSE BONET Autonomous University of Barcelona, Spain Several European Union (EU) member states have consistently opposed European Commission (EC) efforts to create a supranational EU spectrum policy, but only Finland voted against the EC at the World Radiocommunication Conference in 2015, proposing the release of the entire ultra-high frequency (UHF) band for mobile use. Originally, in 2007, the EC and Finland wanted quick release of the UHF for mobile, but the EC has changed its UHF policy completely. Based on a new institutionalism approach, this article argues that one of the main reasons for this development is that the EU’s spectrum policy planning system has become intergovernmental. The EU members are now able to force the EC to seek a wide consensus on spectrum policy. The unique Finnish spectrum policy stand is based on certain nation-specific institutional factors: concentration of power in the spectrum policy, strong economic orientation of the communication policy, and oversupply of UHF frequencies. Keywords: European Union, Finland, spectrum policy, broadcasting, mobile telecommunication A political power struggle between the European Commission (EC), with ambitions for a more supranational spectrum policy, and the European Union (EU) member states, defending their own national competence and government cooperation on spectrum decisions, has continued for nearly two decades. Each commission, one after another, has promoted the benefits of a centralized spectrum policy and management, and in 2014, this policy was made one of the EC’s top priorities (Juncker, 2014). -

Towards a More Inclusive Economy

THE GLOBAL COMMON GOOD: TOWARDS A MORE INCLUSIVE ECONOMY Vatican City, Casina Pio IV, 11 – 12 July, 2014 Seminar Description p. Agenda p. List of Participants p. Pontifical Council for Justice and Peace p. Participant Biographies p. The Global Common Good: Towards a More Inclusive Economy “No” to an economy of exclusion […] Human beings are themselves considered consumer goods to be used and then discarded. We have created a “throw away” culture which is now spreading. It is no longer simply about exploitation and oppression, but something new. Exclusion ultimately has to do with what it means to be a part of the society in which we live; those excluded are no longer society’s underside or its fringes or its disenfranchised – they are no longer even a part of it. The excluded are not the “exploited” but the outcast, the “leftovers”. In this context, some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naïve trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system. Meanwhile, the excluded are still waiting. To sustain a lifestyle which excludes others, or to sustain enthusiasm for that selfish ideal, a globalization of indifference has developed. Almost without being aware of it, we end up being incapable of feeling compassion at the outcry of the poor, weeping for other people’s pain, and feeling a need to help them, as though all this were someone else’s responsibility and not our own. -

The Conservative Embrace of Progressive Values Oudenampsen, Merijn

Tilburg University The conservative embrace of progressive values Oudenampsen, Merijn Publication date: 2018 Document Version Publisher's PDF, also known as Version of record Link to publication in Tilburg University Research Portal Citation for published version (APA): Oudenampsen, M. (2018). The conservative embrace of progressive values: On the intellectual origins of the swing to the right in Dutch politics. [s.n.]. General rights Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. • Users may download and print one copy of any publication from the public portal for the purpose of private study or research. • You may not further distribute the material or use it for any profit-making activity or commercial gain • You may freely distribute the URL identifying the publication in the public portal Take down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. Download date: 25. sep. 2021 The conservative embrace of progressive values On the intellectual origins of the swing to the right in Dutch politics The conservative embrace of progressive values On the intellectual origins of the swing to the right in Dutch politics PROEFSCHRIFT ter verkrijging van de graad van doctor aan Tilburg University op gezag van de rector magnificus, prof. dr. E.H.L. Aarts, in het openbaar te verdedigen ten overstaan van een door het college voor promoties aangewezen commissie in de aula van de Universiteit op vrijdag 12 januari 2018 om 10.00 uur door Merijn Oudenampsen geboren op 1 december 1979 te Amsterdam Promotor: Prof. -

Elisa Wirsching Best Dissertation Prize Winner Msc Political Science and Political Economy 2016-17

Elisa Wirsching Best Dissertation Prize Winner MSc Political Science and Political Economy 2016-17 [email protected] The Revolving Door for Political Elites: An Empirical Analysis of the Linkages between Government Officials’ Professional Background and Financial Regulation A dissertation submitted to the Department of Government, the London School of Economics and Political Science, in part completion of the requirements for the MSc in Political Science and Political Economy. August, 2017 9,917 Words MSc PSPE – GV499 MSc PSPE – GV499 Abstract Regulatory capture of public policy by financial entities, especially via the revolving door between government and financial services, has increasingly become a subject of intense public scrutiny. This paper empirically analyses the relation between public-private career crossovers of high-ranking government officials and financial policy. Using information based on curriculum vitae of more than 400 central bank governors and finance ministers from 32 OECD countries between 1973-2005, a new dataset was compiled including details on officials’ professional careers before as well as after their tenure and data on financial regulation. Time-series cross-sectional analyses show that central bank governors with past experience in the financial sector deregulate significantly more than governors without a background in finance (career socialisation hypothesis). Using linear probability regressions, the results also indicate that finance ministers, especially from left-wing parties, are more likely to be hired by financial entities in the future if they please their future employers through deregulatory policies during their time in office (career concerns hypothesis). Thus, although the revolving door effects differ between government officials, this study shows that career paths and career concerns of policy-makers should be taken into account when analysing financial policy outcomes. -

European Membership List

THE TRILATERAL COMMISSION MAY 2012 *Executive Committee JEAN-CLAUDE TRICHET JOSEPH S. NYE, JR. YOTARO KOBAYASHI European Chairman North American Chairman Pacific Asian Chairman VLADIMIR DLOUHY ALLAN E. GOTLIEB HAN SUNG-JOO European North American Pacific Asian Deputy Chairman Deputy Chairman Deputy Chairman MICHAEL FUCHS JAIME SERRA JUSUF WANANDI European North American Pacific Asian Deputy Chairman Deputy Chairman Deputy Chairman DAVID ROCKEFELLER Founder and Honorary Chairman PETER SUTHERLAND GEORGES BERTHOIN PAUL A. VOLCKER European European North American Honorary Chairman Honorary Chairman Honorary Chairman *** PAUL RÉVAY MICHAEL J. O'NEIL TADASHI YAMAMOTO European Director North American Director Pacific Asian Director EUROPEAN GROUP Alexandre Adler, Scientific Director for Geopolitics, University of Paris-Dauphine; Journalist and Commentator, Paris Urban Ahlin, Member of the Swedish Parliament and Deputy Chairman of the Committee on Foreign Affairs, Stockholm *Esko Aho, Executive Vice President, Nokia, Helsinki; former Prime Minister of Finland *Edmond Alphandéry, Chairman, CNP Assurances, Paris; former Chairman, Electricité de France (EDF); former Minister of the Economy and Finance Jacques Andréani, Ambassadeur de France, Paris; former Ambassador to the United States Jorge Armindo, Chairman, Amorim Turismo, Lisbon Jerzy Baczynski, Editor-in-Chief, Polityka, Warsaw Estela Barbot, former Director, AGA; Director, Bank Santander Negocios; Member of the General Council, AEP -- Portuguese Business Association, Porto; General Honorary -

View Annual Report

Annual10 Report Contents 3 Foreword 94 Report of the Supervisory Board 6 Management Board 100 ullstein bild 8 Highlights 116 Consolidated Financial Statements 117 Responsibility Statement 22 The Axel Springer share 118 Auditor’s Report 119 Consolidated Statement of Financial Position 25 Employees 120 Consolidated Statement of Comprehensive Income 28 Social responsibility 121 Consolidated Statement of Cash Flows 122 Consolidated Statement of Changes in Equity 30 Combined Management Report of the Group and of Axel Springer AG 124 Notes to the Consolidated Financial Statements 31 Business and framework conditions 168 Boards 45 Financial performance, liquidity, and financial position 170 Glossary 63 Economic position of Axel Springer AG 66 Events after the reporting date 67 Report on risks and opportunities 74 Forecast report 78 Disclosures pursuant to Sections 289 (4), 315 (4) HGB and Explanatory Report pursuant to Section 176 (1) (1) AktG 82 Statement on governance pursuant to Section 289a HGB and Corporate Governance Report GroupGroup KeyKey FiguresFigures in € millions Change yoy 2010 2009 2008 2007 Group Total revenues 10.8 % 2,893.9 2,611.6 2,728.5 2,577.9 Digital Media revenues as percent of total revenues (pro forma) 24.4 % 21.2 % - - International revenues as percent of total revenues 28.1 % 21.0 % 21.9 % 20.8 % Circulation revenues – 0.2 % 1,174.3 1,176.2 1,215.8 1,190.6 Advertising revenues 21.6 % 1,384.8 1,138.5 1,248.1 1,207.5 Other revenues 12.8 % 334.8 296.9 264.7 179.8 1) EBITDA 53.0 % 510.6 333.7 486.2 470.0 1) EBITDA margin -

Annual Report 2010 Deutsche Wohnen

financial report in the annual report 2010 Ro to OMgrow KEY FIGURES Key figures of Deutsche Wohnen Group 2010 2009 KPROFIT AND LOSS STATEMENT Earnings from residential property management EUR m 150.9 151.0 Earnings from disposals EUR m 12.7 9.7 Earnings from nursing and assisted living EUR m 8.9 9.1 Corporate expenses EUR m -31.8 -34.61) EBITDA EUR m 136.1 133.51) EBT (adjusted) EUR m 33.7 18.6 EBT (as reported) EUR m 57.1 3.4 Earnings after taxes EUR m 23.8 -13.3 Earnings after taxes per share EUR per share 0.29 -0.162) FFO (without disposals) EUR m 33.1 25.1 FFO (without disposals) per share EUR per share 0.40 0.31 FFO (incl. disposals) EUR m 45.8 34.8 FFO (incl. disposals) per share EUR per share 0.56 0.43 BALANCE SHEET Investment properties EUR m 2,821.0 2,835.5 Current assets EUR m 108.8 123.1 Equity EUR m 889.9 862.0 Net financial liabilities EUR m 1,738.5 1,772.2 Loan-to-Value Ratio (LTV) in % 60.6 61.5 Total assets EUR m 3,038.2 3,079.3 Share 2010 2009 Share price (closing price) EUR per share 10.50 6.70 Number of shares m 81.84 81.84 Market capitalisation EUR m 859 548 Dividend per share EUR per share 0.203) - Net Asset Value (NAV) 2010 2009 EPRA NAV EUR m 964.0 915.2 EPRA NAV per share EUR per share 11.78 11.18 Fair values 2010 2009 Fair value of real estate properties4) EUR m 2,672.3 2,749.8 Fair value per sqm residential and commercial area4) EUR per sqm 926 895 1) Adjusted for restructuring- and reorgansiational costs 2) Based on 81.84m shares outstanding 3) Dividend proposal for fiscal year 2010 4) Only comprises residential -

IM 03 09 Family Offices Xxxk.Qxd 21.09.2009 20:32 Seite 120

IM_03_09_Family Offices_XXXk.qxd 21.09.2009 20:32 Seite 120 INVESTOREN & BERATER: FAMILY OFFICES Schweigen war Gold Family Offices agieren weitgehend frei von rechtlichen Restriktionen, und die Benchmark wird durch die Vermögensinhaber vorgegeben. Durch die Krise in Mitleidenschaft gezogen, rücken Reporting, Controlling und Corporate Governance jetzt stärker in den Fokus. ine der letzten Bastionen der European Business School leitet, bestätigt Gewinnung neuer Kunden ist für Multi Finanzwelt, die mit öffentli- die Verschwiegenheit: „Insbesondere Single Family Offices in den nächsten Jahren zwar cher Information hinterm Berg Family Offices, die sich um das Wohlerge- ein ausgewiesen wichtiges Ziel, aber das halten kann, sind Family Offi- hen einer einzigen Familie kümmern, agie- wird nicht über Werbung erreicht“, weiß Eces. Während die meisten anderen großen ren bevorzugt diskret.“ Sie sind in keinem Schaubach aus der Praxis. Kapitalmarktteilnehmer längst gezwungen Verband zusammengeschlossen, und es gibt Umso bemerkenswerter ist die jüngst sind, ihre Karten zumindest teilweise auf kein offizielles Register und keine Bran- erschienene Studie „Mythos Family Office“, den Tisch zu legen, können die Hüter der chenkonferenz, zu der sich ein Großteil der die gemeinsam von J.P. Morgan Asset großen Familienvermögen nach wie vor im Insider einfindet. So kann es schon mal vor- Management, der Complementa Invest- Hintergrund arbeiten. Und das, obwohl die kommen, dass die überreichte Visitenkarte ment-Controlling AG und dem Bayerischen betreuten Summen vieler Family Offices lediglich den Namen des Gesprächspartners Finanz Zentrum erstellt wurde. An der denen von institutio- nellen Anlegern nicht nachstehen. Das kol- lektive Vermögen die- »70 Prozent der Multi Family Offices gaben an, ser Gruppe erhielt zwar im Horrorjahr dass ihre Kunden eine durchschnittlich dreipro- 2008 mit einem Mi- zentige absolute Nachsteuerrendite vorgeben. -

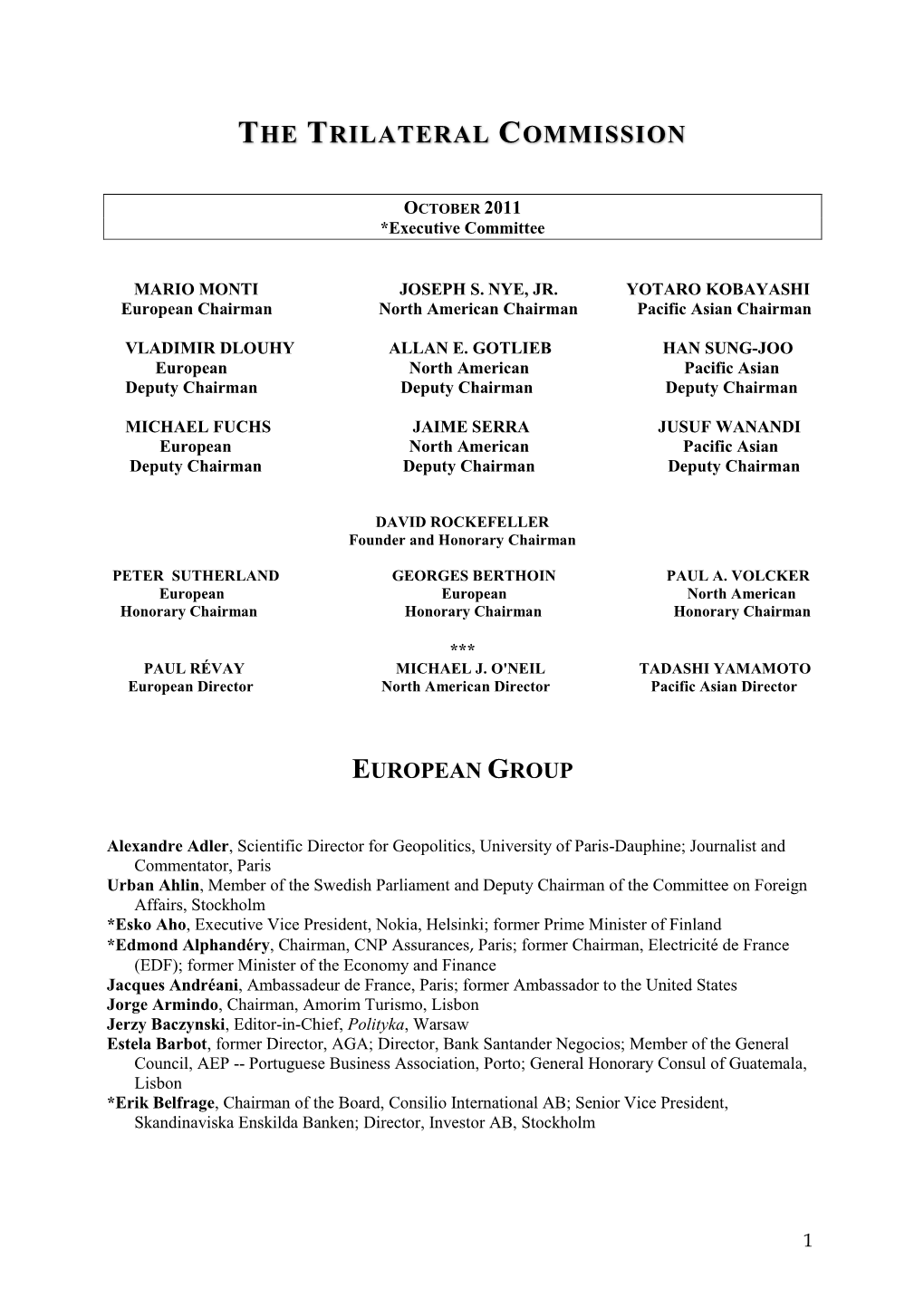

The Trilateral Commission

THE TRILATERAL COMMISSION AUGUST 2011 *Executive Committee MARIO MONTI JOSEPH S. NYE, JR. YOTARO KOBAYASHI European Chairman North American Chairman Pacific Asian Chairman VLADIMIR DLOUHY ALLAN E. GOTLIEB HAN SUNG-JOO European North American Pacific Asian Deputy Chairman Deputy Chairman Deputy Chairman MICHAEL FUCHS JAIME SERRA JUSUF WANANDI European North American Pacific Asian Deputy Chairman Deputy Chairman Deputy Chairman DAVID ROCKEFELLER Founder and Honorary Chairman PETER SUTHERLAND GEORGES BERTHOIN PAUL A. VOLCKER European European North American Honorary Chairman Honorary Chairman Honorary Chairman *** PAUL RÉVAY MICHAEL J. O'NEIL TADASHI YAMAMOTO European Director North American Director Pacific Asian Director EUROPEAN GROUP Alexandre Adler, Scientific Director for Geopolitics, University of Paris-Dauphine; Journalist and Commentator, Paris Urban Ahlin, Member of the Swedish Parliament and Deputy Chairman of the Committee on Foreign Affairs, Stockholm *Esko Aho, Executive Vice President, Nokia, Helsinki; former Prime Minister of Finland *Edmond Alphandéry, Chairman, CNP Assurances, Paris; former Chairman, Electricité de France (EDF); former Minister of the Economy and Finance Jacques Andréani, Ambassadeur de France, Paris; former Ambassador to the United States Jorge Armindo, Chairman, Amorim Turismo, Lisbon Jerzy Baczynski, Editor-in-Chief, Polityka, Warsaw Patricia Barbizet, Chief Executive Officer and Member of the Board of Directors, Artémis Group, Paris Estela Barbot, Director, AGA; Director, Bank Santander Negocios; Member