Trends in International Nuclear Markets and Impending Issues for Japan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The World Nuclear Industry Status Report 2009 with Particular Emphasis on Economic Issues

The World Nuclear Industry Status Report 2009 With Particular Emphasis on Economic Issues By Mycle Schneider Independent Consultant, Mycle Schneider Consulting, Paris (France) Project Coordinator Steve Thomas Professor for Energy Policy, Greenwich University (UK) Antony Froggatt Independent Consultant, London (UK) Doug Koplow Director of Earth Track, Cambridge (USA) Modeling and Additional Graphic Design Julie Hazemann Director of EnerWebWatch, Paris (France) Paris, August 2009 Commissioned by German Federal Ministry of Environment, Nature Conservation and Reactor Safety (Contract n° UM0901290) About the Authors Mycle Schneider is an independent international consultant on energy and nuclear policy based in Paris. He founded the Energy Information Agency WISE-Paris in 1983 and directed it until 2003. Since 1997 he has provided information and consulting services to the Belgian Energy Minister, the French and German Environment Ministries, the International Atomic Energy Agency, Greenpeace, the International Physicians for the Prevention of Nuclear War, the Worldwide Fund for Nature, the European Commission, the European Parliament's Scientific and Technological Option Assessment Panel and its General Directorate for Research, the Oxford Research Group, and the French Institute for Radiation Protection and Nuclear Safety. Since 2004 he has been in charge of the Environment and Energy Strategies lecture series for the International MSc in Project Management for Environmental and Energy Engineering Program at the French Ecole des Mines in Nantes. In 1997, along with Japan's Jinzaburo Takagi, he received the Right Livelihood Award, also known as the ―Alternative Nobel Prize‖. Antony Froggatt works as independent European energy consultant based in London. Since 1997 Antony has worked as a freelance researcher and writer on energy and nuclear policy issues in the EU and neighboring states. -

Press Release

Press release The ATMEA1 reactor pre-qualified in Argentina Paris, July 12, 2012 The national utility Nucleoeléctrica Argentina (NA-SA) has informed ATMEA that it had pre-qualified the ATMEA1 technology for the next Request For Proposals that will be issued for the construction of its fourth nuclear power plant. By pre-selecting the ATMEA1 technology, NA-SA acknowledges that the ATMEA1 reactor is a qualified design that could meet the most stringent safety requirements and fit needs of the NA-SA. “After Jordan pre-selection of the ATMEA1 design last May and as confirmed by the recent positive statement of the French Safety Authority ASN on the ATMEA1 reactor’s safety options, this NA-SA decision confirms the trust being placed in the ATMEA1 technology. I’m confident that its design will fulfil stringent Argentina’s requirements, with its highest safety level as a Generation III+ reactor, its proven technology and its superior operation performance”, outlined Philippe Namy, ATMEA President. In 2006, Argentina announced the reactivation of a strategic plan for the country’s nuclear power sector, including the construction of a fourth nuclear reactor. The ATMEA1 reactor is a pressurized water reactor of 1,100 MWe, intended for any types of electrical networks and in particular for medium power grids. It was designed and developed by ATMEA, the 50/50 Joint Venture created in 2007 by Mitsubishi Heavy Industries and AREVA. Taking support on these two parent companies, ATMEA capitalizes on their experience of about 130 nuclear power plants which are operating in the world for around 50 years, and representing approximately 3300 cumulative reactor years of operation. -

Report: Fukushima Fallout | Greenpeace

Fukushima Fallout Nuclear business makes people pay and suffer February 2013 Contents Executive summary 4 Chapter 1: 10 Fukushima two years later: Lives still in limbo by Dr David McNeill Chapter 2: 22 Summary and analysis of international nuclear liability by Antony Froggatt Chapter 3: 38 The nuclear power plant supply chain by Professor Stephen Thomas For more information contact: [email protected] Written by: Antony Froggatt, Dr David McNeill, Prof Stephen Thomas and Dr Rianne Teule Edited by: Brian Blomme, Steve Erwood, Nina Schulz, Dr Rianne Teule Acknowledgements: Jan Beranek, Kristin Casper, Jan Haverkamp, Yasushi Higashizawa, Greg McNevin, Jim Riccio, Ayako Sekine, Shawn-Patrick Stensil, Kazue Suzuki, Hisayo Takada, Aslihan Tumer Art Direction/Design by: Sue Cowell/Atomo Design Cover image: Empty roads run through the southeastern part of Kawamata, as most residents were evacuated due to radioactive contamination.© Robert Knoth / Greenpeace JN 444 Published February 2013 by Greenpeace International Ottho Heldringstraat 5, 1066 AZ Amsterdam, The Netherlands Tel: +31 20 7182000 greenpeace.org Image: Kindergarten toys, waiting for Greenpeace to carry out radiation level testing. 2 Fukushima Fallout Nuclear business makes people pay and suffer © NORIKO HAYASHI / G © NORIKO HAYASHI REENPEACE Governments have created a system that protects the benefits of companies while those who suffer from nuclear disasters end up paying the costs.. Fukushima Fallout Nuclear business makes people pay and suffer 3 © DigitaLGLOBE / WWW.digitaLGLOBE.COM Aerial view 2011 disaster. Daiichi nuclear of the Fukushima plant following the Image: Nuclear business makes people pay and suffer Fukushima Fallout 4 for its failures. evades responsibility evades responsibility The nuclear industry executive summary executive summary Executive summary From the beginning of the use of nuclear power to produce electricity 60 years ago, the nuclear industry has been protected from paying the full costs of its failures. -

After Years of Stagnation, Nuclear Power Is On

5 Vaunted hopes Climate Change and the Unlikely Nuclear Renaissance joshua William Busby ft er years oF s TaGNaTioN, Nucle ar P oWer is oN The atable again. Although the sector suffered a serious blow in the wake of the Fukushima Daiichi nuclear meltdown that occurred in Japan in early 2011, a renewed global interest in nuclear power persists, driven in part by climate concerns and worries about soaring energy demand. As one of the few relatively carbon-free sources of energy, nuclear power is being reconsid- ered, even by some in the environmental community, as a possible option to combat climate change. As engineers and analysts have projected the poten- tial contribution of nuclear power to limiting global greenhouse gas emis- sions, they have been confronted by the limits in efficiency that wind, water, and solar power can provide to prevent greenhouse gas emissions from rising above twice pre-industrial levels. What would constitute a nuclear power renaissance? In 1979, at the peak of the nuclear power sector’s growth, 233 power reactors were simultaneously under construction. By 1987, that number had fallen to 120. As of February 2012, 435 nuclear reactors were operable globally, capable of producing roughly 372 gigawatts (GW) of electricity (WNA 2012). Some analysts suggest that, with the average age of current nuclear plants at twenty-four years, more than 170 reactors would need to be built just to maintain the current number in 2009 1 Copyright © 2013. Stanford University Press. All rights reserved. Press. All © 2013. Stanford University Copyright operation (Schneider et al. a). -

Specials Steels and Superalloys for Nuclear Industry

Specials Steels and Superalloys for Nuclear Industry Enhancing your performance or almost 60 years Aubert & Duval has been a key partner for the development Aubert & Duval: Your partner F of forged and rolled products, especially those customized for the nuclear market. to energize your success With full vertical integration from melting, to remelting, hot converting and machining (rough machining through to near-net-shape parts), Aubert & Duval offers wide-ranging cutting edge capabilities for nuclear application. Equipment Process flow . MELTING Melting furnaces (EAF, AOD, LF) Melting up to 60 tons Vacuum Induction Melting (VIM) HPS NiSA up to 20 tons Remelting furnaces (ESR, VAR) up to 30 tons powder atomization (Gaz, VIM) . FORGING Open-die forging presses Remelting Powder atomization from 1,500 to 10,000 tons Closed-die forging presses from 4,500 to 65,000 tons . ROLLING MILL HPS 7-200 mm diameter bars High Performance Steels: Conversion . HEAT TREATMENT A range of alloyed steels with Solution and ageing furnaces tightly controlled characteristics HPS Ti NiSA AL PM Horizontal and vertical quenching offering optimum value for equipment customers. TESTING Forging Closed-die Hot Isostatic Immersion UT up to 13 tons and/or rolling Forging Forging Pressing (HIP) ©Valinox-Franck Dunouau (28,000 lbs) Automated contact UT up to 20 tons NiSA Aubert & Duval has also put in place over many decades dedicated skills to co-design re-engineered Nickel-base Superalloys: Nickel-based superalloys: materials metallurgical solutions with our clients. keeping high surface integrity while Sales of alloys and superalloys have progressively expanded across a broad spectrum of primary withstanding severe mechanical circuit contractors and their subcontractors. -

NUCLEAR REACTOR PRESSURE VESSEL CRISIS | Greenpeace

NUCLEAR REACTOR PRESSURE VESSEL CRISIS GREENPEACE BRIEFING "This may be a global problem for the entire nuclear industry.” Belgian Nuclear Regulator, FANC, Director General, Jan Bens, February 13th 2015.1 WENRA recommends “Examination of the base material of the vessels if considered necessary.”2 Western European Nuclear Regulators Association, December 2014. “Failure of the pressure vessel of a PWR or a BWR constitutes an accident beyond the design basis for which there is no safety system - inevitably leading to a catastrophic release of radioactive material to the environment.” Nuclear Reactor Hazards Greenpeace, 2005.3 FEBRUARY 15th 2015 1 http://deredactie.be/cm/vrtnieuws/binnenland/1.2238955, accessed February 14th 2015. 2 Report Activities in WENRA countries following the Recommenda- tion regarding flaw indications found in Belgian reactors December 17 2014 http://www.wenra.org/media/filer_public/2014/12/26/flaws_in_rpv_feedback_2014-12-19.pdf, accessed February 2014. 3 Nuclear Reactor Hazards Ongoing Dangers of Operating Nuclear Technology in the 21st Century Report, Greenpeace International, Helmut Hirsch, Oda Becker, Mycle Schneider, Antony Froggatt April 2005, http://www.greenpeace.org/seasia/th/PageFiles/106897/nuclearreactorhazards.pdf, accessed February 2015. Introduction On February 13th 2015, the Director General of the Federal Agency for Nuclear Control (FANC) responsible for nuclear safety in Belgium revealed that the problems found in two nuclear reactors had implications for nuclear safety worldwide. FANC later posted a statement on its website announcing that thousands “flaw indications” had been found during investigations in the Doel 3 and Tihange 2 nuclear reactor pressure vessels. The 'flaw indications' are in reality microscopic cracks. -

Global Nuclear Markets – Market Arrangements and Service Agreements

INL/EXT-16-38796 Global Nuclear Markets – Market Arrangements and Service Agreements Brent Dixon Leilani Beard June 2016 The INL is a U.S. Department of Energy National Laboratory operated by Battelle Energy Alliance DISCLAIMER This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their employees, makes any warranty, expressed or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness, of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. References herein to any specific commercial product, process, or service by trade name, trade mark, manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favoring by the U.S. Government or any agency thereof. The views and opinions of authors expressed herein do not necessarily state or reflect those of the U.S. Government or any agency thereof. INL/EXT-16-38796 Global Nuclear Markets – Market Arrangements and Service Agreements Brent Dixon Leilani Beard June 2016 Idaho National Laboratory Nuclear Systems Design & Analysis Division Idaho Falls, Idaho 83415 Prepared for the U.S. Department of Energy Office of Energy Policy and Systems Analysis Under U.S. Department of Energy-Idaho Operations Office Contract DE-AC07-05ID14517 Forward The U.S. Department of Energy’s Office of Energy Policy and Systems Analysis (EPSA) requested an assessment of global nuclear markets, including the structure of nuclear companies in different countries and the partnerships between reactor vendors and buyers. -

Nuclear Energy Systems Business Operation

Nuclear Energy Systems Business Operation June 3, 2010 Akira Sawa Director, Executive Vice President, General Manager, Nuclear Energy Systems Headquarters 1 Contents 1. Highlights in Corporate News, 2009-2010 2. Results of the 2008 Business Plan 3. Overview of the 2010 Business Plan 4. Operation in Global Business 5. Operation in Domestic Light Water Reactor Business 6. Operation in Nuclear Fuel Cycle Business 7. Value Chain Innovation 2 1. Highlights in Corporate News, 2009-2010 Projects Delivered Realizing Major Projects The latest PWR power plant 3rd US-APWR selected started commercial operation Hokkaido Electric Dominion Resources Tomari unit 3 North Anna unit 3 (Dec 2009) (May 2010) Inheriting plant Plant export starts in technologies Tomari unit 3 (right) earnest Existing North Anna unit 1/2 1st plutonium thermal operation Large-scale order received started in Japan for nuclear fuel cycle Kyushu Electric Japan Nuclear Fuel Genkai unit 3 Limited (Dec 2009) Rokkasho MOX fuel Shikoku Electric fabrication plant Ikata unit 3 (June 2009) (Mar 2010) Genkai No. 3 reactor Rokkasho MOX fuel fabrication plant MOX fuel loaded (J-MOX) Nuclear Fuel Cycle Contribution to Japanese Advanced nuclear fuel cycle 3 2. Results of the 2008 Business Plan Orders, Sales and Profit Steady business mostly in domestic maintenance services, nuclear fuel cycle and components export Major Actions and Achievements Steady business promotion and construction of business foundation towards global deployment Overseas business ○Dominion selected US-APWR, a 1,700MWe class large-sized PWR, the third unit following the 2 units selected by Luminant. ○The basic design of ATMEA1, a 1,100 MWe class mid-sized PWR, completed. -

The Recent Activities of Nuclear Power Globalizationour Provision

Recent Activities of Nuclear Power Globalization Provisions against Global Warming through the Global Deployment of Technologies as an “Integrated Nuclear Power Plant Supply Company” KIYOSHI YAMAUCHI*1 SHIGEMITSU SUZUKI*1 Mitsubishi Heavy Industries, Ltd. (MHI) is striving to expand and spread nuclear power plants as an “Integrated Nuclear Power Plant Supply Company” based on its engineering, manufacturing, and technological support capabilities. The company also has ample experience in the export of major components. MHI is accelerating its global deployment through the market introduction of large-sized strategic reactor US-APWR, the joint development of a mid-sized strategic reactor ATMEA1 with AREVA, and a small strategic reactor PBMR. The company also plans to internationally deploy technologies for the nuclear fuel cycle. We present here the leading-edge trends in the global deployment of these nuclear businesses, all of which help to solve the energy and environmental issues in the world. most effective countermeasures against global warming, 1. Role of nuclear power generation as together with countermeasures to promote energy saving a countermeasure against global warming and new energies. In December 1997, targets were determined for the The CO2 emissions per kWh of energy generated by reduction of greenhouse effect gas during the Conference nuclear power generation are extremely small in comparison on the United Nations Framework Convention on Climate to the emissions from thermal power generation with coal Change (COP3) held in Kyoto. About 90% of greenhouse and oil, and from natural energy power generation with effect gas from Japan is energy-derived CO2 generated photovoltaic effects, wind power, and so on (see Fig. -

JAPAN Roundtable Series: Partners in Nuclear

SessionSession IIIIII ofof thethe U.S.U.S. -- JAPANJAPAN RoundtableRoundtable Series:Series: PartnersPartners inin NuclearNuclear EnergyEnergy Competitiveness Strategies for Emerging Markets/The U.S.-Japan Private Industry Model vs. State Owned Industry Model February 23, 2011 Kiyoshi Yamauchi Executive Officer Nuclear Headquarters 1 Contents 1. Nuclear Energy As a Key Player 2. Overview of MHI Nuclear 3. U.S.- Japan Cooperation in Emerging Market 4. Closing 2 1. Nuclear Energy As a Key Player 3 Nuclear Energy As a Key Player Growing Needs for Clean & Affordable Energy - Concern About Climate Change Continue - Energy Security - Energy Needs in the Developing World - Proliferation Issues - No Single Winner, No Loser in Energy Portfolio The Role of Nuclear Power - Solution to Cover Spectrum of Needs - Engineering / Technological Advances - Safe, Clean and Economical NPP Development 4 U.S.- Japan Cooperation As a Key Player New Build in US and Japan Efficient and Safe Operation Emerging Market 5 2. Overview of MHI Nuclear 6 Mitsubishi Nuclear Organization Approximately 4,500 employees on a consolidated basis (as of April 2010) MFBR Nuclear Energy Systems U.S.A.:MNES (MITSUBISHI (Mitsubishi Nuclear FBR SYSTEMS, INC.) HQ (Mr. Sawa) Energy Systems, Inc.) (Control/Managing of Nuclear Business) ATMEA.SAS. Kobe Shipyard & Takasago 三菱電機Mitsubishi Machinery Works Machinery Electric 電気設備 (Nuclear Island) Works Corporation (Turbine Island) (Electricalとりまと Equipment) め Mitsubishi Nuclear Nuclear Nuclear Nuclear Takasago Nuclear Fuel Development Plant Power R&D Transport Service Fuel Co., Corporation Training Center Ltd. System Co., Engineering Center, Ltd. Ltd. Co., Ltd. 7 Kobe Shipyard & Machinery Works Established : 1905 Employees : 3,900 (For Nuclear Division: 1,700) Kobe Engineering Land Area Center 1. -

AREVA in 2007, Growth and Profitability

AREVA in 2007, growth and profi tability AREVA 33, rue La Fayette – 75009 Paris – France Tel.: +33 1 34 96 00 00 – Fax: +33 1 34 96 00 01 www.areva.com Energy is our future, don’t waste it! ACTIVITY AND SUSTAINABLE DEVELOPMENT REPORT If you only have a moment to devote to this report, read this. Our energies have a future. A future without CO 2 OUR MISSION no.1 worldwide Enable everyone to have access to ever cleaner, safer and more economical energy. in the entire nuclear cycle OUR STRATEGY To set the standard in CO 2-free power generation and electricity transmission and distribution. no.3 worldwide I Capitalize on our integrated business model to spearhead in electricity transmission and distribution the nuclear revival: – build one third of new nuclear generating capacities; – make the fuel secure for our current and future customers. I Ensure strong and profi table growth in T&D. OUR PERFORMANCE IN 2007 I Expand our renewable energies offering. Backlog With manufacturing facilities in 43 countries and a sales network in more than 100, e +55.4% AREVA offers customers reliable technological solutions for CO 2-free power generation and 39.83 B electricity transmission and distribution. We are the world leader in nuclear power and the only company to cover all industrial activities in this fi eld. Sales Our 65,000 employees are committed to continuous improvement on a daily basis, making sustainable development the focal point of the group’s industrial strategy. e11.92 B +9.8 % AREVA’s businesses help meet the 21 st century’s greatest challenges: making energy available to all, protecting the planet, and acting responsibly towards future generations. -

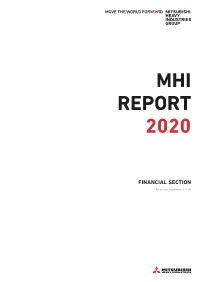

Mhi Report 2020 Financial Section Impairment Loss

MHI REPORT 2020 MITSUBISHI HEAVY INDUSTRIES GROUP FINANCIAL SECTION For the Year Ended March 31, MHI REPORT 2020 FINANCIAL SECTION For the Year Ended March 31, 2020 SEGMENT INFORMATION Mitsubishi Heavy Industries, Ltd. and Consolidated Subsidiaries Fiscal years ended March 31, 2019 and 2020 REVENUE Thousands of Millions of yen U.S. dollars Billions of yen 5,000 Industry Segment 2019 2020 2020 Power Systems ¥1,525,108 ¥1,590,293 $14,612,634 4,000 Industry & Infrastructure 1,907,871 1,778,095 16,338,279 Power Systems Aircraft, Defense & Space 677,577 704,985 6,477,855 3,000 Others 71,661 75,190 690,894 2,000 Industry & Subtotal 4,182,218 4,148,565 38,119,682 Infrastructure 1,000 Eliminations or Corporate (103,874) (107,189) (984,921) Aircraft, Defense & Space Total ¥4,078,344 ¥4,041,376 $37,134,760 0 2019 2020 Others, Eliminations or Corporate PROFIT FROM BUSINESS ACTIVITIES Thousands of Millions of yen U.S. dollars Billions of yen Industry Segment 2019 2020 2020 240 Power Systems ¥133,196 ¥144,383 $1,326,683 Power Systems Industry & Infrastructure 70,753 54,883 504,300 120 Aircraft, Defense & Space (28,230) (208,792) (1,918,515) Industry & Infrastructure 0 Others 39,156 6,565 60,323 Aircraft, Defense Subtotal 214,876 (2,958) (27,180) & Space -120 Eliminations or Corporate (14,305) (26,579) (244,224) Others, Eliminations Total ¥200,570 ¥ (29,538) $ (271,414) or Corporate -240 2019 2020 DEPRECIATION AND AMORTIZATION Thousands of Millions of yen U.S. dollars Industry Segment 2019 2020 2020 Power Systems ¥ 42,861 ¥ 47,085 $ 432,647 Industry & Infrastructure 51,187 57,015 523,890 Aircraft, Defense & Space 29,982 27,082 248,846 Others 6,263 1,970 18,101 Subtotal 130,294 133,154 1,223,504 Corporate 5,364 11,485 105,531 Total ¥135,658 ¥144,639 $1,329,036 1 MHI REPORT 2020 FINANCIAL SECTION IMPAIRMENT LOSS Thousands of Millions of yen U.S.