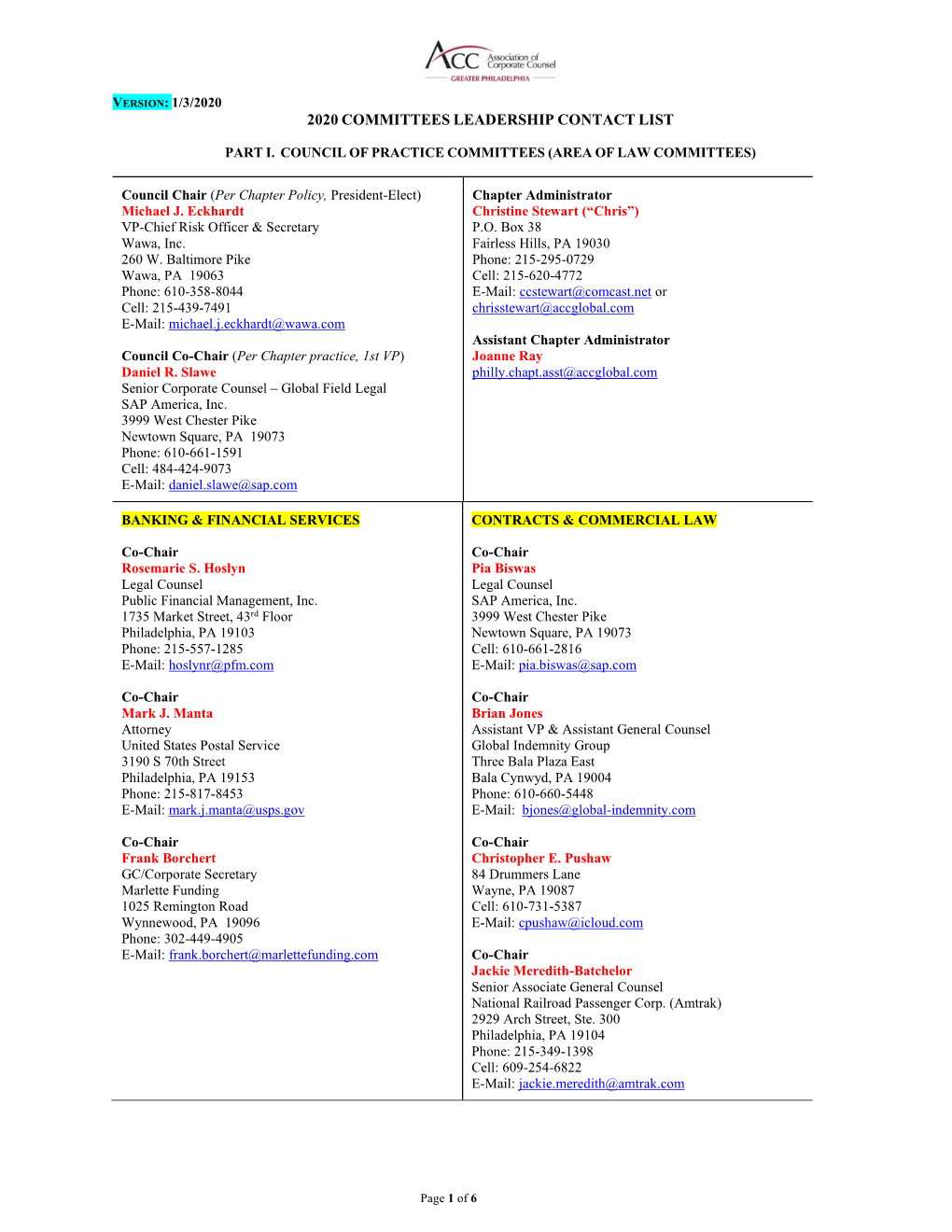

2020 Committees Leadership Contact List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

Market Update M&Amarlin & Associates Investment Banking and Strategic Advisory to the Technology and Information Industries

March 2019 MARKET UPDATE M&AMARLIN & ASSOCIATES INVESTMENT BANKING AND STRATEGIC ADVISORY TO THE TECHNOLOGY AND INFORMATION INDUSTRIES New York Washington, D.C. Toronto www.MarlinLLC.com © Marlin & Associates Holdings LLC, All Right Reserved DEAR CLIENTS AND FRIENDS, It’s About Revenue Synergies, Stupid: Our March Infotech M&A update Dear Clients and Friends, Please see below for our March Infotech m&a report. As many of you know, over the past 17+ years we have advised on more than 200 successful m&a transactions. We use the term “successful” to mean that the deal completed. But we recognize that investors and acquirers assess if a transaction was “successful” in hindsight. For a financial sponsor, the answer eventually becomes clear. For them, it’s all about exit value. But for a strategic acquirer the answer can be more amorphous - it’s all about whether the acquired firm added enough value to the combined firm to justify the cost – It’s not only about the purchase price, it’s also about the distraction and the disruption – and that means realizing “synergies”. A few months ago, EY- Parthenon put out an insightful series of articles on successful m&a integration. They noted that [for strategic acquirers] “… the identification and realization of synergies are at the heart of M&A value creation”. “…Synergies can be the competitive advantage in a bidding process.” And “… they are a major part of the narrative that executives use to explain the strategic objectives of a transaction to their own boards, shareholders and the market.” Clearly, it is the potential for synergies that can allow one strategic to outbid another (or a financial sponsor). -

L'institution Royale Pour L'avancement

L’INSTITUTION ROYALE POUR L’AVANCEMENT DES SCIENCES / UNIVERSITÉ McGILL ACTIONS AMÉRICAINES │ au 31 mars 2019 Actions américaines d’une valeur supérieure à 500 000 $ cotées en bourse et détenues dans des comptes distincts (en $ CAN) GRAND CANYON EDUCATION INC 2 464 502 WADDELL & REED FINANCIAL INC 838 294 VIRTU FINANCIAL INC 2 098 163 DXP ENTERPRISES INC/TX 829 531 EURONET WORLDWIDE INC 2 075 232 OSHKOSH CORP 772 848 IRIDIUM COMMUNICATIONS INC 2 021 967 CIENA CORP 748 266 MARKETAXESS HOLDINGS INC 1 969 545 SNAP‐ON INC 710 950 UNIVERSAL HEALTH SERVICES INC 1 924 707 PULTEGROUP INC 705 975 MAXIMUS INC 1 697 760 VISHAY INTERTECHNOLOGY INC 703 237 ENVESTNET INC 1 539 593 UNUM GROUP 659 850 CHARLES RIVER LABORATORIES INT 1 531 805 LEAR CORP 652 686 CHEMED CORP 1 484 619 JETBLUE AIRWAYS CORP 649 127 MARRIOTT VACATIONS WORLDWIDE C 1 442 976 AVNET INC 643 136 US SILICA HOLDINGS INC 1 434 222 AMC NETWORKS INC 636 960 ACUSHNET HOLDINGS CORP 1 352 421 HUNTINGTON INGALLS INDUSTRIES 636 660 GENTHERM INC 1 321 685 WESTROCK CO 635 298 LAUREATE EDUCATION INC 1 308 706 CIT GROUP INC 628 038 FOX FACTORY HOLDING CORP 1 274 121 DOMTAR CORP 623 501 HURON CONSULTING GROUP INC 1 242 872 REGIONS FINANCIAL CORP 614 370 INTL. FCSTONE INC 1 242 806 ARBOR REALTY TRUST INC 608 950 RE/MAX HOLDINGS INC 1 238 584 QUEST DIAGNOSTICS INC 600 643 TEMPUR SEALY INTERNATIONAL INC 1 225 928 OWENS CORNING 598 025 GLOBUS MEDICAL INC 1 212 789 GLOBAL BRASS & COPPER HOLDINGS 593 531 THERMON GROUP HOLDINGS INC 1 209 830 FEDERAL AGRICULTURAL MORTGAGE 590 253 SHUTTERSTOCK INC 1 202 -

BNYM Investment Port:Midcap Stock Port (Unaudited) As of Date: 09/30/2020 Common Stocks

BNYM Investment Port:MidCap Stock Port (Unaudited) As of date: 09/30/2020 Common Stocks Identifier Security Description Shares Market Value ($) 002535300 Aaron's 7,450 422,043 00404A109 Acadia Healthcare 5,480 161,550 004498101 ACI Worldwide 13,250 346,223 00508Y102 Acuity Brands 9,470 969,255 BD845X2 Adient 12,480 216,278 00737L103 Adtalem Global Education 6,800 166,872 00766T100 AECOM 4,170 174,473 018581108 Alliance Data Systems 7,130 299,317 01973R101 Allison Transmission Holdings 7,110 249,845 00164V103 AMC Networks 10,710 264,644 023436108 Amedisys 2,760 652,547 025932104 American Financial Group 3,310 221,704 03073E105 AmerisourceBergen 2,220 215,162 042735100 Arrow Electronics 5,620 442,069 04280A100 Arrowhead Pharmaceuticals 5,670 244,150 045487105 Associated Banc-Corp 47,940 605,003 05329W102 Autonation 6,980 369,451 05368V106 Avient 23,030 609,374 053774105 Avis Budget Group 10,600 278,992 05464C101 Axon Enterprise 2,410 218,587 062540109 Bank of Hawaii 4,830 244,012 06417N103 Bank OZK 6,630 141,352 090572207 Bio-Rad Laboratories 1,480 762,881 09073M104 Bio-Techne 880 218,002 05550J101 BJs Wholesale Club Holdings 11,270 468,269 09227Q100 Blackbaud 3,750 209,363 103304101 Boyd Gaming 18,350 563,162 105368203 Brandywine Realty Trust 93,500 966,790 11120U105 Brixmor Property Group 6,300 73,647 117043109 Brunswick 8,150 480,117 12685J105 Cable One 300 565,629 127190304 CACI International, Cl. A 3,980 848,377 12769G100 Caesars Entertainment 11,890 666,553 133131102 Camden Property Trust 11,390 1,013,482 134429109 Campbell Soup 4,440 -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Wilmington Funds Holdings Template DRAFT

Wilmington Large-Cap Strategy Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS APPLE INC 4.97% MICROSOFT CORP 4.69% AMAZON.COM INC 3.45% FACEBOOK INC 1.99% ALPHABET INC 1.80% ALPHABET INC 1.77% BERKSHIRE HATHAWAY INC 1.48% JPMORGAN CHASE & CO 1.35% TESLA INC 1.20% JOHNSON & JOHNSON 1.12% UNITEDHEALTH GROUP INC 0.98% VISA INC 0.96% NVIDIA CORP 0.96% BANK OF AMERICA CORP 0.89% HOME DEPOT INC/THE 0.87% WALT DISNEY CO/THE 0.82% MASTERCARD INC 0.80% PAYPAL HOLDINGS INC 0.77% EXXON MOBIL CORP 0.68% PROCTER & GAMBLE CO/THE 0.67% COMCAST CORP 0.66% ADOBE INC 0.62% INTEL CORP 0.59% VERIZON COMMUNICATIONS INC 0.59% CISCO SYSTEMS INC 0.57% CHEVRON CORP 0.55% PFIZER INC 0.54% NETFLIX INC 0.54% AT&T INC 0.53% SALESFORCE.COM INC 0.53% ABBOTT LABORATORIES 0.51% ABBVIE INC 0.50% MERCK & CO INC 0.48% WELLS FARGO & CO 0.48% BROADCOM INC 0.47% THERMO FISHER SCIENTIFIC INC 0.47% ACCENTURE PLC 0.46% CITIGROUP INC 0.45% MCDONALD'S CORP 0.44% TEXAS INSTRUMENTS INC 0.44% COCA-COLA CO/THE 0.44% HONEYWELL INTERNATIONAL INC 0.44% LINDE PLC 0.43% MEDTRONIC PLC 0.43% NIKE INC 0.43% ELI LILLY & CO 0.42% PEPSICO INC 0.42% UNITED PARCEL SERVICE INC 0.41% WALMART INC 0.40% DANAHER CORP 0.40% UNION PACIFIC CORP 0.40% QUALCOMM INC 0.38% BRISTOL-MYERS SQUIBB CO 0.37% ORACLE CORP 0.37% LOWE'S COS INC 0.36% BLACKROCK INC 0.35% CATERPILLAR INC 0.35% AMGEN INC 0.35% BOEING CO/THE 0.35% MORGAN STANLEY 0.35% COSTCO WHOLESALE CORP 0.35% RAYTHEON TECHNOLOGIES CORP 0.34% STARBUCKS CORP 0.34% GOLDMAN SACHS GROUP INC/THE 0.34% GENERAL ELECTRIC -

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT of FLORIDA Miami Division in Re: MIAMI INTERNATIONAL MEDI

Case 18-12741-LMI Doc 97 Filed 04/03/18 Page 1 of 23 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF FLORIDA Miami Division www.flsb.uscourts.gov In re: MIAMI INTERNATIONAL MEDICAL CENTER, LLC1 Case No. 18-12741-LMI d/b/a THE MIAMI MEDICAL CENTER, Chapter 11 Debtor. / SUPPLEMENTAL CERTIFICATE OF SERVICE I HEREBY CERTIFY that a true and correct copy of the Debtor’s Motion for Entry of (A) an Order Approving Bidding Procedures, (B) Approving Certain Protections to Stalking Horse Purchaser, (C) Approving Notice Procedures, and (D) an Order (I) Approving the Asset Purchase Agreement, (II) Authorizing the Sale of all or Substantially all of the Assets of the Debtor Free and Clear of all Liens, Claims, Encumbrances and Other Interests, (III) Authorizing the Assumption and Assignment of Certain Executory Contracts and Unexpired Leases, (IV) Scheduling Dates to Conduct Auction and Hearing to Consider Final Approval of Sale, and (V) Granting Related Relief [ECF No. 84] was served via Regular U.S. Mail on April 2, 2018, on all REMAINDER OF PAGE LEFT INTENTIONALLY BLANK 1The Debtor’s current mailing address is 5959 NW 7 St, Miami, FL 33126 and its EIN ends 4362. 1 LAW OFFICES OF MELAND RUSSIN & BUDWICK, P.A. 3200 SOUTHEAST FINANCIAL CENTER, 200 SOUTH BISCAYNE BOULEVARD, MIAMI, FLORIDA 33131 • TELEPHONE (305) 358-6363 Case 18-12741-LMI Doc 97 Filed 04/03/18 Page 2 of 23 parties listed on the Court’s Matrix attached hereto as Exhibit 12, and to all parties listed on the Patients Matrix which was filed under seal pursuant to Court Order [ECF No. -

1St Quarter 2014 FINAL BOOK

SCOTT-MACON HEALTHCARE REVIEW: FIRST QUARTER 2014 Healthcare Overview, Mean Revenue Multiples 2 Healthcare Overview, Mean EBITDA Multiples 4 Analysis of Selected Healthcare 6 Merger and Acquisition Transactions January 1—March 31, 2014 Analysis of Selected 22 CONTENTS Publicly-Traded Healthcare Companies SCOTT-MACON Healthcare Investment Banking 2 FIRST QUARTER 2014 HEALTHCARE REVIEW Dear Clients and Friends, Scott-Macon is pleased to present our quar- quisition of an Oklahoma health insurer by an invest- terly Healthcare Review covering the first quarter of ment firm, perhaps indicating that the perceived op- 2014. If you haven’t done so already, please email me portunities in this sector are now more significant at [email protected] to automatically con- than the potential pitfalls now that the Affordable tinue receiving our publications in the future as we Care Act is in full swing. Turning to Technology, are transitioning to digital publishing with email dis- once again we are seeing an incredibly diverse group tribution. of acquirors attracted to Healthcare Technology com- Pages four and five represent a visual snapshot panies—international companies, medical equipment of the average multiples for all of the healthcare, makers, private equity/investment firms and their medical and pharmaceutical transactions that either portfolio companies, and of course other Healthcare closed or were announced during the first quarter, (as well as Non-Healthcare) Technology companies, along with the average multiples for the major pub- both publicly-traded and privately-held. Outsourcing licly-traded healthcare, medical and pharmaceutical companies witnessed one of the busiest quarters we companies. have ever seen for this segment, a perennial favorite due to the inherent growth characteristics of the in- In the Insurance sector, there were two deals of dustry and the opportunities to create efficiencies for note in the First Quarter: the merger of two of the providers, payors and product companies as well. -

Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017

Report of Activities Pursuant to Act 44 of 2010 Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017 Appendix D: Securities Held by Funds The Four Funds hold thousands of publicly and privately traded securities. Act 44 directs the Four Funds to publish “a list of all publicly traded securities held by the public fund.” For consistency in presenting the data, a list of all holdings of the Four Funds is obtained from Pennsylvania Treasury Department. The list includes privately held securities. Some privately held securities lacked certain data fields to facilitate removal from the list. To avoid incomplete removal of privately held securities or erroneous removal of publicly traded securities from the list, the Four Funds have chosen to report all publicly and privately traded securities. The list below presents the securities held by the Four Funds as of June 30, 2017. 1345 AVENUE OF THE A 1 A3 144A AAREAL BANK AG ABRY MEZZANINE PARTNERS LP 1721 N FRONT STREET HOLDINGS AARON'S INC ABRY PARTNERS V LP 1-800-FLOWERS.COM INC AASET 2017-1 TRUST 1A C 144A ABRY PARTNERS VI L P 198 INVERNESS DRIVE WEST ABACUS PROPERTY GROUP ABRY PARTNERS VII L P 1MDB GLOBAL INVESTMENTS L ABAXIS INC ABRY PARTNERS VIII LP REGS ABB CONCISE 6/16 TL ABRY SENIOR EQUITY II LP 1ST SOURCE CORP ABB LTD ABS CAPITAL PARTNERS II LP 200 INVERNESS DRIVE WEST ABBOTT LABORATORIES ABS CAPITAL PARTNERS IV LP 21ST CENTURY FOX AMERICA INC ABBOTT LABORATORIES ABS CAPITAL PARTNERS V LP 21ST CENTURY ONCOLOGY 4/15 -

Technology a White Paper on the Internet of Things “The Dawn of Inanimate Consciousness”

TECHNOLOGY A White Paper on The Internet of Things “The Dawn of Inanimate Consciousness” Equity Research Industry Analysis | February 2014 Kevin E. Cassidy | (202) 778-1595 | [email protected] Aaron C. Rakers, CFA | (314) 342-8401 | [email protected] Brad R. Reback, CFA | (404) 869-8051 | [email protected] Tom M. Roderick | (312) 269-0323 | [email protected] Matthew Sheerin | (212) 271-3753 | [email protected] Tore Svanberg | (415) 364-7461 | [email protected] Sanjiv R. Wadhwani, CFA | (415) 364-2538 | [email protected] Technology: The Internet of Things 1 Industry Analysis Table of Contents Introduction: The Dawn of Inanimate Consciousness 3 Semiconductors: Processors & Components – Kevin E. Cassidy 7 Enterprise Storage – Aaron C. Rakers, CFA 11 Enterprise Software – Brad R. Reback 19 Software: Applications & Communications – Tom M. Roderick 23 Electronic Supply Chain – Matthew Sheerin 25 Semiconductors: Analog & Mixed Signal – Tore Svanberg 31 Communications Equipment & Mobility – Sanjiv R. Wadhwani, CFA 51 Important Disclosures and Certifications 61 All prices are as of 1/23/14 market close. All statements in this report attributable to Gartner represent Stifel's interpretation of data, research opinion or viewpoints published as part of a syndicated subscription service by Gartner, Inc., and have not been reviewed by Gartner. Each Gartner publication speaks as of its original publication date (and not as of the date of this report). The opinions expressed in Gartner publications are not representations of fact, and are subject to change without notice. Stifel does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. -

Final Program

2014 ANNUAL MEETING Welcome UPCOMING MEETINGS 11th Annual International Pediatric Orthopaedic Symposium December 3-6, 2014 – Orlando, FL Presented by POSNA and AAOS POSNA Specialty Day March 28, 2015 – Las Vegas, Nevada POSNA 2015 Annual Meeting and Pre-Course April 29 – May 2, 2015 Marriott Marquis – Atlanta, Georgia Acknowledgments The Pediatric Orthopaedic Society of North America gratefully acknowledges the following for their generous financial support during 2014: Howard Steel Foundation St. Giles Foundation Angela S.M. Kuo Memorial Fund Double Diamond Level K2M* Medtronic* OrthoPediatrics* Diamond Level DePuy Synthes* Stryker* Platinum Level Biomet Spine/Trauma* Shriners Hospitals for Children Gold Level Arthrex, Inc. BioMarin Pharmaceutical Inc. Globus Medical Medicrea, USA* Pega Medical* Wright Medical Silver Level Alphatec Spine* Ellipse Technologies, Inc. Orthofix* *Provided financial support for the 2014 Annual Meeting Thank-2- You On behalf of our local host, David Skaggs and his wife Val Ulene, we welcome you to Hollywood and the 2014 POSNA Annual Meeting. Many POSNA volunteers and staff Welcomehave been working hard to make our experience in Hollywood spectacular. The meeting opens on Wednesday morning with the pre-course entitled “Quality, Safety, Value: From Theory to Practice Management.” Min Kocher has enlisted experts both inside and outside of POSNA to help all of us understand how the changing healthcare environment and a focus on quality and value will affect our practice. The scientific sessions begin Wednesday afternoon: Todd Milbrandt and his program committee have assembled some of the high- est rated papers submitted into an outstanding quality and value session that will help your patients. The opening ceremony on Wednesday evening allows us to recognize our industry spon- sors and the outstanding achievement of several of our members. -

Marsh & Mclennan Companies, Inc

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Pursuant to §240.14a-12 Marsh & McLennan Companies, Inc. (Name of Registrant as Specified in its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: