1St Quarter 2014 FINAL BOOK

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

L'institution Royale Pour L'avancement

L’INSTITUTION ROYALE POUR L’AVANCEMENT DES SCIENCES / UNIVERSITÉ McGILL ACTIONS AMÉRICAINES │ au 31 mars 2019 Actions américaines d’une valeur supérieure à 500 000 $ cotées en bourse et détenues dans des comptes distincts (en $ CAN) GRAND CANYON EDUCATION INC 2 464 502 WADDELL & REED FINANCIAL INC 838 294 VIRTU FINANCIAL INC 2 098 163 DXP ENTERPRISES INC/TX 829 531 EURONET WORLDWIDE INC 2 075 232 OSHKOSH CORP 772 848 IRIDIUM COMMUNICATIONS INC 2 021 967 CIENA CORP 748 266 MARKETAXESS HOLDINGS INC 1 969 545 SNAP‐ON INC 710 950 UNIVERSAL HEALTH SERVICES INC 1 924 707 PULTEGROUP INC 705 975 MAXIMUS INC 1 697 760 VISHAY INTERTECHNOLOGY INC 703 237 ENVESTNET INC 1 539 593 UNUM GROUP 659 850 CHARLES RIVER LABORATORIES INT 1 531 805 LEAR CORP 652 686 CHEMED CORP 1 484 619 JETBLUE AIRWAYS CORP 649 127 MARRIOTT VACATIONS WORLDWIDE C 1 442 976 AVNET INC 643 136 US SILICA HOLDINGS INC 1 434 222 AMC NETWORKS INC 636 960 ACUSHNET HOLDINGS CORP 1 352 421 HUNTINGTON INGALLS INDUSTRIES 636 660 GENTHERM INC 1 321 685 WESTROCK CO 635 298 LAUREATE EDUCATION INC 1 308 706 CIT GROUP INC 628 038 FOX FACTORY HOLDING CORP 1 274 121 DOMTAR CORP 623 501 HURON CONSULTING GROUP INC 1 242 872 REGIONS FINANCIAL CORP 614 370 INTL. FCSTONE INC 1 242 806 ARBOR REALTY TRUST INC 608 950 RE/MAX HOLDINGS INC 1 238 584 QUEST DIAGNOSTICS INC 600 643 TEMPUR SEALY INTERNATIONAL INC 1 225 928 OWENS CORNING 598 025 GLOBUS MEDICAL INC 1 212 789 GLOBAL BRASS & COPPER HOLDINGS 593 531 THERMON GROUP HOLDINGS INC 1 209 830 FEDERAL AGRICULTURAL MORTGAGE 590 253 SHUTTERSTOCK INC 1 202 -

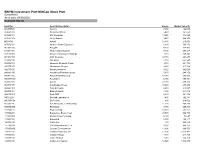

BNYM Investment Port:Midcap Stock Port (Unaudited) As of Date: 09/30/2020 Common Stocks

BNYM Investment Port:MidCap Stock Port (Unaudited) As of date: 09/30/2020 Common Stocks Identifier Security Description Shares Market Value ($) 002535300 Aaron's 7,450 422,043 00404A109 Acadia Healthcare 5,480 161,550 004498101 ACI Worldwide 13,250 346,223 00508Y102 Acuity Brands 9,470 969,255 BD845X2 Adient 12,480 216,278 00737L103 Adtalem Global Education 6,800 166,872 00766T100 AECOM 4,170 174,473 018581108 Alliance Data Systems 7,130 299,317 01973R101 Allison Transmission Holdings 7,110 249,845 00164V103 AMC Networks 10,710 264,644 023436108 Amedisys 2,760 652,547 025932104 American Financial Group 3,310 221,704 03073E105 AmerisourceBergen 2,220 215,162 042735100 Arrow Electronics 5,620 442,069 04280A100 Arrowhead Pharmaceuticals 5,670 244,150 045487105 Associated Banc-Corp 47,940 605,003 05329W102 Autonation 6,980 369,451 05368V106 Avient 23,030 609,374 053774105 Avis Budget Group 10,600 278,992 05464C101 Axon Enterprise 2,410 218,587 062540109 Bank of Hawaii 4,830 244,012 06417N103 Bank OZK 6,630 141,352 090572207 Bio-Rad Laboratories 1,480 762,881 09073M104 Bio-Techne 880 218,002 05550J101 BJs Wholesale Club Holdings 11,270 468,269 09227Q100 Blackbaud 3,750 209,363 103304101 Boyd Gaming 18,350 563,162 105368203 Brandywine Realty Trust 93,500 966,790 11120U105 Brixmor Property Group 6,300 73,647 117043109 Brunswick 8,150 480,117 12685J105 Cable One 300 565,629 127190304 CACI International, Cl. A 3,980 848,377 12769G100 Caesars Entertainment 11,890 666,553 133131102 Camden Property Trust 11,390 1,013,482 134429109 Campbell Soup 4,440 -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Wilmington Funds Holdings Template DRAFT

Wilmington Large-Cap Strategy Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS APPLE INC 4.97% MICROSOFT CORP 4.69% AMAZON.COM INC 3.45% FACEBOOK INC 1.99% ALPHABET INC 1.80% ALPHABET INC 1.77% BERKSHIRE HATHAWAY INC 1.48% JPMORGAN CHASE & CO 1.35% TESLA INC 1.20% JOHNSON & JOHNSON 1.12% UNITEDHEALTH GROUP INC 0.98% VISA INC 0.96% NVIDIA CORP 0.96% BANK OF AMERICA CORP 0.89% HOME DEPOT INC/THE 0.87% WALT DISNEY CO/THE 0.82% MASTERCARD INC 0.80% PAYPAL HOLDINGS INC 0.77% EXXON MOBIL CORP 0.68% PROCTER & GAMBLE CO/THE 0.67% COMCAST CORP 0.66% ADOBE INC 0.62% INTEL CORP 0.59% VERIZON COMMUNICATIONS INC 0.59% CISCO SYSTEMS INC 0.57% CHEVRON CORP 0.55% PFIZER INC 0.54% NETFLIX INC 0.54% AT&T INC 0.53% SALESFORCE.COM INC 0.53% ABBOTT LABORATORIES 0.51% ABBVIE INC 0.50% MERCK & CO INC 0.48% WELLS FARGO & CO 0.48% BROADCOM INC 0.47% THERMO FISHER SCIENTIFIC INC 0.47% ACCENTURE PLC 0.46% CITIGROUP INC 0.45% MCDONALD'S CORP 0.44% TEXAS INSTRUMENTS INC 0.44% COCA-COLA CO/THE 0.44% HONEYWELL INTERNATIONAL INC 0.44% LINDE PLC 0.43% MEDTRONIC PLC 0.43% NIKE INC 0.43% ELI LILLY & CO 0.42% PEPSICO INC 0.42% UNITED PARCEL SERVICE INC 0.41% WALMART INC 0.40% DANAHER CORP 0.40% UNION PACIFIC CORP 0.40% QUALCOMM INC 0.38% BRISTOL-MYERS SQUIBB CO 0.37% ORACLE CORP 0.37% LOWE'S COS INC 0.36% BLACKROCK INC 0.35% CATERPILLAR INC 0.35% AMGEN INC 0.35% BOEING CO/THE 0.35% MORGAN STANLEY 0.35% COSTCO WHOLESALE CORP 0.35% RAYTHEON TECHNOLOGIES CORP 0.34% STARBUCKS CORP 0.34% GOLDMAN SACHS GROUP INC/THE 0.34% GENERAL ELECTRIC -

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT of FLORIDA Miami Division in Re: MIAMI INTERNATIONAL MEDI

Case 18-12741-LMI Doc 97 Filed 04/03/18 Page 1 of 23 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF FLORIDA Miami Division www.flsb.uscourts.gov In re: MIAMI INTERNATIONAL MEDICAL CENTER, LLC1 Case No. 18-12741-LMI d/b/a THE MIAMI MEDICAL CENTER, Chapter 11 Debtor. / SUPPLEMENTAL CERTIFICATE OF SERVICE I HEREBY CERTIFY that a true and correct copy of the Debtor’s Motion for Entry of (A) an Order Approving Bidding Procedures, (B) Approving Certain Protections to Stalking Horse Purchaser, (C) Approving Notice Procedures, and (D) an Order (I) Approving the Asset Purchase Agreement, (II) Authorizing the Sale of all or Substantially all of the Assets of the Debtor Free and Clear of all Liens, Claims, Encumbrances and Other Interests, (III) Authorizing the Assumption and Assignment of Certain Executory Contracts and Unexpired Leases, (IV) Scheduling Dates to Conduct Auction and Hearing to Consider Final Approval of Sale, and (V) Granting Related Relief [ECF No. 84] was served via Regular U.S. Mail on April 2, 2018, on all REMAINDER OF PAGE LEFT INTENTIONALLY BLANK 1The Debtor’s current mailing address is 5959 NW 7 St, Miami, FL 33126 and its EIN ends 4362. 1 LAW OFFICES OF MELAND RUSSIN & BUDWICK, P.A. 3200 SOUTHEAST FINANCIAL CENTER, 200 SOUTH BISCAYNE BOULEVARD, MIAMI, FLORIDA 33131 • TELEPHONE (305) 358-6363 Case 18-12741-LMI Doc 97 Filed 04/03/18 Page 2 of 23 parties listed on the Court’s Matrix attached hereto as Exhibit 12, and to all parties listed on the Patients Matrix which was filed under seal pursuant to Court Order [ECF No. -

Final Program

2014 ANNUAL MEETING Welcome UPCOMING MEETINGS 11th Annual International Pediatric Orthopaedic Symposium December 3-6, 2014 – Orlando, FL Presented by POSNA and AAOS POSNA Specialty Day March 28, 2015 – Las Vegas, Nevada POSNA 2015 Annual Meeting and Pre-Course April 29 – May 2, 2015 Marriott Marquis – Atlanta, Georgia Acknowledgments The Pediatric Orthopaedic Society of North America gratefully acknowledges the following for their generous financial support during 2014: Howard Steel Foundation St. Giles Foundation Angela S.M. Kuo Memorial Fund Double Diamond Level K2M* Medtronic* OrthoPediatrics* Diamond Level DePuy Synthes* Stryker* Platinum Level Biomet Spine/Trauma* Shriners Hospitals for Children Gold Level Arthrex, Inc. BioMarin Pharmaceutical Inc. Globus Medical Medicrea, USA* Pega Medical* Wright Medical Silver Level Alphatec Spine* Ellipse Technologies, Inc. Orthofix* *Provided financial support for the 2014 Annual Meeting Thank-2- You On behalf of our local host, David Skaggs and his wife Val Ulene, we welcome you to Hollywood and the 2014 POSNA Annual Meeting. Many POSNA volunteers and staff Welcomehave been working hard to make our experience in Hollywood spectacular. The meeting opens on Wednesday morning with the pre-course entitled “Quality, Safety, Value: From Theory to Practice Management.” Min Kocher has enlisted experts both inside and outside of POSNA to help all of us understand how the changing healthcare environment and a focus on quality and value will affect our practice. The scientific sessions begin Wednesday afternoon: Todd Milbrandt and his program committee have assembled some of the high- est rated papers submitted into an outstanding quality and value session that will help your patients. The opening ceremony on Wednesday evening allows us to recognize our industry spon- sors and the outstanding achievement of several of our members. -

SUMMER 2017 — PAGE 1 the Life Sciences Executive Network at the Sarian Group Presents Biotech Bulletin | Summer 2017

BIOTECH BULLETIN SUMMER 2017 — PAGE 1 The Life Sciences Executive Network At The Sarian Group Presents Biotech Bulletin | Summer 2017 Tracking The Pulse Of The Philadelphia Life Sciences Industry Table Of Contents Stay up to date on the pulse of the Philadelphia Life Sciences industry with our Biotech 1. Government Interference Bulletin. This is a quarterly newsletter, with data and perspectives from local leaders Unnecessary in Medicare within the industry. Greg Sarian of The Sarian Group is the author of the Biotech Bulletin. Drug-Pricing Process By Ted Piper, Director, Bravo Group Each issue will include insight on the latest industry trends, performance metrics on local biotech companies as well as current acquisitions and IPO news in this area. 2. Emerging Trends to Improve Productivity in Drug Development By Jeffrey J. DiFrancesco, Founder & Government Interference Unnecessary in Medicare Drug- Executive Director, Avancer Group Inc. Pricing Process 3. A Spotlight on Trovita Health Science By Ted Piper, Director, Bravo Group A conversation with Mr. Will Brown We’ve all heard the same question when it comes to prescription drug 4. Pre-Transaction Planning Considerations Before a prices under Medicare Part D: Why can’t the government negotiate Transaction prices? By Greg Sarian, CPWA®, CIMA® , CFP® , ChFC® , CEPA® The funny thing is that prices are negotiated — just not by the government. 5. The Sarian Group Index Medicare Part D allows private insurers to bargain with pharmaceutical companies for 6. Philly Fundings discounts and rebates so that enrollees can enjoy the lower prices through a third party called pharmacy benefit managers. And it’s been successful, netting discounts of 30 percent to 50 percent of list prices. -

MIAMI INTERNATIONAL MEDICAL CENTER, LLC1 Case No

Case 18-12741-LMI Doc 268 Filed 07/09/18 Page 1 of 28 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF FLORIDA MIAMI DIVISION www.flsb.uscourts.gov In re: MIAMI INTERNATIONAL MEDICAL CENTER, LLC1 Case No. 18-12741-LMI d/b/a THE MIAMI MEDICAL CENTER, Chapter 11 Debtor. / NOTICE OF FILING MATRIX PLEASE BE ADVISED that, pursuant to the Agreement to Serve as Third-Party Noticing & Claims Agent for the Clerk [ECF No. 55], attached is the current Matrix2, as of July 5, 2018. s/ Daniel N. Gonzalez Peter D. Russin, Esquire Florida Bar No. 765902 [email protected] Daniel N. Gonzalez, Esquire Florida Bar No. 592749 [email protected] MELAND RUSSIN & BUDWICK, P.A. 3200 Southeast Financial Center 200 South Biscayne Boulevard Miami, Florida 33131 Telephone: (305) 358-6363 Telecopy: (305) 358-1221 Attorneys for Debtor-in-Possession 1The Debtor’s current mailing address is 5959 NW 7 St, Miami, FL 33126 and its EIN ends 4362. 2 “NEF” means that service was via the Court’s Notice of Electronic Filing and is not being additionally served by mail. “NNR” means no notice is required. “ATTY” means that the party is represented by an attorney who has been served on their behalf. 1 LAW OFFICES OF MELAND RUSSIN & BUDWICK, P.A. 3200 SOUTHEAST FINANCIAL CENTER, 200 SOUTH BISCAYNE BOULEVARD, MIAMI, FLORIDA 33131 • TELEPHONE (305) 358-6363 Label Matrix for local noticing Case 18-12741-LMI Aquila NH DocHoldings, 268 LLC Filed 07/09/18 Page Aramark 2 of 28Healthcare Support Services, Inc. 113C-1 c/o Peter Fullerton, Esquire c/o Harvey W. -

New Covenant Growth Fund

SCHEDULE OF INVESTMENTS (Unaudited) September 30, 2020 New Covenant Growth Fund Market Value Market Value Description Shares ($ Thousands) Description Shares ($ Thousands) COMMON STOCK — 98.7% COMMON STOCK (continued) Bosnia and Herzegovina — 0.0% Live Nation Entertainment Inc * 181 $ 10 RenaissanceRe Holdings Ltd 248 $ 42 Madison Square Garden Entertainment – Corp * 39 3 Canada — 0.1% Match Group Inc * 1,537 170 Lululemon Athletica Inc * 1,171 386 – Meredith Corp * 1,401 18 Cayman Islands — 0.0% MSG Networks Inc * 2,988 29 Herbalife Nutrition Ltd * 1,088 51 New York Times Co/The, Cl A 439 19 – Ireland — 1.0% Nexstar Media Group Inc, Cl A 455 41 Accenture PLC, Cl A 11,297 2,553 Omnicom Group Inc 10,137 502 Jazz Pharmaceuticals PLC * 616 88 Scholastic Corp 1,266 27 Medtronic PLC 19,976 2,076 Shenandoah Telecommunications Co 222 10 NortonLifeLock Inc 13,065 272 Sirius XM Holdings Inc 7,153 38 Perrigo Co PLC 211 10 Spotify Technology SA * 1,265 307 Take-Two Interactive Software Inc * 830 137 4,999 – TechTarget Inc * 1,986 87 Puerto Rico — 0.0% TEGNA Inc 3,052 36 Popular Inc 1,507 55 – T-Mobile US Inc * 6,009 687 Switzerland — 0.0% Twitter Inc * 7,369 328 Garmin Ltd 1,092 103 Verizon Communications Inc 57,853 3,442 – ViacomCBS Inc, Cl B 1,000 28 United Kingdom — 0.1% Walt Disney Co/The * 26,709 3,314 Healthpeak Properties Inc ‡ 9,384 255 – World Wrestling Entertainment Inc, Cl A 780 32 United States — 97.5% Zillow Group Inc, Cl C * 752 76 Communication Services — 8.3% Zynga Inc, Cl A * 14,448 132 Activision Blizzard Inc 8,807 713 39,734 Alphabet -

22Nd Century Technologies AAA National AB Jets Abaci Group

22nd Century Technologies Ampcus Inc. AAA National AMTIS AB Jets Angel Publishing Anheuser Abaci Group AOCE Abacus Technologies AP3 SI Abbott APEX AbbVie APL ABS Freight Apogee Accenture Apple Accuride Corporation Aramark Acme Construction Supply Arc Aspicio Action Water Sports Arconic Addison Group Arcturus UAV Adecco Arizona Department of Health Services ADP ARMA Global Corporation Advanced Onion Armed Forces Services Corporation Advanced Technology Leaders Armstrong Archives Advanced Technology Services (ATS) Army Audit Agency AECOM Ashfield AEDP Associated Building Specialties AERMOR Assurance Technology Aeroptic Assured Consulting Solutions Aerostar Technical Solutions Assured Space Access Technology Affordable Solutions AT&T AIG ATF AIM Aerospace Atlanta Police Department AirBus Atlas Advisors AK Steel Atlas Sands AKF Partners ATS Aleris Augmenix Alion Science & Technology Augustine Consulting Allied Machine & Engineering Aurora Behavioral Health Allied Universal Autobase Inc. Altair AVCOR Construction and Consulting Altec Inc. Aveningtech Altitude Built AXA Advisors Altria Axe & Arrow LLC Amatech Ayni Brigade Amazon BAE America's Staffing Partner Baird American Institute Baker Electric American Red Cross Baker Tilly Virchow Krause LLP American Tire Distributors Balanced Enterprise Solutions Americorps VISTA Bank of America Amerijet International Bank of America Merrill Lynch Amgen Banning Contracting Services Baptist Health Brooksource Barclays Brown Brothers Asphalt & Concrete Barry University Brunswick High School Basco Group -

EQUITIES Assets Under Management 7 460 075 108 €

FRR PORTFOLIO COMPOSITION AS OF SEPTEMBER 30, 2020 EQUITIES Assets under management 7 460 075 108 € Value as at Control ratio on Securities name Quantity 30/09/2020 the issuer 3M 4 847 662 083,71 € 0,0008% 4IMPRINT GROUP 97 986 2 017 946,62 € 0,3489% A2A 7 061 530 8 756 297,20 € 0,2254% AALBERTS INDUST. 315 612 9 727 161,84 € 0,2854% AARHUSKARLSHAMN AB 129 141 2 056 732,16 € 0,0506% ABBOTT LABO. 158 359 14 696 806,35 € 0,0089% ABBVIE 64 300 4 802 828,64 € 0,0036% ABIOMED 10 086 2 383 001,88 € 0,0223% ABN AMRO GROUP 866 040 6 193 918,08 € 0,0921% ACADEMEDIA AB 248 185 1 747 540,22 € 0,2357% ACCELERON PHARMA 20 574 1 974 325,01 € 0,0341% ACCENTURE PLC-CL 33 640 6 483 011,64 € 0,0053% ACCESSO TECHNOLOGY 213 224 699 345,57 € 0,5173% ACCIONA 68 704 6 375 731,20 € 0,1252% ACCOR 169 118 4 058 832,00 € 0,0647% ACCSYS TECHNOLOGIE 1 185 363 1 209 070,26 € 0,7216% ACERINOX 309 184 2 165 524,74 € 0,1143% ACKERMANS HAAREN 81 838 9 059 466,60 € 0,2443% ACS ACT.CONSTR. 380 796 7 374 114,55 € 0,1226% ACTIVISION 99 244 6 850 980,09 € 0,0128% ADDLIFE AB 388 064 5 143 990,25 € 0,3532% ADDTECH RG-B 20 728 232 258,67 € 0,0080% ADDUS HOMECARE 28 826 2 323 238,19 € 0,1823% ADEKA 193 500 2 362 659,32 € 0,1866% ADIDAS NOM.