New Covenant Growth Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unisys Company Overview Disclaimer

Unisys Company Overview Disclaimer • This presentation includes certain financial measures not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including, but not limited to, EBITDA, Adjusted EBITDA, Free Cash Flow, Adjusted Free Cash Flow, and constant currency, and certain ratios and other metrics derived therefrom. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. • Therefore, these measures should not be considered in isolation or as an alternative to cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the Company’s presentation of these measures may not be comparable to similarly-titled measures used by other companies. Reconciliations of all non-GAAP financial measures are available in this presentation. © 2016 Unisys Corporation. All rights reserved. 2 Unisys at a Glance >1,500 >20,000 130+ $3.0B Global clients Associates Countries 2015 globally served revenue >60 million air cargo 300 government transactions per agencies worldwide month More than 90 of the Fortune Global 500 companies Over half of the top 25 global banks and 18 of the top 25 Building one of the 10 of the world’s global airlines largest cloud-based, on top insurance demand U.S. state companies government computing environments © 2016 Unisys Corporation | All rights reserved. 3 Key Company Highlights 1 Diversified Revenue Model 2 Long-Standing Relationships with Blue-chip Client Base 3 Leading-Edge Technological Solutions 4 Recurring Service Revenue with Large Contractual Backlog 5 Financial Progress 6 Experienced Management Team © 2016 Unisys Corporation. -

Cynthia Kyriazis Is a Productivity Strategist, Organization Consultant, Time Management Coach, Speaker, and Author

Cynthia Kyriazis is a productivity strategist, organization consultant, time management coach, speaker, and author. She leads decision-makers, their teams, and staff in navigating the 24/7 demands on their time and energy by developing a clear line of sight on what’s important and a plan for how to get there. 80% of Cynthia’s clients report saving at least 45 minutes a day in real time and 91% have improved their overall productivity. Cynthia possesses a 20-year track record of success in serving Fortune 500 companies, entrepreneurial businesses, government, and non-profit agencies. Regardless of the organization size, Cynthia guides leaders and Cynthia star performers to make choices that create and sustain a productive kyriazis mindset, and positively impact both personal growth and organizational profitability. Cynthia is the Amazon best-selling author of Get Organized. Get Focused. Get Productivity Moving. How to Overcome Productivity Potholes. She has also been featured & Organization as an expert on Forbes.com, Wall Street Journal online, the Philadelphia Consultant Inquirer, Legal Intelligencer, and many regional publications, radio, and television shows – and was named one of the “28 Best Online Productivity Experts” by New York Times best-selling author Hank Reardon in his book Time Management 2.0. Organizations Qualifications & Education We Have Served • Past-Secretary to the National Association of Professional Organizers (NAPO) • American Diabetes Association • Past-President of the Kansas City chapter of the International Society for • Avery Dennison Performance Improvement (KC-ISPI) • Bayer HealthCare • Consultant to the American Coaching Association • Campbell Soup Company • Certified Professional Behavioral Analyst (CPBA) • Cerner • Certified Professional Values Analyst (CPVA) • Cisco • B.S., Communication, University of Kansas • Coca Cola Bottling • Eli Lily Endorsements • GlaxoSmithKline • G.E. -

March 31, 2021

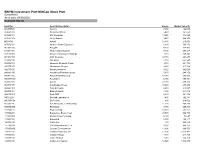

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

Astrazeneca-Oxford Vaccine Approved for Use in the U.K

P2JW366000-6-A00100-17FFFF5178F ****** THURSDAY,DECEMBER 31,2020~VOL. CCLXXVI NO.154 WSJ.com HHHH $4.00 DJIA 30409.56 À 73.89 0.2% NASDAQ 12870.00 À 0.2% STOXX 600 400.25 g 0.3% 10-YR. TREAS. À 3/32 , yield 0.926% OIL $48.40 À $0.40 GOLD $1,891.00 À $10.50 EURO $1.2300 YEN 103.21 Deadly Attack at Airport Targets New Yemen Government U.S. IPO What’s News Market Reaches Business&Finance Record nvestorspiled into IPOs Iat a record rate in 2020, with companies raising Total $167.2 billion via 454 of- ferings on U.S. exchanges this year through Dec. 24. Few see signs of letup Few expect the euphoria after companies raise to wear off soon. A1 more than $167 billion Detenteisending in the global fight over tech taxes, despite pandemic with Franceresuming collec- tion of itsdigital-services tax BY MAUREEN FARRELL and the U.S. poised to retali- atewith tariffs.Other coun- Defying expectations,inves- tries areset to join the fray. A1 S tors piled intoinitial public of- China finished 2020 PRES feringsatarecordrateiN with a 10th consecutive TED 2020, and few expect the eu- month of expansion in its CIA phoria to wear off soon. manufacturing sector. A7 SO Companies raised $167.2 AS TheEUand China agreed TENSIONS HIGH: People fled after an explosion Wednesday at the airport in Aden, Yemen, moments after members of the billion through 454 offerings in principle on an invest- country’s newly sworn-in cabinet arrived. At least 22 people were killed, but all the members of the cabinet were safe. -

03.031 Socc04 Final 2(R)

STATEOF CENTER CITY 2008 Prepared by Center City District & Central Philadelphia Development Corporation May 2008 STATEOF CENTER CITY 2008 Center City District & Central Philadelphia Development Corporation 660 Chestnut Street Philadelphia PA, 19106 215.440.5500 www.CenterCityPhila.org TABLEOFCONTENTSCONTENTS INTRODUCTION 1 OFFICE MARKET 2 HEALTHCARE & EDUCATION 6 HOSPITALITY & TOURISM 10 ARTS & CULTURE 14 RETAIL MARKET 18 EMPLOYMENT 22 TRANSPORTATION & ACCESS 28 RESIDENTIAL MARKET 32 PARKS & RECREATION 36 CENTER CITY DISTRICT PERFORMANCE 38 CENTER CITY DEVELOPMENTS 44 ACKNOWLEDGEMENTS 48 Center City District & Central Philadelphia Development Corporation www.CenterCityPhila.org INTRODUCTION CENTER CITY PHILADELPHIA 2007 was a year of positive change in Center City. Even with the new Comcast Tower topping out at 975 feet, overall office occupancy still climbed to 89%, as the expansion of existing firms and several new arrivals downtown pushed Class A rents up 14%. For the first time in 15 years, Center City increased its share of regional office space. Healthcare and educational institutions continued to attract students, patients and research dollars to downtown, while elementary schools experienced strong demand from the growing number of families in Center City with children. The Pennsylvania Convention Center expansion commenced and plans advanced for new hotels, as occupancy and room rates steadily climbed. On Independence Mall, the National Museum of American Jewish History started construction, while the Barnes Foundation retained designers for a new home on the Benjamin Franklin Parkway. Housing prices remained strong, rents steadily climbed and rental vacancy rates dropped to 4.6%, as new residents continued to flock to Center City. While the average condo sold for $428,596, 115 units sold in 2007 for more than $1 million, double the number in 2006. -

NACD Public Company Full Board Members

NACD Public Company Full Board Members: Rank | Company Rank | Company Rank | Company Rank | Company A.O. Smith Corp. Analog Devices Bridge Housing Corporation Clearwire Corp. AAA Club Partners Ansys, Inc. Briggs & Stratton Corp. Cliffs Natural Resources Inc. AARP Foundation Apogee Enterprises, Inc. Brightpoint, Inc. Cloud Peak Energy Inc. Aastrom Biosciences, Inc. Apollo Group, Inc. Bristow Group Inc. CME Group Acadia Realty Trust Applied Industrial Technologies, Broadwind Energy CoBiz, Inc. ACI Worldwide, Inc. Inc. Brookdale Senior Living Inc. Coherent, Inc. Acme Packet, Inc. Approach Resources, Inc. Bryn Mawr Bank Corporation Coinstar, Inc. Active Power, Inc. ArcelorMittal Buckeye Partners L.P. Colgate-Palmolive Co. ADA-ES, Inc. Arch Coal, Inc. Buffalo Wild Wings, Inc. Collective Brands, Inc. Adobe Systems, Inc. Archer Daniels Midland Co. Bunge Limited Commercial Metals Co. Advance Auto Parts ARIAD Pharmaceuticals, Inc. CA Holding Community Health Systems Advanced Energy Industries, Inc. Arkansas Blue Cross Blue Shield CACI International, Inc. Compass Minerals Aerosonic Corp. Arlington Asset Investment Corp. Cal Dive International, Inc. Comverse Technology, Inc. Aetna, Inc. Arthur J. Gallagher & Co. Calamos Asset Management, Inc. Conmed Corp. AFC Enterprises, Inc. Asbury Automobile Cameco Corp. Connecticut Water Service, Inc. AG Mortgage Investment Trust Inc. Aspen Technology, Inc. Cameron ConocoPhillips Agilent Technologies Associated Banc-Corp.5 Campbell Soup Co. CONSOL Energy Inc. Air Methods Corp. Assurant, Inc. Capella Education Co. Consolidated Edison Co. Alacer Gold Corp. Assured Guaranty Ltd. Capital One Financial Corp. Consolidated Graphics, Inc. Alaska Air Group, Inc. ATMI Capstead Mortgage Corp. Consolidated Water Co., Ltd. Alaska Communication Systems Atwood Oceanics, Inc. Cardtronics, Inc. Continental Resources, Inc. Group, Inc. Auxilium Pharmaceuticals Inc. -

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

L'institution Royale Pour L'avancement

L’INSTITUTION ROYALE POUR L’AVANCEMENT DES SCIENCES / UNIVERSITÉ McGILL ACTIONS AMÉRICAINES │ au 31 mars 2019 Actions américaines d’une valeur supérieure à 500 000 $ cotées en bourse et détenues dans des comptes distincts (en $ CAN) GRAND CANYON EDUCATION INC 2 464 502 WADDELL & REED FINANCIAL INC 838 294 VIRTU FINANCIAL INC 2 098 163 DXP ENTERPRISES INC/TX 829 531 EURONET WORLDWIDE INC 2 075 232 OSHKOSH CORP 772 848 IRIDIUM COMMUNICATIONS INC 2 021 967 CIENA CORP 748 266 MARKETAXESS HOLDINGS INC 1 969 545 SNAP‐ON INC 710 950 UNIVERSAL HEALTH SERVICES INC 1 924 707 PULTEGROUP INC 705 975 MAXIMUS INC 1 697 760 VISHAY INTERTECHNOLOGY INC 703 237 ENVESTNET INC 1 539 593 UNUM GROUP 659 850 CHARLES RIVER LABORATORIES INT 1 531 805 LEAR CORP 652 686 CHEMED CORP 1 484 619 JETBLUE AIRWAYS CORP 649 127 MARRIOTT VACATIONS WORLDWIDE C 1 442 976 AVNET INC 643 136 US SILICA HOLDINGS INC 1 434 222 AMC NETWORKS INC 636 960 ACUSHNET HOLDINGS CORP 1 352 421 HUNTINGTON INGALLS INDUSTRIES 636 660 GENTHERM INC 1 321 685 WESTROCK CO 635 298 LAUREATE EDUCATION INC 1 308 706 CIT GROUP INC 628 038 FOX FACTORY HOLDING CORP 1 274 121 DOMTAR CORP 623 501 HURON CONSULTING GROUP INC 1 242 872 REGIONS FINANCIAL CORP 614 370 INTL. FCSTONE INC 1 242 806 ARBOR REALTY TRUST INC 608 950 RE/MAX HOLDINGS INC 1 238 584 QUEST DIAGNOSTICS INC 600 643 TEMPUR SEALY INTERNATIONAL INC 1 225 928 OWENS CORNING 598 025 GLOBUS MEDICAL INC 1 212 789 GLOBAL BRASS & COPPER HOLDINGS 593 531 THERMON GROUP HOLDINGS INC 1 209 830 FEDERAL AGRICULTURAL MORTGAGE 590 253 SHUTTERSTOCK INC 1 202 -

BNYM Investment Port:Midcap Stock Port (Unaudited) As of Date: 09/30/2020 Common Stocks

BNYM Investment Port:MidCap Stock Port (Unaudited) As of date: 09/30/2020 Common Stocks Identifier Security Description Shares Market Value ($) 002535300 Aaron's 7,450 422,043 00404A109 Acadia Healthcare 5,480 161,550 004498101 ACI Worldwide 13,250 346,223 00508Y102 Acuity Brands 9,470 969,255 BD845X2 Adient 12,480 216,278 00737L103 Adtalem Global Education 6,800 166,872 00766T100 AECOM 4,170 174,473 018581108 Alliance Data Systems 7,130 299,317 01973R101 Allison Transmission Holdings 7,110 249,845 00164V103 AMC Networks 10,710 264,644 023436108 Amedisys 2,760 652,547 025932104 American Financial Group 3,310 221,704 03073E105 AmerisourceBergen 2,220 215,162 042735100 Arrow Electronics 5,620 442,069 04280A100 Arrowhead Pharmaceuticals 5,670 244,150 045487105 Associated Banc-Corp 47,940 605,003 05329W102 Autonation 6,980 369,451 05368V106 Avient 23,030 609,374 053774105 Avis Budget Group 10,600 278,992 05464C101 Axon Enterprise 2,410 218,587 062540109 Bank of Hawaii 4,830 244,012 06417N103 Bank OZK 6,630 141,352 090572207 Bio-Rad Laboratories 1,480 762,881 09073M104 Bio-Techne 880 218,002 05550J101 BJs Wholesale Club Holdings 11,270 468,269 09227Q100 Blackbaud 3,750 209,363 103304101 Boyd Gaming 18,350 563,162 105368203 Brandywine Realty Trust 93,500 966,790 11120U105 Brixmor Property Group 6,300 73,647 117043109 Brunswick 8,150 480,117 12685J105 Cable One 300 565,629 127190304 CACI International, Cl. A 3,980 848,377 12769G100 Caesars Entertainment 11,890 666,553 133131102 Camden Property Trust 11,390 1,013,482 134429109 Campbell Soup 4,440 -

PORTFOLIO of INVESTMENTS – As of December 31, 2020 (Unaudited)

PORTFOLIO OF INVESTMENTS – as of December 31, 2020 (Unaudited) Loomis Sayles Small Cap Value Fund ________________________________Shares Description ____________________________________________________________ Value (†) Common Stocks – 98.9% of Net Assets Aerospace & Defense – 1.0% 64,870 Aerojet Rocketdyne Holdings, Inc.(a) $ 3,428,379 36,809 BWX Technologies, Inc. ______________2,218,847 ______________5,647,226 Auto Components – 3.2% 134,171 Cooper Tire & Rubber Co. 5,433,925 288,336 Dana, Inc. 5,628,319 20,928 Fox Factory Holding Corp.(a) 2,212,299 38,655 LCI Industries ______________5,012,780 ______________18,287,323 Banks – 13.5% 158,448 Ameris Bancorp 6,032,115 185,530 Atlantic Union Bankshares Corp. 6,111,358 172,148 BancorpSouth Bank 4,723,741 147,547 Bryn Mawr Bank Corp. 4,514,200 215,661 CVB Financial Corp. 4,205,390 271,568 Home BancShares, Inc. 5,290,145 234,144 OceanFirst Financial Corp. 4,362,103 95,010 Pinnacle Financial Partners, Inc. 6,118,644 132,588 Popular, Inc. 7,467,356 76,931 Prosperity Bancshares, Inc. 5,335,934 62,945 South State Corp. 4,550,924 133,304 TCF Financial Corp. 4,934,914 146,089 Triumph Bancorp, Inc.(a) 7,092,621 113,313 Wintrust Financial Corp. ______________6,922,291 ______________77,661,736 Beverages – 1.0% 364,847 Primo Water Corp. ______________5,720,801 Biotechnology – 1.6% 45,738 Emergent BioSolutions, Inc.(a) 4,098,125 31,964 United Therapeutics Corp.(a) ______________4,851,815 ______________8,949,940 Building Products – 2.6% 45,224 American Woodmark Corp.(a) 4,244,273 52,093 Armstrong World Industries, Inc. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Wilmington Funds Holdings Template DRAFT

Wilmington Large-Cap Strategy Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS APPLE INC 4.97% MICROSOFT CORP 4.69% AMAZON.COM INC 3.45% FACEBOOK INC 1.99% ALPHABET INC 1.80% ALPHABET INC 1.77% BERKSHIRE HATHAWAY INC 1.48% JPMORGAN CHASE & CO 1.35% TESLA INC 1.20% JOHNSON & JOHNSON 1.12% UNITEDHEALTH GROUP INC 0.98% VISA INC 0.96% NVIDIA CORP 0.96% BANK OF AMERICA CORP 0.89% HOME DEPOT INC/THE 0.87% WALT DISNEY CO/THE 0.82% MASTERCARD INC 0.80% PAYPAL HOLDINGS INC 0.77% EXXON MOBIL CORP 0.68% PROCTER & GAMBLE CO/THE 0.67% COMCAST CORP 0.66% ADOBE INC 0.62% INTEL CORP 0.59% VERIZON COMMUNICATIONS INC 0.59% CISCO SYSTEMS INC 0.57% CHEVRON CORP 0.55% PFIZER INC 0.54% NETFLIX INC 0.54% AT&T INC 0.53% SALESFORCE.COM INC 0.53% ABBOTT LABORATORIES 0.51% ABBVIE INC 0.50% MERCK & CO INC 0.48% WELLS FARGO & CO 0.48% BROADCOM INC 0.47% THERMO FISHER SCIENTIFIC INC 0.47% ACCENTURE PLC 0.46% CITIGROUP INC 0.45% MCDONALD'S CORP 0.44% TEXAS INSTRUMENTS INC 0.44% COCA-COLA CO/THE 0.44% HONEYWELL INTERNATIONAL INC 0.44% LINDE PLC 0.43% MEDTRONIC PLC 0.43% NIKE INC 0.43% ELI LILLY & CO 0.42% PEPSICO INC 0.42% UNITED PARCEL SERVICE INC 0.41% WALMART INC 0.40% DANAHER CORP 0.40% UNION PACIFIC CORP 0.40% QUALCOMM INC 0.38% BRISTOL-MYERS SQUIBB CO 0.37% ORACLE CORP 0.37% LOWE'S COS INC 0.36% BLACKROCK INC 0.35% CATERPILLAR INC 0.35% AMGEN INC 0.35% BOEING CO/THE 0.35% MORGAN STANLEY 0.35% COSTCO WHOLESALE CORP 0.35% RAYTHEON TECHNOLOGIES CORP 0.34% STARBUCKS CORP 0.34% GOLDMAN SACHS GROUP INC/THE 0.34% GENERAL ELECTRIC