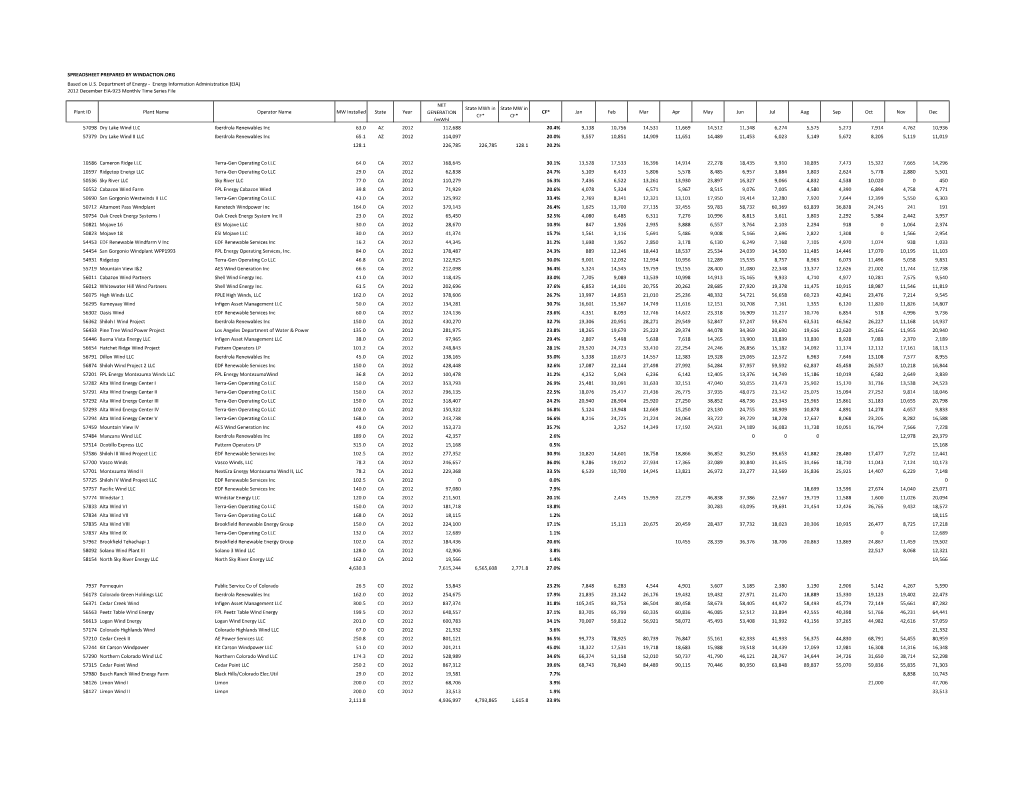

Energy Information Administration (EIA) 2012 December EIA-923 Monthly Time Series File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WASHINGTON – the Energy Department Released Two New

Wind Scalability and Performance in the real World: A performance analysis of recently deployed US Wind Farms G. Bothun and B. Bekker, Dept. of Physics, University of Oregon. Abstract We are engaged in researching the real world performance, costs, and supply chain issues regarding the construction of wind turbines in the United States for the purpose of quantitatively determining various aspects of scalability in the wind industry as they relate to the continued build out of wind energy in the US. Our analysis sample consists of ~600 individual wind farms that have come into operation as of January 2011. Individual unit turbine capacity in these farms ranges from 1-5 to 3 MW, although the bulk of the installations are ≤ 2.0 MW. Starting in late 2012, however, and continuing with current projects, turbines of size 2.5 – 3.0 MW are being installed. As of July 1, 2014 the Horse Hollow development in Texas has the largest individual wind farm nameplate capacity of 736 MW and 10 other locations have aggregate capacity that exceeds 500 MW. Hence, large scale wind farm operations are now here. Based on our analysis our overall findings are the following: 1) at the end of 2014, cumulative wind nameplate capacity in the US will be at ~ 70 GW or ~ 5% of total US electrical infrastructure 2) over the period of 2006—2012, cumulative wind capacity growth was sustained at a rate of 23.7% per annum, 3) production in 2013 was dramatically lower than in 2012 and was just starting to pick up in 2014 due to lingering uncertainty about the future of the -

Energy Information Administration (EIA) 2014 and 2015 Q1 EIA-923 Monthly Time Series File

SPREADSHEET PREPARED BY WINDACTION.ORG Based on U.S. Department of Energy - Energy Information Administration (EIA) 2014 and 2015 Q1 EIA-923 Monthly Time Series File Q1'2015 Q1'2014 State MW CF CF Arizona 227 15.8% 21.0% California 5,182 13.2% 19.8% Colorado 2,299 36.4% 40.9% Hawaii 171 21.0% 18.3% Iowa 4,977 40.8% 44.4% Idaho 532 28.3% 42.0% Illinois 3,524 38.0% 42.3% Indiana 1,537 32.6% 29.8% Kansas 2,898 41.0% 46.5% Massachusetts 29 41.7% 52.4% Maryland 120 38.6% 37.6% Maine 401 40.1% 36.3% Michigan 1,374 37.9% 36.7% Minnesota 2,440 42.4% 45.5% Missouri 454 29.3% 35.5% Montana 605 46.4% 43.5% North Dakota 1,767 42.8% 49.8% Nebraska 518 49.4% 53.2% New Hampshire 147 36.7% 34.6% New Mexico 773 23.1% 40.8% Nevada 152 22.1% 22.0% New York 1,712 33.5% 32.8% Ohio 403 37.6% 41.7% Oklahoma 3,158 36.2% 45.1% Oregon 3,044 15.3% 23.7% Pennsylvania 1,278 39.2% 40.0% South Dakota 779 47.4% 50.4% Tennessee 29 22.2% 26.4% Texas 12,308 27.5% 37.7% Utah 306 16.5% 24.2% Vermont 109 39.1% 33.1% Washington 2,724 20.6% 29.5% Wisconsin 608 33.4% 38.7% West Virginia 583 37.8% 38.0% Wyoming 1,340 39.3% 52.2% Total 58,507 31.6% 37.7% SPREADSHEET PREPARED BY WINDACTION.ORG Based on U.S. -

Analyzing the Energy Industry in United States

+44 20 8123 2220 [email protected] Analyzing the Energy Industry in United States https://marketpublishers.com/r/AC4983D1366EN.html Date: June 2012 Pages: 700 Price: US$ 450.00 (Single User License) ID: AC4983D1366EN Abstracts The global energy industry has explored many options to meet the growing energy needs of industrialized economies wherein production demands are to be met with supply of power from varied energy resources worldwide. There has been a clearer realization of the finite nature of oil resources and the ever higher pushing demand for energy. The world has yet to stabilize on the complex geopolitical undercurrents which influence the oil and gas production as well as supply strategies globally. Aruvian's R'search’s report – Analyzing the Energy Industry in United States - analyzes the scope of American energy production from varied traditional sources as well as the developing renewable energy sources. In view of understanding energy transactions, the report also studies the revenue returns for investors in various energy channels which manifest themselves in American energy demand and supply dynamics. In depth view has been provided in this report of US oil, electricity, natural gas, nuclear power, coal, wind, and hydroelectric sectors. The various geopolitical interests and intentions governing the exploitation, production, trade and supply of these resources for energy production has also been analyzed by this report in a non-partisan manner. The report starts with a descriptive base analysis of the characteristics of the global energy industry in terms of economic quantity of demand. The drivers of demand and the traditional resources which are used to fulfill this demand are explained along with the emerging mandate of nuclear energy. -

Wind Powering America FY07 Activities Summary

Wind Powering America FY07 Activities Summary Dear Wind Powering America Colleague, We are pleased to present the Wind Powering America FY07 Activities Summary, which reflects the accomplishments of our state Wind Working Groups, our programs at the National Renewable Energy Laboratory, and our partner organizations. The national WPA team remains a leading force for moving wind energy forward in the United States. At the beginning of 2007, there were more than 11,500 megawatts (MW) of wind power installed across the United States, with an additional 4,000 MW projected in both 2007 and 2008. The American Wind Energy Association (AWEA) estimates that the U.S. installed capacity will exceed 16,000 MW by the end of 2007. When our partnership was launched in 2000, there were 2,500 MW of installed wind capacity in the United States. At that time, only four states had more than 100 MW of installed wind capacity. Seventeen states now have more than 100 MW installed. We anticipate five to six additional states will join the 100-MW club early in 2008, and by the end of the decade, more than 30 states will have passed the 100-MW milestone. WPA celebrates the 100-MW milestones because the first 100 megawatts are always the most difficult and lead to significant experience, recognition of the wind energy’s benefits, and expansion of the vision of a more economically and environmentally secure and sustainable future. WPA continues to work with its national, regional, and state partners to communicate the opportunities and benefits of wind energy to a diverse set of stakeholders. -

Kansas Wind Energy Update House Energy & Utilities Committee Kimberly Svaty on Behalf of the Wind Coalition 23 January 2012

KANSAS WIND ENERGY UPDATE HOUSE ENERGY & UTILITIES COMMITTEE KIMBERLY SVATY ON BEHALF OF THE WIND COALITION 23 JANUARY 2012 Operating Kansas Wind Projects •1272.4 MW total installed wind generation •10 operating wind projects •Equates to billions in capital investment and thousands of construction jobs and more than 100 permanent jobs •Kansas has the second best wind resource in the nation th •Ranked 14 in the nation in overall wind power production • Percent of Kansas Power by wind in 2010 – 7.1% th •Kansas ranked 5 in the US in 2010 for percentage of electricity delivered from wind • Operating Kansas Wind Projects Project County Developer Size Power Turbine Installed In-Service Name (MW) Offtaker Type Turbines Year (MW) Gray County Gray NextEra 112 MKEC Vestas 170 2001 KCP&L 660kW Elk River Butler Iberdola 150 Empire GE 1.5 100 2005 Spearville Ford enXco 100.4 KCP&L GE 1.5 67 2006 Spearville II 48 48 2010 Smoky Hills Lincoln/ TradeWind 100.8 Sunflower – 50 Vestas 56 2008 Phase I Ellsworth Energy KCBPU- 25 1.8 Midwest Energy – 24 Smoky Hills Lincoln/ TradeWind 150 Sunflower – 24 GE 99 2008 Phase II Ellsworth Energy Midwest – 24 1.5 IP&L – 15 Springfield -50 Meridian Cloud Horizon 204 Empire – 105 Vestas 67 2008 Way EDP Westar - 96 3.0 Flat Ridge Barber BP Wind 100 Westar Clipper 40 2009 Energy 2.5 Central Wichita RES 99 Westar Vestas 33 2009 Plains Americas 3.0 Greensburg Kiowa John Deere/ 12.5 Kansas Power Pool Suzlon 10 2010 Exelon 1.2 Caney River Elk TradeWind 200 Tennessee Valley Vestas 111 2011 Energy Authority (TVA) 1.8 Operating Kansas Wind Projects Gray County Wind Farm- Gray County, Kansas - Kansas' first commercial wind farm was erected near the town of Montezuma by FPL Energy (now NextEra Energy Resources) in 2001. -

Jp Elektroprivrede Hz Herceg Bosne

Vjesnik JP ELEKTROPRIVREDE HZ HERCEG BOSNE CHE Čapljina – 30 godina www.ephzhb.ba INFORMATIVNO - STRUČNI LIST / Godina X. / Broj 44 / Mostar, srpanj 2009. Informativno-stručni list, Vjesnik Glavni i odgovorni urednik: JP Elektroprivreda HZ HB d.d., Mostar Vlatko Međugorac Izdaje: Uredništvo: Sektor za odnose s javnošću Vlatko Međugorac, Mira Radivojević, mr. sc. Irina Budimir, Vanda Rajić, Zoran Pavić Ulica dr. Mile Budaka 106A, Mostar tel.: 036 335-727 Naklada: 800 primjeraka faks: 036 335-779 e-mail: [email protected] Tisak: www.ephzhb.ba FRAM-ZIRAL, Mostar Rukopisi i fotografije se ne vraćaju. 2 INFORMATIVNO STRUČNI LIST JAVNOGA PODUZEĆA ELEKTROPRIVREDE HZ HERCEG BOSNE Sadržaj Novim informacijskim sustavom (SAP-om) do boljega poslovanja .......4 Održana VII. skupština Elektroprivrede HZ HB ................................7 Izvješće neovisnoga revizora ..................................................................8 str. 4 Potpisani ugovori o istražnim radovima na CHE Vrilo.......................10 Elektroprivreda i liberalizacija tržišta ..................................................11 30. rođendan CHE Čapljina ...............................................................13 Posjet njemačkoga veleposlanika i predstavnika KfW banke hidroelektrani Rama ............................................................................14 Primjena novih Općih uvjeta i Pravilnika o priključcima ....................16 HE Mostarsko Blato u izgradnji .........................................................17 str. 7 Uspješno provedena -

Global Trends in Renewable Energy Investment 2012 Copyright © Frankfurt School of Finance and Management Ggmbh 2012

GLOBAL TRENDS IN RENEWABLE ENERGY INVESTMENT 2012 Copyright © Frankfurt School of Finance and Management gGmbH 2012. This publication may be reproduced in whole or in part and in any form for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgement of the source is made. Frankfurt School - UNEP Collaborating Centre for Climate Change & Sustainable Energy Finance would appreciate receiving a copy of any publication that uses this publication as a source. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from Frankfurt School of Finance & Management gGmbH. TABLE OF CONTENTS TABLE OF CONTENTS ACKNOWLEDGEMENTS ................................................................................................................................... 4 FOREWORD FROM ACHIM STEINER ................................................................................................................ 5 FOREWORD FROM UDO STEFFENS ................................................................................................................. 6 LIST OF FIGURES ............................................................................................................................................. 7 METHODOLOGY AND DEFINITIONS ............................................................................................................... 9 KEY FINDINGS ............................................................................................................................................... -

Mojave Desert Wind Farm - Wind Farm 'Mega-Project' Underway in Mojave Desert - Los Angeles Times

Mojave Desert Wind Farm - Wind farm 'mega-project' underway in Mojave Desert - Los Angeles Times ← Back to Original Article Wind farm 'mega-project' underway in Mojave Desert The Alta Wind Energy Center — with plans for thousands of acres of turbines to generate electricity for 600,000 Southern California homes — officially breaks ground Tuesday. July 27, 2010 | By Tiffany Hsu, Los Angeles Times It's being called the largest wind power project in the country, with plans for thousands of acres of towering turbines in the Mojave Desert foothills generating electricity for 600,000 homes in Southern California. And now it's finally kicking into gear. The multibillion-dollar Alta Wind Energy Center has had a tortured history, stretching across nearly a decade of ownership changes, opposition from local residents and transmission infrastructure delays. But on Tuesday, the project is officially breaking ground in the Tehachapi Pass, a burgeoning hot spot for wind energy about 75 miles north of Los Angeles. When completed, Alta could produce three times as much energy as the country's largest existing wind farm, analysts said. It's slated to be done in the next decade. The project will probably be a wind power bellwether, affecting the way renewable energy deals are financed, the development of new electricity storage systems and how governments regulate the industry, said Billy Gamboa, a renewable energy analyst with the California Center for Sustainable Energy. "It's a super-mega-project — it'll definitely set a precedent for the rest of the state and have a pretty large impact on the wind industry in general," he said. -

Appendix D Avian Fatality Studies in the Western Ecosystems Technology, Inc

Appendix D Avian Fatality Studies in the Western Ecosystems Technology, Inc. (WEST) Database This page intentionally left blank. Avian Fatality Studies in the Western Ecosystems Technology, Inc (West) Database Appendix D APPENDIX D. AVIAN FATALITY STUDIES IN THE WESTERN ECOSYSTEMS TECHNOLOGY, INC. (WEST) DATABASE Alite, CA (09-10) Chatfield et al. 2010 Alta Wind I, CA (11-12) Chatfield et al. 2012 Alta Wind I-V, CA (13-14) Chatfield et al. 2014 Alta Wind II-V, CA (11-12) Chatfield et al. 2012 Alta VIII, CA (12-13) Chatfield and Bay 2014 Barton I & II, IA (10-11) Derby et al. 2011a Barton Chapel, TX (09-10) WEST 2011 Beech Ridge, WV (12) Tidhar et al. 2013 Beech Ridge, WV (13) Young et al. 2014a Big Blue, MN (13) Fagen Engineering 2014 Big Blue, MN (14) Fagen Engineering 2015 Big Horn, WA (06-07) Kronner et al. 2008 Big Smile, OK (12-13) Derby et al. 2013b Biglow Canyon, OR (Phase I; 08) Jeffrey et al. 2009a Biglow Canyon, OR (Phase I; 09) Enk et al. 2010 Biglow Canyon, OR (Phase II; 09-10) Enk et al. 2011a Biglow Canyon, OR (Phase II; 10-11) Enk et al. 2012b Biglow Canyon, OR (Phase III; 10-11) Enk et al. 2012a Blue Sky Green Field, WI (08; 09) Gruver et al. 2009 Buffalo Gap I, TX (06) Tierney 2007 Buffalo Gap II, TX (07-08) Tierney 2009 Buffalo Mountain, TN (00-03) Nicholson et al. 2005 Buffalo Mountain, TN (05) Fiedler et al. 2007 Buffalo Ridge, MN (Phase I; 96) Johnson et al. -

Using GIS to Determine Wind Energy Potential in Minnesota, USA Zihan

Using GIS to Determine Wind Energy Potential in Minnesota, USA Zihan Yang Department of Resource Analysis, Saint Mary’s University of Minnesota, Winona, MN 55987 Keywords: GIS, Wind Energy, Terrain Elevation, Multi-Criteria, Spatial Analysis Abstract Wind power is an alternative to fossil fuels. It is plentiful, renewable, widely distributed, clean, produces no greenhouse gas emissions during operation and uses relatively little land. Recent studies indicate that Minnesota has plentiful wind energy potential including the possibility to use wind to generate 25 times the electricity Minnesota used in 2010 (American Wind Energy Association, 2012a). This study evaluates the potential wind energy resources in Minnesota by analyzing technical, environmental, and political criteria for developing local renewable wind energy resources. The approach assesses suitable locations for exploring wind turbines energy sources with the aid of a geographic information system. The study considers local wind conditions and other restrictions such as terrain, land use, environment, and human activities. The model identifies areas that have an excellent suitability for future wind turbine placement in Minnesota. When it compares to the approximate estimations based solely on analysis of wind speed, this rule-based model may provide a more accurate method to evaluate wind energy in Minnesota. Introduction contributing cause of global warming is the emission of greenhouse gases (in The issue of global warming is particular carbon dioxide), mainly becoming a -

Barren Ridge FEIS-Volume IV Paleo Tech Rpt Final March

March 2011 BARREN RIDGE RENEWABLE TRANSMISSION PROJECT Paleontological Resources Assessment Report PROJECT NUMBER: 115244 PROJECT CONTACT: MIKE STRAND EMAIL: [email protected] PHONE: 714-507-2710 POWER ENGINEERS, INC. PALEONTOLOGICAL RESOURCES ASSESSMENT REPORT Paleontological Resources Assessment Report PREPARED FOR: LOS ANGELES DEPARTMENT OF WATER AND POWER 111 NORTH HOPE STREET LOS ANGELES, CA 90012 PREPARED BY: POWER ENGINEERS, INC. 731 EAST BALL ROAD, SUITE 100 ANAHEIM, CA 92805 DEPARTMENT OF PALEOSERVICES SAN DIEGO NATURAL HISTORY MUSEUM PO BOX 121390 SAN DIEGO, CA 92112 ANA 032-030 (PER-02) LADWP (MARCH 2011) SB 115244 POWER ENGINEERS, INC. PALEONTOLOGICAL RESOURCES ASSESSMENT REPORT TABLE OF CONTENTS 1.0 INTRODUCTION ........................................................................................................................... 1 1.1 STUDY PERSONNEL ....................................................................................................................... 2 1.2 PROJECT DESCRIPTION .................................................................................................................. 2 1.2.1 Construction of New 230 kV Double-Circuit Transmission Line ........................................ 4 1.2.2 Addition of New 230 kV Circuit ......................................................................................... 14 1.2.3 Reconductoring of Existing Transmission Line .................................................................. 14 1.2.4 Construction of New Switching Station ............................................................................. -

Wind Powering America Fy08 Activities Summary

WIND POWERING AMERICA FY08 ACTIVITIES SUMMARY Energy Efficiency & Renewable Energy Dear Wind Powering America Colleague, We are pleased to present the Wind Powering America FY08 Activities Summary, which reflects the accomplishments of our state Wind Working Groups, our programs at the National Renewable Energy Laboratory, and our partner organizations. The national WPA team remains a leading force for moving wind energy forward in the United States. At the beginning of 2008, there were more than 16,500 megawatts (MW) of wind power installed across the United States, with an additional 7,000 MW projected by year end, bringing the U.S. installed capacity to more than 23,000 MW by the end of 2008. When our partnership was launched in 2000, there were 2,500 MW of installed wind capacity in the United States. At that time, only four states had more than 100 MW of installed wind capacity. Twenty-two states now have more than 100 MW installed, compared to 17 at the end of 2007. We anticipate that four or five additional states will join the 100-MW club in 2009, and by the end of the decade, more than 30 states will have passed the 100-MW milestone. WPA celebrates the 100-MW milestones because the first 100 megawatts are always the most difficult and lead to significant experience, recognition of the wind energy’s benefits, and expansion of the vision of a more economically and environmentally secure and sustainable future. Of course, the 20% Wind Energy by 2030 report (developed by AWEA, the U.S. Department of Energy, the National Renewable Energy Laboratory, and other stakeholders) indicates that 44 states may be in the 100-MW club by 2030, and 33 states will have more than 1,000 MW installed (at the end of 2008, there were six states in that category).