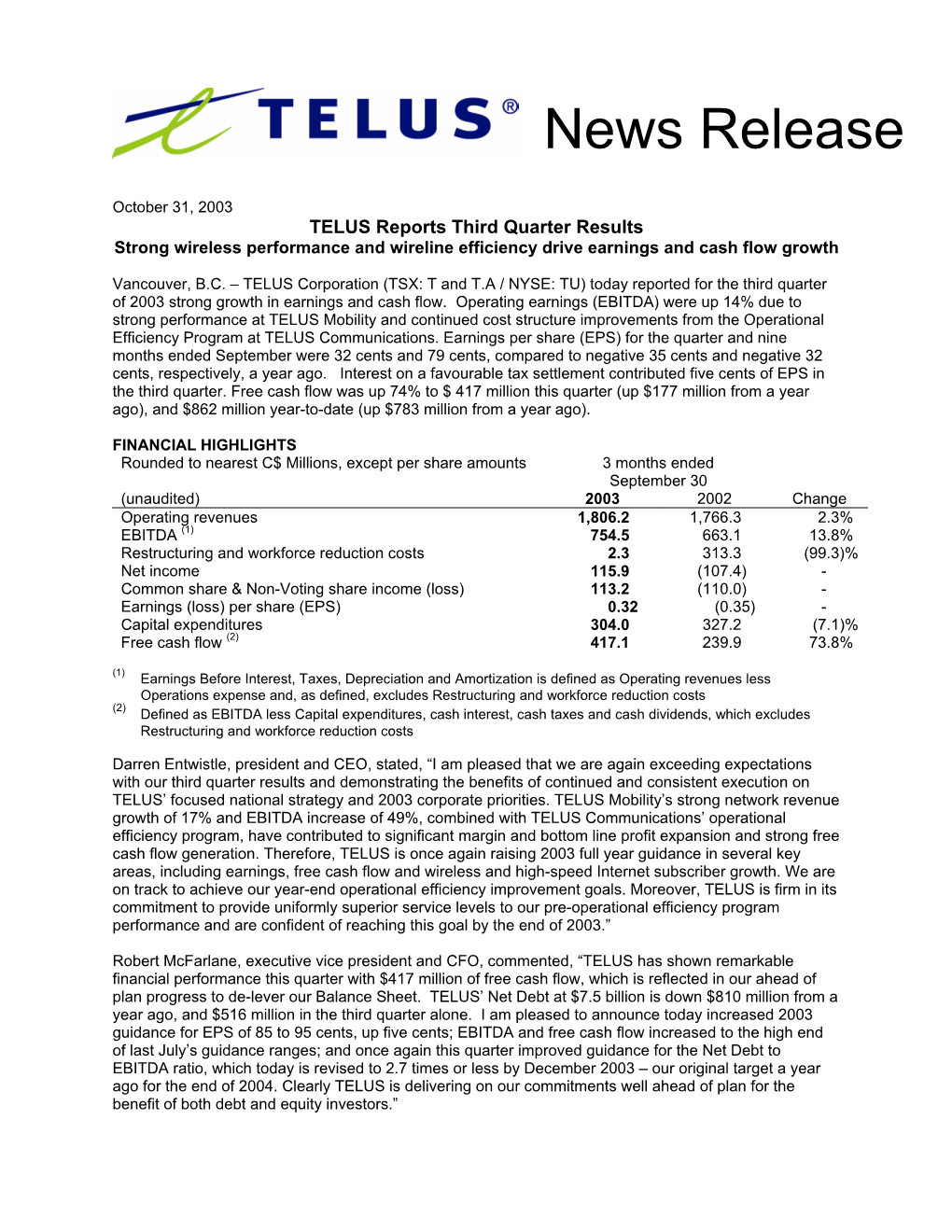

TELUS Reports Third Quarter Results Strong Wireless Performance and Wireline Efficiency Drive Earnings and Cash Flow Growth

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Volume I: Application, Company Evidence & Exhibits

Newfoundland Power Inc. 55 Kenmount Road PO Box 8910 A FORTIS COMmNY St. John's. Newfoundland A1 B 3P6 Business: (709) 737-5600 Facsimile: (709) 737-2974 www.newfwnd!ar!dpower.mm DELIVERED BY HAND May 10,2007 Board of Commissioners of Public Utilities P.O. Box 21040 120 Torbay Road St. John's, NL AIA 5B2 Attention: G. Cheryl Blundon Director of Corporate Services and Board Secretary Ladies and Gentlemen: Re: 2007 General Rate Application Forwarded with this letter are 10 copies of a general rate application for a full review of Newfoundland Power's 2008 costs (the "2008 General Rate Application"). The 2008 General Rate Application and prefiled supporting materials have been provided in tluee volumes set out as follows: Vol~nne1: Application, Conttpanty Evidence artd Exltibits Vol~in~re3: Expert Evidctrce It is the Company's intention to file an Adobe portable document format (pdf) copy of this filing within the next few days. Additional copies of the filing will be made available as required and, to that end, we would be pleased if the Board could indicate its requirements, if any, at its convenience. The Company will post a copy of tl~e2008 General Rate Application on its website at www.newfoundlandpower.com. In addition copies will be available at the Company's offices in Stephenville, Comer Brook, Grand Falls-Winsor, Gander, Clarenville, Burin, Carbonear, and St. John's. - Board of Commissioners of Public Utilities May 10,2007 Page 2 of 2 Attached to the formal Application as Schedule A are proposed rates. These rates are based upon the rate stabilization and municipal tax adjustments ("RSAMTA adjustments") crrwcrrtly in effect. -

CRTC 3001 1St Revised Title Page INDEX of TARIFFS Cancels Original Title Page TITLE PAGE

CRTC 3001 1st Revised Title Page INDEX OF TARIFFS Cancels Original Title Page TITLE PAGE TELEPHONE SERVICE GENERAL TARIFF “OPERATING TERRITORY” NORTHERN BRITISH COLUMBIA, YUKON TERRITORY NORTHWEST TERRITORIES AND NUNAVUT TERRITORIES (C) For explanation of symbols see Page 1 Issued: 22 January 2001 Effective: 22 February 2001 Approved in Telecom Order CRTC 2001-154, 22 February 2001 © 2001 Northwestel Inc. CRTC 3001 2nd Revised Page 1 INDEX OF TARIFFS Cancels 1st Revised Page 1 EXPLANATION OF SYMBOLS EXPLANATION OF SYMBOLS (A) - to denote increases (C) (R) - to denote reductions (C) - to denote changes in wording which result in neither increases nor reductions in rates or charges (D) - to denote material previously shown has now been deleted (M) - to denote information moved to or from another page (N) (N) - to denote new rates or items (C) (S) - to denote reissued matter (V) - not available for new installations or for expansion of existing (Z) - available on recovery basis only and at the discretion of the Company (D) For explanation of symbols see Page 1 Issued: 27 April 1998 Effective: 28 May 1998 Approved in Telecom Order CRTC 1998-507, 28 May 1998 © 1998 Northwestel Inc. CRTC 3001 214th Revised Page 2 GENERAL TARIFF Cancels 213th Revised Page 2 CHECK SHEET Original and revised pages of this Tariff listed below are in effect. PAGE REVISION PAGE REVISION PAGE REVISION Title 1 36B Original 60 2 1 2 36C Original 61 9 2 214 (C) 37 1 62 17 (C) 3 79 (C) 38 3 63 5 3A 116 38A 7 64 4 4 1 38B Original 65 6 5 9 39 2 66 8 6 13 39A Original 66A -

In the Matter of Canada Gazette, Part I, 4 April 2009 Notice No

IN THE MATTER OF CANADA GAZETTE, PART I, 4 APRIL 2009 NOTICE NO. DGTP-004-09 PETITIONS TO THE GOVERNOR IN COUNCIL BY BELL CANADA, BELL ALIANT REGIONAL COMMUNICATIONS, L.P., AND TELUS COMMUNICATIONS COMPANY SEEKING TO VARY TELECOM DECISION CRTC 2008-117 AND RESCIND TELECOM ORDER CRTC 2009-111 COMMENTS OF THE COMPETITOR COALITION 4 MAY 2009 1. I. INTRODUCTION 1. These comments are submitted by a coalition of independent telecommunications service providers (the “Competitors”) in opposition to the above-noted petitions to the Governor in Council filed by Bell Canada, Bell Aliant Regional Communications, L.P. and TELUS Communications Company ( “Bell and Telus” or the “phone companies”).1 2. The Competitors are all Canadian based companies that provide a wide variety of telecommunications services to both the residential and small- to medium-sized business (“SMB”) markets. Among the services provided by the Competitors to their customers are Internet access services, local and long distance voice services (including VoIP-based services), wireless services and broadband data services. 3. Because the local access and transport networks of Bell and Telus represent natural monopolies that cannot be economically or practically duplicated, many of the Competitors must lease “last mile” facilities and services from Bell and Telus in order to provision services to their own end-user customers. Included among the last mile facilities and services leased by the Competitors from Bell and Telus are a set of services that are sometimes called wholesale ADSL access (“WAA”) services. 4. WAA services are not Internet access services. In fact, they do not provide access to the Internet at all. -

Downloading Speeds Diversify Bahrain’S Economy and Achieve Based Economy.” Mr

Volume 09, July, 2018 A SAMENA Telecommunications Council Newsletter www.samenacouncil.org SAMENA TRENDS EXCLUSIVELY FOR SAMENA TELECOMMUNICATIONS COUNCIL'S MEMBERS BUILDING DIGITAL ECONOMIES VIVA’s Analytics Transformation 35 Nokia: Building Critical Communications Netw- orks for Aviation... 46 Interview Eng. Ahmed El Beheiry Managing Director and CEO Telecom Egypt THIS MONTH DATA ANALYTICS & MONETIZATION Durban 10-13 September BETTER SOONER Accelerating ICT innovation to improve lives faster. The global event for governments, corporates and tech SMEs. 10-13 September 2018, Durban, South Africa ITU Telecom World 2018 is the global platform to accelerate ICT innovations for social and economic development. It’s where policy makers and regulators meet industry experts, investors, SMEs, entrepreneurs and innovators to exhibit solutions, share knowledge and speed change. Our aim is to help ideas go further, faster to make the world better, sooner. Visit telecomworld.itu.int to find out more. Enjoy 10% discount with SAMENA Council code: C-00005168 #ituworld telecomworld.itu.int VOLUME 09, JULY, 2018 Contributing Editors Contributions Publisher Izhar Ahmad Blockchain in Telecom SAMENA Telecommunications Council SAMENA Javaid Akhtar Malik Cisco Huawei Subscriptions TRENDS Koolspan [email protected] Nokia Editor-in-Chief Tech Mahindra Advertising Bocar A. BA Telecom Egypt [email protected] Umniah Viva - Kuwait SAMENA TRENDS [email protected] Tel: +971.4.364.2700 CONTENTS INTERVIEW 05 EDITORIAL 10 REGIONAL & MEMBERS UPDATES Members News Regional News 48 SATELLITE UPDATES Satellite News 56 WHOLESALE UPDATES Wholesale News 64 TECHNOLOGY UPDATES The SAMENA TRENDS newsletter is wholly Technology News owned and operated by The SAMENA 07 Eng. Ahmed El Beheiry Telecommunications Council (SAMENA 74 Managing Director and CEO Council). -

Q1 2004 MD A.Pdf

News Release May 5, 2004 TELUS Reports First Quarter Results Strong wireless performance drives earnings and cash flow growth Vancouver, B.C. – TELUS Corporation (TSX: T and T.A / NYSE: TU) today reported for the first quarter of 2004 excellent wireless performance at TELUS Mobility and a strong increase in free cash flow. Operating revenues of $1.8 billion in the quarter increased 4% from a year ago. Overall operating earnings (EBITDA) were up 9% due to strong performance at TELUS Mobility. Reported earnings per share for the first quarter were 28 cents, compared to 26 cents for the same period a year ago. Free cash flow was $443 million this quarter, a $176 million improvement from a year ago. FINANCIAL HIGHLIGHTS Rounded to nearest C$ Millions, except per share amounts 3 months ended March 31 (unaudited) 2004 2003 % Change Operating revenues 1,803.8 1,740.9 3.6 EBITDA(1) 721.3 664.3 8.6 Net income 101.3 89.5 13.2 Earnings per share (EPS) 0.28 0.26 7.7 Capital expenditures 309.7 207.8 49.0 Cash provided by operating activities 588.1 404.7 45.3 Free cash flow (2) 443.3 267.6 65.7 (1) Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) is defined as Operating revenues less Operations expense less Restructuring and workforce reduction costs. (2) See note 2 of the Consolidated highlights table in management’s discussion and analysis. Darren Entwistle, president and CEO, commented that “Our strategy to evolve the revenue mix of TELUS into the growth businesses of wireless and data has driven consolidated top and bottom line growth. -

Canadian Radio-Television and Telecommunications Commission

Canadian Radio-television and Telecommunications Commission Performance Report For the period ending March 31, 2007 The Honourable Josée Verner, P.C., M.P. Minister of Canadian Heritage, Status of Women and Official Languages Table of Contents SECTION I: Overview ................................................................................. 3 Minister’s Message ....................................................................................................... 5 Chairman’s Message..................................................................................................... 7 Management Representation Statement...................................................................... 10 Raison d’être ............................................................................................................... 11 SECTION II: Analysis of Performance by Strategic Outcome.............. 15 Strategic Outcome....................................................................................................... 16 Planned and actual spendings for the strategic Outcome............................................ 17 CRTC – Result Chain ................................................................................................. 18 Status of Performance on CRTC’s Priorities for 2006-2007...................................... 19 Broadcasting and Telecom Accomplishments............................................................ 21 Cultural Prosperity ............................................................................................ -

Service Excellence Initiative

Service Excellence Initiative 598 Management Report Kirsten McCaig June 20, 2003 Table of Contents ACKNOWLEDGEMENTS .......................................................................................................... 1 1.0 EXECUTIVE SUMMARY..................................................................................................2 2.0 INTRODUCTION................................................................................................................8 3.0 GOVERNMENT AGENTS BRANCH ............................................................................ 12 4.0 SERVING THE PUBLIC.................................................................................................. 15 4.1 WHY GOVERNMENT SHOULD BE FOCUSED ON IMPROVING CUSTOMER SERVICE ....... 17 5.0 THE CANADIAN APPROACH TO SERVICE IMPROVEMENT – A BEST PRACTICES REVIEW..................................................................................................... 21 5.1 SURVEYS: DETERMINING CUSTOMER SERVICE PRIORITIES....................................... 24 5.1.1 Employee Surveys – Uncovering Internal Service Barriers ............................. 27 5.1.2 Mystery Shopper – Alternative Survey Method ................................................ 28 5.2 SERVICE STANDARDS................................................................................................. 29 5.2.1 What are service standards? ............................................................................ 30 5.2.2 Why develop customer service standards?...................................................... -

Telecom Decision CRTC 2010-789

Telecom Decision CRTC 2010-789 PDF version Ottawa, 25 October 2010 Final 2010 revenue-percent charge and related matters File number: 8695-C12-201005455 In this decision, the Commission approves on a final basis, effective 1 January 2010, a 2010 contribution collection revenue-percent charge of 0.73 percent, the 2010 subsidy amounts for Northwestel and the small incumbent local exchange carriers (ILECs), and the 2010 subsidy per residential network access service (NAS) amounts for the territories of the large ILECs, Télébec, and People’s Tel Limited Partnership (People’s). In addition, the Commission approves on an interim basis, effective 1 January 2011, a 2011 contribution collection revenue-percent charge of 0.73 percent, the 2011 subsidy amounts for Northwestel and the small ILECs, and the 2011 subsidy per residential NAS amounts for the territories of the large ILECs, Télébec, and People’s. Introduction 1. In Decision 2000-745, the Commission introduced a national revenue-based contribution collection mechanism and a new methodology for calculating the subsidy for high-cost serving areas (HCSAs) in the territories of the large incumbent local exchange carriers (ILECs)1 and Télébec, Limited Partnership (Télébec).2 2. In Decision 2001-238, the Commission established the costing rules to be used for determining the subsidy per residential network access service (NAS) amounts for the territories of the large ILECs. The subsidy per residential NAS amounts for HCSAs is approved annually by the Commission. 3. In Telecom Decision 2009-702, the Commission set, on an interim basis for 2010, a revenue-percent charge of 0.81 percent and the subsidy per residential NAS amounts for the territories of the large ILECs, Télébec, and People’s Tel Limited Partnership (People’s). -

CRTC Review of Basic Telecommunications Services

Review of Basic Telecommunications Services CRTC Telecom Notice of Consultation 2015-134 CYBERA Calgary Office: Suite 200, 3512 - 33 St NW, Calgary, AB T2N 2A6 T: 403-210-5333 Edmonton Office: 3-43, Computing Science Centre, University of Alberta, Edmonton, AB T6G 2E8 @cybera [email protected] www.cybera.ca 1 Introduction Cybera is a notforprofit, technologyneutral agency responsible for accelerating hightech adoption in Alberta. One of Cybera’s core roles is the operation of Alberta’s Research and Education Network, called CyberaNet. This is the dedicated network for unmetered, notforprofit traffic used by Alberta’s schools, postsecondary institutions and business incubators to aid innovation, enterprise and ingenuity. Cybera receives both provincial and federal government funding to spearhead pilot projects that improve efficiencies and the competitiveness of Canadian institutions and businesses, and support internationallevel research. It is guided by a strategic leadership team, and is home to some of the world’s top cloud and networking experts, who work together to build cloud infrastructure, data storage, and advanced networking solutions. Drawing on this expertise and public service mandate, Cybera is pleased to provide the following response to the CRTC Telecom Notice of Consultation 2015134 regarding the review of Canada’s basic telecommunications services. It is our view that broadband Internet be considered a basic st telecommunication 21 century service, and should be affordable and accessible to all Canadians equal in th importance to the touchtone telephone service of the 20 century. The importance of this review cannot be understated. It represents a critical turning point in Canada’s digital economy. -

Phase-Out of the Local Service Subsidy Regime

Telecom Regulatory Policy CRTC 2018-213 PDF version References: 2017-92 and 2017-92-1 Ottawa, 26 June 2018 Public record: 1011-NOC2017-0092 Phase-out of the local service subsidy regime Consistent with the Commission’s shift of its regulatory frameworks away from wireline voice services, the Commission determines in this decision that the phase-out of the local service subsidy will occur over three years, from 1 January 2019 to 31 December 2021, through semi-annual reductions. The total subsidy amounts for 2018 for each incumbent local exchange carrier (ILEC) are to be used to calculate the amounts of subsidy to be paid during the transition period from 2019 to 2021. However, funding for Northwestel’s service improvement plan will continue as planned and then cease on 31 December 2020. This decision also sets out the Commission’s determinations regarding certain policies for the small ILECs’ subsidies. The Commission also determines that several regulated residential high-cost serving area exchanges are eligible for forbearance and are therefore no longer eligible for the local service subsidy, subject to other applicable forbearance criteria being met. The Commission directs each of the ILECs listed in the Appendix to this decision to file a streamlined forbearance application with respect to these exchanges no later than 30 days after the date of this decision. Background 1. The local service subsidy regime1 was established to subsidize the provision of residential local voice telephone services in high-cost serving areas (HCSAs).2 Telecommunications service providers (TSPs), or groups of related TSPs, that have $10 million or more in annual Canadian telecommunications revenues are required to contribute to the National Contribution Fund (NCF). -

Telecom Order CRTC 2005-84

Telecom Order CRTC 2005-84 Ottawa, 2 March 2005 Instalment payment plans for service improvement plans Reference: Aliant Telecom Tariff Notice 70, Bell Canada Tariff Notices 6731 and 6731A, MTS Tariff Notice 519, Télébec Tariff Notice 294, TCI Tariff Notice 87, and TELUS Québec Tariff Notice 346 In this Order, the Commission approves a large construction charges instalment payment plan for Aliant Telecom Inc., Bell Canada, MTS Communications Inc., Société en commandite Télébec (Télébec), TELUS Communications Inc., and TELUS Communications (Québec) Inc. (TELUS Québec), as well as small and medium instalment payment plans for Télébec and TELUS Québec for telephone service provided to residential customers under the companies' service improvement plans. Background 1. In Telephone service to high-cost serving areas, Telecom Decision CRTC 99-16, 19 October 1999, the Commission defined the basic service objective (BSO) as, among other things, an individual line with privacy features and the capability to connect via low-speed data transmission to the Internet at local rates. The Commission set three goals: (i) to extend service to the few areas that were unserved; (ii) to upgrade service levels in those areas where customers did not have access to telecommunication services that meet the BSO; and (iii) to maintain service levels. In order to achieve these goals, the Commission directed the incumbent local exchange carriers (ILECs) to develop service improvement plans (SIPs) which would be reviewed in the price cap review proceeding, which ultimately led to Regulatory framework for second price cap period, Telecom Decision CRTC 2002-34, 30 May 2002 (Decision 2002-34). 2. -

An Open Gateway to Deliver the Promise of Broadband

The Qimirluk Proposal: An Open Gateway to Deliver the Promise of Broadband Further Intervention by the SSI Group of Companies In Response to Telecom Notice of Consultation CRTC 2015-134 Review of basic telecommunications services February 1, 2016 SSI Further Intervention to TNC CRTC 2015-134 Table of Contents 1. Introduction and overview....................................................................................3 2. A dedicated strategy for identifiable needs...........................................................6 3. Change the policy focus: Broadband is already the New Basic...............................8 3.1 Broadband as an essential service.............................................................................8 3.2 Evolving the subsidy system: voice as an “App” or subset of broadband service....10 3.3 Broadband as a driver of economic development ................................................ 12 4. Change the mechanism to implement the BSO policy .......................................... 14 4.1. Technology and competitive neutrality ................................................................. 14 4.2. Qimirluk: focus on the transport ............................................................................ 15 4.3. Two-levels of assistance mechanisms: enable competition and empower the consumer ...................................................................................................................... 16 5. Conclusions: the time has come to implement change ........................................