View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Communications Commission Before the Federal

Federal Communications Commission Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Existing Shareholders of Clear Channel ) BTCCT-20061212AVR Communications, Inc. ) BTCH-20061212CCF, et al. (Transferors) ) BTCH-20061212BYE, et al. and ) BTCH-20061212BZT, et al. Shareholders of Thomas H. Lee ) BTC-20061212BXW, et al. Equity Fund VI, L.P., ) BTCTVL-20061212CDD Bain Capital (CC) IX, L.P., ) BTCH-20061212AET, et al. and BT Triple Crown Capital ) BTC-20061212BNM, et al. Holdings III, Inc. ) BTCH-20061212CDE, et al. (Transferees) ) BTCCT-20061212CEI, et al. ) BTCCT-20061212CEO For Consent to Transfers of Control of ) BTCH-20061212AVS, et al. ) BTCCT-20061212BFW, et al. Ackerley Broadcasting – Fresno, LLC ) BTC-20061212CEP, et al. Ackerley Broadcasting Operations, LLC; ) BTCH-20061212CFF, et al. AMFM Broadcasting Licenses, LLC; ) BTCH-20070619AKF AMFM Radio Licenses, LLC; ) AMFM Texas Licenses Limited Partnership; ) Bel Meade Broadcasting Company, Inc. ) Capstar TX Limited Partnership; ) CC Licenses, LLC; CCB Texas Licenses, L.P.; ) Central NY News, Inc.; Citicasters Co.; ) Citicasters Licenses, L.P.; Clear Channel ) Broadcasting Licenses, Inc.; ) Jacor Broadcasting Corporation; and Jacor ) Broadcasting of Colorado, Inc. ) ) and ) ) Existing Shareholders of Clear Channel ) BAL-20070619ABU, et al. Communications, Inc. (Assignors) ) BALH-20070619AKA, et al. and ) BALH-20070619AEY, et al. Aloha Station Trust, LLC, as Trustee ) BAL-20070619AHH, et al. (Assignee) ) BALH-20070619ACB, et al. ) BALH-20070619AIT, et al. For Consent to Assignment of Licenses of ) BALH-20070627ACN ) BALH-20070627ACO, et al. Jacor Broadcasting Corporation; ) BAL-20070906ADP CC Licenses, LLC; AMFM Radio ) BALH-20070906ADQ Licenses, LLC; Citicasters Licenses, LP; ) Capstar TX Limited Partnership; and ) Clear Channel Broadcasting Licenses, Inc. ) Federal Communications Commission ERRATUM Released: January 30, 2008 By the Media Bureau: On January 24, 2008, the Commission released a Memorandum Opinion and Order(MO&O),FCC 08-3, in the above-captioned proceeding. -

Townsquare Media Texarkana License, LLC KKYR, KPWW, KYGL, KMJI & KOSY EEO PUBLIC FILE REPORT February 1, 2019 – January 31, 2020

Townsquare Media Texarkana License, LLC KKYR, KPWW, KYGL, KMJI & KOSY EEO PUBLIC FILE REPORT February 1, 2019 – January 31, 2020 I. VACANCY LIST Recruitment Source (“RS”) Used to Interviewees Job Title RS Referring Hiree Fill Vacancy per vacancy Account Executive 1-13 13 3 Production Director 1-13 13 4 Account Executive 1-13 15 2 Account Executive 1-13 12 2 Account Executive 1-13 13 2 *See Section II, the “Master Recruitment Source List” (“MRSL”) for recruitment source data. II. MASTER RECRUITMENT SOURCE LIST (“MRSL”) Source Entitled No. of Interviewees RS Referred by RS RS Information to Vacancy Number Notification? over (Yes/No) reporting period 1 Texas A&M N 0 2 Church On The Rock N 0 3 Texarkana Chamber of Commerce N 0 4 Texarkana College N 0 5 University of Arkansas, Pine Bluff N 0 6 Greater Texarkana Workforce Center N 0 7 Greater Texarkana Chapter of the N.A.A.C.P. N 0 8 University of Arkansas Community College N 0 9 Little River Chamber N 0 10 Quachita Baptist University N 0 11 Henderson State University N 0 12 All radio station websites: www.kkyr.com , www.kygl.com , N 1 www.mymajic933.com , www.power959.com www.kosy790am.com 13 Indeed.com (via Greenhouse) N 11 14 Townsquaremedia.com N 0 15 LinkedIn.com N 1 13 TOTAL INTERVIEWEES OVER REPORTING PERIOD III. RECRUITMENT INITIATIVES TYPE OF RECRUITMENT INITIATIVE BRIEF DESCRIPTION OF ACTIVITY (MENU SELECTION) 1 Expo presented by Workforce Solutions Northeast Texas on April 16 th , 2019. The stations’ Participation in Job Fair Director of Sales & Operations Manager attended and accepted resumes’ and applications. -

He KMBC-ÍM Radio TEAM

l\NUARY 3, 1955 35c PER COPY stu. esen 3o.loe -qv TTaMxg4i431 BItOADi S SSaeb: iiSZ£ (009'I0) 01 Ff : t?t /?I 9b£S IIJUY.a¡:, SUUl.; l: Ii-i od 301 :1 uoTloas steTaa Rae.zgtZ IS-SN AlTs.aantur: aTe AVSí1 T E IdEC. 211111 111111ip. he KMBC-ÍM Radio TEAM IN THIS ISSUE: St `7i ,ytLICOTNE OSE YN in the 'Mont Network Plans AICNISON ` MAISHAIS N CITY ive -Film Innovation .TOrEKA KANSAS Heart of Americ ENE. SEDALIA. Page 27 S CLINEON WARSAW EMROEIA RUTILE KMBC of Kansas City serves 83 coun- 'eer -Wine Air Time ties in western Missouri and eastern. Kansas. Four counties (Jackson and surveyed by NARTB Clay In Missouri, Johnson and Wyan- dotte in Kansas) comprise the greater Kansas City metropolitan trading Page 28 Half- millivolt area, ranked 15th nationally in retail sales. A bonus to KMBC, KFRM, serv- daytime ing the state of Kansas, puts your selling message into the high -income contours homes of Kansas, sixth richest agri- Jdio's Impact Cited cultural state. New Presentation Whether you judge radio effectiveness by coverage pattern, Page 30 audience rating or actual cash register results, you'll find that FREE & the Team leads the parade in every category. PETERS, ñtvC. Two Major Probes \Exclusive National It pays to go first -class when you go into the great Heart of Face New Senate Representatives America market. Get with the KMBC -KFRM Radio Team Page 44 and get real pulling power! See your Free & Peters Colonel for choice availabilities. st SATURE SECTION The KMBC - KFRM Radio TEAM -1 in the ;Begins on Page 35 of KANSAS fir the STATE CITY of KANSAS Heart of America Basic CBS Radio DON DAVIS Vice President JOHN SCHILLING Vice President and General Manager GEORGE HIGGINS Year Vice President and Sally Manager EWSWEEKLY Ir and for tels s )F RADIO AND TV KMBC -TV, the BIG TOP TV JIj,i, Station in the Heart of America sú,\.rw. -

Blast FM 'Delinquent! Production

RADIO DAILY, Tuesday, April 15! Blast FM 'Delinquent! production. He declared that when lishing Co., New York; Roy L. Albertson, WBNY- Hofheinz Demands uthe American public today buys "a FM, Buffalo, N. Y.; Armine E. Allen, Philco Geo. Sterling, 1 Corp., Philadelphia; Addison Amor, NBC Radio- QuicU Action On radio without FM it is buying some- Rccording Div., N. Y.; John Andrew, Associated thing already obsolete." Program 'Service, N. Y.; John Edward Arens, Lauds Progret Leonard Marks, general counsel of WFAS and WFAS-FM, White Plains, N. Y.; Construction Leonard L. Asch, WBCA, Schenectady; Bill Of Medium, the FM Association, urged the mem- Bailey, FMA, Washington; Stuart Bailey, Jan- (Continued from Page 1) bers to use the national headquarters sky & Bailey, Washington; David Baltimore, Supply Corp., Rochester, N. Y.; The as Hofheinz, of Houston, Texas, de- of the organization at Washington as WBRE and WBRE-FM, Wilkes-Barre, Pa.; Graeme McNulty, president, WMCP, Baltimori clared that there were some "hip a clearing house for their problems. C. Bannerman, Mayer, Bannerman & Rigby, W. K. Macy, vice-president, WFSS, Washington; William L. Barlow, FMA, Wash- N. Y.; J. Woodrow Magnuson, WBEN-F pocket" licensees bent on waiting Leonard Asch was general chair- ington; Ellis Barrett, WPTL, Providence, Rhode falo, N. Y. until the new system of broadcasting man of the sessions. Island; Joseph Behr, WREL, Long Island City, Leonard H. Marks, general counsel was in full swing, and then hoping Practically all large receiver N. Y.; A. G. Belle, WSYR-FM, Syracuse, N. Y.; Washington; William Maron, WTOE, El to obtain quick and easy profits. -

The M Street Journal Radio's Journal of Record ' EW YORK NASHVILLE CAPSTAR ACROSS AFRICA

The M Street Journal Radio's Journal of Record ' EW YORK NASHVILLE CAPSTAR ACROSS AFRICA. Capstar Broadcasting Partners will spend $60 million for twenty stations in four separate transactions covering five markets. Terms of the individual deals weren't disclosed. Two of the deals involve Point Communications, which is the managing partner of six stations in Madison, WI and owns five in the Roanoke - Lynchburg area, owned through a subsidiary. In Madison, the stations are standards WTSO; CHR WZEE; news -talk WIBA; rock WIBA -FM; new rock WMAD -FM, Sun Prairie, WI; and soft AC WMLI, Sauk City, WI. In Roanoke - Lynchburg -- oldies simulcast WLDJ, Appomattox and WRDJ, Roanoke; urban oldies WJJS, Lynchburg; and dance combo WJJS -FM, Vinton, and WJJX, Lynchburg. The third deal gives Capstar three stations in the Yuma, AZ market, including oldies KBLU, country KTTI, and classic rocker KYJT, from Commonwealth Broadcasting of Arizona, LLC. Finally, COMCO Broadcasting's Alaska properties, which include children's KYAK, CHR KGOT, and AC KYMG, all Anchorage; and news -talk KIAK, country KIAK -FM, and AC KAKQ -FM, all Fairbanks. WE DON'T NEED NO STINKIN' LICENSE . It's spent almost ten weeks on the air without a license, but the new religious -programmed station on 105.3 MHz in the Hartford, CT area, is being investigated by the Commission's New England Field Office. According to the Hartford Courant, Mark Blake is operating the station from studios in Bloomfield, CT, and says that he "stands behind" the station's operation. Although there have been no interference complaints filed, other stations in the area are claiming they are losing advertising dollars to the pirate. -

Townsquare Media Licensee of Utica/Rome, Inc. WFRG-FM, WLZW

Townsquare Media Licensee of Utica/Rome, Inc. WFRG-FM, WLZW-FM, WODZ-FM, WIBX-AM Equal Employment Opportunity Public File Report February 1, 2013 through January 31, 2014 I. POSITIONS FILLED DURING THE REPORTING PERIOD Job Title Sources Used to Fill Position Source Referring (Numbers Correspond to the Recruitment Source List Hiree in Part II) Account Executive 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 12, 14, 19, 18, 21 Word of Mouth Account Executive 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 12, 14, 19, 18, 21 Word of Mouth Digital Sales Manager 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 12, 16, 19 Word of Mouth Administrative Assistant 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 19, 20, 21 Word of Mouth Reporter 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 13, 16, 19, 20 Word of Mouth On-Air Host 19 Word of Mouth – Exigent Circumstances DC\775326.1 Townsquare Media Licensee of Utica/Rome, Inc. WFRG-FM, WLZW-FM, WODZ-FM, WIBX-AM Equal Employment Opportunity Public File Report February 1, 2013 through January 31, 2014 II. RECRUITMENT SOURCE LIST No. Recruitment Source Entitled to No. Interviewees (Name, address, contact person, telephone number) Vacancy Referred During Notification Reporting Period by (Y/N) Source 1 Working Solutions One Stop Center N 0 NYS Office Building 207 Genesee St. Utica, NY 13501 (315) 793-2229 2 Mohawk Valley Community College N 0 Employment Office Academic Building, Room 135 1101 Sherman Dr. Utica, NY 13501 (315) 792-5488 3 Herkimer County Community College N 0 Career Counseling Center RMCC 262 Reservoir Rd. -

Broadcast Radio

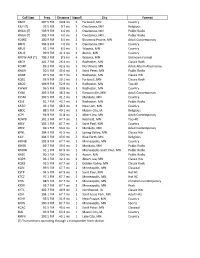

Call Sign Freq. Distance Signal City Format KBGY 107.5 FM 10.8 mi. 5 Faribault, MN Country KJLY (T) 93.5 FM 0.7 mi. 5 Owatonna, MN Religious KNGA (T) 103.9 FM 4.0 mi. 5 Owatonna, MN Public Radio KNGA (T) 105.7 FM 4.0 mi. 5 Owatonna, MN Public Radio KOWZ 100.9 FM 8.5 mi. 5 Blooming Prairie, MN Adult Contemporary KRFO 104.9 FM 2.0 mi. 5 Owatonna, MN Country KRUE 92.1 FM 8.5 mi. 5 Waseca, MN Country KAUS 99.9 FM 31.4 mi. 4 Austin, MN Country KFOW-AM (T) 106.3 FM 8.5 mi. 4 Waseca, MN Unknown Format KRCH 101.7 FM 26.4 mi. 4 Rochester, MN Classic Rock KCMP 89.3 FM 42.6 mi. 3 Northfield, MN Adult Album Alternative KNGA 90.5 FM 45.6 mi. 3 Saint Peter, MN Public Radio KNXR 97.5 FM 43.7 mi. 3 Rochester, MN Classic Hits KQCL 95.9 FM 19.1 mi. 3 Faribault, MN Classic Rock KROC 106.9 FM 52.9 mi. 3 Rochester, MN Top-40 KWWK 96.5 FM 30.8 mi. 3 Rochester, MN Country KYBA 105.3 FM 38.3 mi. 3 Stewartville, MN Adult Contemporary KYSM 103.5 FM 41.2 mi. 3 Mankato, MN Country KZSE 91.7 FM 43.7 mi. 3 Rochester, MN Public Radio KATO 93.1 FM 48.2 mi. 2 New Ulm, MN Country KBDC 88.5 FM 49.1 mi. 2 Mason City, IA Religious KCPI 94.9 FM 31.8 mi. -

Draft Copy « Licensing and Management System «

Approved by OMB (Office of Management and Budget) 3060-0031 March 2019 (REFERENCE COPY - Not for submission) Notification of Consummation File Number: 0000138336 Submit Date: 03/11/2021 Lead Call Sign: KYSS-FM FRN: 0030479497 Service: Full Power AM Purpose: Notification of Consummation Status: Accepted Status Date: 03/11/2021 Filing Status: Active General Section Question Response Information Attachments Are attachments (other than associated schedules) being No filed with this application? Applicant Applicant Name, Type, and Contact Information Information Applicant Address Phone Email Applicant Type Townsquare License, 1 Manhattanville +1 (203) 861- fcccontact@townsquaremedia. Limited Liability LLC Road 0900 com Company Suite 202 Purchase, NY 10577 United States Contact Contact Name Address Phone Email Contact Type Representatives Information (1) Howard Liberman 1800 M Street, NW +1 (202) 383- hliberman@wbklaw. Legal Wilkinson Barker Knauer, Suite 800N 3373 com Representative LLP Washington, DC 20036 United States Consummation Details Notification Details Date of Consummation FRN of Licensee Post-consummation 2021-03-09 0030479497 Consummate the Following Authorizations: Select all the authorizations in the table below that will not be consummated Call Sign Facility ID File Number Will Not Consummate KLYQ 4699 0000135646 KENR 88404 0000135647 KAMM-FM 166027 0000135648 K251CH 22911 0000135649 KGVO 71751 0000135650 KYSS-FM 71759 0000135651 KENR-FM1 133545 0000135652 K259DD 202318 0000135653 KBAZ 4700 0000135654 K252FP 138129 0000135655 KMPT 71754 0000135656 Certification Section Question Response Authorized Party to Sign WILLFUL FALSE STATEMENTS MADE ON THIS FORM OR ANY ATTACHMENTS ARE PUNISHABLE BY FINE AND/OR IMPRISONMENT (U.S. Code, Title 18, §1001) AND/OR REVOCATION OF ANY STATION AUTHORIZATION (U.S. -

Townsquare Media Texarkana License, LLC KKYR, KPWW, KYGL, KMJI & KOSY EEO PUBLIC FILE REPORT February 1, 2018 – January 31, 2019

Townsquare Media Texarkana License, LLC KKYR, KPWW, KYGL, KMJI & KOSY EEO PUBLIC FILE REPORT February 1, 2018 – January 31, 2019 I. VACANCY LIST Recruitment Source (“RS”) Used to Interviewees Job Title RS Referring Hiree Fill Vacancy per vacancy Director of Sales 13-15 14 2 Account Executive 1-16 12 3 1-16 Account Executive 13 2 Account Executive 1-16 14 1 Director of Sales 15 15 1 *See Section II, the “Master Recruitment Source List” (“MRSL”) for recruitment source data. II. MASTER RECRUITMENT SOURCE LIST (“MRSL”) No. of Source Entitled Interviewees RS RS Information to Vacancy Referred by RS Number Notification? over (Yes/No) reporting period 1 Texas A&M N 0 2 Church On The Rock N 0 3 Texarkana Chamber of Commerce N 0 4 Texarkana College N 0 5 University of Arkansas, Pine Bluff N 0 6 Greater Texarkana Workforce Center N 0 7 Greater Texarkana Chapter of the N.A.A.C.P. N 0 8 University of Arkansas Community College N 0 9 Little River Chamber N 0 10 Quachita Baptist University N 0 11 Henderson State University N 0 12 All radio station websites: www.kkyr.com, www.kygl.com, N 3 www.mymajic933.com, www.power959.com www.kosy790am.com 13 Townsquaremedia.com N 1 14 Indeed N 2 Indeed.com 15 Glassdoor N 2 Glassdoor.com 16 On air ads: KKYR,KPWW,KYGL,KMJI.KOSY N 1 9 TOTAL INTERVIEWEES OVER REPORTING PERIOD III. RECRUITMENT INITIATIVES TYPE OF RECRUITMENT INITIATIVE BRIEF DESCRIPTION OF ACTIVITY (MENU SELECTION) 1 Expo presented by Workforce Solutions Northeast Texas on April 10th, 2018. -

Minnesota Emergency Alert System Statewide Plan 2018

Minnesota Emergency Alert System Statewide Plan 2018 MINNESOTA EAS STATEWIDE PLAN Revision 10 Basic Plan 01/31/2019 I. REASON FOR PLAN The State of Minnesota is subject to major emergencies and disasters, natural, technological and criminal, which can pose a significant threat to the health and safety of the public. The ability to provide citizens with timely emergency information is a priority of emergency managers statewide. The Emergency Alert System (EAS) was developed by the Federal Communications Commission (FCC) to provide emergency information to the public via television, radio, cable systems and wire line providers. The Integrated Public Alert and Warning System, (IPAWS) was created by FEMA to aid in the distribution of emergency messaging to the public via the internet and mobile devices. It is intended that the EAS combined with IPAWS be capable of alerting the general public reliably and effectively. This plan was written to explain who can originate EAS alerts and how and under what circumstances these alerts are distributed via the EAS and IPAWS. II. PURPOSE AND OBJECTIVES OF PLAN A. Purpose When emergencies and disasters occur, rapid and effective dissemination of essential information can significantly help to reduce loss of life and property. The EAS and IPAWS were designed to provide this type of information. However; these systems will only work through a coordinated effort. The purpose of this plan is to establish a standardized, integrated EAS & IPAWS communications protocol capable of facilitating the rapid dissemination of emergency information to the public. B. Objectives 1. Describe the EAS administrative structure within Minnesota. (See Section V) 2. -

WENJ(FM), WFPG(FM), WPGG(AM), WPUR(FM), WSJO(FM) EEO PUBLIC FILE REPORT February 1, 2020 - January 31, 2021

Page: 1/6 WENJ(FM), WFPG(FM), WPGG(AM), WPUR(FM), WSJO(FM) EEO PUBLIC FILE REPORT February 1, 2020 - January 31, 2021 I. VACANCY LIST See Section II, the "Master Recruitment Source List" ("MRSL") for recruitment source data Job Title Recruitment Sources ("RS") RS Referring Used to Fill Vacancy Hiree Account Executive 1-12, 14-23 14 Page: 2/6 WENJ(FM), WFPG(FM), WPGG(AM), WPUR(FM), WSJO(FM) EEO PUBLIC FILE REPORT February 1, 2020 - January 31, 2021 II. MASTER RECRUITMENT SOURCE LIST ("MRSL") RS RS Information Source Entitled No. of Interviewees Number to Vacancy Referred by RS Notification? Over (Yes/No) Reporting Period 1 Allied Personnel Services N 0 91 Larry Holmes Drive, Suite 110 Easton, Pennsylvania 18042 Phone : 610-253-9779 Fax : 1-610-253-6183 Dan Corpora 2 Atlantic Community College N 0 Route 322 Mays Landing, New Jersey 08330 Phone : 609-343-5109 Email : [email protected] Fax : 1-609-343-5030 Joe Rossi 3 Atlantic County Department of Family and Community N 0 Development 1333 Atlantic Ave. 2nd Floor Atlantic City, New Jersey 08401 Phone : 609-345-6700 x2735 Email : [email protected] Fax : 1-609-343-2374 Rhonda Fleming-Lowery 4 Brookdale Community College N 0 765 Newman Springs Rd. Lincroft, New Jersey 07738 Phone : 732-224-2572 Email : [email protected] Fax : 1-732-224-2580 Linda Mass 5 Caldwell College N 0 9 Ryerson Ave. Room 4102 Caldwell, New Jersey 07006 Phone : 973-618-3536 Fax : 1-973-618-3425 Judy Casey 6 Camden County OEO/Urban Women's Center N 0 900 Broadway Camden, New Jersey 08103 Phone : 856-365-8989 Email : [email protected] Fax : 1-856-365-8009 G. -

List of Radio Stations in Texas

Not logged in Talk Contributions Create account Log in Article Talk Read Edit View history Search Wikipedia List of radio stations in Texas From Wikipedia, the free encyclopedia Main page The following is a list of FCC-licensed AM and FM radio stations in the U.S. state of Texas, which Contents can be sorted by their call signs, broadcast frequencies, cities of license, licensees, or Featured content programming formats. Current events Random article Contents [hide] Donate to Wikipedia 1 List of radio stations Wikipedia store 2 Defunct 3 See also Interaction 4 References Help 5 Bibliography About Wikipedia Community portal 6 External links Recent changes 7 Images Contact page Tools List of radio stations [edit] What links here This list is complete and up to date as of March 18, 2019. Related changes Upload file Call Special pages Frequency City of License[1][2] Licensee Format[3] sign open in browser PRO version Are you a developer? Try out the HTML to PDF API pdfcrowd.com sign Permanent link Page information DJRD Broadcasting, KAAM 770 AM Garland Christian Talk/Brokered Wikidata item LLC Cite this page Aleluya Print/export KABA 90.3 FM Louise Broadcasting Spanish Religious Create a book Network Download as PDF Community Printable version New Country/Texas Red KABW 95.1 FM Baird Broadcast Partners Dirt In other projects LLC Wikimedia Commons KACB- Saint Mary's 96.9 FM College Station Catholic LP Catholic Church Languages Add links Alvin Community KACC 89.7 FM Alvin Album-oriented rock College KACD- Midland Christian 94.1 FM Midland Spanish Religious LP Fellowship, Inc.