Mallstreams and Attribution Case Study: Tale of Two Malls

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

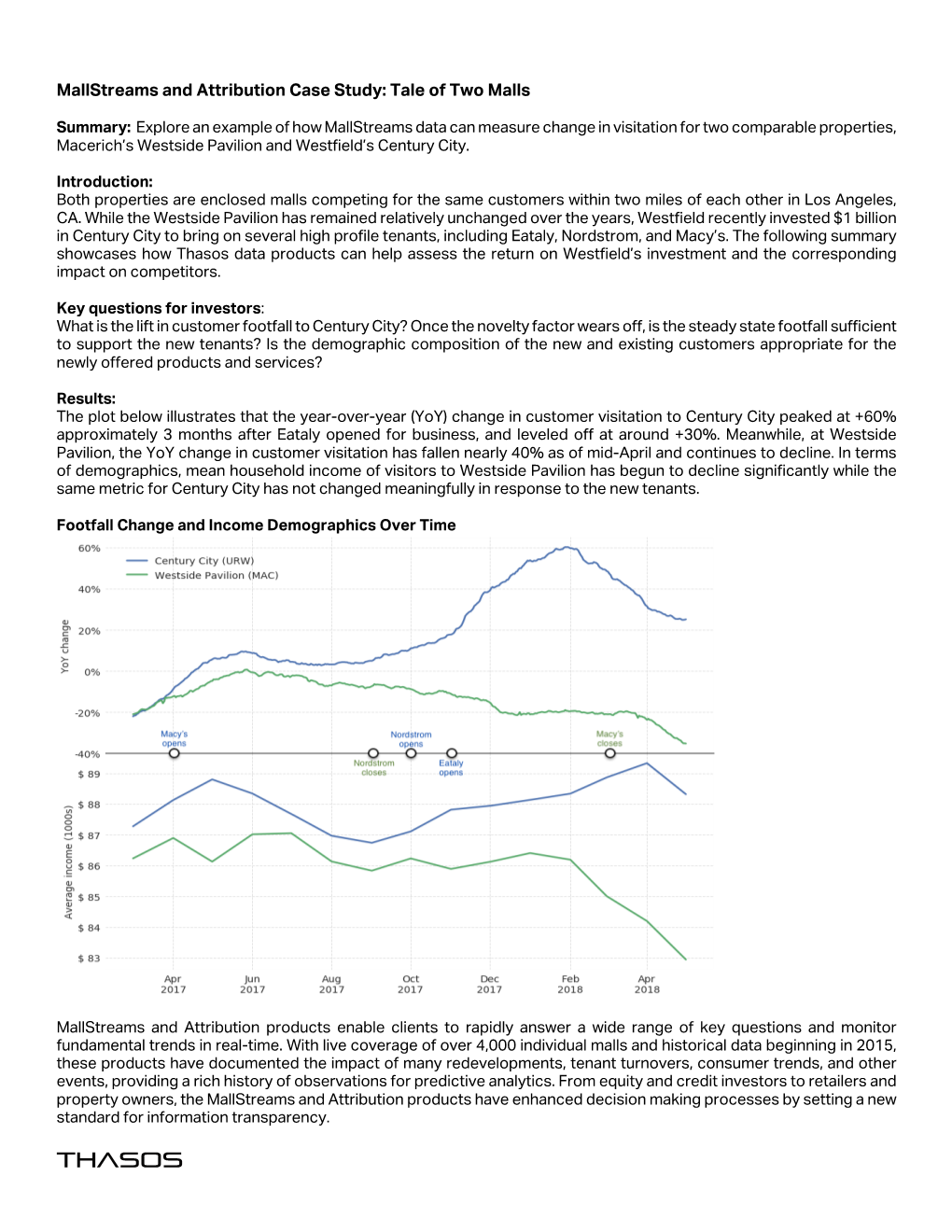

-

Candidates Present Diverse Visions for L.A. 4Th Council District

BEVERLYPRESS.COM INSIDE • Local merchants mourned pg. 3 Sunny, with • Rapper killed in highs in the Hollywood Hills 70s pg. 4 Volume 30 No. 8 Serving the Beverly Hills, West Hollywood, Hancock Park and Wilshire Communities February 20, 2020 PAC supporting incumbents Candidates present diverse visions criticized in Beverly Hills for L.A. 4th Council District n Group’s funding individuals that list Beverly Hills n largely comes from addresses: Dominium Management Incumbent, three Corporation, which donated challengers participate real estate developers $9,500; Gearys Beverly Hills, which donated $9,000; Steven in Los Feliz forum BY CAMERON KISZLA Gordon, who donated $9,500; Stephen Massman, who donated BY EDWIN FOLVEN A political action committee with $9,999 and is listed as the PAC’s Homelessness, housing, trans- many contributors connected to the treasurer; Outsourcing portation and pedestrian safety real estate and development indus- Management Concepts Inc., which were primary topics at a forum on try has made waves in the Beverly donated $5,000; S&A Realty Corp., Feb. 16 for candidates running in Hills City Council race. which donated $9,999; and Rodeo Los Angeles City Council’s 4th The PAC, Beverly Hills United Family LLC, which gave $9,500. District race. to Support Bosse and Gold for Thomas Blumenthal, CEO of Candidates Susan Collins, Council 2020, has sent out mailers Gearys Beverly Hills, said the busi- Sarah Kate Levy and Nithya and placed advertisements on ness is predominantly located in Raman joined incumbent photo by Edwin Folven Beverly Hills, and Gearys wanted behalf of the incumbents, Dr. -

2019 North America Design and Development Awards Winners

2019 North America North America Design and Development Awards Winners RENOVATIONS Retail Projects under 150,000 sq. ft. of total retail space GOLD Los Angeles International Airport (LAX) Terminal 1 Los Angeles, California Development Company: Unibail-Rodamco-Westfield Airports, LLC (URW Airports) Owner: Los Angeles World Airports Design Architects: PGAL (base-building architect); URW (commercial fit-out) Production/Executive Architects: Corgan Lighting Designers: Lighting Design Alliance General Contractors: Hensel Phelps (common areas); PCL Construction (marketplace) Management/Leasing Company: URW The partnership between Los Angeles World Airports, Southwest Airlines and Unibail-Rodamco-Westfield Airports, resulted in the spectacular transformation of Los Angeles International Airport’s Terminal 1. The $517 million curb-to-gate project incorporated a modernized check-in experience, fully automated baggage systems, updated and expanded restrooms, new customer boarding bridges, unobstructed sightlines, and enhanced waiting lounge environments. The New T1 also offers more than 23,500 square feet of retail and food-and- beverage tenants, including 13 introductory brands and eight airport firsts, to provide commuters with a blending of the city’s celebrated brands alongside national stalwarts. The interior east-meets-west design features origami inspired architectural elements, accented with unexpected pops of color, patterns, sculptures, and lighting fixtures, to add whimsy and create selfie- worthy backdrops. 1 2019 North America Design -

Malled by Westfield

Malled by West!eld: The Consequences of Corporate Property Tax Avoidance August 2013 LG:dso opeiu 537, a!-cio 8/13 Executive Summary With 21 shopping malls statewide, the West"eld Group is California’s largest retail landlord. It is also a leader in corporate tax avoidance. The West"eld Group routinely publishes two di#erent values for its properties in California. The "rst value, which it reports to shareholders, is high. The second value, which it reports to the state, is low. As a result, we estimate that West"eld underpays property taxes by about $41 million per year.1 If West"eld paid its fair share of taxes, it would bring in additional annual revenues of: $18.7 million for Los Angeles County; $8.1 million for San Diego County; and $9.8 million for Santa Clara County. Such additional revenues could be spent to improve public education, bolster police and "re services and generally raise the quality of public services across the State of California. 1 The authors have examined assessed values and shareholder reported values for all of .BMMFECZ8FTUöFME5IF$POTFRVFODFTPG$PSQPSBUF1SPQFSUZ5BY"WPJEBODFt"VHVTU West!eld: A Global Giant and California’s Largest Retail Landlord The West"eld Group (WDC), by market value, is the largest retail property group in the world and the ninth largest company on the Australian Stock Exchange.2 Sydney-based West"eld owns and operates 100 malls in Australia, New Zealand, the United States and the United Kingdom with 21,997 retail outlets in 9.5 million square meters of retail space.3 In 2012, West"eld malls had more than 1.1 billion customer visits, which generated $41.5 billion in retail sales.4 West"eld’s global property portfolio was valued at $66.5 billion.5 In 2012, West"eld made a net pro"t of $1.78 billion and was managing a $12.44 billion development pipeline.6 By most measures, the United States is the company’s largest and most important market. -

2019 INVESTOR DAYS 4 the Westfield Acquisition Rationale

INVESTOR DAYS LONDON - JUNE 13-14, 2019 THE KEY ISSUES WE WANT TO ADDRESS DURING THESE TWO DAYS 1 2 3 THE WFD ACQUISITION OUR BALANCE SHEET, OUR STRATEGY & THE FUTURE DISPOSALS & IN THE US AND UK OF RETAIL DIVIDEND SUSTAINABILITY 4 5 IS OUR EUROPEAN WILL THE UR WAY GROWTH WORK IN THE SUSTAINABLE? FORMER WFD BUSINESS? THE WESTFIELD ACQUISITION The Westfield acquisition fits our strategy perfectly Concentration Differentiation Innovation 88% of ex-WFD GMV in Unique platform of assets Complementary expertise Flagship malls in key global in design, development, markets marketing, digital and commercial partnerships A unique opportunity to create a premier global operator 2019 INVESTOR DAYS 4 The Westfield acquisition rationale 1. Design the future of retail 2. Build the strongest portfolio to deliver consistent growth 3. Largest development pipeline to drive growth with flagship projects 4. Capitalize on best in class management teams 5. Synergies will deliver additional earnings and cash flows 6. Transaction to: Unlock NAV and REPS accretion €3.0 Bn of disposals to preserve strong balance sheet 7. Efficient structure for shareholders 8. Common strategy - clear action plan – best in class governance Westfield World Trade Center 2019 INVESTOR DAYS 5 The Westfield acquisition: what is different 1. Transaction diverted WFD senior management from US operations → delays in leasing and projects; no ex-UR input pending closing 2. Deterioration of retail environment in US and UK more severe than anticipated 3. Occupancy in recent developments 4. -

Mission Valley

MISSION VALLEY GERMANY CentrO - Oberhausen Gera Arcaden - Gera Gropius Passagen - Berlin Höfe am Brühl - Leipzig Minto - Mönchengladbach Palais Vest - Recklinghausen Pasing Arcaden - Munich Paunsdorf Center - Leipzig OUR PORTFOLIO Ring-Center - Berlin Ruhr Park - Bochum Westfield Hamburg- Überseequartier - Hamburg THE NETHERLANDS Citymall Almere - Almere SWEDEN Westfield Mall of Greater Stockholm the Netherlands - Leidschendam Westfield Mall of Scandinavia Stadshart Amstelveen - Amstelveen Nacka Forum SEATTLE Stadshart Zoetermeer - Zoetermeer Solna Centrum Westfield Southcenter Täby Centrum POLAND SAN FRANCISCO AREA Warsaw Westfield Galleria at Roseville UNITED KINGDOM DENMARK Westfield Arkadia Westfield Oakridge CHICAGO London Copenhagen Centrum Ursynów Westfield San Francisco Centre Westfield Old Orchard Westfield Stratford City Fisketorvet Galeria Mokotów Westfield Valley Fair Chicago O’Hare International CONNECTICUT Croydon Galeria Wileńska Westfield Meriden Westfield London Złote Tarasy Westfield Trumbull Wrocław Wroclavia BELGIUM Brussels CZECH REPUBLIC Mall of Europe Prague SLOVAKIA Westfield Chodov NEW YORK AREA Bratislava Bubny Westfield Garden State Plaza Aupark Centrum Černý Most Metropole Zličín Westfield South Shore ITALY Westfield Sunrise Milan Westfield World Trade Center Westfield Milano JFK International AUSTRIA Newark Liberty International Vienna Donau Zentrum Shopping City Süd WASHINGTON D.C. AREA Westfield Annapolis Westfield Montgomery Westfield Wheaton SPAIN FRANCE UNITED STATES Benidorm - Benidorm Westfield Carré Sénart - Greater Paris -

Los Angeles San Francisco

JCB优惠指南[美国・洛杉矶 / 旧金山] JCB Special Offers Guide 本优惠指南的使用方法 Los Angeles 洛杉矶 商铺 shop JCB推荐优惠店铺!优惠期限 到2014年6月末为止 1 Sanrio 25%OFF 除服装、玩具、饰品、小商品等 使用方法 原价购买的一件商品可以享受 25% 的 Hello Kitty的人气商品外,三 折扣优惠。※ 折扣商品除外。不可同其他优 在优惠店出示指南的优惠部分,并使 丽欧卡通人物也种类繁多,让 惠同时使用。仅限 1 次。 您爱不释手。 用JCB信用卡结账,即可享受相应的 Please provide customers with a special 25% discount 优惠指南 on single regular priced item. ※ Sale items excluded. JCB 优惠服务。 Cannot be combined with any other offers. One time usage only. JCB Special Offers Guide ※带有这一标识的信用卡均为JCB信用卡。 MAP 1. C-3 MAP 3 ※何时出示优惠部分﹕以优惠店规定为准。 1-1 Sanrio(South Coast Plaza) 1-2 Sanrio(Little Tokyo) 使用须知 注意事项 地 South Coast Plaza Level 1 地 115 Japanese Village Plaza Mall, Los 电 (714)979-2338 Angeles [美国·洛杉矶 / 旧金山] ※本指南中所刊登的优惠内容,报道和地图等均为 时 星期一至星期五 10:00AM 〜 9:00PM /星期 电 (213)620-0830 2013年6月的信息。一切信息均以JCB官网为准。若 有此标识的信用卡皆为 JCB 信用卡。 六 10:00AM〜8:00PM/星期日 11:00AM 〜 时 星期日至星期四 10:00AM 〜 10:00PM /星 优惠期限 因商户原因而导致刊登内容变更或优惠活动被终止 6:30PM 期五・六 10:00AM 〜 11:00PM ※ 节假日营 时,怒不提前告知,由此给您带来的不便敬请谅解。 休 感恩节、圣诞节 业时间可能发生变更。 休 感恩节、圣诞节 ※优惠服务,若无特别说明,原则上仅限JCB持卡人一人享受一次。 2013.7.1 - 2014.6.30 商铺 shop ※如付款时未出示本指南或付款后再出示,或与商户直接交涉价格时不能享受指南中刊载的优惠,敬请注意。 ※此优惠不得与其他优惠并用,敬请谅解。 American Eagle Outfitters ※特价商品以及特惠期间,会有不可享受优惠的可能。 2 15%OFF ※原则上消费税以及餐厅服务费不在优惠范围内。 American Eagle Outfitters 原价 15%的折扣优惠。 ※有关顾客与商户对商品,服务以及优惠而发生的一切纠纷,JCB均不承担责任,敬请谅解。 为您提供高品质现代时尚 ※ 礼品卡・税金・运费・服务费除外。 不可 ※已预约的情况下如需取消,请致电店方。 服装和饰品, 价格公道, 同其他优惠同时使用。 任您挑选。 Please provide customers with a special 15% discount. CODE:1110001532819 * 窗口服务! ※ Valid July 1, 2013 through June 30, 2014. This original coupon(no copies)must be presented at the American Eagle Outfitters store register with JCB Card. -

The Westside Neigbourhoods

NEIGHBOURHOOD FACTSHEET PETERSEN AUTOMOTIVE MUSEUM The Westside neigbourhoods The westside is known for its top restaurants, high-end shopping, SUGGESTED DINING palm tree lined streets and acclaimed cultural attractions. Beverly Hills: Maude Century City: Hinoki & the Bird is known worldwide as a premier destination for luxury. Beverly Hills: Mid-City/Mid-Wilshire: The Original Farmer’s Market Stroll along world-famous Rodeo Drive and admire the incomparable Westwood: 800 Degrees Neapolitan Pizzeria designer boutiques. Sawtelle/Japantown: Tsujita Artisan Noodles Century City: Born from the backlot of historic Fox Studios, Century City Brentwood: Brentwood County Mart is home to gleaming high rises and luxe hotels, where movers and shakers Culver City: Helms Bakery District work and play. SHOPPING Mid-City/Mid-Wilshire: is a vital hub for culture, art and dining. Stroll Beverly Hills: Rodeo Drive & Beverly Centre through the La Brea Tar Pits and peruse the impressive collection of Century City: Westfield Century City exhibits at the L.A. County Museum of Art. Shop at The Grove and grab a Mid-City/Mid-Wilshire: The Grove & Original bite at The Original Farmer’s Market. Farmer’s Market Westwood: Visit the UCLA campus or explore the Hammer Museum’s Westwood: Westwood Village renowned collections of modern and Impressionist art. Sawtelle/Japantown: Sawtelle Blvd Brentwood: Brentwood County Mart a slice of Japanese culture on the Westside. The Sawtelle/Japantown: Culver City: Westfield Culver City historic neighbourhood has become a foodie paradise, home to authentic Japanese restaurants, modern eateries, artisan coffee and ramen shops. TRANSPORTATION Take Metro Expo Line from Culver City Brentwood: is one of L.A.’s most affluent neighbourhoods, known for its Downtown: palatial estates, tree-lined streets, A-list residents and home of the famed towards Union Station – 45 mins Getty Center. -

1 List of Group's Standing Assets 1. France: Shopping

LIST OF GROUP’S STANDING ASSETS 1. FRANCE: SHOPPING CENTRES GLA of Portfolio as at Dec. 31, 2020 the whole complex Consolidation method1 (sqm) SHOPPING CENTRES IN THE PARIS REGION Westfield Carré Sénart (Lieusaint) 155,500 FC Westfield Les 4 Temps (La Défense) 142,000 FC Westfield Parly 2 (Le Chesnay) 129,800 FC Westfield Vélizy 2 (Vélizy-Villacoublay) 124,300 FC Westfield Rosny 2 (Rosny-sous-Bois) 114,500 FC & EM-JV Aéroville (Roissy-en-France) 84,900 EM-A Westfield Forum des Halles (Paris 1) 75,700 FC So Ouest (Levallois-Perret) 56,900 EM-A Ulis 2 (Les Ulis) 54,200 FC CNIT (La Défense) 28,400 FC L'Usine Mode & Maison (Vélizy-Villacoublay) 21,100 FC Carrousel du Louvre (Paris 1) 13,500 FC Les Ateliers Gaîté2 (Paris 14) n.a FC SHOPPING CENTRES IN THE FRENCH PROVINCES La Part-Dieu (Lyon) 156,400 FC La Toison d’Or (Dijon) 78,700 EM-A Polygone Riviera (Cagnes-sur-Mer) 75,200 FC Westfield Euralille (Lille) 67,700 FC Villeneuve 2 (Villeneuve-d'Ascq) 56,600 FC Rennes Alma (Rennes) 55,700 EM-A Confluence (Lyon) 53,900 EM-A La Valentine (Marseille) 39,500 FC OTHER ASSETS Bel-Est (Bagnolet) 48,800 FC Aquaboulevard (Paris) 38,400 FC Maine Montparnasse (Paris) 35,500 FC Villabé (Corbeil) 35,300 FC Go Sport (Saintes) 2,500 FC 1 FC = Fully Consolidated; EM-JV = Joint Venture under the equity method; EM-A = Associates under the equity method; JO = Joint Operation. 2 Under redevelopment. 1 2. FRANCE: OFFICES & OTHERS Total floor space Portfolio as at Dec. -

RETAIL CENTERS NEXT WEEK the LIST Ranked by Gross Leasable Area Public Companies

10 LOS ANGELES BUSINESS JOURNAL JULY 15, 2019 RETAIL CENTERS NEXT WEEK THE LIST Ranked by gross leasable area Public Companies Rank Retail Center Gross Profile Year Anchors Owner General Manager • name Leasable Area • stores Opened • name • name • address • square feet • parking spaces • headquarters • phone Del Amo Fashion Center 2,371,068 240 1975 AMC 18 Theatres, Barnes & Noble, Burlington, Crate & Simon Property Group Nathan Svihlik 1 3525 Carson St. 11,453 Barrel, Dave & Buster's, Dick's Sporting Goods, Inc. (310) 542-8525 Torrance 90503 JCPenney, LA Fitness, Macy's, Marshalls, Nordstrom, Indianapolis Sears Lakewood Center 2,166,115 285 1951 24 Hour Fitness, Albertsons, Bed Bath & Beyond, Best Macerich Co. Deena Henry 2 500 Lakewood Center Mall 8,329 Buy, Burlington, Costco, Forever 21, JCPenney, Macy's, Santa Monica (562) 531-6707 Lakewood 90712 Target, The Home Depot Westfield Topanga 2,109,018 263 1964 Macy's, Neiman Marcus, Nordstrom, Target Unibail-Rodamco- Molly Unger 3 6600 Topanga Canyon Blvd. 6,145 Westfield (818) 594-8732 Canoga Park 91303 Paris Westfield Santa Anita 1,476,319 254 1974 AMC Theatres, Dave & Buster's, Gold's Gym, JCPenney, Unibail-Rodamco- Greg Ramirez 4 400 S. Baldwin Ave., Suite 231 6,199 Macy's, Nordstrom Westfield (626) 445-3116 Arcadia 91007 Paris Northridge Fashion Center 1,407,532 185 1971 Dave & Buster's, JCPenney, Macy's, Macy's Men/Home, Brookfield Properties Daniyel John 5 9301 Tampa Ave. 7,000 Pacific Theatres 10Plex, Sears Retail Group (818) 885-9700 Northridge 91324 Chicago Glendale Galleria 1,336,292 204 1976 Bloomingdale's, Dick's Sporting Goods, Gold's Gym, Brookfield Properties Brent Gardner 6 100 W. -

Tue & Wed Open House Directories

140 | TUESDAY, JUNE 5, 2018 THE MLS BROKER CARAVAN™ | TUE & WED CHECKLIST REFRESHMENTS LUNCH THEMLSPRO™ OPEN HOUSES TUE & WED OPEN HOUSE DIRECTORIES 1284 Highland Park Single Family 18-349332 11-2 6233 TIPTON WAY rev $749,000 2+1 * 18-349546 11-2 6130 POPPY PEAK DR rev $679,000 2+1 * 2045 Valley Glen Single Family 18-347476 11-2 6230 VENTURA CANYON AVE NEW $768,000 2+2 p.188 11-2 6136 NAGLE AVE NEW $747,000 3+2.5 p.188 WEDNESDAY OPEN HOUSE DIRECTORY 10 West Hollywood Vicinity Income 18-347424 11-1 905 N GENESEE AVE NEW $1,725,000 * 11 Venice Condo / Co-op 18-349030 6-8 2439 WALNUT AVE rev $1,999,000 4+4 * FREE REALTOR® Member Login For Access 15 Pacific Palisades Condo / Co-op to Agent Features 18-340492 10-5 17314 TRAMONTO DR #801 rev $5,185,990 4+5 * 18-341042 10-5 17318 TRAMONTO #602 rev $5,136,990 3+4 * 18-341058 10-5 17318 TRAMONTO #601 rev $4,885,990 3+4 * 18-341052 10-5 17322 TRAMONTO #305 rev $3,003,990 2+4 * 32 Malibu Beach Lease 16-181076 10-12:30 21010 PACIFIC COAST HWY NEW $23,500 3+3 * 33 Malibu Lease 18-348128 10-12:30 2002 LAS FLORES CANYON RD NEW $8,000 2+3 * 71 East Van Nuys Single Family 18-335464 1-5 14109 MONROE PL rev $671,990 3+4 * 18-335354 1-5 14122 MONROE PL rev $647,990 3+4 * 86 Pasadena Condo / Co-op 18-348646 2-5 358 W GREEN ST #112 rev $3,097,990 3+4 * 18-348674 2-5 358 W GREEN ST #212 rev $2,986,990 3+4 * 18-349192 2-5 358 W GREEN ST #111 rev $2,897,990 3+4 * 18-348700 2-5 358 W GREEN #211 rev $2,765,990 3+4 * Special Features for REALTOR® Members 17-298264 2-5 382 W GREEN ST #135 rev $2,656,990 4+5 * 18-341018 -

Shopping Malls Designed for Diversity, JANUS Et Cie Furnishings Are Cleverly Suited to Shopping Centers, Cafés, Cafeterias and Lounges

Shopping Malls Designed for diversity, JANUS et Cie furnishings are cleverly suited to shopping centers, cafés, cafeterias and lounges. In addition to function and durability, our collections celebrate variety—of form, material, application, and color. Dining and lounge styles range from classic to contemporary, and are available to suit a variety of budgets. Each design is precisely engineered, exquisitely manufactured, and skillfully finished using processes that combine the latest industrial technologies with the expert touch of a craftsman’s hand. ANNAPOLIS MALL, MD DEVARGES CENTER, NM AUCHAN SHOPPING CENTER LUXEMBOURG, FRANCE EASTON TOWN CENTER, OH BARTON CREEK SQUARE MALL, TX ERIN MILLS, ONTARIO, CANADA CENTURY CITY SHOPPING CENTER, CA FASHION ISLAND, CA CITADEL, AZ FIRST COLONY MALL, TX COASTLAND MALL, FL GOLDEN HALL, GREECE ©2018 JANUS et Cie® All rights reserved. JANUS et Cie and the Topiary logo are trademarks and service marks of JANUS et Cie, registered in the United States and in several other countries. Our tag lines, slogans, photography and the designs of certain furniture are also the proprietary intellectual property of JANUS et Cie. All third party marks and third party photographs are used with permission from their respective owners. Violation of JANUS et Cie’s intellectual property rights will be prosecuted to the fullest extent of the law. HALIFAX MALL, CANADA NORTH STAR MALL, TX IRVINE CENTER, CA OAKBROOK CENTER, IL LA PIAZZA, VA PARK PLACE LEXUS, TX LA PLAZA, TX PARTRIDGE CREEK STERLING HEIGHTS, MI LONDONDERRY MALL, ONTARIO, CANADA RIVERWALK MALL, LA MALL OF AMERICA, MN SHERMAN OAKS GALLERIA, CA ©2018 JANUS et Cie® All rights reserved. -

Retail Centers Renovate, Redevelop and Re-Tenant to Remain Relevant

Retail centers renovate, redevelop and re-tenant to remain relevant jllretail.com 2 Retail Research Point of View | United States | 2017 U.S. malls have spent billions of dollars on renovations to captivate shoppers with food and fun, foster community connections and elevate curb appeal Some enclosed malls are just more popular than others. Top malls boast low vacancy rates and command significantly higher rents. For example, the 81 top tier US malls command average asking rents of $72.44 per square foot1, more than 3.5 times higher than the average asking rent of the second tier of malls. Mall performance is based partially on the quality of the neighborhood in which it’s located—not much a mall can do to change that. But, improved aesthetics coupled with an appealing tenant mix can affect footfall and a mall’s value. And luckily for owners and investors, these elements can be changed and enhanced. JLL has studied 90 malls that have taken control of some or all of these elements in the past four years. Image Source: Shutterstock 1 September 2017 JLL analysis of regional and super-regional mall asking rents 3 Retail Research Point of View | United States | 2017 Renovate or redevelop We looked at 90 super regional and regional shopping centers2 that are currently undergoing or have completed a significant renovation since 2014. More than one-half of malls reported on renovation budgets, and of those, more than $8 billion3 has been spent upgrading retail space across the U.S. Most major mall renovations fall into four categories: • Food