Make Your Life Abroad Even More Rewarding with HSBC Expat

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tariff of Charges

HSBC Expat Tariff of Charges The prices and information in this Tariff Details of other charges not listed are form part of the Terms that apply to your available by calling +44(0) 1534 616313 account. The information, rates and prices for Premier customers and, for Advance in this Tariff of Charges (“Tariff”) are correct customers, please call +44(0) 1534 616212. as at 28 September 2021. To help us to continually improve our The information, fees, rates and prices service, and in the interest of security, in this Tariff apply to your HSBC Expat we may monitor and/or record your account. communications with us. References in this Tariff to the UK also include Jersey. Where fees are quoted in sterling, we reserve the right to convert the fee into the currency of the account to which the fee relates. Such conversions will be made at the HSBC Expat exchange rate that is prevailing when we take the fee. ELIGIBILITY CRITERIA FOR HSBC EXPAT Minimum Relationship Annual Sole Underfunding Service Balance Salary Fee HSBC Premier £50,000* or £100,000* £35* HSBC Advance £15,000* N/A £15* * or currency equivalent Our fees are usually deducted on the fifth working day of the month, or the next working day after the fifth. PREMIER Customers who qualify as an HSBC Premier customer in any other part of the HSBC Group are automatically eligible for our HSBC Premier service. Therefore such customers already fulfill the minimum requirements for Premier service and do not have to maintain the Relationship Balance or the Annual Sole Salary threshold with HSBC Expat. -

Outward Payment Instruction

1 OUTWARD PAYMENT INSTRUCTION To make safe and secure payments online, why not visit our website at www.expat.hsbc.com to find out more details about our Internet Banking service. PLEASE TICK THIS BOX IF YOU ARE A PREMIER CUSTOMER: Yes No PLEASE COMPLETE THE FORM IN BLOCK CAPITALS DETAILS OF ACCOUNT TO BE DEBITED ACCOUNT NAME SORT CODE (For an Offshore ACCOUNT NUMBER Bank Account only) CURRENCY OF ACCOUNT TO BE DEBITED BANK NAME HSBC BANK PLC, JERSEY BRANCH ADDRESS HSBC HOUSE, ESPLANADE, ST HELIER, JERSEY CLICK TO CHOOSE WHICH CURRENCY PAYMENT IS TO BE MADE IN: y AUSTRALIAN DOLLAR y CANADIAN DOLLAR y CHINESE RENMINBI y CZECH KORUNA y DANISH KRONE y EURO y HONG KONG DOLLAR y HUNGARIAN FORINT y ISRAELI SHEKEL y JAPANESE YEN y NEW ZEALAND DOLLAR y NORWEGIAN KRONE y PHILIPPINE PESO y POLISH ZLOTY y SAUDI RIYAL y SINGAPORE DOLLAR y SOUTH AFRICAN RAND y STERLING y SWEDISH KRONA y SWISS FRANC y THAI BAHT y UAE DIRHAM y US DOLLAR CURRENCY OF PAYMENT AMOUNT OF PAYMENT AMOUNT OF PAYMENT IN WORDS VALUE DATE FOR FOREIGN EXCHANGE RATE TRANSACTIONS (Payment date) (If already agreed) SPT (Where agreed) DETAILS OF ACCOUNT TO BE CREDITED BANK NAME ADDRESS SWIFT (if known) FOR UK TRANSFERS: BANK SORTING CODE US DOLLAR: OTHER LOCAL FEDWIRE ROUTING NO. CLEARING CODE ACCOUNT NUMBER/IBAN BENEFICIARY ACCOUNT NAME BENEFICIARY ADDRESS IF KNOWN OR PREVIOUSLY PROVIDED, PLEASE SUPPLY NAME, ADDRESS AND SWIFT OF INTERMEDIARY BANK MESSAGE OR INSTRUCTION TO BENEFICIARY PURPOSE OF PAYMENT HSBC EXPAT: AND BENEFICIARY/FOREIGN BANK: PLEASE SELECT WHO DEDUCT FROM THE PAYMENT DEBIT FINAL DESTINATION WILL PAY FOR CHARGES TO MAKE THIS TRANSFER: DEBIT MY ACCOUNT AND SEND DEBIT MY/OUR ACCOUNT WITH FULL PAYMENT AMOUNT HSBC BANK INTERNATIONAL CUSTOMER AUTHORISATION SIGNATURE OF CUSTOMER/S next DATE OF SIGNATURE print 2 This OUTWARD PAYMENT INSTRUCTION should be sent to: HSBC Expat For any queries, please telephone us at: HSBC House Premier Customers: Ridgeway Street +44 1534 616313 Douglas Isle Of Man International Direct Banking: IM99 1BU +44 1534 616000 Lines are open 24 hours a day, 7 days a week. -

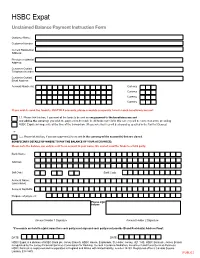

Unclaimed Balances Payment Form

HSBC Expat Unclaimed Balance Payment Instruction Form Customer Name: Customer Number: Current Residential Address: Previous residential Address: Customer Contact Telephone Number: Customer Contact Email Address: Account Number(s): Currency Currency Currency Currency If you wish to send the funds to MULTIPLE accounts, please complete a separate form for each beneficiary account. 1.1. Please tick this box, if you want all the funds to be sent as one payment to the beneficiary account and advise the currency you wish the payment to be made in. All funds not held in this currency will be converted at the prevailing HSBC Expat exchange rate at the time of the transaction. (Please note that fees will be charged as specified in the Tariff of Charges) or 1.2. Please tick this box, if you want payment(s) to be sent in the currency of the account(s) that are closed. BENEFICIARY DETAILS OF WHERE TO PAY THE BALANCE OF YOUR ACCOUNT(S): Please note the balance can only be sent to an account in your name. We cannot send the funds to a third party. Bank Name: Address: Sort Code: Swift Code: Account Name: (your name) Account No/IBAN: Purpose of payment: Please sign below: Account Holder 1 Signature Account Holder 2 Signature *If accounts are held in a joint name then each party must sign and each party must provide ID and Residential Address Proof. DATE:Date DATE: HSBC Expat is a division of HSBC Bank plc, Jersey Branch: HSBC House, Esplanade, St. Helier, Jersey, JE1 1HS. HSBC Bank plc, Jersey Branch is regulated by the Jersey Financial Services Commission for Banking, General Insurance Mediation, Investment and Fund Services Business. -

Annual Report and Accounts 2020

HSBC Bank plc Annual Report and Accounts 2020 Contents Cautionary Statement Regarding Forward- Looking Statements Page Strategic Report This Annual Report and Accounts 2020 contains certain forward- Highlights 2 looking statements with respect to the financial condition, results Responding to the new environment 3 of operations and business of the group. Key financial metrics 3 Purpose and strategy 4 Statements that are not historical facts, including statements about the group’s beliefs and expectations, are forward-looking Products and services 6 statements. Words such as ‘expects’, ‘anticipates’, ‘intends’, How we do business 7 ‘plans’, ‘believes’, ‘seeks’, ‘estimates’, ‘potential’ and ‘reasonably Key Performance Indicators 12 possible’, variations of these words and similar expressions are Economic background and outlook 13 intended to identify forward-looking statements. These statements Financial summary 14 are based on current plans, estimates and projections, and Risk overview 20 therefore undue reliance should not be placed on them. Forward- Report of the Directors looking statements speak only as of the date they are made. HSBC Risk 22 Bank plc makes no commitment to revise or update any forward- – Our approach to risk 22 looking statements to reflect events or circumstances occurring or – Top and emerging risks 23 existing after the date of any forward-looking statement. – Areas of special interest 27 – Our material banking and insurance risks 31 Forward-looking statements involve inherent risks and Capital 72 uncertainties. Readers are cautioned that a number of factors Corporate Governance Report 86 could cause actual results to differ, in some instances materially, – Directors 86 from those anticipated or implied in any forward-looking – Company Secretary 88 statement. -

What Did You Miss Last Month? Currencies Global

3 December 2019 What did you miss last month? Currencies Global Tariff rollback in talks, UK Conservatives lead, and rising geopolitical tensions Reports suggest the US and China agree to roll back tariffs in ‘phases’ Conservatives lead in UK General Election opinion polls New record lows for some LatAm currencies versus the USD Key Dates November 1 US non-farm payrolls 128k versus 85k expected November 5 US ISM non-manufacturing 54.7 versus 53.5 expected USD-RMB moves below 7.00 for the first time since August November 7 China reportedly agrees with the US to roll back tariffs in ‘phases’ The Bank of England keeps rates on hold; two members vote for a 25bp cut November 8 The Reserve Bank of Australia’s (RBA) monetary policy statement shows GDP forecast revised lower Canada net change in employment -1.8k versus 15.0k expected November 9 US President Trump describes the amount of tariffs the US is reportedly willing to roll back as “incorrect” November 11 Brexit Party leader Nigel Farage announces the party will not contest Conservative-held seats in the UK General Election November 12 National strike in Chile calls for President Piñera’s resignation November 13 The Reserve Bank of New Zealand keeps rates on hold at 1.00% versus a 25bp cut expected November 14 Australia unemployment rate 5.3% versus 5.2% expected November 19 The Bank of Canada’s Senior Deputy Governor Wilkins says policy rate still has “room to manoeuvre” November 22 US manufacturing flash PMI 52.2 versus 51.4 expected UK services flash PMI 48.6 versus 50.1 expected The European Central Bank’s President Lagarde states monetary policy will “undergo strategic review” November 25 The Federal Reserve’s Chair Powell describes the US economy’s glass as being “more than half full” November 26 The RBA’s Governor Lowe states quantitative easing (QE) not to be considered before a cash rate of 0.25% November 27 YouGov poll points to Conservative majority with 68 seats Currencies ● Global 3 December 2019 Summary – EUR-USD falling asleep The USD index (DXY) gained 0.9%1 in November. -

HSBC in India HSBC's Origins in India Date Back to 1853, When The

INTRODUCTION:- HSBC in India HSBC's origins in India date back to 1853, when the Mercantile Bank of India was established in Mumbai. The Bank has since, steadily grown in reach and service offerings, keeping pace with the evolving banking and financial needs of its customers. In India, the Bank offers a comprehensive suite of world-class products and services to its corporate and commercial banking clients as also to a fast growing personal banking customer base. Since our inception, we have entered new markets and launched innovative new products to help our clients seize investment opportunities around the world. Our origins The HSBC group was founded in Hong Kong in 1865 to finance trade between the China coast and Europe and the United States. Since then, the HSBC Group has expanded through both internal growth and acquisition. Members of the Group include HSBC Private Bank (UK) Limited (formerly Samuel Montagu & Co Limited), founded in 1853, HSBC Trinkaus & Burkhardt KG (1785), HSBC Guyerzeller Bank AG (1866), HSBC Bank USA (formerly Republic National Bank of New York) (1966) and Crédit Commercial de France (CCF, 1894). HSBC Private Bank (formerly HSBC (Republic) was established on 31 December 1999, when HSBC acquired Republic New York Corporation and Safra Republic Holdings, parent companies of Republic National Bank of New York. Founded in 1966 and built on a banking tradition established during the Ottoman Empire, Republic National Bank of New York specialized in private banking. Since then, our business has grown substantially, both organically and through acquisition. We are currently building a strong onshore business to complement our historical franchise. -

Douglas Blakey Speaks to the Ceo of Monitise

April 2016 Issue 724 www.retailbankerinternational.com CANDID CAMERON DOUGLAS BLAKEY SPEAKS TO THE CEO OF MONITISE ● STRATEGY: Ceska Sporitelna ● MARKETING: The Facebook Top 100 ● DISTRIBUTION: MUFG Union Bank ● ANALYSIS: Myanmar RBI 724.indd 1 04/04/2016 10:13:00 Multichannel digital solutions for fi nancial services providers To fi nd out more about us please visit: www.intelligentenvironments.com Intelligent Environments is an international provider of innovative mobile and online solutions for fi nancial services providers. Our mission is to enable our clients to always stay close to their own customers. We do this through Interact®, our single software platform, which enables secure customer acquisition, engagement, transactions and servicing across any mobile and online channel and device. Today these are predominantly focused on smartphones, PCs and tablets. However Interact® will support other devices, if and when they become mainstream. We provide a more viable option to internally developed technology, enabling our clients with a fast route to market whilst providing the expertise to manage the complexity of multiple channels, devices and operating systems. Interact® is a continuously evolving technology that ensures our clients keep pace with the fast moving digital landscape. We are immensely proud of our achievements, in relation to our innovation, our thought leadership, our industrywide recognition, our demonstrable product differentiation, the diversity of our client base, and the calibre of our partners. For many years we have been the digital heart of a diverse range of fi nancial services providers including Atom Bank, Generali Wealth Management, HRG, Ikano Retail Finance, Lloyds Banking Group and Think Money Group. -

View Annual Report

2008 HSBC Holdings plc Annual Review Strength, diversity and resilience HSBC Holdings plc 8 Canada Square London E14 5HQ United Kingdom Telephone: 44 020 7991 8888 Facsimile: 44 020 7992 4880 www.hsbc.com Contact Bermuda Overseas Branch Register HSBC Holdings plc Corporate Shareholder Services Incorporated in England with limited liability The Bank of Bermuda Limited Registered in England: number 617987 6 Front Street Hamilton HM11 Registered office and Bermuda Group Management Office Telephone: 1 441 299 6737 8 Canada Square London E14 5HQ ADR Depositary United Kingdom BNY Mellon Shareowner Services Telephone: 44 020 7991 8888 PO Box 358516 Facsimile: 44 020 7992 4880 Pittsburgh Web: www.hsbc.com PA 15252-8516 USA Registrars Telephone: 1 877 283 5786 Cover photography: Principal Register Contents Computershare Investor Services PLC Paying Agent (France) Strength, diversity and resilience PO Box 1064, The Pavilions HSBC France Customers are silhouetted Bridgwater Road 103 avenue des Champs Elysées against typhoon shutters as they Bristol BS99 3FA 75419 Paris Cedex 08 travel up an escalator to the Highlights of 2008 1 United Kingdom France Telephone: 44 0870 702 0137 Telephone: 33 1 40 70 22 56 banking hall of the HSBC Main Group at a Glance 2 Building in Central district, Hong Hong Kong Overseas Branch Register Stockbrokers Kong. The building overlooks Computershare Hong Kong Investor Goldman Sachs International Group Chairman’s Statement 4 Hong Kong harbour and Services Limited Peterborough Court protective shutters are lowered Rooms 1806-1807, 18th Floor 133 Fleet Street Operating Environment Hopewell Centre London EC4A 2BB when a typhoon is expected. -

Payment Into Your HSBC Expat Account Form

Payment into your HSBC Expat Account next 2 This form can help you transfer money into your account quickly and easily. Please send this form to your other bankers or the remitter only when we have advised you of your HSBC Expat account number. How do I use this form? Simply click onto your chosen currency below, complete all your details on screen, print the document and then forward to your other bankers or the remitter. Remember to have all your relevant account number/s to hand when completing this form. Why should I use this form? To help save you time, many of the sections in this form will be pre-filled at the touch of a button. Click below for the form you require: STERLING OTHER CURRENCIES back CP001482/170803/BW/240 © HSBC Bank plc 2017. All Rights Reserved. 3 INWARD PAYMENT INSTRUCTION GBP IMPORTANT: ONCE WE HAVE ADVISED YOU OF YOUR ACCOUNT NUMBER, PLEASE COMPLETE ALL YOUR DETAILS ON SCREEN, THEN PRINT AND SEND THIS FORM TO YOUR OTHER BANKERS OR THE REMITTER. PLEASE COMPLETE THE FORM IN BLOCK CAPITALS DETAILS OF ACCOUNT TO BE DEBITED BANK NAME BANK ADDRESS ACCOUNT NAME ACCOUNT NUMBER CURRENCY AND AMOUNT OF PAYMENT AMOUNT OF PAYMENT IN WORDS BENEFICIARY BANK DETAILS BANK NAME HSBC BANK PLC, JERSEY BRANCH ADDRESS HSBC HOUSE, ESPLANADE, ST HELIER, JERSEY CHANNEL ISLANDS POSTCODE JE1 1HS PLEASE SELECT ACCOUNT OTHER STERLING ACCOUNT TO BE CREDITED STERLING BANK ACCOUNT SORT CODE SWIFT CODE MIDLGB22 BENEFICIARY ACCOUNT NAME BENEFICIARY ACCOUNT NUMBER/IBAN MESSAGE TO BENEFICIARY/REFERENCE ADDITIONAL INFORMATION PURPOSE OF PAYMENT CUSTOMER SIGNATURE OF CUSTOMER/S AUTHORISATION DATE OF SIGNATURE MESSAGE TO REMITTING BANK WHEN SENDING FUNDS TO US, PLEASE SEND THEM BY ‘SWIFT’ TO MIDLGB22. -

HSBC Expat Banking Terms of Business These Banking Terms of Business Are Effective from 1St October 2017

HSBC Expat Banking Terms of Business These Banking Terms of Business are effective from 1st October 2017. Your agreement with us consists of these Banking Terms of Business, which include Section 1 (General Terms), Section 2 (Your Accounts), Section 3 (Product Conditions) and Section 4 (General Information), together with any Additional Conditions that apply to any products/services that you have with us (together known as the “Terms”). Additional Conditions include the following, as applicable to your product/service: • all interest rates and charges that apply to the relevant product/service and are covered in the Tariff of Charges applicable to your product/service, and on our website at http://www.expat.hsbc.com/1/2/hsbc-expat/terms (and which are available by telephoning us. HSBC Premier customers please call +44(0) 1534 616 313 and HSBC Advance customers please call +44(0) 1534 616 212); and • any further terms we provide to you. If any Additional Conditions contradict these Banking Terms of Business, then the Additional Conditions will apply. 2 Contents Section 1 General Terms 4 General 4 Telephone Banking Service 5 Online Banking Service 6 Security Details 6 Collection and use of your information 7 Changing the Terms – general information 10 Interest Rate Charges 10 Other changes to the Terms 10 Reasons for making changes 10 Other reasons for making changes 11 What you can do when we tell you about a change 11 Section 2 Your Accounts 11 Opening an account 11 Operating your account(s) 11 Payments into your account(s) 12 Payments -

Layout 1 (Page 1)

BUSINESS WITH PERSONALITY HOW TO BECOME A TRAVEL TOURING GREAT ENTREPRENEUR AMERICA’S WILD WEST IN OUR SIX POINT GUIDE P29 STYLE P30 Issue 1,525 Monday 5 December 2011 www.cityam.com FREE Life science CALLS FOR PM TO firms to get £180m fund ▲ POLITICS PROTECT THE CITY BY DAVID CROW DAVID Cameron will today unveil a ▲ POLITICS new £180m fund to help firms in the BY TIM WALLACE life science sector bring their prod- ucts to market more quickly, as part A RECORD 49 new EU regulations are of a new strategy designed to boost about to hit the City, prompting calls Britain’s biomedical industry. from industry groups, think-tanks and The Prime Minister hopes the fund Tory MPs for David Cameron to do will help bridge the so-called “valley more to protect British interests at a of death” – the period between when European level. a firm conceives a new drug or med- A tidal wave of rules, covering areas ical technology and the moment at from derivatives trading to the loca- which the market is ready to invest tion of clearing houses and short-sell- in it. ing to insurance, will hit the UK The government says that private disproportionately hard, think tank investors want to see evidence that Open Europe warns today in a compre- products will work in humans – hensive report underlining the creep rather than laboratory animals – of European financial legislation. meaning that some of the best inno- John Redwood, the influential vations never see the light of day. Conservative MP, told City A.M. -

Your HSBC Expat Visa Debit Card Guide

C M Y K Your HSBC PMS ??? PMS ??? Expat Visa PMS ??? PMS ??? Non-printing Debit Card Guide Colours COLOUR COLOUR JOB LOCATION: Whether you’re new to PRINERGY 3 debit or seeking a refresher, read this guide for handy tips and helpful hints HSB-NRFB1530-MCP54989.indd 1 04/05/2020 17:30 2 Your HSBC Debit Card Using your card in shops and online More than just a card. Whether you are shopping in-store, online or travelling abroad Paying for goods and services around the world your HSBC Debit Card can come in handy. As well as making You can use your HSBC Visa Debit Card wherever you see purchases quickly, safely and securely you can also withdraw the Visa logo to pay for goods and services or to get cashback. cash - just look out for the Visa logo. You can spend up to the balance on your account, or the amount of any arranged overdraft and details of all transactions ® Quick, easy and secure - shop with confidence whether will be shown on your statements. You cannot withdraw your in-store, online or telephone consent to make a card payment after you have authorised it, ® Make payments or cash machine withdrawals wherever but a retailer or supplier may make a refund. We will credit your *1 you are – simply look out for the Visa logo account when we receive the refund. Your card doesn’t need to be activated. This is a Chip & PIN card Cashback and you will need to know your PIN to use it. All new customers will be sent their PIN automatically in a separate mailing.