Hsbc Offshore Fixed Term Deposit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Make Your Life Abroad Even More Rewarding with HSBC Expat

Make your life abroad even more rewarding with HSBC Expat Click to enter Make your life abroad even more rewarding Your future means the world to us At HSBC Expat, we have a unique Our home is Jersey, Channel Islands, one of Start exploring focus. Every day we help our customers the world’s leading International Finance Centres. prosper as they expand their horizons From here we can connect you to HSBC products to build fulfilling and successful lives and services that could save you time and make ◆ To get the best experience from this digital brochure, please download it for themselves and their families. life easier for you and your family. and view in Adobe Reader®. Explore this interactive brochure – and find out In 2019, we won the APAC EMMA award for how we could help you make the most of the ◆ Use the on-screen navigation to ‘Banking, Tax or Financial Services opportunities your international lifestyle has guide you through the brochure Innovation’* and the EMEA EMMA award for to offer. ‘Expatriate Banking and Financial Services ◆ Go directly to a page using the Innovation’**. contents bar on the left of each page The award recognises the provider who has ◆ Need a hard copy? Use the print demonstrated ‘best in class banking or innovative financial services’. button at the foot of the contents bar In presenting the award, the judges commented: Let’s go “HSBC combines scale, industry knowledge and an eco-system to support expatriate financial needs. It’s an expat must have.” *Forum for Expatriate Management awards (APAC Region) **Forum for Expatriate Management awards (EMEA Region) Make your life abroad even more rewarding I’m an expat with an existing expat/offshore account Uniquely placed to help you prosper We have Foreign exchange specialists at Why open an HSBC Expat account Not all international/expatriate banking services are the same. -

FINANCE Offshore Finance.Pdf

This page intentionally left blank OFFSHORE FINANCE It is estimated that up to 60 per cent of the world’s money may be located oVshore, where half of all financial transactions are said to take place. Meanwhile, there is a perception that secrecy about oVshore is encouraged to obfuscate tax evasion and money laundering. Depending upon the criteria used to identify them, there are between forty and eighty oVshore finance centres spread around the world. The tax rules that apply in these jurisdictions are determined by the jurisdictions themselves and often are more benign than comparative rules that apply in the larger financial centres globally. This gives rise to potential for the development of tax mitigation strategies. McCann provides a detailed analysis of the global oVshore environment, outlining the extent of the information available and how that information might be used in assessing the quality of individual jurisdictions, as well as examining whether some of the perceptions about ‘OVshore’ are valid. He analyses the ongoing work of what have become known as the ‘standard setters’ – including the Financial Stability Forum, the Financial Action Task Force, the International Monetary Fund, the World Bank and the Organization for Economic Co-operation and Development. The book also oVers some suggestions as to what the future might hold for oVshore finance. HILTON Mc CANN was the Acting Chief Executive of the Financial Services Commission, Mauritius. He has held senior positions in the respective regulatory authorities in the Isle of Man, Malta and Mauritius. Having trained as a banker, he began his regulatory career supervising banks in the Isle of Man. -

Tariff of Charges

HSBC Expat Tariff of Charges The prices and information in this Tariff Details of other charges not listed are form part of the Terms that apply to your available by calling +44(0) 1534 616313 account. The information, rates and prices for Premier customers and, for Advance in this Tariff of Charges (“Tariff”) are correct customers, please call +44(0) 1534 616212. as at 28 September 2021. To help us to continually improve our The information, fees, rates and prices service, and in the interest of security, in this Tariff apply to your HSBC Expat we may monitor and/or record your account. communications with us. References in this Tariff to the UK also include Jersey. Where fees are quoted in sterling, we reserve the right to convert the fee into the currency of the account to which the fee relates. Such conversions will be made at the HSBC Expat exchange rate that is prevailing when we take the fee. ELIGIBILITY CRITERIA FOR HSBC EXPAT Minimum Relationship Annual Sole Underfunding Service Balance Salary Fee HSBC Premier £50,000* or £100,000* £35* HSBC Advance £15,000* N/A £15* * or currency equivalent Our fees are usually deducted on the fifth working day of the month, or the next working day after the fifth. PREMIER Customers who qualify as an HSBC Premier customer in any other part of the HSBC Group are automatically eligible for our HSBC Premier service. Therefore such customers already fulfill the minimum requirements for Premier service and do not have to maintain the Relationship Balance or the Annual Sole Salary threshold with HSBC Expat. -

Offshore Markets for the Domestic Currency: Monetary and Financial Stability Issues

BIS Working Papers No 320 Offshore markets for the domestic currency: monetary and financial stability issues by Dong He and Robert N McCauley Monetary and Economic Department September 2010 JEL classification: E51; E58; F33 Keywords: offshore markets; currency internationalisation; monetary stability; financial stability BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and from time to time by other economists, and are published by the Bank. The papers are on subjects of topical interest and are technical in character. The views expressed in them are those of their authors and not necessarily the views of the BIS. Copies of publications are available from: Bank for International Settlements Communications CH-4002 Basel, Switzerland E-mail: [email protected] Fax: +41 61 280 9100 and +41 61 280 8100 This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2010. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISSN 1020-0959 (print) ISBN 1682-7678 (online) Abstract We show in this paper that offshore markets intermediate a large chunk of financial transactions in major reserve currencies such as the US dollar. We argue that, for emerging market economies that are interested in seeing some international use of their currencies, offshore markets can help to increase the recognition and acceptance of the currency while still allowing the authorities to retain a measure of control over the pace of capital account liberalisation. The development of offshore markets could pose risks to monetary and financial stability in the home economy which need to be prudently managed. -

Gray Areas of Offshore Financial Centers

University of Tennessee, Knoxville TRACE: Tennessee Research and Creative Exchange Supervised Undergraduate Student Research Chancellor’s Honors Program Projects and Creative Work Spring 5-2008 Gray Areas of Offshore Financial Centers Matthew Benjamin Davis University of Tennessee - Knoxville Follow this and additional works at: https://trace.tennessee.edu/utk_chanhonoproj Recommended Citation Davis, Matthew Benjamin, "Gray Areas of Offshore Financial Centers" (2008). Chancellor’s Honors Program Projects. https://trace.tennessee.edu/utk_chanhonoproj/1167 This is brought to you for free and open access by the Supervised Undergraduate Student Research and Creative Work at TRACE: Tennessee Research and Creative Exchange. It has been accepted for inclusion in Chancellor’s Honors Program Projects by an authorized administrator of TRACE: Tennessee Research and Creative Exchange. For more information, please contact [email protected]. Gray Areas of Offshore Financial Centers Matthew Davis Chancellor's Honors Program Senior Project Introduction Offshore finance often brings to mind illegal activities such as money laundering and tax evasion. Over the years, these shady dealings have become associated with offshore banking due to its lax regulations and strict adherence to client secrecy. On the other hand, offshore financial centers can also be used for legitimate reasons such as setting up offshore hedge funds. Many motives drive the move of funds offshore and increase the activity of offshore financial centers. Some are completely legal, while others focus more on criminal activity. Often, the line between these legal and illegal activities is a very thin one. Specific regulations cannot be made to cover every single new situation, and taxpayers are forced to make decisions about how to interpret the law. -

Outward Payment Instruction

1 OUTWARD PAYMENT INSTRUCTION To make safe and secure payments online, why not visit our website at www.expat.hsbc.com to find out more details about our Internet Banking service. PLEASE TICK THIS BOX IF YOU ARE A PREMIER CUSTOMER: Yes No PLEASE COMPLETE THE FORM IN BLOCK CAPITALS DETAILS OF ACCOUNT TO BE DEBITED ACCOUNT NAME SORT CODE (For an Offshore ACCOUNT NUMBER Bank Account only) CURRENCY OF ACCOUNT TO BE DEBITED BANK NAME HSBC BANK PLC, JERSEY BRANCH ADDRESS HSBC HOUSE, ESPLANADE, ST HELIER, JERSEY CLICK TO CHOOSE WHICH CURRENCY PAYMENT IS TO BE MADE IN: y AUSTRALIAN DOLLAR y CANADIAN DOLLAR y CHINESE RENMINBI y CZECH KORUNA y DANISH KRONE y EURO y HONG KONG DOLLAR y HUNGARIAN FORINT y ISRAELI SHEKEL y JAPANESE YEN y NEW ZEALAND DOLLAR y NORWEGIAN KRONE y PHILIPPINE PESO y POLISH ZLOTY y SAUDI RIYAL y SINGAPORE DOLLAR y SOUTH AFRICAN RAND y STERLING y SWEDISH KRONA y SWISS FRANC y THAI BAHT y UAE DIRHAM y US DOLLAR CURRENCY OF PAYMENT AMOUNT OF PAYMENT AMOUNT OF PAYMENT IN WORDS VALUE DATE FOR FOREIGN EXCHANGE RATE TRANSACTIONS (Payment date) (If already agreed) SPT (Where agreed) DETAILS OF ACCOUNT TO BE CREDITED BANK NAME ADDRESS SWIFT (if known) FOR UK TRANSFERS: BANK SORTING CODE US DOLLAR: OTHER LOCAL FEDWIRE ROUTING NO. CLEARING CODE ACCOUNT NUMBER/IBAN BENEFICIARY ACCOUNT NAME BENEFICIARY ADDRESS IF KNOWN OR PREVIOUSLY PROVIDED, PLEASE SUPPLY NAME, ADDRESS AND SWIFT OF INTERMEDIARY BANK MESSAGE OR INSTRUCTION TO BENEFICIARY PURPOSE OF PAYMENT HSBC EXPAT: AND BENEFICIARY/FOREIGN BANK: PLEASE SELECT WHO DEDUCT FROM THE PAYMENT DEBIT FINAL DESTINATION WILL PAY FOR CHARGES TO MAKE THIS TRANSFER: DEBIT MY ACCOUNT AND SEND DEBIT MY/OUR ACCOUNT WITH FULL PAYMENT AMOUNT HSBC BANK INTERNATIONAL CUSTOMER AUTHORISATION SIGNATURE OF CUSTOMER/S next DATE OF SIGNATURE print 2 This OUTWARD PAYMENT INSTRUCTION should be sent to: HSBC Expat For any queries, please telephone us at: HSBC House Premier Customers: Ridgeway Street +44 1534 616313 Douglas Isle Of Man International Direct Banking: IM99 1BU +44 1534 616000 Lines are open 24 hours a day, 7 days a week. -

THE AML JARGON-BUSTER Your Guide to Anti-Money Laundering Definitions

THE AML JARGON-BUSTER Your guide to Anti-Money Laundering definitions TERM DEFINITION TERM DEFINITION AML See Anti-Money Laundering Enhanced Due An enhanced form of customer due Diligence (EDD) diligence (CDD) that must be adopted Anti-Money The systems and controls that regulated when the firm has ascertained that the Laundering (AML) firms are required to put in place in customer poses a higher risk of money order to prevent, detect and report laundering. It typically requires the money laundering. collection of additional documentation, or further verification checks. Anonymous An anonymous account is one for which Account the financial institution holds no records FATF See Financial Action Task Force concerning the identity of the account holder. Most jurisdictions now prohibit Financial Action An inter-governmental organisation the use of anonymous accounts Task Force (FATF) founded by the G7 in 1989 to develop although numerous ‘anonymous’ a global set of standards to combat accounts and facilities are still offered money laundering. FATF is based in via the Internet. Paris, France and the latest version of its 40 recommendations were published Beneficial Owner The person who ultimately owns in February 2012. They focus on the (BO) an asset and on whom AML checks importance of taking a risk-based need to be carried out. On occasions, approach to combatting money particularly with offshore entities, the laundering and terrorist financing. identity of the beneficial owner may not be disclosed in the public domain. Financial The Financial Action Task Force Sufficient KYC checks will not be Intelligence Unit recommends that each country should deemed to have been carried out if the (FIU) establish a financial intelligence unit identity of the beneficial owner(s) is not (FIU) – a national central authority to established, and then verified as per the receive, analyse and act upon suspicious risk-based approach. -

Global Financial Services Regulatory Guide

Global Financial Services Regulatory Guide Baker McKenzie’s Global Financial Services Regulatory Guide Baker McKenzie’s Global Financial Services Regulatory Guide Table of Contents Introduction .......................................................................................... 1 Argentina .............................................................................................. 3 Australia ............................................................................................. 10 Austria ................................................................................................ 22 Azerbaijan .......................................................................................... 34 Belgium .............................................................................................. 40 Brazil .................................................................................................. 52 Canada ................................................................................................ 64 Chile ................................................................................................... 74 People’s Republic of China ................................................................ 78 Colombia ............................................................................................ 85 Czech Republic ................................................................................... 96 France ............................................................................................... 108 Germany -

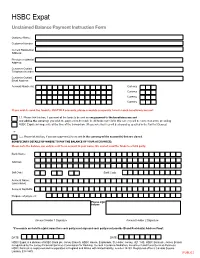

Unclaimed Balances Payment Form

HSBC Expat Unclaimed Balance Payment Instruction Form Customer Name: Customer Number: Current Residential Address: Previous residential Address: Customer Contact Telephone Number: Customer Contact Email Address: Account Number(s): Currency Currency Currency Currency If you wish to send the funds to MULTIPLE accounts, please complete a separate form for each beneficiary account. 1.1. Please tick this box, if you want all the funds to be sent as one payment to the beneficiary account and advise the currency you wish the payment to be made in. All funds not held in this currency will be converted at the prevailing HSBC Expat exchange rate at the time of the transaction. (Please note that fees will be charged as specified in the Tariff of Charges) or 1.2. Please tick this box, if you want payment(s) to be sent in the currency of the account(s) that are closed. BENEFICIARY DETAILS OF WHERE TO PAY THE BALANCE OF YOUR ACCOUNT(S): Please note the balance can only be sent to an account in your name. We cannot send the funds to a third party. Bank Name: Address: Sort Code: Swift Code: Account Name: (your name) Account No/IBAN: Purpose of payment: Please sign below: Account Holder 1 Signature Account Holder 2 Signature *If accounts are held in a joint name then each party must sign and each party must provide ID and Residential Address Proof. DATE:Date DATE: HSBC Expat is a division of HSBC Bank plc, Jersey Branch: HSBC House, Esplanade, St. Helier, Jersey, JE1 1HS. HSBC Bank plc, Jersey Branch is regulated by the Jersey Financial Services Commission for Banking, General Insurance Mediation, Investment and Fund Services Business. -

Offshore Banking and the Prospects for the Ghanaian Economy

GHAN F A O K N 7 A B 5 9 1 EST. OFFSHORE BANKING AND THE PROSPECTS FOR THE GHANAIAN ECONOMY RESEARCH DEPARTMENT BANK OF GHANA OCTOBER 2008 The Sector Study reports are prepared by the Research Department of Bank of Ghana for the deliberations of the Bank’s Board of Directors. The reports are subsequently made available as public information. This Study Report was prepared under the general direction of Dr. Ernest Addison. Primary contributors were Dr. Johnson Asiama and Ibrahim Abdulai. Further information may be obtained from: The Head Research Department Bank of Ghana P. O. Box GP 2674 Accra, Ghana. Tel: 233-21-666902-8 ISBN: 0855-658X TabLE of Contents 1.0 IntrodUction 1 1.1 History and Size 2 2.0 OVerVieW of Offshore FinanciaL Centres 4 2.1 Definitional Issues and Uses of Offshore Financial Centres 4 2.2 The Potential Risks from Offshore Operations and Country Experiences 7 3.0 FinanciaL SerVices Centre And Offshore Banking in Ghana 11 3.1 Background 11 3.2 Prospects and Benefits to the Ghanaian Economy 12 3.3 Channel of Influence between Offshore Banks and Domestic Banking Institutions 14 4.0 RegULation of Offshore Banks in Ghana 16 4.1 Why regulate 16 4.2 The Banking (Amendment) Act, 2007 (Act 738) and offshore banking 16 5.0 ConcLUsion and POLicy Recommendations 18 AppendiX 19 References 20 1.0 IntrodUction One of the key developments in the world economy during the last few decades has been the growing international mobility of capital. An element in this process has been the growth of offshore finance. -

Offshore Bank Accounts by ZENRON Capital Inc

Offshore Bank Accounts by ZENRON Capital Inc. Opening Offshore bank accounts can be a straight forward process if managed by an experienced corporate services firm like ZENRON Capital Inc. Offshore accounts typically offer a broader range of services than those offered by onshore banks. ZENRON Consultants provides strategic advice on offshore banking and manages the process for opening offshore bank accounts for our clients. 1. Opening an offshore bank account must be supported by detailed information on the individual, or company's activities. For an offshore corporate bank account information such as the company's clients and suppliers, as well as information about its management team (shareholders and directors) and financial projections can also be required. 2. ZENRON Consultants staff prepare the application form for opening the offshore bank account and attend a bank interview on the clients behalf. 3. Offshore banking jurisdictions usually require banks to enforce strict 'know your client' procedures as part of their Offshore corporate banking policies. Prior to opening offshore bank accounts, our clients are required to submit information on the company's activities and shareholders' and directors' details. 4. ZENRON Consultants collects the required due diligence and submits the application on the clients behalf. 5. Once approved, the bank will then issue internet banking passwords, check book, ATM cards and other necessary paperwork. Our consultants assist clients become familiar with using the account and the offshore banks services. 1. Offshore merchant account services - This type of offshore bank account allows you to accept credit card orders from your customers via an offshore credit card processing service provider. -

LEVERAGING OFFSHORE FINANCING to EXPAND AFRICAN NON-TRADITIONAL EXPORTS: the CASE of the HORTICULTURAL SECTOR (New Case Studies)

UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT UNCTAD Series on Innovative Financing in the Commodity Sector and Dynamic Industries LEVERAGING OFFSHORE FINANCING TO EXPAND AFRICAN NON-TRADITIONAL EXPORTS: THE CASE OF THE HORTICULTURAL SECTOR (new case studies) Prepared by the UNCTAD secretariat UNITED NATIONS New York and Geneva, 2007 UNCTAD/DITC/COM/2006/13 UNITED NATIONS PUBLICATION ISSN 1817-4515 Copyright © United Nations, 2007 All rights reserved ii TABLE OF CONTENTS Chapter Page Foreword....................................................................................................................... v Introduction.................................................................................................................. vii I. Risks and constraints in financing Africa’s horticultural trade.......................... 1 II. How can various parties play a role in structured finance for horticultural trade in Africa? ........................................................................................................ 7 A. The role of Governments...................................................................................... 9 B. The role of producers, exporters and associations ............................................... 12 C. The role of local banks......................................................................................... 13 D. The role of international banks............................................................................. 14 E. The role of offshore buyers and auction floors ...................................................