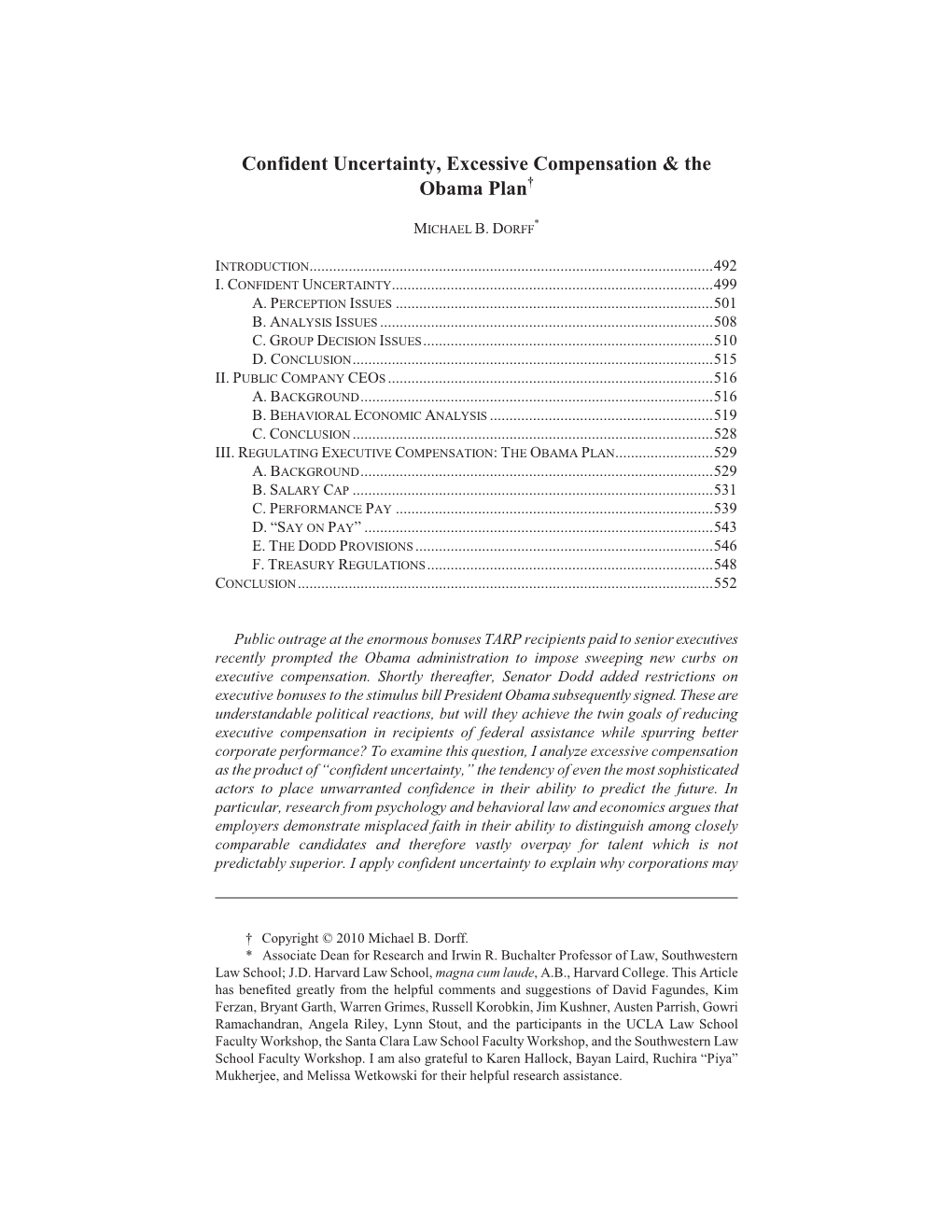

Confident Uncertainty, Excessive Compensation & the Obama Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Contra Costa Superior Court Martinez, California Department: 33 Hearing Date: 05/04/17

CONTRA COSTA SUPERIOR COURT MARTINEZ, CALIFORNIA DEPARTMENT: 33 HEARING DATE: 05/04/17 1. TIME: 9:00 CASE#: MSC10-01534 CASE NAME: JEWELL VS. BARCLAYS HEARING ON MOTION FOR ENTRY OF JUDGMENT OF DISMISSAL PURSUANT TO SETTLEMENT / FILED BY BARCLAYS CAPITAL REAL ESTATE, INC., et al. * TENTATIVE RULING: * Defendants’ current motion (1) to dismiss, or (2) in the alternative for leave to amend defendants’ answer and to file a cross-complaint based on the parties’ abandoned settlement agreement, is denied in full. The trial date of October 30, 2017, is confirmed. In the Court’s order on the previous motion to dismiss, the Court found in pertinent part as follows: The Court further finds that it is too late for defendants to move to set aside the judgment of dismissal entered more than two years ago, on January 14, 2015. Defendants did not move to set aside the judgment after learning of its entry; instead, defendants ratified the judgment by filing a memorandum of costs and a motion for attorney fees in May 2015, and by defending the judgment on appeal. After the remittitur was issued, defendants still did not move to set aside the judgment; instead, they filed a renewed motion for summary judgment on the merits. Even now, as of the date of this ruling, no motion to set aside the judgment is before the Court; a reply memorandum cannot serve the function of a completely new motion seeking new relief. Finally, any motion to set aside the Court’s prior judgment is moot; the judgment has already been vacated by the Court of Appeal. -

Buffy's Glory, Angel's Jasmine, Blood Magic, and Name Magic

Please do not remove this page Giving Evil a Name: Buffy's Glory, Angel's Jasmine, Blood Magic, and Name Magic Croft, Janet Brennan https://scholarship.libraries.rutgers.edu/discovery/delivery/01RUT_INST:ResearchRepository/12643454990004646?l#13643522530004646 Croft, J. B. (2015). Giving Evil a Name: Buffy’s Glory, Angel’s Jasmine, Blood Magic, and Name Magic. Slayage: The Journal of the Joss Whedon Studies Association, 12(2). https://doi.org/10.7282/T3FF3V1J This work is protected by copyright. You are free to use this resource, with proper attribution, for research and educational purposes. Other uses, such as reproduction or publication, may require the permission of the copyright holder. Downloaded On 2021/10/02 09:39:58 -0400 Janet Brennan Croft1 Giving Evil a Name: Buffy’s Glory, Angel’s Jasmine, Blood Magic, and Name Magic “It’s about power. Who’s got it. Who knows how to use it.” (“Lessons” 7.1) “I would suggest, then, that the monsters are not an inexplicable blunder of taste; they are essential, fundamentally allied to the underlying ideas of the poem …” (J.R.R. Tolkien, “Beowulf: The Monsters and the Critics”) Introduction: Names and Blood in the Buffyverse [1] In Joss Whedon’s Buffy the Vampire Slayer (1997-2003) and Angel (1999- 2004), words are not something to be taken lightly. A word read out of place can set a book on fire (“Superstar” 4.17) or send a person to a hell dimension (“Belonging” A2.19); a poorly performed spell can turn mortal enemies into soppy lovebirds (“Something Blue” 4.9); a word in a prophecy might mean “to live” or “to die” or both (“To Shanshu in L.A.” A1.22). -

Angel Free Episodes

Angel free episodes Latest Episodes. May 12, First Date Tips. Power Play. May 19, First Date Tips. Not Fade Away. The vampire Angelus, now known as Angel, has a Episode 1 · Season 1 · Season 3 · Season 5. Angel. 5 Seasons available with subscription. Start Your Free Trial. Season 1 22 Episodes. Season 2 22 Episodes. Season 3 22 Episodes. Season 4 Watch Angel full episodes online watch series. Synopsis: Leaving his true love, Buffy, behind in Sunnydale, the vampire Angel tries to get a fresh start in Los Angel Episode 18 · Angel Episode 12 · Angel Episode 19 · Angel Episode Watch Angel Online: Watch full length episodes, video clips, highlights and more. Watch Angel now on Hulu logo. kill. Newest First All Free (0); All Paid (). Click to watch all "Angel" episodes online -- and "Buffy" ones too -- at the Slayer Online found a partner, GorillaVid, that will let us embed episodes for free. Angel was not renewed for a sixth season. The WB decided to cancel it during its fifth season, citing low ratings for repeat episodes and high production costs. Watch full episodes of Angel From Hell on View the Available Full Episodes: 5 Free 07/02/16 EDTAngel Appreciation Day. Watch full episodes of the classic tv show Touched by an Angel on Try 1 Week FREE · Touched Touched By An Angel - A Rock And A Hard Place. Watch full episodes free online of the tv series Angel Eyes - with subtitles. Subtitled in Arabic, German, Greek, English, Spanish, French, Indonesian. Facing one of our biggest fears, Criss attempts to be burned alive. -

What Can We Learn from the Gamestop Short-Selling Drama? Hedge Funds Are Alternative Broker and Then Sell the Shares

WINTER 2021 THE Wealth Management Strategies from Jentner Wealth Management What Can We Learn from the GameStop Short-Selling Drama? Hedge funds are alternative broker and then sell the shares. Then investments using pooled funds to they wait until the stock drops in employ different strategies to earn price, buy the shares back, return the active returns, or alpha, for their shares to the broker with interest, investors. Some of those strategies and keep the profit. Essentially, they are to sell stock short, use leveraged inverse the winning formula for and structured investments, and use stock picking: sell high and buy low. derivatives. There are stories of great success but also some spectacular Here’s the risk. If the speculators implosions. The recent controversy cannot buy the shares back at a INSIDE THIS ISSUE surrounding a retail video-game lower price, they are forced to store adds several more hedge funds buy the shares for more than they to the list of those who have lost sold the borrowed shares for. This billions of dollars. For the long-term is called a short squeeze. Enter a investor, this situation shows how little-known chat room on a blog What Can We Learn quickly information gets priced into site called Reddit. Here, millennial from the GameStop stocks and how the active stock investors grew angry that hedge picker can be taken by surprise. funds were targeting GameStop and Short-Selling collaborated to buy the stock in Drama? . 1-2 Around August of 2019, GameStop mass. They used a favorite trading announced its plan to restructure app among younger investors its organization. -

Lorne Douglas Villani May 4, 1962 - May 26, 2014

REMEMBERING Lorne Douglas Villani May 4, 1962 - May 26, 2014 Tribute from Stubberfield Funeral Home Ltd. Staff Stubberfield Funeral Home Ltd. Staff send our condolences to family and friends. Tribute from Wendy Prosperi-Porta Relation: Friend I would like to send my condolences to the Villani family. Lorne will be in our hearts forever, may he rest in peace. Love Wendy Tribute from Adena and James Reimer Relation: Friends Dear Don and Rita, Our hearts are aching for you. We are deeply saddened. We will always remember Lorne. We feel blessed to have known him, and your family. We send you all our love. Lorne will be very missed. With all of our love, Adena and James Tribute from June Messmer Relation: Friend I am saddened. Some people our paths cross touch us in a very special way. The world improves for those who live in quiet inspiration. We must honor Lorne by embracing life. May you find peace in your memories. Love June Messmer Tribute from Karen Foster ( McDonald) Relation: Friend Heaven has gained a very special angel. Sleep well Lorne. Deepest sympathy to the Villani family, hold tight to all your memories. Tribute from Gloria & Wayne Lambert Relation: Lung Transplant TGH Our thoughts and prayers are being sent your way. He will be missed. Tribute from John & Susan Reid Relation: Relationship - How did you know the deceased? Dear Don, Rina & family ~ Our heartfelt sympathy on the passing of Lorne .He was such a nice guy and always seemed to have a smile on his face. He will always be remembered . -

25TH ANNUAL CANADIAN SECURITY TRADERS CONFERENCE Hilton Quebec, QC August 16-19, 2018 TORONTO STOCK EXCHANGE Canada’S Market Leader

25TH ANNUAL CANADIAN SECURITY TRADERS CONFERENCE Hilton Quebec, QC August 16-19, 2018 TORONTO STOCK EXCHANGE Canada’s Market Leader 95% 2.5X HIGHEST time at NBBO* average size average trade at NBBO vs. size among nearest protected competitor* markets* tmx.com *Approximate numbers based on quoting and trading in S&P/TSX Composite Stock over Q2 2018 during standard continuous trading hours. Underlying data source: TMX Analytics. ©2018 TSX Inc. All rights reserved. The information in this ad is provided for informational purposes only. This ad, and certain of the information contained in this ad, is TSX Inc.’s proprietary information. Neither TMX Group Limited nor any of its affiliates represents, warrants or guarantees the completeness or accuracy of the information contained in this ad and they are not responsible for any errors or omissions in or your use of, or reliance on, the information. “S&P” is a trademark owned by Standard & Poor’s Financial Services LLC, and “TSX” is a trademark owned by TSX Inc. TMX, the TMX design, TMX Group, Toronto Stock Exchange, and TSX are trademarks of TSX Inc. CANADIAN SECURITY TRADERS ASSOCIATION, INC. P.O. Box 3, 31 Adelaide Street East, Toronto, Ontario M5C 2H8 August 16th, 2018 On behalf of the Canadian Security Traders Association, Inc. (CSTA) and our affiliate organizations, I would like to welcome you to our 25th annual trading conference in Quebec City, Canada. The goal of this year’s conference is to bring our trading community together to educate, network and hopefully have a little fun! John Ruffolo, CEO of OMERS Ventures will open the event Thursday evening followed by everyone’s favourite Cocktails and Chords! Over the next two days you will hear from a diverse lineup of industry leaders including Kevin Gopaul, Global Head of ETFs & CIO BMO Global Asset Mgmt., Maureen Jensen, Chair & CEO Ontario Securities Commission, Kevan Cowan, CEO Capital Markets Regulatory Authority Implementation Organization, Kevin Sampson, President of Equity Trading TMX Group, Dr. -

Slayage, Number 16

Roz Kaveney A Sense of the Ending: Schrödinger's Angel This essay will be included in Stacey Abbott's Reading Angel: The TV Spinoff with a Soul, to be published by I. B. Tauris and appears here with the permission of the author, the editor, and the publisher. Go here to order the book from Amazon. (1) Joss Whedon has often stated that each year of Buffy the Vampire Slayer was planned to end in such a way that, were the show not renewed, the finale would act as an apt summation of the series so far. This was obviously truer of some years than others – generally speaking, the odd-numbered years were far more clearly possible endings than the even ones, offering definitive closure of a phase in Buffy’s career rather than a slingshot into another phase. Both Season Five and Season Seven were particularly planned as artistically satisfying conclusions, albeit with very different messages – Season Five arguing that Buffy’s situation can only be relieved by her heroic death, Season Seven allowing her to share, and thus entirely alleviate, slayerhood. Being the Chosen One is a fatal burden; being one of the Chosen Several Thousand is something a young woman might live with. (2) It has never been the case that endings in Angel were so clear-cut and each year culminated in a slingshot ending, an attention-grabber that kept viewers interested by allowing them to speculate on where things were going. Season One ended with the revelation that Angel might, at some stage, expect redemption and rehumanization – the Shanshu of the souled vampire – as the reward for his labours, and with the resurrection of his vampiric sire and lover, Darla, by the law firm of Wolfram & Hart and its demonic masters (‘To Shanshu in LA’, 1022). -

New Original Web Series CHATEAU LAURIER Gains 3 Million Views and 65,000 Followers in 2 Months

New Original Web Series CHATEAU LAURIER gains 3 million views and 65,000 followers in 2 months Stellar cast features Fiona Reid, Kate Ross, Luke Humphrey and the late Bruce Gray May 9, 2018 (Toronto) – The first season of the newly launched web series CHATEAU LAURIER has gained nearly 3 million views and 65,000 followers in less than 2 months, it was announced today by producer/director, James Stewart. Three episodes have rolled out on Facebook thus far, generating an average of nearly 1 million views per episode. In addition, it has been nominated for Outstanding Canadian Web Series at T.O. WEBFEST 2018, Canada's largest international Webfest. The charming web series consisting of 3 episodes of 3 minutes each features a stellar Canadian cast, including Fiona Reid (My Big Fat Greek Wedding), Kate Ross (Alias Grace), Luke Humphrey (Stratford’s Shakespeare in Love), and the late Bruce Gray (Traders) in his last role. Fans across the world—from Canada, the US, and UK—to the Philippines and Indonesia have fallen for CHATEAU LAURIER since the first season launched on March 13, 2018. Set in turn-of-the-century Ottawa's historic grand hotel on the eve of a young couple's arranged wedding, CHATEAU LAURIER offers a wry slice-of-life glimpse into romance in the early 1900s. Filmed in one day, on a low budget, the talent of the actors and the very high production value, stunning sets and lush costumes (with the Royal York standing in for the Chateau), make this series a standout in a burgeoning genre. -

The March of the Robo-Traders Sep 15Th 2005 from the Economist Print Edition

Economist.com http://www.economist.com/printedition/PrinterFriendly.cfm?story_i... REPORTS The march of the robo-traders Sep 15th 2005 From The Economist print edition Software: Programs that buy and sell shares are becoming ever more sophisticated. Might they replace human traders? IMAGINE the software equivalent of a golden goose: a program that continually produces money as its output. It sounds fanciful, but such software exists. Indeed, if you have a pension or endowment policy, or have money invested in share-based funds, the chances are that such a program—variously known as an “autonomous trading agent”, “algorithmic trading” system or simply as a “robo-trader”—has already been used to help your investments grow. Simple software-based traders have been around for many years, but they are now becoming far more sophisticated, and make trades worth tens of billions of dollars, euros and pounds every day. They are proving so successful that in the equity markets, where they are used to buy and sell shares, they already appear to be outperforming their human counterparts, and it now seems likely that their success will be repeated in foreign-exchange markets too. Proponents of robo-traders claim that, as well as making more money, they can also help to make markets more stable. And, of course, being made of software, they do not demand lunch breaks, holidays or bonuses. This has prompted an arms race as companies compete to develop the best sets of rules, or algorithms, to govern the behaviour of their robo-traders. “We live and die by how well they perform,” says Richard Balarkas, global head of advanced execution services at Credit Suisse First Boston, an investment bank. -

Algorithmic Trading Strategies

CSP050 MAY 2020 Algorithmic Trading Strategies ANZHELIKA ISHKHANYAN AND ASHER TRANGLE Memorandum TO: Special Counsel, CFTC Division of Market Oversight FROM: Director, CFTC Division of Market Oversight RE: Algorithmic Trading and Regulation Automated Trading DATE: January 9, 2020 Welcome to DMO. I’m confident that you’ll find the position a challenging one, and I’ve already got a meaty topic to get you started on. I recently received an email from the Chairman expressing his concerns regarding the negative effects of algorithmic trading on financial markets. The Chairman is convinced that the CFTC should have direct access to trading systems’ source code to prevent potential market abuses with systemic implications. To that end, the Chairman proposes we reconsider Regulation Automated Trading (“Regulation AT”) which would require all traders using algorithms to register with the CFTC and would give CFTC direct and unfettered access to their source code. Please find attached the Chairman’s email which outlines his priorities and main concerns pertaining to algorithmic trading. In addition, I have sketched out my own reactions to reconsidering Regulation AT in an informal memo, attached as Appendix I. In addition, you may find it useful to refer to a legal intern’s memoranda, attached as Appendix II, which offers a brief overview of Regulation AT, its history, and a short discussion of other regulators’ efforts to address algorithmic trading. After considering these materials, please come and brief me on the following questions: ● What, precisely, are the public policy challenges posed by the emergence of algorithmic trading, and does this practice pose any serious problems to U.S. -

Hos Ho in Heatre Orty

WHO’S WHO IN THEATRE FORTY BOARD OF DIRECTORS Jim Jahant, Chairperson Lya Cordova-Latta Dr. Robert Karns Charles Glenn Myra Lurie Frederick G. Silny, Treasurer David Hunt Stafford, Secretary Gloria Stroock Bonnie Webb Marion Zola ARTISTIC COMMITTEE Gail Johnston • Jennifer Laks • Alison Blanchard Diana Angelina • John Wallace Combs • Leda Siskind ADMINISTRATIVE STAFF David Hunt Stafford . .Artistic/Managing Director Jennifer Parsons . .Bookkeeper Richard Hoyt Miller . .Database Manager Philip Sokoloff . .Director of Public Relations Jay Bell . .Reservationist Dean Wood . .Box Office Manager Susan Mermet . .Assistant Box Office Manager Larry Rubinstein . .Technology Guru PRODUCTION STAFF Artistic/Managing Director David Hunt Stafford Set Design Jeff G. Rack Costume Design Michèle Young Lighting Design Ric Zimmerman Sound Design Joseph “Sloe” Slawinski Photograp her Ed Kreiger Program Design Richard Hoyt Miller Publicity Philip Sokoloff Reservations & Information Jay Bell / 310-364-0535 This production is dedicated to the memory of DAVID COLEMAN THEATRE FORTY PRESENTS The 6th Production of the 2017-2018 Season BY A.A. MILNE DIRECTED BY JULES AARON PRODUCED BY DAVID HUNT STAFFORD Set Designer..............................................JEFF G. RACK Costume Designer................................MICHÈLE YOUNG Lighting Designer................................RIC ZIMMERMAN Sound Designer .................................GABRIEAL GRIEGO Stage Manager ................................BETSY PAULL-RICK Assistant Stage Manager ..................RICHARD -

Farmers, Traders, and Processors: Estimating the Welfare Loss from Double Marginalization for the Indonesian Rubber Sector

FARMERS, TRADERS, AND PROCESSORS: ESTIMATING THE WELFARE LOSS FROM DOUBLE MARGINALIZATION FOR THE INDONESIAN RUBBER SECTOR Thomas Kopp1 & Richard J. Sexton2 [email protected] 1The University of Göttingen, Germany 2University of California, Davis, USA 2019 Vortrag anlässlich der 59. Jahrestagung der GEWISOLA (Gesellschaft für Wirtschafts- und Sozialwissenschaften des Landbaues e.V.) „Landwirtschaft und ländliche Räume im gesellschaftlichen Wandel“ Braunschweig, 25. bis 27. September 2019 Copyright 2019 by Thomas Kopp and Richard J. Sexton. All rights reserved. Readers may make verbatim copies of this document for non-commercial purposes by any means, provided that this copyright notice appears on all such copies. Farmers, Traders, and Processors: Estimating the Welfare Loss from Double Marginalization for the Indonesian Rubber Sector Abstract Reducing buyer market power over farmers is a key strategy to improve rural livelihoods in emerging economies. This paper focuses on implications for farm income and market efficiency of failure of a supply chain to coordinate vertically to eliminate a second stage of buyer power in the vertical market chain – the so-called “double marginalization” problem. Our specific application is to the Indonesian rubber industry. In the Jambi province production is mainly in the hands of smallholder farmers, who sell via spot transactions to a network of traders who in turn sell in spot exchanges to rubber processors. Processing is highly concentrated, and concentration among traders is also quite high in localized procurement markets. Barriers to buyer coordination are largely absent, and evidence indicates that both traders and processors exercise oligopsony power, a classic problem of double marginalization. We estimate the extent of buyer market power in farmer-trader and trader-processor interactions and then explore the nature of this market failure and quantify the extent of welfare loss and redistribution of income among market participants.