Tomra Annual Report 1998

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2626667.Pdf (1.837Mb)

BI Norwegian Business School - campus Oslo GRA 19703 Master Thesis Thesis Master of Science Evaluating the Predictive Power of Leading Indicators Used by Analysts to Predict the Stock Return for Norwegian Listed Companies Navn: Amanda Marit Ackerman Myhre Hadi Khaddaj Start: 15.01.2020 09.00 Finish: 01.09.2020 12.00 GRA 19703 0981324 0983760 Evaluating the Predictive Power of Leading Indicators Used by Analysts to Predict the Stock Return for Norwegian Listed Companies Supervisor: Ignacio Garcia de Olalla Lopez Programme: Master of Science in Business with Major in Accounting and Business Control Abstract This paper studies the predictive power of leading indicators used by interviewed analysts to predict the monthly excess stock returns for some of the most influential Norwegian companies listed on the Oslo Stock Exchange. The thesis primarily seeks to evaluate whether a multiple factor forecast model or a forecast combination model incorporating additional explanatory variables have the ability to outperform a five common factor (FCF) benchmark forecast model containing common factors for the Norwegian stock market. The in-sample and out-of- sample forecasting results indicate that a multiple factor forecast model fails to outperform the FCF benchmark model. Interestingly, a forecast combination model with additional explanatory variables for the Norwegian market is expected to outperform the FCF benchmark forecast model. GRA 19703 0981324 0983760 Acknowledgements This thesis was written as the final piece of assessment after five years at BI Norwegian Business School and marks the completion of the Master of Science in Business program. We would like to thank our supervisor Ignacio Garcia de Olalla Lopez for his help and guidance through this process. -

The Annual Report 2002 Documents Telenor's Strong Position in the Norwegian Market, an Enhanced Capacity to Deliver in The

The Annual Report 2002 documents Telenor’s strong position in the Norwegian market, an enhanced capacity to deliver in the Nordic market and a developed position as an international mobile communications company. With its modern communications solutions, Telenor simplifies daily life for more than 15 million customers. TELENOR Telenor – internationalisation and growth 2 Positioned for growth – Interview with CEO Jon Fredrik Baksaas 6 Telenor in 2002 8 FINANCIAL REVIEW THE ANNUAL REPORT Operating and financial review and prospects 50 Directors’ Report 2002 10 Telenor’s Corporate Governance 18 Financial Statements Telenor’s Board of Directors 20 Statement of profit and loss – Telenor Group 72 Telenor’s Group Management 22 Balance sheet – Telenor Group 73 Cash flow statement – Telenor Group 74 VISION 24 Equity – Telenor Group 75 Accounting principles – Telenor Group 76 OPERATIONS Notes to the financial statements – Telenor Group 80 Activities and value creation 34 Accounts – Telenor ASA 120 Telenor Mobile 38 Auditor’s report 13 1 Telenor Networks 42 Statement from the corporate assembly of Telenor 13 1 Telenor Plus 44 Telenor Business Solutions 46 SHAREHOLDER INFORMATION Other activities 48 Shareholder information 134 MARKET INFORMATION 2002 2001 2000 1999 1998 MOBILE COMMUNICATION Norway Mobile subscriptions (NMT + GSM) (000s) 2,382 2,307 2,199 1,950 1,552 GSM subscriptions (000s) 2,330 2,237 2,056 1,735 1,260 – of which prepaid (000s) 1,115 1,027 911 732 316 Revenue per GSM subscription per month (ARPU)1) 346 340 338 341 366 Traffic minutes -

Asset Listing for the New York State Common Retirement Fund As Of

New York State Common Retirement Fund Asset Listing as of March 31, 2017 Domestic and International Equity 1 - 62 Commingled Stock Funds 63 Global Fixed Income 64 - 84 Mortgage Holdings 85 - 89 Real Estate Investments 90 - 92 Short-Term Investments 93 - 94 Alternative Investments Assets: Private Equity Investments 95 - 99 Private Equity Investments / Fund of Funds Listing 100 - 109 Absolute Return Strategy / Fund of Funds Listing 110 Opportunistic Funds 111 Real Assets 112 DOMESTIC AND INTERNATIONAL EQUITY As of March 31, 2017 Security Description Shares Cost Fair Value 180 Degree Capital Corp. 960,396 $1,986,291 $1,392,574 1-800-Flowers.com, Inc. - Class A 22,800 222,660 232,560 1st Source Corp. 21,434 657,207 1,006,326 2U, Inc. 43,925 1,368,977 1,742,065 3D Systems Corp. 110,800 1,434,860 1,657,568 3M Company 1,705,000 120,381,155 326,217,650 77 Bank, Ltd./The 280,000 1,266,651 1,211,164 888 Holdings plc 30,937 103,808 103,289 8X8, Inc. 329,016 3,456,968 5,017,494 A10 Networks, Inc. 37,100 224,604 339,465 AA, Ltd. 2,603,082 11,942,240 8,645,343 AAC Holdings, Inc. 9,300 340,886 79,329 AAC Technologies Holdings, Inc. 1,578,900 13,719,169 18,477,894 AAON, Inc. 42,500 647,616 1,502,375 AAR Corp. 35,200 872,406 1,183,776 Aarons, Inc. - Class A 632,650 16,352,050 18,815,011 Abaxis, Inc. -

Prospectus of 31 March 2014

Statoil ASA, prospectus of 31 March 2014 Registration Document Prospectus Statoil ASA Registration Document Stavanger, 31 March 2014 Dealer: 1 of 47 Statoil ASA, prospectus of 31 March 2014 Registration Document Important information The Registration Document is based on sources such as annual reports and publicly available information and forward looking information based on current expectations, estimates and projections about global economic conditions, the economic conditions of the regions and industries that are major markets for the Company's and Guarantor’s (including subsidiaries and affiliates) lines of business. A prospective investor should consider carefully the factors set forth in chapter 1 Risk factors, and elsewhere in the Prospectus, and should consult his or her own expert advisers as to the suitability of an investment in the bonds. This Registration Document is subject to the general business terms of the Dealer, available at its website (www.dnb.no). The Dealer and/or affiliated companies and/or officers, directors and employees may be a market maker or hold a position in any instrument or related instrument discussed in this Registration Document, and may perform or seek to perform financial advisory or banking services related to such instruments. The Dealer’s corporate finance department may act as manager or co-manager for this Company and/or Guarantor in private and/or public placement and/or resale not publicly available or commonly known. Copies of this presentation are not being mailed or otherwise distributed or sent in or into or made available in the United States. Persons receiving this document (including custodians, nominees and trustees) must not distribute or send such documents or any related documents in or into the United States. -

Dnb NOR (DNBNOR) Services Group with Total Combined Assets 65,00 of NOK 1470 Billion

DERIVATIVES, OSLO BØRS - NOVEMBER 2009 The OBX index has increased for five consecutive months. The index rose 9% in November, from 299.29 to 326 points, and so far this year the OBX is up almost 64%. The premium turnover fell in November. The stock options decreased by 23% to 92 MNOK and the stock forwards fell by 20% to 806 MNOK. The open interest, however, increased for both options and forwards. The OBX futures turnover fell slightly in November (3%) from 21.8 BNOK to 21.2 BNOK, whereas the OBX options decreased by 33% to 38 MNOK. The average number of contracts traded in November was 49 400 contracts/day, whereas the average for the year is 54 082 contracts/day. The most traded stock option in October was Statoil with 26 MNOK or 28% of the stock option premium turnover. Yara and Seadrill followed with 27.7% and 12% of the total. Tandberg was the most traded stock forward followed by Statoil and Norsk Hydro. They had 23%, 18% and 17% of the total forward exposure respectively. Expirations in November: OBX, Statoil, DnB NOR, Norsk Hydro, Storebrand, Tandberg and Yara. Expirations next month (17 December): OBX, Statoil, Norske Skog, Tomra, Marine Harvest and Seadrill. For more detailed information, please read ahead This summary continues with a presentation of general statistics, followed by a product- and volatility overview towards the end. We hope to see you back in the derivatives market next month. Disclaimer: All information in this presentation is obtained from documents already available to the public. -

NORW-Factsheet.Pdf

Global X MSCI Norway ETF ETF Category: International Access ± Single-Country NORW As of 8/31/2021 KEY FEATURES FUND DETAILS Inception Date 11/09/2010(1) Underlying Index MSCI Norway IMI 25/50 Index Efficient Access Efficient access to a broad basket of Norwegian securities. Number of Holdings 70 Assets Under Management $44.94 mil Total Expense Ratio 0.50% Distribution Frequency Semi-Annually Targeted Exposure TRADING DETAILS The Fund targets exposure to a single country. Ticker NORW CUSIP 37950E747 Exchange NYSE Arca Bloomberg IOPV Ticker NORWIV Index Ticker M1NO5IM PERFORMANCE (%) TOP 10 HOLDINGS (%) Holdings Subject to Change Since 1M YTD 1Y 3Y 5Y 10Y Inception Equinor Asa 11.30% Norsk Hydro Asa 4.67% NAV 2.21% 14.65% 31.37% 4.02% 10.17% 3.73% 3.11% Dnb Bank Asa 10.69% Tomra Systems Asa 3.84% Market 3.01% 16.19% 32.52% 4.30% 10.34% 3.70% 3.13% Telenor Asa 6.72% Orkla Asa 3.77% Price Mowi Asa 6.46% Nordic Semiconductor Asa 2.82% Hybrid 2.21% 14.96% 32.01% 4.37% 10.48% 4.25% 3.67% Index(2) Yara International Asa 4.83% Adevinta Asa 2.73% The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. High short- term performance of the Fund, when observed, is unusual and investors should not expect such performance to be repeated. -

Market Maker Agreement

Market Maker Agreement MARKET MAKER AGREEMENT THIS AGREEMENT is made BETWEEN: (1) London Stock Exchange plc, under registration number 02075721, of 10 Paternoster Square, London EC4M 7LS. (“the Exchange”) AND (2) ________________________________________ of ______________________________________ (“Market Maker”) ON _____________________________________ THIS AGREEMENT is made in relation to the following product group(s): ________________________________________ (Refer to Annex 1 for further details) Capacity(ies) ________________________________________ 1 Market Maker Agreement 1. INTRODUCTION 1.1 This Agreement is to be read in conjunction with (i) the London Stock Exchange Derivatives Market, Market Making Obligations Document (hereafter the “Market Making Obligations Document”); (ii) the London Stock Exchange Derivatives Market Tariff Schedule (the “Tariff Schedule”); and (iii) the Rules of the London Stock Exchange Derivatives Market (hereafter the “Rules”) in their entirety1. 1.2 Capitalised terms shall be assigned meanings as outlined in the Rules or the Market Making Obligations Document. In the case of any inconsistency, the Rules shall prevail 1.3 The Effective Date of this Agreement shall be the date upon which it is ratified, as stated above. 1.4 Annex 1 contains the contracts in which the Market Maker has agreed to act in the capacity of a Primary Market Maker or Qualified Liquidity Provider, as detailed in, and in accordance with, the Market Making Obligations Document. All capacities are considered Market Makers for the purpose of this agreement and the Rules. 2. MARKET MAKER’S OBLIGATIONS 2.1 The Market Maker must be a Member Firm of the Exchange and, as such, it agrees to be bound by the Rules which apply to all Member Firms. -

Equinor Insurance AS Årsberetning Og Regnskap Annual Report and Accounts

2018 Equinor Insurance AS Årsberetning og regnskap Annual report and accounts EQUINOR FORSIKRING - 2018 ÅRSRAPPORT 1 2 EQUINOR FORSIKRING - 2018 ÅRSRAPPORT STYRETS ÅRSBERETNING 2018 Styret Forretningsfører Russell Alton, styreleder Lars Gaute Østebø Marit Lunde Anne-Margrethe Tostrup Smith Revisjon Mads Rømer Holm KPMG AS Lars Atle Kjøde Statsaut. revisorer Equinor Insurance AS. er et heleid datterselskap geografi og ulike verdipapirer. Equinor Insurance AS av Equinor ASA, lokalisert i Stavanger. Selskapet benytter også finansielle instrumenter (derivater) i er engasjert i skadeforsikring og bærer i det stedet for underliggende papirer (aksjer, obligasjoner vesentligste risiko for tingskade, avbruddstap og og sertifikater) hvis dette er mer hensiktsmessig og tredjemannsansvar i tilknytning til Equinorkonsernets kostnadseffektivt. Selskapet følger etiske retningslinjer virksomhet. for forvaltningen. Selskapet har ingen ansatte, men kjøper tjenester I forbindelse med endring i porteføljesammensetning fra morselskapet og av Gabler Triton. Styrets brukes det tidvis også børsnoterte futureskontrakter sammensetning ved årsslutt består av to kvinner og tre på aksjeindekser. Innenfor renteområdet brukes menn. rentefutures, fremtidige renteavtaler, rentebytteavtaler, gjenkjøpsavtaler og renteopsjoner for å forvalte Styret er ikke kjent med at selskapets virksomhet hensiktsmessig og kostnadseffektivt. I forbindelse med gjennom året har medført forurensing av det ytre miljø. styring av valutarisiko benyttes valutaswapper og valutaterminer. Styret -

Nordic Board Index Contents

2016 Nordic Board Index Contents 1 Foreword 2 HigHligHts oF tHe 2016 Nordics Board iNdex 4 Our survey approacH 5 Board compositioN 8 diversity 12 New directors, age aNd leNgtH oF service 15 remuNeratioN 18 Board meetiNgs aNd committees 21 ComparisoN taBles 22 International comparison 28 Board composition 36 Board remuneration in 2015 44 Board committees 48 About speNcer stuart Foreword The Spencer Stuart 2016 Nordic Board Index is an annual study which analyses aspects of board governance, including board composition, committees and director remuneration, among major listed companies. First published 30 years ago in the US, there are now Board Indexes in 18 countries around the world. The Nordic Board Index analyses 125 of the largest listed companies in the region which comprise the following indices: OMX Copenhagen (25 companies), OMX Helsinki (25 companies), OBX (25 companies), OMX Stockholm (50 companies). Our purpose is to provide business leaders with a snapshot of current practice on boards across the region. In our analysis we examine year-on-year changes on a wide range of measures, from board size and diversity to director commitments and remuneration. We also compare Nordic companies with their counterparts in other countries, both in Europe and the US. We include a chart showing how different boards in different countries compare on key governance parameters, and conclude the Board Index with tables showing detailed information on all 125 featured companies. We hope you find this edition of the Nordic Board Index useful. The latest edition of each Spencer Stuart Board Index can be found on our website, (www.spencerstuart.com/board-indexes) alongside a wide range of other publications covering board and corporate governance issues. -

Dnb NOR (DNBNOR)

DERIVATIVES, OSLO BØRS - JULY 2013 The OBX index fell 5% to 431.03 points in June. So far this year the index is up 5%. During the half yearly June revision of the OBX, Songa exited the index whereas Polarcus entered. The average number of contracts traded in June was 62 821 contracts/day, the highest since June 2011! The average for the year is 45 755 contracts/day. June has been a good month, and the turnover increased for all groups. The stock option premium increased by 26% to 83 MNOK, the highest since February 2012 (2013 avg: 63 MNOK). The forward exposure rose by 85% to 988 MNOK (2013 avg: 762 MNOK). As for the index products, the OBX option premium increased by 52% to 47 MNOK (2013 avg: 38 MNOK), and the index future turnover rose by 18% to 14.5 BNOK, the highest this year (2013 avg: 12.9 BNOK). The most traded stock option in June was Subsea 7 with 17 MNOK or 21% of the total stock option premium turnover. Statoil and Yara followed. The top three stock derivatives accounted for 48% of the total stock option turnover for the month. Norsk Hydro, Yara and Statoil were the most traded stock forwards. Norsk Hydro had a turnover of 187 MNOK, 19% of the total. Options and forwards/futures on Norwegian Air Shuttle (NAS) were offered from June 17th. June 20th was the last listing day of standardised derivatives on Tomra (TOM). This summary continues with a presentation of general statistics, followed by a product- and volatility overview towards the end. -

Transparency in Corporate Reporting

TRANSPARENCY IN CORPORATE REPORTING ASSESSING LARGE COMPANIES ON OSLO STOCK EXCHANGE (2013) Transparency International is the global civil society organisation leading the fight against corruption. Through more than 90 chapters worldwide and an international secretariat in Berlin, we raise awareness of the damaging effects of corruption and work with partners in government, business and civil society to develop and implement effective measures to tackle it. Transparency International’s Norwegian chapter (TI Norway) was founded in 1999 and has its office in Oslo. Transparency International Norge Telephone: + 47 22 83 48 00 www.transparency.no Copyright: 2013, Transparency International Norge ISBN 978-82-93348-02-3 (English, printed) ISBN 978-82-93348-03-0 (English, digital) Graphic design: EY (Ernst & Young AS) Print: IT Grafisk AS Issued in first edition: 6 December 2013 This report is available in Norwegian and English language editions. It can be downloaded from TI Norway’s website: www.transparency.no The study described in the report is financially supported by KLP Kapitalforvaltning AS. The study is conducted by EY (Ernst & Young AS) on behalf of TI Norway. EY has been responsible for data collection and for structuring and summarising the results. Analyses are conducted and the report is written in collaboration between EY and TI Norway. The Transparency International Secretariat has assisted with advice and clarifications on study methodology. CONTENTS 1. Introduction 4 2. Executive summary 5 3. Project rationale and methodology 8 4. Transparency of company anti-corruption programme 10 5. Organisational transparency (subsidiaries and ownership interests) 18 6. Country-by-country reporting 24 7. -

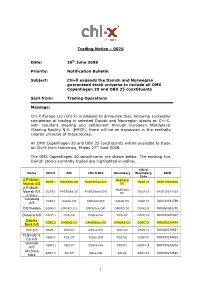

20080626 Trading Notice Functional 0076

Trading Notice – 0076 Date: 26 th June 2008 Priority: Notification Bulletin Subject: Chi-X expands the Danish and Norwegian guaranteed stock universe to include all OMX Copenhagen 20 and OBX 25 constituents Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce that, following successful completion of trading in selected Danish and Norwegian stocks on Chi-X, with resultant clearing and settlement through European Multilateral Clearing Facility N.V. (EMCF), there will be an expansion in the centrally cleared universe of these stocks. All OMX Copenhagen 20 and OBX 25 constituents will be available to trade on Chi-X from tomorrow, Friday 27 th June 2008. The OMX Copenhagen 20 constituents are shown below. The existing five Danish stocks currently traded are highlighted in yellow. CHI-X Name CHI-X RIC CHI-X RIC Bloomberg Bloomberg ISIN Code A P Moller - MAERSKB MAER.I MAERSKb.CO MAERSKbco.CHI MAER IX DK0010244508 Maersk A/S DC A P Moller - MAERSKA DSAA.I MAERSKa.CO MAERSKaco.CHI DSAA IX DK0010244425 Maersk A/S EC A Share Carlsberg CARP.I CARLb.CO CARLbco.CHI CARLB DC CARP IX DK0010181759 A/S D/S Norden DSNO.I DNORD.CO DNORDco.CHI DNORD DC DSNO IX DK0060083210 Danisco A/S DEMC.I DCO.CO DCOco.CHI DCO DC DEMC IX DK0010207497 Danske DDBC.I DANSKE.CO DANSKEco.CHI DANSKE DC DDBC IX DK0010274414 Bank A/S DSV A/S DSVB.I DSV.CO DSVco.CHI DSV DC DSVB IX DK0060079531 FLSmidth & FLBB.I FLS.CO FLSco.CHI FLS DC FLBB IX DK0010234467 Co A/S Genmab GENM.I GEN.CO GENco.CHI FEN DC GENM IX DK0010272202 A/S GN Store GNTC.I GN.CO