Danieli & C. Officine Meccaniche

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hiprofile Lite

HIPROFILE LITE Laser Profile Gauge for hot & cold long products DANIELI AUTOMATION HiPROFILE LITE is a laser based 3D measurement Features instrument providing non-contact on-line profile > Blur-free profile acquisition and minimum-noise HiPROFILE LITE shape inspection and dimension measurement for measuring either hot or cold rolled products. > No need for water and compressed air (electric From small rounds, squares and flats through rebar, power is the only utility required) HiPROFILE LITE provides the optimum solution to > Fully synchronized laser triangulation heads improve production performance and quality. > Specific algorithms for real profile measurement of rebar and Kocks-like sections Principle of operation > Alarms in case of out of tolerance products The HiPROFILE LITE system is based on laser- > Continuous real time production control & sectioning optical measurement techniques tracking and image processing algorithms. Geometries, > Control points on the profile configurable by components and design solution of the 3 laser- operator sectioning heads and of the whole system are > No moving parts optimized to fulfil the requirements of hot steel > Historical database for quality control purposes detection and measurement. > Statistical Process Control (SPC) to analyze production trends The three measuring heads are synchronized > User friendly operator interface (Numerical & to acquire, at high sampling rate, the contour Graphical visualization Applications of an extremely thin slice of the hot-rolled bar. > Easy system diagnostic interface > Hot and cold long This feature guarantees for a superior blur-free > Integration via TCP/IP with existing customer products behaviour in presence of the vibrations and network > Wire rod & bar mills transversal bar movements typical of the hot rolling > Dedicated software to export CAD files of the > Light section mills process. -

Danieli & C. Officine Meccaniche

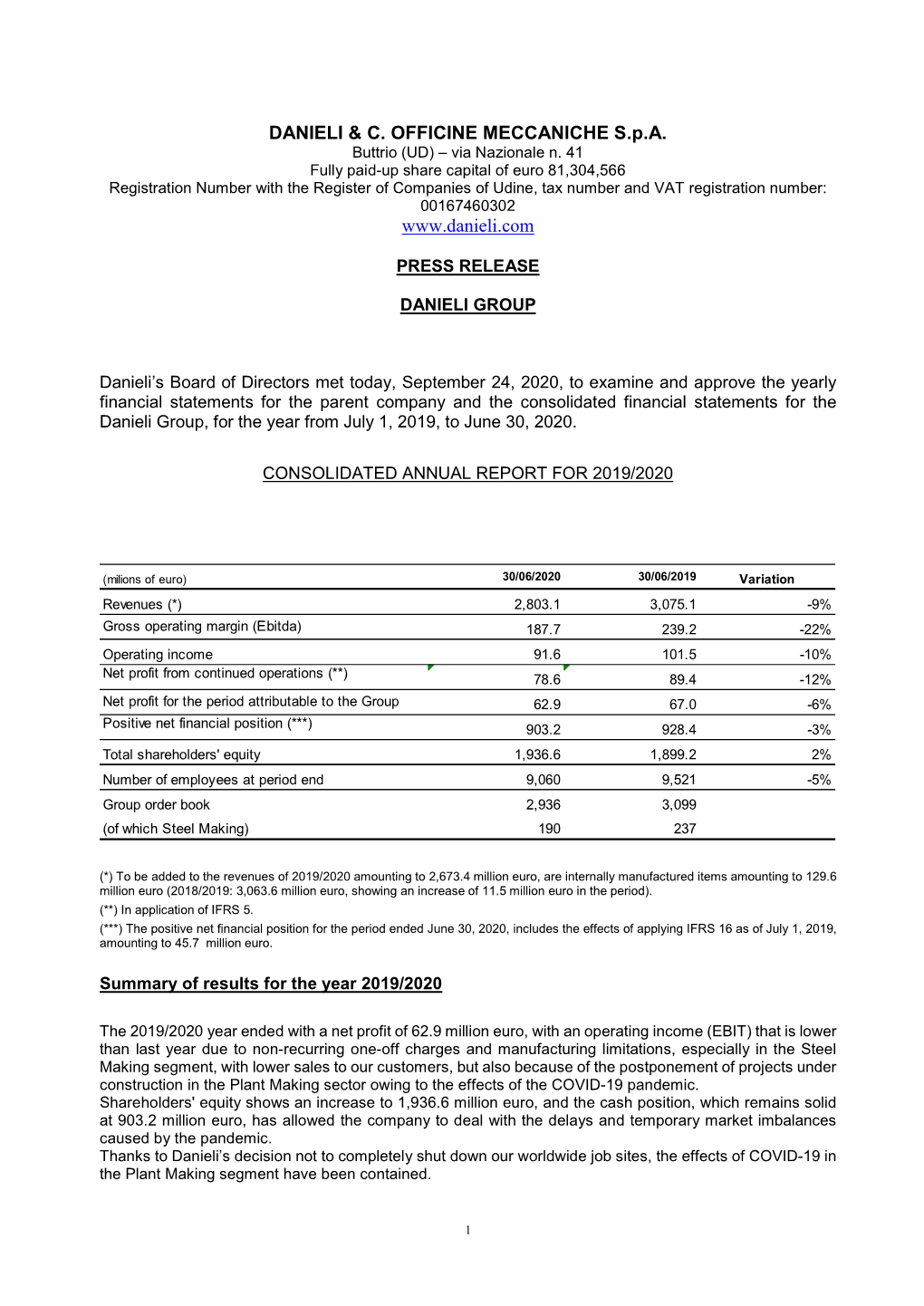

DANIELI & C. OFFICINE MECCANICHE S.p.A. Buttrio (UD) – via Nazionale n. 41 Fully paid-up share capital of euro 81,304,566 Registration Number with the Register of Companies of Udine, tax number and VAT registration number 00167460302 www.danieli.com PRESS RELEASE DANIELI GROUP Danieli’s Board of Directors met today, September 25, 2019, to examine and approve the yearly financial statements for the parent company and the consolidated financial statements for the Danieli Group, for the year from July 1, 2018, to June 30, 2019. CONSOLIDATED ANNUAL REPORT FOR 2018/2019 Summary of results for the year 2018/2019 The 2018/2019 year ended according to forecasts, with sales, EBITDA and profits higher than in 2017/2018, with an 11%. Group revenues went up compared to last year, with rising sales in the Plant Making segment and increased sales in the Steel Making segment as well, which is also showing greater production volumes than in 2017/18, thanks to the re-start of the ABS Sisak steelmaking facility and in spite of the losses of the EWS pipe mill, for which we are in the process of determining the appropriate corrective actions to be taken in regard to the business. The year basically ended in a satisfactory manner, having correctly analyzed the situation by updating an operating vision that produced good results. EBITDA (which essentially reflects the margins correlated with the order book for the period) was according to forecasts and will be even better in the next fiscal year as we don’t foresee any extraordinary penalties due to local situations (Algeria), and some major innovative prototype plants will be starting up. -

Danieli Annual Report at June 30, 2019

DANIELI ANNUAL REPORT AT JUNE 30, 2019 T Annual report for the period R EPO R L July 01, 2018 to June 30, 2019 A NNU A Contents 2 Danieli Group structure 5 Boards and officers 6 Mission statement 7 Financial highlights of the Danieli Group 8 Key share data DIRECTORS' REPORT 9 The steel market 9 The market for steel making plants 10 Danieli Group operations 12 Danieli Group structure 24 Analysis of/commentary on the economic and financial position of the Danieli Group 25 Highlights of the consolidated income statement as at June 30, 2019 27 Summary of results by business segment 27 Revenues by geographical area 28 Highlights of the reclassified consolidated balance sheet as at June 30, 2019 28 Analysis of the consolidated net financial position as at June 30, 2019 29 Key consolidated financial ratios 30 Statement of changes in net financial position 30 Investments and research activities 31 Analysis of/commentary on the economic and financial position of Danieli & C. Officine Meccaniche S.p.A. 31 Highlights of the income statement as at June 30, 2019 31 Highlights of the reclassified balance sheet as at June 30, 2019 32 Analysis of the net financial position as at June 30, 2019 33 Key financial ratios 33 Management of business risks 35 Atypical and unusual transactions 35 Treasury shares 35 Secondary headquarters 35 Management and coordination 36 Statement pursuant to Art. 2.6.2 of the Stock Exchange Regulations 36 Governance 37 Events occurring after the reporting period 37 Outlook 37 Reconciliation between Parent Company shareholders’ equity and profit for the year and Group shareholders’ equity and profit for the year 38 Proposals by the Board of Directors to the annual general meeting 39 Consolidated non-financial statement pursuant to Italian Legislative Decree no. -

DANIELI YEAR 2018 Preview

DANIELI TEAM A CENTURY OF PARTNERSHIP DANIELI Preview EXPERIENCE YEAR 2018 ITALY GERMANY SWEDEN AUSTRIA FRANCE THE NETHERLANDS UK SPAIN RUSSIA TURKEY USA BRAZIL THAILAND INDIA CHINA JAPAN PREVIEW VERSION CONTENTS 2 LETTER TO THE STAKEHOLDERS 6 SOME THOUGHTS ABOUT MARKET STRATEGY Danieli Year 2018 8 DANIELI AT A GLANCE: Results from GROUP STRUCTURE Innovation, Reliability 10 DANIELI AT A GLANCE: and Partnership GROUP PERFORMANCE 16 DANIELI TEAM: THE RELIABLE INNOVATIVE PARTNER IN THE METALS INDUSTRY 23 MAIN EVENTS OF THE YEAR Danieli & C. Officine Meccaniche S.p.A. The data in this publication Headquarters in Buttrio (Udine) Italy refer to the period Share Capital: euro 81,304,566 fully-paid 01.07.2017 / 30.06.2018 Dear Shareholders, Customers and Colleagues Letter to the Stakeholders Results for the fiscal year 2017 / 2018: (millions of euro) 2017 / 18 2018 / 19 Group Results Group Forecast Revenue 2,706 2,750 / 2,850 EBITDA 229 220 / 230 Order book 2,954 2,900 / 3,100 The fiscal year 2017/18 ended according to forecast, with sales In spite of this, the plant-making division is expected to record and EBITDA improved compared to 2016/17 by respectively 9% low margins also for the fiscal year 2018/19, since its invoiced and 13.%. value will include the low-priced sales of plants of 2017. However, an improvement is expected starting from 2019/20, certainly as a result of a reduction in the under-absorption costs, Market and Scenario Forecast and we also will try hard to improve sales margins, which today are not yet adequate. -

2016 Top 250 International Contractors – Subsidiaries by Rank Rank Company Subsidiary Rank Company Subsidiary

Overview p. 38 // International Market Analysis p. 38 // Past Decade’s International Contracting Revenue p. 38 // International Region Analysis p. 39 // 2015 Revenue Breakdown p. 39 // 2015 New Contracts p. 39 // Domestic Staff Hiring p. 39 // International Staff Hiring p. 39 // Profit-Lossp. 40 // 2015 Backlog p. 40 // Top 10 by Region p. 40 // Top 10 by Market p. 41 // Top 20 Non-U.S. International Construction/Program Managers p. 42 // Top 20 Non-U.S. Global Construction/Program Managers p. 42 // VINCI Builds a War Memorial p. 43 // How Contractors Shared the 2015 Market p. 44 // How To Read the Tables p. 44 // Top 250 International Contractors List p. 45 // International Contractors Index p. 50 // Top 250 Global Contractors List p. 53 // Global Contractors Index p. 58 THE FALCON EMERGES Turkey’s Polimeks is building the NUMBER 40 $2.3-billion Ashgabot International Airport in Turkmenistan. The terminal shape is based on a raptor species. PHOTO COURTESY OF POLIMAEKS INSAATTAAHUT VE SAN TIC. AS TIC. VE SAN OF POLIMAEKS INSAATTAAHUT PHOTO COURTESY International Contractors Seeking Stable Markets Political and economic uncertainty in several regions have global firms looking for markets that are reliable and safe By Peter Reina and Gary J. Tulacz enr.com August 22/29, 2016 ENR 37 0829_Top250_Cover_1.indd 37 8/22/16 3:52 PM THE TOP 250 INTERNATIONAL CONTRACTORS 27.9% Transportation $139,563.9 22.9% Petroleum 21.4% Int’l Market Analysis $114,383.2 Buildings $106,839.6 (Measured $ millions) 10.8% Power $54,134.5 6.0% Other 2.2% 4.1% $29,805.5 0.8% Manufacturing Industrial Telecom $10,808.9 $20,615.7 $ 4,050.5 2.8% 0.2% 1.0% Water Hazardous Sewer/Waste $13,876.8 Waste $4,956.0 $1,210.5 SOURCE: ENR DATA. -

An Introduction to Thin Slab Technologies

AN INTRODUCTION TO THIN SLAB TECHNOLOGIES By: Elham Kordzadeh1 1. Independent Researcher of Mines and Metals Industries With Cooperation of: Mr. B. Radfar2 April 2016 1 Elham Kordzadeh Education: 2001-2004 M. Sc. Corrosion Science and Engineering Shahid Bahonar University of Kerman, Iran, GPA: 3.42 of 4 Thesis: The Evaluation of Corrosion and Mechanical Properties of Aluminum Heat Resistant Alloys for Replacing to Converter Openings of Copper Complex Industries Grade: 4 of 4 1998-2001 B. Sc. Material science and Engineering Shahid Bahonar University of Kerman, Iran, GPA: 3.09 of 4 B.Sc. Thesis: Completion, Calibration, Operation of Salt Spray Apparatus and Evaluation of Resistance of Galvanized Coatings/ST12 Steel in Salt Spray Test Grade: 3.9 of 4 Grants and Awards: First rank in M.Sc., 2004, Iran Second rank in B. Sc., 2001, Iran Current Title and Position: An Enginering Company May 2016-Present Technology and Innovation June 2014-May 2016 (Namad Sanat Pars Holding) -Fakoor Sanat Tehran Head of Metallurgy Department Technology and Know how Engineering of pelletizing and steel making plants Se Chahun pelletizing plant(Kobe Steel) Sangan pelletizing plant (NETC) Bonab steel making tender Ghadir steel making tender (Danieli) Hosco pelletizing tender Gol-e-Gohar steel making tender Sephid Dasht Thin slab tender January 2013-June 2014 (Namad Sanat Pars Holding) -TIV Energy Head of Mines and Metals -Business Development Department Consultant of Ghadir steel making plant (Danieli & Fakoor Sanat) Head of technical and commercial -

Download the ENR Ranking

Overview p. 34 // International Market Analysis p. 34 // Past Decade’s International Contracting Revenue p. 34 // International Region Analysis p. 35 // 2019 Revenue Breakdown p. 35 // 2019 New Contracts p. 35 // Domestic Staff Hiring p. 35 International Staff Hiring p. 35 // Profit-Loss p. 36 // 2019 Backlog p. 36 // Top 10 by Region p. 36 // Top 10 by Market p. 37 Top 20 Non-U.S. International Construction/Program Managers p. 38 // Top 20 Non-U.S. Global Construction/Program Managers p. 38 // Larsen & Toubro Ltd. Installs Massive Fusion Equipment p. 39 // How Contractors Shared the 2019 Market p. 40 // How To Read the Tables p. 40 // Top 250 International Contractors List p. 41 // International Contractors Index p. 46 // Top 250 Global Contractors List p. 47 // Global Contractors Index p. 52 CONNECTIONS China Communications 4 NUMBER Construction Group Ltd. is building the $500-million, 7,887-ft cable-stayed bridge connecting the Pelješac Peninsula with Croatia’s mainland. PHOTO COURTESY OF CHINA COMMUNICATIONS CONSTRUCTION GROUP LTD. GROUP CONSTRUCTION COMMUNICATIONS CHINA OF COURTESY PHOTO International Contractors Struggling With COVID-19 Rocked by the worldwide pandemic and plunging oil prices, the global construction market attempts to cope. By Gary J. Tulacz & Peter Reina enr.com August 17/24, 2020 ENR 33 0824_Top250_Intro_3.indd 33 8/18/20 5:44 PM 31.0% Transportation THE TOP 250 INTERNATIONAL CONTRACTORS $146,582.3 26.1% Buildings $123,456.9 Int’l Market Analysis 15.0% Petroleum $70,934.4 (2019 revenue measured in millions) 10.3% Power $48,556.6 5.6% Other 2.3% 3.4% $26,447.9 1.7% Manufacturing Industrial Telecom $10,822.1 $16,048.1 $7,842.1 % 0.1% 1.7% 2.9 Hazardous Sewer/Waste Water Waste $7,948.7 $13,904.0 $525.0 SOURCE: ENR Comparing the Past Decade’s International $383.7 $453.0 $511.1 $544.0 $521.6 $501.1 $468.1 $482.4 $487.3 $473.1 Contractor Revenue 2010* 2011* 2012 2013 2014 2015 2016 2017 2018 2019 (in $ billions) * Figures for 2010-2011 represent the Top 225 International Contractors before ENR expanded the list to 250. -

The Partnership of Nucor and Danieli Teams Will Bring the Gallatin Casting and Rolling Plant to the Next Level of High-Quality Production and Competitiveness

The partnership of Nucor and Danieli teams will bring the Gallatin casting and rolling plant to the next level of high-quality production and competitiveness. This is the first time that a classical compact thin slab casting and rolling plant is fully reconfigured into an ultra-modern QSP® (Quality Strip Production) plant. Both Nucor and Danieli teams are committed to set a new benchmark in Casting and Rolling Technology. Formerly known as the Gallatin Steel Company, the thin slab rolling plant located in Ghent, KY has a name plate capacity of 1.6 million shTPY of hot rolled coils having a thickness range from 1.4 to 12.7 mm, widths up to 1,625 mm and maximum coil weight of 35 shTon. The existing plant operates a 185 t twin shell DC EAF, a single LMF, a vertical caster, 206 m tunnel furnace, a six-stand close-coupled rolling mill, traditional laminar cooling and one down coiler. The current capabilities of the steel plant are mostly structural steel, micro-alloyed grades and thin line pipe grades. Like similar compact plants, Gallatin was originally designed for doubling the annual capacity by means of a second meltshop, second vertical caster and tunnel furnace connected by a swivel ferry system to the in-line HSM. The new equipment was originally meant to be a copy of the existing one. In October 2014, Nucor became the owner of the Gallatin Steel Company and has recently approved an investment to advance the technological capabilities and competitiveness of the Nucor Steel Gallatin Sheet Mill. Danieli is the selected technology supplier for the complete equipment and automation system, from raw materials to hot rolled coil. -

China-Italy Chamber of Commerce Career Day 2020 Job Description

China-Italy Chamber of Commerce Career Day 2020 Job Description Position: Software Engineer Job Description (100 words): - Presale technical support; - Independently do site survey under support of Italy head quarter; - Software developing for Digital/Automation product; - Site commissioning if necessary. Job location: Changshu/Suzhou Type of job (full-time, part-time, internship): Full-time Required experience: N/A Starting date: July 1,2020 Salary (if indicated): N/A Candidates’ requirements (100 words) - Suitable major in automation or electronics or mechatronics or IT; - Knowledge of Industrial L2/L3 concept; - Basic Knowledge of the Database, data mining, intelligent concept; - Basic Knowledge of networks (Ethernet), network protocols; - General knowledge of metal industry process and process flow; - Full of passion and desire to succeed; - Availability to short but frequent business trips; - Communication skills, team player, comfortable with ambiguity and able to business travel; - Good spoken and written English; - Good team working sense and be professional, self-encourage. Company Information Company Name: Danieli Metallurgical Equipment & Service (China) Co., Ltd. Company Description (100 words): Danieli is one of the three top manufacturers of plants and machines for the metals in-dustry in the world, both as single units and on turnkey or product-in-hand basis. Established in 1914, its main activities are the design, manufacturing, and installation of a complete range of machines, plants, and services that cover the entire production cycle, from ore to the finished steel products. Danieli boasts a unique series of modern production facilities located in Italy, China, Germany, Austria, Thailand, India, and Russia, honoring its motto "We do not shop around for noble equipment". -

Enr Top International Contractors

ENR TOP INTERNATIONAL CONTRACTORS ENR August 19/26, 2019 1 The Top 250 Global Contractors How to use the tables: • Companies are ranked according to total construction revenue in 2018 in U.S. $ millions. • Figures include prime contracts, shares of joint ventures, subcontracts, design-construct contracts and construction management-at-risk contracts when a firm's risks are similar to those of a general contractor. • Figures also include the value of installed equipment when a firm has prime responsibility for specifying and procuring it within the scope of a construction contract. – **: Firms not ranked last year – NA: Not available – †: Includes revenue of subsidiaries, names available through www.enr.com ENR August 19/26, 2019 2 ENR rankings: Top 250 Global Contractors Rank Firm 2018 Revenue (US $ m) New Contracts in 2019 2018 Total Int’l 2018 (US $ m) 1 1 China State Construction Eng’g Corp. Ltd., Beijing, China 170,435.3 12,812.5 342,947.9 2 2 China Railway Group Ltd., Beijing, China 140,090.0 6,181.9 248,847.0 3 3 China Railway Construction Corp. Ltd., Beijing, China 111,656.0 6,695.0 239,537.0 4 4 China Communications Constr. Group Ltd., Beijing, China 83,278.3 22,727.4 182,646.5 5 6 Power Construction Corp. Of China, Beijing, China 52,982.8 13,775.4 96,805.4 6 5 Vinci, Rueil-Malmaison, France 52,139.0 22,207.0 45,547.9 7 7 Grupo ACS, Madrid, Spain 44,188.2 38,041.0 51,007.8 8 10 China Metallurgical Group Corp., Beijing, China 37,238.9 2,858.9 93,878.7 9 9 Shanghai Construction Group, Shanghai, China 34,247.9 674.5 45,896.0 10 8 Bouygues SA, Paris, France 32,023.0 15,582.0 34,858.0 11 11 HOCHTIEF, Essen, Germany 29,121.0 27,797.0 33,047.0 12 12 China Energy Eng’g Corp. -

Reliability of Engineering News-Record International Construction Data

Reliability of Engineering News-Record international construction data Weisheng Lu1 Abstract Since the late 1970s, the Engineering News-Record (ENR) has produced annual lists ranking firms involved in building environment development on the basis of their international revenues. ENR lists, such as the Top 225 International Contractors and the Top 200 International Design Firms, have become popular datasets for international construction research. Nonetheless, given that the ENR data is self-reported, reviewers for journals and research funding bodies frequently question its reliability. The aim of this research is to ascertain the extent to which the self-report ENR data can be considered reliable for international construction research. Inter-data reliability tests conducted to measure the levels of resemblance between the ENR data and annual report data of 51 sample companies found that, contrary to the prevalent view that companies reporting to the ENR tend to inflate their revenues, there are no systematic errors in the ENR data. Although slight discrepancies were found, ENR data can be confidently used for international construction research. Journal reviewers and editors should be more open to ENR international construction data, rather than taking the default position that the data is inherently and seriously problematic and thus automatically dismissing those studies that use it. Keywords: International construction, Engineering News-Record, international companies, self-report data, data reliability 1 Assistant Professor, Department of Real Estate and Construction, Faculty of Architecture, The University of Hong Kong, Pokfulam, Hong Kong. Email: [email protected] 1 Introduction ‘International construction’ is when a company resident in one country performs work in another country (Ngowi et al., 2005). -

DANIELI YEAR 2017 Preview

DANIELI TEAM A CENTURY OF PARTNERSHIP DANIELI Preview EXPERIENCE YEAR 2017 ITALY GERMANY SWEDEN AUSTRIA FRANCE THE NETHERLANDS UK SPAIN RUSSIA TURKEY USA BRAZIL THAILAND INDIA CHINA JAPAN PREVIEW VERSION CONTENTS 2 LETTER TO THE SHAREHOLDERS 4 DANIELI AT A GLANCE: GROUP STRUCTURE Danieli Year 2017 6 DANIELI AT A GLANCE: Results from GROUP PERFORMANCE Innovation, Reliability 7 REPORT OF THE BOARD and Partnership OF DIRECTORS 12 ENGINEERING AND PLANTMAKING LEADING TEAM 14 DANIELI TEAM: THE RELIABLE INNOVATIVE PARTNER IN THE METALS INDUSTRY 21 MAIN EVENTS OF THE YEAR Danieli & C. Offi cine Meccaniche S.p.A. The data in this publication Headquarters in Buttrio (Udine) Italy refer to the period Share Capital: euro 81,304,566 fully-paid 01.07.2016 / 30.06.2017 Letter to the Shareholders Results for the fi scal year 2016 / 2017: (millions of euro) 2016 / 17 2017 / 18 2017 / 18 2017 / 18 Group Results Group Forecast Forecast Steelmaking Forecast Plantmaking Revenue 2,490.9 2,450 / 2,550 850 / 900 1,600 / 1,650 EBITDA 202.5 200 / 220 95 / 105 105 / 115 Order book 2,532 2,800 / 3,100 350 / 400 2,450 / 2,700 Dear Shareholders, Customers and Colleagues But, investments in new plants are still below par if compared to the period 2000-2012. Fiscal 2016/2017 was another challenging year for metals plant A decline in sales is therefore expected for plant builders, but builders. profi tability probably will increase thanks to the restructuring of As expected, the market for investments in new plants contracted engineering and manufacturing resources to rebalance supply and by an average of 30/35% for the third year in a row, reconfi rming the demand.