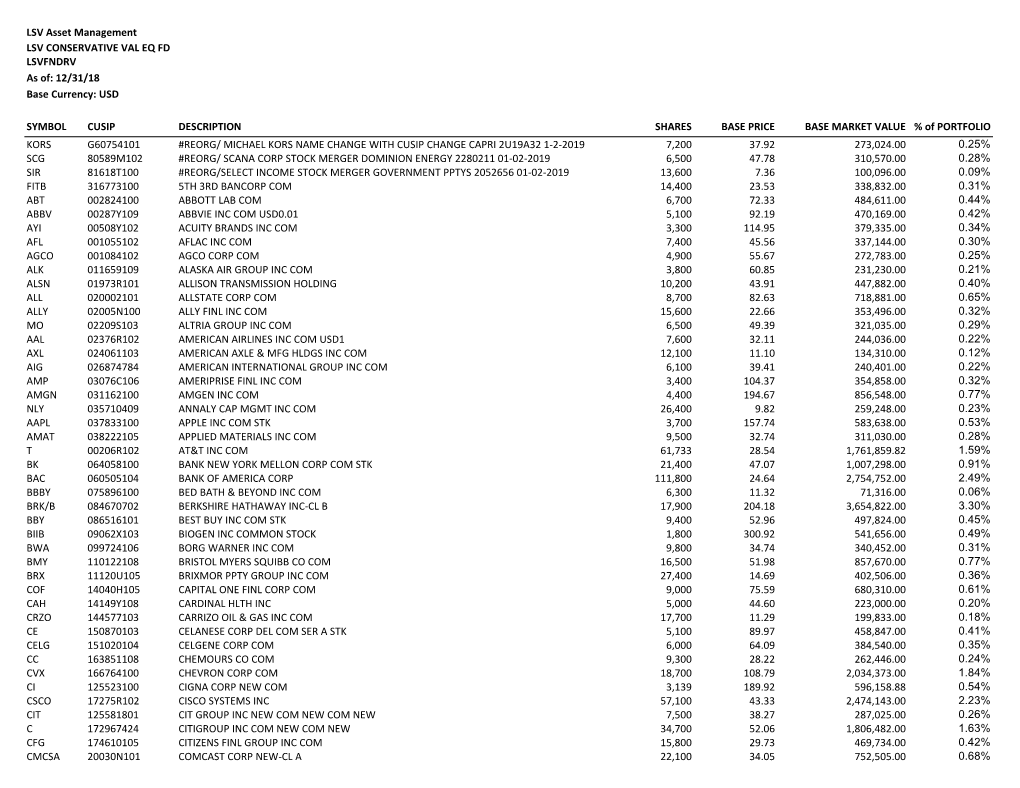

Symbol Cusip Description Shares

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case 17-12443 Doc 1 Filed 11/15/17 Page 1 Of

Case 17-12443 Doc 1 Filed 11/15/17 Page 1 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 2 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 3 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 4 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 5 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 6 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 7 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 8 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 9 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 10 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 11 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 12 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 13 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 14 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 15 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 16 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 17 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 18 of 502 Case 17-12443 Doc 1 Filed 11/15/17 Page 19 of 502 1 CYCLE CENTER H/D 1-ELEVEN INDUSTRIES 100 PERCENT 107 YEARICKS BLVD 3384 WHITE CAP DR 9630 AERO DR CENTRE HALL PA 16828 LAKE HAVASU CITY AZ 86406 SAN DIEGO CA 92123 100% SPPEDLAB LLC 120 INDUSTRIES 1520 MOTORSPORTS 9630 AERO DR GERALD DUFF 1520 L AVE SAN DIEGO CA 92123 30465 REMINGTON RD CAYCE SC 29033 CASTAIC CA 91384 1ST AMERICAN FIRE PROTECTION 1ST AYD CO 2 CLEAN P O BOX 2123 1325 GATEWAY DR PO BOX 161 MANSFIELD TX 76063-2123 ELGIN IN 60123 HEISSON WA 98622 2 WHEELS HEAVENLLC 2 X MOTORSPORTS 241 PRAXAIR DISTRIBUTION INC 2555 N FORSYTH RD STE A 1059 S COUNTRY CLUB DRRIVE DEPT LA 21511 ORLANDO FL 32807 MESA AZ -

2021 Honored Companies Please Join Us As We Give Special Recognition and Honor S&P 500 and F1000 Companies with at Least 35% of Board Seats Held by Women

Cipriani 42nd St | November 10, 2021 | 7:30 AM-11:00 AM 2021 Honored Companies Please join us as we give special recognition and honor S&P 500 and F1000 companies with at least 35% of board seats held by women. 50% + AMN Healthcare General Motors Co. Sally Beauty Holdings, Inc. Autodesk, Inc. Hasbro, Inc. Schnitzer Steel Industries, Inc. Bed, Bath & Beyond, Inc. Hawaiian Electric Industries, Inc. Science Applications International Corporation (SAIC) Best Buy Companies Inc. Healthpeak Properties, Inc. Steelcase Inc. Big Lots Inc. Herman Miller, Inc. Summit Materials, Inc. Bright Horizons Family Solutions, Inc. HNI Corporation Tapestry, Inc. Caleres, Inc. J.Crew Group, Inc. Thrivent Financial Casey’s General Stores, Inc. L Brands, Inc. TIAA Celanese Corporation Micron Technology Inc Tiffany & Co. Chico’s Fas, Inc. Navient Corporation ULTA Beauty Inc. Citi Omnicom Group Inc. ViacomCBS Inc. Coty Inc. PC Connection, Inc. Welltower Inc. DaVita Pitney Bowes, Inc. Western Digital Corporation EQT Corporation The Procter & Gamble Co. Williams-Sonoma, Inc. Etsy, Inc. The Progressive Corporation 40% + Abercrombie & Fitch Co. Genworth Financial The ODP Corporation ABM Industries, Inc. Globe Life Inc. Penn Mutual Accenture The Goldman Sachs Group, Inc. Phillips 66 Company AES Corporation Groupon Inc. Principal Financial Group Inc. Afliated Managers Group (AMG) H & R Block, Inc. PROG Holdings, Inc. AGNC Investment Corp. The Hershey Companies Quest Diagnostics Inc. Alliant Energy Hewlett Packard Enterprise RR Donnelley & Sons Co. Amazon.com, Inc. Hill-Rom Holdings Inc. Reinsurance Group Of America, Inc. American Water Works, Inc. Hilton Worldwide Holdings, Inc. Reliance Steel and Aluminum Co. Amica Mutual Insurance Company HP Inc. -

In This Month's Newsletter

Data-Based Consulting Heavy Equipment Rental In this month’s newsletter: 2 Monthly Commentary and Summary 3 Recent Industry News 6 Loan Market Update & Technical Conditions Knowledge-Based Cons. Non-Heavy Equip. Rental 8 Revolver and Term Loan Recent Issuance 11 Investment Grade Bond Market Update & Outlook 13 Investment Grade Recent Bond Issuance 14 Investment Grade Debt Comparables Advertising / Marketing Facility Services 17 High Yield Bond Market Update & Outlook 19 High Yield Recent Bond Issuance 20 High Yield Debt Comparables 22 Equity Capital Markets Update & Outlook Printing Services Auction Services 24 Equity Capital Markets Relative Valuation 25 Equity Capital Markets Recent Issuance 26 Operating Statistics Diversified / Other 29 Macroeconomic Indicators 32 Current Interest Rate Environment 33 Notable Mergers and Acquisitions Activity 36 KeyCorp & KBCM Overview & Capabilities Disclosure: KeyBanc Capital Markets is a trade name under which corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., Member NYSE/FINRA/SIPC, and KeyBank National Association (“KeyBank N.A.”), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives, who may also be employees of KeyBank N.A. Banking products and services are offered by KeyBank N.A. This report was not issued by our research department. The information contained in this report has been obtained from sources deemed to be reliable but is not represented to be complete, and it should not be relied upon as such. This report does not purport to be a complete analysis of any security, issuer, or industry and is not an offer or a solicitation of an offer to buy or sell any securities. -

Illinois Workers' Compensation Commission

ILLINOIS WORKERS' COMPENSATION COMMISSION PAGE 1 C A S E H E A R I N G S Y S T E M ROWE-SULLIVAN, MELIN 072 ARBITRATION CALL FOR BLOOMINGTON 14001 ON 07/23/2018 SEQ CASE NBR PETITIONER NAME RESPONDENT NAME ACCIDENT DATE ATTORNEY NAME ATTORNEY NAME *********************************************************************************** * = NEW CASE # = FATAL @ = STATE EMPLOYEE W = IWBF - 1 95WC 53229 KILLAM, VALERIE K MITSUBISHI MOTOR MANUFACT 08/18/95 OSTLING ENSIGN & BARRY WILLIAM A LOWRY 2 04WC 41225 GARLOCK, TIM STATE FARM MUTUAL AUTO 10/17/01 WILLIAMS & SWEE LAW OFFICES STEPHEN CARTER 3 05WC 23899 LICHTEN, THOMAS R THOMAS R LICHTEN, LTD 05/28/02 4 07WC 37085 FISH, TIMOTHY STATE OF IL/PONTIAC CORR @ 03/09/06 LAW OFFICE EDWARD LICHTENS ASSISTANT ATTORNEY GENERAL 15WC021826 -C PONTIAC CORRECTIONAL CENTE 5 08WC 17268 TURNER, ALLAN AMERICAN BUILDINGS CO 02/01/08 WILLIAMS & SWEE SPIEGEL & CAHILL, PC 6 08WC 37597 BELLOT, MARY JOAN R R DONNELLEY & SONS 01/02/08 STROW LAW LLC INMAN & FITZGIBBONS 10WC030217 -C R.R. DONNELLEY 7 09WC 09488 GARLOCK, TIM STATE FARM MUTUAL 11/06/08 WILLIAMS & SWEE LAW OFFICES STEPHEN CARTER 8 09WC 23495 NAPIER, STEVEN KENNEY'S DELIVERY INC 04/11/09 WILLIAMS & SWEE JAMES M KELLY 9 09WC 34857 LAMBERT, LARRY STATE OF ILLINOIS @ 12/29/08 WILLIAMS & SWEE ASSISTANT ATTORNEY GENERAL 09WC035170 -C ST OF IL DEP OF 12WC001061 -C 10 09WC 43424 STICKLEN, MARK NESTLE USA INC & NESTLE N 08/08/09 WILLIAMS & SWEE LTD KEEFE CAMPBELL & ASSOC LLC 11 09WC 48608 CAMPBELL, CYNTHIA LIVINGSTON COUNTY SHERIFF 11/20/08 WILLIAMS & SWEE RUSIN & -

Chicago's Largest Publicly Traded Companies | Crain's Book of Lists

Chicago’s Largest Publicly Traded Companies | Crain’s Book of Lists 2018 Company Website Location Walgreens Boots Alliance Inc. www.walgreensbootsalliance.com Deerfield, IL Boeing Co. www.boeing.com Chicago, IL Archer Daniels Midland Co. www.adm.com Chicago, IL Caterpillar Inc. www.caterpillar.com Peoria, IL United Continental Holdings Inc. www.unitedcontinental-holdings.com Chicago, IL Allstate Corp. www.allstate.com Northbrook, IL Exelon Corp. www.exeloncorp.com Chicago, IL Deere & Co. www.deere.com Moline, IL Kraft Heinz Co. www.kraftheinz-company.com Chicago, IL Mondelez International Inc. www.mondelez-international.com Deerfield, IL Abbvie Inc. www.abbvie.com North Chicago, IL McDonald’s Corp. www.aboutmcdonalds.com Oak Brook, IL US Foods Holding Corp. www.USfoods.com Rosemont, IL Sears Holdings Corp. www.searsholdings.com Hoffman Estates, IL Abbott Laboratories www.abbott.com North Chicago, IL CDW Corp. www.cdw.com Lincolnshire, IL Illinois Tool Works Inc. www.itw.com Glenview, IL Conagra Brands Inc. www.conagrabrands.com Chicago, IL Discover Financial Services Inc. www.discover.com Riverwoods, IL Baxter International Inc. www.baxter.com Deerfield, IL W.W. Grainger Inc. www.grainger.com Lake Forest, IL CNA Financial Corp. www.cna.com Chicago, IL Tenneco Inc. www.tenneco.com Lake Forest, IL LKQ Corp. www.lkqcorp.com Chicago, IL Navistar International Corp. www.navistar.com Lisle, IL Univar Inc. www.univar.com Downers Grove, IL Anixter International Inc. www.anixter.com Glenview, IL R.R. Donnelly & Sons Co. www.rrdonnelly.com Chicago, IL Jones Lang LaSalle Inc. www.jll.com Chicago, IL Dover Corp. www.dovercorporation.com Downers Grove, IL Treehouse Foods Inc. -

Morning News Call

MORNING NEWS CALL TOP NEWS • Anthem quarterly profit beats estimates, raises 2018 forecast Anthem Inc reported quarterly profit that topped analysts' estimates on lower medical costs and the No.2 U.S. health insurer raised its full-year adjusted earnings forecast. • Printing firm Quad/Graphics to buy peer LSC in $1.4 billion deal Printing services firm Quad/Graphics Inc said it would buy peer LSC Communications in an all-stock deal valued at about $1.4 billion, to expand its footprint in the industry. • Yum Brands quarterly revenue beats estimates Yum Brands Inc's third-quarter revenue beat Wall Street estimates , as more people visited its KFC and Taco Bell chains. • Carlyle reports 25 cents for Q3 earnings per unit, misses forecast Alternative asset manager Carlyle Group LP missed estimates for earnings per unit for the third quarter, as the value of its private equity investments rose less than that one of its key rivals. • Samsung slashes capex, calls end to chip boom after record Q3 Samsung Electronics Co Ltd slashed 2018 capex by more than a quarter and warned of lower profit until early next year, calling an end to a two-year boom in memory chips that fuelled record third-quarter profit. BEFORE THE BELL U.S. stock futures rose, taking cues from global markets, after a brutal October that saw sharp downturns in equity markets. The dollar steadied against a basket of currencies ahead of ADP national employment report. Oil prices rose as markets braced for the imposition of U.S. sanctions on Iran next week and gold prices slipped. -

2020 Meeder Funds Annual Report

Meeder Funds Annual Report December 31, 2020 Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.meederinvestment.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-325-3539 or by sending an email request to [email protected]. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-800-325-3539 or send an email request to [email protected] to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the Fund complex if you invest directly with a Fund. -

Corporate Counsel Institute

58TH ANNUAL Corporate Counsel Institute September 26–27, 2019 Chicago, Illinois In-house Counsel Tuition Rates as Low as $325! Register at: www.law.northwestern.edu/cci Mark M. MacCarthy, Senior Fellow, Institute for Technology Law and Policy, Georgetown Law School, Washington, DC Sarah Pearce, Paul Hastings LLP, London Highlights 10–11 a.m. | Current Trends in Litigation • Best practices for defending class actions • Sessions on Corporate Governance, • Jury trials: Have reality TV and the current Labor and Employment, political climate impacted best practices for Mindfulness, and Leadership presenting your case? • An ethics session based on the • Data privacy: risks and best practices book Bad Blood: Secrets and Lies • AI and other tools to assess litigation risk and in a Silicon Valley Startup manage litigation MODERATOR • Network with 300 in‑house counsel Rebecca Weinstein Bacon, Bartlit Beck LLP, Chicago and industry experts PANELISTS And Stacey Dixon Mahone, Assistant General Counsel, Litigation and Compliance, Green • Earn up to 12.5 CLE credit hours Thumb Industries, Chicago including (as applicable) 1 diversity Additional panelists to be announced credit, 1 legal ethics credit, and 1 mental health and substance 11:15 a.m.–12:15 p.m. | Implicit Bias abuse credit & the Law: Navigating the Legal Implications Within Your Organization Beyond recognizing our own implicit biases, we need to understand how these biases affect our organizations’ internal policies and informal cultural expectations. Implicit bias influences many aspects of how we work, including hiring and managing, compliance, and providing guidance to business units. This presentation will help you understand the practical implications of implicit biases and best practices to navigate them. -

Variable Product Trust Semi-Annual Report

June 30, 2018 State Farm Variable Product Trust SEMI-ANNUAL REPORT Large Cap Equity Fund Small/Mid Cap Equity Fund International Equity Fund Large Cap Equity Index Fund Small Cap Equity Index Fund International Equity Index Fund Stock and Bond Balanced Fund Bond Fund Money Market Fund Table of Contents 1-888-702-2307 Message to Variable Product Customers 1 State Farm VP Management Corp. Customer Service Representatives are available Portfolio Summary 4 8:00 a.m. until 5:00 p.m. (Central Time) Monday through Friday (except holidays) Expense Example 7 This report and any financial information contained herein are submitted for the general information of the owners of interests Board Approval of Investment in State Farm Life Insurance Company and State Farm Life and Advisory and Sub-Advisory Agreements 9 Accident Assurance Company Variable Life Separate Accounts or Variable Annuity Separate Accounts (the “Accounts”). This Schedule of Investments report provides the results of operations for each of the Funds of the State Farm Variable Product Trust. It is possible to Large Cap Equity Fund 12 invest in these underlying Funds only through the Small/Mid Cap Equity Fund 14 purchase of a State Farm Variable Universal Life Insurance International Equity Fund 16 policy or State Farm Variable Deferred Annuity policy. Large Cap Equity Index Fund 19 Please read the prospectus and consider the investment Small Cap Equity Index Fund 25 objectives, charges and expenses and other information it contains about the Accounts carefully before investing. International Equity Index Fund 45 Stock and Bond Balanced Fund 56 Variable Deferred Annuity (VA) policy series 97040 & 97090 in all states except MT, NY,WI; 97090 in MT; A97040 & A97090 in Bond Fund 57 NY,WI. -

2017 ► Do Not Enter Social Security Numbers on This Form As It May Be Made Public

l efile GRAPHIC print - DO NOT PROCESS As Filed Data - DLN:93491317017238 OMB No 1545-0052 I Form 990-PF Return of Private Foundation Department of the Trea^un or Section 4947( a)(1) Trust Treated as Private Foundation Internal Rev enue Ser ice 2017 ► Do not enter social security numbers on this form as it may be made public. ► Information about Form 990 - PF and its instructions is at www.irs.gov/form990pf. For calendar year 2017, or tax year beginning 01 - 01-2017 , and ending 12-31-2017 Name of foundation A Employer identification number Seidman Family Foundation 13-6098204 °/ Foundation Source Number and street (or P O box number if mail is not delivered to street address) Room/suite B Telephone number (see instructions) Foundation Source 501 Silverside Rd (800) 839-1754 City or town, state or province, country, and ZIP or foreign postal code Wilmington, DE 198091377 C If exemption application is pending, check here q G Check all that apply q Initial return q Initial return of a former public charity D 1. Foreign organizations, check here ► q Final return q Amended return 2 Foreign organizations meeting the 85% q test, check here and attach computation ► El Address change El Name change E If private foundation status was terminated H Check typ e of org anization q Section 501(c)(3) exem p t p rivate foundation under section 507(b)(1)(A), check here ► q Section 4947(a)(1) nonexempt charitable trust q Other taxable private foundation I Fair market value of all assets at end J Accounting method 9 Cash q Accrual F If the foundation is -

Eligible Company List - Updated 2/1/2018

Eligible Company List - Updated 2/1/2018 S10009 3 Dimensional Services Rochester Hills, MI Supplier Employees Only S65830 3BL Media LLC North Hampton, MA Supplier Employees Only S69510 3D Systems Rock Hill, SC Supplier Employees Only S65364 3IS Inc Novi, MI Supplier Employees Only S70521 3R Manufacturing Company Goodell, MI Supplier Employees Only S61313 7th Sense LP Bingham Farms, MI Supplier Employees Only D18911 84 Lumber Company Eighty Four, PA DCC Employees Only S42897 A & S Industrial Coating Co Inc Warren, MI Supplier Employees Only S73205 A and D Technology Inc Ann Arbor, MI Supplier Employees Only S57425 A G Manufacturing Harbour Beach, MI Supplier Employees Only S01250 A G Simpson (USA) Inc Sterling Heights, MI Supplier Employees Only F02130 A G Wassenaar Denver, CO Fleet Employees Only S80904 A J Rose Manufacturing Avon, OH Supplier Employees Only S19787 A OK Precision Prototype Inc Warren, MI Supplier Employees Only S62637 A Raymond Tinnerman Automotive Inc Rochester Hills, MI Supplier Employees Only S82162 A Schulman Inc Fairlawn, OH Supplier Employees Only S78336 A T Kearney Inc Chicago, IL Supplier Employees Only D80005 A&E Television Networks New York, NY DCC Employees Only S64720 A.P. Plasman Inc. Fort Payne, AL Supplier Employees Only S36205 AAA National Office (Only EMPLOYEES Eligible) Heathrow, FL Supplier Employees Only S31320 AAF McQuay Inc Louisville, KY Supplier Employees Only S14541 Aarell Process Controls Group Troy, MI Supplier Employees Only F05894 ABB Inc Cary, NC Fleet Employees Only S10035 Abbott Ball Co -

Investment Holdings As of June 30, 2018 Transparency of the Montana Investment Holdings

Investment Holdings As of June 30, 2018 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The Independent Auditor’s Report and Consolidated Unified Investment Program Financial Statement will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/ publications/audit/agency-search-report by selecting Board of Investments under Agency and the Board’s website http://investmentmt.com/AnnualReportsAudits will contain a link. Additional information can be found at www.investmentmt.com Montana Board of Investments | June 30, 2018 | 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equity 5 CAPP - International Equity 20 CAPP - Private Equity 34 CAPP - Natural Resources 36 CAPP - Private