Nov01 Pgs 1-64.Qxd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nanisivik – Canada’S First High Arctic Mine

INUIT ENCOUNTERS WITH COLONIAL CAPITAL: NANISIVIK – CANADA’S FIRST HIGH ARCTIC MINE by Tee Wern Lim B.Com. (Hons)., The University of Otago, 2006 B.A., The University of Otago, 2008 A THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ARTS in THE FACULTY OF GRADUATE STUDIES (Resource Management and Environmental Studies) THE UNIVERSITY OF BRITISH COLUMBIA (Vancouver) January 2013 © Tee Wern Lim, 2013 Abstract Mineral development has a long history of occurring in the territory of Indigenous communities. In Canada’s North, mineral exploration and mine development has become the most significant economic development strategy for Nunavut, with unprecedented levels of investment taking place today. However, broader and long-term implications of mineral development, and relevant historical experiences, are not well understood or documented. This thesis investigates a historically significant case: Canada’s first high Arctic mine, the Nanisivik lead-zinc mine, which operated near the Inuit community of Arctic Bay from 1976- 2002. Across two papers, this thesis focuses on the mine’s development in the early 1970s, and closure in the 2000s. Through a Marxian analysis utilizing the constructs of primitive accumulation and modes of production, chapter 2 outlines non-renewable resource-based industrial capitalism (exemplified by Nanisivik) as a distinct and severe structure of dispossession. This is contrasted with prior periods of similarly colonial but merchant capitalist resource extraction, namely whaling and the fur trade. I explain how the State and capital combined to impose capitalist relations of production on a predominantly noncapitalist Inuit social formation. Aspects of structural resistance to this imposition are also discussed. -

Morumbi Resources Inc. Ni 43-101 Technical Report On

MORUMBI RESOURCES INC. NI 43-101 TECHNICAL REPORT ON THE EL MOCHITO ZINC-LEAD-SILVER MINE, HONDURAS Report Date: September 9, 2016 Effective Date: December 31, 2015 Report By: Bogdan Damjanović, P.Eng. B. Terrence Hennessey, P.Geo. Christopher R. Lattanzi, P.Eng. David Makepeace, M.Eng., P.Eng. Jane Spooner, P.Geo. 900 - 390 BAY STREET, TORONTO ONTARIO, CANADA M5H 2Y2 Telephone +1 416 362 5135 Fax +1 416 362 5763 Page Table of Contents 1.0 SUMMARY ................................................................................................................... 1 1.1 RECOMMENDATIONS ............................................................................................ 3 2.0 INTRODUCTION......................................................................................................... 5 2.1 TERMS OF REFERENCE ......................................................................................... 5 2.2 INFORMATION SOURCES ..................................................................................... 5 2.3 QUALIFIED PERSONS, SITE VISITS, AND AREAS OF RESPONSIBILITY .................................................................................................... 5 2.4 UNITS AND ABBREVIATIONS .............................................................................. 6 3.0 RELIANCE ON OTHER EXPERTS.......................................................................... 7 4.0 PROPERTY DESCRIPTION AND LOCATION ..................................................... 8 4.1 ROYALTIES AND TAXES .................................................................................... -

Prospects for Mining in British Columbia

Prospects for Mining in British Columbia A REPORT FOR THE BRITISH COLUMBIA BUSINESS COUNCIL IN SUPPORT OF THE OPPORTUNITY 2020 PROJECT SEPTEMBER 2009 By : Michael R. J. McPhie, M.Sc., QEP Managing Director Natural Resource and Infrastructure Projects Sponsored by HB Global Advisors Corp. • Montreal Toronto Vancouver Calgary Ottawa Paris Singapore • heenanblaikie.com The opinions expressed in this document are those of the author and do not necessarily reflect those of the Business Council of British Columbia. Permission to use or reproduce this report is granted for personal or classroom use without fee and without formal request provided that it is properly cited. Copies may not be made or distributed for profit or commercial advantage. TABLE OF CONTENTS Acknowledgments Part 1: Background 1 Part 2: Overview of the Sector in 2009 3 Part 3: Global Drivers for the Future 10 3.1 Commodities 10 3.1.1 Copper 10 3.1.2 Coal 13 3.1.3 Molybdenum 14 3.1.4 Zinc 14 3.1.5 Aggregates 16 3.2 Mergers, Acquisitions and Access to Credit 16 3.3 Investment Attractiveness 17 3.4 New Discoveries and Development 3.5 Industry’s Ability to Respond to Increasing Societal Expectations for Performance 20 3.6 Role of Indigenous/Aboriginal People in Resource Development 22 Part 4: Prospects for Growth to 2020 23 4.1 Low Growth Scenario 24 4.2 Strong Growth Scenario 26 4.3 Steps to Maximize the Growth Potential of BC’s Mineral Exploration and Mining Sector 28 Part 5: Conclusions 34 References 35 Appendix A: Operating Mines of British Columbia in 2009 Appendix B: List -

Zinc Producer

A PURE PLAY ZINC PRODUCER PROFITABILITY GROWTH OPPORTUNITY March 2018 Production Ramp Up 2018 EBITDA Guidance 2018 Free Cash Flow 2018 ZnEq Production Increase Guidance Guidance (Since Jan. 2017) ($US) ($US) (lbs) 81% 32-40M 14-20M 93-109M Production began at the El Mochito mine in 1948 and has been ongoing for PUERTO CORTÉS SAN PEDRO SULA 70 years continuously. Ascendant is a Toronto-based mining company focused on its EL MOCHITO MINE 100%-owned producing El Mochito zinc, silver and lead mine in west- central Honduras, which has been in production since 1948. After TEGUCIGALPA acquiring the mine in December 2016, Ascendant implemented a rigorous optimization program aimed at restoring the historic potential of the El Mochito mine. In 2017, the Company successfully completed the operational turnaround it set out to achieve with sustained production at record levels and profitability restored. The Company now remains focused on cost reduction and further operational improvements to drive robust free cash flow in 2018 and beyond. Ascendant is also focused on expanding and upgrading known resources through extensive exploration work for near-term growth. With a significant land package of 11,000 hectares and an abundance of historical data there are several regional targets providing longer term exploration upside which could lead to further resource growth. The Company is also engaged in the evaluation of producing and development stage mineral resource opportunities, on an ongoing basis. The Company’s common shares are principally listed on the Toronto Stock Exchange under the symbol “ASND”. www.ascendantresources.com El Mochito Mine - Zinc, Lead, Silver ASND 100% owned underground Zn/Pb/Ag Significant Reserve and Resource mine in continual operation since 1948. -

Exploration Overview 2009

2373_01_00_Layout 1 07/01/10 9:17 PM Page 1 2373_01_00_Layout 1 07/01/10 9:29 PM Page 2 (Above) Qikiqtarjuaq, August 2009 COURTESY OF GN-EDT Contents: Acknowledgements Land Tenure in Nunavut........................................................................................................3 The 2009 Exploration Overview Indian and Northern Affairs Canada....................................................................................4 was written by Karen Costello (INAC), Andrew Fagan Government of Nunavut........................................................................................................6 (consultant) and Linda Ham (INAC) with contributions from Nunavut Tunngavik Inc. ........................................................................................................8 Don James (CNGO), Canada-Nunavut Geoscience Office ...................................................................................10 Keith Morrison (NTI) and Eric Prosh (GN). Summary of 2009 Exploration Activities Front cover photo: Kitikmeot Region .........................................................................................................20 Installation of power plants, Kivalliq Region .............................................................................................................41 Meadowbank Mine COURTESY OF AGNICO-EAGLE MINES LIMITED Qikiqtaaluk/Baffin Region...........................................................................................61 Back cover photo: Index .....................................................................................................................................75 -

Nyrstar Way Zincbe the Leading Integrated Metals and Mining Business Multi Metals Growth Resources for a Changing World Deliver Sustainable Growth Sustainable Deliver

Achieve excellenceCreating in everything we do Value From volumeFrom to value to Through Integration Unlocking untapped value The Nyrstar Way ZincBe the leading integrated metals and mining business Multi metals Growth Resources for a changing world Deliver sustainable growth sustainable Deliver ANNUAL REPORT 2011 Key figures (EUR millions unless otherwise stated) 2011 2010 2009 MINING PRODUCTION Zinc in concentrate (‘000 tonnes) 207 84 - Gold in concentrate (‘000 troy ounces) 49.9 4.7 - Silver in concentrate (‘000 troy ounces)1 3,673 271 - Copper in concentrate (‘000 tonnes) 7.7 0.2 - SMELTING PRODUCTION2 Zinc metal (‘000 tonnes) 1,125 1,076 809 Lead metal (‘000 tonnes) 211 198 227 MARKET Average LME zinc price (USD/t) 2,191 2,159 1,659 Average exchange rate (EUR/USD) 1.39 1.33 1.39 KEY FINANCIAL DATA Revenue 3,348 2,696 1,664 Mining EBITDA3 72 24 (3) Smelting EBITDA3 235 198 97 Other & Eliminations EBITDA3 (42) (12) (2) EBITDA3,4 265 210 93 Results from operating activities before exceptional items 122 112 32 Profit/(loss) for the period 36 72 10 Mining EBITDA/t3 348 286 - Smelting EBITDA/t3 209 184 120 Group EBITDA/t3 199 181 115 Underlying EPS (EUR)5 0.38 0.85 0.32 Basic EPS (EUR) 0.24 0.62 0.10 Capital Expenditure 229 147 68 Net operating cash flow 121 232 (19) Net debt/(cash), end of period 718 296 38 6 Gearing (%) 35% 26% 5% 1 75% OF THE SILVER PRODUCED BY CAMPO MORADO IS SUBJECT TO A STREAMING AGREEMENT WITH SILVER WHEATON CORPORATION WHEREBY ONLY USD 3.90/OZ IS PAYABLE. -

Royal Gold to Acquire Barrick Gold's Royalty Portfolio 7/31/2008 7:20:00 AM DENVER, July 31 /Prnewswire-Firstcall/ -- ROYAL GOLD, INC

Royal Gold to Acquire Barrick Gold's Royalty Portfolio 7/31/2008 7:20:00 AM DENVER, July 31 /PRNewswire-FirstCall/ -- ROYAL GOLD, INC. (Nasdaq: RGLD; TSX: RGL), the leading precious metals royalty company, announced that it has entered into a definitive agreement to acquire a portfolio of royalties from Barrick Gold Corporation ("Barrick") for net cash consideration of $150 million and a restructuring of certain Royal Gold royalty positions at Barrick's Cortez Pipeline Mining Complex ("Cortez") in Nevada. The restructuring of these royalty positions will reduce the royalty burden on the undeveloped Crossroads deposit at Cortez while having only a minimal impact on Royal Gold's royalty revenue from the current production. The Barrick portfolio consists of royalties on 77 properties, including eight producing royalties, 20 development and evaluation stage properties, and 49 exploration projects. Over 75% of the portfolio consists of precious metals royalties. The purchase price for the acquisition will be paid from cash on hand. Royalty revenue generated from the Barrick portfolio in calendar 2007 was approximately $12 million. Revenues are expected to grow, assuming current commodity prices, as development stage projects commence production. The transaction is expected to be immediately accretive on all key financial measures. This royalty package complements Royal Gold's existing geographical royalty positions with significant growth into Canada and Australia. Terms of the Transaction Currently, Royal Gold holds four gold royalty interests at Cortez, consisting of two sliding-scale gross smelter return ("GSR") royalties ("GSR1 and GSR2"), a fixed rate GSR royalty ("GSR3") and a net value return royalty ("NVR1"). -

Proposed Acquisition of Breakwater Resources Ltd. Delivering on Our Strategy

Proposed acquisition of Breakwater Resources Ltd. Delivering on our strategy 15 June 2011 15 June 2011 Important Notice ‒ This announcement has been prepared by Nyrstar NV (the "Company"). It does not constitute or form part of, and should not be construed as, an offer, solicitation or invitation to subscribe for, underwrite or otherwise acquire, any securities of the Company or any member of its group nor should it or any part of it form the basis of, or be relied on in connection with, any contract to purchase or subscribe for any securities of the Company or any member of its group, nor shall it or any part of it form the basis of or be relied on in connection with any contract or commitment whatsoever. ‒ The information included in this announcement has been provided to you solely for your information and background and is subject to updating, completion, revision and amendment and such information may change materially. Unless required by applicable law or regulation, no person is under any obligation to update or keep current the information contained in this announcement and any opinions expressed in relation thereto are subject to change without notice. No representation or warranty, express or implied, is made as to the fairness, accuracy, reasonableness or completeness of the information contained herein. Neither the Company nor any other person accepts any liability for any loss howsoever arising, directly or indirectly, from this announcement or its contents. ‒ This announcement includes forward-looking statements that reflect the Company's intentions, beliefs or current expectations concerning, among other things, the results of operations, financial condition, exploration potential, liquidity, performance, prospects, growth, strategies of the Company and Breakwater Resources Ltd. -

Mining and Communities in Northern Canada : History, Politics, and Memory

University of Calgary PRISM: University of Calgary's Digital Repository University of Calgary Press University of Calgary Press Open Access Books 2015-11 Mining and communities in Northern Canada : history, politics, and memory Keeling, Arn; Sandlos, John University of Calgary Press Keeling, A., & Sandlos, J. (Eds.). (2015). Mining and Communities in Northern Canada: History, Politics, and Memory. Canada: University of Calgary Press. http://hdl.handle.net/1880/51021 book http://creativecommons.org/licenses/by-nc-nd/4.0/ Attribution Non-Commercial No Derivatives 4.0 International Downloaded from PRISM: https://prism.ucalgary.ca MINING AND COMMUNITIES IN NORTHERN CANADA: HISTORY, POLITICS, AND MEMORY Edited by Arn Keeling and John Sandlos ISBN 978-1-55238-805-1 THIS BOOK IS AN OPEN ACCESS E-BOOK. It is an electronic version of a book that can be purchased in physical form through any bookseller or on-line retailer, or from our distributors. Please support this open access publication by requesting that your university purchase a print copy of this book, or by purchasing a copy yourself. If you have any questions, please contact us at [email protected] Cover Art: The artwork on the cover of this book is not open access and falls under traditional copyright provisions; it cannot be reproduced in any way without written permission of the artists and their agents. The cover can be displayed as a complete cover image for the purposes of publicizing this work, but the artwork cannot be extracted from the context of the cover of this specific work without breaching the artist’s copyright. -

The Mining Industry and the Social Stakes of Development in the Arctic

The Mining Industry and the Social Stakes of Development in the Arctic Gérard Duhaime Nick Bernard Pierre Fréchette Marie-Anick Maillé Alexandre Morin Andrée Caron Collection RECHERCHE EN LIGNE La Chaire de recherche du Canada sur la condition autochtone comparée est affiliée au Centre interuniversitaire d’études et de recherches autochtones (CIÉRA) et à la Faculté des sciences sociales de l'Université Laval. Le présent document a été publié initialement dans la collection Recherche du Groupe d’études inuit et circumpolaires (GÉTIC) de l’Université Laval. Adresse postale: Chaire de recherche du Canada sur la condition autochtone comparée Centre interuniversitaire d’études et de recherches autochtones Pavillon Charles-De Koninck Université Laval Québec, QC Canada G1K 7P4 Téléphone: (418) 656-7596 Télécopieur: (418) 656-3023 [email protected] © Gérard DUHAIME, Nick BERNARD, Pierre FRÉCHETTE, Marie-Anick MAILLÉ, Alexandre MORIN and Andrée CARON 2003 ISBN : Dépôt légal: Bibliothèque nationale du Québec, 1er trimestre 2003 Bibliothèque nationale du Canada, 1er trimestre 2003 THE MINING INDUSTRY AND THE SOCIAL STAKES OF DEVELOPMENT IN THE ARCTIC1 Gérard Duhaime2 Nick Bernard Pierre Fréchette Marie-Anick Maillé Alexandre Morin Andrée Caron 1 This research was funded by the Humanities Research Council of Canada, to which the authors express their gratitude. 2 Louis-Edmond-Hamelin Chair, Université Laval, Pavillon Charles-de-Koninck, 0450, Université Laval, Québec, Canada G1K 7P4. [email protected]. TABLE OF CONTENTS Introduction . 1 1 – Corporate rationality and society. 2 – The mining industry and economic activity . 3 – Common characteristics . 4 – Corporations that pay little attention to social concerns . 5 – Corporations that pay greater attention to social concerns . -

Jun01 Pgs 1-64.Qxd

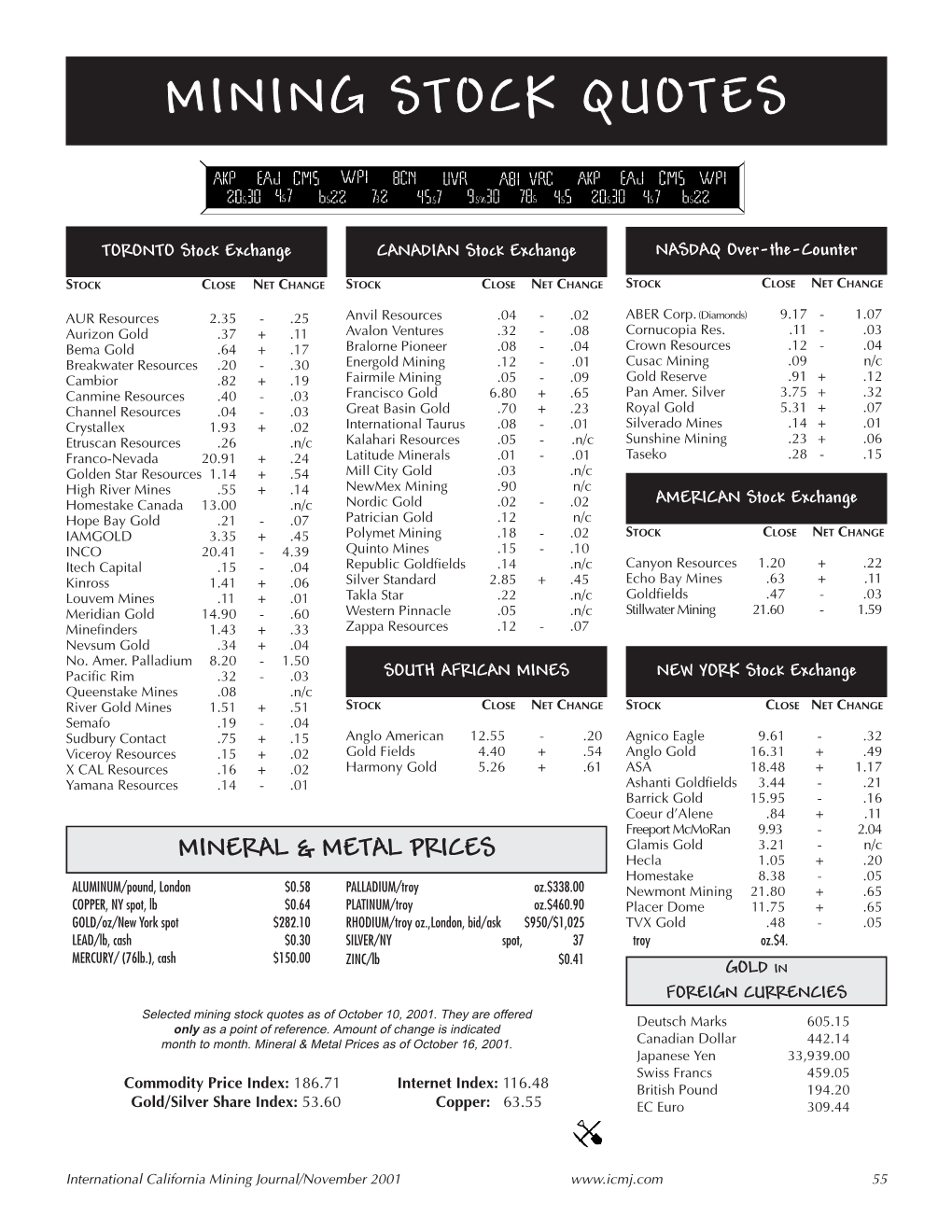

MMIINNIINNGG SSTTOOCCKK QQUUOOTTEESS TORONTO Stock Exchange CANADIAN Stock Exchange NASDAQ Over-the-Counter STOCK CLOSE NET CHANGE STOCK CLOSE NET CHANGE STOCK CLOSE NET CHANGE AUR Resources 2.83 + .84 Anvil Resources .09 -.01 ABER Corp. (Diamonds) 10.19 + .69 Aurizon Gold .40 -.10 Avalon Ventures .62 + .02 Cornucopia Res. .15 + .01 Bema Gold .41 + .09 Bralorne Pioneer .10 + .02 Crown Resources .23 -.01 Breakwater Resources 1.34 + .23 Energold Mining .13 + .01 Cusac Mining .09 + .01 Cambior .58 + .08 Fairmile Mining .15 + .03 Gold Reserve .64 + .16 Canmine Resources .47 -N/C Francisco Gold 5.25 + .25 Pan Amer. Silver 2.97 + .45 Channel Resources .07 -.01 Great Basin Gold .85 -.08 Royal Gold 2.99 + .48 Crystallex 2.20 + 1.04 International Taurus .13 -.01 Silverado Mines .30 + .05 Etruscan Resources .25 -.05 Kalahari Resources .09 -.02 Sunshine Mining .61 + N/C Franco-Nevada 18.60 + .90 Latitude Minerals .07 -.02 Taseko .63 + .07 Golden Star Resources .97 + .34 Mill City Gold .05 + N/C High River Mines .40 + .06 NewMex Mining .95 + .15 Homestake Canada 10.25 + 1.68 Nordic Gold .04 + .01 AMERICAN Stock Exchange Hope Bay Gold .40 + .01 Patrician Gold .13 -.01 IAMGOLD 2.90 + .57 Polymet Mining .47 + .06 STOCK CLOSE NET CHANGE INCO 28.81 + 3.84 Quinto Mines .25 - .09 Itech Capital .20 -.02 Republic Goldfields .06 -N/C Canyon Resources 1.20 + .18 Kinross .94 + .23 Silver Standard 2.36 + .16 Cominco 21.46 + 1.96 Louvem Mines .06 -.01 Takla Star .47 -.02 Echo Bay Mines .87 + .27 Meridian Gold 12.06 + 1.08 Western Pinnacle .04 + .01 Goldfields .59 + .13 Minefinders 1.01 -.02 Zappa Resources .11 + .01 Stillwater Mining 31.43 + 4.22 Nevsum Gold .22 -N/C No. -

Mining and Communities in Northern Canada : History, Politics, and Memory

University of Calgary PRISM: University of Calgary's Digital Repository University of Calgary Press University of Calgary Press Open Access Books 2015-11 Mining and communities in Northern Canada : history, politics, and memory Keeling, Arn; Sandlos, John University of Calgary Press Keeling, A., & Sandlos, J. (Eds.). (2015). Mining and Communities in Northern Canada: History, Politics, and Memory. Canada: University of Calgary Press. http://hdl.handle.net/1880/51021 book http://creativecommons.org/licenses/by-nc-nd/4.0/ Attribution Non-Commercial No Derivatives 4.0 International Downloaded from PRISM: https://prism.ucalgary.ca MINING AND COMMUNITIES IN NORTHERN CANADA: HISTORY, POLITICS, AND MEMORY Edited by Arn Keeling and John Sandlos ISBN 978-1-55238-805-1 THIS BOOK IS AN OPEN ACCESS E-BOOK. It is an electronic version of a book that can be purchased in physical form through any bookseller or on-line retailer, or from our distributors. Please support this open access publication by requesting that your university purchase a print copy of this book, or by purchasing a copy yourself. If you have any questions, please contact us at [email protected] Cover Art: The artwork on the cover of this book is not open access and falls under traditional copyright provisions; it cannot be reproduced in any way without written permission of the artists and their agents. The cover can be displayed as a complete cover image for the purposes of publicizing this work, but the artwork cannot be extracted from the context of the cover of this specific work without breaching the artist’s copyright.