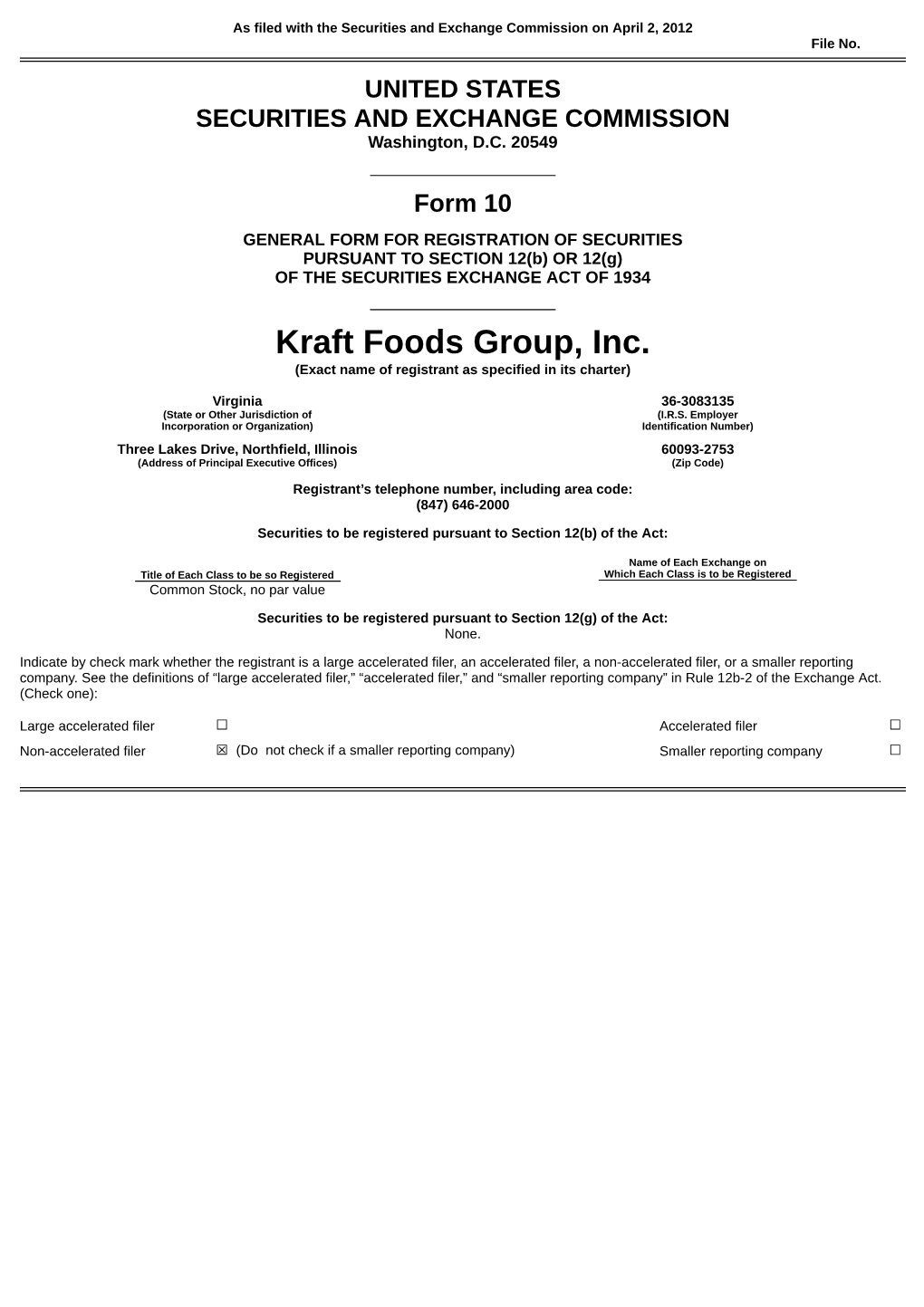

Kraft Foods Group, Inc. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GENERAL FOODS CORPORATE TIMELINE 1895 Charles William

GENERAL FOODS CORPORATE TIMELINE 1895 Charles William (C.W.) Post makes his first batch of Postum cereal beverage in a little white barn in Battle Creek, Michigan. With that step he enters the new retail cereal industry. 1896 Post’s company incorporates as The Postum Cereal Company, Ltd. 1897 C.W. Post introduces Post Grape-Nuts cereal, one of the first ready-to-eat cold cereals. 1914 C.W. Post dies and ownership of the business passes to his daughter, Marjorie. The Postum Cereal Company continues to follow the formula for success which C.W. established: selling high-quality, nutritious cereal products through marketing and advertising techniques that appealed to the common man and woman. The company invests over twelve million dollars in advertising between 1895 and 1914. 1922 The company reorganizes as the Postum Cereal Company, Incorporated. By 1923 The company’s executive offices are located at 342 Madison Avenue, New York with manufacturing facilities in Battle Creek, Michigan and Windsor, Ontario. 1923 The Postum Cereal Company, Inc. establishes an employee stock plan. 1924 An Educational Department is formed and one of its principal activities is providing consumer nutrition education. The department publishes nutrition stories for children and a nutrition handbook on school lunches for use by teachers, health workers and food service directors. In 1931, the department name is changed to Consumer Services. The Postum Cereal Company posts sales of over $24 million. The company’s executive offices are now located in the Postum Building at 250 Park Avenue, New York City. 1925 The Postum Cereal Company acquires the Jell-O Company for $67 million in cash and stock. -

The History of Kraft Foods Inc

The History of Kraft Foods Inc. All About Kraft Learn everything there is to know about Kraft: like who we are, how you can reach us and what we’re doing in your community. Kraft Foods Inc. is a company with many different roots and founders, all sharing a commitment to quality, a willingness to take risks and a spirit of innovation. Among the products now sold by Kraft Foods Inc. are so many “firsts” and innovations that a history of the company is almost a history of the food industry. Kraft traces its history to three of the most successful food entrepreneurs of the late 19th and early 20th centuries — J.L. Kraft, who started his cheese business in 1903; C.W. Post, who founded Postum Cereal Company (later renamed General Foods Corporation) in 1895; and Oscar Mayer, who began his meat business in 1883. The Story of J.L. Kraft The history of KRAFT goes back to 1903, when, with $65 in capital, a rented wagon and a horse named Paddy, J.L. Kraft started purchasing cheese at Chicago’s Water Street wholesale market and reselling it to local merchants. Within a short time, four of J.L. Kraft’s brothers joined him in the business, and, in 1909, they incorporated as J.L. Kraft & Bros. Co. In 1914, J.L. Kraft and his brothers purchased their first cheese factory in Stockton, Illinois. In 1915, they began producing processed cheese in 3-1/2 and 7-3/4 ounce tins. J.L. Kraft’s method of producing processed cheese was so revolutionary, in 1916 he obtained a patent for it and in 1917 the company started supplying cheese in tins to the U.S. -

Guide to the Product Cookbooks Collection

Guide to the Product Cookbooks Collection NMAH.AC.0396 Erin Molloy and Alison Oswald 2012 Archives Center, National Museum of American History P.O. Box 37012 Suite 1100, MRC 601 Washington, D.C. 20013-7012 [email protected] http://americanhistory.si.edu/archives Table of Contents Collection Overview ........................................................................................................ 1 Administrative Information .............................................................................................. 1 Biographical / Historical.................................................................................................... 2 Arrangement..................................................................................................................... 2 Scope and Contents........................................................................................................ 2 Names and Subjects ...................................................................................................... 2 Container Listing ............................................................................................................. 4 Product Cookbooks Collection NMAH.AC.0396 Collection Overview Repository: Archives Center, National Museum of American History Title: Product Cookbooks Collection Identifier: NMAH.AC.0396 Date: 1874-2009 Creator: Wells, Ellen B. (Creator) Extent: 18 Cubic feet (20 boxes) Language: Collection is in English. Some materials in German, Swedish and Yiddish. Summary: The collection consists -

World Nutrition Volume 5, Number 3, March 2014

World Nutrition Volume 5, Number 3, March 2014 World Nutrition Volume 5, Number 3, March 2014 Journal of the World Public Health Nutrition Association Published monthly at www.wphna.org Processing. Breakfast food Amazing tales of ready-to-eat breakfast cereals Melanie Warner Boulder, Colorado, US Emails: [email protected] Introduction There are products we all know or should know are bad for us, such as chips (crisps), sodas (soft drinks), hot dogs, cookies (biscuits), and a lot of fast food. Nobody has ever put these items on a healthy list, except perhaps industry people. Loaded up with sugar, salt and white flour, they offer about as much nutritional value as the packages they’re sold in. But that’s just the tip of the iceberg, the obvious stuff. The reach of the processed food industry goes a lot deeper than we think, extending to products designed to look as if they’re not really processed at all. Take, for instance, chains that sell what many people hope and believe are ‘fresh’ sandwiches. But since when does fresh food have a brew of preservatives like sodium benzoate and calcium disodium EDTA, meat fillers like soy protein, and manufactured flavourings like yeast extract and hydrolysed vegetable protein? Counting up the large number of ingredients in just one sandwich can make you cross-eyed. I first became aware of the enormity of the complex field known as food science back in 2006 when I attended an industry trade show. That year IFT, which is for the Institute of Food Technologists, and is one of the food industry’s biggest gatherings, was held in New Warner M. -

THE BEST BREW for EVERY CUP Put Our Brands to Work in Your Hot Beverage Portfolio

THE BEST BREW FOR EVERY CUP Put our brands to work in your hot beverage portfolio www.kraftheinz-foodservice.com CAFÉ A full family of brands with over 300 years of tradition and experience. PAGE ROAST & GROUND SOLUABLE WHOLE BEAN # FP BP PODS BP INDV BP 7 Maxwell House 10 Café Collection 11 Gevalia 12 Specialty 13 Yuban & Sanka PRODUCT DIRECTORY PRODUCT FP Fractional Packs BP Bulk Packs PODS Individual Pods INDV Individual Packets www.kraftheinz-foodservice.com 45% Roasted & Ground 46% 15% of coffee occasions Soluble occur away from With the average price rising for coffee on home menu, this restaurant staple can increase Technomic Beverage checks as a flexible offering. Occasions Report, 2019 NPD, Supply Track YE Feb 2019 40% 60% Whole Bean Cold Brew has seen a 60% rise in menu penetration, providing an on-trend profitable beverage with innovative flavor options. Use use traditional coffee to control costs & customize. Datassential, 2019 Lorem ipsum www.kraftheinz-foodservice.com Coffee Formats & Associated Equipment From whole bean bags to soluble quick-use, Kraft Heinz Foodservice has a wide range of product types, along with Key flavors like equipment servicing formats from urns to mochas & toffee thermal brewers. shape seasonal show Roasting & Flavor Expertise With roast types playing important roles in consumer decisions and menu development, having a full portfolio of light, medium, dark, growth year over year and espresso is essential. on menu, an easy differentiator & addition to menus Partner with KHC to explore these products -

Little Cookbooks – Accent – Accent International, Skokie, Illinois

Little Cookbooks – Accent – Accent International, Skokie, Illinois No Date – Good. Accent Cookout Recipes open up a wonderful world of flavor through seasoning. Vertical three-folded black and white sheet. Each panel 5” x 3 3/5”. No Date – Very Good. Accent Flavor Enhancer Serve Half, Freeze Half. Saves your budget …time…and energy! Everyone is looking for ways to serve good-tasting nutritious meals yet stay within the food budget. “Freeze Half. Serve Half” helps you to do just that! Vertical three-folded beige and brown sheet. Each panel 5” x 3”. No Date – Very Good. “Great American Recipes” Magazine insert. Title in red with servings of food and package of Accent in the center. Food in color. Recipes on three panels. Single folded sheet. Each panel 5” x 3”. 11/29/05 Little Cookbooks – Ace Hi – California Milling Corporation, 55th and Alameda, Los Angeles, California 1937 – Fine. Personally Proven Recipes BREAD, BISCUITS, PASTRY. California Milling Corporation, 55th and Alameda, Los Angeles, California. Modern drawing of woman in yellow dress, white apron holding Ace-Hi recipe book. Royal blue background. Back: Ace Hi in bright pink in circle and Family Flour and Packaged Cereals on royal blue background. 4 ¾”x 6 1/8”, no page numbers. 02/13/06 Little Cookbooks – Adcock Pecans – Adcock Pecans, Tifton, Georgia No date – Very Good. Enjoy ADCOCK’S FRESH Papershell Pecans prize-winning Recipes inside . Four folded sheet, blue and white. Brown pecan under title. Each panel, 3 ½”x 8 ½”. 8/21/05 Little Cookbooks – Airline Bee Products – The A. I. Root Company, Medina, Ohio 1915 – Poor. -

Kraft Canada

FROM CERTO TO KRAFT ALMOST A CENTURY OF FOOD MANUFACTURING IN COBOURG Scattered throughout the Town of Cobourg there remain THE FIRST FOOD ARRIVAL today a number of sites that hide the stories of major In 1919, with the war over and the building empty, the industries no longer with us. Munitions Board sold the property to Robert Douglas of Among these are the now Rochester, New York, who owned the York State Fruit vacant site of the Crossen Car Company. This area was the heart of apple-growing Works (later a tannery) and country, with orchards stretching from Bowmanville the abandoned remains of the to Trenton. The bounty of apples and preferential woolen mills on Tremaine business rates attracted Douglas to Cobourg. Street. The large food facility From here he had more favourable access to still known as Kraft looms Canadian and British markets. between William and Ontario Streets. His Cobourg Company, Douglas Packing, began as a manufacturer of vinegar, but Douglas looked ahead to Provincial Steel was the first industry to occupy the site on William St., just other products he could manufacture here. His theory, north of the railroad tracks, known in modern times as General Foods then as outlined in a patent application filed in 1913, was that Kraft. In 1909 the steel company erected the small red brick Classical Revival commercial jams could be made to building and a large plant. But their tenure was short-lived - in 1914 the plant gel both more reliably and more quickly with was acquired by the Imperial Munitions Board and became a warehouse for the the addition of a single, somewhat elusive storage of nitrate of soda, used in ammunition shells for the First World War. -

Kraft Foods - Wikipedia Visited on 09/19/2017

Kraft Foods - Wikipedia Visited on 09/19/2017 Not logged in Talk Contributions Create account Log in Article Talk Read Edit View history Wiki Loves Monuments: The world's largest photography competition is now open! Photograph a historic site, learn Main page more about our history, and win prizes. Contents Featured content Current events Kraft Foods Random article From Wikipedia, the free encyclopedia Donate to Wikipedia Wikipedia store "Kraft" redirects here. For other uses, see Kraft (disambiguation). Interaction This article is about the company spun off following the 2012 split of the original Kraft Foods. Help For the original company that became Mondelez International, see Kraft Foods Inc. For the About Wikipedia current brand-holder, see Kraft Heinz. Community portal Kraft Foods Group, Inc. is an American Recent changes Kraft Foods Group, Inc. manufacturing and processing conglomerate [4] Contact page headquartered in the Chicago suburb of Northfield, Tools Illinois.[5] What links here The company was restructured in 2012 as a spin off Related changes from Kraft Foods Inc ., which in turn was renamed Type Subsidiary[1] Upload file Food processing Special pages Mondelēz International. The new Kraft Foods Group Industry Permanent link was focused mainly on grocery products for the North Predecessor Kraft Foods Inc. Page information American market while Mondelēz is focused on Founded October 1, 2012; 4 years Wikidata item international confectionery and snack brands. Until the ago Cite this page merger with Heinz , Kraft Foods Group was an Headquarters Northfield, Illinois, U.S. Area served Worldwide Print/export independent public company listed on the NASDAQ stock exchange. -

GENERAL FOODS INTERNATIONAL Irish Creme Cappuccino

FOR MORE INFORMATION: Jessica Butera The Food Group 212-329-6273 [email protected] Kraft Foods 847-646-4538 [email protected] FOR IMMEDIATE RELEASE Celebrate St. Patrick’s Day and Energize Sales with GENERAL FOODS INTERNATIONAL Irish Creme Cappuccino January 29, 2014 - The luck of the Irish is here with GENERAL FOODS INTERNATIONAL (GFI) Irish Creme cappuccino! With St. Patrick’s Day right around the corner, it’s time to update your hot beverage offerings and energize your sales with this exciting limited time flavor. GFI Irish Creme cappuccino has a refreshing flavor that evokes the mists of Ireland, perfect for St. Patrick’s Day celebrations. Seasonality plays a part in consumers’ flavor preferences, with almost two in five consumers (38%) saying their flavor preferences shift according to the time of year. 1 This year, boost your sales by offering fresh and relevant LTO’s to satisfy consumers’ demand. Lucky for you, GFI offers on-trend front-of-house merchandising and a valuable rebate to help your bottom line. Operators can create excitement and communicate the new flavors with attention-grabbing merchandise, including door clings, wobblers, flavor tags, counter cards and translite stickers. Irish Creme is available through the end of March to commemorate St. Patrick’s Day with a warm, barista-quality cappuccino that takes customers “across the pond” to Ireland. Interested new operators can earn up to $100 now through December 31, 2014. Future LTO flavors from GFI include S’mores featuring JET-PUFFED Marshmallow, English Raspberry Tea and Pumpkin Spice. For more information, visit kraftfoodservice.com/GFI. -

Carnegie Consulting Strategic Solutions for Business

Carnegie Consulting Strategic Solutions for Business Engines for Growth: Opportunities Outside of the Traditional RTE Cereal Market Prepared for: The Kellogg Company Table of Contents Executive Summary................................................................................... 2 Company History ....................................................................................... 2 Internal Rivalry........................................................................................... 4 Substitutes and Complements................................................................... 6 Entry .......................................................................................................... 7 Buyer Power .............................................................................................. 9 Supplier Power .......................................................................................... 9 Strengths, Weaknesses, Opportunities and Threats............................... 10 Financial Outlook..................................................................................... 14 Strategic Analysis: Engines for Growth................................................... 17 Conclusion............................................................................................... 18 ______________________________________________________________________________ Carnegie Consulting 425 N. College Ave s Claremont, CA 91711 - 1 - Executive Summary Over the last century, the Kellogg Company has maintained a leading position -

Filed by Kraft Foods Inc. Pursuant to Rule 425 Under the Securities Act of 1933

Filed by Kraft Foods Inc. Pursuant to Rule 425 Under the Securities Act of 1933 Subject Company: Cadbury plc Commission File No.: 333-06444 The following communications are available at www.transactioninfo.com/kraftfoods and/or www.kraftfoodscompany.com and/or were otherwise disseminated by Kraft Foods. FORWARD-LOOKING STATEMENTS These communications contain forward-looking statements regarding Kraft Foods’ possible offer to combine with Cadbury plc. Such statements include statements about the benefits of the proposed combination, expected future earnings, revenues and cost savings and other such items, based on Kraft Foods’ plans, estimates and projections. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those predicted in any such forward-looking statements. Such factors include, but are not limited to, the possibility that the possible offer will not be pursued and the risk factors set forth in Kraft Foods’ filings with the U.S. Securities and Exchange Commission (“SEC”), including Kraft Foods’ most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Kraft Foods disclaims and does not undertake any obligation to update or revise any forward-looking statement in these communications except as required by applicable law or regulation. ADDITIONAL U.S.-RELATED INFORMATION Each of these communications is provided for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Cadbury plc or Kraft Foods. Subject to future developments, Kraft Foods may file a registration statement and/or tender offer documents with the SEC in connection with the proposed combination. -

Corporate Timeline

Historic Timeline 1901 1924 2000 Philip Morris Cos. 1990 acquires Nabisco Holdings Corp. for $19.2 billion and 1767 Kraft opens a sales office Kraft General Foods (KGF) 1916 integrates it into Kraft Foods, in London, England. International acquires Jacobs 1933 giving Kraft ownership of Bayldon and Berry begin Suchard AG for $4.2 billion. 1952 many powerhouse brands. selling candied fruit peel J.L. Kraft receives the first of many patents This includes Toblerone, Milka and The Suchard company, to the citizens of for his method of producing process cheese. Côte d’Or chocolates and Jacobs established in Switzerland National Biscuit Company sees 1969 York, England. Joseph coffee, among other brands. in 1825 by Philippe Suchard, the need for a unifying symbol Terry soon joins and Postum Company, maker Toblerone is now available in introduces its first milk Miracle Whip salad dressing to attract consumers’ attention the business grows to of Post cereals, changes bittersweet, dark chocolate. chocolate brand, Milka. General Foods is introduced at the Chicago’s and introduces the now- become Terry’s of York. its name to Kraft Foods partners with Century of Progress World’s Fair. familiar red graphic Nabisco Corporation after acquiring Rainforest Alliance on several brands, including triangle in the upper left-hand corner of all its packaging. 1970 sustainable coffee initiative Baker’s, Maxwell House, and in 2005 expands the Minute tapioca and Jell-O. 1929 2003 partnership to cocoa. Freia Marabou, 1993 1903 the leading confectionery company in Scandinavia, Kraft launches Tobler and Suchard merge is acquired for $1.3 billion.