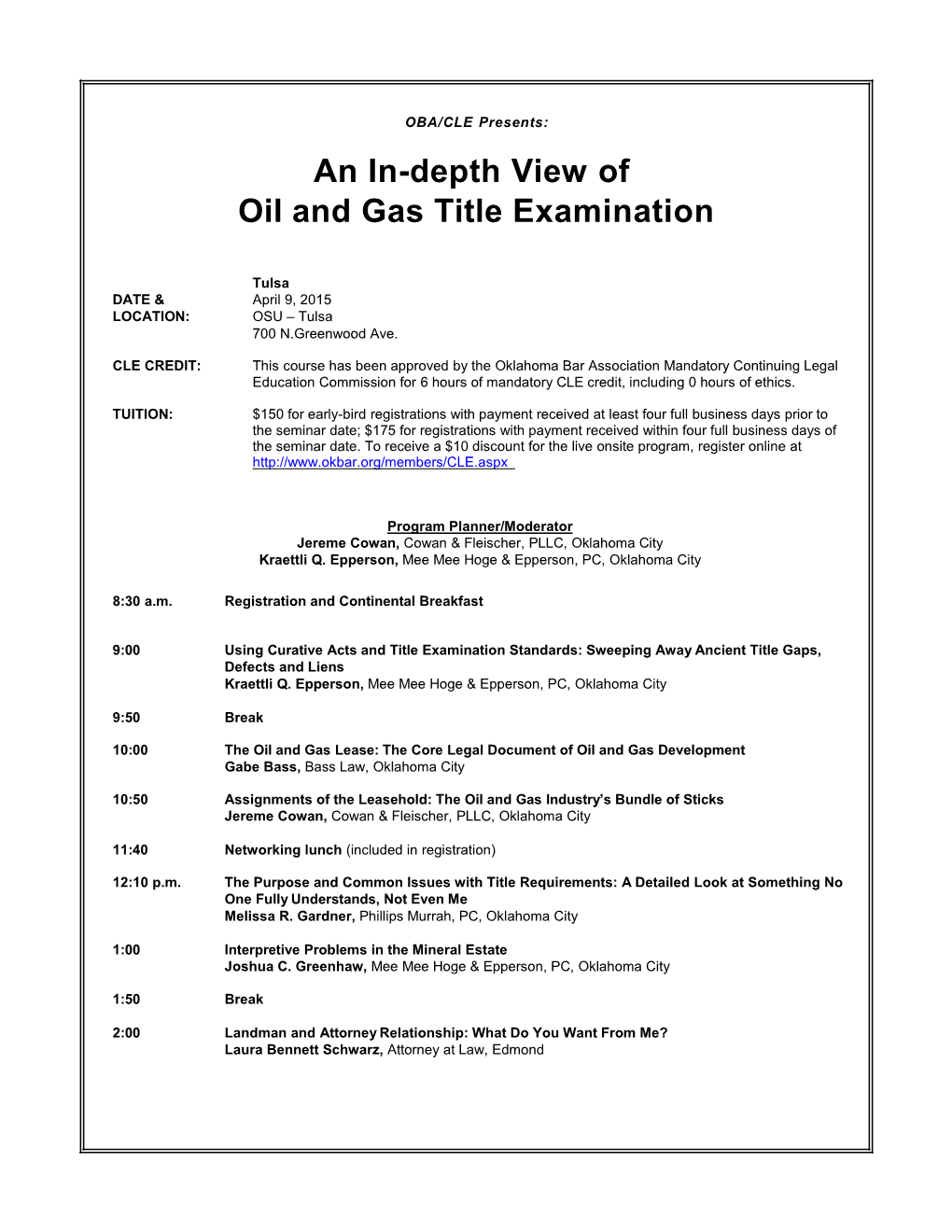

An In-Depth View of Oil and Gas Title Examination

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Law of Property

THE LAW OF PROPERTY SUPPLEMENTAL READINGS Class 14 Professor Robert T. Farley, JD/LLM PROPERTY KEYED TO DUKEMINIER/KRIER/ALEXANDER/SCHILL SIXTH EDITION Calvin Massey Professor of Law, University of California, Hastings College of the Law The Emanuel Lo,w Outlines Series /\SPEN PUBLISHERS 76 Ninth Avenue, New York, NY 10011 http://lawschool.aspenpublishers.com 29 CHAPTER 2 FREEHOLD ESTATES ChapterScope ------------------- This chapter examines the freehold estates - the various ways in which people can own land. Here are the most important points in this chapter. ■ The various freehold estates are contemporary adaptations of medieval ideas about land owner ship. Past notions, even when no longer relevant, persist but ought not do so. ■ Estates are rights to present possession of land. An estate in land is a legal construct, something apart fromthe land itself. Estates are abstract, figments of our legal imagination; land is real and tangible. An estate can, and does, travel from person to person, or change its nature or duration, while the landjust sits there, spinning calmly through space. ■ The fee simple absolute is the most important estate. The feesimple absolute is what we normally think of when we think of ownership. A fee simple absolute is capable of enduringforever though, obviously, no single owner of it will last so long. ■ Other estates endure for a lesser time than forever; they are either capable of expiring sooner or will definitely do so. ■ The life estate is a right to possession forthe life of some living person, usually (but not always) the owner of the life estate. It is sure to expire because none of us lives forever. -

6/17/97 in the Court of Appeals of the State of Mississippi

6/17/97 IN THE COURT OF APPEALS OF THE STATE OF MISSISSIPPI NO. 94-CA-00125 COA CAROLYN HARRIS HYNSON APPELLANT v. JOHN L. JEFFRIES AND MALCOLM COOPER, CO- TRUSTEES OF THE ROBERT C. HYNSON MARITAL DEDUCTION TRUST; E. BROOKE FERRIS, III, GUARDIAN AD LITEM OF ROBERT C. HYNSON II, A MINOR; WILLIAM W. SUMRALL, GUARDIAN AD LITEM OF BROOKS R. EASTERLING AND WILLIAM H. EASTERLING, MINORS; SALLY BLANKENSHIP AND FRED CHANDLER APPELLEES MANDATE ISSUED: 7/8/97 BEFORE THOMAS, P.J., AND DIAZ AND SOUTHWICK, JJ. SOUTHWICK, J., FOR THE COURT: The only issue in this case is whether the owner of a life estate in a trust that contains producing oil and gas properties will receive the entire royalties from those minerals, or whether the royalty must be invested and the life tenant receive only the interest on that investment. The chancellor found that under the common law doctrine of waste the life tenant would receive only the interest on the royalties, while the royalty itself would be added to corpus and later be received by the remaindermen. We hold that the chancellor erred in finding that the Mississippi Uniform Principal and Income Law was inapplicable. We reverse and remand for further proceedings. FACTS Robert C. Hynson was the owner of substantial oil and gas properties. At his death, he left a detailed last will and testament, prepared by a highly competent and experienced attorney. The provisions that are relevant for this dispute are found in Item VII. In summary, the will gave to trustees of the Robert C. -

Ownership of Mineral Rights Under Texas Law

Ownership of Mineral Rights under Texas Law RICHARD L. MERRILL FABIO & MERRILL TWELVE GREENWAY PLAZA, SUITE 101 HOUSTON, TEXAS 77046-1208 713-961-0408 713-961-2934 (FAX) [email protected] www.fabioandmerrill.com www.fabiomerrill.com I. CHARACTERIZATION OF MINERAL RIGHTS UNDER TEXAS LAW In order to understand title to oil, gas and other minerals, it is important to know what is considered a mineral under Texas law and what materials and elements which from a Webster’s dictionary definition would be considered as minerals actually are considered part of the surface estate. A. Oil, Gas and Constituent Elements There are a number of statutory and regulatory definitions of oil and gas which are similar but not identical. Texas Natural Resources Code Sections 85.001, 86.002, 91.001 define the terms “oil” and “gas” as well as some of the constituent elements produced in conjunction with oil and gas. Oil and gas also have other statutory definitions than those listed below, but the other definitions are generally broader because they are used in the context of pollution, health and safety, and environmental matters, underground storage of gas, taxation, and compression and liquification of natural gas. For example, in the context of pollution statutes, it matters little whether the oil is crude or refined so the definition for oil is broadened. 1. Oil "Oil" means crude oil and crude petroleum oil (Sec. 91.001); "Oil" means crude petroleum oil (Sec. 86.002); "Oil" means crude petroleum oil, crude petroleum, and crude oil (Sec. 85.001) The word "petroleum" comes from a Greek word that literally means "rock oil" or "oil from the earth." and the usual dictionary definition of the word “crude” as it applies to oil or other natural substances is “existing in a natural state and not altered by cooking or processing.” This definition is embodied in 34 TAC Sec. -

Upham), Good Faith (NY), Aggressive Ii

TABLE OF CONTENTS TABLE OF CONTENTS ....................................................................................................................................... I ATTACK OUTLINE ................................................................................................................................................. IV I. ACQUIRING AND EXPLOITING PROPERTY ....................................................................................................... 1 A. Sovereignty ................................................................................................................................................................ 1 1. Johnson v. McIntosh (US 1823) .......................................................................................................................... 1 2. Oneida III (2d 2010) ............................................................................................................................................ 2 3. Mabo v. Queensland (Austr. 1992) ...................................................................................................................... 2 B. The Significance of Labor and Possession .............................................................................................................. 2 1. Pierson v. Post (NY 1805) ................................................................................................................................... 2 2. Ghen v. Rich (MA 1881) ..................................................................................................................................... -

In the Supreme Court State of North Dakota

Filed 02/12/2020 by Clerk of Supreme Court IN THE SUPREME COURT STATE OF NORTH DAKOTA 2020 ND 35 Cheryl D. Reese, Plaintiff and Appellant v. Tia D. Reese-Young, Defendant and Appellee No. 20190202 Appeal from the District Court of Mountrail County, North Central Judicial District, the Honorable Douglas L. Mattson, Judge. REVERSED AND REMANDED. Opinion of the Court by VandeWalle, Justice, in which Justices McEvers and Tufte joined. Justice Crothers filed an opinion concurring specially, in which Chief Justice Jensen joined. Scott M. Knudsvig (argued) and Matthew H. Olson (on brief), Minot, ND, for plaintiff and appellant. Joshua A. Swanson, Fargo, ND, for defendant and appellee. Reese v. Reese-Young No. 20190202 VandeWalle, Justice. [¶1] Cheryl Reese appealed from an amended judgment entered after the district court granted summary judgment deciding ownership of certain mineral interests and the right to receive the mineral royalties and bonus payments. Cheryl Reese argues the district court erred when it concluded the open mines exception to the doctrine of waste does not apply and, as a holder of a life estate in the property, she is not entitled to the royalties and bonus payments resulting from the production of oil and gas from the property. We reverse and remand. I [¶2] The minerals at issue in this case underlie the property located in Mountrail County described as: TOWNSHIP 153 N.; RANGE 89 W. Section 20: S1/2N1/2; SE1/4 Section 29: E1/2NE1/4; S1/2; SW1/4NW1/4 Section 30: SE1/4; E1/2SW1/4; Lot 4 Section 31: Lots 1, 2, 3 and E1/2NW1/4; NE1/4 [¶3] In 2005, Dennis Reese and Tia Reese-Young, who both owned an interest in the minerals at the time, entered into an oil and gas lease for the property. -

Probate Estates In

PROBATE ESTATES IN: TEXAS OKLAHOMA LOUISIANA OKLAHOMA CITY ASSOCIATION OF PROFESSIONAL LANDMEN Oklahoma City, Oklahoma October 4, 2004 George A. Snell, III Attorney at Law Herring Bank Building 2201 Civic Circle, Suite 508 Amarillo, TX 79109 (806) 359-8611 (806) 359-1274 FAX [email protected] Timothy C. Dowd Richard W. Revels, Jr. Elias, Books, Brown, Peterson & Massad Liskow & Lewis 211 North Robinson, Suite 1300 822 Harding Street Oklahoma City, OK 73102-7114 P. O. Box 52008 (405) 235-1551 Lafayette, LA 70505-2008 (405) 235-1572 FAX (337) 232-7424 [email protected] (337) 267-2399 FAX [email protected] Copyright © 1996 by George A. Snell, III, Timothy C. Dowd and Richard W. Revels, Jr. INTRODUCTION The authors attempt herein to summarize the estate procedures of Texas, Oklahoma and Louisiana, and to point out the significant differences between said procedures. DISCLAIMER The purpose of this article is to provide general principles of probate procedure and its impact upon the mineral estate. All of the subjects discussed herein could be and likely have been discussed in much greater detail in other articles or legal treatises. This article is intended only to provide these principles in a summary form so that a division order analyst may review these principles prior to interpreting instruments that may or may not convey a mineral or royalty interest. This article is not intended to give specific legal advice! While the authors have sought to draw together statutory and case law from numerous jurisdictions, the law is subject to many exceptions or variations from general principles, depending on the precise fact situation. -

ACT No. 17 HOUSE BILL NO

ENROLLED 2020 Regular Session ACT No. 17 HOUSE BILL NO. 123 BY REPRESENTATIVE GREGORY MILLER (On Recommendation of the Louisiana State Law Institute) Provides relative to the allocation of receipts and expense to income and principal 1 AN ACT 2 To amend and reenact R.S. 9:2141 through 2144, 2145(1), 2146, 2147 through 2154, and 3 2156(A), (C), and (E), to enact R.S. 9:2151.1, 2151.2, 2156.1, 2156.2, and Subpart 4 F of Part V of Chapter 1 of Code Title II of Code Book III of Title 9 of the Louisiana 5 Revised Statutes of 1950, to be comprised of R.S. 9:2164, and to repeal R.S. 9:2155 6 and 2157, relative to the administration of trusts; to provide with respect to allocation 7 to income and principal; to provide for the apportionment and allocation of various 8 types of receipts and expenses; to provide for the obligation to pay money; to provide 9 for charges against income and principal; to provide for transfers from income to 10 principal for depreciation; to provide with respect to the payment of income taxes; 11 to provide for underproductive property; to provide for an effective date and 12 applicability; to provide for redesignation; and to provide for related matters. 13 Be it enacted by the Legislature of Louisiana: 14 Section 1. R.S. 9:2141 through 2144, 2145(1), 2146, 2147 through 2154, and 15 2156(A), (C), and (E) are hereby amended and reenacted, and R.S. 9:2151.1, 2151.2, 2156.1, 16 2156.2, and Subpart F of Part V of Chapter 1 of Code Title II of Code Book III of Title 9 of 17 the Louisiana Revised Statutes of 1950, comprised of R.S. -

Court of Appeals Second District of Texas Fort Worth

COURT OF APPEALS SECOND DISTRICT OF TEXAS FORT WORTH NO. 02-13-00349-CV ALLEGIANCE EXPLORATION, LLC, APPELLANTS ENEXCO, INC., CENTENNIAL GROUP, LLC, AND KINGSWOOD HOLDINGS, LLC V. CHARLES CHANDLER DAVIS, APPELLEES FABDA, INC., THOMAS M. MCMURRAY, AS TRUSTEE OF THE TMM FAMILY TRUST, AND NASA ENERGY CORP. A/K/A NASA EXPLORATION, INCORPORATED ---------- FROM THE 16TH DISTRICT COURT OF DENTON COUNTY TRIAL COURT NO. 2011-10854-16 ---------- MEMORANDUM OPINION1 ---------- 1See Tex. R. App. P. 47.4. This summary judgment appeal involves three successive mineral leases on a tract of land, multiple conveyances of the leased property, and one gas well. The dispute among the parties is about which of the three leases are still live. The appellants—Allegiance Exploration, LLC; Enexco, Inc.; Centennial Group, LLC; and Kingswood Holdings, LLC (collectively the Allegiance parties)— all argue that the third lease is in effect and that the prior two leases terminated by their own terms. The appellees—Charles Chandler Davis; FABDA, Inc.; Thomas M. McMurray, as trustee of the TMM Family Trust (TMM); and NASA Energy Corp. a/k/a NASA Exploration, Incorporated (NASA)—argue that the third lease is ineffective. In four issues, the Allegiance parties argue that the trial court erred by granting summary judgment for NASA, Davis, FABDA, and McMurray and by failing to render certain declarations in favor of the Allegiance parties. Because we hold that the trial court erred by granting summary judgment and by not rendering the requested declarations, we reverse the trial court’s judgment. A. Background The dispute in this case arose out of Davis’s and McMurray’s attempts to have declared void a lease that Allegiance signed with FABDA. -

The Antiwilderness Bias in American Property Law John G

The Antiwilderness Bias in American Property Law John G. Spranklingt The American wilderness' is dying. At the dawn of the nine- teenth century, over 95 percent of the nation was pre-Columbian wilderness:2 forests, prairies, wetlands, deserts, and other lands in primeval condition, without any human imprint. Today, on the eve of the twenty-first century, wilderness remnants occupy between 10 and 20 percent of the country.3 After two hundred years of development, the United States is almost a postwilderness nation.4 As the legendary environmentalist Bob t Professor of Law, McGeorge School of Law, University of the Pacific. BA. 1972, University of California, Santa Barbara; J.D. 1976, University of California, Berkeley; J.S.M. 1984, Stanford University. I thank McGeorge School of Law and Dean Gerald Caplan for summer research funding for this Article. I also thank Christopher H. Doyle, Christopher M. Forrester, Julie L. Harlan, and Annie M. Rogaski for their excellent research assistance. Most importantly, I thank my wife Gail Heckemeyer whose encour- agement and support made this Article possible. I This Article uses three somewhat different definitions of wilderness: (1) "pre- Columbian wilderness," meaning wilderness of the quality that existed before the Europe- an discovery of America (see note 34); (2) "statutory wilderness," meaning wilderness as defined under the Wilderness Act of 1964, 16 USC § 1131(c) (1994); and (3) "de facto wilderness," a term adapted from judicial usage, meaning any parcel of undeveloped land that appears to be substantially in natural condition with no significant human imprint. See text accompanying notes 217-20. -

HB123 Original

HLS 20RS-507 ORIGINAL 2020 Regular Session HOUSE BILL NO. 123 BY REPRESENTATIVE GREGORY MILLER (On Recommendation of the Louisiana State Law Institute) TRUSTS: Provides relative to the allocation of receipts and expense to income and principal 1 AN ACT 2 To amend and reenact R.S. 9:2141 through 2144, 2145(1), 2146, 2147 through 2154, and 3 2156(A), (C), and (E), to enact R.S. 9:2151.1, 2151.2, 2156.1, 2156.2, and Subpart 4 F of Part V of Chapter 1 of Code Title II of Code Book III of Title 9 of the Louisiana 5 Revised Statutes of 1950, to be comprised of R.S. 9:2164, and to repeal R.S. 9:2155 6 and 2157, relative to the administration of trusts; to provide with respect to allocation 7 to income and principal; to provide for the apportionment and allocation of various 8 types of receipts and expenses; to provide for the obligation to pay money; to provide 9 for charges against income and principal; to provide for transfers from income to 10 principal for depreciation; to provide with respect to the payment of income taxes; 11 to provide for underproductive property; to provide for an effective date and 12 applicability; to provide for redesignation; and to provide for related matters. 13 Be it enacted by the Legislature of Louisiana: 14 Section 1. R.S. 9:2141 through 2144, 2145(1), 2146, 2147 through 2154, and 15 2156(A), (C), and (E) are hereby amended and reenacted, and R.S. 9:2151.1, 2151.2, 2156.1, 16 2156.2, and Subpart F of Part V of Chapter 1 of Code Title II of Code Book III of Title 9 of 17 the Louisiana Revised Statutes of 1950, comprised of R.S. -

No. 48,932-CA COURT of APPEAL SECOND CIRCUIT STATE OF

Judgment rendered May 14, 2014. Application for rehearing may be filed within the delay allowed by Art. 2166, LSA-CCP. No. 48,932-CA COURT OF APPEAL SECOND CIRCUIT STATE OF LOUISIANA * * * * * PRESTON WILLIAM FORD, Plaintiffs-Appellants ELISSA AMARAL FORD, AND GENE BARTLETT HASKINS versus MARY ELIZABETH GUNNING LESTER, Defendants-Appellees CLYDE CHARLIE LESTER, JR. AND CHESAPEAKE LOUISIANA, L.P. * * * * * Appealed from the First Judicial District Court for the Parish of Caddo, Louisiana Trial Court No. 542962 Honorable Leon L. Emanuel, III, Judge * * * * * THE PESNELL LAW FIRM Counsel for Appellants By: J. Whitley Pesnell Preston William Ford, Elissa Amaral Ford, Gene Bartlett Haskins and Andrea Lynn Ford Braniff JONES WALKER Counsel for Appellees By: Michael B. Donald Chesapeake Louisiana, L.P. Nicole Duarte PXP Louisiana, L.L.C. and Krystal P. Scott Larchmont Resources, L.L.P. KEVIN W. HAMMOND Counsel for Appellees Mary Elizabeth Gunning Lester and Clyde Charlie Lester, Jr. * * * * * Before WILLIAMS, STEWART and CARAWAY, JJ. STEWART, J. At issue in this appeal is the ownership of mineral rights underlying two 20.2-acre tracts of land (“the disputed property”) in Caddo Parish. After a bench trial, the trial court denied the claims of the plaintiffs, who are the surface owners of the disputed property and who sought, along with other relief, to be declared owners of the mineral rights underlying their land. The plaintiffs now appeal. For the reasons set forth in this opinion, we affirm the trial court’s judgment. FACTS Plaintiffs Gene Bartlett Haskins (“Haskins”) and spouses Preston William Ford and Elissa Amaral Ford (“the Fords”) filed suit on July 21, 2010, against spouses Clyde Lester and Mary Elizabeth Gunning Lester (“the Lesters”), along with Chesapeake Louisiana, L.P. -

Rights of the Usufructuary: Louisiana and Comparative Law A

Louisiana Law Review Volume 27 | Number 4 June 1967 Rights of the Usufructuary: Louisiana and Comparative Law A. N. Yiannopoulos Repository Citation A. N. Yiannopoulos, Rights of the Usufructuary: Louisiana and Comparative Law, 27 La. L. Rev. (1967) Available at: https://digitalcommons.law.lsu.edu/lalrev/vol27/iss4/4 This Article is brought to you for free and open access by the Law Reviews and Journals at LSU Law Digital Commons. It has been accepted for inclusion in Louisiana Law Review by an authorized editor of LSU Law Digital Commons. For more information, please contact [email protected]. RIGHTS OF THE USUFRUCTUARY; LOUISIANA AND COMPARATIVE LAW A. N. Yiannopoulos* Articles 544-556 of the Louisiana Civil Code of 1870 deal comprehensively with the rights of the usufructuary, i.e., his enjoyment of the property subject to usufruct and his legal powers vis-a-vis the naked owner and third persons. These ar- ticles, deriving from the reservoir of the civilian tradition, have, for the most part, exact equivalents in foreign civil codes. The following discussion is devoted to an analysis of the rights of the usufructuary under the laws of Louisiana, France, Germany, and Greece. I. THE USUFRUCTUARY'S RIGHT OF ENJOYMENT 1. Use of the Thing The usufructuary's right of enjoyment comprises, in all legal systems under consideration, two elements: the right to use the thing and the right to draw its fruits.' The usufructuary's right to use the thing is as extensive as that of an owner. Article 597 of the French Civil Code provides expressly that the usu- fructuary "enjoys..