Wuling Cortez Turbo Manual

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2017 Passenger Vehicles Actual and Reported Fuel Consumption: a Gap Analysis

2017 Passenger Vehicles Actual and Reported Fuel Consumption: A Gap Analysis Innovation Center for Energy and Transportation December 2017 1 Acknowledgements We wish to thank the Energy Foundation for providing us with the financial support required for the execution of this report and subsequent research work. We would also like to express our sincere thanks for the valuable advice and recommendations provided by distinguished industry experts and colleagues—Jin Yuefu, Li Mengliang, Guo Qianli,. Meng Qingkuo, Ma Dong, Yang Zifei, Xin Yan and Gong Huiming. Authors Lanzhi Qin, Maya Ben Dror, Hongbo Sun, Liping Kang, Feng An Disclosure The report does not represent the views of its funders nor supporters. The Innovation Center for Energy and Transportation (iCET) Beijing Fortune Plaza Tower A Suite 27H No.7 DongSanHuan Middle Rd., Chaoyang District, Beijing 10020 Phone: 0086.10.6585.7324 Email: [email protected] Website: www.icet.org.cn 2 Glossary of Terms LDV Light Duty Vehicles; Vehicles of M1, M2 and N1 category not exceeding 3,500kg curb-weight. Category M1 Vehicles designed and constructed for the carriage of passengers comprising no more than eight seats in addition to the driver's seat. Category M2 Vehicles designed and constructed for the carriage of passengers, comprising more than eight seats in addition to the driver's seat, and having a maximum mass not exceeding 5 tons. Category N1 Vehicles designed and constructed for the carriage of goods and having a maximum mass not exceeding 3.5 tons. Real-world FC FC values calculated based on BearOil app user data input. -

Products Catalogue

XHORSE PRODUCTS Xhorse Electronics www.xhorse.com CATALOGUE 2019 . 01 ANNUAL PRODUCT Xhorse Electronics www.xhorse.com MANUAL 2019.01 ANNUAL PRODUCT MANUAL Xhorse Electronics 2019.01 www.xhorse.com Xhorse Product Catalogue CONDOR DOLPHIN VVDI I Introduction II III V Key Cutting Machine Series Key Cutting Machine Series Universal Remote Series DOLPHIN XP-005 Company Introduction CONDOR XC-MINI Plus 39 71 VVDI KEY TOOL 03 07 (Automatic Key Cutting machine) (Automatic Key Cutting machine) DOLPHIN XP-007 74 MINI KEY TOOL Patent and software copyright 23 CONDOR XC-002 44 04 (Automatic Key Cutting machine) certificates (Manual Key Cutting machine) 77 Wireless Remote 29 CONDOR XC-003 (Manual Key Cutting machine) 78 Smarty Remote IV VVDI Series 33 CONDOR XC-008 80 Wireless Remote (Manual Key Cutting machine) 47 VVDI 2 35 CONDOR XC-009 85 Wire Remote (Manual Key Cutting machine) 51 VVDI MB TOOL 92 Garage Remote 53 VVDI BMW 95 Renew Adapter 59 VVDI PROG VI Other Product Series 105 Frequency tester 106 VVDI RKE BOX 107 46、4D、48 transponder 02 Company Introduction Certificate Patent and Software Copyright Certificates Xhorse Electronics Co., Ltd. Xhorse Electronics Co., Ltd. is a specialized company which was founded in 2010 with the aim to develop products and services based on intelligent market research and development. It is the leading brand in the automobile security industry. Xhorse has a complete system of independent Certificate NO:26918Q00142R0M Thisistocertifythat Shenzhen Xhorse Electronics Co.,Ltd. intellectual property rights and it is dedicated to providing security products and solutions Unified social credit code: 91440300553867739G Address:2009-2011,Changhong Science and Technology Building, Science Park South Twelfth Road, Nanshan District, Shenzhen, Guangdong, China Hasbeenauditedto conformto thefollowingQualitymanagementsystem worldwide. -

Chancen Und Risiken Deutscher Automobilhersteller Im Bereich Alternative Antriebe in Der VR China (Induktive Analyse)

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Kurz, Kristina; Kleine-Möllhoff, Peter; Steinbiß, Kristina Working Paper Chancen und Risiken deutscher Automobilhersteller im Bereich Alternative Antriebe in der VR China (induktive Analyse) Reutlinger Diskussionsbeiträge zu Marketing & Management, No. 2014-03 Provided in Cooperation with: ESB Business School, Hochschule Reutlingen Suggested Citation: Kurz, Kristina; Kleine-Möllhoff, Peter; Steinbiß, Kristina (2014) : Chancen und Risiken deutscher Automobilhersteller im Bereich Alternative Antriebe in der VR China (induktive Analyse), Reutlinger Diskussionsbeiträge zu Marketing & Management, No. 2014-03, Hochschule Reutlingen, ESB Business School, Reutlingen This Version is available at: http://hdl.handle.net/10419/97624 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen -

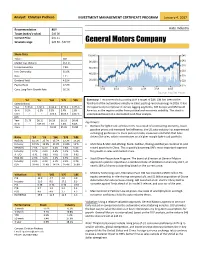

INVESTMENT MANAGEMENT CERTIFICATE PROGRAM January 4, 2017

Analyst: Christian Pacheco INVESTMENT MANAGEMENT CERTIFICATE PROGRAM January 4, 2017 Recommendation BUY Auto Industry Target (today’s value) $46.00 Current Price $35.15 52 week range $26.69 - $37.97 General Motors Company Share Data Ticker: GM Market Cap. (Billion): $53.15 Inside Ownership 7.8% Inst. Ownership 61.6% Beta 1.21 Dividend Yield 4.32% Payout Ratio 17.2% Cons. Long-Term Growth Rate 16.1% ‘14 ‘15 ‘16E ‘17E ‘18E Summary: I recommend a buy rating with a target of $46. GM has been at the Sales (billions) forefront of the automotive industry in sales, posting record earnings in 2016. It has Year $155.9 $152.4 $164.9 $170.6 $175.3 the opportunity to improve in its two lagging segments, GM Europe and GM South Gr % 0.3% -2.3% 8.3% 3.4% 2.8% America, as the regions settles from political and economic volatility. The stock is Cons - - 163.6 $163.3 $167.6 undervalued based on a discounted cash flow analysis. EPS Year $1.75 $6.11 $6.18 $6.33 $6.86 Key Drivers: Gr % - 249.6% 1.2% 2.4% 8.4% Cons - - $5.92 $5.76 $5.80 Demand for light-truck vehicles in US: As a result of a recovering economy, lower gasoline prices and increased fuel efficiency, the US auto industry has experienced a changing preference to more pick-up trucks, crossovers and SUVs that have Ratio ‘14 ‘15 ‘16E ‘17E ‘18E driven GM sales, which concentrates on a higher margin light-truck portfolio. ROE (%) 10.1% 25.7% 25.7% 22.2% 18.2% Industry 10.5% 13.0% 13.0% 13.8% 12.% GM China & SAIC-GM-Wuling: Buick, Cadillac, Wuling and Baojun continue to post NPM (%) 2.5% 6.4% 6.4% 5.8% 5.4% record quarters in China. -

Feb. 2017 Communications Volkswagen Group China Dr

Production: ca. 3.9 million vehicles (12/2016) Feb. 2017 Models: SAIC VOLKSWAGEN Volkswagen: New Polo, New Lavida, Gran Lavida, New Santana, Gran Santana, New Passat, Touran, All New Touran L, All New Tiguan L, Tiguan Silk Road, Lamando, PHIDEON, Teramont; engines. ŠKODA: Fabia, Octavia, Superb, Rapid, Yeti, Kodiaq FAW-VW Volkswagen: Jetta, New Bora, New Golf incl. GTI & Sportsvan, New Sagitar, Magotan, CC, C-TREK; engines, gearboxes Audi: Q3, Q5, A4L, A6L, A3 Employees: ca. 95.000 (12/2016) Management: Prof. Dr. Jochem Heizmann Management Production: Mr. Jörg Müller (Volkswagen Group China) Dr. Christian Vollmer (SAIC VOLKSWAGEN) Dr. Jürgen Unser (FAW-VW) Ownership Structure: SAIC VOLKSWAGEN: 50% SAIC, 40% Volkswagen Aktiengesellschaft (incl. ŠKODA AUTO a.s.), 10% Volkswagen China Investment Company Ltd. FAW-VW: 60% FAW, 20% Volkswagen Aktiengesellschaft, 10% AUDI AG, 10% Volkswagen China Investment Company Ltd. Communications Volkswagen Group China Dr. Christoph Ludewig; Tel: +86 10 6531 5482; [email protected] page 1 Production Two joint ventures, SAIC VOLKSWAGEN AUTOMOTIVE COMPANY LIMITED (SAIC VOLKSWAGEN) and First Automotive Works-Volkswagen Automobile Co., Ltd. (FAW-VW), produce Volkswagen Group brand models, including Volkswagen, Audi and ŠKODA passenger cars, in China, for the Chinese market. Engines, transmissions, chassis components and seat systems are also produced in China. The Volkswagen Group is strategically positioned in China with a total of 20 production locations. In 2015, Volkswagen China opened a vehicle plant in Changsha and a new engine plant in Changchun. Two more vehicle plants, located in Qingdao and Tianjin, will be start their production in 2018. The Volkswagen Group is among the most successful companies in the Chinese automobile industry. -

15Celebrating 15 Years of Listing and Four Decades of Growth

,;;+227 EJJOGI FHLKMN B@@D AC AC =9.1-/2 S]b]ZeYgac_ QR X]Yef d^ Wafgac_ <64<*385>0-: Yc\ Udhe T][Y\]f d^ Vedig` Table of Contents Group Profile 3 Corporate Information 4 Principal Offices 5-6 Chairman’s Statement 7-14 Results in Brief 15 Profile of Directors and Senior Management 16-18 Financial Summary 19-20 Corporate Governance Report 21-25 Directors’ Report 26-36 Independent Auditor’s Report 37-38 Consolidated Income Statement 39 Consolidated Balance Sheet 40-41 Balance Sheet 42 Consolidated Statement of Changes in Equity 43-44 Consolidated Cashflow Statement 45-46 Notes to the Financial Statements 47-102 Celebrating 15 Years of Listing and Four Decades of Growth While 2008 represents a milestone 40 years of operation for Pico, the financial year of 2007 marks the 15th anniversary of Pico Far East Holdings Limited’s listing on the Hong Kong Stock Exchange, a period that has seen our listed company grow from turnover of HK$250 million to over HK$2,100 million in 2007. From employing less than 300 people when we listed in 1992, we now employ more than 2,300 talented individuals working in our offices on five continents. Our achievements in China have been remarkable. Since entering the market with only two representative offices in the early 1980s, we have established permanent offices and production facilities in Beijing, Chengdu, Chongqing, Dongguan, Guangzhou, Shanghai, Shenzhen and Xian. In South East Asia, our business continues to expand. In particular, Pico Thailand was listed on the Stock Exchange of Thailand in 2004. -

Electrifying the World's Largest New Car Market; Reinstate At

August 31, 2016 ACTION Buy BYD Co. (1211.HK) Return Potential: 15% Equity Research Electrifying the world’s largest new car market; reinstate at Buy Source of opportunity Investment Profile Electrification is set to reshape China’s auto market and we expect BYD to Low High lead this trend given its strong product portfolio, vertically integrated model Growth Growth and high OPM vs. peers. A comparative analysis with Tesla shows many Returns * Returns * strategic similarities but BYD’s new energy vehicle business trades at a sizable Multiple Multiple discount, which we see as unjustified given its large cost savings, capacity Volatility Volatility utilization, and front-loaded investment. China’s new energy vehicle market is Percentile 20th 40th 60th 80th 100th poised to deliver c.30% CAGR (vs. 4% for traditional cars) over the next decade. BYD Co. (1211.HK) We have removed the RS designation from BYD. It is on the Buy List with a Asia Pacific Autos & Autoparts Peer Group Average * Returns = Return on Capital For a complete description of the investment 12-m TP of HK$61.93, implying 15% upside. Our scenario analysis, flexing profile measures please refer to the disclosure section of this document. sales volume and margin assumptions, implies a further 30% valuation upside. Catalyst Key data Current Price (HK$) 54.00 1) More cities in China are likely to announce local preferential policies in 12 month price target (HK$) 61.93 Market cap (HK$ mn / US$ mn) 110,705.4 / 14,270.1 the new energy vehicle (NEV) segment once the result of the subsidy fraud Foreign ownership (%) -- probe is announced. -

About General Motors China 02 2018 GM China Corporate Social Responsibility Report 03

For years, we have said that the auto industry is experiencing more change today than in the past 50 years. That pace of change is only accelerating. With the right team, technology, resources and scale to achieve our vision of zero Contents crashes, zero emissions and zero congestion, I believe the only thing that can stop us is not acting quickly enough. Disruption creates uncertainty, but it also creates vast possibilities 02 Leadership Message that will lead to a better world. 04 2018 Highlights Mary Barra, General Motors Chairman and CEO 06 Sustainable Vision Creating a Future of Zero Crashes, Zero Emissions and Zero Congestion 08 Sustainable Growth Innovate Now: Seeing Things Not as They Are But as They Could Be Products, Technology and Experience Driving Industry Development 14 On the Spot Optimizing Our Facilities Committed to Safety in Everything We Do Addressing New Security Challenges 20 Special Focus Green Supply Chain 22 Working Together for a Sustainable Future GM and Our Customers GM and Our Employees GM and Our Community 32 Corporate Social Responsibility Management Corporate Social Responsibility Strategy Stakeholder Involvement Honors and Recognition 35 About General Motors China 02 2018 GM China Corporate Social Responsibility Report 03 Leadership Message Corporate Social Responsibility is Synonymous with Our Business Strategy in How do employee volunteers support GM China activities? China at General Motors Our employees have long been active What role does corporate social GM is on track to deliver 10 NEV models participants in many of GM China's CSR responsibility (CSR) play in GM China’s in China between 2016 and 2020, and activities. -

2018.09.30 8 K Exhibit 99.1 Press Release

Immediate Release Contact: Patrick Nolan 248.754.0884 BORGWARNER REPORTS THIRD QUARTER 2018 U.S. GAAP NET EARNINGS OF $0.98 PER DILUTED SHARE, OR $1.00 PER DILUTED SHARE EXCLUDING NON-COMPARABLE ITEMS MAINTAINS FULL YEAR ORGANIC GROWTH AND EPS GUIDANCE Auburn Hills, Michigan, October 25, 2018 – BorgWarner Inc. (NYSE: BWA) today reported third quarter results. Third Quarter Highlights: • U.S. GAAP net sales of $2,479 million, up 2.6% compared with third quarter 2017. ◦ On a comparable basis, excluding the impact of foreign currencies and the acquisition of Sevcon, net sales were up 3.6% compared with third quarter 2017. • U.S. GAAP net earnings of $0.98 per diluted share. ◦ Excluding non-comparable items (detailed in the table below), net earnings were $1.00 per diluted share. • U.S. GAAP operating income of $278.0 million. ◦ Adjusted operating income was 11.8% of net sales. Full Year 2018 Guidance: The company has reaffirmed its 2018 full year organic growth guidance. Full year net sales are expected to be in the range of $10.49 billion to $10.58 billion. This implies organic sales growth of approximately 4.5% to 5.5% or 500 to 600 basis points over the company's light vehicle market exposure. Foreign currencies are expected to increase sales by $192 million, due to the appreciation of the Euro and Chinese Yuan. The acquisition of Sevcon will increase sales by approximately $57 million. Excluding the impact of noncomparable items, operating margin is expected to be in the range of 12.3% to 12.4%. -

2015 Annual Report

(Incorporate in Bermuda with limited liability) HKEx Stock Code : 305 2015 ANNUAL REPORT Unit 2403, 24/F, Great Eagle Centre, 23 Harbour Road, Wanchai, Hong Kong www.wuling.com.hk ANNUAL REPORT 2015 REPORT ANNUAL CORPORATE PROFILE Wuling Motors Holdings Limited (“Wuling Motors Holdings” or the “Company”) and its subsidiaries (collectively referred to as the “Wuling Group” or the “Group”) are principally engaged in the businesses of trading and manufacturing of automotive components, engines and specialized vehicles in China. Our Group’s corporate goal is to grasp the tremendous business opportunities arising from the rapidly growing automobile industry in China. We supply engines and automotive components to commercial-type mini-vehicles and passenger vehicles. We are also a qualified enterprise for manufacturing electrical mini-truck in China. The Group’s main production facilities are located in Liuzhou, Qingdao and Chongqing. Since 2011, it has been ranked as one of the Fortune China 500 Enterprises. GROUP STRUCTURE WULING MOTORS DRAGON HILL GUANGXI 15.5% HOLDINGS 56.5% AUTOMOBILE HKEx:305 54.9% 45.1% WULING INDUSTRIAL AUTOMOTIVE SPECIALIZED ENGINES AND COMPONENTS VEHICLES AND RELATED PARTS OTHER INDUSTRIAL (INCLUDING NEW SERVICES ENERGY VEHICLES) CONTENTS Corporate Profile Group Structure 2 Chairman’s Statement 7 Report of the CEO 10 Operation Review Main Business Segments Engines and Related Parts Automotive Components and Other Industrial Services Specialized Vehicles (including New Energy Vehicles) 21 Financial Review 25 Environmental, -

The Future of Mobility Ride-Hailing and New Businesses to Fuel $7Tn+

EQUITY RESEARCH | June 4, 2019 | 6:25 AM EDT The following is a redacted version of the original report. See inside for details. THE FUTURE OF M BILITY Ride-hailing and new businesses to fuel $7tn+ global mobility market The next 10 years of mobility will bring more change in the way that people and products move than any decade since the invention of the automobile. Emerging technologies and business models like ride-hailing and sharing, autonomous driving and delivery, micro-mobility and even eVTOL (flying cars, finally) stand to disrupt profit pools that we estimate exceed $700bn, and venture backed startups and incumbents will attempt to address over $7tn in spend- ing. Given the size of the opportunity, it should come as no surprise that access to capital has created a hyper competi- tive environment marked by massive operating losses driven by marketing, subsidies, incentives, and capital in- vestment. As this environment matures and rationalizes, we expect consolidation that will lead to profitability, the establishment of category leaders, and significant opportunities for investors. Heath P. Terry, CFA Daniel Powell Piyush Mubayi Frank Jarman David Tamberrino, CFA Adam Hotchkiss +1 212 357-1849 +1 917 343-4120 +852 2978-1677 +1 212 902-7537 +1 212 357-7617 +1 212 902-3941 [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] Goldman Sachs & Co. LLC Goldman Sachs & Co. LLC Goldman Sachs (Asia) L.L.C. Goldman Sachs & Co. LLC Goldman Sachs & Co. LLC Goldman Sachs & Co.LLC Goldman Sachs does and seeks to do business with companies covered in its research reports. -

ANNUAL REPORT 2016 Hkex Stock Code : 305 CORPORATE PROFILE

五菱汽車集團控股有限公司 (Incorporated in Bermuda with limited liability) ANNUAL REPORT 2016 HKEx Stock Code : 305 CORPORATE PROFILE Wuling Motors Holdings Limited (“Wuling Motors Holdings” or the “Company”) and its subsidiaries (collectively referred to as the “Wuling Group” or the “Group”) are principally engaged in the businesses of trading and manufacturing of automotive components, engines and specialized vehicles in China. Our Group’s corporate goal is to grasp the tremendous business opportunities arising from the rapidly growing automobile industry in China and Asia. We supply engines and automotive components to commercial-type mini-vehicles and passenger vehicles. We are also a qualified enterprise for manufacturing electrical mini-truck in China. The Group’s main production facilities are located in Liuzhou, Qingdao and Chongqing. Since 2011, we have been ranked as one of the Fortune China 500 Enterprises. GROUP STRUCTURE GUANGXI DRAGON HILL WULING MOTORS AUTOMOBILE 15.3% HOLDINGS 56.0% HKEx:305 54.9% 45.1% WULING INDUSTRIAL AUTOMOTIVE SPECIALIZED ENGINES AND COMPONENTS VEHICLES RELATED PARTS AND (INCLUDING NEW OTHER INDUSTRIAL ENERGY VEHICLES) SERVICES Wuling Motors Holdings Limited / Annual Report 2016 CONTENTS Corporate Profile Group Structure 2 Chairman’s Statement 8 Report of the CEO 13 Operation Review Main Business Segments Engines and Related Parts Automotive Components and Other Industrial Services Specialized Vehicles (including New Energy Vehicles) 24 Financial Review 27 Environmental, Social and Governance Review 38 Directors’ and Senior Management’s Biographies 46 Corporate Governance Report 60 Report of the Directors 73 Independent Auditor’s Report 77 Consolidated Statement of Profit or Loss and Other Comprehensive Income 78 Consolidated Statement of Financial Position 80 Consolidated Statement of Changes in Equity 81 Consolidated Statement of Cash Flows 83 Notes to the Consolidated Financial Statements Corporate Information 01 Wuling Motors Holdings Limited / Annual Report 2016 CHAIRMAN’SAIRMAN’S SSTATEMENTTATEMENT Mr.