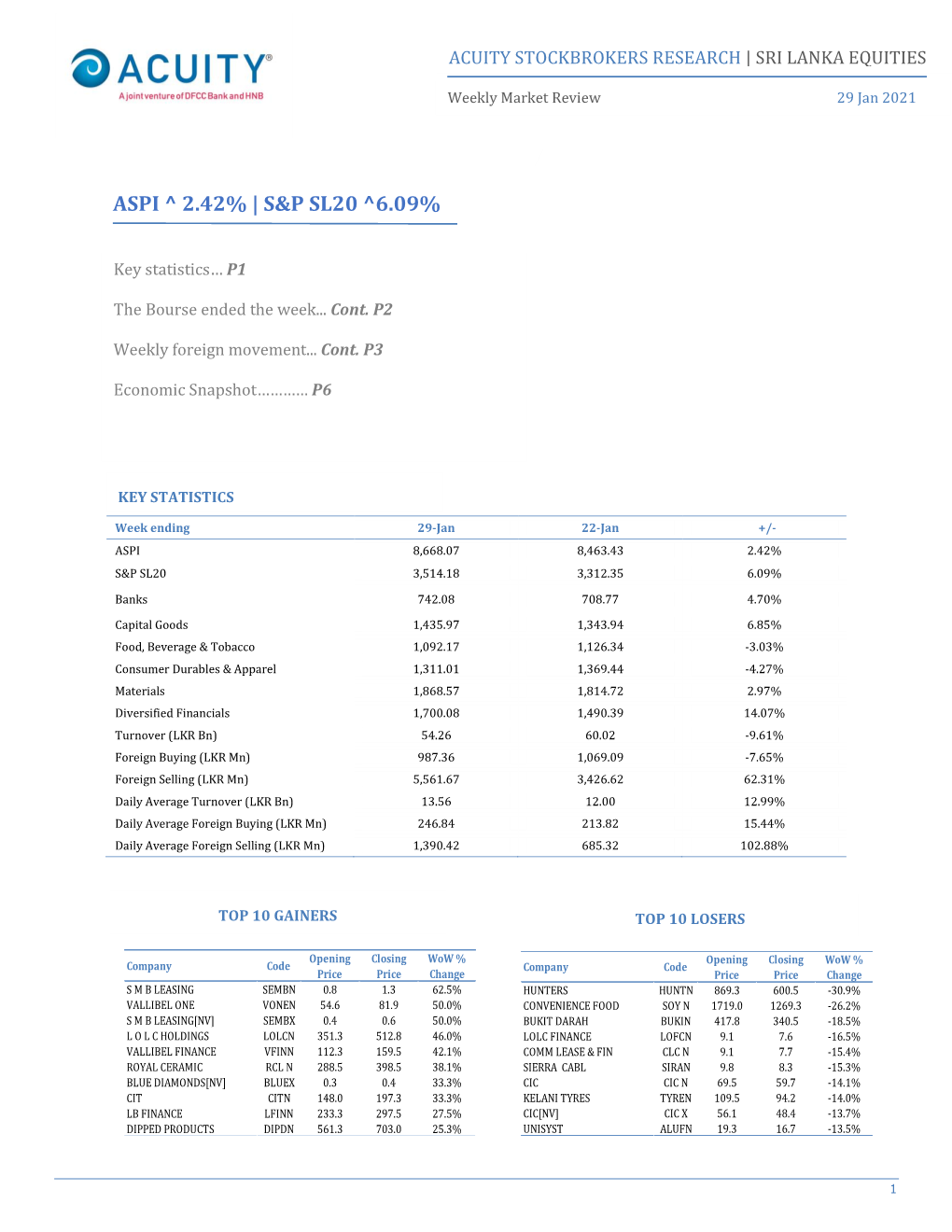

S&P Sl20 ^6.09%

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Expolanka Holdings Plc Integrated Annual Report

EXPOLANKA HOLDINGS PLC INTEGRATED ANNUAL REPORT 2020/21 EXPOLANKA HOLDINGS PLC | INTEGRATED REPORT 2020/21 2 fruitionEXPOLANKA HOLDINGS PLC | INTEGRATED ANNUAL REPORT 2020/21 At Expolanka, we remain fully committed to our promise made several years ago, to drive long term sustainable value, by adapting a focused, constant and consistent strategy. Even though the year under review post several challenges, we were able to pursue our said strategies and bring to fruition our plans for progress which was fueled by our innate resilience and strength. The seeds we planted have taken root and we keep our focus upward, expanding in our focused direction in order to adapt to the current environment. We remain fruitful in our optimism, our can-do attitude and endurance, a recipe for success that will carry us through to more opportunity. Overview EXPOLANKA HOLDINGS PLC | INTEGRATED ANNUAL REPORT 2020/21 2 CONTENTS Chairman’s Overview Compliance Reports 12 About Us 3 Corporate Governance 71 Message About this Report 4 Risk Management Report 93 Group Milestones 5 Related Party Transactions Financial Highlights 6 Review Committee Report 101 15 Group CEO’s Highlights of the Year 7 Remuneration Committee Report 103 Review Chairman’s Message 12 Group CEO’s Review 15 Financial Reports Board of Directors 18 Annual Report of the Board of Directors Group Senior Management Team 20 on the Affairs of the Company 108 23 Financial Indicators 22 The Statement of Directors’ Responsibility 112 Performance Group Performance 23 Audit Committee Report 113 Overcoming -

Acuity Stockbrokers Research | Sri Lanka Equities

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 22 May 2020 ASPI Gains 361 Points amid Heavy Local Buying Indices vs. Turnover (18th May – 22nd May) Interest… S&P Downgrades Credit Rating to 'B- Stable' 5,000 ASPI 2,300 ASPI ^ 8.13% | S&P SL20 ^ 15.89% S&P SL20 4,900 2,200 S&P SL20 S&P 4,800 2,100 ASPI The Bourse ended the week… Cont. P2 4,700 2,000 4,600 1,900 Foreign investors closed the week... Cont. P3 4,500 1,800 18-Mar19-Mar20-Mar21-Mar22-Mar 2.50 Sri Lankan equities reversed ….… Cont. P4 2.00 1.50 1.00 LKR Bn) LKR (Turnover 0.50 Economic Snapshot………… P5 0.00 18-Mar 19-Mar 20-Mar 21-Mar 22-Mar KEY STATISTICS Week ending 22-May 15-May +/- ASPI 4,799.89 4,439.04 8.13% S&P SL20 2,034.38 1,755.51 15.89% Banks 507.01 435.44 16.44% Capital Goods 613.52 528.92 15.99% Food, Beverage & Tobacco 704.89 667.23 5.64% Consumer Durables & Apparel 649.76 583.51 11.35% Materials 514.33 483.50 6.38% Diversified Financials 711.04 654.33 8.67% Turnover (LKR Bn) 8.05 9.61 -16.24% Foreign Buying (LKR Mn) 593.11 1,588.91 -62.67% Foreign Selling (LKR Mn) 3,996.15 5,098.28 -21.62% Daily Average Turnover (LKR Bn) 1.61 1.92 -16.24% Daily Average Foreign Buying (LKR Mn) 118.62 317.78 -62.67% Daily Average Foreign Selling (LKR Mn) 799.23 1,019.66 -21.62% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change TEA SMALLHOLDER TSMLN 20.0 32.5 62.5% INDUSTRIAL ASPH.* ASPHNN 388.4 0.2 -99.9% BROWNS INVSTMNTS BIL N 2.1 3.2 52.4% BLUE DIAMONDS[NV] BLUEX 0.3 0.2 -

Sri Lanka Equities Aspi ^ 4.46% | S&P Sl20 ^ 7.04%

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 02 Nov 2018 th nd ASPI Hits 2-Month High Amid Higher Volatility… LKR Indices vs. Turnover (29 Oct – 02 Nov) Falls as Foreign Sell-Off of Assets Increases… 6,300 3,500 ASPI Increases 6,200 S&P SL20 3,400 S&P SL20 S&P ASPI ^ 4.46% | S&P SL20 ^ 7.04% 6,100 3,300 ASPI 6,000 3,200 The Bourse ended the week… Cont. P2 5,900 3,100 5,800 3,000 29-Oct 30-Oct 31-Oct 01-Nov02-Nov Foreign investors closed the week... Cont. P3 5.00 4.00 3.00 Equity market volatility ….… Cont. P4 2.00 LKR Bn) LKR (Turnover 1.00 0.00 Economic Snapshot………… P5 29-Oct 30-Oct 31-Oct 01-Nov 02-Nov KEY STATISTICS Week ending 02-Nov 26-Oct +/- ASPI 6,092.21 5,831.96 4.46% S&P SL20 3,208.43 2,997.33 7.04% Banking & Finance 16,242.78 15,368.05 5.69% Food & Beverage 24,368.96 24,096.79 1.13% Diversified 1,591.90 1,482.33 7.39% Hotel & Travel 2,677.50 2,642.53 1.32% Plantations 749.11 725.44 3.26% Manufacturing 2,963.05 2,742.56 8.04% Turnover (LKR Bn) 9.92 3.15 215.37% Foreign Buying (LKR Mn) 2,656.24 1,959.06 35.59% Foreign Selling (LKR Mn) 6,519.96 2,403.48 171.27% Daily Average Turnover (LKR Bn) 1.98 0.79 152.29% Daily Average Foreign Buying (LKR Mn) 531.25 489.76 8.47% Daily Average Foreign Selling (LKR Mn) 1,303.99 600.87 117.02% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change MTD WALKERS KAPIN 8.0 12.9 61.3% KELSEY KDL N 35.0 29.5 -15.7% BLUE DIAMONDS[NV] BLUEX 0.2 0.3 50.0% UDAPUSSELLAWA UDPL 35.0 29.6 -15.4% AMANA LIFE ATLLN 9.0 12.9 43.3% MERC. -

EXPOLANKA HOLDINGS PLC Annual Report 2015/16

Waygrow to EXPOLANKA HOLDINGS PLC EXPOLANKA HOLDINGS PLC ANNUAL REPORT 2015/16 ANNUAL REPORT 2015/16 CORPORATE G4-3,5,7 INFORMATION NAME OF COMPANY REMUNERATION COMMittEE COMPANY SECRETARIES Expolanka Holdings PLC V Harsha Amarasekera – Chairman SSP Corporate Services (Private) Limited V Sanjay Kulatunga P V 931 LEGAL FORM 101, Inner Flower Road The Company is a Public Limited Liability COntAct DETAILS Colombo 03 Company. Incorporated in Sri Lanka on 05th P. O. Box 1162 Sri Lanka March 2003 as a Private Limited Liability 10, Mile Post Avenue Telephone : +94 11 2573894 Company under the Companies Act No. 17 Colombo 03 +94 11 2576871 of 1982 and re-registered on 11th November Sri Lanka Facsimile : +94 11 2573609 2008 as a Public Limited Liability Company Telephone : +94 11 4659500 under the Companies Act No 07 of 2007. Facsimile : +94 11 4659565 Currently ordinary shares have been listed on Internet : www.expolanka.com the Colombo Stock Exchange. COntAct FOR MEDIA COMPANY REGistRATION NUMBER Marketing and Corporate Communications PB 744PQ Expolanka Holdings PLC 15 A, Clifford Avenue BOARD OF DIREctORS Colombo 03 V Nobuaki Kondo – Chairman Sri Lanka V Hanif Yusoof – Chief Executive Officer Telephone : +94 11 4659500 V Osman Kassim Facsimile : +94 11 4659565 V Harsha Amarasekera Web : www.expolanka.com V Sanjay Kulatunga V Naosuke Kawasaki INVEstOR RELATIOns V Yoshifumi Matsubara Expolanka Holdings PLC V Motonori Matsuzono 15 A, Clifford Avenue V Toji Shiho Colombo 03 Sri Lanka REGistERED OFFICE OF THE COMPANY Telephone : +94 11 4659500 10, Mile Post Avenue Facsimile : +94 11 4659565 Colombo 03 Web : www.expolanka.com Sri Lanka E mail : [email protected] AUDIT COMMittEE V Sanjay Kulatunga – Chairman V Harsha Amarasekera V Toji Shiho Design & Concept by: Optima Designs (Pvt) Ltd. -

371 1614591002086.Pdf

Contents About this Report – 02 About DFCC Bank – 03 A Pioneer’s Journey – 04 DFCC Group Structure – 05 Highlights – 06 Leadership 08 Message from the Chairman – 08 Chief Executive’s Review – 10 Board of Directors – 13 Corporate Management – 17 Management Team – 18 20 Business Model Our Value Creation Model – 20 Operating Environment – 22 Strategic Direction and Outlook – 24 Stakeholders – 26 Materiality – 30 Management 32 Discussion and Analysis Financial Capital – 32 Institutional Capital – 46 Investor Capital – 51 Customer Capital – 54 Employee Capital – 63 Business Partner Capital – 68 Social and Environmental Capital – 71 Financial By combining the 145 Reports commercial banking mindset with the Financial Calendar – 146 development banking Statement of Directors’ Responsibilities mindset we have crafted in Relation to Financial Statements – 147 over 65 years, DFCC Chief Executive’s and Chief Financial Bank is well placed to Officer’s Statement of Responsibility – 148 leverage this expertise to build long-lasting Independent Auditors’ Report – 149 relationships that Income Statement – 154 benefit both our customers and our bank. Statement of Profit or Loss and other Comprehensive Income – 155 J Durairatnam Statement of Financial Position – 156 Chairman Statement of Changes in Equity – 158 Statement of Cash Flows – 160 Notes to the Financial Statements – 163 Other Disclosures – 297 The Bank’s agility was on full display in 2020 as it fully embraced its goal of becoming a customer centric, digital-first bank to serve our customers during unprecedented times. L H A L Silva Chief Executive Officer Supplementary Recognition Stewardship 77 79 301 Information Awards and Accolades – 77 Integrated Risk Management – 79 Quantitative Disclosures Key Events of the Year – 78 as per Schedule III of Banking w Corporate Governance – 104 Act Direction No. -

Freight & Logistics

LOOK SEE About this report This is our first Integrated Report. Through it we wish to demonstrate the strategies that shaped the business during the reporting period and the opportunities we look to garner to create greater value and wealth across stakeholder groups. As our business re-shaped through strategic reconfiguration in 2013/14, the discussions and disclosures in our Annual Report pivot around them. As such, the performance highlights, management discussion, sustainability, governance & risk reports illustrate our position consequent to the re- configuration. This Integrated Report has been prepared in accordance with the GRI G4 guidelines and has been externally audited for GRI compliance. Our Integrated Annual Report has been prepared to assist all stakeholders – our shareholders, potential investors, the broader investment community, employees, customers, valued business partners and the society at large – understand our strategic trajectory and make informed assessments of Expolanka’s potential to garner and sustain value. This Report is available on CD format and on our website www.expolanka.com Forward Looking Statements This Integrated Annual Report contains forward looking statements that relate to the financial position and operations of the Group based on the vivacity of the global and local economies. The statements are purely based on projected economic performances and by their nature involve risk and uncertainty as they relate to events and depend on circumstances that may occur in the future. These forward- looking statements have not been reviewed or reported on by the Group’s External Auditors. 010 LOOK SEEHaving a vision doesn’t just mean that we look at the future and formulate our plans, we really SEE the possibilities, and what it has to offer. -

EPF Department of Central Bank of Sri Lanka Listed Equity Portfolio (Trading) As at 30/09/2018

EPF Department of Central Bank of Sri Lanka Listed Equity Portfolio (Trading) as at 30/09/2018 Rs. 000 Original Purchased No. Company Name No. of Shares Market Value Cost 1 ACL Cables Ltd 407,166 22,978.15 15,146.58 2 ACL Placstics PLC 153,063 19,892.82 12,183.81 3 Access Engineering PLC 4,694,885 102,915.50 65,258.90 4 Aitken Spence Co 3,170,859 280,028.13 136,029.85 5 Aitken Spence Hotels 2,838,466 164,977.10 71,529.34 6 Asian Hotels & Properties PLC 1,907,562 96,297.36 75,539.46 7 Balangoda Plantations 1,351,098 40,338.11 17,699.38 8 Bogawantalawa Tea State PLC 81,724 1,463.19 817.24 9 Browns & Co PLC 249,050 25,399.54 12,452.50 10 Browns Capital PLC 104,900 524.50 356.66 11 Browns Investment PLC_Voting 2,082,858 3,689.83 3,957.43 12 Bukith Darah 3,639 2,613.79 764.19 13 C W Mackie PLC 139,740 12,643.85 6,288.30 14 CIC Holdings PLC - Non Voting 341,335 29,551.80 12,083.26 15 CIC Holdings PLC Voting 1,114,909 119,043.32 52,400.72 16 Cargills (Cey) PLC 16,514 2,274.24 3,301.21 17 Carsons Cumberbatch PLC 30,429 13,160.41 5,172.93 18 Central Finance Company PLC 654,169 74,971.02 59,660.25 19 Ceylon Guardian Investment PLC 229,142 40,107.95 16,039.92 20 Ceylon Hospitals PLC - Voting 1,076,985 106,534.11 80,666.18 21 Ceylon Tea Services PLC 32,225 23,494.57 17,788.20 22 Ceylon Theatres 50,016 6,506.74 9,002.86 23 Chemanex PLC 23,288 1,454.47 1,276.18 24 DIMO PLC 125,282 88,707.20 43,811.12 25 Dialog Telekom 48,068 505.44 572.01 26 Dipped Products 582,865 65,127.94 44,880.61 27 EXPOLANKA HOLDINGS PLC_VOTING 966,450 8,420.58 3,865.80 28 Hayleys -

Acuity Stockbrokers Research | Sri Lanka Equities

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 14 Aug 2020 Daily Average Turnover Hits 7-Month High…Oil Indices vs. Turnover (10th Aug – 14th Aug) Heads for Weekly gain Amid Demand Woes… 5,400 ASPI 2,400 ASPI ^ 1.65% | S&P SL20 ^ 4.17% S&P SL20 5,280 2,350 S&P SL20 S&P 5,160 2,300 ASPI The Bourse ended the week… Cont. P2 5,040 2,250 4,920 2,200 4,800 2,150 Foreign investors closed the week... Cont. P3 10-Aug11-Aug12-Aug13-Aug14-Aug 3.50 2.80 2.10 Sri Lankan equities continued to rally….… Cont. P4 1.40 LKR Bn) LKR (Turnover 0.70 0.00 Economic Snapshot………… P5 10-Aug 11-Aug 12-Aug 13-Aug 14-Aug KEY STATISTICS Week ending 14-Aug 07-Aug +/- ASPI 5,261.99 5,176.48 1.65% S&P SL20 2,320.10 2,227.19 4.17% Banks 562.10 538.80 4.32% Capital Goods 700.95 683.95 2.49% Food, Beverage & Tobacco 735.34 736.05 -0.10% Consumer Durables & Apparel 796.89 805.49 -1.07% Materials 706.62 691.90 2.13% Diversified Financials 772.03 771.52 0.07% Turnover (LKR Bn) 11.43 4.29 166.60% Foreign Buying (LKR Mn) 722.83 53.53 1250.23% Foreign Selling (LKR Mn) 3,595.86 929.20 286.99% Daily Average Turnover (LKR Bn) 2.29 1.07 113.28% Daily Average Foreign Buying (LKR Mn) 144.57 13.38 980.18% Daily Average Foreign Selling (LKR Mn) 719.17 232.30 209.59% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change BOGAWANTALAWA BOPLN 10.4 13.6 30.8% INDUSTRIAL ASPH. -

John Keells Holdings PLC Annual Report 2014/15 CONTENTS 2

HELPING YOU TO SEE John Keells Holdings PLC John Keells Holdings PLC US MORE l Annual Report Annual 2014/2015 CLEARLY John Keells Holdings PLC Annual Report 2014/15 HELPING YOU TO SEE US MORE CLEARLY John Keells Holdings has never been a company that took the short-term view or the easy way out. Over the decades of our existence, we have relied on our solid foundations to withstand the challenges of a fast changing business environment; working towards our immediate business concerns whilst always keeping the long- term perspective in view. That’s how we have built a legacy of values that remain as relevant to contemporary Sri Lankans today as they were 145 years ago. Over those years of constant change and growing competition, our corporate agility, resilience and business adaptability have driven the successful diversification of our industry portfolio and the dynamism of our strategies. This Report is as always, a detailed and comprehensive one, in which we bring clarity and detail to the complex task of reporting on one year of business operations at John Keells Holdings; the business integrity, good governance, stakeholder value creation and sustainability that help you, our stakeholder, to see the John Keells Group and all its operations more comprehensively and clearly. John Keells Holdings PLC Annual Report 2014/15 CONTENTS 2 Group Highlights Financial Statements 3 Introduction to the Report 170 Annual Report of the Board Of Directors 4 About Us 178 The Statement of Directors’ Responsibility 5 Organisational Structure 179 Independent -

ASB Research Weekly 18.09.2020

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 18 Sep 2020 ASPI Hits 7-Month High Amid Retail Driven Indices vs. Turnover (14th Sep – 18th Sep) Momentum… Trade Deficit Narrows in Jul’20 6,000 ASPI 2,700 ASPI ^ 5.18% | S&P SL20 ^ 6.49% S&P SL20 5,850 2,600 S&P SL20 S&P 5,700 2,500 ASPI The Bourse ended the week… Cont. P2 5,550 2,400 5,400 2,300 5,250 2,200 Foreign investors closed the week... Cont. P3 14-Sep 15-Sep 16-Sep 17-Sep 18-Sep 4.00 Domestic equities jumped ….… Cont. P4 3.20 2.40 1.60 LKR Bn) LKR (Turnover 0.80 Economic Snapshot………… P5 0.00 14-Sep 15-Sep 16-Sep 17-Sep 18-Sep KEY STATISTICS Week ending 18-Sep 11-Sep +/- ASPI 5,720.67 5,438.91 5.18% S&P SL20 2,512.40 2,359.24 6.49% Banks 595.59 559.68 6.42% Capital Goods 805.12 771.59 4.35% Food, Beverage & Tobacco 796.71 764.76 4.18% Consumer Durables & Apparel 932.82 824.37 13.16% Materials 874.94 789.47 10.83% Diversified Financials 801.38 783.76 2.25% Turnover (LKR Bn) 15.98 9.45 69.05% Foreign Buying (LKR Mn) 958.88 348.54 175.11% Foreign Selling (LKR Mn) 3,038.98 2,312.77 31.40% Daily Average Turnover (LKR Bn) 3.20 1.89 69.05% Daily Average Foreign Buying (LKR Mn) 191.78 69.71 175.11% Daily Average Foreign Selling (LKR Mn) 607.80 462.55 31.40% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change EXPOLANKA EXPON 6.9 9.8 42.0% BLUE DIAMONDS[NV] BLUEX 0.3 0.2 -33.3% RENUKA AGRI RAL N 3.1 4.1 32.3% KELSEY KDL N 34.8 29.7 -14.7% HAYLEYS FABRIC MGT N 16.8 22.1 31.5% BLUE DIAMONDS BLUEN 0.7 0.6 -14.3% HNB FINANCE HNBFN 5.4 7.1 31.5% ARPICO ARPIN 124.9 116.3 -6.9% LANKA IOC LIOCN 17.7 23.0 29.9% EQUITY TWO PLC ETWON 55.9 52.1 -6.8% LAUGFS POWER[NV] LPLX 3.4 4.4 29.4% AMANA LIFE ATLLN 9.7 9.1 -6.2% CIT CITN 62.0 80.0 29.0% PDL PDL N 149.7 142.9 -4.5% RENUKA FOODS[NV] COCOX 11.0 14.1 28.2% MILLENNIUM HOUSE MHDLN 7.0 6.7 -4.3% LAUGFS POWER LPLN 4.5 5.7 26.7% LOTUS HYDRO HPFLN 7.2 6.9 -4.2% S M B LEASING SEMBN 0.4 0.5 25.0% LANKEM DEV. -

ASB Research Weekly-10.03.2017

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 10 March 2017 HNI & Institutional Investors Dominate Market Indices vs. Turnover (06th Mar – 10th Mar) Activity … Cumulative 9M Results Up 20% Y-o-Y 6,150 ASPI 3,580 S&P SL20 6,130 3,560 ASPI v 0.27% | S&P SL20 v 0.80% SL20 S&P 6,110 3,540 ASPI 6,090 3,520 The Bourse ended in… Cont. P2 6,070 3,500 6,050 3,480 Foreign Investors Closed the Week in... Cont. P3 06-Mar07-Mar08-Mar09-Mar10-Mar 1.5 Institutional and HNI interest continued … Cont. P5 1.1 0.8 LKR Bn) LKR 0.4 Economic Snapshot………… P6 (Turnover 0.0 06-Mar 07-Mar 08-Mar 09-Mar 10-Mar KEY STATISTICS Week ending 10-Mar 03-Mar +/- ASPI 6,084.99 6,101.51 -0.27% S&P SL20 3,496.58 3,524.77 -0.80% Banking & Finance -1.98% 14,975.39 15,277.88 Food & Beverage 21,396.37 21,207.46 0.89% Diversified 1,532.23 1,546.04 -0.89% Hotel & Travel 2,935.27 2,935.66 -0.01% Plantations 678.38 674.62 0.56% Manufacturing 4,225.32 4,283.44 -1.36% Turnover (LKR Bn) 3.90 6.13 -36.35% Foreign Buying (LKR Mn) 2,500.10 2,864.33 -12.72% Foreign Selling (LKR Mn) 1,342.46 1,765.80 -23.97% Daily Average Turnover (LKR Bn) 0.78 1.23 -36.35% Daily Average Foreign Buying (LKR Mn) 500.02 572.87 -12.72% Daily Average Foreign Selling (LKR Mn) 268.49 353.16 -23.97% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change KOTMALE HOLDINGS LAMBN 60.1 73.6 22.5% BLUE DIAMONDS[NV] BLUEX 0.4 0.3 -25.0% MULLERS MULLN 1.0 1.2 20.0% LANKEM DEV. -

Sri Lanka Equity Marketwatch: Daily 19-Oct-20 Focus : ASPI Remains Flat

Sri Lanka Equity MarketWatch: Daily 19-Oct-20 Focus : ASPI remains flat Capital Goods sector contributed mostly to the market turnover while the sector index Index Performance was up by 0.6%. ASPI 5,946 0.00% S&P SL 20 2,383 0.52% Foreign investors were in a selling sentiment, while the net foreign outflows amounted to LKR 162 Mn. Key Statistics Turnover(LKR '000) 2,542,378 -29.51% Focus Volume ('000) 139,862 -33.82% During the day, ASPI remained flat and S&P SL20 was up by 12 points. PER (source: Bloomberg) 15.05 Foreign Pur.(LKR '000) 35,324 ASPI remained flat for the day where as the market turnover surpassed LKR 2.5 Bn due to retail activities. On counters such as JKH, EXPO and SLTL lifted the main index by 12.45 points. Foreign Sales (LKR '000) 196,363 Dom. Pur.(LKR '000) 2,507,054 Dom. Sales (LKR '000) 2,346,015 EXPO topped the turnover list while there was one crossing which amounted to 23 Mn. Market Cap (LKR Mn) 2,588,268 Foreign investors continued to be the net sellers while the net foreign outflow amounted to LKR Gainers/ Losers 93/109 162 Mn. Foreign selling was observed on JKH. YTD Net Foreign Inflow LKR Bn -43.46 Meanwhile, ASPI started daily operations at 5920 level and increased during the day to reached 5946. During the day losers surpassed gainers by 109 to 93. Sector Performance 8.41% Intraday ASPI Performance Automobiles & Components 8.41% Banks -0.41% Capital Goods -0.22% Commercial & Professional Services 2.89% Consumer Durables & Apparel -1.06% Consumer Services Industry 0.69% Diversified Financials 0.87% 11:15 11:30 11:45 12:00 12:15 12:30 12:45 13:00 13:15 13:30 13:45 14:00 14:15 14:45 Energy 0.03% News Highlight: Food & Staples Retailing 2.31% Food, Beverage & Tobacco 0.60% Sri Lanka stocks closed 0.19 per cent higher on Monday pushed by John Keels Holdings, Expolanka and Sri Lanka Telecom, Colombo Stock Exchange provisional data showed.