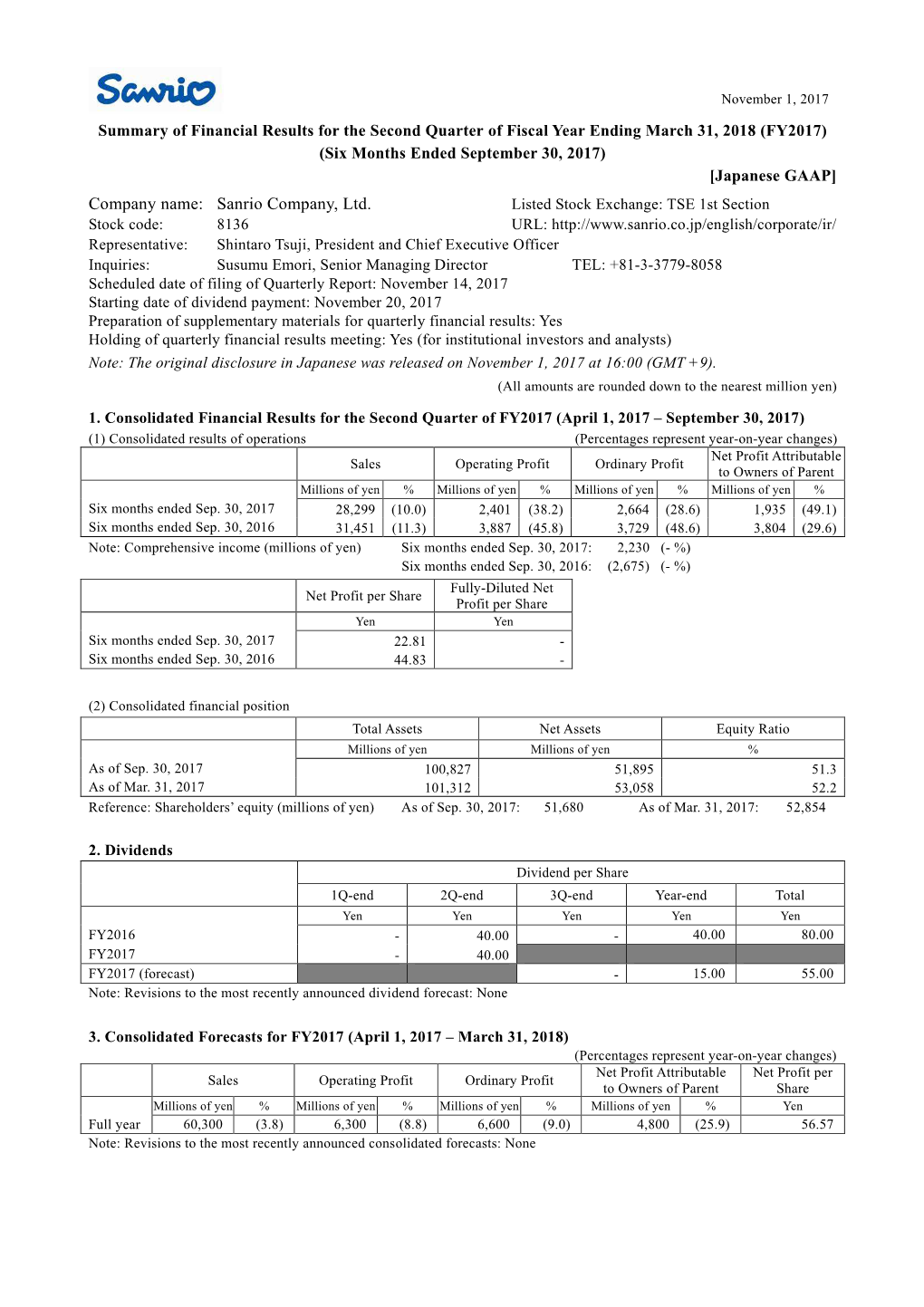

Company Name: Sanrio Company, Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Registration Document

REGISTRATION DOCUMENT 2018 CONTENTS 1 GROUP OVERVIEW 3 4 SUSTAINABLE DEVELOPMENT 157 1.1 Business environment, economic 4.1 Klépierre’s CSR strategy 158 model and strategy 4 4.2 Act for the Planet 162 1.2 Key figures 8 4.3 Act for Territories 179 1.3 Share ownership and stock information 12 4.4 Act for People 184 1.4 Background 12 4.5 Sustainability governance 200 1.5 Property portfolio as of December 31, 2018 14 4.6 Supplemental data, methodology 1.6 Simplified organization chart and concordance tables 203 as of December 31, 2018 25 1.7 Risk management 26 5 CORPORATE GOVERNANCE 219 BUSINESS FOR THE YEAR 35 5.1 Management and oversight of the Company 221 2 5.2 Compensation and benefits of executive 2.1 Business overview 36 corporate officers 244 2.2 Business activity by region 41 2.3 Net current cash flow 45 2.4 Investments, developments, and disposals 46 2.5 Parent company earnings and distribution 49 6 SHARE CAPITAL, SHARE 2.6 Portfolio valuation 49 OWNERSHIP, GENERAL 2.7 Financial policy 54 MEETING OF SHAREHOLDERS 267 2.8 EPRA performance indicators 57 2.9 Outlook 61 6.1 Share capital and share ownership 268 6.2 General Meeting of Shareholders 282 FINANCIAL STATEMENTS 63 3 ADDITIONAL INFORMATION 309 3.1 Consolidated financial statements 7 for the year ended December 31, 2018 64 7.1 General information 310 3.2 Statutory auditors’ report on the 7.2 Documents on display 312 consolidated financial statements 122 7.3 Statement by the person responsible for 3.3 Company financial statements for the year the registration document, which serves -

“Dream TOMICA Sanrio Characters Collection” to Be Launched

News Release For Immediate Release December 11, 2019 A gathering of popular Sanrio characters spanning generations! Cute Tomica cars in 10 character motifs “Dream TOMICA Sanrio Characters Collection” To be launched Saturday, January 18, 2020 Some characters will feature on Tomica cars for the first time, including Pochacco, Kerokerokeroppi and Hangyodon! TOMY Company, Ltd. Sanrio Company, Ltd. TOMY Company. Ltd. (Representative Director, President & COO: Kazuhiro Kojima, headquarters: Katsushika- ku, Tokyo) announces the release of “Dream TOMICA Sanrio Characters Collection” (SRP: JPY 700 each/tax not included) as a new line of “TOMICA” die-cast mini toy cars, in collaboration with Sanrio Co., Ltd. (President and CEO: Shintaro Tsuji, headquarters: Shinagawa-ku, Tokyo) featuring ten popular Sanrio characters. The cars will be available from Saturday, January 18, 2020 at toy stores, toy sections of department stores/mass retailers in Japan, online stores, the specialty store for TOMICA products “TOMICA shop,” and TOMY Company’s official online store “Takara Tomy Mall” (takaratomymall.jp), selected Sanrio stores, Sanrio ONLINE SHOP (https://shop.sanrio.co.jp/), etc. Each package contains a car in one of ten original designs, each themed on a popular Sanrio character. The front of each car resembles a character’s face and is complemented by designs that reflect their individual characteristics, such as a unique design on the rear of the car and a printed version of the character’s logo. Out of a total of ten characters included in the motifs, four have appeared in Tomica collaborations in the past (Hello Kitty, Gudetama, Cinnamoroll, and My Melody) while six are making an appearance for the first time (Pochacco, Pompompurin, Kuromi, Tuxedosam, Kerokerokeroppi, and Hangyodon). -

Mergers & Acquisitions Mexico Annual Issue

Seale & Associates Creative Solutions. Trusted Advice. MERGERS & ACQUISITIONS MEXICO 2019 ANNUAL ISSUE SUMMARY OF MERGERS & ACQUISITIONS IN MEXICO In 2019, the volume and value of announced transactions accumulated to 169 and USD$15.8 billion, respectively, representing a decrease in volume of 25.0% and an increase in reported value 33.7% Year-Over-Year. It is necessary to clarify that two megadeals in the infrastructure sector represent US$7.1 billion of the total value reported 18 18 18 16 17 16 16 13 13 12 11 9 10 Deal Volume in Mexico # of Transactions per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $15.8 226 2016 $8.6 210 2017 $11.4 240 2018 $8.6 $15.8 Deal Volume and 212 Value in Mexico Annual Transactions 2019 $8.7 $7.1* 169 (US$ billion) $7.1 *Megadeals Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. Trusted Advice. SUMMARY OF MERGERS & ACQUISITIONS BY MEXICAN COMPANIES ABROAD In 2019, the volume and value of announced transactions accumulated to 40 deals worth US$3.8 billion, representing a decrease in volume of 14.8% and a decrease in reported value of 26.9% Year-Over-Year 7 6 6 4 4 3 3 3 3 2 2 Deal Volume 1 Abroad # of Transactions 0 per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $13.4 47 2016 $9.6 49 2017 $8.9 39 2018 $5.2 47 Deal Volume and Value Abroad Annual Transactions (US$ billion) 2019 $3.8 40 Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. -

Swedish Bublar Group Teams up with Amazon Game Tech for the Upcoming Hello Kitty Augmented Reality Mobile Game and Starts Pre-Registration of the Game

Press release Stockholm November 21, 2019 Swedish Bublar Group teams up with Amazon Game Tech for the upcoming Hello Kitty augmented reality mobile game and starts pre-registration of the game Hello Kitty fans and gamers will, as from today, be able to pre-register for the location based mobile game “Hello Kitty AR: Kawaii World” that will go live during 2020. The famous Hello Kitty-character, founded by Japanese Sanrio, is one of the highest grossing media franchises in the world. The game, under production by the XR technology company Bublar, will use Amazon Game Tech´s backend infrastructure. We now celebrate Hello Kitty´s 45th birthday month with an announcement trailer and a landing page. Fans and players that has pre-registered will be pioneers. They will be the first ones to have the opportunity to play the mobile game featuring Hello Kitty and her awesome friends through taking part in the soft launch. During the period until launch they will be able to take part of game news, competitions and other activities. The game will be tested on selected geographic markets in the first half of next year 2020 with the aim of launching in Summer 2020. - Since her debut in Japan in 1974, Hello Kitty has inspired generations of people around the world with her positive message of friendship and kindness. With this game from Bublar, our dedicated fan base can play with her and the Sanrio characters through their smartphones wherever they are in a mixed reality experience. We are happy to continue sharing the joy of Hello Kitty and the Kawaii lifestyle, says Jiro Kishimura, Managing Director, Sanrio Co Ltd. -

Valuation Multiples by Industry

Valuation Multiples by Industry https://www.eval.tech SIC Sector: (5200-5999) Retail Trade Report Date: 31 March 2021 Country: United States of America (U.S.A.) Industry Valuation Multiples The table below provides a summary of median industry enterprise value (EV) valuation multiples, as at the Report Date. The data is grouped by industry SIC code: EV Multiple Max # Rev EBITDA EBIT TotAss TanAss Retail-Lumber & Other Building Materials Dealers (5211) 6 1.52 13.48 16.37 3.01 3.38 Retail-Variety Stores (5331) 9 0.91 13.55 18.73 1.83 2.15 Retail-Grocery Stores (5411) 10 0.37 7.19 10.75 0.90 0.95 Retail-Auto Dealers & Gasoline Stations (5500) 21 0.94 12.34 17.63 1.64 1.74 Retail-Auto & Home Supply Stores (5531) 6 1.48 12.72 14.68 2.13 2.67 Retail-Apparel & Accessory Stores (5600) 7 1.17 14.18 39.80 1.34 1.45 Retail-Family Clothing Stores (5651) 10 1.23 15.85 53.84 1.31 1.56 Retail-Shoe Stores (5661) 5 - - - 1.24 1.20 Retail-Home Furniture, Furnishings & Equipment Stores 6 1.17 - - 1.22 2.20 (5700) Retail-Eating & Drinking Places (5810) 6 4.61 54.28 - 1.68 2.55 Retail-Eating Places (5812) 39 2.28 23.89 28.25 1.67 2.20 Retail-Miscellaneous Retail (5900) 7 2.16 - 18.46 1.49 2.69 Retail-Drug Stores And Proprietary Stores (5912) 7 0.59 16.69 39.50 0.78 1.38 Retail-Miscellaneous Shopping Goods Stores (5940) 8 0.79 7.46 10.79 0.95 1.16 Retail-Catalog & Mail-Order Houses (5961) 23 1.17 14.70 22.10 2.88 3.27 Retail-Retail Stores, Nec (5990) 12 0.91 10.77 13.84 1.32 1.28 © 2021 eVal 1 20210427 EV/Revenue Valuation Multiple We provide additional data relating to industry EV/Revenue valuation multiples: # Average Median Std. -

MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020

MINISO InvestorRoom MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020 GUANGZHOU, China, Dec. 18, 2020 /PRNewswire/ -- MINISO Group Holding Limited (NYSE: MNSO) ("MINISO" or the "Company"), a fast-growing global value retailer offering a variety of design-led lifestyle products, today announced its unaudited financial results for the first fiscal quarter ended September 30, 2020. Financial Highlights for the 2021 First Fiscal Quarter Ended September 30, 2020 Revenue for the fiscal quarter ended September 30, 2020, was RMB2,072.1 million (US$305.2 million), representing a decrease of 30.7% from the fiscal quarter endedS eptember 30, 2019, and an increase of 33.4% from the previous fiscal quarter ended June 30, 2020. Gross profit for the fiscal quarter ended September 30, 2020, was RMB522.4 million (US$76.9 million), representing a decrease of 44.3% from the fiscal quarter endedS eptember 30, 2019, and an increase of 37.7% from the previous fiscal quarter ended June 30, 2020. Loss from continuing operations for the fiscal quarter ended September 30, 2020, was RMB1,676.3 million (US$246.9 million) as compared to RMB20.3 million for the fiscal quarter ended September 30, 2019, and RMB74.8 million for the previous fiscal quarter ended June 30, 2020. Adjusted net profit[1] for the fiscal quarter ended September 30, 2020, was RMB102.1 million (US$15.0 million), representing a decrease of 74.6% from the fiscal quarter endedS eptember 30, 2019, and an increase of 140.8% from the previous fiscal quarter endedJ une 30, 2020. -

VIEWPOINT Weekly Rating Pages for Veritas Coverage Universe

July 28, 2017 VIEWPOINT Weekly Rating Pages for Veritas Coverage Universe WEEK ENDING JULY 27, 2017 SUMMARY PAGES 3-11 V-LIST 12 WATCHLIST 13 RATING PAGES 14-105 Viewpoint July 28, 2017 C OMPANY R ATING P AGES Click on company name below for a link to the rating page Shading indicates an updated rating page Agnico-Eagle Mines Ltd. 14 CGI Group Inc. 45 Macy’s, Inc. 76 Aimia Inc. 15 Choice Properties REIT 46 Magna International Inc. 77 Allied Properties REIT 16 Cogeco Cable Inc. 47 Manulife Financial Corp. 78 Air Canada 17 Constellation Software Inc. 48 Maple Leaf Foods Inc. 79 Amaya Inc. 18 Crescent Point Energy Corp. 49 Martinrea International Inc. 80 ARC Resources Ltd. 19 Crombie REIT 50 Metro Inc. 81 Artis REIT 20 CT Real Estate Investment Trust 51 National Bank of Canada 82 ATCO Ltd. 21 Dollarama Inc. 52 Newmont Mining Corp. 83 Badger Daylighting Ltd. 22 ECN Capital Corp. 53 Northland Power Inc. 84 Bank of Montreal 23 Element Fleet Management 54 Peyto Exploration & Development Corp. 85 Bank of Nova Scotia 24 Eldorado Gold Corp. 55 PrairieSky Royalty Ltd. 86 Barrick Gold Corp. 25 Emera Inc. 56 Quebecor Inc. 87 Baytex Energy Corp. 26 Empire Company Ltd. 57 Restaurant Brands International 88 BCE Inc. 27 Rogers Communications Inc. 89 Enbridge Inc. 58 BlackBerry Ltd. 28 Royal Bank of Canada 90 Encana Corp. 59 Boardwalk REIT 29 Enerplus Corp. 60 Shaw Communications Inc. 91 Bombardier Inc. 30 Fortis Inc. 61 Sun Life Financial Inc. 92 Bonavista Energy Corp. 31 George Weston Ltd. -

Retaillier-Magazine.Pdf

AMITY BUSINESS SCHOOL ABS works with a mission to create an ambience of academic excellence in which new ideas, research projects flourish and the leaders and innovators of tomorrow emerge. In any top university of the world, research is the foundation which leads to a strong academic orientation. ABS has one of the most distinctive team of faculty and Researchers who are constantly augmenting their research and publications and hence leading the institute to pinnacles of academic achievement. ABS provides holistic education and strives to create managers of vision, mission, and the action and above all of the commitment. It attracts committed students from all across the globe. The focus of ABS is on developing a global perspective amongst their student to create a new cadre of management professionals who are multi-skilled and have a capability to function as cross functional teams and with a deep understanding of ethical and value based business processes. Amitians of ABS are instilled with compassion, loyalty and commitment that makes them an invaluable asset of any organisation. Our Missionary Leaders Inspires us to higher ends My mission is nation building through education and beyond Dr. Ashok K. Chauhan Founder President, Ritnand Balved Education Foundation (The Foundation of Amity Institutions and the sponsoring Body o Amity Universities), AKC Group of Companies Our Role Models Who Motivate us to attain the unattainable “From the Editor-In-Chief’s Desk The Indian retailing sector has flourished to cope up with metamorphosis from the age of offline to online platform that is being rapidly adopted by the consumers. -

The Influence of Product Diversity

ISSN 2303-1174 L.S.A.Pojoh., P.Kindangen., F.V.Arie…… THE INFLUENCE OF PRODUCT DIVERSITY AND STORE ATMOSPHERE ON CUSTOMER SATISFACTION AT MINISO MANADO PENGARUH KERAGAMAN PRODUK DAN SUASANA TOKO TERHADAP KEPUASAN PELANGGAN DI MINISO MANADO By: Lourina S.A. Pojoh1 Paulus Kindangen2 Fitty V. Arie3 123International Business Administration, Management Program, Faculty of Economics and Business University of Sam Ratulangi Manado E-mail: [email protected] [email protected] [email protected] Abstract: Diversity of business keeps developing through times, which creates more fierce competition in business. Companies do marketing strategies to survive the competition and to stay relevant with the industry. Companies have many ways to make the business become more competitive and can overcome the competition. One of the things that can be done to survive in the industry is to pursue customer satisfaction. There are many ways to pursue customer satisfaction in which there are a diversity of products and the atmosphere of the store offered. So this research aims to know the influence of product diversity and store atmosphere on customer satisfaction at Miniso Manado. This study uses a quantitative method with questionnaires used to collect the data. This research derived and examined the model through ordinal regression model in a sample of 100 respondents who have already bought a product at Miniso Manado. The finding of this research shows that the product diversity and store atmosphere have no significant influence on customer satisfaction at Miniso Manado. Retailers should pay attention to other things such as price, the quality of product, and the service. -

Page 1 of 375 6/16/2021 File:///C:/Users/Rtroche

Page 1 of 375 :: Access Flex Bear High Yield ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited) Repurchase Agreements(a) (27.5%) Principal Amount Value Repurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received $129,000. $ 129,000 $ 129,000 TOTAL REPURCHASE AGREEMENTS (Cost $129,000) 129,000 TOTAL INVESTMENT SECURITIES 129,000 (Cost $129,000) - 27.5% Net other assets (liabilities) - 72.5% 340,579 NET ASSETS - (100.0%) $ 469,579 (a) The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to view the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase. Futures Contracts Sold Number Value and Unrealized of Expiration Appreciation/ Contracts Date Notional Amount (Depreciation) 5-Year U.S. Treasury Note Futures Contracts 3 7/1/21 $ (371,977) $ 2,973 Centrally Cleared Swap Agreements Credit Default Swap Agreements - Buy Protection (1) Implied Credit Spread at Notional Premiums Unrealized Underlying Payment Fixed Deal Maturity April 30, Amount Paid Appreciation/ Variation Instrument Frequency Pay Rate Date 2021(2) (3) Value (Received) (Depreciation) Margin CDX North America High Yield Index Swap Agreement; Series 36 Daily 5 .00% 6/20/26 2.89% $ 450,000 $ (44,254) $ (38,009) $ (6,245) $ 689 (1) When a credit event occurs as defined under the terms of the swap agreement, the Fund as a buyer of credit protection will either (i) receive from the seller of protection an amount equal to the par value of the defaulted reference entity and deliver the reference entity or (ii) receive a net amount equal to the par value of the defaulted reference entity less its recovery value. -

Gudetama Transcript

This is Gudetama. It’s an egg yolk with a little butt crack. Gudetama looks like a character someone gave up on… it has limbs but no fingers or toes. It has a mouth but no teeth — and yet people can’t get enough of it. You can find it on backpacks, cups, airplanes, credit cards, and it even has its own themed cafe. But Gudetama’s cute looks aren’t the driving force behind its insane popularity. Its main attraction is its lazy personality. Gudetama comes from a Japanese company called Sanrio. You might have heard of them. They’re the creators behind Hello Kitty. In 2013, Sanrio held a company wide competition to come up with a food-based character. And once people voted, Gudetama didn't end up on top. Kirimichan, the salmon filet came in first — we actually started to release products based on the salmon filet and its friends. Gudetama, the lazy egg came in second, but we also released products based on Gudetama…. and it really really took off. The appeal of Gudetama’s melancholy stands in contrast to the American concept of cuteness, which is pretty straightforward. The idea of cute represents goodness and optimism, while pessimism tends to define evil. This is evident in some of Disney’s early films. SNOW WHITE Oh, they do look very delicious! WITCH Yes... As you can see— there’s a clear divide between good and evil. Villains are usually depicted as unappealing, scary, and old — draped in shadows and dark colors. They are meant to be identified as evil, which means that they can never be cute. -

Advances in Theory and Practice in Store Brand Operations Advances in Theory and Practice in Store Brand Operations Jiazhen Huo

Jiazhen Huo Advances in Theory and Practice in Store Brand Operations Advances in Theory and Practice in Store Brand Operations Jiazhen Huo Advances in Theory and Practice in Store Brand Operations Jiazhen Huo School of Economics and Management Tongji University Shanghai, China ISBN 978-981-15-9876-0 ISBN 978-981-15-9877-7 (eBook) https://doi.org/10.1007/978-981-15-9877-7 Jointly published with Tongji University Press The print edition is not for sale in China (Mainland). Customers from China (Mainland) please order the print book from: Tongji University Press. © Tongji University Press 2021 This work is subject to copyright. All rights are solely and exclusively licensed by the Publisher, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfilms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed. The use of general descriptive names, registered names, trademarks, service marks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use. The publishers, the authors, and the editors are safe to assume that the advice and information in this book are believed to be true and accurate at the date of publication. Neither the publishers nor the authors or the editors give a warranty, express or implied, with respect to the material contained herein or for any errors or omissions that may have been made.