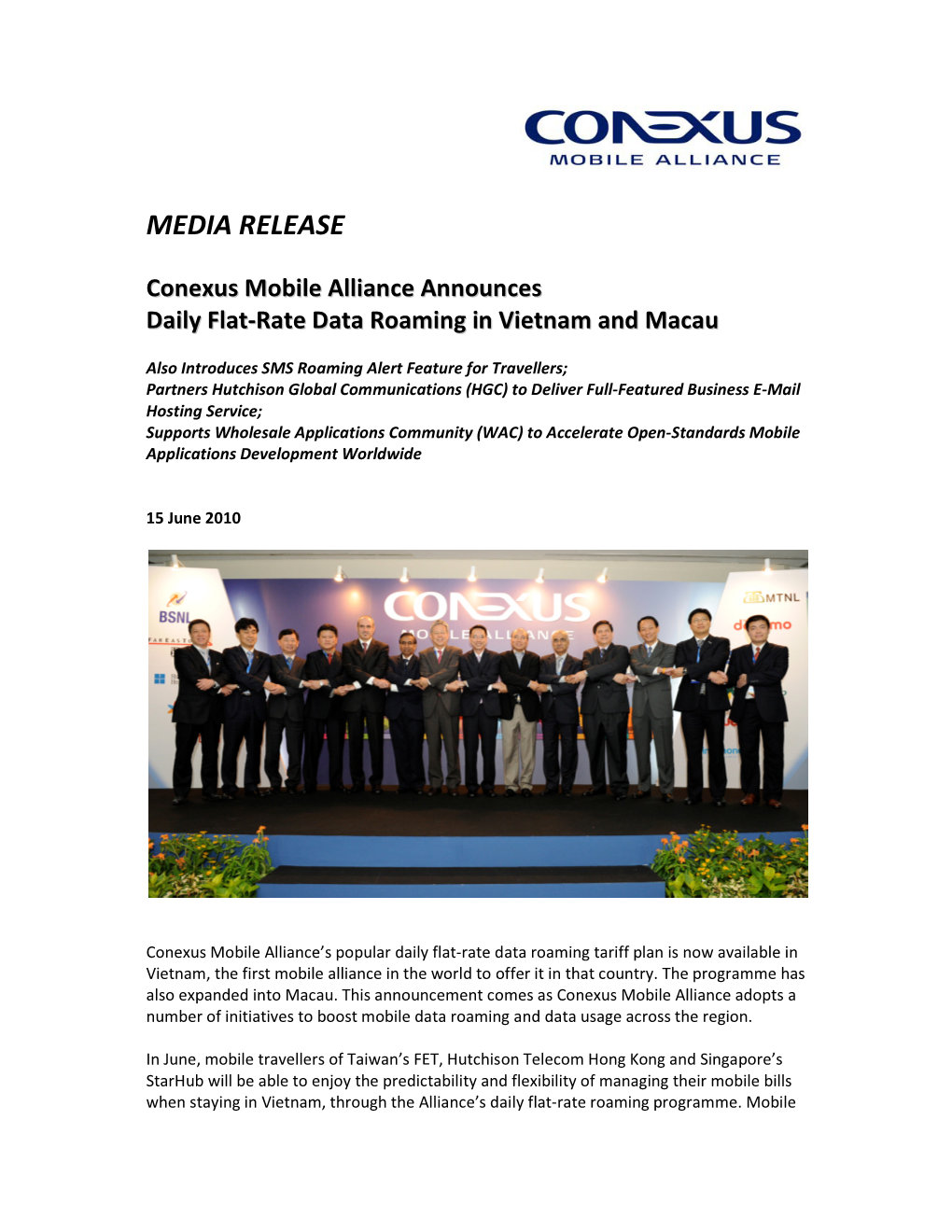

Media Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Indosat Ooredoo Selects Ericsson Operations Engine

PRESS RELEASE May 13, 2020 Indosat Ooredoo selects Ericsson Operations Engine • Deal will provide nationwide AI-driven managed services and network automation for Indosat Ooredoo in Indonesia • Indosat Ooredoo to launch Ericsson Operations Engine in July 2020 • Solution will deliver operational, energy, cost efficiency and strengthened network capabilities to Indosat Ooredoo Ericsson (NASDAQ: ERIC) has been selected by Indonesian communications service provider Indosat Ooredoo (IDX:ISAT) to provide AI-powered data driven and customer-centric managed network operations through the Ericsson Operations Engine. The five-year deal will see Indosat Ooredoo launching Ericsson Operation Engine in July 2020. Ericsson will deploy the latest automation, machine learning and AI technologies to enhance network performance and user experience. Ericsson will also manage Indosat Ooredoo’s network operations center and field maintenance activities across Indonesia. The deal builds on the long-standing collaboration between Ericsson and Indosat Ooredoo in Indonesia. This new partnership will leverage Ericsson’s global capabilities in AI-based data driven automated network technology upgrades to boost Indosat Ooredoo’s competitive edge. It will also deliver operational, energy and cost efficiency for Indosat Ooredoo and stronger network capabilities to deliver an enhanced end-user experience for its customers. Vikram Sinha, Chief Operating Officer, Indosat Ooredoo, says: “Network performance is key for customer satisfaction today, especially in a market -

News Release

NEWS RELEASE FOR IMMEDIATE RELEASE ST Telemedia and Qatar Telecom Form Strategic Alliance to Expand in the Asia-Pacific Region Qatar Telecom to invest a 25% equity stake in Asia Mobile Holdings Singapore and Qatar, 15 January 2007 – Singapore Technologies Telemedia Pte Ltd (“ST Telemedia”), a leading information-communications company with operations in the Asia-Pacific, the Americas and Europe, and Qatar Telecom (Qtel) QSC (“Qtel”), one of the Middle East’s fast- growing telecommunications companies, today announced the formation of a new strategic alliance to explore and invest in new mobile telecoms opportunities while strengthening existing businesses in the Asia-Pacific region. Agreements for the strategic alliance were signed on 12 January 2007 by ST Telemedia’s Deputy Chairman, Mr. Peter Seah, and President and Chief Executive Officer, Mr. Lee Theng Kiat; and Qtel’s Group Chairman, HE Sheikh Abdullah Bin Mohammed Bin Saud Al Thani, and Chief Executive Officer, Dr. Nasser Marafih. Under the terms of the Agreements, Qtel will invest up to US$635 million in cash for an approximate 25 percent equity stake in ST Telemedia’s Asia Mobile Holdings Pte. Ltd. (“AMH”). ST Telemedia will remain the controlling shareholder with an approximate 75 percent equity stake in AMH. The transaction values AMH at an enterprise value of up to US$3.5 billion. AMH will be the parties’ preferred vehicle for future mobile telecoms investments in selected key markets in the Asia-Pacific region. AMH currently holds ST Telemedia’s stakes in StarHub Ltd, Singapore’s second largest info- communication company, and PT Indosat Tbk, Indonesia’s second largest operator with over 14 million mobile subscribers. -

Indosat Ooredoo (ISAT IJ) Maintain Operational Momentum and Milestone Moment

Equity Research Result Note Friday,30 July 2021 BUY Indosat Ooredoo (ISAT IJ) Maintain Operational momentum and Milestone moment Last price (IDR) 5,925 Indosat delivered topline growth in 2Q21 amid market uncertainties and nd Target Price (IDR) 7,800 impact from tower sales and OPEX, posting quarterly net profit for 2 consecutive time. 2Q21 is an Indosat milestone with cash balances of Upside/Downside +31.6% Rp10.9tn, low leverage, and generating solid operating cashflow. Solid BUY Previous Target Price (IDR) 7,800 recommendation. Stock Statistics Navigating through a tough set of challenges. Indosat successfully navigated 2Q21 the market uncertainties from price competition, school subsidies, Sector Telco potential weakness in purchasing power, structural decline in legacy services. Bloomberg Ticker ISAT IJ The latest 4,247 towers sale by Indosat have permanent reduction impact of No of Shrs (mn) 5,434 tower leases revenue, whilst the sale lease back resulted into higher financial Mkt. Cap (IDRbn/USDmn) 32,196/2,221 cost from leases in 2Q21. Nonetheless Indosat marched through 2Q21 with great execution, and setting foundations with 5G initiatives for B2B. Avg. daily T/O (IDRbn/USDmn) 35.1/2.4 Solid effort by Indosat grinding to generate value. Indosat 2Q21 revenue were Major shareholders (%) Rp7.64tn delivering growth +4.0%qoq, demonstrating sound operations. Its Ooredoo Asia Pte. Ltd. 65.0 quarterly growth was based on ARPU improvement monetizing the subscriber base and lifting the average monthly data consumption over 10GB. This reflects Government 14.3 the positive reception by its users (Indosat exhibits gains in NPS, CSAT, and Estimated free float 20.7 brand equity). -

Division of Corporation Finance Incoming No-Action Letter: Qtel

Dewey & LeBoeuf LLP 1301 Avenue of the Americas New York, NY 10019-6092 tel +1 212 259 6640 fax +1 212 259 7407 [email protected] January 5, 2009 VIA EMAIL Office of Mergers and Acquisitions Division of Corporation Finance Securities and Exchange Commission 100 F. Street, N.E. Washington, D.C. 20549 Attn: Michele Anderson, Esq. Christina E. Chalk, Esq. Daniel F. Duchovny, Esq. Re: Mandatory Tender Offer for Series B Shares of PT Indosat Tbk Dear Mss. Anderson and Chalk and Mr. Duchovny: We are writing on behalf of Qatar Telecom (Qtel) Q.S.C., a corporation organized under the laws of Qatar (“Qtel”).1 On June 26, 2008 (the “Announcement Date”), in accordance with Indonesian law, Qtel announced its plans to make a tender offer, as mandated by applicable Indonesian law, to acquire all of the outstanding Series B common shares, par value Indonesia Rupiah 100 per share (“Series B Shares”), of PT Indosat Tbk, a publicly listed limited liability company established under the laws of the Republic of Indonesia (“Indosat”), including Series B Shares represented by American Depositary Shares (the “ADSs”). Qtel proposes to make the offer to acquire Series B Shares (including Series B Shares held as ADSs) pursuant to a dual offer structure, consisting of: • a U.S. offer open to all holders of ADSs wherever located (the “U.S. Offer”); and 1 We are admitted to practice only in the State of New York. To the extent this letter summarizes Indonesian law, we have relied on advice from Bahar & Partners, Qtel’s Indonesian counsel. -

Indosat Buy (ISAT IJ) (Maintain)

[Indonesia] Telecommunication Indosat Buy (ISAT IJ) (Maintain) 3Q20 review: Strong top-line growth, yet net loss TP: IDR3,050 recorded in 3Q20 Upside: 51.7% Mirae Asset Sekuritas Indonesia Lee Young Jun [email protected] Turn to net loss in 3Q20 High finance cost dragging down earnings improvement In 3Q20, Indosat (ISAT) booked a net loss of IDR116.4bn (vs. net profit of IDR47.3bn in 3Q19). While revenue increased by 8.8% YoY, EBIT and EBITDA grew by 39.0% YoY and 8.2% YoY, respectively. ISAT booked meaningful positive EBIT for two consecutive months, but bottom line turned negative as top line was not enough to cover finance cost. We think ISAT needs one to two fiscal years to sustainably exceed the breakeven point. Thus, we expect negative earnings to continue in 4Q20 and 2021. Of a note, cumulative 9M20 net loss came in at IDR457.5bn, achieving 34% and 48% of our and the consensus’ full-year estimate each. Data traffic as the key driver of 3Q20 operational highlights revenue growth ISAT booked strong revenue growth (8.8% YoY, 3.1% QoQ) in 3Q20 on the back of growing subscriber base and data traffic. ISAT added 3.2mn subscribers, bringing total subscribers to 60.4mn. Data traffic growth remained solid at 4.8% QoQ (1.6mn TB in 3Q20). However, quarterly ARPU decreased from IDR33.2k in 2Q20 to IDR32.3k in 3Q20, which we attribute to low cost-effective packages amid COVID-19. In 3Q20, ISAT’s total number of BTS decreased once again to 117k. -

Asia & Pacific

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Asia & Pacific 162 72 5 25 American Samoa Total 21 0 0 American Samoa Telecom (BlueSky American Samoa Communications) 11 0 0 American Samoa Telecommunications American Samoa Authority (ASTCA) 10 0 0 Australia Total 43 1 3 Australia Optus Mobile 21 0 1 Australia Telstra 11 0 1 Australia Vodafone Hutchison Australia (VHA) 11 1 1 Bangladesh Total 41 0 0 Bangladesh Banglalink 10 0 0 Bangladesh GrameenPhone (GP) 10 0 0 Bangladesh Robi Axiata 11 0 0 Bangladesh Teletalk 10 0 0 Bhutan Total 20 0 0 Bhutan Bhutan Telecom (BT) 10 0 0 Bhutan Tashi InfoComm (TashiCell) 10 0 0 Brunei Total 40 0 0 Datastream Technology (DST Brunei Communications) 10 0 0 Brunei imagine (formerly Telekom Brunei) 10 0 0 Brunei Progresif 10 0 0 Brunei Unified National Networks (UNN) 10 0 0 Cambodia Total 43 0 0 Cambodia CamGSM (Cellcard) 11 0 0 Cambodia SEATEL (yes) 10 0 0 Cambodia Smart Axiata 11 0 0 Cambodia Viettel Cambodia (Metfone) 11 0 0 China Total 61 0 3 China China Mobile 20 0 1 China China Telecom Corporation 21 0 1 China China Unicom 20 0 1 Cocos (Keeling) Islands Total 00 0 0 Cook Islands Total 11 0 0 Vodafone Cook Islands (formerly Cook Islands Bluesky) 11 0 0 Fiji Total 22 1 0 Fiji Digicel Fiji 11 1 0 Fiji Vodafone Fiji 11 0 0 French Polynesia Total 30 0 0 French Polynesia Ora (Viti) 10 0 0 French Polynesia Vini 10 0 0 Vodafone French Polynesia (Pacific French Polynesia Mobile Telecom, PMT) 10 0 0 Guam Total 40 0 0 Guam Choice Phone (iConnect Guam) 10 0 0 Guam DOCOMO Pacific (Guam) 10 0 0 Guam GTA 10 0 0 Guam IT&E (Guam) 10 0 0 Hong Kong Total 64 2 4 China Mobile Hong Kong (CMHK, Hong Kong formerly Peoples) 21 1 1 Hong Kong HKT/PCCW (incl. -

Analisis Kinerja Keuangan Berdasarkan Metode Eva Studi Pada Perusahaan Telekomunikasi Yang Tercatat Di Bursa Efek Indonesia (Bei) Tahun 2013

Vol. 3. No. 1, Juni 2015 Ekuitas – Jurnal Pendidikan Ekonomi ANALISIS KINERJA KEUANGAN BERDASARKAN METODE EVA STUDI PADA PERUSAHAAN TELEKOMUNIKASI YANG TERCATAT DI BURSA EFEK INDONESIA (BEI) TAHUN 2013 Ni Made Tatsani Widi Arini Jurusan Pendidikan Ekonomi Universitas Pendidikan Ganesha Singaraja, Indonesia e-mail: [email protected] ABSTRAK Penelitian ini bertujuan untuk mengetahui (1) nilai NOPAT pada Perusahaan Telekomunikasi yang telah tercatat di BEI tahun 2013, (2) nilai biaya modal pada perusahaan telekomunikasi yang telah tercatat di BEI tahun 2013, (3) kinerja keuangan perusahaan telekomunikasi yang telah tercatat di BEI tahun 2013 ditinjau dengan metode EVA. Jenis penelitian ini adalah deskriptif kuantitatif. Data dikumpulkan dengan metode dokumentasi dan analisis data yang digunakan yaitu analisis EVA. Hasil penelitian menunjukkan (1) nilai NOPAT PT Telekomunikasi Indonesia Tbk. adalah Rp 20.987.000.000.000,00, PT Indosat Tbk. sebesar Rp 841.838.000.000,00, PT Smartfren Tbk. sebesar Rp -1.784.682.909.136,00, PT XL Axiata Tbk. sebesar Rp 1.301.438.000.000,00, PT Bakrie Telecom sebesar Rp 27.320.180.033,00. (2) Biaya modal untuk PT Telekomunikasi Indonesia Tbk. sebesar Rp 10.284.848.546.016,00, PT Indosat Tbk. sebesar Rp 3.273.701.158.489,00, PT Smartfren Tbk. sebesar Rp 790.441.706.857,00, PT XL Axiata sebesar Tbk. Rp 1.670.800.564.235,00, dan biaya modal PT Bakrie Telecom sebesar Rp 196.585.006.260,00. (3) Hasil analisis EVA menunjukkan PT Telekomunikasi Indonesia Tbk. memililki nilai EVA>0, ini berarti kinerja keuangan perusahaan telah mampu menciptakan nilai tambah bagi perusahaan. -

Analysis and Testing of Data Transmission of Providers in Indonesia Using Gsm and Cdma Modem

(IJID) International Jurnal on Informatics for Development, Vol. 6, No. 1, 2017 ANALYSIS AND TESTING OF DATA TRANSMISSION OF PROVIDERS IN INDONESIA USING GSM AND CDMA MODEM Fanni Rakhman Hakim Bambang Sugiantoro Department of Informatics Department of Informatics Faculty of Sains and Technology Faculty of Sains and Technology State Islamic University Sunan Kalijaga State Islamic University Sunan Kalijaga Yogyakarta, Indonesia Yogyakarta, Indonesia [email protected] AbstractFThe technology of internet nowadays has Basically everyone who is connected to the Internet, become most important aspect and becomes they can exchange information and data between one primary need for certain group of peoples who person with others, either in the form of images, work in some field like sounds, video, text and more. With the it community, education,economy,health,etc. One of the biggest utilizing it in resolving the problem of the daily work problem which mostly brought by so many people that demands speed and accuracy. One of them is in is speed in data transfer. This paper emphasize in the speed of the data transfer. directly testing the quality of data transmission from each transmission technology. The equipment Mobile technology is also growing rapidly in line used by this paper is ZTE Join Air help, the with the needs of the community to get simcard provided by Telkomsel,XL, and indosat, communication service that is quick and easy. Some while CDMA technology used simcard provided by service providers mid-haul vying Indonesia good- smartfren and esia and modem provided by based Global System for Mobile Communication Smartfren which its series is EC176-2. -

Attachment 1. About Vodafone Vodafone Is One of the World's

Attachment 1. About Vodafone Vodafone is one of the world's largest mobile communications companies by revenue with approximately 382 million customers in its controlled and jointly controlled markets as at 30 June 2011. Vodafone currently has equity interests in over 30 countries across five continents and more than 40 partner networks worldwide. For more information, please visit www.vodafone.com. 2. About Conexus and member companies One of the largest alliances of mobile phone carriers in the Asia-Pacific region, formed in April 2006 to promote mutual cooperation in international roaming services and corporate sales to enhance convenience for customers. Member companies are as below. Bharat Sanchar Nigam limited (BSNL) Business area India Mobile subscribers 88.46 million (as of June 2011) Establishment 2000 Far EasTone Telecommunications Co., Ltd. (FET) Business area Taiwan Mobile subscribers 6.5 million people (as of June 2011) Date of foundation 1998 Hutchison Telecommunications (Hong Kong) Limited (Hutchison Telecom) Business area Hong Kong and Macau Mobile subscribers 2.97 million (Hong Kong; as of June 2011) Establishment 1983 KT Corporation (KT) Business area South Korea Mobile subscribers 16.3 million (as of June 2011) Establishment 1997 Mahanagar Telephone Nigam Limited (MTNL) Business area India Mobile subscribers 5.24 million (as of June 2011) Establishment 1986 PT Indosat, Tbk (Indosat) Business area Indonesia Mobile subscribers 47.25 million (as of June 2011) Establishment 1967 Smart Communications, Inc. (Smart) Business area Philippines Mobile subscribers 47.83 million (as of June 2011) Establishment 1967 StarHub Ltd. (StarHub) Business area Singapore Mobile subscribers 2.15 million (as of June 2011) Establishment 1998 True Move Company Limited (True Move) Business area Thailand Mobile subscribers 17.93 million (as of June 2011) Establishment 2002 Vietnam Telecom Services Company (VinaPhone) Business area Vietnam Mobile subscribers 27.57 million (as of June 2011) Establishment 1996 . -

Top up Agent Commissions-1.Xlsx

Zone Country Carrier Available Denominations (in USD) Zone 1 Mexico Iusacell 15, 20, 50 Zone 1 Mexico Movistar 12, 20, 50 Zone 1 Mexico Nextel 20, 50 Zone 1 Mexico Telcel 15, 20, 50 Zone 1 Mexico Unefon 15, 20, 50 Zone 2 Benin MTN 15 Zone 2 Cameroon MTN 15 Zone 2 Canada CallDirek 5 , 10 , 12 , 14 , 15 , 20 , 25 , 36 , 50 , 100 Zone 2 Egypt Etisalat 5 , 10 , 12 , 14 , 15 , 20 , 25 , 36 , 50 Zone 2 Indonesia Bakrie Esia 14 Zone 2 Indonesia Telkom Flexi 14 Zone 2 Ivory Coast MTN 15 Zone 2 Mexico Iusacell 5, 10 Zone 2 Mexico Movistar 10 Zone 2 Mexico Nextel 5, 10 Zone 2 Mexico Telcel 5, 10 Zone 2 Mexico Unefon 5, 10 Zone 2 Pakistan Mobilink 14 Zone 2 Pakistan Telenor 14 Zone 2 Pakistan Ufone 14 Zone 2 Pakistan Warid 14 Zone 2 Pakistan ZONG 14 Zone 2 Republic of Congo MTN 15 Zone 2 Rwanda MTN 50 Zone 2 Vietnam Beeline (Gtel) 12 Zone 2 Vietnam EVN Telecom 12 Zone 2 Vietnam MobiFone 12 Zone 2 Vietnam Sfone 12 Zone 2 Vietnam VietnamMobile 12 Zone 2 Vietnam VinaPhone 12 Zone 3 Afghanistan Etisalat 12, 36 Zone 3 Afghanistan Roshan 36 Zone 3 Brazil Claro 5 Zone 3 Brazil Vivo 5 Zone 3 Costa Rica Kolbi 12 Zone 3 Ecuador Alegro 12, 36 Zone 3 Ecuador Claro 12, 36 Zone 3 Ecuador Movistar 12, 36 Zone 3 Egypt Mobinil 5 , 10 , 12 , 14 , 15 , 20 , 25 , 36 , 50 , 100 Zone 3 Egypt Vodafone 5 , 10 , 12 , 14 , 15 , 20 , 25 , 36 Zone 3El Salvador Intelfon/Red 12 Zone 3El Salvador Movistar 12 Zone 3 Fiji Vodafone 36 Zone 3 Guinea MTN (Conakry) 10, 20 Zone 3 India Aircel 12 Zone 3 India Bharti Airtel 12 Zone 3 India Idea Cellular 12 Zone 3 India Loop Mobile 12 Zone -

Ahead with Hubbing

Ahead with Hubbing Annual Report 2012 Hubbing Delivers In two short years, after the commercial launch of StarHub in 2000, we became Singapore’s fi rst fully integrated info-communications and entertainment company. We have continuously created compelling reasons for customers to use Hubbing, a ‘quadruple power play’ of service offerings combining mobile, pay TV, broadband and fi xed network services. In the process, we have consistently delivered value and returns to our stakeholders. History of Winning Sustainable Content Results from 2005 to 2012 1 Key Figures Revenue Total Mobile Customers 2 The Group Today FROM $1.57b TO $2.42b FROM 1.39m TO 2.20m 4 Our Financial Highlights 6 Chairman’s Message 10 Hubbing Enhances Success 1.5x 1.6x 12 Hubbing Powers Business 14 Hubbing Raises Performance 16 Hubbing Heightens Recognition Profi t Attributable to Shareholders Pay TV Households FROM $221m TO $359m FROM 448,000 TO 536,000 18 Board of Directors 24 In Discussion with StarHub’s Management 32 Senior Management 1.6x 1.2x 34 The Nucleus Connect Conversation 36 Hubbing in Review Free Cash Flow Broadband Households 50 Group Financial Review FROM $257m TO $417m FROM 277,000 TO 444,000 55 Corporate Governance 72 Directors’ Particulars 75 Awards and Industry Honours 1.6x 1.6x 76 Investor Relations 80 Sustainability Report 125 Financial Statements Triple-Service Household Hubbing Index from 2005 to 2012 www.starhub.com/ir Visit us online to learn more about StarHub and download the annual report. Download a QR code reader app on your FROM 107,000 TO 214,000 smartphone and scan this A triple-service household subscribes to all three services code for more 2x - Mobile, TV and Home Broadband information. -

Depressed Valuations, Worth Their Uplift

Equity Research Telco Monday,24 May 2021 Telco OVERWEIGHT Depressed valuations, worth their uplift TLKM relative to JCI Index Our key thesis remains the buoyant data traffic enhanced by OTT and ecommerce solutions. Mobile competition could potentially ease off, and xxxx new competition levers will enhance outlook. Remain OVERWEIGHT. Telco M&A; short to medium term beneficiaries. 4,247 Towers divestment was performed at lightning speed by Indosat in the eyes of investors, and is able now to announce debt repayments. Their 1Q21 results renders a higher 2021 prospect to turn net profit and therefore Indosat becomes an attractive asset, unimaginable a few quarters back, – and offers a commanding lead in their M&A negotiation with Hutch3. Although M&A talks took extension implying stumbling issues in their way; but definitely will set the backdrop for the remainder of 2021. Last week telco stocks gained as catalysts reinforced one another; Indosat positive 1Q21 results and together with Smartfren aiming to post near zero net losses and become more attractive M&A targets, Telkomsel EXCL relative to JCI Index additional investment placing in Goto, and XL Axiata looking to benefit from xxxx slack in Indosat+Hutch3 combined future performance. Buoyant data traffic enhanced by OTT and ecommerce. XL 1Q21 numbers showed signs of market weakness XL posted results in 1Q21, with topline/EBITDA dragged by competition. 4Q20 and FY20 periods were heavily influenced by promotion of Unlimited data plans, smaller validity data plans to address weakening purchasing power, and from school data subsidies. These apply also in Indosat but it had better its capex resources and spectrum migration to 4G.