The State of Fashion 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enhancing the In-Store Experience

Enhancing the in-store experience for female customers of Tommy Hilfiger Achieving more together Foreword The ‘Anton Dreesmann Leerstoel voor Retailmarketing’ Foundation - supported by a group of leading retailers in the Netherlands - has chosen Rabobank as its partner to host and co-organise its annual congress. The partnership started in 2011 and we have prolonged this successful collaboration until at least 2020. We appreciate the opportunity to share our knowledge and views on retail with key players and other stakeholders in the sector. The January 2017 congress, ‘Retailing Beyond Borders – Working on Transition’ took place in the Duisenberg Auditorium in Utrecht. During this congress the ‘Rabobank Anton Dreesmann Thesis Award´ was granted to Samira Darkaoui for her thesis entitled ‘Enhancing the in-store experience for female customers of Tommy Hilfiger´. Part of this award is the publication of the thesis as a book. The result of which is now in front of you. Capturing and embedding knowledge is important, both for Rabobank as a knowledge-driven financial organisation and for retailers. We therefore support the initiatives of the Foundation to combine scholarly knowledge with retail practice. The ´Rabobank Anton Dreesmann Thesis Award´ is one of these initiatives. The thesis of Samira Darkaoui, who graduated from the Delft University of Technology, discusses an actual and interesting case at Tommy Hilfiger, the well-known fashion player. The problem for Tommy Hilfiger is the lack of connection that women have with the brand. In order to address this issue, a systematic approach is followed. A wide number of topics is taken into account including brand identity, store interior and (female) consumer behaviour in order to understand the complete shopping experience. -

SHEL Holdings Europe Limited ANNUAL REPORT AND

SHEL Holdings Europe Limited ANNUAL REPORT AND FINANCIAL STATEMENTS For the period ended 28 January 2017 Pag© CONTENDS Strategic report Directors' report 5 Statement of directors' responsibilities 6 Independent auditors' report to the members of SHEL Holdings Europe Limited g Consolidated income statement and other comprehensive income 10 Consolidated balance sheet 12 Consolidated statement of changes In equity 13 Consolidated cash flow statement 14 Notes to the financial statements 51 Company balance sheet 52 Company statement of changes in equity 53 Company cash flow statement 54 Notes to the company financial statements COMPANY SECRETARY AND REGISTERED OFFICE S Hemsley, 400 Oxford Street, London \A/1 A1AB INDEPENDENT AUDITORS PricewaterhouseCoopers LLP, Chartered Accountants and Statutory Auditors, The Atrium, 1 Harefield Road, Oxbridge, UBB1EX COMPANY'S REGISTERED NUMBER The Company's registered number is 07826605. SHEL Holdings Europe Limited Strategic report for the period ended 28 January 2017 The directors present their strategic report and the audited financial statements of the Company and the Group for the period ended 28 January 2017. Review of the business Principal activities The principal activity of the Company is as a holding Company for Group activities which are department store arid online retailing. Results The financial statements reflect the results of SHEL Holdings Europe Limited and Its subsidiary undertakings. Turnover for the 52 weeks to 28 January 2017 was £1,205.7 million (52 weeks ended 30 January 2016; £1,032.8 million). Group profit on ordinary activities before taxation was £105.2 million (2016: £81.1 million). The profit after taxation for the financial period of £78.5 million (2016: £64.3 million) has been transferred to reserves. -

Unrecorded Cross-Border Trade Between Tanzania and Her Neighbors Implications for Food Security

SD Publication Series Office of Sustainable Development Bureau for Africa Unrecorded Cross-Border Trade Between Tanzania and Her Neighbors Implications for Food Security C. Ackello-Ogutu P. N. Echessah TechnoServe Inc. Technical Paper No. 89 September 1998 This publication is part of the Regional Trade Agenda Series USAID / Africa Bureau Office of Sustainable Development Productive Sector Growth and Environment Division Food Security and Productivity Unit and Regional Economic Development Support Office Eastern and Southern Africa, Office of Agriculture and Natural Resources Activity Title Regional Trade and Comparative Advantage in Eastern and Southern Africa: Implications for Food Security The series includes the following publications: n TradeNet: User’s Guide to InterMail n Comparative Analysis of Economic Reform and Structural Adjustment Programs in East Africa: With Emphasis on Trade Policies n Comparative Analysis of Economic Reform and Structural Adjustment Programs in East Africa: With Emphasis on Trade Policies—ANNEX n Comparative Transportation Cost Analysis in East Africa: Executive Summary n Comparative Transportation Cost Analysis in East Africa: Final Report n Comparative Analysis of Structural Adjustment Policies in Southern Africa: With Emphasis on Agriculture and Trade n Comparative Cost of Production Analysis in East Africa: Implications for Competitiveness and Comparative Advantage n Methodologies for Estimating Informal Cross-Border Trade in Eastern and Southern Africa n Reported Trade in East and Southern Africa: -

COVID-19 and Consumer Behavior #26 June 5, 2020 Consumer

COVID-19 and Consumer Behavior #26 June 5, 2020 Consumer Behavior and Attitudes Only 26% of Americans say they were self-isolating May 29-June 1, down from a peak of 55% at the beginning of April, while 80% say they are still social distancing as much as possible.1 In the past few weeks: • 18% have dined out, 69% have gotten takeout, 12% have visited a barbershop or spa, and 37% have visited a retail store. • 45% have visited friends or relatives, and 15% have visited elderly relatives. Americans vary on when they will be ready to dine in a restaurant again, but 55% say they will be ready within six months.2 • 25% say within one month, 17% within three months, and 13% within six months. • 15% say they will be ready only after a year or more, with 16% still unsure. 60% of Americans believe opening business puts too many people at risk, compared to 40% who say risk is minimal.3 • 48% believe most of the jobs lost will quickly return once lockdown is lifted – fairly even with the 45% who disagree. Only 49% of Americans think most individuals and businesses will follow social-distancing measures as the economy reopens.4 70% of American consumers would prefer to use voice interfaces in public places to avoid touching things. While voice control was seeing moderate growth in at-home use pre-pandemic, consumers’ new aversion to touch is pushing it out of the home for the first time.5 E-commerce is expected to account for 23% of retail purchases made by consumers in 2020, a growth of 5 percentage points year-over-year – compressing two years of adoption penetration into one.6 64% of Americans say now is a good time to buy a car, up from 57% in April.7 Students enrolled in or applying to colleges have new expectations post-pandemic.8 • 43% want smaller class sizes, 40% want temperature checks at every building, and 34% want private dorm rooms. -

Hyatt Announces Plans for a Park Hyatt Hotel in Brazil

Hyatt Announces Plans for a Park Hyatt Hotel in Brazil 9/3/2014 Park Hyatt Foz do Iguaçu will become the first Park Hyatt hotel in Brazil CHICAGO--(BUSINESS WIRE)-- Hyatt Hotels Corporation (NYSE: H) announced today that a Hyatt affiliate has entered into a management services agreement with 5 Star Empreendimentos Imobiliários Ltda for a Park Hyatt hotel in Foz do Iguaçu, Brazil. Park Hyatt Foz do Iguaçu will become the first Park Hyatt hotel in Brazil and is expected to open in 2017. Park Hyatt Foz do Iguaçu will be located in the city of Foz do Iguaçu, Paraná in southwest Brazil. The city is home to Iguaçu National Park, a world heritage site that is world-renown for its waterfalls aptly named Iguaçu Falls. The national park shares its borders with Paraguay and Argentina, making it a coveted resort, eco-travel and meetings and incentives destination. The hotel will be an important component of a mixed-use development that will be situated on a 98-acre parcel of land located on the riverbank of the Iguaçu River. The development will also include 30 Park Hyatt-branded two and three-bedroom homes, residential sites for single-family homes and a 25 acre protected nature reserve. Park Hyatt Foz do Iguaçu will offer the brand’s signature personalized services with 170 luxury rooms and suites, four restaurants and bars, a spa, a fitness center, an outdoor pool, and more than 16,146 square feet (1,500 square meters) of meeting and event space. The hotel is located 15 minutes from downtown Foz do Iguaçu and approximately six miles (10 kilometers) from Foz do Iguaçu National Park. -

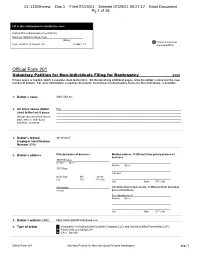

Petition for Non-Individuals Filing for Bankruptcy 04/20 If More Space Is Needed, Attach a Separate Sheet to This Form

21-11369-mew Doc 1 Filed 07/29/21 Entered 07/29/21 09:27:17 Main Document Pg 1 of 19 - Fill in this information to identify the case: United States Bankruptcy Court for the: Southern District of New York (State) Check if this is an Case number (if known): 21- Chapter 11 amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor’s name and the case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available. 1. Debtor’s name GBG USA Inc. 2. All other names debtor N/A used in the last 8 years Include any assumed names, trade names, and doing business as names 3. Debtor’s federal 94-3032467 Employer Identification Number (EIN) 4. Debtor’s address Principal place of business Mailing address, if different from principal place of business 350 Fifth Ave Number Street Number Street 10th Floor P.O. Box New York NY 10118 City State ZIP Code City State ZIP Code Manhattan Location of principal assets, if different from principal County place of business See Attachment A Number Street City State ZIP Code 5. Debtor’s website (URL) https://www.globalbrandsgroup.com 6. Type of debtor Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) Partnership (excluding LLP) Other. Specify: Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy page 1 21-11369-mew Doc 1 Filed 07/29/21 Entered 07/29/21 09:27:17 Main Document Debtor GBG USA Inc. -

Shopping for Christmas 2016: Retail Prospects

Shopping for Christmas 2016: Retail Prospects ~ A Research Report for VoucherCodes.co.uk, part of RetailMeNot Report Prepared by Centre for Retail Research Limited, Nottingham September 2016 Research Report Shopping for Christmas 2016 Shopping for Christmas 2016: Retail Prospects ~ A Research Report for VoucherCodes.co.uk, part of RetailMeNot Executive Brief Report. This independent report into the prospects for Holiday or Christmas shopping in 2016 has been commissioned by RetailMeNot, the world’s leading marketplace of digital offers, and carried out by the Centre for Retail Research based in Nottingham, England. Spending on shopping by consumers in the final weeks before Christmas is vital to most retailers’ profitability and many achieve 20% or more of their annual sales in this period. This is only so because, irrespective of background, the Holiday festivities, including celebrations and gift-giving, are an important and traditional part of social and family life. Shopping for Christmas 2016, considers the Holiday/Christmas prospects for retailers and consumers in nine important countries: Belgium, France, Germany, Italy, The Netherlands, Spain, UK, the U.S.A. and Canada. Their combined populations are 699.2 million. We estimate that Christmas spending this year will be: £280.991 bn (€323.895 bn) in Europe; £492.246 bn ($635.96 bn) in the U.S.; and £38.470 bn ($49.84 bn) in Canada. The 2016 report has taken account of major shifts in exchange rates and both the 2015 and the 2016 figures are based on current rates of exchange. This is to ensure that changes given in the report reflect only changes in the retail sector, and not currency movements. -

American Culture: Fashion and Sustainability

AMERICAN CULTURE: FASHION AND SUSTAINABILITY A thesis submitted to the Kent State University Honors College in partial fulfillment of the requirements for Departmental Honors by Kelsey Merritt May, 2018 Thesis written by Kelsey Merritt Approved by _____________________________________________________________________, Advisor _____________________________________________________________________, Co Advisor ______________________________________________, Director of Fashion Accepted by ___________________________________________________, Dean, Honors College ii TABLE OF CONTENTS LIST OF FIGURES…..……………………………………………...……………………iv LIST OF TABLES………..………………………………………………………………vi ACKNOWLEDGMENT………………………………………….……………………..vii CHAPTERS I. INTRODUCTION……………………………………………….………..1 Delimintations……………………………………………………………..4 II. LITERATURE REVIEW………………………………………….………6 III. DATA COLLECTION METHODS……………………………………..12 IV. FINDINGS AND DISCOVERINGS…………………………………….42 V. RECOMMENDATIONS………………………………………………...48 REFERENCES……………………………………………………………………...…...54 APPENDIX 1. Appendix A………………………………………………………………58 2. Appendix B………………………………………………………………60 3. Appendix C………………………………………………………………63 4. Appendix D………………………………………………………………66 iii LIST OF FIGURES Figure 1: Inside Stoll knit factory………………………………………………………..15 Figure 2: Stoll’s knit factory entrance…………………………………………………...16 Figure 3: Sample garments created………………………………………………………16 Figure 4: Ka de We shoe floor…………………………………………………………...18 Figure 5: Rug maker……………………………………………………………………..20 Figure 6: Testing rug making myself…………………………………………………….20 -

Annual Report 2013/14 Contents

ANNUAL REPORT 2013/14 CONTENTS 02 12 Corporate Profile Board of Directors 03 16 Corporate Directory Senior Management 04 18 Executive Chairman’s Review Brand Highlights 06 41 Chief Executive Officer’s Report Corporate Governance 08 50 Geographical Presence Financial Contents 09 125 Corporate Structure Statistics of Shareholdings 10 127 Group Five-Year Financial Summary Notice of Annual General Meeting CORPORATE PROFILE With a rich heritage dating back to 1959, SGX-listed F J Benjamin Holdings Ltd is an industry leader in brand building and management, and development of retail and distribution networks for international luxury and lifestyle brands across Asia. Headquartered in Singapore and listed on the Singapore Exchange since November 1996, F J Benjamin has offices in eight cities, manages over 20 iconic brands and operates 226 stores. The Group employs over 3,000 employees and runs three core businesses: LUXURY AND LIFESTYLE TIMEPIECE DISTRIBUTION FASHION RETAILING AND DISTRIBUTION F J Benjamin exclusively distributes timepiece brands – Alpina, F J Benjamin exclusively retails and Bell & Ross, ChronoSwiss, distributes brands such as Banana Frédérique Constant, Gc, Republic, Catherine Deane, Céline, Guess, Julien Coudray, Nautica, Gap, Givenchy, Goyard, Guess, Superdry, Victorinox Swiss Army La Senza, Loewe, Raoul, Sheridan, and Vulcain across Asia. Superdry, Tom Ford, Valextra and VNC across various territories. CREATIVE AND DESIGN Its retail footprint includes Southeast Asia and Hong Kong. It distributes F J Benjamin’s Creative & Design in-house labels Raoul and Catherine division handles the creation and Deane through points-of-sale across production of Raoul designs. China, Europe, the United States and the Middle East. -

2015-Bvlgari-Jewelry-Catalog

Since 1884, Bulgari has exemplified Italian excellence. Built upon 2700 years of Roman history, Bulgari honors its rich past within its modern designs. Renowned for a stylistic audacity and a penchant for color, a Bulgari piece is immediately recognizable. The sensuality of volume, a love of linearity, and a reverence for the art and architecture of its ancient roots – such characteristics define each creation. With a mastery of artisanal craftsmanship, Bulgari innovates the future of design, and guards the legend of exquisite beauty. Finding its Roman beginnings as a jewelry shop, Bulgari was founded in 1884 by Greek silversmith Sotirio Bulgari. Today an icon of luxury, Bulgari is known for its unrivalled design, striking volumes and bold colors. Finding endless inspiration in the Eternal City, Bulgari reinterprets the majestic symbols of Rome into exquisite editions of jewelry, watches, accessories and perfumes. Honoring its history, Bulgari engraved the original Latin “V” epigraphy of its name above the prestigious Via dei Condotti store in 1934, inspiring the BVLGARI logo. In 2014, the magnificent DOMVS was built in the flagship store as a gallery to house Bulgari Heritage Collection treasures. The Bulgari name has become synonymous with brilliant color, symbolic storytelling, and peerless craftsmanship – for over 130 years. IN ALL THINGS BVLGARI, LUXURY IS LEGEND THE ART OF JEWELRY MAKING: THE BVLGARI SAVOIR-FAIRE Intricate and striking, Bulgari jewelry is highly recognizable. Some of Bulgari’s trademark designs – vivid cabochon-cut gemstones, coiling Serpenti creations, ancient Monete coin jewels – are only possible because of the masterful jewelry making of the Maison. From the trained eye of the gemologist to the meticulous hand of the goldsmith, Bulgari gems can take years to find and assemble, while Bulgari craftsmen devote months to each piece of wearable perfection. -

Managing Cost and Delivering Savings in Professional Services Agenda

Managing Cost and Delivering Savings in Professional Services Agenda • Introductions • Objectives & Background • Building Blocks • Types of Fee Arrangements • Case Studies • Conclusion Speaker Bios Kala Bhatt • Current Head of IP & Legal Controlling for BASF Corporation • Over 20 years of diverse experience in Finance • Received a B.S. in Accounting (Rutgers University) • Active, licensed CPA Fred Paulmann • Founder of The Counsel Management Group, LLC • Served as the Director of Law Firm Management at Pfizer • Previously worked at a NY law firm (Kaye Scholer) • Received his BA from Boston College, JD from New York University, and MBA from New York University Background Emerging Trends in Finance “Data and analytics” represent the top strategic priority for CFOs, according to a recent survey 1 “Cost reduction is a focus of most companies globally (86 percent)”2 but “nearly two-thirds (63 percent) of organizations are failing to meet their goals”2 in this area. Evolving role of Finance: data “black belts”, change agents, fiscal discipline for savings, strong ROI to invest in growth 1 http://engage.kornferry.com/2018-cfo-pulse-survey 2 https://www.mindtools.com/pages/article/newCDV_52.htm Q&A with Kala • How would you describe the focus on cost management at BASF? • What do your colleagues want / need? • What are the challenges? Professional Services • Professional services and external expertise will be critical for future change and growth opportunities • Include accountants, financial advisers, lawyers, advertising professionals, architects, engineers, and consultants, among others • Usually provide skills / expertise that cannot be found, or in short supply in-house – highly specialized and often expensive • However, professional services can be costly and be difficult to forecast depending on the engagement Presentation Objectives 1. -

Djokovic, Kenin Defend Titles but No Federer at Unique Australian Open

Sports Sunday, February 7, 2021 13 beIN SPORTS to broadcast Djokovic, Kenin defend titles but no Australian Open exclusively Federer at unique Australian Open across MENA DPA TRIBUNE NEWS NETWORK BERLIN The coronavirus has made the Australian Open a massive challenge DOHA THE contrast to 2020 could for tennis players and organizers alike but the best in the world – BEIN MEDIA GROUP, the hardly be starker when the global sports and entertain- Australian Open starts Mon- ment broadcaster and its day with Novak Djokovic and most of them – are now ready to take to the court in Melbourne. flagship sports channel beIN Sofia Kenin defending the ti- SPORTS will broadcast the tles they won 13 months ago in long awaited 2021 Australian Melbourne. Open live and exclusively for Those wins heralded the its viewers and subscribers start of a tennis season which across the Middle East and would soon be halted by the North Africa (MENA) – in- coronavirus pandemic and cluding exclusive footage of then resumed in limited fash- Tunisian star Ons Jabeur and ion only months later, after Egyptian talent Mayar Sherif. the cancellation of Wimble- The date for the start of don, and with a completely re- the 2021 Australian Open was worked schedule. previously scheduled to begin The global health situation in January but was postponed has forced Australian Open to February (8-21) due to the organizers to delay their tour- COVID-19 pandemic. The nament from its usual slot by 2021 Australian Open men’s three weeks from the intended qualifying was successfully January 18 start.