View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2016 Annual Report (Translation)

Stock Code 2204 China Motor Corporation 2016 Annual Report (Translation) Printed on March 31, 2017 Notice to Readers The Annual Report have been translated into English from the original Chinese version. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese version shall prevail. I. Information regarding Spokesperson, Deputy Spokesperson Spokesperson: Ching-Wu Chien Title: Vice President Deputy Spokesperson: Yu-Chun Su Title: General Manager, Corporate Planning Division, China Motor Corporation Tel: 886-3-4783191 Email: [email protected] II. Contact Information of Headquarter, Branch Company and Plant Headquarter Address: 11F., No.2, Sec. 2, Dunhua S. Rd., Da’an Dist., Taipei City 106, Taiwan Tel: 886-2-23250000 China Motor Training Center Address: No.3, Qingnian Rd., Yangmei Dist., Taoyuan City 326, Taiwan Tel: 886-3-4641100 Yang Mei Plant Address: No.618, Xiucai Rd., Yangmei Dist.,Taoyuan City 326, Taiwan Tel: 886-3-4783191 Hsin Chu Plant Address: No.2, Guangfu Rd., Hukou Township, Hsinchu County 303, Taiwan Tel: 886-3-5985841 III. Common Share Transfer Agent and Registrar Company: China Motor Corporation Address: 7F., No.150, Sec. 2, Nanjing E. Rd., Zhongshan Dist., Taipei City 104, Taiwan Tel: 886-2-25156421 Website: http:// www.china-motor.com.tw IV. Information regarding 2016 Auditors Company: Deloitte & Touche Auditors: Eddie Shao, Lilac Shue Address: 12F, 156, Sec. 3, Min-Sheng E. Rd., Taipei 105-96, Taiwan Tel: 886-2-25459988 Website: http://www.deloitte.com.tw V. Information regarding Depositary: N.A. -

![Global Operational Presence [P81-82]144KB](https://docslib.b-cdn.net/cover/9830/global-operational-presence-p81-82-144kb-89830.webp)

Global Operational Presence [P81-82]144KB

Global Operational Presence Today, Nissan has major production and office facilities in global company, Nissan will continue to focus on Japan, the United States, Mexico, Europe, the Middle providing value to all our stakeholders as we work toward East, South Africa, China and the Southeast Asian our vision of Enriching People’s Lives. countries, as well as in other regions of the world. As a Europe North America Japan Middle East Asia Africa South America Oceania Regional Headquarters R&D Automobile Production NISSAN Worldwide Main National Sales Company Network ●R&D: 11 countries/areas ●Automobile ●Design: Six design centers in four countries/areas Production Plants: 16 countries/areas (Japan, USA, U.K., Taiwan) ●Sales Network: More than 160 countries/ approximately 10,000 dealers ●Retail Sales by Region in Fiscal 2005 Japan United States 842,000 1,075,000 units units Europe General Overseas Markets* 541,000 1,111,000 units units *Including Mexico and Canada 81 Nissan Sustainability Report 2006 Nissan Group Operations The Nissan Group’s organization aims to integrate including research, development, purchasing and regional activities with global functional activities. Four production, are in charge of global, functional coordination. management committees for Japan, the Americas, Nissan’s Global Headquarters takes a cross-organizational Europe and the General Overseas Markets supervise approach adding value to regional and functional activities regional activities, while each functional department, while coordinating our global operations. Global Nissan Regional Activities Headquarters General Overseas Japan Americas Europe Market Management Management Management Management Committee Committee Committee Committee Nissan Motor Nissan Nissan General Overseas Co., Ltd. North America, Inc. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

FTSE World Asia Pacific

2 FTSE Russell Publications 19 August 2021 FTSE World Asia Pacific Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.04 NEW Asustek Computer Inc 0.1 TAIWAN Cheil Worldwide 0.02 KOREA ZEALAND ASX 0.12 AUSTRALIA Cheng Shin Rubber Industry 0.03 TAIWAN AAC Technologies Holdings 0.05 HONG KONG Atlas Arteria 0.05 AUSTRALIA Chiba Bank 0.04 JAPAN ABC-Mart 0.02 JAPAN AU Optronics 0.08 TAIWAN Chicony Electronics 0.02 TAIWAN Accton Technology 0.07 TAIWAN Auckland International Airport 0.06 NEW China Airlines 0.02 TAIWAN Acer 0.03 TAIWAN ZEALAND China Development Financial Holdings 0.07 TAIWAN Acom 0.02 JAPAN Aurizon Holdings 0.05 AUSTRALIA China Life Insurance 0.02 TAIWAN Activia Properties 0.03 JAPAN Ausnet Services 0.03 AUSTRALIA China Motor 0.01 TAIWAN ADBRI 0.01 AUSTRALIA Australia & New Zealand Banking Group 0.64 AUSTRALIA China Steel 0.19 TAIWAN Advance Residence Investment 0.05 JAPAN Axiata Group Bhd 0.04 MALAYSIA China Travel International Investment <0.005 HONG KONG ADVANCED INFO SERVICE 0.06 THAILAND Azbil Corp. 0.06 JAPAN Hong Kong Advantech 0.05 TAIWAN B.Grimm Power 0.01 THAILAND Chow Tai Fook Jewellery Group 0.04 HONG KONG Advantest Corp 0.19 JAPAN Bandai Namco Holdings 0.14 JAPAN Chubu Elec Power 0.09 JAPAN Aeon 0.2 JAPAN Bangkok Bank (F) 0.02 THAILAND Chugai Seiyaku 0.27 JAPAN AEON Financial Service 0.01 JAPAN Bangkok Bank PCL (NVDR) 0.01 THAILAND Chugoku Bank 0.01 JAPAN Aeon Mall 0.02 JAPAN Bangkok Dusit Medical Services PCL 0.07 THAILAND Chugoku Electric Power 0.03 JAPAN Afterpay Touch Group 0.21 AUSTRALIA Bangkok Expressway and Metro 0.02 THAILAND Chunghwa Telecom 0.17 TAIWAN AGC 0.08 JAPAN Bangkok Life Assurance PCL 0.01 THAILAND CIMB Group Holdings 0.08 MALAYSIA AGL Energy 0.04 AUSTRALIA Bank of East Asia 0.03 HONG KONG CIMIC Group 0.01 AUSTRALIA AIA Group Ltd. -

Business Groups in South Korea and Taiwan

Institute of Governmental Affairs University of California, Davis Business Groups in South Korea and Taiwan: A Comparison and Database by Robert C. Feenstra Revised, October 1997 Program on Pacific Rim Business and Development 2 Business Groups in South Korea and Taiwan: A Comparison and Database by Robert C. Feenstra Dept. of Economics, University of California, Davis and National Bureau of Economic Research Revised, October 1997 Abstract This paper describes a database of business groups in South Korea and Taiwan. The most detailed data are available for 1989 in South Korea and 1994 for Taiwan, though additional information is provided for the groups in both countries in 1983 and 1986. The detailed data includes a transactions matrix for each major business group, which specifies the sales to other member firms within the group, as well as total sales and other information for each firm. Thus, the detailed data can be used to construct measures of the vertical integration for each business group, and can also be used to analyze their sales across different sectors of the economy. These results are reported in the paper, along with documentation of the variables included in the database. The database for each country can be ordered for $50 from: Shelagh Matthews Mackay, Institute of Governmental Affairs, University of California, Davis, CA 95616, or downloaded from www.internationaldata.org (choose “Asia”). Note: This database has been assembled over the past decade at the Pacific Rim Business and Development Program, Institute of Governmental Affairs, under the direction of Gary Hamilton and Robert Feenstra. It would not have been possible without the help of the staff there and many research assistants. -

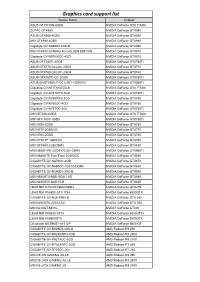

Graphics Card Support List

Graphics card support list Device Name Chipset ASUS GTXTITAN-6GD5 NVIDIA GeForce GTX TITAN ZOTAC GTX980 NVIDIA GeForce GTX980 ASUS GTX980-4GD5 NVIDIA GeForce GTX980 MSI GTX980-4GD5 NVIDIA GeForce GTX980 Gigabyte GV-N980D5-4GD-B NVIDIA GeForce GTX980 MSI GTX970 GAMING 4G GOLDEN EDITION NVIDIA GeForce GTX970 Gigabyte GV-N970IXOC-4GD NVIDIA GeForce GTX970 ASUS GTX780TI-3GD5 NVIDIA GeForce GTX780Ti ASUS GTX770-DC2OC-2GD5 NVIDIA GeForce GTX770 ASUS GTX760-DC2OC-2GD5 NVIDIA GeForce GTX760 ASUS GTX750TI-OC-2GD5 NVIDIA GeForce GTX750Ti ASUS ENGTX560-Ti-DCII/2D1-1GD5/1G NVIDIA GeForce GTX560Ti Gigabyte GV-NTITAN-6GD-B NVIDIA GeForce GTX TITAN Gigabyte GV-N78TWF3-3GD NVIDIA GeForce GTX780Ti Gigabyte GV-N780WF3-3GD NVIDIA GeForce GTX780 Gigabyte GV-N760OC-4GD NVIDIA GeForce GTX760 Gigabyte GV-N75TOC-2GI NVIDIA GeForce GTX750Ti MSI NTITAN-6GD5 NVIDIA GeForce GTX TITAN MSI GTX 780Ti 3GD5 NVIDIA GeForce GTX780Ti MSI N780-3GD5 NVIDIA GeForce GTX780 MSI N770-2GD5/OC NVIDIA GeForce GTX770 MSI N760-2GD5 NVIDIA GeForce GTX760 MSI N750 TF 1GD5/OC NVIDIA GeForce GTX750 MSI GTX680-2GB/DDR5 NVIDIA GeForce GTX680 MSI N660Ti-PE-2GD5-OC/2G-DDR5 NVIDIA GeForce GTX660Ti MSI N680GTX Twin Frozr 2GD5/OC NVIDIA GeForce GTX680 GIGABYTE GV-N670OC-2GD NVIDIA GeForce GTX670 GIGABYTE GV-N650OC-1GI/1G-DDR5 NVIDIA GeForce GTX650 GIGABYTE GV-N590D5-3GD-B NVIDIA GeForce GTX590 MSI N580GTX-M2D15D5/1.5G NVIDIA GeForce GTX580 MSI N465GTX-M2D1G-B NVIDIA GeForce GTX465 LEADTEK GTX275/896M-DDR3 NVIDIA GeForce GTX275 LEADTEK PX8800 GTX TDH NVIDIA GeForce 8800GTX GIGABYTE GV-N26-896H-B -

Taiwan's Top 50 Corporates

Title Page 1 TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATES We provide: A variety of Chinese and English rating credit Our address: https://rrs.taiwanratings.com.tw rating information. Real-time credit rating news. Credit rating results and credit reports on rated corporations and financial institutions. Commentaries and house views on various industrial sectors. Rating definitions and criteria. Rating performance and default information. S&P commentaries on the Greater China region. Multi-media broadcast services. Topics and content from Investor outreach meetings. RRS contains comprehensive research and analysis on both local and international corporations as well as the markets in which they operate. The site has significant reference value for market practitioners and academic institutions who wish to have an insight on the default probability of Taiwanese corporations. (as of June 30, 2015) Chinese English Rating News 3,440 3,406 Rating Reports 2,006 2,145 TRC Local Analysis 462 458 S&P Greater China Region Analysis 76 77 Contact Us Iris Chu; (886) 2 8722-5870; [email protected] TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATESJenny Wu (886) 2 872-5873; [email protected] We warmly welcome you to our latest study of Taiwan's top 50 corporates, covering the island's largest corporations by revenue in 2014. Our survey of Taiwan's top corporates includes an assessment of the 14 industry sectors in which these companies operate, to inform our views on which sectors are most vulnerable to the current global (especially for China) economic environment, as well as the rising strength of China's domestic supply chain. -

Manual, Chapter 1 and 2 Contains the Introduction of the Motherboard and Step-By-Step Installation Guides

Version 1.0 Published June 2018 Copyright©2018 ASRock INC. All rights reserved. Copyright Notice: No part of this documentation may be reproduced, transcribed, transmitted, or translated in any language, in any form or by any means, except duplication of documentation by the purchaser for backup purpose, without written consent of ASRock Inc. Products and corporate names appearing in this documentation may or may not be registered trademarks or copyrights of their respective companies, and are used only for identification or explanation and to the owners’ benefit, without intent to infringe. Disclaimer: Specifications and information contained in this documentation are furnished for informational use only and subject to change without notice, and should not be constructed as a commitment by ASRock. ASRock assumes no responsibility for any errors or omissions that may appear in this documentation. With respect to the contents of this documentation, ASRock does not provide warranty of any kind, either expressed or implied, including but not limited to the implied warranties or conditions of merchantability or fitness for a particular purpose. In no event shall ASRock, its directors, officers, employees, or agents be liable for any indirect, special, incidental, or consequential damages (including damages for loss of profits, loss of business, loss of data, interruption of business and the like), even if ASRock has been advised of the possibility of such damages arising from any defect or error in the documentation or product. This device complies with Part 15 of the FCC Rules. Operation is subject to the following two conditions: (1) this device may not cause harmful interference, and (2) this device must accept any interference received, including interference that may cause undesired operation. -

John Hancock Emerging Markets Fund

John Hancock Emerging Markets Fund Quarterly portfolio holdings 5/31/2021 Fund’s investments As of 5-31-21 (unaudited) Shares Value Common stocks 98.2% $200,999,813 (Cost $136,665,998) Australia 0.0% 68,087 MMG, Ltd. (A) 112,000 68,087 Belgium 0.0% 39,744 Titan Cement International SA (A) 1,861 39,744 Brazil 4.2% 8,517,702 AES Brasil Energia SA 14,898 40,592 Aliansce Sonae Shopping Centers SA 3,800 21,896 Alliar Medicos A Frente SA (A) 3,900 8,553 Alupar Investimento SA 7,050 36,713 Ambev SA, ADR 62,009 214,551 Arezzo Industria e Comercio SA 1,094 18,688 Atacadao SA 7,500 31,530 B2W Cia Digital (A) 1,700 19,535 B3 SA - Brasil Bolsa Balcao 90,234 302,644 Banco Bradesco SA 18,310 80,311 Banco BTG Pactual SA 3,588 84,638 Banco do Brasil SA 15,837 101,919 Banco Inter SA 3,300 14,088 Banco Santander Brasil SA 3,800 29,748 BB Seguridade Participacoes SA 8,229 36,932 BR Malls Participacoes SA (A) 28,804 62,453 BR Properties SA 8,524 15,489 BrasilAgro - Company Brasileira de Propriedades Agricolas 2,247 13,581 Braskem SA, ADR (A) 4,563 90,667 BRF SA (A) 18,790 92,838 Camil Alimentos SA 11,340 21,541 CCR SA 34,669 92,199 Centrais Eletricas Brasileiras SA 5,600 46,343 Cia Brasileira de Distribuicao 8,517 63,718 Cia de Locacao das Americas 18,348 93,294 Cia de Saneamento Basico do Estado de Sao Paulo 8,299 63,631 Cia de Saneamento de Minas Gerais-COPASA 4,505 14,816 Cia de Saneamento do Parana 3,000 2,337 Cia de Saneamento do Parana, Unit 8,545 33,283 Cia Energetica de Minas Gerais 8,594 27,209 Cia Hering 4,235 27,141 Cia Paranaense de Energia 3,200 -

K10n78hsli-Wifi / K10n78hsli-1394

K10N78hSLI-WiFi / K10N78hSLI-1394 User Manual Version 1.0 Published April 2008 Copyright©2008 ASRock INC. All rights reserved. 1 Copyright Notice: No part of this manual may be reproduced, transcribed, transmitted, or translated in any language, in any form or by any means, except duplication of documentation by the purchaser for backup purpose, without written consent of ASRock Inc. Products and corporate names appearing in this manual may or may not be regis- tered trademarks or copyrights of their respective companies, and are used only for identification or explanation and to the owners’ benefit, without intent to infringe. Disclaimer: Specifications and information contained in this manual are furnished for informa- tional use only and subject to change without notice, and should not be constructed as a commitment by ASRock. ASRock assumes no responsibility for any errors or omissions that may appear in this manual. With respect to the contents of this manual, ASRock does not provide warranty of any kind, either expressed or implied, including but not limited to the implied warran- ties or conditions of merchantability or fitness for a particular purpose. In no event shall ASRock, its directors, officers, employees, or agents be liable for any indirect, special, incidental, or consequential damages (including damages for loss of profits, loss of business, loss of data, interruption of business and the like), even if ASRock has been advised of the possibility of such damages arising from any defect or error in the manual or product. This device complies with Part 15 of the FCC Rules. Operation is subject to the following two conditions: (1) this device may not cause harmful interference, and (2) this device must accept any interference received, including interference that may cause undesired operation. -

K10N78-1394.Pdf

K10N78-1394 / K10N78 User Manual Version 1.1 Published August 2008 Copyright©2008 ASRock INC. All rights reserved. 1 Copyright Notice: No part of this manual may be reproduced, transcribed, transmitted, or translated in any language, in any form or by any means, except duplication of documentation by the purchaser for backup purpose, without written consent of ASRock Inc. Products and corporate names appearing in this manual may or may not be regis- tered trademarks or copyrights of their respective companies, and are used only for identification or explanation and to the owners’ benefit, without intent to infringe. Disclaimer: Specifications and information contained in this manual are furnished for informa- tional use only and subject to change without notice, and should not be constructed as a commitment by ASRock. ASRock assumes no responsibility for any errors or omissions that may appear in this manual. With respect to the contents of this manual, ASRock does not provide warranty of any kind, either expressed or implied, including but not limited to the implied warran- ties or conditions of merchantability or fitness for a particular purpose. In no event shall ASRock, its directors, officers, employees, or agents be liable for any indirect, special, incidental, or consequential damages (including damages for loss of profits, loss of business, loss of data, interruption of business and the like), even if ASRock has been advised of the possibility of such damages arising from any defect or error in the manual or product. This device complies with Part 15 of the FCC Rules. Operation is subject to the following two conditions: (1) this device may not cause harmful interference, and (2) this device must accept any interference received, including interference that may cause undesired operation. -

R.C.S. Luxembourg B-104.413

R.C.S. Luxembourg B-104.413 Audited Annual Report as at 31 January 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. DB Platinum Table of contents Page Management and Administration 3 Directors’ Report 5 Independent Auditor’s Report 14 Statement of Net Assets 17 Key Figures as at 31 January 2018 21 Statement of Operations and Changes in Net Assets 26 Statistics 30 Statement of Investments DB Platinum Commodity Euro 37 DB Platinum CROCI Branchen Stars 38 DB Platinum Commodity USD 40 DB Platinum CROCI World 41 DB Platinum PWM CROCI Multi Fund 45 DB Platinum CROCI Sectors Fund 46 DB Platinum CROCI Global Dividends 48 DB Platinum CROCI US Dividends 51 DB Platinum Chilton Diversified 53 DB Platinum Ivory Optimal 55 DB Platinum CROCI World ESG 57 DB Platinum Chilton European Equities 60 DB Platinum MCP Terra Grove Pan Asia 62 DB Platinum MidOcean Absolute Return Credit 63 Notes to the Financial Statements 68 Information to Shareholders (unaudited) 164 DB Platinum Management and Administration Registered Office DB Platinum 11-13, boulevard de la Foire L-1528 Luxembourg Grand-Duchy of Luxembourg Board of Directors - Alexander McKenna (chairman of the Board of Directors), Head of Product Platform Engineering, Deutsche Asset Management (UK) Limited, Winchester House, 1 Great Winchester Street, London EC2N 2DB, United Kingdom. - Freddy Brausch, Independent director, Linklaters LLP, 35, avenue John F.