R.C.S. Luxembourg B-104.413

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Formerly Streettracks Index Shares Funds

SECURITIES AND EXCHANGE COMMISSION FORM N-CSRS Certified semi-annual shareholder report of registered management investment companies filed on Form N-CSR Filing Date: 2012-06-04 | Period of Report: 2012-03-31 SEC Accession No. 0000950123-12-008860 (HTML Version on secdatabase.com) FILER SPDR INDEX SHARES FUNDS (Formerly streetTRACKS Mailing Address Business Address ONE LINCOLN STREET ONE LINCOLN STREET Index Shares Funds) CPH0326 CPH0326 BOSTON MA 02111 BOSTON MA 02111 CIK:1168164| IRS No.: 421537593 | State of Incorp.:MA | Fiscal Year End: 0930 866-787-2257 Type: N-CSRS | Act: 40 | File No.: 811-21145 | Film No.: 12885812 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-CSR CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number: 811-21145 SPDR® INDEX SHARES FUNDS (Exact name of registrant as specified in charter) One Lincoln Street, Boston, Massachusetts 02111 (Address of principal executive offices) (zip code) Ryan M. Louvar, Esq. State Street Bank and Trust Company One Lincoln Street CPH0326 Boston, MA 02111 (Name and address of agent for service) Copy to: W. John McGuire, Esq. Morgan, Lewis & Bockius LLP 1111 Pennsylvania Avenue, N.W. Washington, DC 20004 Registrants telephone number, including area code: (866) 787-2257 Date of fiscal year end: September 30 Date of reporting period: March 31, 2012 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 1: Report to Shareholders Copyright © 2012 www.secdatabase.com. -

Flexshares 2019 Semiannual Report

FlexShares® Trust Semiannual Report April 30, 2019 Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of FlexShares® Trust’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from FlexShares® Trust or your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on FlexShares® Trust’s website (www.flexshares.com) and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you have already elected to receive your shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from FlexShares® Trust electronically at any time by contacting your financial intermediary. You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds in FlexShares® Trust that you hold in your account at the financial intermediary. You must provide separate instructions to each of your financial intermediaries. Table of Contents Statements of Assets and Liabilities ................................................ 2 Statements of Operations................................................................. 9 Statements of Changes -

Quarterly Portfolio Disclosure

Schroders 29/05/2020 ASX Limited Schroders Investment Management Australia Limited ASX Market Announcements Office ABN:22 000 443 274 Exchange Centre Australian Financial Services Licence: 226473 20 Bridge Street Sydney NSW 2000 Level 20 Angel Place 123 Pitt Street Sydney NSW 2000 P: 1300 180 103 E: [email protected] W: www.schroders.com.au/GROW Schroder Real Return Fund (Managed Fund) Quarterly holdings disclosure for quarter ending 31 March 2020 Holdings on a full look through basis as at 31 March 2020 Weight Asset Name (%) 1&1 DRILLISCH AG 0.000% 1011778 BC / NEW RED FIN 4.25 15-MAY-2024 144a (SECURED) 0.002% 1011778 BC UNLIMITED LIABILITY CO 3.875 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 4.375 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 5.0 15-OCT-2025 144a (SECURED) 0.004% 1MDB GLOBAL INVESTMENTS LTD 4.4 09-MAR-2023 Reg-S (SENIOR) 0.011% 1ST SOURCE CORP 0.000% 21VIANET GROUP ADR REPRESENTING SI ADR 0.000% 2I RETE GAS SPA 1.608 31-OCT-2027 Reg-S (SENIOR) 0.001% 2I RETE GAS SPA 2.195 11-SEP-2025 Reg-S (SENIOR) 0.001% 2U INC 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 361 DEGREES INTERNATIONAL LTD 0.000% 3D SYSTEMS CORP 0.000% 3I GROUP PLC 0.002% 3M 0.020% 3M CO 1.625 19-SEP-2021 (SENIOR) 0.001% 3M CO 1.75 14-FEB-2023 (SENIOR) 0.001% 3M CO 2.0 14-FEB-2025 (SENIOR) 0.001% 3M CO 2.0 26-JUN-2022 (SENIOR) 0.001% 3M CO 2.25 15-MAR-2023 (SENIOR) 0.001% 3M CO 2.75 01-MAR-2022 (SENIOR) 0.001% 3M CO 3.25 14-FEB-2024 (SENIOR) 0.002% -

Proposed B.A. in Global Cultural Studies

PROPOSAL: BACHELOR OF ARTS IN GLOBAL CULTURAL STUDIES Department of International Language and Culture Studies Ana Benito CONTENT Global Cultural Studies Proposal ................................................................ 3 Proposed Curriculum .................................................................................. 7 Syllabi of New/Modified Courses .............................................................. 10 Letters of Endorsement ................................................................................ 24 Global Cultural Studies Jobs ........................................................................ 26 International Companies in Indiana ............................................................ 29 Northeast Indiana College and University Majors ....................................... 38 Proposal for a B.A. in Global Cultural Studies Purdue University Fort Wayne May 5, 2018 Ana Benito, Ph.D., Department of International Language and Culture Studies. Introduction: This degree would be offered by the Department of International Language and Culture Studies in the College of Arts and Sciences. The new B.A. degree would cover studies in the areas of international languages and global cultures, with three possible concentrations divided as follows: 1- Global Cultural Studies (33 credits): It will combine the study of two different languages. For example, students might combine the study of German and Japanese or the study of French and Arabic or Spanish and Arabic. Students in this track are encouraged to -

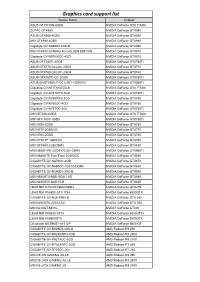

Graphics Card Support List

Graphics card support list Device Name Chipset ASUS GTXTITAN-6GD5 NVIDIA GeForce GTX TITAN ZOTAC GTX980 NVIDIA GeForce GTX980 ASUS GTX980-4GD5 NVIDIA GeForce GTX980 MSI GTX980-4GD5 NVIDIA GeForce GTX980 Gigabyte GV-N980D5-4GD-B NVIDIA GeForce GTX980 MSI GTX970 GAMING 4G GOLDEN EDITION NVIDIA GeForce GTX970 Gigabyte GV-N970IXOC-4GD NVIDIA GeForce GTX970 ASUS GTX780TI-3GD5 NVIDIA GeForce GTX780Ti ASUS GTX770-DC2OC-2GD5 NVIDIA GeForce GTX770 ASUS GTX760-DC2OC-2GD5 NVIDIA GeForce GTX760 ASUS GTX750TI-OC-2GD5 NVIDIA GeForce GTX750Ti ASUS ENGTX560-Ti-DCII/2D1-1GD5/1G NVIDIA GeForce GTX560Ti Gigabyte GV-NTITAN-6GD-B NVIDIA GeForce GTX TITAN Gigabyte GV-N78TWF3-3GD NVIDIA GeForce GTX780Ti Gigabyte GV-N780WF3-3GD NVIDIA GeForce GTX780 Gigabyte GV-N760OC-4GD NVIDIA GeForce GTX760 Gigabyte GV-N75TOC-2GI NVIDIA GeForce GTX750Ti MSI NTITAN-6GD5 NVIDIA GeForce GTX TITAN MSI GTX 780Ti 3GD5 NVIDIA GeForce GTX780Ti MSI N780-3GD5 NVIDIA GeForce GTX780 MSI N770-2GD5/OC NVIDIA GeForce GTX770 MSI N760-2GD5 NVIDIA GeForce GTX760 MSI N750 TF 1GD5/OC NVIDIA GeForce GTX750 MSI GTX680-2GB/DDR5 NVIDIA GeForce GTX680 MSI N660Ti-PE-2GD5-OC/2G-DDR5 NVIDIA GeForce GTX660Ti MSI N680GTX Twin Frozr 2GD5/OC NVIDIA GeForce GTX680 GIGABYTE GV-N670OC-2GD NVIDIA GeForce GTX670 GIGABYTE GV-N650OC-1GI/1G-DDR5 NVIDIA GeForce GTX650 GIGABYTE GV-N590D5-3GD-B NVIDIA GeForce GTX590 MSI N580GTX-M2D15D5/1.5G NVIDIA GeForce GTX580 MSI N465GTX-M2D1G-B NVIDIA GeForce GTX465 LEADTEK GTX275/896M-DDR3 NVIDIA GeForce GTX275 LEADTEK PX8800 GTX TDH NVIDIA GeForce 8800GTX GIGABYTE GV-N26-896H-B -

Manual, Chapter 1 and 2 Contains the Introduction of the Motherboard and Step-By-Step Installation Guides

Version 1.0 Published June 2018 Copyright©2018 ASRock INC. All rights reserved. Copyright Notice: No part of this documentation may be reproduced, transcribed, transmitted, or translated in any language, in any form or by any means, except duplication of documentation by the purchaser for backup purpose, without written consent of ASRock Inc. Products and corporate names appearing in this documentation may or may not be registered trademarks or copyrights of their respective companies, and are used only for identification or explanation and to the owners’ benefit, without intent to infringe. Disclaimer: Specifications and information contained in this documentation are furnished for informational use only and subject to change without notice, and should not be constructed as a commitment by ASRock. ASRock assumes no responsibility for any errors or omissions that may appear in this documentation. With respect to the contents of this documentation, ASRock does not provide warranty of any kind, either expressed or implied, including but not limited to the implied warranties or conditions of merchantability or fitness for a particular purpose. In no event shall ASRock, its directors, officers, employees, or agents be liable for any indirect, special, incidental, or consequential damages (including damages for loss of profits, loss of business, loss of data, interruption of business and the like), even if ASRock has been advised of the possibility of such damages arising from any defect or error in the documentation or product. This device complies with Part 15 of the FCC Rules. Operation is subject to the following two conditions: (1) this device may not cause harmful interference, and (2) this device must accept any interference received, including interference that may cause undesired operation. -

Agilent Irda Data Link Design Guide

Agilent IrDA Data Link Design Guide Introduction Welcome to the World of Infrared Data Communications! This guide is designed to provide you with the background necessary to design and implement your very own IrDA compatible data link. Within these pages, you will find detailed information on all phases of the design process, from architectural considerations through board layout. You will also learn about the Infrared Data Association (IrDA) — about it’s purpose, and about the IrDA specification for IR data transfer. In addition, a selection guide of Agilent’s infrared components has been included. More information is available from the sources listed in the References. In particular, be sure to check the Agilent IR website where you will find the most recent data sheets and application notes. References Agilent Technologies, http://www.agilent.com/view/ir Semiconductor Products Group Sales Offices and Authorized Distributors, Product Data Sheets, Application Notes HP JetSend Information http://www.jetsend.hp.com/ Infrared Data Association (IrDA) http:www.irda.org/ Support Hardware and Software Actisys Corp. http: //www.actisys.com/ Extended Systems, Inc. http: //www.extendsys.com/ inSilicon Corporation http://www.insilicon.com Link Evolution Corporation http://www.linkevolution.com Motorola, Inc. http: //www.motorola.com/ National Semiconductor http: //www.nsc.com/ Okaya SystemWare Co., Ltd. http: //www.okaya-system.co.jp/ (Japanese) http://www.osw.co.jp/index-e.htm (English) Parallax Systems http://www.parallax-research.com/ Phoenix Technologies, Inc. http://www.phoenix.com http://www.ptltd.com Puma Technology, Inc. http://www.pumatech.com/ Standard Microsystems http://www.smc.com/ VLSI Technology http://www.vlsi.com/ 2 Table of Contents References ......................................................................................................... -

View Annual Report

2007 ANNUAL REPORT TSE:2303 NYSE:UMC Corporate Information Spokesperson Fab 8C ADR Depositary and Registrar Chitung Liu No.6 Li-Hsin 3rd Rd., Hsinchu Science Citibank, N.A. Chief Financial Officer Park, Hsinchu, Taiwan 30078, R.O.C. Depositary Receipt Services 886 (2) 2700 6999 886 (3) 578 2258 14F, 388 Greenwich Street, [email protected] New York, NY 10013, U.S.A. Fab 8D 1 (877) 248 4237 (Toll-free) Deputy Spokesperson(s) No.8 Li-Hsin 3rd Rd., Hsinchu Science Stockholder Service Representatives are Sandy Yen Park, Hsinchu, Taiwan 30078, R.O.C. available Monday through Friday, The Chairman and CEO Office 886 (3) 578 2258 8:30a.m. to 6:00p.m., Eastern Time. Senior Manager http://wwss.citissb.com/adr/www/ 886 (2) 2700 6999 Fab 8E [email protected] [email protected] No.17 Li-Hsin Rd., Hsinchu Science Park, Hsinchu, Taiwan 30078, R.O.C. ADR Exchange Marketplace Bowen Huang 886 (3) 578 2258 New York Stock Exchange, Inc. Finance Division 11 Wall Street Senior Manager Fab 8F New York, NY 10005, U.S.A. 886 (2) 2700 6999 No.3 Li-Hsin 6th Rd., Hsinchu Science 1 (212) 656 3000 [email protected] Park, Hsinchu, Taiwan 30078, R.O.C. www.nyse.com 886 (3) 578 2258 Ticker/Search Code: UMC Headquarters No.3 Li-Hsin 2nd Rd., Hsinchu Science Fab 8S Exchangeable Bond Exchange Park, Hsinchu, Taiwan 30078, R.O.C. No.16 Creation 1st Rd., Hsinchu Science Marketplace 886 (3) 578 2258 Park, Hsinchu, Taiwan 30077, R.O.C. -

K10n78hsli-Wifi / K10n78hsli-1394

K10N78hSLI-WiFi / K10N78hSLI-1394 User Manual Version 1.0 Published April 2008 Copyright©2008 ASRock INC. All rights reserved. 1 Copyright Notice: No part of this manual may be reproduced, transcribed, transmitted, or translated in any language, in any form or by any means, except duplication of documentation by the purchaser for backup purpose, without written consent of ASRock Inc. Products and corporate names appearing in this manual may or may not be regis- tered trademarks or copyrights of their respective companies, and are used only for identification or explanation and to the owners’ benefit, without intent to infringe. Disclaimer: Specifications and information contained in this manual are furnished for informa- tional use only and subject to change without notice, and should not be constructed as a commitment by ASRock. ASRock assumes no responsibility for any errors or omissions that may appear in this manual. With respect to the contents of this manual, ASRock does not provide warranty of any kind, either expressed or implied, including but not limited to the implied warran- ties or conditions of merchantability or fitness for a particular purpose. In no event shall ASRock, its directors, officers, employees, or agents be liable for any indirect, special, incidental, or consequential damages (including damages for loss of profits, loss of business, loss of data, interruption of business and the like), even if ASRock has been advised of the possibility of such damages arising from any defect or error in the manual or product. This device complies with Part 15 of the FCC Rules. Operation is subject to the following two conditions: (1) this device may not cause harmful interference, and (2) this device must accept any interference received, including interference that may cause undesired operation. -

K10N78-1394.Pdf

K10N78-1394 / K10N78 User Manual Version 1.1 Published August 2008 Copyright©2008 ASRock INC. All rights reserved. 1 Copyright Notice: No part of this manual may be reproduced, transcribed, transmitted, or translated in any language, in any form or by any means, except duplication of documentation by the purchaser for backup purpose, without written consent of ASRock Inc. Products and corporate names appearing in this manual may or may not be regis- tered trademarks or copyrights of their respective companies, and are used only for identification or explanation and to the owners’ benefit, without intent to infringe. Disclaimer: Specifications and information contained in this manual are furnished for informa- tional use only and subject to change without notice, and should not be constructed as a commitment by ASRock. ASRock assumes no responsibility for any errors or omissions that may appear in this manual. With respect to the contents of this manual, ASRock does not provide warranty of any kind, either expressed or implied, including but not limited to the implied warran- ties or conditions of merchantability or fitness for a particular purpose. In no event shall ASRock, its directors, officers, employees, or agents be liable for any indirect, special, incidental, or consequential damages (including damages for loss of profits, loss of business, loss of data, interruption of business and the like), even if ASRock has been advised of the possibility of such damages arising from any defect or error in the manual or product. This device complies with Part 15 of the FCC Rules. Operation is subject to the following two conditions: (1) this device may not cause harmful interference, and (2) this device must accept any interference received, including interference that may cause undesired operation. -

Z590 Pro4.Pdf

Version 1.0 Published February 2021 Copyright©2021 ASRock INC. All rights reserved. Copyright Notice: No part of this documentation may be reproduced, transcribed, transmitted, or translated in any language, in any form or by any means, except duplication of documentation by the purchaser for backup purpose, without written consent of ASRock Inc. Products and corporate names appearing in this documentation may or may not be registered trademarks or copyrights of their respective companies, and are used only for identification or explanation and to the owners’ benefit, without intent to infringe. Disclaimer: Specifications and information contained in this documentation are furnished for informational use only and subject to change without notice, and should not be constructed as a commitment by ASRock. ASRock assumes no responsibility for any errors or omissions that may appear in this documentation. With respect to the contents of this documentation, ASRock does not provide warranty of any kind, either expressed or implied, including but not limited to the implied warranties or conditions of merchantability or fitness for a particular purpose. In no event shall ASRock, its directors, officers, employees, or agents be liable for any indirect, special, incidental, or consequential damages (including damages for loss of profits, loss of business, loss of data, interruption of business and the like), even if ASRock has been advised of the possibility of such damages arising from any defect or error in the documentation or product. This device complies with Part 15 of the FCC Rules. Operation is subject to the following two conditions: (1) this device may not cause harmful interference, and (2) this device must accept any interference received, including interference that may cause undesired operation. -

COST to COST CORRSAIR 2590 106-107, Meghdoot Building, Nehru Place TRANSCEND I-3---4290 2GB--700 4GB--1142

DUAL CORE DDR3 3.0GHZ-- COST TO COST CORRSAIR 2590 106-107, Meghdoot Building, Nehru Place TRANSCEND I-3---4290 2GB--700 4GB--1142 Rate List Date: 8/27/2011 FREE USB MOUSE (MOSERBAER) WITH ANY LED/LCD MONITOR 35 GIGABYTE / ASUS G41 2325 71 DDR2-2GB simmtronics (5 YEAR) 928 110 NVIDEA 9500GS/512/HDMI/DVI/V 2900 36 INTEL DX 58 OG SATA/USB 3 10500 72 DDR 3 KINGSTON 2GB 738 111 NVIDEA 9600/DDR3/512 HYPER 2750 CPU INTEL 37 GIGABYTE H55M-D2H 3900 73 DDR1 512MB HYNIX LAPTOP 714 112 XFX/ZOTAC 210 NVIDIA 1GB DD 1900 1 INTEL DUAL CORE 3.06 ASK 38 GIGABYTE P55-US3L 6350 74 DDR1 1GB HYNIX LAPTOP 1323 113 ATI 6870 1GB DDR5 SAPPHIRE 9800 2 INTEL (I-5 /2310) ASK 39 INTEL G43RK (OEM) 2750 75 DDR2 2GB TRANSCEND/KINGST 1100 114 ATI 5670 1GB DDR3 SAPPHIRE 3333 3 INTEL (I-5 /2500K) 9740 40 INTEL DG41 WV (BOX) 2675 76 DDR1 1GB HYNIX 976 115 5670 1GB DDR3 SAPPHIRE 3333 4 INTEL (I-5 /2500) 9190 41 INTEL H55TC (OEM) 3950 77 DDR2 1GBTRANS/KING LAPTOP 714 116 5450 1GB DDR3 SAPPHIRE 1900 5 INTEL (I-7 /2600) 13400 42 GIGABYTE X58A-USB3 (1366) 10700 78 DDR2 2GB KINGSTON LAPTOP 1200 117 NVIDEA 9300GE /512MB 1800 6 INTEL I-7/960 4 CORE 8 MB CAS 13700 43 GIGABYTE /ASUS H55M 3600 79 DDR 3 4GB TRANSCEND (1333) 1142 118 NVIDEA 9600GS 768MB (192BIT 3000 7 INTEL I-3 540/3.06GHZ 4290 44 INTEL H55TC BOX 4050 80 DDR2 2GB TRANSCEND LAPTO 1100 119 AGP ATI 9200 1200 8 INTEL CORE 2 QUAD 2.66 GHZ ASK 45 ASUS G41 COMBO 2400 81 DDR3 GSKILL 4GB 1333 1200 120 PCI-E ATI X200SE 1250 9 INTEL CORE 2 DUO 2.93 GHZ 4990 82 DDR1 512MB HYNIX 428 10 INTEL (I-5 /2400) 8240 83 4GB TWINMOS DDR3 1333