Winter 2015 Issue

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Register of Historic Places Registration Form

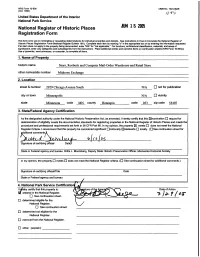

NPS Form 10-900 OMB No. 1024-0046 (Oct. 1990) United States Department of the Interior National Park Service National Register of Historic Places Registration Form This form is for use in nominating or requesting determinations for individual properties and districts. See instructions in How to Complete the National Register of Historic Places Registration Form (National Register Bulletin 16A). Complete each item by marking "x" in the appropriate box or by entering the information requested. If an item does not apply to the property being documented, enter "N/A" for "not applicable." For functions, architectural classification, materials, and areas of significance, enter only categories and subcategories from the instructions. Place additional entries and narrative items on continuation sheets (NPS Form 10-900a). Use a typewriter, word processor, or computer, to complete all items. 1. Name of Property ____ __ historic name Sears, Roebuck and Company Mail-Order Warehouse and Retail Store other names/site number Midtown Exchange 2. Location street & number 2929 Chicago Avenue South N/A D not for publication city or town Minneapolis N/A D vicinity state Minnesota code MN county Hennepin code 053 zip code 55407 3. State/Federal Agency Certification As the designated authority under the National Historic Preservation Act, as amended, I hereby certify that this ^nomination D request for determination of eligibility meets the documentation standards for registering properties in the National Register of Historic Places and meets the procedural and professional requirements set forth in 36 CFR Part 60. In my opinion, the property E3 meets D does not meet the National Register Criteria. -

Corporate Governance and Managerial Incompetence: Lessons from Kmart

Brigham Young University Law School BYU Law Digital Commons Faculty Scholarship 4-30-1996 Corporate Governance and Managerial Incompetence: Lessons from Kmart D. Gordon Smith Follow this and additional works at: https://digitalcommons.law.byu.edu/faculty_scholarship Part of the Business Law, Public Responsibility, and Ethics Commons, and the Business Organizations Law Commons Recommended Citation D. Gordon Smith, Corporate Governance and Managerial Incompetence: Lessons from Kmart, 74 N.C. L. REV., 1037 (1996). This Article is brought to you for free and open access by BYU Law Digital Commons. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of BYU Law Digital Commons. For more information, please contact [email protected]. CORPORATE GOVERNANCE AND MANAGERIAL INCOMPETENCE: LESSONS FROM KMART D. GORDON SMIm Modern corporategovernance scholars often extol an activist role by institutional investors in directing corporate activity. Widely viewed as a solution to the "collective action" problems that inhibit such activism by individual investors, institutional investors are praised for adding value to corporationsthrough their participationin the decisionmaking process. The ouster of Joseph Antonini as Chief Executive Officer of Kmart Corporation in 1995 might be taken as a vindication of this view, because substantialevidence indicates that institutionalinvestors played a crucial role in influencing Kmart's board of directors to remove him. In this Article, Professor Gordon Smith challenges this potential reading of the events at Kmart. Professor Smith poses the fundamental question of whether institutionalinvestor activism designed to address perceived incompetence among corporate managers consistently adds value to corporations in which such activism is present. ProfessorSmith analyzes the effect of internal and external forces on managers, particularly on Antonini. -

Apple Blossom Times

Town of Newfane Historical Society’s Apple Blossom Times Since 1975 Spring 2019 Inside This Issue Spring is in the Air which we hope you enjoy! President’s Letter From the desk of our President One last thing: if you appreciate our newsletters, Minute History It was a wonderful autumn for the society, as I encourage you to renew we created great new memories from our fall your annual membership. The catalog that changed fundraisers. We had good turnouts for the They also make great gifts the world Apple Harvest Festival, Candlelight Tours at for others! Please check your the Van Horn Mansion, and our Annual Carol newsletter address label for Members Update Sing. Thanks to all our society members and current member status. Save the Date volunteers who made these events successful; Members up for renewal have asterisks * at the your hard work was very appreciated! end of their name. Use the enclosed form, or Historical Fun Fact Unfortunately I do not have everyone’s order online at newfanehistoricalsociety.com. names who helped, and thus don’t want to Membership is a vital way to support our society, Van Horn Mansion Tours single certain people out while appearing to especially during these quieter months. neglect others. Please know your efforts made a Calendar big difference in keeping our historical society Enjoy the coming spring, and we look forward to alive and well! writing again in May. Minute History As our locations are closed for the winter, this edition of our newsletter has additional space Vicki Banks For a short time Olcott was a to allow for a more extensive historical article, President known port on water routes at a time when boating was among the fastest ways to travel. -

Zak Kitnick Craftsman by Sears at Kmart Press Release

ribordy contemporary ZAK KITNICK: Craftsman by Sears at Kmart May 17 - July 6, 2018 1886: Richard Warren Sears starts a mail order watch business called R.W Sears Watch Company in Minneapolis Minnesota 1887: The R.W Sears Watch Company relocates to Chicago Illinois 1887: The R.W Sears Watch Company publishes their first mail order catalog offering watches, diamonds, and jewelry 1889: Sears sells his business for $100,000 ($2.7 million today) and relocates to Iowa 1892: Richard Sears returns to Chicago and establishes a new mail order with his partner, Alvah Curtis Roebuck, operating as the A.C. Roebuck Watch Company 1893: They rename the company to Sears, Roebuck and Company and begin to diversity the offerings in their catalog 1894: The Sears catalog grows to 322 pages, featuring sewing machines, bicycles, sporting goods, automobiles, and other items 1906: Sales continue to grow rapidly, and the prosperity of the company and their vision for greater expansion leads Sears to take the company public. Sears' 1906 initial public offering marks the first major retail IPO in American financial history 1925: Sears opens its first store in Chicago Illinois 1927: Arthur Barrows, head of the Sears hardware department buys the right to use the name Craftsman from the Marion-Craftsman Tool Company for $500 1927: Sears creates the Kenmore brand for appliances and the Craftsman brand for tools. 1927: The Craftsman trademark is registered by Sears on May 20, 1927 1927: The first Craftsman tools are sold 1930: At this time, Craftsman tools are a hodge-podge of styles and designs. -

The Check Is in the Mail (And So Is the House): an Analysis of the Short-Lived Catalog Home Phenomenon

University at Albany, State University of New York Scholars Archive Geography and Planning Honors College 1-2017 The Check is in the Mail (And so is the House): An Analysis of the Short-Lived Catalog Home Phenomenon Madison Caswell Squires University at Albany, State University of New York Follow this and additional works at: https://scholarsarchive.library.albany.edu/honorscollege_gp Part of the Geography Commons Recommended Citation Squires, Madison Caswell, "The Check is in the Mail (And so is the House): An Analysis of the Short-Lived Catalog Home Phenomenon" (2017). Geography and Planning. 2. https://scholarsarchive.library.albany.edu/honorscollege_gp/2 This Honors Thesis is brought to you for free and open access by the Honors College at Scholars Archive. It has been accepted for inclusion in Geography and Planning by an authorized administrator of Scholars Archive. For more information, please contact [email protected]. The Check is in the Mail (And so is the House): An Analysis of the Short-Lived Catalog Home Phenomenon An honors thesis presented to the Department of Geography and Planning, University at Albany, State University of New York In partial fulfillment of the requirements For graduation with Honors in Geography and Urban Planning And Graduation from The Honors College. Madison Caswell Squires Research Advisor: John Pipkin, Ph.D. January, 2017 Abstract This thesis seeks to examine the concept of mail-order, “kit” housing, as pioneered at the beginning of the 20th century. Of primary focus will be the (then) new technologies and innovations having made this industry possible, as well as the marketing methods used in the concept’s advertisement. -

The Searsmod Art Book

This book is dedicated to the lives of the men and women who built the Sears Mail Order Building and the foundation for modern American retail. It is their spirit of determination that inspired Shomof Group and their partners to rebuild a legacy of fulfillment that brings exceptional experiences back home to downtown Los Angeles. As strong as the steel pillars and concrete walls that uphold the values of America itself, the Mail Order District fulfills the needs and wishes of a new America like never before. 01 THE MAIL ORDER DISTRICT THE MAIL ORDER DISTRICT IS A DYNAMIC NEW NEIGHBORHOOD IN DTLA THAT FULFILLS THE NEEDS OF MODERN URBAN ENTHUSIASTS. IZEK SHOMOF CEO | EAST RIVER GROUP, LLC One of the first developers to embark upon the preservation and revitalization of Los Angeles’ Historic Core, Izek Shomof is a respected and admired real estate entrepreneur who credits his success to a unique brand of charm coupled with a strong work ethic and an eternal sense of honor. A thoughtful investor/developer, Izek began his career in the mid 1980s, developing tract homes and apartment buildings before eventually going on to develop an extensive portfolio of historic adaptive-reuse properties. GROUNDBREAKER THE MAIL ORDER DISTRICT 02 03 THE MAIL ORDER DISTRICT A STRONGHOLD IN THE PIONEERING EFFORTS OF AN EXPANDING ECONOMY, THE SEARS MAIL ORDER BUILDING, BUILT IN 1926, PUT A DEFINING STAMP ON THE LEGACY OF AMERICAN CONSUMERISM. THE MAIL ORDER DISTRICT 04 05 THE MAIL ORDER DISTRICT MEET THE MAIL ORDER DISTRICT DELIVERING EXCEPTIONAL EXPERIENCES The original epicenter of mass distribution and expansion in Los Angeles, the Mail Order District offers a vast array of options that transcend expectations. -

Kit Houses in Orange County

MMAGAZINEAGAZINE April 19–May 16, 2019 • One Copy FREE OOCC ORANGE COUNTY, VIRGINIA HHousesouses WithWith HistoryHistory Kit Houses in Orange County PPageage 3 PEOPLE GGardenarden GGuruuru KKentent AAnnualnnual FriedFried OOCSSCSS FFineine RRussellussell ttoo SSpeakpeak CChickenhicken FFestivalestival AArtsrts FairFair PPageage 1100 PPageage 1111 PPageage 1122 COMPANY SHOWCASE Sunday - May 5 (2:00pm) Piedmont Virginia Community College MUSICAL THEATRE SHOWCASE May 15 & 16 (7:00pm) OSPA Firehouse Theatre OSPA SPRING SHOWCASE June 1 (12:00pm & 2:30pm) Orange County High School Auditorium Please call OSPA for ticket OR Company Audition Information! Celebrating our 26th season... OSPA – Where The Arts Come To Life! Call 540-672-9038 Or Visit us at 108 Belleview Ave - Orange, Va Or on the web at www.ospa.net 2• OC Magazine • April 19–May 16, 2019 OC Magazine A monthly publication Houses With History Publisher C. M. Santos [email protected] Kit Houses in Orange County Advertising Director By Barbara Wimble Judi Price Correspondent 434-207-0223 [email protected] Office Manager f you are a fan of HGTV like I Edee Povol am, wherein the complex [email protected] Iworld of homebuilding and decorating is entertainment, you may have heard about prefab houses that Graphic Production Designer were very popular and widely marketed Marilyn Ellinger in the first half of the 20th century. I was first introduced to “Kit Houses” Correspondents when Rose Thornton, considered to be Barbara Wimble the foremost authority on them, gave a Matthew Franks talk for the Historic Staunton Foundation, where I was employed Contributors before moving to Orange. Finding her Pat Wilson lecture fascinating, I caught the “kit house mania” and was excited to iden- E-mail: [email protected] tify my bungalow in Staunton as one of Advertising Sales: them. -

The 100 Most Significant Events in American Business : an Encyclopedia / Quentin R

THE 100 MOST SIGNIFICANT EVENTS IN AMERICAN BUSINESS An Encyclopedia Quentin R. Skrabec, Jr. (c) 2012 ABC-Clio. All Rights Reserved. The 100 Most Significant Events in American Business (c) 2012 ABC-Clio. All Rights Reserved. THE 100 MOST SIGNIFICANT EVENTS IN AMERICAN BUSINESS An Encyclopedia Quentin R. Skrabec, Jr. (c) 2012 ABC-Clio. All Rights Reserved. Copyright 2012 by ABC-CLIO, LLC All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, except for the inclusion of brief quotations in a review, without prior permission in writing from the publisher. Library of Congress Cataloging-in-Publication Data Skrabec, Quentin R. The 100 most significant events in American business : an encyclopedia / Quentin R. Skrabec, Jr. p. cm. Includes bibliographical references and index. ISBN 978-0-313-39862-9 (hbk. : alk. paper) — ISBN 978-0-313-39863-6 (ebook) 1. United States—Commerce—History—Encyclopedias. 2. Industries— United States—History—Encyclopedias. 3. Business—History—Encyclopedias. I. Title. II. Title: One hundred most significant events in American business. HF3021.S57 2012 338.097303—dc23 2011050442 ISBN: 978-0-313-39862-9 EISBN: 978-0-313-39863-6 16 15 14 13 12 1 2 3 4 5 This book is also available on the World Wide Web as an eBook. Visit www.abc-clio.com for details. Greenwood An Imprint of ABC-CLIO, LLC ABC-CLIO, LLC 130 Cremona Drive, P.O. Box 1911 Santa Barbara, California 93116-1911 This book is printed on acid-free paper Manufactured in the United States of America (c) 2012 ABC-Clio. -

Location of Legal Description

Form No. 10-300 (Rev. 10-74) UNITtD STATES DEPARTMENT OF THt INTERIOR NATIONAL PARK SERVICE NATIONAL REGISTER OF HISTORIC PLACES INVENTORY -- NOMINATION FORM SEE INSTRUCTIONS IN HOWTO COMPLETE NATIONAL REGISTER FORMS TYPE ALL ENTRIES -- COMPLETE APPLICABLE SECTIONS I NAME HISTORIC Sears, Roebuck and Company Complex AND/OR COMMON Sears, Roebuck and Company Complex LOCATION STREET & NUMBER 923 South Homan Avenue _NOT FOR PUBLICATION CITY. TOWN CONGRESSIONAL DISTRICT VICINITY OF STATE CODE COUNTY CODE Illinois 17 Cook 031 CLASSIFICATION CATEGORY OWNERSHIP STATUS PRESENTUSE —DISTRICT _ PUBLIC X-OCCUPIED _ AGRICULTURE _ MUSEUM X-BUILDING(S) X-PRIVATE _ UNOCCUPIED X-COMMERCIAL —PARK —STRUCTURE —BOTH —WORK IN PROGRESS _ EDUCATIONAL —PRIVATE RESIDENCE —SITE PUBLIC ACQUISITION ACCESSIBLE —ENTERTAINMENT —RELIGIOUS —OBJECT _IN PROCESS —YES: RESTRICTED —GOVERNMENT —SCIENTIFIC —BEING CONSIDERED _YES: UNRESTRICTED —INDUSTRIAL —TRANSPORTATION —NO _ MILITARY —OTHER. (OWNER OF PROPERTY (contact: Mr. William P. McCurdy, NAME Vice President for Public ____Sears, Roebuck and Company________Relations .___________ STREET&NUMBER " Mr. Rembrandt C. Miller, Jr., ____Sears Tower_____________________Mid-West Director Pub. Re 1 s) CITY. TOWN STATE VICINITYOF Illinois LOCATION OF LEGAL DESCRIPTION COURTHOUSE, REGISTRY OF DEEDS.ETC. Recorder Qf , City Hall and County Building STREET & NUMBER 118 North Clark Street CITY. TOWN STATE Chicago Illinois El REPRESENTATION IN EXISTING SURVEYS TITLE Illinois Land and Historic Site Survey DATE .1215. — FEDERAL X-STATE —COUNTY _LOCAL DEPOSITORY FOR SURVEYRECQRDS iiiinois Land and Historic Site Survey CITY. TOWN STATE Springfield Illinois DESCRIPTION CONDITION CHECK ONE CHECK ONE —EXCELLENT —DETERIORATED —UNALTERED X_ORIGINAL SITE X-GOOD —RUINS X__ALTERED _MOVED DATE_______ _FAIR _UNEXPOSED ———————————DESCRIBE THE PRESENT AND ORIGINAL (IF KNOWN) PHYSICAL APPEARANCE Since its construction in 1905-6, the Sears, Roebuck and Company Complex, situated on Chicago's west side, has been symbolic of that company's dominance of the mail order industry. -

Zak Kitnick Craftsman by Sears at Kmart Press Release

ribordy contemporary ZAK KITNICK: Craftsman by Sears at Kmart May 17 - July 6, 2018 1886: Richard Warren Sears starts a mail order watch business called R.W Sears Watch Company in Minneapolis Minnesota 1887: The R.W Sears Watch Company relocates to Chicago Illinois 1887: The R.W Sears Watch Company publishes their first mail order catalog offering watches, diamonds, and jewelry 1889: Sears sells his business for $100,000 ($2.7 million today) and relocates to Iowa 1892: Richard Sears returns to Chicago and establishes a new mail order with his partner, Alvah Curtis Roebuck, operating as the A.C. Roebuck Watch Company 1893: They rename the company to Sears, Roebuck and Company and begin to diversity the offerings in their catalog 1894: The Sears catalog grows to 322 pages, featuring sewing machines, bicycles, sporting goods, automobiles, and other items 1906: Sales continue to grow rapidly, and the prosperity of the company and their vision for greater expansion leads Sears to take the company public. Sears' 1906 initial public offering marks the first major retail IPO in American financial history 1925: Sears opens its first store in Chicago Illinois 1927: Arthur Barrows, head of the Sears hardware department buys the right to use the name Craftsman from the Marion-Craftsman Tool Company for $500 1927: Sears creates the Kenmore brand for appliances and the Craftsman brand for tools. 1927: The Craftsman trademark is registered by Sears on May 20, 1927 1927: The first Craftsman tools are sold 1930: At this time, Craftsman tools are a hodge-podge of styles and designs. -

Wild Mannered Designers Are Going Crazy for Animal Prints, Colorful Beads and African Handicrafts Kellwood Waves the Flag PAGE 8 ▼ This Spring

PLUS: BANGKOK WRIGHT CHOICE RETAIL BOOMS. PAGE 12 Robin Wright and Peter Lindbergh teamed up again for Gerard Darel’s latest ad campaign, which will be the French firm’s first international one. PAGE 9 HOLIDAY HANGOVER Sears Shares Plummet On Store Closure Plan By VICKI M. YOUNG SEARS HOLDINGS CORP. is the latest company to join the store-closing game that is likely to be a WWD major feature of retailing in the year ahead. The company on Tuesday said it expects to close between 100 and 120 Kmart and Sears full-line WEDNESDAY, DECEMBER 28, 2011 Q $3.00 Q WOMEN’S WEAR DAILY stores, or 5 percent of its 2,200 full-line store loca- tions. It joins the ranks of specialty women’s chains Talbots, Coldwater Creek and Christopher & Banks, which are cutting their store base by 12 to 15 percent each. In addition, Gap Inc. said at its annual inves- tors meeting in October that it plans to shave 189 locations from the brand’s nonoutlet fleet in North America, reducing it to 700 stores by the end of 2013. The planned closures indicate the increasing squeeze on retailers that have struggled through the holiday period, and even before. And Sears is perhaps among the most pressured of them all, as the strategy of chairman and owner, hedge fund bil- lionaire Edward Lampert, misfires in the current consumer environment. Further evidence of Sears’ financial woes came Tuesday, when the company said it expects to record a noncash charge of $1.6 billion to $1.8 billion in the fourth quarter in connection with a valuation allowance on certain deferred tax assets. -

Turnaround of Sears Holdings

Turnaround of Sears Holdings Naveen Jindal School of Management The University of Texas at Dallas Advisor: Professor David Springate Author: Chris Clark Page | 1 TABLE OF CONTENTS Executive Summary .......................................................................................................................................................................... 5 Department Store Industry Overview ............................................................................................................................................... 6 Products ....................................................................................................................................................................................... 6 Market Segments ......................................................................................................................................................................... 7 Industry Trends ............................................................................................................................................................................ 7 Key Industry Drivers ..................................................................................................................................................................... 9 Industry Challenges ...................................................................................................................................................................... 9 Industry Policy & Regulation .....................................................................................................................................................