Task Force Notes, December 1 2014.Docx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Faster, Cheaper, Better

audiTors and comPTrollers faster, cheaper, better: demands for financial reporting from state governments by nancy Kopp Financial reporting and auditing professionals ensure that the public has a clear view of the health and viability of state governments. They are keepers of the public trust. Today, how- ever, these professionals face more demands than ever and have fewer resources than ever to support their important efforts. Cumbersome, and often burdensome, processes and financial limitations are now colliding with a multi-faceted push for financial reporting that is faster, cheaper and better. Can states sustain current efforts, and even go beyond, pushing the limits of their capacity to provide speed, economy and quality? Setting the Stage terly grant reporting became a reality beginning in Faster comprehensive annual financial reports, September 2009. faster annual single audits of federal grant funds, Satisfaction with this accomplishment, how- quarterly financial statements, quarterly grant ever, was short-lived, as the demands continued to reporting, more transparent reporting of state gov- increase. ernment pension plans, interim financial report- Recent reports by the U.S. Government Account- ing—these items are just part of a growing list of ability Office have concluded there is a need for reporting demands presenting real challenges to faster reporting of single audits (the organization- state government financial management and audit wide audit of any entity expending $500,000 or professionals. more of federal assistance), particularly reporting One can hardly open a newspaper, go online or of internal control deficiencies.2 To accomplish even watch the local evening news these days with- faster single audits, states must complete compre- out confronting a headline about state government hensive annual financial reports in a more timely financial woes. -

THE MARYLANDER AAUW Maryland Newsletter AAUW’S Mission Advancing Equity for Women and Girls Through Advocacy, Education, and Research

THE MARYLANDER AAUW Maryland Newsletter AAUW’s Mission Advancing equity for women and girls through advocacy, education, and research. VOLUME 79, NO. 4 http://www.aauwmd.org SPRING 2012 AAUW Maryland Annual Convention Bethesda, Maryland April 28, 2012 This year our annual convention will be a one- In addition to hearing from Ms. Larocco in the day gala filled with informative talks, election of morning, we will hear from Connie Hildebrand, officers, a scrumptious luncheon and the an AAUW Board member, who will be here annual meeting. from her home in North Dakota. She will provide us an update on projects of the We hear all the time about the men who Association. founded our country and all they accomplished. Agenda Isn’t there a saying: Behind every good man there’s a woman? Women, however, have not 9:00 - 9:30 am Registration and Continental just been behind the men but have been out Breakfast front. We need to recognize those women who have contributed to our way of life. 9:35 - 10:35 am Connie Hildebrand, AAUW Board Member: AAUW Be sure to attend the AAUW Maryland Projects Update Convention, April 28, to hear our luncheon speaker, Christina Larocco, who will talk to us 10:45 am - 12:30 pm Business Meeting about “Women in History.” She is an AAUW 12:30 - 1:00 pm Installation of New Officers American Fellow, working toward her Ph.D. in women’s history at the University of Maryland, 1:00 - 2:00 pm Lunch College Park. 2:15 - 3:15 pm Christina Larocco, AAUW AAUW awarded over $1.5 million to 83 Fellow: Women in History American Fellowship recipients, who were selected from 500 applicants. -

Iam Pleased to Serve As President of Women Legislators of Maryland

Untitled-1 1 12/21/2018 1:23:26 PM Untitled-1 2 12/21/2018 1:23:28 PM A Message President of Women Legislators of Maryland Foundation, Incorporated I am pleased to serve as President of Women Legislators of Maryland Foundation, Incorporated. WLMF was established in 2006 through the efforts of The Honorable Eileen Rehrmann, a former delegate and the first woman to serve as County Executive of Harford County. WLMF’s first President was the late Delegate Pauline Menes, a founder of Women Legislators of Maryland (Women’s Caucus). WLMF was organized to assist the Women’s Caucus in achieving its funding potential in support of its agenda. The Women’s Caucus’ agenda addresses equal rights for women and children, primarily in connection with education, employment, economic development, and social opportunities. Throughout the history and advancement of our great nation, women have been an untapped and underutilized resource. However, today we celebrate! We are ecstatic to report that 2018 has truly been the year of the woman. I am delighted to share that record numbers of women ran successfully for office nationwide during the 2018 mid-term elections. The number of women in the Maryland General Assembly reached an all-time high of 72 members. In addition, WLMF is proud to report and salute the historical appointment of Victoria “Vicki” L. Gruber to the position of Executive Director of the Maryland Department of Legislative Services, on January 1, 2018. WLMF and the Women’s Caucus recognize and appreciate the leadership of Thomas V. “Mike” Miller Jr., President, Maryland Senate, and Michael E. -

Innovation in Action the University of Maryland School of Nursing from Its Founding in 1889 to 2012 3

Innovation in Action The University of Maryland School of Nursing From Its Founding in 1889 to 2012 3 TABLE OF CONTENTS Letter from the Dean 5 The Way We Were: The School of Nursing from 1889 to 1978 6 A Role Model of Professionalism: The Work of Dr. Mary V. Neal 16 Setting the Standards: 1978-1989 18 Realizing the Vision: 1990-2002 24 A New Century: 2002-2012 46 Appendices 68 Dean, Superintendents, and Directors Alumni Association Executive Committee and Past Presidents Honorary Degree Recipients School of Nursing Board of Visitors DEAN’S LETTER 5 Jane M. Kirschling PhD, RN, FAAN For more than a century, the University of Maryland School of Nursing has been committed to excellence in educating nurses who have become experts in their fields, clinicians, educators, and leaders in Maryland, the nation, and around the globe. The School of Nursing was established as a hospital training school in 1889, emerged as an autonomous entity in 1952, and is celebrating its 125th anniversary in 2014. As we celebrate our past and look to our future, we cannot forget the nurse pioneers who came before us. We value the legacy of those who carried the torch in the name of nursing, including Clara Barton, Dorothea Dix, Mary Mahoney, Florence Nightingale, Louisa Parsons, Lucile Petry, and Lillian Wald, whose names Evaluation Laboratory was expanded, as was our nursing are all etched on the façade of our building. If I might program at the Universities at Shady Grove. And, we borrow the sentiment of Robert Burton’s quote, launched a Student Success Center to help nursing “I light my candle from their torches.” students become more efficient and effective learners. -

The Value of a Good Organization Is

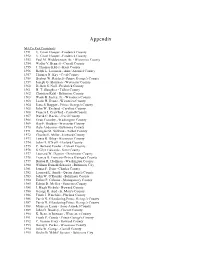

Appendix MACo Past Presidents 1951 U. Grant Hooper - Frederick County 1952 U. Grant Hooper - Frederick County 1953 Paul M. Widdownson, Sr. - Wicomico County 1954 Walter V. Bennett - Carroll County 1955 J. Thomas Kibler - Kent County 1956 Ralph L. Lowman - Anne Arundel County 1957 Thomas N. Kay - Cecil County 1958 Herbert W. Reichelt - Prince George's County 1959 Joseph G. Harrison - Worcester County 1960 Delbert S. Null - Frederick County 1961 H. T. Slaughter - Talbot County 1962 Christian Kahl - Baltimore County 1963 Wade H. Insley, Jr. - Wicomico County 1963 Leslie H. Evans - Wicomico County 1964 Jesse S. Baggett - Prince George's County 1965 John W. Eveland - Caroline County 1966 Francis J. Crawford - Carroll County 1967 David C. Racine - Cecil County 1968 Evan Crossley - Washington County 1969 Ray F. Redden - Worcester County 1970 Dale Anderson - Baltimore County 1971 Douglas M. Sullivan - Talbot County 1972 Charles E. Miller - Howard County 1973 Lewis R. Riley - Wicomico County 1974 John H. O'Neill - Harford County 1975 C. Bernard Fowler - Calvert County 1976 S. Glyn Edwards - Kent County 1977 Leonard W. Dayton - Dorchester County 1978 Francis B. Francois- Prince George's County 1979 Burton R. Hoffman - Washington County 1980 William Donald Schaefer - Baltimore City 1981 James F. Dent - Charles County 1982 Leonard E. Smith - Queen Anne's County 1983 John W. O'Rourke - Baltimore County 1984 Esther P. Gelman - Montgomery County 1985 Edwin D. McGee - Somerset County 1986 J. Hugh Nichols - Howard County 1986 George R. Aud - St. Mary's County 1986 Frank J. Hutchins - Harford County 1986 Parris N. Glendening-Prince George's County 1987 Parris N. -

Annual Report 2017

ANNUAL REPORT 2017 2 | INSTITUTE OF HUMAN VIROLOGY | ANNUAL REPORT About The Institute of Human Virology (IHV) is the first centter in the United States—peerhaps the world—d to combine the disciplines of basic science, epidemiology andd clinical reseearch in a concerted efforrt to speed the discovery of diagnostics and therapeutics for a wide variety of chronin c and deada ly viral and immune disorders—most notably HIV, the cause of AIDS. Formed in 1996 as a parrtnersr hiip beetween the State of Maryland, the City of Baltimore, the University System of Maryland and the University of Maryland Medical Syystem, IHV is an institute of the University of Maryland School of Medicine and is home to some of the most globally-recognized and world-renowned experts in the field of human virology. IHV was co-founded by Robert Gallo, MD, director of the of the IHV, Robert Redfield, MD, associate director off ththe IHV and d didirector t of f IHV’IHV’s DiDivision i i of f CliClinical i l CCare and d RResearch h and d WilliWilliam Blattner, MD, retired since 2016 and formerly associate director of the IHV and director of IHV’s Division of Epidemiology and Prevention. IHV is also comprised of a Basic Science Division, Vaccine Research Division, and four Scientific Core Facilities. The Institute, with its various laboratory and patient care facilities, is uniquely housed in a 250,000-square-foot building located in the center of Baltimore and our nation’s HIV/AIDS pandemic. IHV creates an environment where multidisciplinary research, education and clinical programs work closely together to expedite the scientific understanding of HIV/AIDS pathogenesis and to develop therapeutic interventions to make AIDS and virally-caused cancers manageable, if not curable, diseases. -

Maryland Breweries Discover They Have to Bottle Capital Before Beer

Real Estate Insider Looking to sue With state and county loans, Discovery In throes of crisis, Anne Arundel contemplates to expand Silver Spring headquarters. 5A filing claims against opioid manufacturers. 8A Thursday, September 7, 2017 Volume 128 | Number 234 TheDailyRecord.com Maryland’s trusted source of business, legal and government news Md. high court considers if flight justifies police search Court of Appeals kicks off new term with Fourth Amendment case BY STEVE LASH [email protected] ANNAPOLIS – Maryland’s top court grappled Wednesday with just how crime-ridden a neighborhood must be to justify police officers giving chase and frisking for weapons an individual MAXIMILIAN FRANZ who runs away upon seeing them. Lauren Ades, an attorney at Pessin Katz Law, at Union Craft Brewing in Baltimore. The defense lawyer and prosecutor arguing before the Court of Appeals on the first public day of its 2017-2018 term agreed that police in high crime, high-vi- olence areas of major cities would have Maryland breweries discover they reasonable suspicion enabling them to pursue a fleeing individual with- out violating their Fourth Amendment right against unreasonable seizure and have to bottle capital before beer search. However, the high-court dispute fo- cused not on the violent streets of Bal- Law rm carves out a speciality before the neighborhood brewer can from banks. timore but on Columbia, where Howard helping companies launch begin bottling and selling his own Weiner and Ades got into brewing County police chased down Jamal Sizer product statewide, he probably needs when Adam Benesch came to Ades, a after he ran upon seeing them, was to raise capital and build infrastruc- friend, to ask for help with raising pri- caught and was found carrying a hand- BY TIM CURTIS ture. -

New PG Post 08.18.05 Vol.73#33

The Pri nce Ge orge’s Pos t A C OMMUNITY NEWSPAPER FOR PRINCE GEORGE ’S COUNTY Since 1932 Vol. 77, No. 39 September 24 — October 1, 2009 Prince George’s County, Maryland Newspaper of Record Phone: 301-627-0900 25 cents State Overpaid Dozens of Retirees Retirement and Pension System Does Not Plan to Recoup Excess BY KAREN ANDERSON some of these retirees have Capital News Service been counting on this money for more than two decades. ANNAPOLIS - The "From the state's perspec - Maryland pension system tive, maintaining that level of overpaid 45 retired non-faculty benefit is not necessarily employees at the Maryland expensive. There are people School for the Deaf by a total who are receiving $1,100 a of $487,000 over 22 years. month and it would go down to Unfortunately for the recipi - $800," Esty said. "It means a ents, it's a mistake that could lot to the retirees." hurt them more than it does the State Treasurer Nancy Kopp state. said those retirees whose bene - The error led 45 retirees to fits are in question gave hands- count on an amount of money on care at the Maryland School that won't likely continue. It for the Deaf during their work also led an additional 56 active for the state. employees to expect more "Put a human face, as the money in retirement than will board had to do, with people actually materialize. who retired thinking these An official decision is pend - would be their benefits," Kopp ing consultation with the state said. -

Maryland Prayer Calendar: 2011 Get Daily Lists at the Free State Prayer Slate at State Senate EXECUTIVE LEGISLATIVE Lt

Maryland Prayer Calendar: 2011 Get daily lists at the Free State Prayer Slate at www.mdprays.wordpress.com State Senate EXECUTIVE LEGISLATIVE Lt. Gov. Anthony Brown U.S. Congress George Edwards Katherine Klausmeier Robert Garagiola National Leadership Sec. of State John Sen. Barbara Mikulski Rep. Donna Edwards Christpher Shank Allen Kittleman Brian Frosh President Barak Obama McDonough Sen. Ben Cardin Rep. Steny Hoyer Ron Young Delores Kelley Jennie Forehand Vice Pres. Joe Biden Atty. Gen. Doug Gansler Rep. Andrew Harris Rep. Roscoe Bartlett David Brinkley Robert Zirkin Richard Madaleno State Leadership Treasurer Nancy Kopp Rep. John Sarbanes Rep. Elijah Cummings Joe Getty Edward Kasemeyer Roger Manno Gov. Martin O’Malley Comptroller Peter Rep. Dutch Rep. Chris Van Hollen Norman Stone James Robey Jamie Raskin Franchot Ruppersberger J. B. Jennings Karen Montgomery James Rosapepe Kevin Kelly Kelly Schulz Michael Weir Paul Pinsky Roy Dyson Nathaniel McFadden E J. Pipkin LeRoy Myers Kathy Afzali Richard Impallaria Douglas Peters John Astle Victor Ramirez Richard Colburn Andrew Serafini Donald Elliott Kathy Szeliga Joanne Benson Bryan Simonaire Bill Ferguson James Mathias Neil Parrott Justin Ready Patrick McDonough Ulysses Currie James DeGrange Joan Carter Conway Nancy King John Donoghue Nancy Stocksdale Joseph Boteler Anthony Muse Edward Reilly Lisa Gladden Catherine Pugh Galen Clagett Wade Kach Eric Bromwell Mike Miller (pres.) Nancy Jacobs James Brochin State Representatives Patrick Hogan Joseph Minnick John Cluster Thomas Middleton Barry -

June 23 Transcript

June 23, 2010 1 STATE OF MARYLAND BOARD OF PUBLIC WORKS GOVERNOR’S RECEPTION ROOM SECOND FLOOR, STATE HOUSE ANNAPOLIS, MARYLAND June 23, 2010 10:22 a.m. June 23, 2010 2 P R E S E N T GOVERNOR MARTIN O’MALLEY, Presiding; HONORABLE PETER FRANCHOT, Comptroller; HONORABLE NANCY KOPP, Treasurer; SHEILA C. MCDONALD, Secretary, Board of Public Works; ALVIN C. COLLINS, Secretary, Department of General Services; T. ELOISE FOSTER, Secretary, Department of Budget and Management; BEVERLEY SWAIM-STALEY, Secretary, Department of Transportation; MEREDITH LATHBURY, Land Acquisition and Planning, Department of Natural Resources; JOHN A. PETTY, Assistant Secretary, MBE Compliance, Governor’s Office of Minority Affairs; MARY JO CHILDS, Procurement Advisor, Board of Public Works; and, MARION BOSCHERT, Recording Secretary, Board of Public Works. June 23, 2010 3 C O N T E N T S Subject Agenda Witness Page Reappointment SEC Sheila McDonald 7 of Brian Item 14, Treasurer Kopp Topping to p. 20 Investment Committee of Board of Trustees of State Retirement and Pension System Approval of DBM T. Eloise Foster 7 Contract Item Treasurer Kopp Modification to 19-S-MOD, Reduce Fees in p. 72B Maryland College Savings Plan Recognition of Governor O’Malley 11 Retiring DHMH John Colmers Employees Presentation on Asuntha Chiang-Smith 13 BRAC Amendments to SEC Sheila McDonald 35 State Item 4, John A. Petty Procurement p. 5 Regulations Preliminary SEC Sheila McDonald 37 Bond Item 15, Treasurer Kopp Resolution p. 21 POS Agenda POS Meredith Lathbury 39 June 23, 2010 4 Subject Agenda Witness Page Extension of DBM T. Eloise Foster 40 Contracts for Item Philip Pie Inmate 24-S-MOD, Health Care p. -

MARYLAND STATE TREASURER Nancy K. Kopp

MARYLAND STATE TREASURER Nancy K. Kopp July 9, 2021 The Honorable Guy J. Guzzone The Honorable Maggie McIntosh Chair, Senate Budget and Taxation Committee Chair, House Appropriations Committee 3 West Miller Senate Office Building 121 House Office Building 11 Bladen Street 6 Bladen Street Annapolis, Maryland 21401 Annapolis, Maryland 21401 The Honorable Anne R. Kaiser Victoria L. Gruber Chair, House Ways and Means Committee Executive Director 131 House Office Building Department of Legislative Services 6 Bladen Street 90 State Circle Annapolis, Maryland 21401 Annapolis, Maryland 21401 Dear Chair Guzzone, Chair McIntosh, Chair Kaiser, and Mrs. Gruber: Section 10A-203 of the State Finance and Procurement Article of the Maryland Annotated Code requires the State Treasurer, in coordination with the Comptroller, to analyze the impact of a Public-Private Partnership (“P3”) Agreement proposed by a unit of State government and submit its report to the Budget Committees and the Department of Legislative Services within 30 days of receiving a copy of the proposed agreement. The Board of Public Works (“BPW”) may not approve the proposed P3 agreement until the report has been submitted. On June 10, 2021, my office received a P3 Agreement proposed to be entered into by the Maryland Department of Transportation (“MDOT”), the Maryland Transportation Authority (“MDTA”), and Accelerate Maryland Partners. In coordination with the Office of the Comptroller and with the cooperation of MDOT and MDTA, my staff has conducted an analysis of the P3 Agreement. The resulting report is included under this cover letter. In addition to analyzing the proposed P3 Agreement, the report discusses our concern that my office was unable to fully engage the State’s Financial Advisor and Bond Counsel to assist with the review due to a lack of funding. -

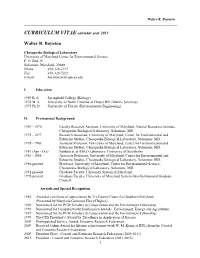

CURRICULUM VITAE Calendar Year 2013

Walter R. Boynton _____________________________________________________________________________________ CURRICULUM VITAE calendar year 2013 Walter R. Boynton Chesapeake Biological Laboratory University of Maryland Center for Environmental Science P. O. Box 38 Solomons, Maryland 20688 Phone: 410-326-7275 Fax: 410-326-7302 E-mail: [email protected] I. Education 1969 B. S. Springfield College (Biology) 1974 M. S. University of North Carolina at Chapel Hill (Marine Sciences) 1975 Ph.D. University of Florida (Environmental Engineering) II. Professional Background 1969 - 1970 Faculty Research Assistant, University of Maryland, Natural Resources Institute, Chesapeake Biological Laboratory, Solomons, MD. 1975 - 1977 Research Associate, University of Maryland, Center for Environmental and Estuarine Studies, Chesapeake Biological Laboratory, Solomons, MD. 1978 - 1983 Assistant Professor, University of Maryland, Center for Environmental and Estuarine Studies, Chesapeake Biological Laboratory, Solomons, MD. 1987 (Apr - Oct) Sabbatical at ASKO Laboratory, University of Stockholm 1983 - 1988 Associate Professor, University of Maryland, Center for Environmental and Estuarine Studies, Chesapeake Biological Laboratory, Solomons, MD. 1988-present Professor, University of Maryland, Center for Environmental Science, Chesapeake Biological Laboratory, Solomons, MD. 1992-present Graduate Faculty, University System of Maryland. 1998-present Graduate Faculty, University of Maryland System Inter-Institutional Graduate Council. Awards and Special Recognition 1982 Awarded certificate of appreciation by Tri-County Council of Southern Maryland (Presented by Maryland Governor Harry Hughes) 1990 Nominated for the PEW Scholars in Conservation and the Environment Fellowship. 1992 Nominated for Computerworld Smithsonian Awards. Environment, Energy and Agriculture. 1997 Nominated for the PEW Scholars in Conservation and the Environment Fellowship. 1999 The CES President’s Award for Excellence in Application of Science. 2003 Distinguished Service Award, Estuarine Research Federation.