Investor Presentation August 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

16 Hours Ert! 8 Meals!

Iron Rattler; photo by Tim Baldwin Switchback; photo by S. Madonna Horcher Great White; photo by Keith Kastelic LIVING LARGE IN THE LONE STAR STATE! Our three host parks boast a total of 16 coasters, including Iron Rattler at Six Flags Fiesta Texas, Switch- Photo by Tim Baldwin back at ZDT’s Amuse- ment Park and Steel Eel at SeaWorld. 16 HOURS ERT! 8 MEALS! •An ERT session that includes ALL rides at Six Flags Fiesta Texas •ACE’s annual banquet, with keynote speaker John Duffey, president and CEO, Six Flags •Midway Olympics and Rubber Ducky Regatta •Exclusive access to two Fright Fest haunted houses at Six Flags Fiesta Texas REGISTRATION Postmarked by May 27, 2017 NOT A MEMBER? JOIN TODAY! or completed online by June 5, 2017. You’ll enjoy member rates when you join today online or by mail. No registrations accepted after June 5, 2017. There is no on-site registration. Memberships in the world’s largest ride enthusiast organization start at $20. Visit aceonline.org/joinace to learn more. ACE MEMBERS $263 ACE MEMBERS 3-11 $237 SIX FLAGS SEASON PASS DISCOUNT NON-MEMBERS $329 Your valid 2017 Six Flags season pass will NON-MEMBERS 3-11 $296 save you $70 on your registration fee! REGISTER ONLINE ZDT’S EXTREME PASSES Video contest entries should be mailed Convenient, secure online registration is Attendees will receive ZDT’s Extreme to Chris Smilek, 619 Washington Cross- available at my.ACEonline.org. Passes, for unlimited access to all attrac- ing, East Stroudsburg, PA, 18301-9812, tions on Thursday, June 22. -

The Official Magazine of American Coaster Enthusiasts Rc! 127

FALL 2013 THE OFFICIAL MAGAZINE OF AMERICAN COASTER ENTHUSIASTS RC! 127 VOLUME XXXV, ISSUE 1 $8 AmericanCoasterEnthusiasts.org ROLLERCOASTER! 127 • FALL 2013 Editor: Tim Baldwin THE BACK SEAT Managing Editor: Jeffrey Seifert uthor Mike Thompson had the enviable task of covering this year’s Photo Editor: Tim Baldwin Coaster Con for this issue. It must have been not only a delight to Associate Editors: Acapture an extraordinary convention in words, but also a source of Bill Linkenheimer III, Elaine Linkenheimer, pride as it is occurred in his very region. However, what a challenge for Jan Rush, Lisa Scheinin him to try to capture a week that seemed to surpass mere words into an ROLLERCOASTER! (ISSN 0896-7261) is published quarterly by American article that conveyed the amazing experience of Coaster Con XXXVI. Coaster Enthusiasts Worldwide, Inc., a non-profit organization, at 1100- I remember a week filled with a level of hospitality taken to a whole H Brandywine Blvd., Zanesville, OH 43701. new level, special perks in terms of activities and tours, and quite Subscription: $32.00 for four issues ($37.00 Canada and Mexico, $47 simply…perfect weather. The fact that each park had its own charm and elsewhere). Periodicals postage paid at Zanesville, OH, and an addition- character made it a magnificent week — one that truly exemplifies what al mailing office. Coaster Con is all about and why many people make it the can’t-miss event of the year. Back issues: RCReride.com and click on back issues. Recent discussion among ROLLERCOASTER! subscriptions are part of the membership benefits for our ROLLERCOASTER! staff American Coaster Enthusiasts. -

Cedar Point Welcomes 2016 Golden Ticket Awards Ohio Park and Resort Host Event for Second Time SANDUSKY, Ohio — the First Chapter in Cedar and Beyond

2016 GOLDEN TICKET AWARDS V.I.P. BEST OF THE BEST! TM & ©2016 Amusement Today, Inc. September 2016 | Vol. 20 • Issue 6.2 www.goldenticketawards.com Cedar Point welcomes 2016 Golden Ticket Awards Ohio park and resort host event for second time SANDUSKY, Ohio — The first chapter in Cedar and beyond. Point's long history was written in 1870, when a bath- America’s top-rated park first hosted the Gold- ing beach opened on the peninsula at a time when en Ticket Awards in 2004, well before the ceremony such recreation was finding popularity with lake island continued to grow into the “Networking Event of the areas. Known for an abundance of cedar trees, the Year.” At that time, the awards were given out be- resort took its name from the region's natural beauty. low the final curve of the award-winning Millennium It would have been impossible for owners at the time Force. For 2016, the event offered a full weekend of to ever envision the world’s largest ride park. Today activities, including behind-the-scenes tours of the the resort has evolved into a funseeker’s dream with park, dinners and receptions, networking opportuni- a total of 71 rides, including one of the most impres- ties, ride time and a Jet Express excursion around sive lineups of roller coasters on the planet. the resort peninsula benefiting the National Roller Tourism became a booming business with the Coaster Museum and Archives. help of steamships and railroad lines. The original Amusement Today asked Vice President and bathhouse, beer garden and dance floor soon were General Manager Jason McClure what he was per- joined by hotels, picnic areas, baseball diamonds and sonally looking forward to most about hosting the a Grand Pavilion that hosted musical concerts and in- event. -

List of Intamin Rides

List of Intamin rides This is a list of Intamin amusement rides. Some were supplied by, but not manufactured by, Intamin.[note 1] Contents List of roller coasters List of other attractions Drop towers Ferris wheels Flume rides Freefall rides Observation towers River rapids rides Shoot the chute rides Other rides See also Notes References External links List of roller coasters As of 2019, Intamin has built 163roller coasters around the world.[1] Name Model Park Country Opened Status Ref Family Granite Park United [2] Unknown Unknown Removed Formerly Lightning Bolt Coaster MGM Grand Adventures States 1993 to 2000 [3] Wilderness Run Children's United Cedar Point 1979 Operating [4] Formerly Jr. Gemini Coaster States Wooden United American Eagle Six Flags Great America 1981 Operating [5] Coaster States Montaña Rusa Children's Parque de la Ciudad 1982 Closed [6] Infantil Coaster Argentina Sitting Vertigorama Parque de la Ciudad 1983 Closed [7] Coaster Argentina Super Montaña Children's Parque de la Ciudad 1983 Removed [8] Rusa Infantil Coaster Argentina Bob Swiss Bob Efteling 1985 Operating [9] Netherlands Disaster Transport United Formerly Avalanche Swiss Bob Cedar Point 1985 Removed [10] States Run La Vibora 1986 Formerly Avalanche Six Flags Over Texas United [11] Swiss Bob 1984 to Operating Formerly Sarajevo Six Flags Magic Mountain States [12] 1985 Bobsleds Woodstock Express Formerly Runaway Reptar 1987 Children's California's Great America United [13] Formerly Green Smile 1984 to Operating Coaster Splashtown Water Park States [14] Mine -

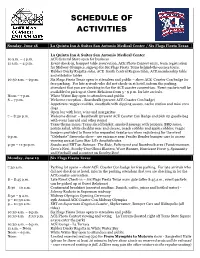

Schedule of Activities

SCHEDULE OF ACTIVITIES Sunday, June 18 La Quinta Inn & Suites San Antonio Me dical Center / Six Flags Fiesta Texas La Quinta Inn & Suites San Antonio Medical Center 10 a.m. – 4 p.m. ACE General Store open for business 11 a.m. – 4 p.m. Event check-in, banquet table reservation, ACE Photo Contest entry, team registration for Midway Olympics, sign-up for Six Flags Fiesta Texas behind-the-scenes tours, Rubber Ducky Regatta sales, ACE South Central Region table, ACE membership table and exhibitor tables 10:30 a.m. – 9 p.m. Six Flags Fiesta Texas open to attendees and public – show ACE Coaster Con badge for free parking. For late arrivals who did not check-in at hotel, inform the parking attendant that you are checking in for the ACE coaster convention. Event packets will be available for pick up at Guest Relations from 5 - 9 p.m. for late arrivals. Noon – 7 p.m. White Water Bay open to attendees and public 6 – 7 p.m. Welcome reception - Boardwalk (present ACE Coaster Con badge) Appetizers: veggie crudités, meatballs with dipping sauces, nacho station and mini corn dogs Open bar with beer, wine and margaritas 7 – 8:30 p.m. Welcome dinner – Boardwalk (present ACE Coaster Con Badge and pick up goodie bag with event lanyard and other items) Texas theme menu: Texas sliced brisket, smoked sausage with peppers, BBQ sauce, potato salad, white cheddar mac and cheese, peach cobbler and apple cobbler; veggie burgers provided to those who requested vegetarian when registering for the event 9 p.m. -

Virtual Reality Roller Coaster: from Fear to Thrill – Without Leaving the Room

Virtual Reality Roller Coaster: From Fear to Thrill – Without Leaving the Room Yevheniia Soroka Yoonsang Kim Stony Brook University Stony Brook University Figure 1: Main scene of our brand-new VR roller coaster experience. into a different direction (which turns out to be the actual direction ABSTRACT of the rails). Also, the effect of physical track elements like block This report contains a detailed description of our brand-new brakes can be utilized in the virtual reality experience for dramatic interactive virtual reality roller coaster application deployed for elements like crashing through a virtual barrier or building.[3] HTC Vive. Application includes an immersive roller coaster Riders report after their first virtual reality roller coaster ride that it experience and functionalities of dynamical choice of tracks, is unlike anything they have ever experienced before.[4] change of play modes, object interaction. Additionally, user While virtual reality roller coaster simulations quickly became discomfort recorder is included, logging real-time user feedback quite popular after the appearance of the Oculus Rift, it showed that during the game. The latest Tobii eye tracking is used for object dizziness and motion sickness, known as virtual reality sickness, interaction and feedback recording. would be a major problem.[5] This was caused by the offset between the simulated motion in virtual reality and the lack of real Index Terms: VR, roller coaster, virtual ride. motion, as the inner sense of balance wouldn't feel the appropriate forces and turns.[6] 1 INTRODUCTION 2 RELATED WORKS With numerous types of VR headsets readily available directly to the public, Virtual Reality is already becoming a tangible reality for The first VR roller coaster experience that became publicly many – all in the comfort of their own home, by making use of their available was Alpenexpress Coastiality created by MackMedia and own smartphone. -

Virtual and Augmented Reality: Are You Sure It Isn't Real?, Which Summarized Market Trends from a Systematic Perspective

VIRTUAL AND AUGMENTED REALITY Are you sure it isn’t real? Citi GPS: Global Perspectives & Solutions October 2016 Citi is one of the world’s largest financial institutions, operating in all major established and emerging markets. Across these world markets, our employees conduct an ongoing multi-disciplinary global conversation – accessing information, analyzing data, developing insights, and formulating advice for our clients. As our premier thought-leadership product, Citi GPS is designed to help our clients navigate the global economy’s most demanding challenges, identify future themes and trends, and help our clients profit in a fast-changing and interconnected world. Citi GPS accesses the best elements of our global conversation and harvests the thought leadership of a wide range of senior professionals across our firm. This is not a research report and does not constitute advice on investments or a solicitation to buy or sell any financial instrument. For more information on Citi GPS, please visit our website at www.citi.com/citigps. Citi GPS: Global Perspectives & Solutions October 2016 Kota Ezawa is a Managing Director covering the Industrial, Consumer Electronics and Electric Components sector. He joined the firm in May 2006. He began his career at the Daiwa Institute of Research, covering the Utility and Machinery sectors before becoming the Small-Cap technology Analyst in 2000. Between 2003 and 2005, he covered European Technology stocks and between 2005 and 2006 he covered Japanese Industrial Electronics stocks. Mr. Ezawa graduated with a Master's degree in engineering from the Interdisciplinary Graduate School of Science and Engineering at the Tokyo Institute of Technology +81-3-6270-4804 | [email protected] Jason B Bazinet Dennis Chan U.S. -

Nues Herald-Spectator

Your oca1 source since 1951. $1 Thursday, May 29, 2014 A W PPTS company ACHICAGO SUNTIMEScorn pubhcation j niles.suntimes.com I Nues Herald-Spectator STORES SUFFERING WITHOUT DOMINICK'S i « GO YOUR GUIDE TO 2014 OUTDOOR CONCERTS FOOD » FORBIDDEN A colorful tribute FRUIT IN THIS RICE PUDDING IS NUTRITION Veterans salute fallen comrades at Memorial Day ceremony i PAGE 6 ©2014 Sun-Times Media I All rights reserved Niles Herald-Spectator I Get up and Your guide to the weekend Blockbuster or flop? and beyond TheMovie Review so::--rLo9LS ii sn section has the scoop. csOOOOo :Lsio OL)4VOiaio M O96 ?000000 6T03 6TO-3LCT1 o&eïTc 2 I ThIJILSDAY, MAY 29,2014 A PIONEER PRESS PUBUCATION NIL eSt:hosp pago nsumer Reports. Patient safety is our top priority, anuit shows. The May2014 issue of Consumer Reports ranked us 1 and in Chicago in five key safety areas. Presence® ')Presence® Resurrection Our Lady of the Resurrection Medical Center Medical Center n more.CaU 877.737.4636 or vsit presencehealth.org/safest Nil. A PIONEER PRESS PUBLICATION THURSDAY, MAY 29,2014 3 Hiring the right employees is critical, but you can't spend all your time on it. Through our partnership with Monster, Pioneer Press can help you find the right person, faster. lt's only part of the comprehensive recruiting solution you'll find with Pioneer Press and Monster. And just one of the ways we're here to help you keep your business running. Pioneèr Find the right fit for your next job at pioneerlocal.com/monster, or call 847.998.3400. -

TOURISM ᭤ PRINCIPLES Ninth Edition P RACTICES

3848_Goeldner_00.qxd 7/11/02 9:28 AM Page iii TOURISM ᭤ PRINCIPLES Ninth Edition P RACTICES PHILOSOPHIES Charles R. Goeldner J. R. Brent Ritchie J OHN W ILEY & SONS, INC. Uploaded By Junaid Ahmad, M.A. Cultural Heritage & Tourism Management [email protected] 3848_Goeldner_00.qxd 7/11/02 9:28 AM Page xviii 3848_Goeldner_00.qxd 7/11/02 9:28 AM Page i TOURISM 3848_Goeldner_00.qxd 7/11/02 9:28 AM Page ii 3848_Goeldner_00.qxd 7/11/02 9:28 AM Page iii TOURISM ᭤ PRINCIPLES Ninth Edition P RACTICES PHILOSOPHIES Charles R. Goeldner J. R. Brent Ritchie J OHN W ILEY & SONS, INC. 3848_Goeldner_00.qxd 7/11/02 9:28 AM Page iv This book is printed on acid-free paper. ᭺∞ Copyright © 2003 by John Wiley & Sons, Inc. All rights reserved Published by John Wiley & Sons, Inc., Hoboken, New Jersey Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Sections 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 750-4470, or on the web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, e-mail: [email protected]. -

Silver Dollar City Hosts 21St Annual Golden Ticket Awards Missouri Theme Park Excels As First-Time Host BRANSON, Mo

TM & ©2018 Amusement Today, Inc. September 2018 | Vol. 22 • Issue 6.2 www.amusementtoday.com Silver Dollar City hosts 21st annual Golden Ticket Awards Missouri theme park excels as first-time host BRANSON, Mo. — Nothing says “Welcome” more than a day at Silver Dollar City. The mid-America theme park has enchanted guests since 1960. With theming cen- tered around the late 1800s, the park has often used the tagline: “You’ve got a great past ahead of you.” Even with Silver Dollar City opened its gates and arms modern thrillers added to the to welcome Golden Ticket Awards attendees. ever-growing lineup of world- The Showboat Branson Belle (above) played class attractions, they all find host to the awards ceremony. their place in the storyline that COURTESY SILVER DOLLAR CITY; AT/TIM BALDWIN makes Silver Dollar City unique. Attendees to the 21st event. “After a hectic summer, Entertainment without Marvel “I am excited and hon- Lake for an exclusive voyage annual Golden Ticket Awards I am hopeful that attendees Cave. The vast Cathedral ored to be presenting for dedicated to the Golden Ticket found much to keep them busy. will be able to take a much Room entrance (tall enough for the first time this year at the Awards and its attendees on “The Networking Event of the needed break, relax and enjoy a 20-story building to stand in!) Golden Tickets Awards at the evening of September 8. Year” provided opportunities all that the Ozark Mountains along with the other natural Silver Dollar City,” said Pete “Gary Slade and the for behind-the-scenes tours have to offer. -

Best New Theme Park Rides: Virtual Reality, Interactivity

Lifestyle FRIDAY, MAY 27, 2016 Best new theme park rides: Virtual reality, interactivity ou’re flying alongside Superman, seeing the world as the California Man of Steel views it, thanks to virtual reality headsets on a On July 4, Universal Studios Hollywood is slated to open The Yroller coaster at Six Flags New England. Or you’re feeling the Walking Dead, based on the hit AMC show. Few details have been fear as you come face to face with King Kong, 30 feet tall, at released but riders should expect a maze of horror. Also at Universal Universal Orlando’s new Skull Island attraction. These are a few Studios Hollywood, fans can immerse themselves in the recently examples of the heightened experiences awaiting visitors at theme opened Wizarding World of Harry Potter. It’s similar to the original parks across the country this summer. Park-goers are no longer just Potter land at Universal Orlando, but the marquee ride, Harry Potter sitting back to enjoy the ride. Thanks to virtual reality, interactive and the Forbidden Journey, has added some unique 3-D technology. features and other new technology, they’re playing roles and expe- Legoland California in Carlsbad joined the interactive fray when it riencing rides as never before. debuted Ninjago in early May. Riders actually influence the outcome “In terms of virtual reality, this has the chance to revolutionize the of the battle by using hand gestures to shoot, rather than laser guns, roller coaster experience,” said Colleen Mangone, director of the to help fight off evil during the experience. -

2017 Publisher's Picks: Supplier, Park

4 AMUSEMENT TODAY Golden Ticket Awards September 2017 2017 Publisher's Picks: Supplier, Park Intamin celebrates 50 years of innovation Morgan’s Wonderland grows its special message For most people in the industry, it is Life doesn’t always go as planned. 2017 2017 hard to imagine a time when high-profile PRESENTED AS Sometimes, the right person with the right PRESENTED AS rides were in short supply. A half century GOLDEN SUPPLIER vision turns an unfortunate situation into GOLDEN PARK OF THE OF THE ago, that was quite the case. With a mere TICKET YEAR something glorious. TICKET AWARD AWARD YEAR handful of theme parks in existence, the PRESENTED TO In 2005 Gordon Hartman made an PRESENTED TO V.I.P. V.I.P. demand wasn’t there. By the late 1960s, Six INTAMIN observation. While vacationing with his MORGAN’S WONDERLAND Flags had opened its second theme park, wife Maggie and daughter Morgan, the and a third wasn’t far off in development. family enjoyed some relaxation time at the Before long, the country, if not the world, hotel pool. Morgan was eager to play with was in the theme park boom. the other children who were on vacation, “By 1970, the park had matured. We but they did not want to interact with her. had already put in all the shelf product that Morgan had special needs. She was differ- was available,” said Errol McKoy, industry ent. At that moment, Gordon resolved to veteran and former Six Flags Over Georgia do something to make a difference. There general manager.