Unusual Limited (SGX:1D1): Price Target $0.38 Team No: 141 Team Leader: Yong Yao Zhen Kevin

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

To Be Released On: 11 March 2010

Corporate Profile UnUsUaL Limited Established in 1997, UnUsUaL Limited started as a stage, sound and lighting equipment rental business. With a history and track record of 20 years, it has grown to become one of the leading names in Asia, specialising in the production and promotion of large-scale live events and concerts by Asian and International artistes. Its presence in the region is represented by UnUsUaL Entertainment, UnUsUaL Productions, UnUsUaL Development, UnUsUaL Productions in Malaysia, UnUsUaL Entertainment International in Hong Kong and UnUsUaL Development Pte. Ltd., Taiwan Branch in Taiwan. In 2016, UnUsUaL Group of Companies was acquired by mm2 Asia Limited, a Singapore- based, SGX Mainboard listed producer of films, TV and online content. It was subsequently listed on the SGX-ST Catalist board as UnUsUaL Limited on 10 April 2017. UnUsUaL Productions Pte Ltd UnUsUaL Productions has one of the largest technical inventory in Singapore. Its ability to deliver a complete technical solution has seen the company working on a diverse range of events such as concert, product launch, press conference, red carpet event, exihibition, trade show, music festival, sports event and more. It is a proud partner of the Singapore Arts Festival, the Chingay Parade, SG50 Youth Celebrate! and the Formula One Singapore Grand Prix. The team is trained to provide creative and quick technical solutions and are familiar with most major venues in Singapore and around the region. UnUsUaL Entertainment Pte Ltd UnUsUaL Entertainment is recognised as one of the key promoters in Singapore and the region. Supported by an experienced team, UnUsUaL Entertainment markets and organises concert, fan meet, private event, music festival and has plans to branch into sports entertainment. -

Paper Title (Use Style: Paper Title)

International Academic Workshop on Social Science (IAW-SC 2013) Grotesque and Gaudy World of Music, Indispensable Narrative Pen Study on The Narrative Strategy of Modern Chinese Pop Songs’ Lyrics Chunjing Zhang College of Applied Technology Southwest University Chongqing,China [email protected] Abstract—Since the 1990s, the creation of pop songs’ lyrics has symbol presents "conation ", which promotes recipient to undergone a lot of changes, transforming from the past take action. According to Jacobsen’s brilliant analysis, lyrics emphasis on inner expression to frequent use of narration. appear to be more emotional or strongly conative. Therefore, Thus, the grotesque and gaudy world of music, concentrating the lyrics have a strong tendency of appealing. Answering is on creators ’narrative pen, unfolds vividly. Some important the basic trend of the lyrics, narrative strategy of “I tell you" narrative strategy has gradually taken shape, including basic is the most fundamental sending mode of lyrics. The narrative strategy of “I tell you” and public participation in appearance of subject expressing is an important “telling a story”, Demonstration of details and fragments in life characteristics of the lyrics. of whole narration and defamiliarization on narration. There are too many examples that we cannot cite them all. Keywords-lyrics; pop songs; narration According to the study of the highest search volume of 100 new songs lyrics on Baidu MP3 search, the author find that 95% of the lyrics comprise the basic strategy of "I tell you", I. INTRODUCTION including "I", "you" or slightly distorted "I" and "you", even No matter what kinds of art form, story-telling is the if starting in the fashion of third person and through the most attractive method. -

Unusual Limited 11 August 2017

Company note UnUsUal Limited 11 August 2017 Unrated Powerful Mix of High Growth and High Profitability Current Price S$0.475 ▪ Integrated business provides high operating flexibility. Unusual is a live event production and promotion company with the largest technical Fair Value S$0.625 inventory in Singapore and a wealth of experience in various technical Up / (downside) 31.6% solutions, meaning that most production work is carried out internally. This is a very strong competitive advantage in Singapore as the financial Stock Statistics breakeven for each show will be comparatively lower than that of a less integrated competitor. In turn, Unusual can work with both new and Market cap S$305.5m established artists in technically complex shows to draw both small and large 52-low S$0.400 crowds, while risking less capital and cultivating relationships with artists. 52-high S$0.540 Avg daily vol 1,473,853 ▪ Established track record and lengthy relationships to top artists. Since No of share 643.2m its founding in 1997, Unusual has produced the concerts of artists such as Free float 17.8% Jay Chou and JJ Lin. Due to its track record and relationships in the industry, Unusual can reassure artists of payment of fees, production quality and venue quality and thus convince them to go on tours promoted by it. Key Indicators ▪ Financial war chest to expand pipeline. With net cash of S$17.1m, ROE 17F 34.8% Unusual is now able to monetise its industry networks by engaging more ROA 17F 26.1% artists and for more shows – both in Singapore and regionally. -

Digital Media and Radical Politics in Postsocialist China

UNIVERSITY OF CALIFORNIA SANTA CRUZ DIGITAL EPHEMERALITY: DIGITAL MEDIA AND RADICAL POLITICS IN POSTSOCIALIST CHINA A dissertation submitted in partial satisfaction of the requirements for the degree of DOCTOR OF PHILOSOPHY in FEMINIST STUDIES by Yizhou Guo June 2020 The Dissertation of Yizhou Guo is approved: __________________________ Professor Neda Atanasoski, co-chair __________________________ Professor Lisa Rofel, co-chair __________________________ Professor Xiao Liu __________________________ Professor Madhavi Murty __________________________ Quentin Williams Acting Vice Provost and Dean of Graduate Studies Copyright © by Yizhou Guo 2020 Table of Contents List Of Figures And Tables IV Abstract V Acknowledgements V Introduction: Digital Ephemerality: Digital Media And Radical Politics In Postsocialist China 1 Chapter One: Queer Future In The Ephemeral: Sexualizing Digital Entertainment And The Promise Of Queer Insouciance 60 Chapter Two: Utopian In The Ephemeral: ‘Wenyi’ As Postsocialist Digital Affect 152 Chapter Three: Livestreaming Reality: Nonhuman Beauty And The Digital Fetishization Of Ephemerality 225 Epilogue: Thinking Of Digital Lives And Hopes In The Era Of The Pandemic And Quarantine 280 Bibliography 291 iii List of Figures and Tables Figure 1-1 Two Frames From The Television Zongyi Happy Camp (2015) 91 Figure 1-2 Color Wheel Of Happy Camp’s Opening Routine 91 Figure 1-3 Four Frames From The Internet Zongyi Let’s Talk (2015) 92 Figure 1- 4 Color Wheel Of The Four Screenshots From Figure 1.3 94 Figure 1-5 Let’s Talk Season -

ST/LIFE/PAGE<LIF-004>

D4 life happenings | THE STRAITS TIMES | FRIDAY, SEPTEMBER 28, 2018 | GIGS Eddino Abdul Hadi Music Correspondent recommends A1 20th Anniversary Reunion Tour Picks Popular boyband A1, who have hits such as Like A Rose, Take On Me and Same Old Brand New You, are Gigs celebrating their 20th anniversary this year. Their concert here will include former member Paul Marazzi, marking the only time the original line-up is appearing together since 2002. WHERE: MES Theatre, 1 Stars Avenue MRT: One-north WHEN: Oct 20, 8pm ADMISSION: $98 - $168, tickets from apactix.com Wakin Chau In Concert Wakin Chau – better known by his stage name Emil Chau in the 1980s and 1990s – will perform at the National Stadium, headlining for WAU Live 2018, which is held in conjunction with the final edition of the BNP Paribas WTA Finals Singapore. Also performing are home-grown acts, jazz vocalist Joanna Dong and duo ShiLi & Adi. Chau had a sold-out concert here in August last year. WHERE: National Stadium, 1 Stadium Drive MRT: Stadium WHEN: Oct 20, 7pm ADMISSION: $98 - $228, tickets from Singapore Indoor Stadium Box Office & SingPost outlets TEL: 3158-7888 INFO: www.sportshubtix.sg Kenny G Live In Singapore Legendary Grammy Award-winning saxophonist Kenny G returns to Singapore for a one-night gig in November. The line-up will include songs from his 14th studio album, SAM SMITH THE THRILL OF IT ALL TOUR named after his second album which went to No. 1 Brazilian Nights. British singer Sam Smith’s (above) two-night concerts are worldwide last year. -

To Be Released On

For Immediate Release UnUsUaL Entertainment, in collaboration with Sun Entertainment, presents Hacken Lee (李克勤) 30th Anniversary Concert in 8 Cities in China, Kuala Lumpur and Singapore With a singing career spanning three decades, Hacken Lee is back with a series of concerts in China, Malaysia and Singapore, specifically commemorating his 30 years in show business and entertaining the world. This concert will feature center-stage production in all venue with expected seating capacity per venue in excess of 10,000. Jointly organised by Sun Entertainment Concert Limited (“Sun Entertainment”) and UnUsUaL Entertainment Pte Ltd (“UnUsUaL Entertainment”), the concert will be performed at Chengdu, Dongguan, Wuhan, Nanning, Foshan, Shanghai, Shenzhen, Guangzhou, Singapore and Kuala Lumpur, starting from September 2018 to November 2019. Exact dates for each city to be announced later. “We are extremely delighted to partner Sun Entertainment again to organise this milestone concert by Hacken Lee to eight cities in China, Kuala Lumpur and Singapore. Hacken needs no introduction as his concerts have dazzled many over the years,” said Mr. Leslie Ong, CEO of UnUsUaL Limited, parent company of UnUsUaL Entertainment. - END - 45 Kallang Pudding Road #01-01 Alpha Building Singapore 349317 T: (65) 6841 4555 F: (65) 6841 0129 www.unusual.com.sg Co. Reg. No: 201611835H About UnUsUaL Entertainment Pte Ltd UnUsUaL Entertainment, a wholly-owned subsidiary of SGX-ST Catalist board listed UnUsUaL Limited, is a leading concert promoter in Asia. It plans and manages concerts, fan meets, private events and music festivals in Singapore and the region. Its target audience ranges from the young to the mature. -

Ke Wang MA Thesis

Motivating, Embodying and Flowing: Music in Teaching and Learning of Chinese as a Foreign Language Thesis Presented in Partial Fulfillment of the Requirements for the Degree Master of Arts in the Graduate School of The Ohio State University By Ke Wang M.A. Graduate Program in East Asian Languages and Literatures The Ohio State University 2020 Thesis Committee: Xiaobin Jian, Advisor Galal Walker Copyright by Ke Wang 2020 Abstract This thesis explores if and how music can be incorporated into the teaching and learning of Chinese as a foreign language (CFL) from a cross-disciplinary perspective. Considering music more than simply a sonic device or a “fun tool” in classrooms, the author discusses the uniqueness of music in human communication, its nature as a cultural artifact in human evolution, and its role in the formation and maintenance of group cohesion among humans through the physiological mechanism of the human mirror neuron system (MNS). From a pedagogical perspective, music provides a critical link in the chain of meaning communication and intention construction due to its associative floating intentionality and its ability to elicit emotional and motivational responses, communicate communions, and enhance coordination within certain social group members. Specifically, Chapter one explores the possibility of integrating music into the CFL field by highlighting the uniqueness of music’s role in human communication. Chapter two examines the connections between music and language from the perspective of their physiological foundations, cognitive mechanisms, and evolutionary pathways. Chapter three focuses on the functions of music and its role in learning and language learning. Finally, Chapter four focuses on material development by providing a sample unit of the music-enhanced Chinese online course—iFriends. -

University of Southampton Research Repository Eprints Soton

University of Southampton Research Repository ePrints Soton Copyright © and Moral Rights for this thesis are retained by the author and/or other copyright owners. A copy can be downloaded for personal non-commercial research or study, without prior permission or charge. This thesis cannot be reproduced or quoted extensively from without first obtaining permission in writing from the copyright holder/s. The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the copyright holders. When referring to this work, full bibliographic details including the author, title, awarding institution and date of the thesis must be given e.g. AUTHOR (year of submission) "Full thesis title", University of Southampton, name of the University School or Department, PhD Thesis, pagination http://eprints.soton.ac.uk UNIVERSITY OF SOUTHAMPTON FACULTY OF HUMANITIES Film Studies Images of the Female Singer The Structural Characteristics of Taiwanese Mandopop Music Videos by Liu, Chu-Ying Thesis for the degree of Doctor of Philosophy May 2016 UNIVERSITY OF SOUTHAMPTON ABSTRACT FACULTY OF HUMANITIES Department of Film Studies Thesis for the degree of Doctor of Philosophy IMAGES OF THE FEMALE SINGER THE STRUCTURAL CHARACTERISTICS OF TAIWANESE MANDOPOP MUSIC VIDEOS Liu, Chu-Ying Music video visually communicates with music, in a storytelling manner with direct or subliminal messages to audiences. It encompasses many discourses over different contexts, and often used in contradictory ways to embody gendered aesthetic values of authenticity. This thesis sets out to investigate Taiwanese Mandopop female stars and their representations in the music videos seen in the Mandopop industry. -

Ifpi-Digital-Music-Report-2015.Pdf

CONTENTS 4 25 Introduction Moving to a global release day in 2015 Plácido Domingo, chairman, IFPI Frances Moore, chief executive, IFPI 27 Country case studies 6 Brazil: a top performing market Market overview China: moving towards paid services An evolving portfolio business Germany: streams grow, CDs resilient Regional picture 32 10 Music and the wider economy Most popular artists and global bestsellers of 2014 The broader effect of investment in artists IFPI Global Recording Artist of the Year 2014 Music helps drive social media Top selling global albums & singles of 2014 Music and economic growth How streaming is changing the charts Tomorrow’s world 14 34 Key recording industry trends in 2014 Labels working with artists: four case studies Subscription drives the music portfolio David Guetta: using data intelligently New global services, more reach Lucas Lucco: artist and digital native Smartphones and partnerships drive growth Sam Smith: innovative promotion Getting subscription to the mass market Wakin Chau: interactive digital promotion Streaming revenue models Streaming services compete on curation 38 Payment options diversify Tackling digital piracy Downloads decline Consumer attitudes towards piracy Video streaming surges Website blocking Search engines 20 Advertising and payment providers New IFPI data shows artist payments Piracy and apps as share of revenues are up IFPI’s content protection work 22 41 Fixing the ‘value gap’ in digital music Digital music services worldwide Cover Taylor Swift photo by Sarah Barlow + Stephen Schofield Robin Schulz photo by Geturshot.com Wakin Chau photo courtesy of Rock Group One Direction photo by RJ Shaughnessy Lucas Lucco photo by Guto Costa Ed Sheeran photo by Ben Watts Katy Perry photo by Cass Bird This report includes new findings from a consumer study carried out by IPSOS in January 2015 across 13 of the world’s leading music markets (Australia, Brazil, Canada, France, Germany, Great Britain, Italy, Japan, Mexico, South Korea, Spain, Sweden, United States), www.ifpi.org commissioned by IFPI. -

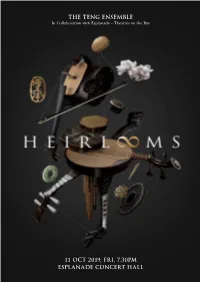

THE TENG ENSEMBLE in Collaboration with Esplanade – Theatres on the Bay

THE TENG ENSEMBLE In Collaboration with Esplanade – Theatres on the Bay 11 OCT 2019, FRI, 7.30PM ESPLANADE CONCERT HALL 2 CREATIVE DIRECTOR’S MESSAGE uch is the melting pot that is known as Singapore network of instrument dealers, luthiers, teachers and - I grew up in an English-educated family, but musicians. Many of these practitioners had other day jobs have been playing the traditional Chinese Pipa and stopped playing music for a decade or so, out of fear for the past 25 years. I dream in English, but of being labelled as communist in Singapore’s early years. my ears are most familiar with melodies from Chinese traditions. I also discovered the very different trajectory that S Chinese music took in Singapore, as compared to in Ten years ago, as a graduate student studying Singapore’s China. In Singapore, Chinese migrants who had brought Chinese music history, I learnt that the first Chinese music from their respective provinces began to integrate orchestra in Singapore was set up by the late Mr Yeo their traditions with each other, creating new methods of How Jiang in 1959, under the auspices of Thau Yong performance and even inventing new instruments. Amateur Musical Association. I had the honour of being the last student taught by Mr In 2016, I had the honour of finally meeting Mr Yeo, Yeo, who passed away in 2017. Through his experiences, who was still with Thau Yong. A very humble man and an I discovered how Chinese music innovated and adapted expert Pipa player himself, Mr Yeo had however stopped itself to Singapore, and how the Chinese forefathers in playing Chinese orchestral music for decades. -

Scanned Using Book Scancenter 5131

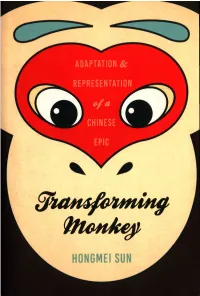

ADAPTATION & REPRESENTATIONiu i< — T > CHINESE C f EPIC SF u tn sfotm in g t H o n k t y SUN GO CD u n iv e r sit y ?" PENNSYLVANIA. LIBRARIES Transforming Monkey Transforming Monkey ADAPTATION AND REPRESENTATION OF A CHINESE EPIC Hongmei Sun UNIVERSITY OF WASHINGTON PRESS Seattle f l l 1 I modern language I I I I initiative THIS BOOK IS MADE POSSIBLE BY A COLLABORATIVE GRANT FROM THE ANDREW W. MELLON FOUNDATION. Copyright © 2.018 by the University of Washington Press Printed and bound in the United States of America zz 21 zo 19 18 54321 All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any information storage or retrieval system, without permission in writing from the publisher. University of Washington Press www.washington.edu/uwpress Cataloging-in-Publication Data available from the Library of Congress. ISBN (hardcover): 978-0-195-74318-9 ISBN (paperback): 978-0-295-74319-6 ISBN (ebook): 978-0-295-743Z0-Z To my parents. With you there, I will never feel lost. To my three sisters. We do not mention the love between us, only because we know it is always there. CONTENTS Acknowledgments ix Introduction 3 1. Who Is Sun Wukong? The Image of the Monkey King in Journey to the West 15 2. The Transmutable Monkey: Between Theater and Fiction in Traditional China 3 6 3. From Trickster to Hero: National Mythmaking in Wartime and Maoist China 60 4. -

Wakin Chau Turns to Jazz Lifestyle Most Popular Lifestyle

Wakin Chau turns to jazz Page 1 of 2 Singapore The Straits Times Web Min:25 °C Max:33 °C » Weather Details March 26, 2010 Friday Updated 3.14 pm Lifestyle HOME > BREAKING NEWS > LIFESTYLE > STORY Mar 26, 2010 « Previous Next » Wakin Chau turns to jazz By jocelyn lee Lifestyle Cheeses cry out for help 7:45 PM HONG Kong-born singer Wakin Chau is ditching pop music in favour of jazz and he will release a new jazz album in the later half of this year. AP lensman for 66 years, dies 10:13 PM Fans of the veteran singer can get an advance preview of Chau the jazz singer at food, wine and music Jaguar XJ's big leap forward 8:10 PM extravaganza Papillon IX at Raffles Hotel on Sunday, as he will be presenting a mini-jazz showcase at Green building saves money 8:02 PM the event. Royston's caged-up emotions 7:58 PM Diners get to taste cuisine from a multiple-course canape wine-pairing menu prepared by Hong Kong chef Alvin Leung Jr and Robert Mondavi Winery chef Jeff Mosher, before enjoying a performance by New MRT stations stun viewers 7:56 PM Chau. As if 'hit by a bus': Gallagher 5:30 PM The 49-year-old singer tells Life! recently in an interview at the Mandarin Oriental: 'I feel that the Music manager sues Axl Rose 4:19 PM current Chinese music industry focuses mainly on pop music, and I want to introduce more listeners to jazz music by coming up with a jazz album.' Tax fee sought from MJ's estate 4:17 PM He adds: 'In the upcoming showcase on Sunday, I will be singing jazz renditions of both English and Heros star calls for end to hunt 4:02 PM Chinese songs, including my old classics such as Let Me Be Happy Let Me Be Sad and Tomorrow I Am Abba come-back show? 12:01 PM Going To Marry You.' Film fest losing its edge? 6:00 AM Chau, who has released more than 40 records to date and has not had a new album in four years, is not the first Chinese singer to tackle jazz music.