Offering Memorandum Offering Welcome to Downtown MIAMI

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Macy's Redevelopment Site Investment Opportunity

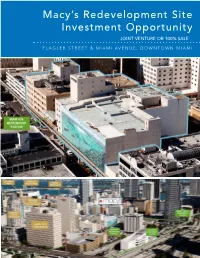

Macy’s Redevelopment Site Investment Opportunity JOINT VENTURE OR 100% SALE FLAGLER STREET & MIAMI AVENUE, DOWNTOWN MIAMI CLAUDE PEPPER FEDERAL BUILDING TABLE OF CONTENTS EXECUTIVE SUMMARY 3 PROPERTY DESCRIPTION 13 CENTRAL BUSINESS DISTRICT OVERVIEW 24 MARKET OVERVIEW 42 ZONING AND DEVELOPMENT 57 DEVELOPMENT SCENARIO 64 FINANCIAL OVERVIEW 68 LEASE ABSTRACT 71 FOR MORE INFORMATION, CONTACT: PRIMARY CONTACT: ADDITIONAL CONTACT: JOHN F. BELL MARIANO PEREZ Managing Director Senior Associate [email protected] [email protected] Direct: 305.808.7820 Direct: 305.808.7314 Cell: 305.798.7438 Cell: 305.542.2700 100 SE 2ND STREET, SUITE 3100 MIAMI, FLORIDA 33131 305.961.2223 www.transwestern.com/miami NO WARRANTY OR REPRESENTATION, EXPRESS OR IMPLIED, IS MADE AS TO THE ACCURACY OF THE INFORMATION CONTAINED HEREIN, AND SAME IS SUBMITTED SUBJECT TO OMISSIONS, CHANGE OF PRICE, RENTAL OR OTHER CONDITION, WITHOUT NOTICE, AND TO ANY LISTING CONDITIONS, IMPOSED BY THE OWNER. EXECUTIVE SUMMARY MACY’S SITE MIAMI, FLORIDA EXECUTIVE SUMMARY Downtown Miami CBD Redevelopment Opportunity - JV or 100% Sale Residential/Office/Hotel /Retail Development Allowed POTENTIAL FOR UNIT SALES IN EXCESS OF $985 MILLION The Macy’s Site represents 1.79 acres of prime development MACY’S PROJECT land situated on two parcels located at the Main and Main Price Unpriced center of Downtown Miami, the intersection of Flagler Street 22 E. Flagler St. 332,920 SF and Miami Avenue. Macy’s currently has a store on the site, Size encompassing 522,965 square feet of commercial space at 8 W. Flagler St. 189,945 SF 8 West Flagler Street (“West Building”) and 22 East Flagler Total Project 522,865 SF Street (“Store Building”) that are collectively referred to as the 22 E. -

Mdm Hotel Group Names Florencia Tabeni Vice President of Operations & Development for Its Hotel Division

FOR IMMEDIATE RELEASE Contact: Israel Kreps Veronica Villegas Kreps DeMaria PR (305) 663-35443 [email protected] [email protected] MDM HOTEL GROUP NAMES FLORENCIA TABENI VICE PRESIDENT OF OPERATIONS & DEVELOPMENT FOR ITS HOTEL DIVISION MIAMI (September 15, 2016) – MDM Hotel Group announced today that it has named Florencia Tabeni Vice President of Operations & Development for MDM Hotel Group, MDM Development LLC’s hotel division, which has been managing and operating its own hotels for nearly 30 years. In her new role, Tabeni will be overseeing all aspects of operations for all of MDM Hotel Group’s properties. She will also oversee the areas of Sales & Marketing, Quality Assurance, Revenue Management, Human Resources, Information Technology, as well as hotel renovation developments for the company as a whole in order to ensure compliance, brand management and consistency throughout all of the hotel properties. Tabeni first began working with MDM in 2002 as the JW Marriott Hotel Miami’s Director of Sales and Marketing and subsequently was named as the hotel’s General Manager. In 2009, she became General Manager for the renowned JW Marriott Marquis Miami & Hotel Beaux Arts during the preopening and has since been overseeing the two hotels while growing the company’s team. “We are very proud to assign this important role to someone with Florencia’s expertise and long track record of success, both within our company and the hospitality industry,” says Alejandro Jerez, CFO of MDM Hotel Group. “She is highly respected by her peers and has been recognized as a proven leader. We look forward to continued success and expansion under her leadership.” Founded in 1990, MDM Development LLC began with the acquisition of the Miami Marriott Dadeland, along with the subsequent acquisition of the Datran I and II office complexes. -

Miami Office Space Can Be Found by Those Who Search February 7, 2017 By: Carla Vianna

Miami Office Space Can Be Found by Those Who Search February 7, 2017 By: Carla Vianna Businesses searching for space in Miami's urban core have more options than they might think. While vacancy rates are down across the board, significant chunks of space are available in several Class A buildings in downtown and the Brickell Avenue financial district. "There are more alternatives available for those companies that take the time to appropriately investigate the market," said Chris Lovell, a senior managing director with Savills Studley in Miami. Leasing space on an upper floor with a view may be difficult since only six buildings on Brickell have a full floor above the 20th story available for lease. For tenants that can live without the view, there is plenty of open space to choose from. Four downtown Class A buildings have at least 75,000 square feet of contiguous space available, one Class A building on Brickell has a 65,000- square-foot block — "and we don't have tenants of that size standing in line to the claim the space," Lovell said. Savills Studley has found many of the large available blocks are in older downtown buildings. "You're always going to have buildings that are going to have certain pockets available," said Tere Blanca, founder of Miami-based Blanca Commercial Real Estate Inc. She said the market is responding well to the new Miami Central project, which is under construction with 60 percent of its office component pre- leased. The mixed-use development will serve as Brightline's downtown train station and will add 286,000 square feet of office space in two buildings. -

One Biscayne Tower Sublease

Success achieved on every floor. Turnkey opportunity at One Biscayne Tower Class A office space located at2 Biscayne Boulevard, 22nd Floor, Miami, Florida. Rise above the rest. Situate your business on the 22nd floor of this 38-story tower. • 10,066 RSF • 14 Private offices • Available for with two corner immediate offices occupancy • Desirable exposed • Sublease Expires ceilings April 30, 2025 • On-Site Parking • Panoramic views • Rate is negotiable 10,066 RSF 2 Biscayne Boulevard Miami, Florida 22nd Floor Gallery In the center Miami’s downtown district 28 NW 7th St NW 7th St NE 6th St Port Blvd Restaurants Hotels Miamarina Pkwy Dr NW 6th St NE 6th St 1 Toro Toro at Intercontinental 20 JW Marriott Marquis 2 Ceviche 105 21 Intercontinental NW 5th St NE 5th St 3 Wolfgang’s Steakhouse 22 Kimpton EPIC Hotel 28 4 Fratelli Milano 23 Hotel Beaux Arts NE 4th St 15 27 5 Kone Sushi 24 Hyatt Regency 6 Eternity Roasters NW 3rd St NE 3rd St NE 1st Ave 7 Starbucks Others 25 American Airlines Arena Biscayne Blvd 8 NW 2nd St NE 2nd St Salad Box Biscayne Blvd 26 29 30 Miami-Dade County Courthouse 9 Union Cafe NE 3rd Ave 2 NE 2nd Ave 27 U.S. Bankruptcy Court NW Miami Ave SW Miami Ave NW 1st Ave NW Miami Ct NE 1st St 10 Il Gabiano NW 1st St 16 28 U.S. District Court 32 26 35 11 Zuma SE 3rd Ave 29 E Flagler St Dade County District Court 31 17 12 Boulud Sud SE 2nd Ave 34 SW 1st Ave 4 5 30 11th Judicial Circuit Court SE 1st Ave 13 Zest SE 1st St 7 31 Gusman Center for the Performing Arts 8 14 Whole Foods 18 6 9 32 Historical Museum of Southern Florida SE 2nd St 1 13 21 14 33 James L. -

AVANT at Met Square

january 2016 volume XVIII AVANT at met square the next generation of urban living SUSTAINED MOMENTUM The U.S. economy remains healthy, with more than 2.8 million new jobs added during the 12 months ending October 2015. U.S. homeownership continues to decline, and at 63.7% percent, hovers near historic lows. These positive trends are continuing to drive rental demand. The third quarter of 2015 was the seventh consecutive quarter of positive net unit absorption. On average, rent growth registered 5.2 percent in the major U.S. markets, and the vacancy rate was 4.3 percent, the lowest level of the current cycle. Industry analysts expect that new unit production will peak in 2016, before tapering through the end of the decade. The near term increase in new supply is expected to have only modest impacts on vacancy and rent growth. However, due to continued job growth and a steady influx of new renters, primarily millennials entering the rental market and aging baby boomers who increasingly find rental housing more attractive than homeownership, the market will continue to perform well. With these positive market forces at work, ZOM is poised for continued success in 2016. In Florida, we will complete lease-ups at Moda and Bel Air Doral in early 2016, and will begin delivering units at Monarc at Met 3, Baldwin Harbor, Delray Preserve, and Luzano. In Texas, our Tate project in Houston will also open its doors. In our Mid-Atlantic region, construction continues at Banner Hill in Baltimore, and we are working on several new projects in other Mid-Atlantic target markets. -

OFFERING MEMORANDUM Miami, FL 33131 235 SE 1St Street Themiamiplaza.Com

THE P LA ZA themiamiplaza.com MEMORANDUM 235 SE 1st Street Miami, FL 33131 OFFERING THE P LA ZA THE P LA ZA 235 SE 1st Street THE OFFERING Miami, FL 33131 he Plaza is a 81,000 SF office building Ton a 20,000 SF corner lot located in the heart of Downtown Miami and its most prominent corner. The site benefits from the most liberal mixed-use zoning in all of South Florida, T6-80-O, allowing up to 489,600 SF of development and 470 residential units. The Plaza is an amazing add value office building with tremendous future uses for development. Developers will benefit from the ability to receive temporary cash flow while waiting on the next cycle or plan approval. THE CORNER OF DOWNTOWN MIAMI THE P LA ZA PROPERTY SUMMARY + + Address: Lot Size: Building Size: Zoning: FLR Allowable FLR Allowable +Bonus Building Height: Building Height +Bonus: Allowable Units: Folio: 235 SE 1st St. 20,400/ 81,382 SF T6-80-O 489,600 SF Unlimited 80 Unlimited 470 01-0112-000-1020 Miami, FL 33131 0.47 Acres 6 7 FOUR SEASONS BRICKELL CITY INVESTMENT CENTRE ICON BRICKELL HIGHLIGHTS SOUTHEAST FINANCIAL CENTER WELLS FARGO CENTER MIAMI TOWER ASTON MARTIN JAMES L. KNIGHT RESIDENCES CENTER MET SQUARE CINEPLEX WHOLE FOODS CENTRO Covered Land with In-Place Income he Plaza is a prime opportunity to repurpose or add value to an existing Tclass C office building located in Downtown’s most highly trafficked corridor. The property is positioned to capture an already active-large tenant base with over 175,000 employees existing within Downtown’s LA EPOCA Central Business District. -

Miami Cbd Large Blocks of Office Space

RESEARCH MIAMI CBD AUGUST 2019 LARGE BLOCKS OF OFFICE SPACE 836 MACARTHUR CAUSEWAY 100,000+ SF Blocks 395 Southeast Financial Center Four Seasons Tower 200 S Biscayne Boulevard 1441 Brickell Avenue Ponte Gadea USA 9 Millennium Partners Management 1 1,225,000 RBA – 67.8% Leased 258,767 RBA – 98.1% Leased 133,120 SF Max Contig. 28,763 SF Max Contig. $53.25/RSF FS $60.00/RSF FS Citigroup Center 1221 Brickell 201 S Biscayne Boulevard 1221 Brickell Avenue Crocker Partners Rockpoint Group 2 809,594 RBA – 74.0% Leased 10 408,649 RBA – 86.1% Leased 95 127,634 SF Max Contig. 26,761 SF Max Contig. $48.00-$52.00/RSF FS $52.50/RSF FS Freedom PORT BLVD A1A Tower Wells Fargo Center 50,000 - 99,999 SF Blocks 333 SE 2nd Avenue AVE MetLife Real Estate Investments AVE 11 ND 752,845 RBA – 85.9% Leased ND SunTrust International Center 26,000 SF Max Contig. 1 SE 3rd Avenue BISCAYNE BLVD BISCAYNE $48.00/RSF FS N MIAMI AVE MIAMI N 2 NE NW 2 NW MiaMarina Pacific Coast Capital Partners MIAMI RIVER 3 440,299 RBA – 66.4% Leased 90,255 SF Max Contig. $38.00-$40.00/RSF FS 15,000 - 24,999 SF Blocks Brickell Office Plaza Brickell World Plaza Downtown 777 Brickell Avenue 600 Brickell Avenue 8 Padua Realty Company Elm Spring, Inc. 4 288,457 RBA – 74.8% Leased 12 631,866 RBA – 92.5% Leased 3 6 68,386 SF Max Contig. CLASS 24,138 SF Max Contig. -

Carlos Lopez-Cantera, Statewide Chair 150 Alhambra Circle, Suite 925 Coral Gables, FL 33134 [email protected]

Carlos Lopez-Cantera, Statewide Chair 150 Alhambra Circle, Suite 925 Coral Gables, FL 33134 [email protected] Southern District Manny Kadre, Conference Chair 133 Sevilla Avenue Coral Gables, FL 33134 (305) 567-3582 Ext. 224 [email protected] Georgina A. Angones University of Miami School of Law 1203 Santona Street Coral Gables, FL 33146 (305)284-6470 [email protected] Ellyn Setnor Bogdanoff Becker & Poliakoff 1 East Broward Blvd. Suite 1800 Ft. Lauderdale, FL 33301 (954)987-7550 [email protected] Reginald J. Clyne Quintairos, Prieto, Wood & Boyer, P.A. 9300 South Dadeland Boulevard, 4th Floor Miami, FL 33156 (305)670-1101 [email protected] Kendall B. Coffey Coffey Burlington 2601 South Bayshore Drive Miami, FL 33133 (305)858-2900 [email protected] 1 Vivian de las Cuevas-Diaz Holland & Knight 701 Brickell Avenue Suite 3000 Miami, FL 33131 (305) 789-7452 [email protected] Renier Diaz de la Portilla 1481 NW 22nd Street Miami, FL 33142 (305) 325-1079 [email protected] Albert E. Dotson, Jr. Bilzin Sumberg Baena Price & Axelrod LLP 1450 Brickell Avenue, 23rd Floor Miami, FL 33131 (305) 350-2411 [email protected] Peter M. Feaman 3695 West Boynton Beach Blvd., Suite 9 Boynton Beach, FL 33436 (561) 734-5552 [email protected] Robert H. Fernandez, Esq. Partner Zumpano Castro 500 South Dixie Highway Suite 302 Coral Gables, FL 33146 (305) 503-2990 [email protected] 2 Daniel Foodman Waserstein Nunez & Foodman 1111 Brickell Ave Suite 2200 Miami, FL 33131 (305) 760-8503 [email protected] Philip Freidin Freidin, Dobrinsky, Brown & Rosenblum P.A. -

Vice 300 Biscayne Boulevard

DOWNTOWN MIAMI FL VICE 300 BISCAYNE BOULEVARD CONCEPTUAL RENDERING SPACE DETAILS LOCATION GROUND FLOOR West block of Biscayne Boulevard between NE 3rd and NE 4th Streets NE 4TH STREET 38 FT SPACE Ground Floor 1,082 SF FRONTAGE 38 FT on NE 4th Street 1,082 SF TERM Negotiable (COMING SOON) POSSESION LEASE OUT Summer 2018 SITE STATUS New construction LEASE OUT CO-TENANTS Caffe Fiorino (coming soon), GOGO Fresh Foods (coming soon) and OXXO Care Cleaners (coming soon) NEIGHBORS Area 31, Fratelli Milano, CVI.CHE 105, Gap, Il Gabbiano, Juan Valdez Coffee, NIU Kitchen, Pollos & Jarras, Segafredo, Skechers, Starbucks, STK Miami, Subway, Ten Fruits, Toro Toro, Tuyo Restaurant, Victoria’s Secret, Wolfgang’s Steakhouse and Zuma COMMENTS VICE is a 464-unit apartment tower under construction in the heart of Downtown Miami Directly across from Bayside Marketplace and neighboring Miami Dade College, two blocks from American Airlines Arena, and adjacent to the College-Bayside Metromover Station Miami-Dade College has over 25,000 students on campus daily (COMING SOON) (COMING SOON) ADDITIONAL RENDERINGS CONCEPTUAL RENDERING CONCEPTUAL RENDERING CONCEPTUAL RENDERING Downtown Miami & Brickell Miami, FL AREASeptember 2017 RETAIL NW 8TH STREET NE 8TH STREET VICE AVENUE 300 BISCAYNE NE 7TH STREET NE 2ND HEAT BOULEVARD BOULEVARD MIAMI FL FREEDOM TOWER NW 6TH STREET PORT BOULEVARD MIAMI-DADE COLLEGE FACULTY Downtown Miami PARKING Movers NW 5TH STREET NE 5TH STREET 300 BISCAYNE BOULEVARDP MIAMI-DADE COLLEGE FEDERAL NE 4TH STREET NE -

Miami Office Market Report

2016 YEAR-END MIAMI OFFICE MARKET REPORT BLANCA COMMERCIAL REAL ESTATE | 4TH QUARTER 2016 MARKET REPORT | PAGE 1 MIAMI OFFICE MARKET STATS lanca Commercial Real Estate’s Q4 2016 research analyzed the four major office submarkets that drive the greater Miami- Dade County market: Downtown, Brickell, Coral Gables and Airport West. All told, these four submarkets comprise B approximately 27 million square feet of Class A and B office space in buildings greater than 50,000 square feet. Average Inventory Asking Rates YOY Submarket Buildings (SF) Vacancy (Gross $/SF) Absorption 4 MAJOR SUBMARKETS Downtown 19 6,728,218 17.2% $34.34 134,922 Brickell 25 6,481,990 11.7% $43.09 308,792 Coral Gables 41 5,645,853 11.3% $38.77 34,370 Airport West 66 8,283,873 9.1% $29.49 99,454 SUBTOTAL 151 27,139,934 12.3% $36.42 577,538 Aventura 9 975,024 4.3% $46.18 -25,643 Biscayne Corridor 5 723,791 28.8% $35.36 17,471 Coconut Grove 7 871,870 2.1% $33.92 26,618 Coral Way 6 439,225 5.3% $27.22 -6,306 Kendall 13 1,709,055 14.1% $31.78 -52,036 Medley 3 201,427 28.0% $22.27 4,421 Miami 4 387,117 0.7% - 55,545 Miami Beach 13 1,288,733 4.2% $43.84 14,462 Miami Lakes 10 592,428 20.2% $23.90 3,418 NE Dade 9 846,748 25.1% $22.23 55,734 South Dade 2 133,994 36.3% $21.75 3,005 SUBTOTAL 81 8,169,412 15.4% $30.84 96,689 TOTAL 232 35,309,346 14.6% $32.44 674,227 Multi-tenant, Class A & B Buildings > 50,000 SF BLANCA COMMERCIAL REAL ESTATE | 4TH QUARTER 2016 MARKET REPORT | PAGE 2 SUBMARKETS Miami’s major office submarkets account for 72% of total Class A & B office inventory and consist of Downtown, Brickell, Coral Gables & Airport West. -

Met 1 Miami Brochure

m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t r o p o l i t a nm e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t r o p o l i t a n m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t r o p o l i t a nm e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t r o p o l i t a n m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t r o p o l i t a nm e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t ropolitan miami m e t r o p o l i t a n heads up, downtown! the renaissance of miami’s oldest neighborhood is on the move. -

Why Downtown Miami's on the Up

September 23, 2011 Circulation: 146,334 Why downtown Miami’s on the up By David Kaufman The neighbourhood has recovered due to foreign investment and has grown into a true cultural destination Of all the cities and all the neighbourhoods affected by America’s recent recession, few were hit harder than downtown Miami. An urban counterpoint to seafront South Beach, this 60‐block swathe of city‐centre property welcomed 22,500 new condominium units between 2003 and 2010. That’s almost double the number built during the preceding four decades combined, according to Condo Vultures, a real estate consultancy based in Bal Harbour. The newcomers were spread over 80 new buildings across “greater downtown Miami”, which includes Brickell Avenue, the Biscayne Boulevard Corridor and downtown itself. Much like in Dubai or Las Vegas, most downtown apartments were Downtown Miami, where new‐build, full‐ service condos now cost around $380 per sq ft – purchased off‐plan, and years from completion, during the 30 to 50 per cent less than before the 2008 development boom of the past decade. As prices rose in economic crash tandem with unfinished inventory, the resulting property bubble saw more than one‐third of the new apartments stand empty and unsold during the depths of America’s financial crisis in June 2009. Now, just over two years later, the downtown Miami market is once again on the move. Propelled by significant shifts in promotion strategies, price points and buyer types, a mere 11 per cent of newly completed condos remain unsold. It helps that tight credit lending has brought additional construction to a virtual standstill, allowing the market to absorb existing inventory.